Apa sebenarnya yang dilakukan oleh taktik ini?

Anda tahu, sebagian besar trader memiliki masalah: mereka melihat sinyal negatif dan langsung lari!😱 Tapi strategi ini berbalik arah dan mengatakan kepada Anda, “Jangan terburu-buru, tunggu dan lihat!”

Strategi ini akan menunggu 3 garis K (bisa disesuaikan) untuk melihat apakah itu benar-benar “putus cinta” atau hanya ekspresi emosional.

Logika Inti: Jangan Membuat Keputusan Impulsif

Syarat masuk:

- Menemukan pola penembusan tinggi rendah

- Konfirmasi K line (kursi harga yang benar)

- Sistem penilaian multi-dimensi: RSI dinamis + Konfirmasi volume transaksi + Analisis volatilitas

- Minimal nilai 3.0 untuk masuk (maksimal nilai 5.0)

Fokus!Sistem penilaian di sini sangat cerdas, dan akan mempertimbangkan:

- K intensitas garis ((persentase entitas)

- Apakah volume transaksi meningkat?

- Apakah RSI berada dalam kisaran yang wajar

- Tingkat fluktuasi saat ini

Kebijaksanaan Yang Dibutuhkan Untuk Menunda Pertandingan

Strategi Tradisional: Melihat Tanda Kekalahan → Bergabung Segera Strategi ini: melihat sinyal kegagalan→ menunggu 3 garis K→ konfirmasi lagi→ masuk akal

Mengapa Ditunda?

- Hindari jebakan penembakan palsuPasar sering “bermain mati-matian” dan penundaan dapat menyaring kebisingan

- Mengurangi frekuensi transaksiMenurunkan biaya proses

- Meningkatkan Rasio KemenanganBerikan waktu untuk tren

️ Manajemen Risiko: Jangan pernah bersikap lemah lembut

Meskipun tampilannya sangat “buddhis”, pengendalian risiko sangat ketat:

- Stop loss1.5 kali ATR (dapat disesuaikan)

- Berhenti2,5 kali ATR (dapat disesuaikan)

- Waktu transaksiBeroperasi hanya pada saat perdagangan saham.

- Penutupan saldoTidak pernah bermalam.

Desain Visual: Perhatikanlah

- Segitiga Hijau: Sering melakukan sinyal ganda

- 🔴 Segitiga merah: sinyal kosong biasa

- Sinyal kualitas tinggi (nilai ≥4.5)

- Orange X: Tanda Kegagalan Awal (dipermalukan)

- 🔴 Red X: Delay Failure Signal (Perjalanan)

Panduan Menghindari PitJangan panik jika Anda melihat X oranye, ini adalah “peringatan palsu” yang sengaja diabaikan oleh taktik!

Skenario yang Cocok

Strategi ini sangat cocok untuk:

- Sebuah kota yang bergolak

- Seorang pedagang yang tidak ingin sering mengalami kerugian

- Investor ingin meningkatkan kualitas sinyal

- Penggemar Dagang Dalam Hari

Ingatlah: Kesabaran adalah senjata terbesar trader, dan kadang-kadang “tunggu dan pergi” lebih bijaksana daripada “beraksi segera”!

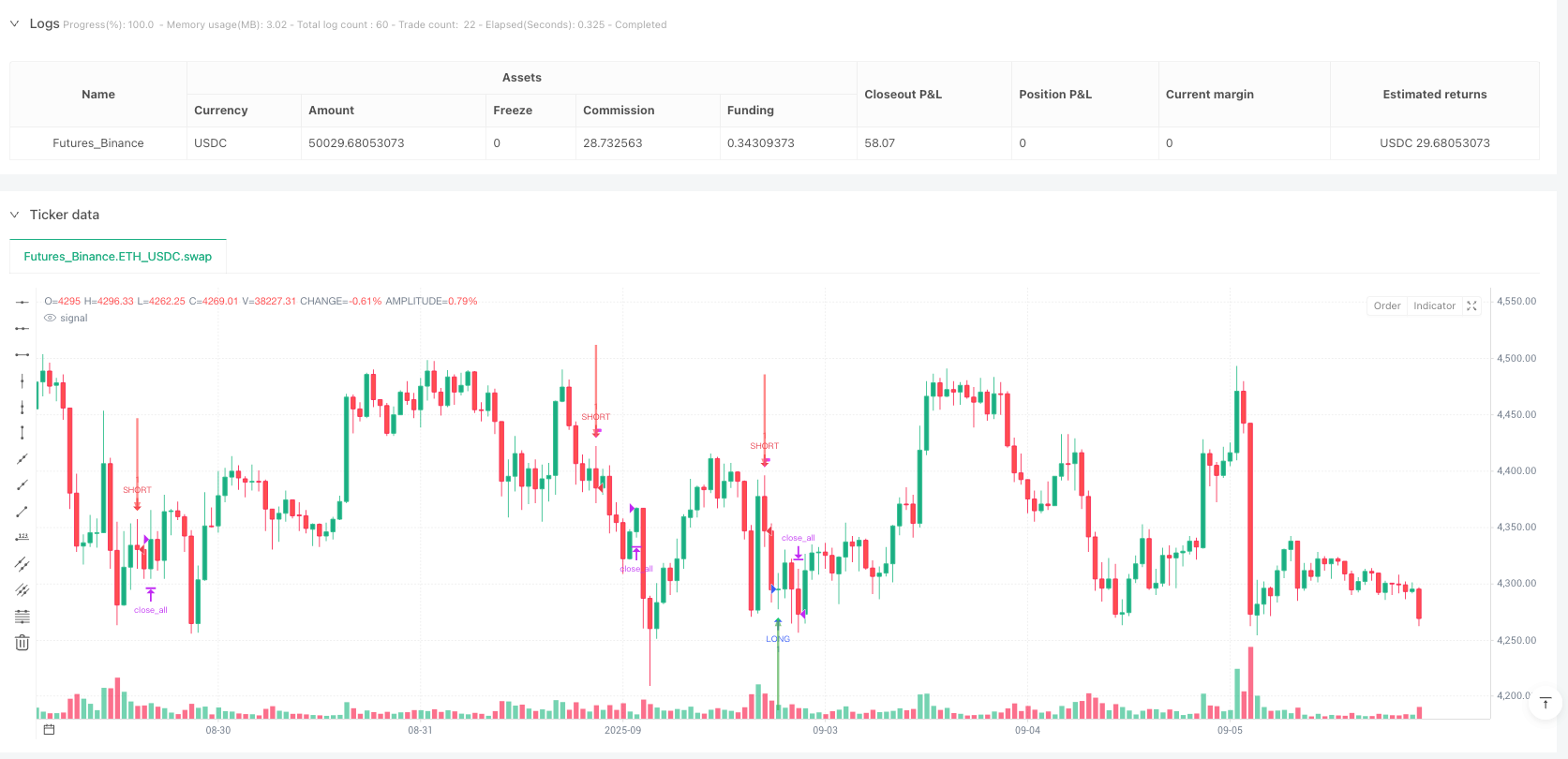

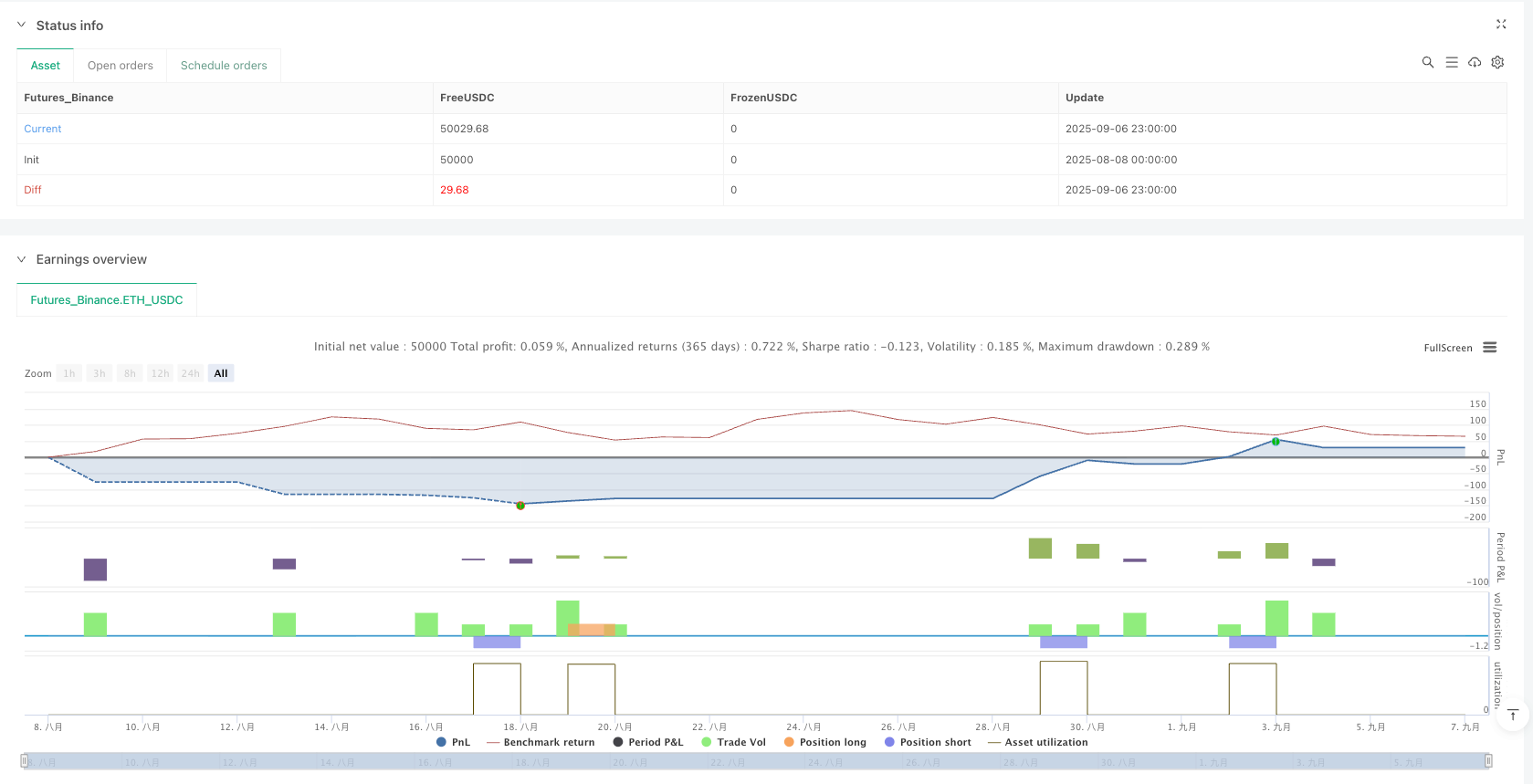

/*backtest

start: 2025-08-08 00:00:00

end: 2025-09-07 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDC"}]

*/

//@version=6

strategy("Delayed X Exit Strategy - Final Version", overlay=true)

// === INPUTS ===

// Strategy Settings

delayBars = input.int(3, "Delay X Exit (bars after entry)", minval=1, maxval=10, group="Exit Strategy")

showScores = input.bool(true, "Show Signal Scores", group="Display")

minScore = input.float(3.0, "Minimum Score to Trade", minval=1.0, maxval=5.0, step=0.1, group="Strategy")

volumePeriod = input.int(20, "Volume Average Period", group="Strategy")

// Risk Management

stopATRMult = input.float(1.5, "Stop Loss ATR Multiplier", minval=0.5, maxval=3.0, step=0.1, group="Risk Management")

targetATRMult = input.float(2.5, "Take Profit ATR Multiplier", minval=1.0, maxval=5.0, step=0.1, group="Risk Management")

// Time Filters - US Market Hours Only

startHour = input.int(9, "Start Trading Hour", minval=0, maxval=23, group="Time Filter")

endHour = input.int(16, "End Trading Hour", minval=0, maxval=23, group="Time Filter")

startMinute = input.int(30, "Start Trading Minute", minval=0, maxval=59, group="Time Filter")

// === TIME FILTER - MARKET HOURS ONLY ===

currentHour = hour(time, "America/New_York")

currentMinute = minute(time, "America/New_York")

marketOpen = (currentHour == startHour and currentMinute >= startMinute) or (currentHour > startHour and currentHour < endHour)

inTradingHours = marketOpen

// --- Original Pattern Detection ---

lowPoint = ta.lowest(low, 3)

prevLowPoint = ta.lowest(low[3], 3)

isHigherLow = low == lowPoint and low > prevLowPoint

bullConfirm = isHigherLow and close > open

highPoint = ta.highest(high, 3)

prevHighPoint = ta.highest(high[3], 3)

isLowerHigh = high == highPoint and high < prevHighPoint

bearConfirm = isLowerHigh and close < open

// --- Pattern Failures (X signals) ---

failHigherLow = isHigherLow[1] and low < low[1]

failLowerHigh = isLowerHigh[1] and high > high[1]

// Track entry information for delayed exit logic

var int entryBar = na

var string entryDirection = na

var float entryPrice = na

// === ENHANCED SCORING SYSTEM ===

rsi = ta.rsi(close, 14)

atr = ta.atr(14)

avgVolume = ta.sma(volume, volumePeriod)

// Scoring components (optimized for delayed exits)

bullCandleStrength = bullConfirm ? (close > open and (close - open) / (high - low) > 0.6 ? 1 : 0.5) : 0

bearCandleStrength = bearConfirm ? (close < open and (open - close) / (high - low) > 0.6 ? 1 : 0.5) : 0

volumeConfirm = volume > avgVolume * 1.2 ? 1 : (volume > avgVolume ? 0.5 : 0)

bullMomentum = bullConfirm ? (rsi > 25 and rsi < 65 ? 1 : (rsi < 75 ? 0.5 : 0)) : 0

bearMomentum = bearConfirm ? (rsi > 35 and rsi < 75 ? 1 : (rsi > 25 ? 0.5 : 0)) : 0

currentRange = high - low

volatilityScore = currentRange > atr * 0.7 ? 1 : 0.5

// Pattern quality (more lenient for delayed exits)

recentBullSignals = ta.barssince(bullConfirm)

recentBearSignals = ta.barssince(bearConfirm)

bullPatternQuality = bullConfirm ? (na(recentBearSignals) or recentBearSignals > 2 ? 1 : 0.5) : 0

bearPatternQuality = bearConfirm ? (na(recentBullSignals) or recentBullSignals > 2 ? 1 : 0.5) : 0

// Calculate total scores

bullScore = bullConfirm ? bullCandleStrength + volumeConfirm + bullMomentum + volatilityScore + bullPatternQuality : 0

bearScore = bearConfirm ? bearCandleStrength + volumeConfirm + bearMomentum + volatilityScore + bearPatternQuality : 0

// === TRADE SIGNALS ===

longSignal = bullConfirm and bullScore >= minScore and inTradingHours

shortSignal = bearConfirm and bearScore >= minScore and inTradingHours

// === STRATEGY ENTRIES ===

if longSignal and strategy.position_size == 0

strategy.entry("LONG", strategy.long, qty=1)

entryBar := bar_index

entryDirection := "LONG"

entryPrice := close

if shortSignal and strategy.position_size == 0

strategy.entry("SHORT", strategy.short, qty=1)

entryBar := bar_index

entryDirection := "SHORT"

entryPrice := close

// === DELAYED EXIT LOGIC ===

// Only consider X exits if they occur delayBars+ after entry

shouldExitOnDelayedFailure = false

barsAfterEntry = na(entryBar) ? 0 : bar_index - entryBar

if strategy.position_size != 0 and not na(entryBar) and barsAfterEntry >= delayBars

// Check for pattern failure that matches our position direction

if strategy.position_size > 0 and failHigherLow

shouldExitOnDelayedFailure := true

if strategy.position_size < 0 and failLowerHigh

shouldExitOnDelayedFailure := true

// Execute delayed failure exits

if shouldExitOnDelayedFailure

if strategy.position_size > 0

strategy.close("LONG", comment="Delayed X Exit")

if strategy.position_size < 0

strategy.close("SHORT", comment="Delayed X Exit")

entryBar := na

entryDirection := na

entryPrice := na

// === STANDARD STOP/TARGET EXITS ===

// Only use stop/target if we haven't exited on delayed failure

if strategy.position_size > 0 and not shouldExitOnDelayedFailure // Long position

stopLevel = strategy.position_avg_price - (atr * stopATRMult)

targetLevel = strategy.position_avg_price + (atr * targetATRMult)

strategy.exit("LONG_EXIT", "LONG", stop=stopLevel, limit=targetLevel)

if strategy.position_size < 0 and not shouldExitOnDelayedFailure // Short position

stopLevel = strategy.position_avg_price + (atr * stopATRMult)

targetLevel = strategy.position_avg_price - (atr * targetATRMult)

strategy.exit("SHORT_EXIT", "SHORT", stop=stopLevel, limit=targetLevel)

// Reset entry tracking when position closes

if strategy.position_size == 0 and not na(entryBar)

entryBar := na

entryDirection := na

entryPrice := na

// End of day exit

if not inTradingHours and strategy.position_size != 0

strategy.close_all(comment="EOD")

entryBar := na

entryDirection := na

entryPrice := na

// === VISUAL ELEMENTS ===

// Main entry signals

plotshape(longSignal, "Long Entry", shape.triangleup, location.belowbar,

color=color.new(color.lime, 0), size=size.normal)

plotshape(shortSignal, "Short Entry", shape.triangledown, location.abovebar,

color=color.new(color.red, 0), size=size.normal)

// Premium signals (score >= 4.5)

premiumLong = longSignal and bullScore >= 4.5

premiumShort = shortSignal and bearScore >= 4.5

plotshape(premiumLong, "Premium Long", shape.flag, location.belowbar,

color=color.new(color.aqua, 0), size=size.large)

plotshape(premiumShort, "Premium Short", shape.flag, location.abovebar,

color=color.new(color.fuchsia, 0), size=size.large)

// Pattern failures - Orange for early (ignored), Red for delayed (actionable)

earlyFailure = (failHigherLow or failLowerHigh) and not na(entryBar) and barsAfterEntry < delayBars

actionableFailure = (failHigherLow or failLowerHigh) and not na(entryBar) and barsAfterEntry >= delayBars

plotshape(earlyFailure, "Early X (Ignored)", shape.xcross, location.abovebar,

color=color.new(color.orange, 0), size=size.small)

plotshape(actionableFailure, "Delayed X (Exit)", shape.xcross, location.abovebar,

color=color.new(color.red, 0), size=size.normal)

// Entry confirmation arrows

plotarrow(longSignal ? 1 : shortSignal ? -1 : 0,

colorup=color.new(color.green, 30), colordown=color.new(color.red, 30))

// === ENHANCED POSITION VISUALIZATION ===

var line stopLine = na

var line targetLine = na

var label positionLabel = na

var label delayLabel = na

if strategy.position_size != 0

// Draw position lines and labels

if strategy.position_size > 0 // Long position

stopPrice = strategy.position_avg_price - (atr * stopATRMult)

targetPrice = strategy.position_avg_price + (atr * targetATRMult)

// Show delay status

delayText = barsAfterEntry < delayBars ?

"X Ignored (" + str.tostring(barsAfterEntry) + "/" + str.tostring(delayBars) + ")" :

"X Active (" + str.tostring(barsAfterEntry) + " bars)"

delayLabel := label.new(bar_index, high + (atr * 2), delayText,

color=barsAfterEntry < delayBars ? color.orange : color.red,

textcolor=color.white, size=size.small)

if strategy.position_size < 0 // Short position

stopPrice = strategy.position_avg_price + (atr * stopATRMult)

targetPrice = strategy.position_avg_price - (atr * targetATRMult)

// Show delay status

delayText = barsAfterEntry < delayBars ?

"X Ignored (" + str.tostring(barsAfterEntry) + "/" + str.tostring(delayBars) + ")" :

"X Active (" + str.tostring(barsAfterEntry) + " bars)"

delayLabel := label.new(bar_index, low - (atr * 2), delayText,

color=barsAfterEntry < delayBars ? color.orange : color.red,

textcolor=color.white, size=size.small)

// === ALERTS ===

alertcondition(longSignal, title="Long Entry", message="LONG Entry Signal Triggered")

alertcondition(shortSignal, title="Short Entry", message="SHORT Entry Signal Triggered")

alertcondition(shouldExitOnDelayedFailure, title="Delayed X Exit", message="Pattern Failure Exit - Delayed Strategy")

alertcondition(premiumLong, title="Premium Long", message="PREMIUM LONG Signal - High Probability Setup")

alertcondition(premiumShort, title="Premium Short", message="PREMIUM SHORT Signal - High Probability Setup")