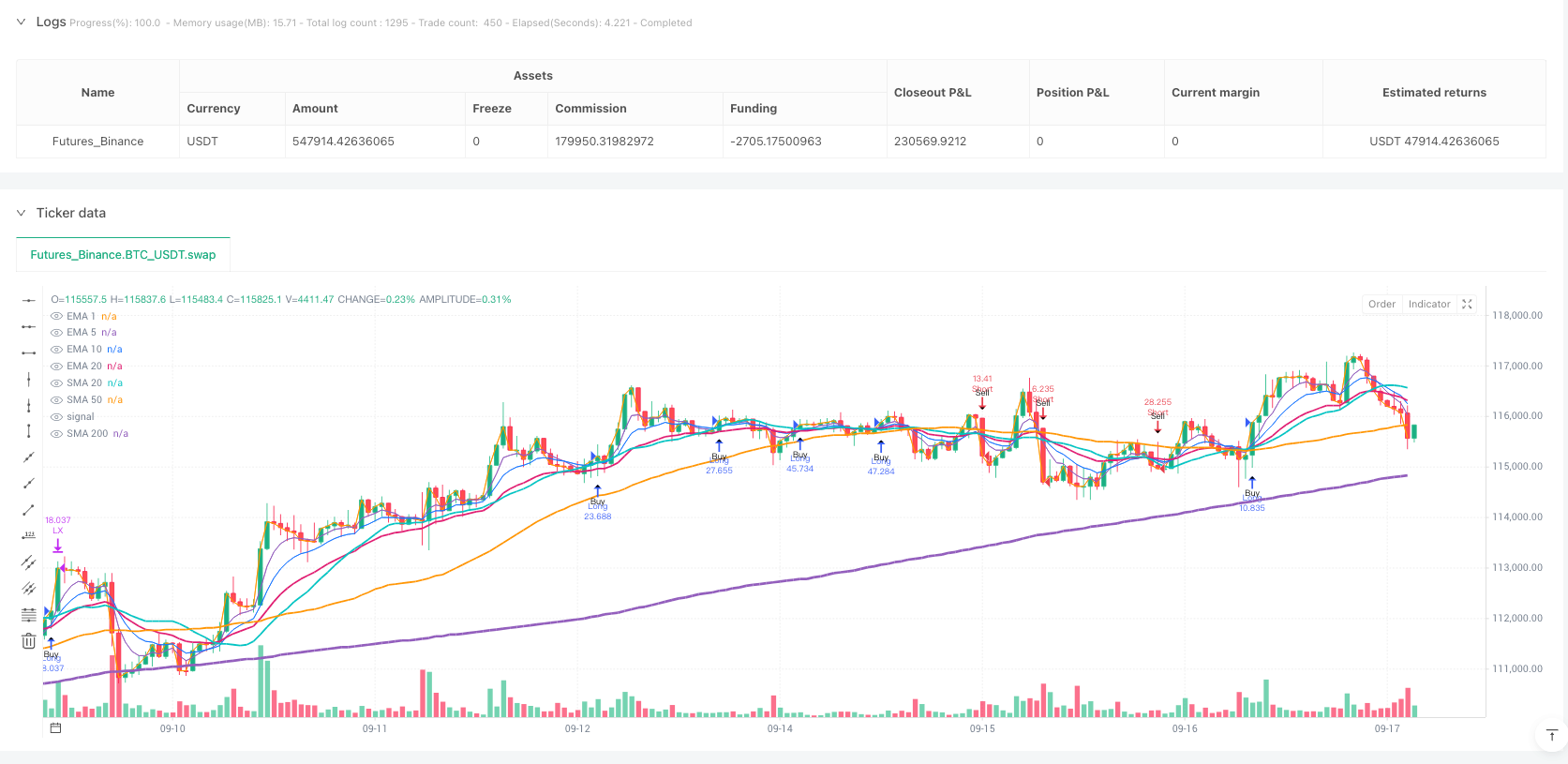

Sorotan Strategi

Anda tahu? Strategi ini seperti “detektif tren” yang sangat cerdas! Ini menggunakan 4 garis EMA ((1, 5, 10, 20 siklus) yang disusun dalam “garis tangga” yang sempurna untuk mengidentifikasi arah tren. Ketika EMA1> EMA5> EMA10> EMA20, itu seperti lampu merah dan hijau yang menyala penuh, memberi tahu Anda “Rush!”; sebaliknya adalah “Stop Stop Stop!”.

Filter multi-penetrasi anti-penetrasi

Strategi ini bukan tipe penakut yang “melihat sinyal dan menerobos”, tetapi memiliki tiga “pintu pemeriksaan keamanan”: SMA20, SMA50, dan SMA200 filter. Seperti penerbangan melalui tiga pemeriksaan keamanan, strategi ini hanya akan melakukan perdagangan jika harga berada di sisi rata-rata bergerak yang benar.

Pengelolaan Risiko Dinamis

Dan yang paling menarik dari strategi ini adalah sistem Stop Loss 4 in 1:

- EMA20 Stop Loss: Ikuti Harga Seperti Penjaga Diri

- Stop loss ATR: Adaptasi cerdas berdasarkan volatilitas pasar

- Persentase Stop Loss: Sederhana, kasar, cocok untuk pemula

- Stop loss: Temukan titik-titik resistensi yang mendukung

Manajemen posisi menggunakan modus persentase risiko, hanya mengambil risiko 1% dari akun Anda setiap kali, bahkan jika Anda mengalami kerugian berturut-turut, Anda tidak akan merasa takut!

Sistem Kontrol Transaksi Cerdas

Strategi ini juga memiliki fitur “periode dingin” yang sangat ramah, seperti permainan keterampilan yang dingin, tunggu beberapa K line setelah posisi kosong untuk membuka posisi lagi, menghindari emosi dan sering berdagang. Juga mendukung mekanisme waktu keluar, pergi ke titik, tidak pernah jatuh cinta! Anda dapat mengatur waktu perdagangan dan hari perdagangan dengan bebas, berpikir kapan istirahat dan kapan istirahat.

/*backtest

start: 2024-09-19 00:00:00

end: 2025-09-18 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":500000}]

*/

//@version=6

strategy("Hilega Milega v6 - Pure EMA/SMA (Nitesh Kumar) + Full Backtest",

overlay=true, initial_capital=100000,

commission_type=strategy.commission.percent, commission_value=0.05,

pyramiding=0, calc_on_order_fills=true, calc_on_every_tick=false,

max_labels_count=200, max_boxes_count=0)

// ============================

// Backtest Controls

// ============================

string G_BT = "Backtest"

bool useDateRange = input.bool(false, "Use Date Range (OFF = all history)", group=G_BT)

int bt_from = input(timestamp("2022-01-01T00:00:00"), "From", group=G_BT)

int bt_to = input(timestamp("2099-12-31T23:59:59"), "To", group=G_BT)

string sess = input("0000-2359:1234567", "Session (Exchange Time)", group=G_BT)

bool mon = input.bool(true, "Mon", group=G_BT)

bool tue = input.bool(true, "Tue", group=G_BT)

bool wed = input.bool(true, "Wed", group=G_BT)

bool thu = input.bool(true, "Thu", group=G_BT)

bool fri = input.bool(true, "Fri", group=G_BT)

bool sat = input.bool(true, "Sat", group=G_BT)

bool sun = input.bool(true, "Sun", group=G_BT)

int cooldownBars = input.int(3, "Cooldown bars after flat", 0, 500, group=G_BT)

int timeExitBars = input.int(0, "Time-based exit (0 = off)", 0, 5000, group=G_BT)

bool allowLongs = input.bool(true, "Allow Longs", group=G_BT)

bool allowShorts = input.bool(true, "Allow Shorts", group=G_BT)

// ============================

// Hilega Milega Inputs

// ============================

string G_HM = "Hilega Milega Filters (Side Rules)"

bool needSMA20 = input.bool(true, "Long above SMA20 / Short below SMA20", group=G_HM)

bool needSMA50 = input.bool(true, "Long above SMA50 / Short below SMA50", group=G_HM)

bool needSMA200 = input.bool(false, "Long above SMA200 / Short below SMA200", group=G_HM)

bool useSlope200= input.bool(false, "200 SMA slope filter (up for long / down for short)", group=G_HM)

int slopeLook = input.int(5, "Slope lookback (bars)", 1, 200, group=G_HM)

// ============================

// Risk / Targets

// ============================

string G_RM = "Risk / Targets"

string stopMode = input.string("EMA20", "Stop Type", options=["EMA20","ATR","Percent","Swing"], group=G_RM)

int atrLen = input.int(14, "ATR Length (for ATR/Swing calc)", 1, 200, group=G_RM)

float atrMult = input.float(2.0, "ATR Stop Mult (if Stop=ATR)", 0.1, 10, group=G_RM)

float pctSL = input.float(1.5, "Percent Stop % (if Stop=Percent)", 0.1, 50, group=G_RM)

int swingLen = input.int(10, "Swing lookback (if Stop=Swing)", 1, 200, group=G_RM)

float rrTarget = input.float(1.5, "Take Profit at R (x Risk)", 0.5, 20, group=G_RM)

bool riskPctMode = input.bool(true, "Position size by Risk % of equity", group=G_RM)

float riskPct = input.float(1.0, "Risk %", 0.05, 20, group=G_RM)

float fixedQty = input.float(1, "Fixed Qty (if Risk% OFF)", 0.0001, 1e9, group=G_RM)

// ============================

// Guards

// ============================

bool inDate = not useDateRange or (time >= bt_from and time <= bt_to)

bool inSess = not na(time(timeframe.period, sess))

bool inDOW = (dayofweek == dayofweek.monday and mon) or

(dayofweek == dayofweek.tuesday and tue) or

(dayofweek == dayofweek.wednesday and wed) or

(dayofweek == dayofweek.thursday and thu) or

(dayofweek == dayofweek.friday and fri) or

(dayofweek == dayofweek.saturday and sat) or

(dayofweek == dayofweek.sunday and sun)

bool canCalc = inDate and inSess and inDOW

// ============================

// Indicators (Pure HM stack)

// ============================

float ema1 = ta.ema(close, 1)

float ema5 = ta.ema(close, 5)

float ema10 = ta.ema(close, 10)

float ema20 = ta.ema(close, 20)

float sma20 = ta.sma(close, 20)

float sma50 = ta.sma(close, 50)

float sma200 = ta.sma(close, 200)

float atrVal = ta.atr(atrLen)

// Visuals

plot(ema1, "EMA 1", linewidth=1)

plot(ema5, "EMA 5", linewidth=1)

plot(ema10, "EMA 10", linewidth=1)

plot(ema20, "EMA 20", linewidth=2)

plot(sma20, "SMA 20", linewidth=2)

plot(sma50, "SMA 50", linewidth=2)

plot(sma200,"SMA 200",linewidth=3)

// ============================

// Hilega Milega Conditions

// ============================

bool emaBull = ema1 > ema5 and ema5 > ema10 and ema10 > ema20

bool emaBear = ema1 < ema5 and ema5 < ema10 and ema10 < ema20

bool sideLong = (not needSMA20 or close > sma20) and (not needSMA50 or close > sma50) and (not needSMA200 or close > sma200)

bool sideShort = (not needSMA20 or close < sma20) and (not needSMA50 or close < sma50) and (not needSMA200 or close < sma200)

bool slopeUp = not useSlope200 or sma200 > sma200[slopeLook]

bool slopeDown = not useSlope200 or sma200 < sma200[slopeLook]

// Entry triggers (classic HM: EMA5/EMA10 cross)

bool trigLong = ta.crossover(ema5, ema10)

bool trigShort = ta.crossunder(ema5, ema10)

bool setupLong = emaBull and sideLong and slopeUp

bool setupShort = emaBear and sideShort and slopeDown

// ============================

// Cooldown & Signals

// ============================

var int barsSinceFlat = 1000000000

barsSinceFlat += 1

bool posChanged = strategy.position_size != nz(strategy.position_size[1], 0)

bool flatNow = posChanged and strategy.position_size == 0

if flatNow

barsSinceFlat := 0

bool coolOK = barsSinceFlat >= cooldownBars

bool longSignal = canCalc and allowLongs and setupLong and trigLong and coolOK

bool shortSignal = canCalc and allowShorts and setupShort and trigShort and coolOK

plotshape(longSignal, title="BUY", style=shape.triangleup, size=size.tiny, location=location.belowbar, text="Buy")

plotshape(shortSignal, title="SELL", style=shape.triangledown, size=size.tiny, location=location.abovebar, text="Sell")

// ============================

// Position Sizing & Orders

// ============================

var float entrySLlong = na

var float entrySLshort = na

// Compute dynamic stops with simple if/else

float slLongByMode = na

if stopMode == "EMA20"

slLongByMode := ema20

else if stopMode == "ATR"

slLongByMode := close - atrMult * atrVal

else if stopMode == "Percent"

slLongByMode := close * (1 - pctSL/100.0)

else

slLongByMode := ta.lowest(low, swingLen)

float slShortByMode = na

if stopMode == "EMA20"

slShortByMode := ema20

else if stopMode == "ATR"

slShortByMode := close + atrMult * atrVal

else if stopMode == "Percent"

slShortByMode := close * (1 + pctSL/100.0)

else

slShortByMode := ta.highest(high, swingLen)

// Entries

if longSignal and strategy.position_size <= 0

float riskPerUnit = math.max(close - slLongByMode, syminfo.mintick)

float qty = riskPctMode ? (strategy.equity * (riskPct/100.0) / riskPerUnit) : fixedQty

entrySLlong := slLongByMode

strategy.entry("Long", strategy.long, qty=qty)

if shortSignal and strategy.position_size >= 0

float riskPerUnitS = math.max(slShortByMode - close, syminfo.mintick)

float qtyS = riskPctMode ? (strategy.equity * (riskPct/100.0) / riskPerUnitS) : fixedQty

entrySLshort := slShortByMode

strategy.entry("Short", strategy.short, qty=qtyS)

// Track entry bar index for time-based exits (no valuewhen)

var int entryBarL = na

var int entryBarS = na

if posChanged

if strategy.position_size > 0 and strategy.position_size[1] == 0

entryBarL := bar_index

entryBarS := na

if strategy.position_size < 0 and strategy.position_size[1] == 0

entryBarS := bar_index

entryBarL := na

// Exits (stop + RR limit) and optional time exit

if strategy.position_size > 0

float ep = strategy.position_avg_price

float rBase = math.max(ep - nz(entrySLlong, ep - atrVal), syminfo.mintick)

float tp = ep + rrTarget * rBase

float st = nz(entrySLlong, ep - atrVal)

strategy.exit("LX", from_entry="Long", stop=st, limit=tp)

if timeExitBars > 0 and not na(entryBarL) and (bar_index - entryBarL >= timeExitBars)

strategy.close("Long", comment="TimeExitL")

if strategy.position_size < 0

float epS = strategy.position_avg_price

float rBaseS= math.max(nz(entrySLshort, epS + atrVal) - epS, syminfo.mintick)

float tpS = epS - rrTarget * rBaseS

float stS = nz(entrySLshort, epS + atrVal)

strategy.exit("SX", from_entry="Short", stop=stS, limit=tpS)

if timeExitBars > 0 and not na(entryBarS) and (bar_index - entryBarS >= timeExitBars)

strategy.close("Short", comment="TimeExitS")

// Reset snapshots when flat

if strategy.position_size == 0

entrySLlong := na

entrySLshort := na

// ============================

// Alerts

// ============================

alertcondition(longSignal, title="HM Long", message="Hilega Milega LONG: EMA1>5>10>20; 5 crossed above 10; side filters OK")

alertcondition(shortSignal, title="HM Short", message="Hilega Milega SHORT: EMA1<5<10<20; 5 crossed below 10; side filters OK")