Apa ini taktik Shin Seon?

Anda tahu? Strategi ini seperti “detektif gelembung” yang super tenang! Ketika pasar naik seperti orang gila, ia tidak mengikuti angin, tetapi dengan sabar menunggu saat gelembung pecah. Seperti melihat orang kaya gila di kalangan teman-temannya, Anda tahu dia mungkin akan segera “bangkrut” 😏

Keterangan Logika Inti Kebijakan

Fokus!Strategi ini memiliki dua peluang masuk yang sangat cerdas:

- Modus pendinginan busaJika RSI naik di atas 70 atau volume naik 1,5 kali lipat, strategi ini ditandai sebagai “periode gelembung” dan kemudian menunggu RSI kembali ke bawah 60 untuk mempertimbangkan shorting

- Model Perangkap Tinggi BaruKetika harga mencapai 20 siklus tertinggi namun tidak ada sinyal gelembung, maka langsung melakukan shorting.

Seperti menunggu bus, tidak setiap mobil harus naik, hanya menunggu yang tepat!

Berapa banyak sapi yang terancam?

Petunjuk untuk keluar dari lubang itu datang!Salah satu hal yang paling menarik dari strategi ini adalah “sistem peringatan” yang dimilikinya:

- Jika Anda sudah melakukan pekerjaan kosong dan tiba-tiba menemukan gelembung mulai muncul lagi, segera keluar dari tempat kerja!

- Stop loss set 2%, stop loss set 6%, risk/reward ratio 1: 3, matematika yang diharapkan sangat bagus

- Ada “zona larangan mengosongkan” khusus untuk menghindari operasi pada saat-saat berbahaya

Yang terlihat sangat ramah

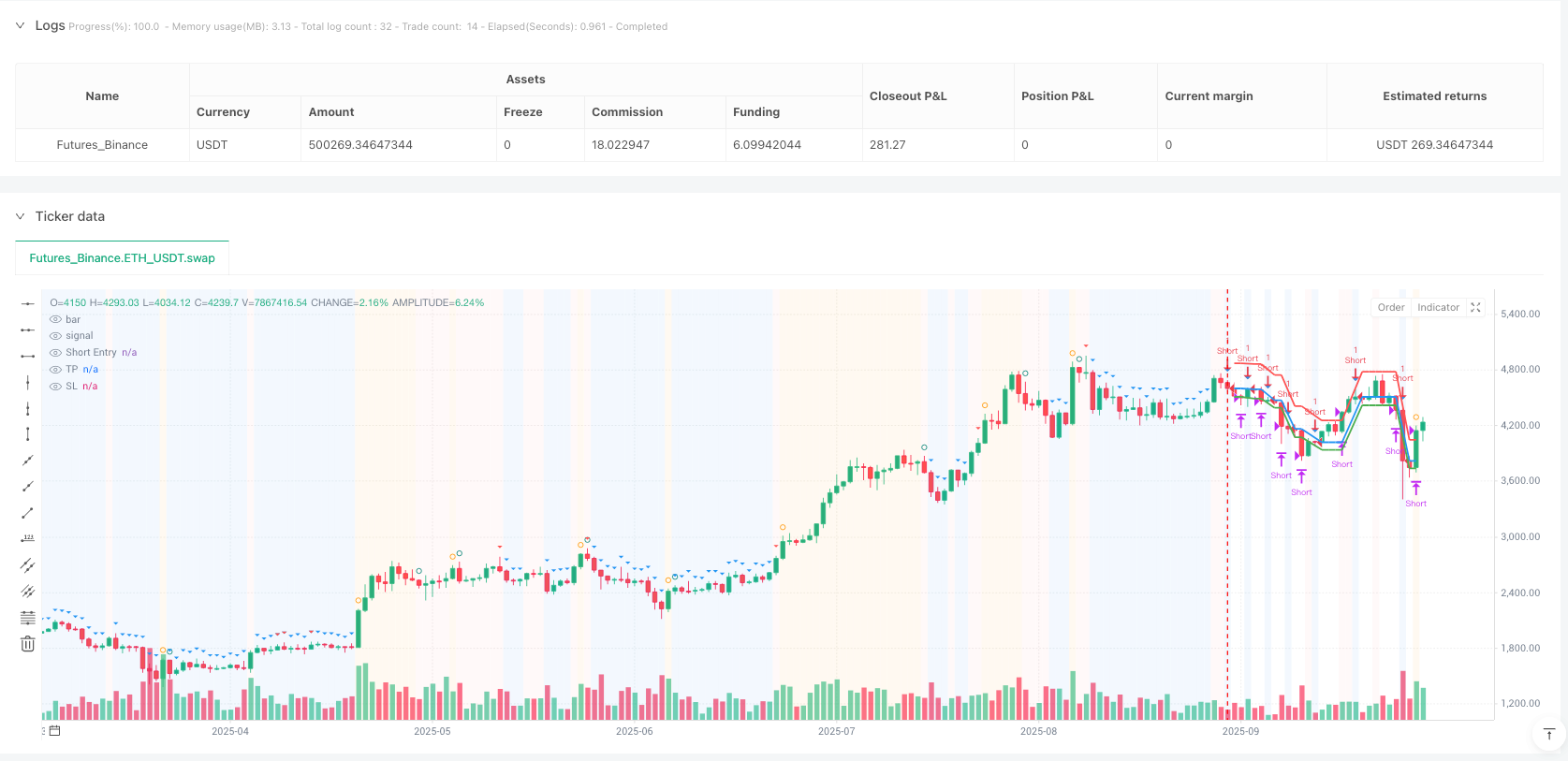

Diagram strategi ini lebih bagus dari pada antarmuka iPhone!

- Latar belakang oranye = Bubble sedang berlangsung, jangan masuk ️

- Latar belakang biru = area kosong setelah gelembung, kesempatan datang 💙

- Latar belakang merah = area yang dilarang untuk dikosongkan.

- Berbagai ikon kecil menandai titik-titik penting, terlihat dengan jelas.

Apa yang cocok untuk Anda?

Jika Anda adalah seorang trader seperti itu, strategi ini disesuaikan untuk Anda:

- Orang-orang yang tidak suka mengejar orang-orang rasional.

- Investor Nilai yang Percaya “Bila Cepat Mendapat, Cepat Jatuh”

- Orang pintar yang suka tenang saat orang lain serakah

Ingat, pasar tidak pernah kekurangan peluang, yang kurang adalah kesabaran dan kebijaksanaan untuk menunggu kesempatan yang baik! ✨

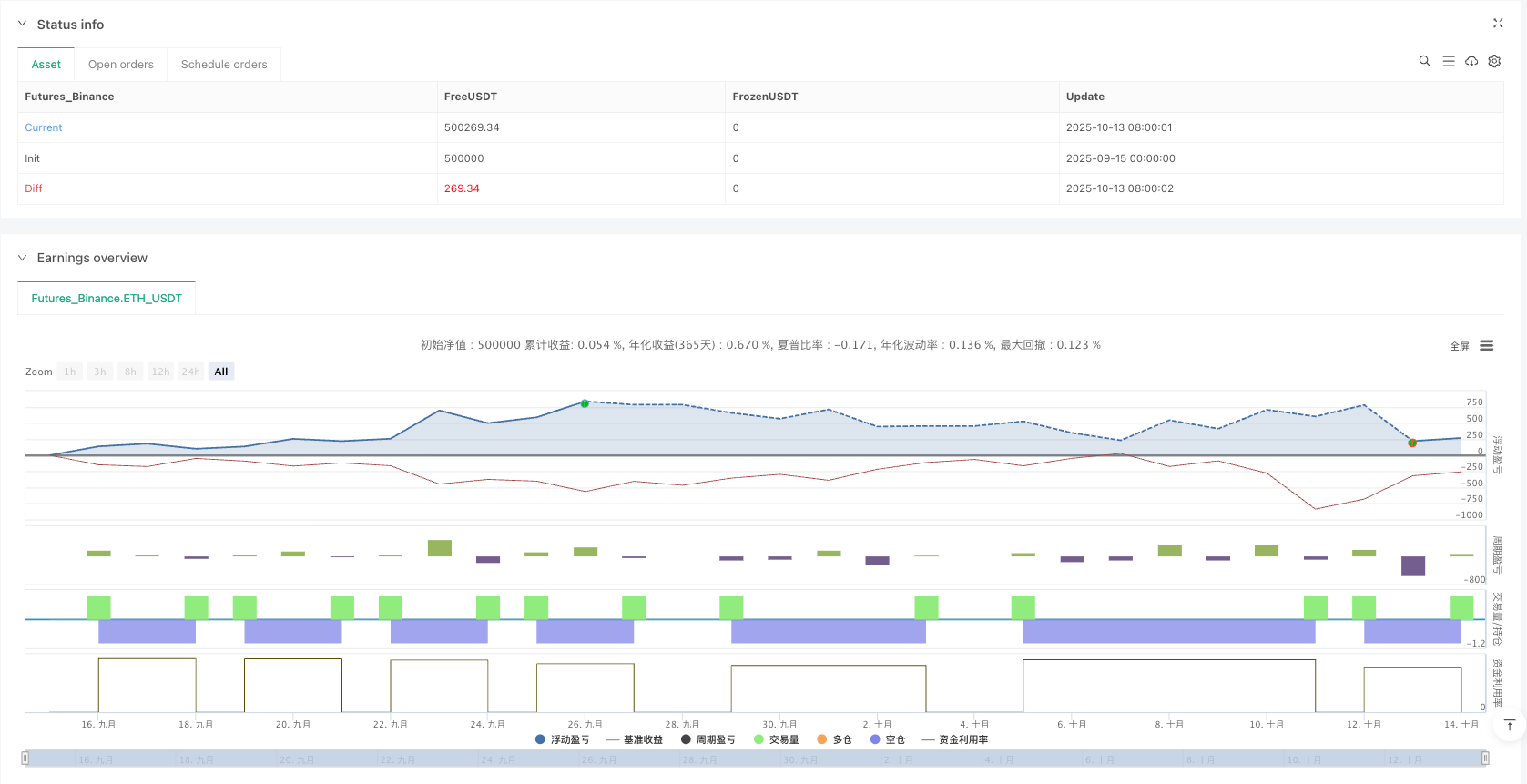

/*backtest

start: 2025-09-15 00:00:00

end: 2025-10-14 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":500000}]

*/

//@version=5

strategy("Pump-Smart Shorting Strategy", overlay=true)

// Inputs

lookbackPeriod = input.int(20, "Lookback Period for New High", minval=5)

minProfitPerc = input.float(0.02, "Take Profit %", minval=0.001)

stopLossPerc = input.float(0.06, "Stop Loss %", minval=0.001)

hedgeTokens = input.int(1, "Hedge Tokens")

// Pump detection inputs

rsiPeriod = input.int(14, "RSI Period")

rsiHigh = input.float(70, "Pump RSI ≥")

rsiCool = input.float(60, "Pump cool-off RSI ≤")

volMult = input.float(1.5, "Volume Pump Multiplier")

pctUp = input.float(0.05, "1-bar Up % for Pump")

barsWait = input.int(0, "Bars to wait after pump ends", minval=0, maxval=10)

// Tech

rsi = ta.rsi(close, rsiPeriod)

avgVol = ta.sma(volume, 20)

oneBarUp = (close - close[1]) / close[1]

// Pump on if any strong up-move pattern

pumpOn = (rsi >= rsiHigh) or (volume > avgVol * volMult and oneBarUp > pctUp)

// Track pump state with var and transitions

var bool wasPump = false

pumpStart = not wasPump and pumpOn

pumpEnd = wasPump and not pumpOn

// Update state each bar

wasPump := pumpOn

// Count bars since pump ended

var int barsSincePumpEnd = 10000

barsSincePumpEnd := pumpEnd ? 0 : math.min(10000, barsSincePumpEnd + 1)

// Define "pump ended and cooled" condition

cooled = (rsi <= rsiCool) and (oneBarUp <= pctUp/2 or volume <= avgVol * (volMult * 0.8))

// Immediate short signal when pump finishes and cooled (with optional wait)

shortAfterPump = (barsSincePumpEnd >= barsWait) and cooled and not pumpOn and strategy.position_size == 0

// Also allow shorts on fresh new highs when not pumping (optional, keep for more entries)

isNewHigh = high > ta.highest(high, lookbackPeriod)[1]

shortOnPeak = isNewHigh and not pumpOn and strategy.position_size == 0

// Define conditions where we DON'T short (for red background)

noShortZone = pumpOn or (isNewHigh and pumpOn) or (barsSincePumpEnd < barsWait) or not cooled

// Preemptive close if pump turns on while short

var float shortEntry = na

inShort = strategy.position_size < 0 and not na(shortEntry)

if inShort and pumpOn

strategy.close("Short")

shortEntry := na

// Entry rules: short either right after pump ends OR on new high when not pumping

if (shortAfterPump or shortOnPeak) and strategy.position_size == 0

strategy.entry("Short", strategy.short, qty=hedgeTokens)

shortEntry := na

// Track entry price

if strategy.position_size < 0 and na(shortEntry)

shortEntry := strategy.position_avg_price

if strategy.position_size == 0

shortEntry := na

inShort := strategy.position_size < 0 and not na(shortEntry)

// TP/SL

tp = shortEntry * (1 - minProfitPerc)

sl = shortEntry * (1 + stopLossPerc)

exitTP = inShort and close <= tp

exitSL = inShort and close >= sl

if exitTP

strategy.close("Short")

if exitSL

strategy.close("Short")

// Visuals - REMOVED TEXT FROM ARROWS

plotshape(pumpStart, style=shape.circle, color=color.orange, location=location.abovebar, size=size.tiny)

plotshape(pumpEnd, style=shape.circle, color=color.teal, location=location.abovebar, size=size.tiny)

plotshape(shortAfterPump, style=shape.triangledown, color=color.blue, location=location.abovebar, size=size.small)

plotshape(shortOnPeak, style=shape.triangledown, color=color.red, location=location.abovebar, size=size.tiny)

plot(inShort ? shortEntry : na, color=color.blue, linewidth=2, title="Short Entry")

plot(inShort ? tp : na, color=color.green, linewidth=2, title="TP")

plot(inShort ? sl : na, color=color.red, linewidth=2, title="SL")

// Background colors - ADDED RED NO-SHORT ZONES

bgcolor(pumpOn ? color.new(color.orange, 92) : na, title="Pump Zone")

bgcolor(shortAfterPump ? color.new(color.blue, 92) : na, title="Post-Pump Short Zone")

bgcolor(noShortZone and not pumpOn ? color.new(color.red, 95) : na, title="No Short Zone")