Strategi traversal cloud yang cerdas

EMA RSI VOLUME Multi-Timeframe

️ Ini bukan strategi rata-rata biasa, ini adalah sistem perdagangan cerdas yang akan “melihat cuaca”!

Apakah Anda tahu? Sebagian besar trader melakukan EMA crossover dengan satu frame waktu, sama seperti hanya melihat cuaca hari ini untuk memutuskan apa yang harus dikenakan minggu ini! Di mana strategi ini hebat? Ini memantau grafik awan EMA 1 menit dan 5 menit secara bersamaan, seperti memiliki prediksi cuaca + jaminan ganda dari stasiun cuaca real-time

Forklifting! 3 filter untuk menghindari jebakan “penerobosan palsu”

Petunjuk untuk keluar dari lubang itu datang!Yang paling cerdas dari strategi ini adalah fitur “menolak transaksi”:

- Verifikasi pengirimanSinyal tanpa amplitudo adalah “macan kertas”, yang harus lebih dari 1,3 kali rata-rata 20 siklus untuk diterima.

- Saringan getaranKetika pasar masuk ke mode horizontal yang membosankan, strategi akan secara otomatis “menyerang” untuk menghindari terbalik di lumpur.

- RSI overbuying dan overselling: Lebih dari 70 dan di bawah 30 otomatis rem, tidak melakukan “pengambil piring”

Bayangkan jika Anda memiliki asisten perdagangan yang super rasional, dan ketika emosi di pasar tidak terkendali, Anda akan berkata, “Saudara, ini bukan waktunya!”

Keempat kondisi pasar, strategi yang dapat diidentifikasi dengan tepat

Strategi ini membagi pasar menjadi empat tahap, seperti melakukan “analisis sentimen” terhadap pasar:

- TRENDING (periode tren)Perdagangan normal, lampu hijau.

- RANGE BOUND (Gangguan dalam rentang)Lampu Kuning, Hentikan Perdagangan

- COILING (periode pertumbuhan)Lampu mati, bersiap-siap

- LOADING (waktu peluncuran)Lampu merah, trik besar akan dirilis 🔴

Seperti mengemudi dan melihat lampu merah dan hijau, dan ketika strategi menunjukkan “RANGE BOUND”, Anda tahu Anda harus pergi minum kopi dan menunggu kesempatan yang lebih baik.

Aplikasi Pertempuran Jitu: Membuat Perdagangan Anda Lebih Cerdas

Apa yang Anda dapatkan dari strategi ini?

- Perpisahan yang sering terjadi“Mengurangi sinyal palsu dengan banyak konfirmasi”

- Meningkatkan Rasio Kemenangan“Saya tidak ingin ada orang yang tidak tahu apa-apa tentang saya, tapi saya tidak ingin ada orang yang tidak tahu apa-apa tentang saya”.

- Pengendalian emosiPeraturan masuk dan keluar yang sistematis, sehingga Anda tidak lagi bisa berdagang berdasarkan perasaan

Ingat, strategi perdagangan terbaik bukan membuat Anda berdagang lebih banyak, tetapi membuat Anda berdagang lebih akurat! Strategi penjelajahan awan ini seperti memberi Anda seorang “penjaga perdagangan” profesional, yang dapat menangkap peluang dan melindungi Anda dari risiko.

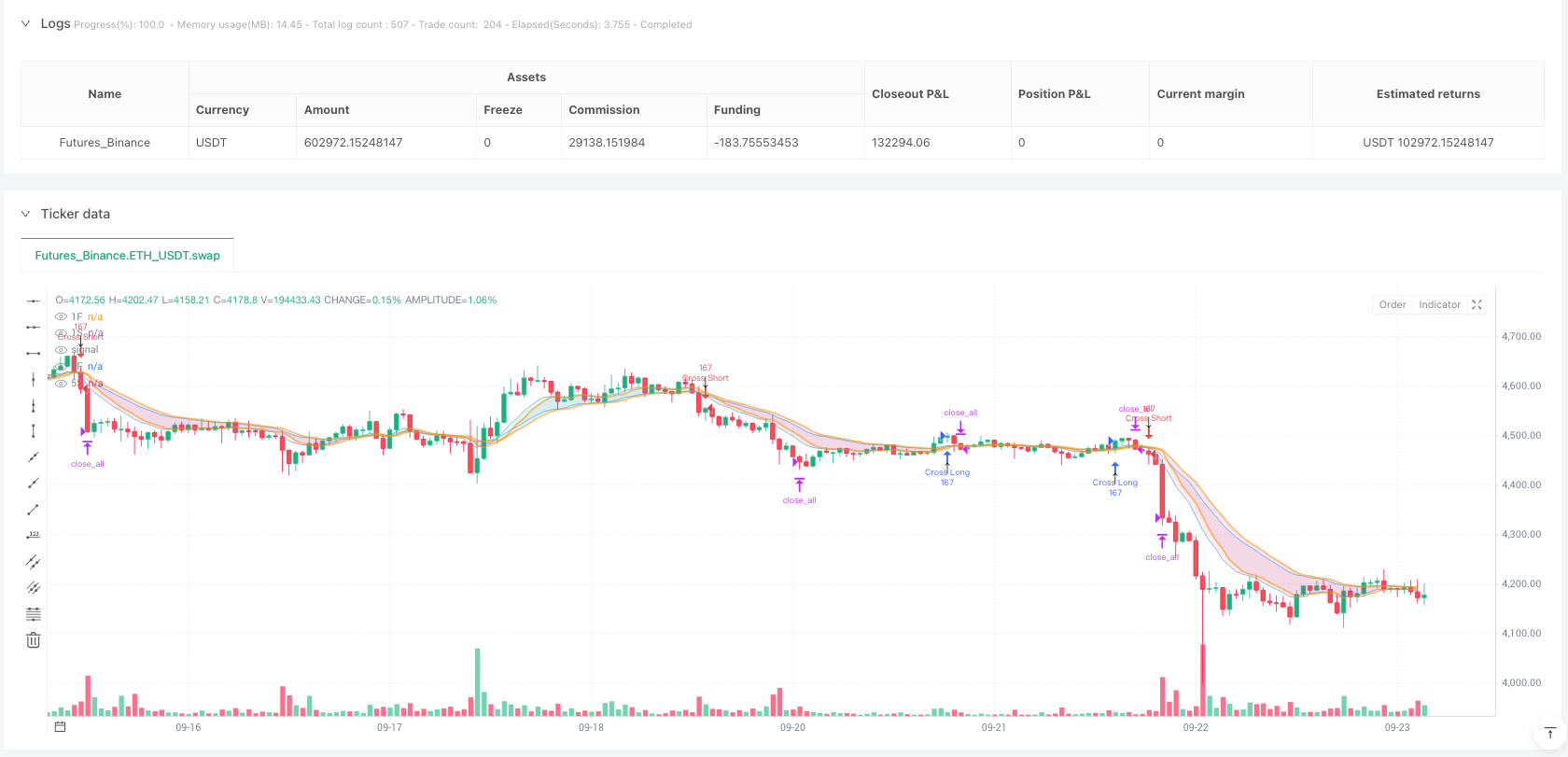

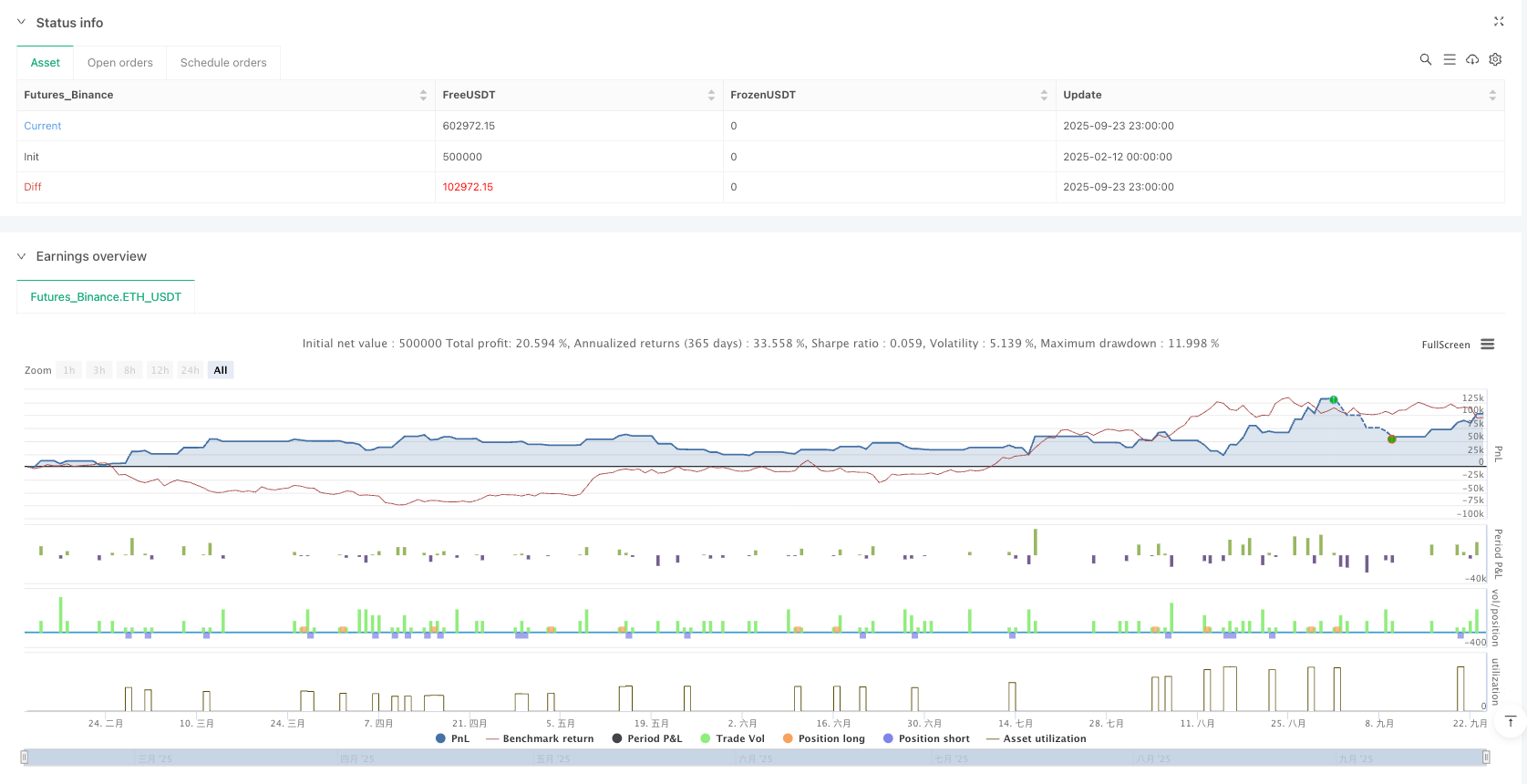

/*backtest

start: 2025-01-01 00:00:00

end: 2025-09-24 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":500000}]

*/

//@version=5

strategy("EMA Crossover Cloud w/Range-Bound Filter", overlay=true, default_qty_type=strategy.fixed, default_qty_value=500, initial_capital=50000)

// === INPUTS ===

rsi_length = input.int(14, "RSI Length")

rsi_overbought = input.int(70, "RSI Overbought Level")

rsi_oversold = input.int(30, "RSI Oversold Level")

ema_fast_1m = input.int(10, "1m Cloud Fast EMA")

ema_slow_1m = input.int(20, "1m Cloud Slow EMA")

ema_fast_5m = input.int(10, "5m Cloud Fast EMA")

ema_slow_5m = input.int(20, "5m Cloud Slow EMA")

volume_multiplier = input.float(1.3, "Volume Multiplier (vs 20-bar avg)")

// === STAY OUT FILTER INPUTS ===

enable_stay_out_filter = input.bool(true, "Enable Stay Out Filter", group="Range-Bound Filter")

enable_filter_for_backtest = input.bool(false, "Apply Filter to Backtest", group="Range-Bound Filter")

range_threshold_pct = input.float(0.5, "Max Range % for Stay Out", group="Range-Bound Filter")

range_period = input.int(60, "Period to Check Range (bars)", group="Range-Bound Filter")

min_bars_in_range = input.int(25, "Min Bars in Range to Trigger", group="Range-Bound Filter")

// === MARKET ATTENTION INPUTS ===

volume_attention_multiplier = input.float(2.0, "Volume Multiplier for Attention", group="Market Attention")

range_attention_threshold = input.float(1.5, "Range ($) Threshold for Attention", group="Market Attention")

// === CALCULATIONS ===

rsi = ta.rsi(close, rsi_length)

volume_avg = ta.sma(volume, 20)

volume_surge = volume > (volume_avg * volume_multiplier)

// Multi-timeframe EMAs

ema_fast_1m_val = ta.ema(close, ema_fast_1m)

ema_slow_1m_val = ta.ema(close, ema_slow_1m)

ema_fast_5m_val = request.security(syminfo.tickerid, "5", ta.ema(close, ema_fast_5m))

ema_slow_5m_val = request.security(syminfo.tickerid, "5", ta.ema(close, ema_slow_5m))

// === STAY OUT FILTER ===

// Range-bound detection: Count consecutive tight-range bars

range_threshold_dollar = close * (range_threshold_pct / 100) // Convert % to dollar amount

// Calculate current bar's range

current_bar_range = high - low

// Count consecutive tight-range bars

var int consecutive_tight_bars = 0

// Check if current bar is within tight range threshold

current_bar_tight = current_bar_range <= range_threshold_dollar

if current_bar_tight

consecutive_tight_bars := consecutive_tight_bars + 1

else

consecutive_tight_bars := 0 // Reset counter when range expands

tight_range_bars = consecutive_tight_bars

// Market is range-bound if we've had enough consecutive tight bars

market_range_bound = enable_stay_out_filter and tight_range_bars >= min_bars_in_range

market_ok_to_trade = not market_range_bound

// Separate condition for backtest - can override the filter

backtest_ok_to_trade = enable_filter_for_backtest ? market_ok_to_trade : true

// For display purposes, also calculate recent period range

highest_in_period = ta.highest(high, range_period)

lowest_in_period = ta.lowest(low, range_period)

dollar_range = highest_in_period - lowest_in_period

// Consolidation stage determination

consolidation_stage = tight_range_bars < min_bars_in_range ? "TRENDING" :

tight_range_bars <= 60 ? "RANGE BOUND" :

tight_range_bars <= 90 ? "COILING" : "LOADING"

consolidation_color = consolidation_stage == "TRENDING" ? color.green :

consolidation_stage == "RANGE BOUND" ? color.red :

consolidation_stage == "COILING" ? color.yellow : color.orange

// === MARKET ATTENTION GAUGE ===

// Current bar activity indicators

current_range = high - low

recent_volume_avg = ta.sma(volume, 10)

volume_spike = volume > (recent_volume_avg * volume_attention_multiplier)

range_expansion = current_range > range_attention_threshold

// Activity level determination

market_activity = volume_spike and range_expansion ? "ACTIVE" :

volume_spike or range_expansion ? "BUILDING" :

not market_range_bound ? "QUIET" : "DEAD"

// Cloud Definitions

cloud_1m_bull = ema_fast_1m_val > ema_slow_1m_val

cloud_5m_bull = ema_fast_5m_val > ema_slow_5m_val

// Price position relative to clouds

price_above_5m_cloud = close > math.max(ema_fast_5m_val, ema_slow_5m_val)

price_below_5m_cloud = close < math.min(ema_fast_5m_val, ema_slow_5m_val)

// === CROSSOVER SIGNALS ===

// When 1m fast crosses above/below 1m slow with volume

crossoverBull = ta.crossover(ema_fast_1m_val, ema_slow_1m_val) and volume_surge and backtest_ok_to_trade

crossoverBear = ta.crossunder(ema_fast_1m_val, ema_slow_1m_val) and volume_surge and backtest_ok_to_trade

// Visual warnings for blocked signals (always uses the indicator filter, not backtest filter)

blocked_crossover_bull = ta.crossover(ema_fast_1m_val, ema_slow_1m_val) and volume_surge and market_range_bound

blocked_crossover_bear = ta.crossunder(ema_fast_1m_val, ema_slow_1m_val) and volume_surge and market_range_bound

// === STRATEGY EXECUTION ===

// Crossover entries (original 1/3 size from diamonds)

if crossoverBull

strategy.entry("Cross Long", strategy.long, qty=167)

if crossoverBear

strategy.entry("Cross Short", strategy.short, qty=167)

// === EXIT LOGIC ===

// Conservative stops using recent swing levels (not wide cloud stops)

longStop = ta.lowest(low[3], 10) // Recent swing low

shortStop = ta.highest(high[3], 10) // Recent swing high

// Position management exits

price_above_1m_cloud = close > math.max(ema_fast_1m_val, ema_slow_1m_val)

price_below_1m_cloud = close < math.min(ema_fast_1m_val, ema_slow_1m_val)

// Exit when price breaks opposite cloud structure

longExit = price_below_1m_cloud and price_below_5m_cloud

shortExit = price_above_1m_cloud and price_above_5m_cloud

// Execute exits for all positions

if strategy.position_size > 0

if close <= longStop

strategy.close_all(comment="Stop Loss")

else if longExit or rsi >= rsi_overbought

strategy.close_all(comment="Exit Signal")

if strategy.position_size < 0

if close >= shortStop

strategy.close_all(comment="Stop Loss")

else if shortExit or rsi <= rsi_oversold

strategy.close_all(comment="Exit Signal")

// === VISUAL ELEMENTS ===

plotshape(crossoverBull, "CROSS BULL", shape.triangleup, location.belowbar,

color.new(color.aqua, 50), size=size.small, text="↑")

plotshape(crossoverBear, "CROSS BEAR", shape.triangledown, location.abovebar,

color.new(color.orange, 50), size=size.small, text="↓")

// STAY OUT warnings - signals you should see but not take

plotshape(blocked_crossover_bull, "BLOCKED BULL", shape.triangleup, location.belowbar,

color.new(color.gray, 0), size=size.tiny, text="RANGE")

plotshape(blocked_crossover_bear, "BLOCKED BEAR", shape.triangledown, location.abovebar,

color.new(color.gray, 0), size=size.tiny, text="RANGE")

// Clouds with abbreviated titles

ema1 = plot(ema_fast_1m_val, "1F", color.new(color.blue, 60), linewidth=1, display=display.none)

ema2 = plot(ema_slow_1m_val, "1S", color.new(color.blue, 60), linewidth=1, display=display.none)

fill(ema1, ema2, color=cloud_1m_bull ? color.new(color.green, 85) : color.new(color.red, 85))

ema3 = plot(ema_fast_5m_val, "5F", color.new(color.orange, 40), linewidth=2, display=display.none)

ema4 = plot(ema_slow_5m_val, "5S", color.new(color.orange, 40), linewidth=2, display=display.none)

fill(ema3, ema4, color=cloud_5m_bull ? color.new(color.blue, 85) : color.new(color.purple, 85))

// === ALERTS ===

// Consolidation stage changes

alertcondition(consolidation_stage == "RANGE BOUND" and consolidation_stage[1] == "TRENDING", "Range Bound Alert", "🔴 TSLA RANGE BOUND - Stay Out!")

alertcondition(consolidation_stage == "COILING" and consolidation_stage[1] == "RANGE BOUND", "Coiling Alert", "🟡 TSLA COILING - Watch Close!")

alertcondition(consolidation_stage == "LOADING" and consolidation_stage[1] == "COILING", "Loading Alert", "🟠 TSLA LOADING - Big Move Coming!")

alertcondition(consolidation_stage == "TRENDING" and consolidation_stage[1] != "TRENDING", "Breakout Alert", "🟢 TSLA BREAKOUT - Back to Trading!")

// Market attention changes

alertcondition(market_activity == "ACTIVE" and market_activity[1] != "ACTIVE", "Market Active", "🔥 TSLA ACTIVE - Watch Close!")

alertcondition(market_activity == "DEAD" and market_activity[1] != "DEAD", "Market Dead", "💀 TSLA DEAD - Handle Other Business")

// Blocked signals

alertcondition(blocked_crossover_bull or blocked_crossover_bear, "Signal Blocked", "⚠️ SIGNAL BLOCKED - Range Bound Period")