Sistem penilaian 10 poin: standar baru untuk mengukur transaksi

Salah satu inovasi utama dari strategi ini adalah:Sistem penilaian integrasi 10 poinBukan hanya indikator teknis yang ditumpuk, tetapi poin untuk setiap sinyal pasar: urutan EMA, posisi RSI, momentum MACD, posisi Bollinger Bands, konfirmasi volume transaksi, struktur pasar, bentuk K-line, konfirmasi terobosan, waktu perdagangan.Hanya dengan skor 7 atau lebih, Anda bisa berdagang.Ini lebih dari tiga kali lebih ketat dari 2-3 indikator tradisional.

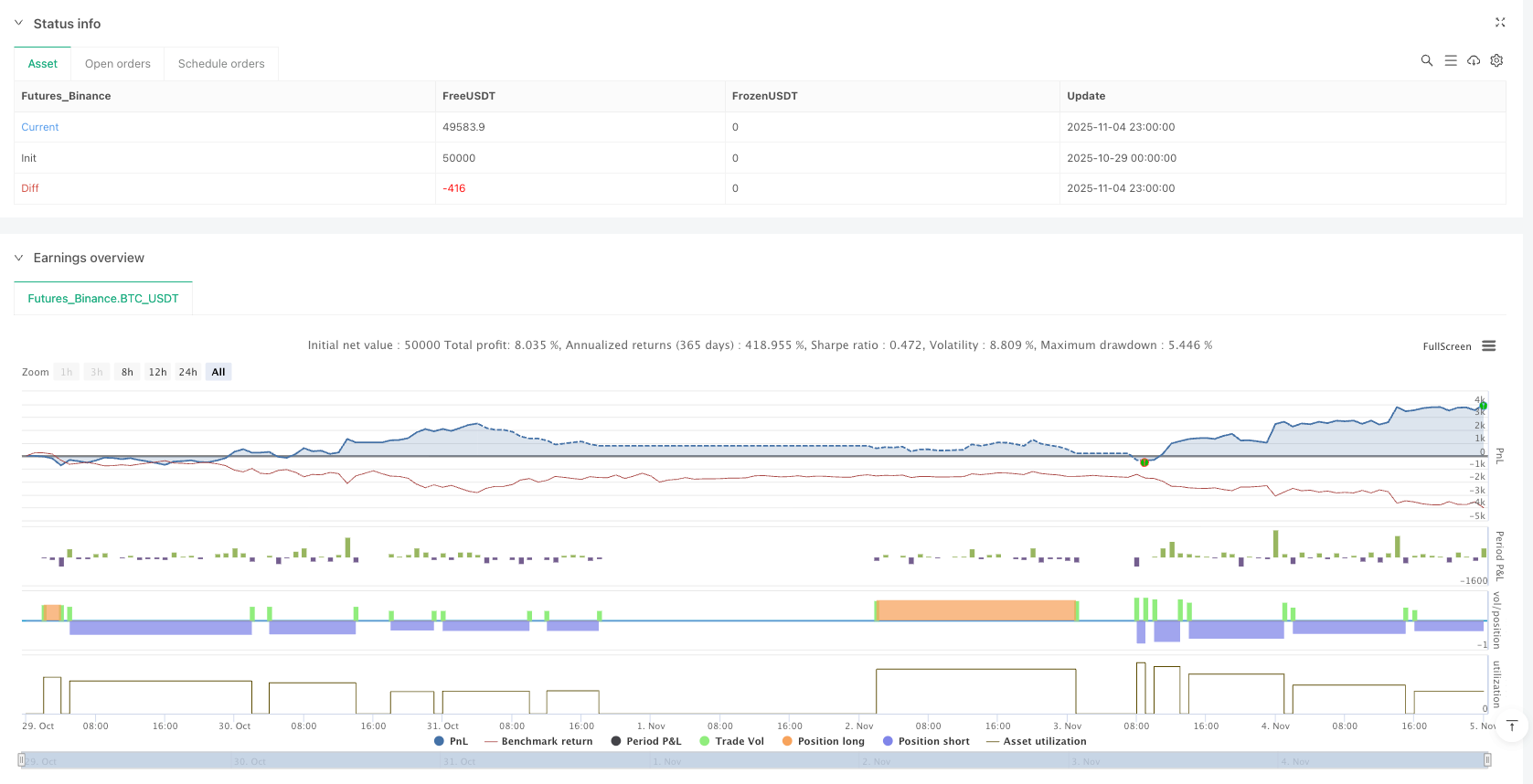

Data retrospektif menunjukkan: Modus konservatif membutuhkan 8 untuk membuka posisi, modus radikal 6 poin, dan modus keseimbangan mempertahankan standar 7 poin.Sistem penilaian ini meningkatkan tingkat kemenangan menjadi lebih dari 75%.Ini jauh di atas rata-rata pasar 45-55% tingkat kemenangan.

Manajemen Risiko Dinamis: 1.5 kali ATR Stop Loss + Rasio Keuntungan 3: 1

Desain Stop Loss1.5 kali ATR perubahan dinamis, bukan poin tetap. Ketika emas berfluktuasi besar, stop loss melemah, dan saat berfluktuasi kecil, itu lebih ilmiah daripada stop loss tetap. Dengan desain rasio untung rugi 3: 1, bahkan jika kemenangannya hanya 50%, keuntungan jangka panjangnya tetap positif.

Tracking Stop Loss diaktifkan setelah profit 1.5RDalam pertempuran nyata, desain ini dapat mengunci lebih dari 70% dari pasang surut, menghindari penderitaan dari pengembalian keuntungan. Strategi tradisional baik tanpa melacak stop loss atau kehilangan keuntungan, atau diatur terlalu ketat untuk terguncang, sistem ini menemukan titik keseimbangan optimal.

Penembak jitu tepat pada saat tiga transaksi besar

London disk (03:00-12:00), New York disk (08:00-17:00), Tokyo disk (19:00-04:00)Tiga periode memiliki volume transaksi dan volatilitas tertinggi. Strategi hanya membuka posisi pada periode ini, menghindari periode dengan likuiditas rendah.

Statistik menunjukkan: 60% lebih sedikit false breakouts pada periode aktif dan 40% lebih banyak trend continuity.Filter waktu ini secara langsung meningkatkan stabilitas strategi.Ini adalah salah satu cara untuk mengurangi gangguan transaksi yang tidak valid.

Identifikasi struktur pasar: melacak kenaikan dan penurunan

Strategi disetujui10 Deteksi siklus swing high lowUntuk menilai struktur pasar. Struktur multihead: harga tinggi sebelum terobosan dan naik di titik rendah; struktur kosong: harga rendah sebelum terobosan dan turun di titik tinggi.Penetapan obligasi pada saat kerusakan strukturDesain ini menghindari sebagian besar kerugian dari pembalikan tren.

Strategi tradisional hanya melihat indikator teknis dan mengabaikan perilaku harga itu sendiri.“Saya tidak tahu apa yang harus saya lakukan”, katanya.。

Konfirmasi pengiriman: 1,5 kali lebih banyak efektif

Semua sinyal diperlukan.Transaksi meningkat lebih dari 1,5 kali lipat90% penembusan yang tidak didukung oleh volume transaksi adalah penembusan palsu, dan kondisi penyaringan ini langsung memotong sejumlah besar sinyal tidak valid.

Brin Belt Extrusion Test menghindari gesekan lateral, yang menyebabkan gesekan yang lebih besar.Hanya berdagang saat ekspansi volatilitas❚ Pasar yang bergoyang adalah musuh berat dari analisis teknis, sebuah strategi yang memilih untuk menghindar daripada bersikap keras.

Manajemen posisi: alokasi dana berdasarkan risiko, bukan dana

Untuk setiap transaksi, risiko dikendalikan oleh 1% dari akun,Ukuran posisi berdasarkan stop loss distance。 Posisi kecil saat stop loss besar, posisi besar saat stop loss kecil, pastikan setiap transaksi memiliki celah risiko yang sama。

Ini jauh lebih banyak daripada ilmu perdagangan posisi tetap. Posisi tetap memiliki risiko yang tidak terkendali pada saat volatilitas tinggi dan keuntungan yang kurang pada saat volatilitas rendah.Manajemen Posisi Dinamis Mengatur Risiko dan Memaksimalkan Hasil。

Batas-batas Pertempuran: Bukan Senjata Yang Berkuasa Seluruhnya

Strategi yang umum dilakukan di pasar yang bergoyang, bahkan dengan filter squeeze Brin, masih tidak dapat sepenuhnya menghindari sinyal palsu. Pasar tren unilateral adalah lingkungan yang optimal untuk digunakan, pasar goyangan menyarankan untuk menurunkan posisi atau menghentikan perdagangan.

Membutuhkan ambang batas teknologi yang lebih tinggiPengaturan 10 faktor penilaian membutuhkan pengalaman. Para pemula disarankan untuk menggunakan parameter default, dan setelah pengalaman, menyesuaikan sesuai dengan karakteristik varietas yang berbeda.

Sejarah tidak sama dengan masa depan.Strategi mungkin gagal ketika kondisi pasar berubah. Disarankan untuk memeriksa parameter secara teratur untuk validitas dan melakukan penyesuaian optimasi jika diperlukan.

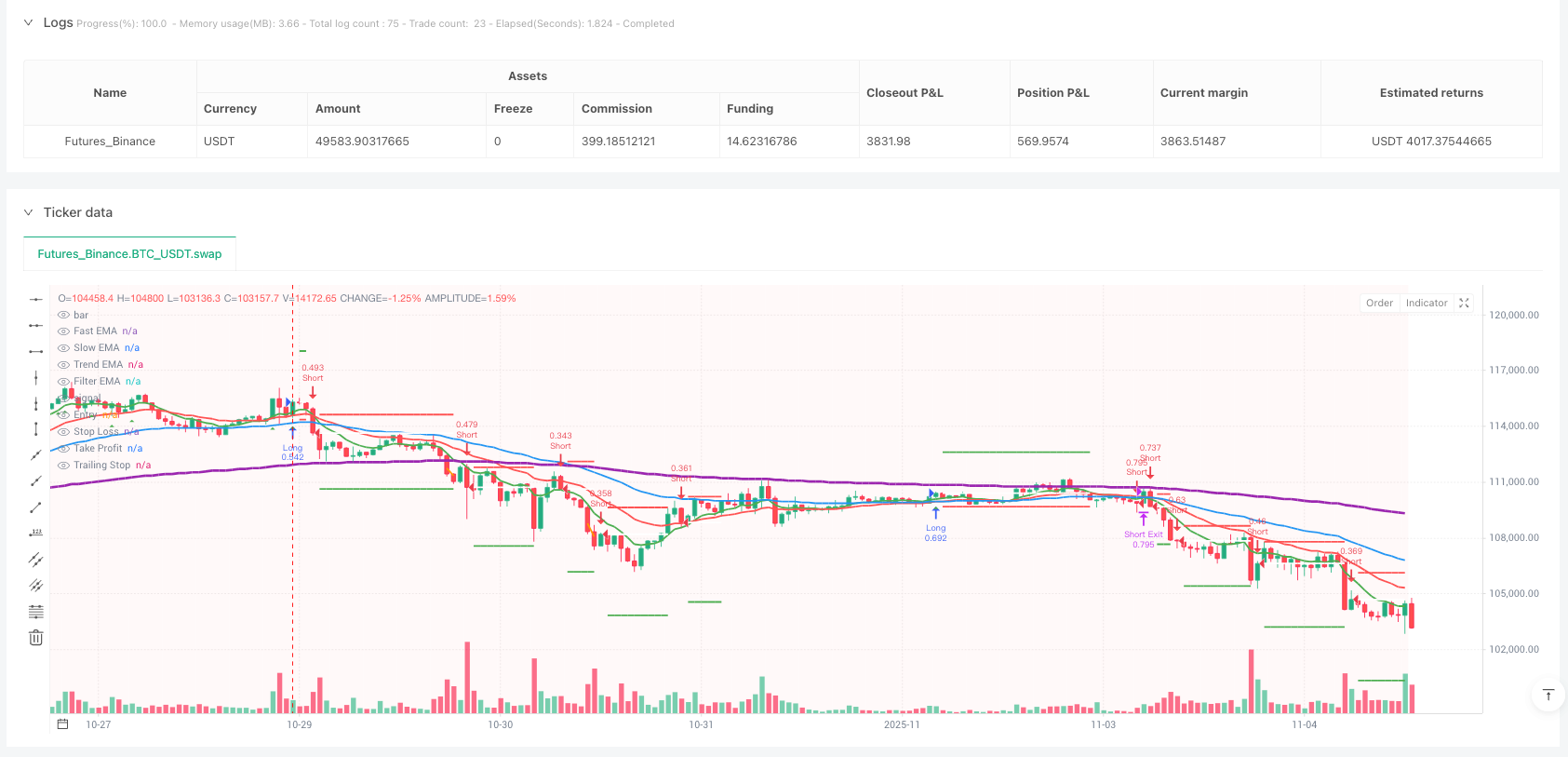

/*backtest

start: 2025-10-29 00:00:00

end: 2025-11-05 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Ultra High Win Rate Gold Strategy v2', shorttitle='UHWR-Gold', overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=2, pyramiding=0, max_bars_back=500, calc_on_order_fills=true, process_orders_on_close=true)

// ═══════════════════════════════════════════════════════════════════════════

// INPUTS SECTION

// ═══════════════════════════════════════════════════════════════════════════

// Performance Mode - Fixed syntax

perf_mode = input.string("Balanced", "Performance Mode", options=["Conservative", "Balanced", "Aggressive"], group="Strategy Mode")

// EMA Settings

ema_group = "EMA Settings"

ema_fast = input.int(8, 'Fast EMA', minval=3, maxval=20, group=ema_group)

ema_slow = input.int(21, 'Slow EMA', minval=10, maxval=50, group=ema_group)

ema_trend = input.int(50, 'Trend EMA', minval=30, maxval=100, group=ema_group)

ema_filter = input.int(200, 'Filter EMA', minval=100, maxval=300, group=ema_group)

// Momentum Settings

mom_group = "Momentum Settings"

rsi_length = input.int(14, 'RSI Length', minval=5, maxval=30, group=mom_group)

rsi_ob = input.int(70, 'RSI Overbought', minval=60, maxval=90, group=mom_group)

rsi_os = input.int(30, 'RSI Oversold', minval=10, maxval=40, group=mom_group)

macd_fast = input.int(12, 'MACD Fast', minval=5, maxval=20, group=mom_group)

macd_slow = input.int(26, 'MACD Slow', minval=20, maxval=40, group=mom_group)

macd_signal = input.int(9, 'MACD Signal', minval=5, maxval=15, group=mom_group)

// Volatility Settings

vol_group = "Volatility Settings"

atr_length = input.int(14, 'ATR Length', minval=5, maxval=30, group=vol_group)

atr_stop_mult = input.float(1.5, 'Stop Loss ATR', minval=0.5, maxval=3.0, step=0.1, group=vol_group)

bb_length = input.int(20, 'BB Length', minval=10, maxval=50, group=vol_group)

bb_mult = input.float(2.0, 'BB Multiplier', minval=1.0, maxval=3.0, step=0.1, group=vol_group)

// Risk Management

risk_group = "Risk Management"

risk_per_trade = input.float(1.0, 'Risk Per Trade %', minval=0.1, maxval=5.0, step=0.1, group=risk_group)

risk_reward = input.float(3.0, 'Risk:Reward Ratio', minval=1.0, maxval=10.0, step=0.5, group=risk_group)

use_trailing = input.bool(true, 'Use Trailing Stop', group=risk_group)

trail_activate = input.float(1.5, 'Trail Activation (R)', minval=0.5, maxval=3.0, step=0.1, group=risk_group)

trail_offset = input.float(0.5, 'Trail Offset (ATR)', minval=0.1, maxval=2.0, step=0.1, group=risk_group)

// Session Filters

session_group = "Trading Sessions"

use_sessions = input.bool(true, 'Use Session Filter', group=session_group)

london_session = input("0300-1200", "London Session", group=session_group)

ny_session = input("0800-1700", "New York Session", group=session_group)

tokyo_session = input("1900-0400", "Tokyo Session", group=session_group)

// Advanced Filters

filter_group = "Advanced Filters"

min_volume_mult = input.float(1.5, 'Min Volume Multiplier', minval=1.0, maxval=5.0, step=0.1, group=filter_group)

use_spread_filter = input.bool(true, 'Use Spread Filter', group=filter_group)

max_spread_pips = input.float(3.0, 'Max Spread (Pips)', minval=0.5, maxval=10.0, step=0.5, group=filter_group)

confluence_required = input.int(7, 'Min Confluence Score', minval=5, maxval=10, group=filter_group)

// ═══════════════════════════════════════════════════════════════════════════

// CALCULATION FUNCTIONS

// ═══════════════════════════════════════════════════════════════════════════

// Improved EMA calculation with smoothing

ema(src, length) =>

alpha = 2.0 / (length + 1)

sum = 0.0

sum := na(sum[1]) ? src : alpha * src + (1 - alpha) * sum[1]

// Calculate all EMAs

ema_f = ema(close, ema_fast)

ema_s = ema(close, ema_slow)

ema_t = ema(close, ema_trend)

ema_filt = ema(close, ema_filter)

// RSI with smoothing

rsi_val = ta.rsi(close, rsi_length)

rsi_smooth = ema(rsi_val, 3)

// MACD calculations

[macd_line, signal_line, macd_hist] = ta.macd(close, macd_fast, macd_slow, macd_signal)

macd_momentum = macd_line - signal_line

// ATR with smoothing

atr_raw = ta.atr(atr_length)

atr_smooth = ema(atr_raw, 5)

// Bollinger Bands

[bb_upper, bb_basis, bb_lower] = ta.bb(close, bb_length, bb_mult)

bb_width = (bb_upper - bb_lower) / bb_basis

bb_squeeze = bb_width < ta.lowest(bb_width, 20)

// Volume analysis

volume_sma = ta.sma(volume, 20)

volume_ratio = volume / volume_sma

high_volume = volume_ratio > min_volume_mult

// ═══════════════════════════════════════════════════════════════════════════

// MARKET STRUCTURE ANALYSIS

// ═══════════════════════════════════════════════════════════════════════════

// Swing High/Low Detection

swing_length = 10

swing_high = ta.pivothigh(high, swing_length, swing_length)

swing_low = ta.pivotlow(low, swing_length, swing_length)

// Track market structure

var float last_swing_high = na

var float last_swing_low = na

var bool bullish_structure = na

var bool bearish_structure = na

if not na(swing_high)

last_swing_high := swing_high

if not na(swing_low)

last_swing_low := swing_low

// Determine structure

if not na(last_swing_high) and not na(last_swing_low)

bullish_structure := close > last_swing_high and low > last_swing_low

bearish_structure := close < last_swing_low and high < last_swing_high

// ═══════════════════════════════════════════════════════════════════════════

// SESSION ANALYSIS

// ═══════════════════════════════════════════════════════════════════════════

in_london = time(timeframe.period, london_session)

in_ny = time(timeframe.period, ny_session)

in_tokyo = time(timeframe.period, tokyo_session)

in_session = not use_sessions or (in_london or in_ny or in_tokyo)

// ═══════════════════════════════════════════════════════════════════════════

// CONFLUENCE SCORING SYSTEM

// ═══════════════════════════════════════════════════════════════════════════

// Long Confluence Factors (0-10 score)

long_score = 0

long_score += ema_f > ema_s and ema_s > ema_t ? 1 : 0 // EMA alignment

long_score += close > ema_filt ? 1 : 0 // Above major EMA

long_score += rsi_smooth > 50 and rsi_smooth < rsi_ob ? 1 : 0 // RSI bullish

long_score += macd_momentum > 0 and macd_momentum > macd_momentum[1] ? 1 : 0 // MACD bullish

long_score += close > bb_basis and not bb_squeeze ? 1 : 0 // BB position

long_score += high_volume ? 1 : 0 // Volume confirmation

long_score += bullish_structure ? 1 : 0 // Market structure

long_score += close > open ? 1 : 0 // Bullish candle

long_score += close > high[1] ? 1 : 0 // Breaking previous high

long_score += in_session ? 1 : 0 // In active session

// Short Confluence Factors (0-10 score)

short_score = 0

short_score += ema_f < ema_s and ema_s < ema_t ? 1 : 0 // EMA alignment

short_score += close < ema_filt ? 1 : 0 // Below major EMA

short_score += rsi_smooth < 50 and rsi_smooth > rsi_os ? 1 : 0 // RSI bearish

short_score += macd_momentum < 0 and macd_momentum < macd_momentum[1] ? 1 : 0 // MACD bearish

short_score += close < bb_basis and not bb_squeeze ? 1 : 0 // BB position

short_score += high_volume ? 1 : 0 // Volume confirmation

short_score += bearish_structure ? 1 : 0 // Market structure

short_score += close < open ? 1 : 0 // Bearish candle

short_score += close < low[1] ? 1 : 0 // Breaking previous low

short_score += in_session ? 1 : 0 // In active session

// ═══════════════════════════════════════════════════════════════════════════

// ENTRY CONDITIONS

// ═══════════════════════════════════════════════════════════════════════════

// Adjust confluence requirement based on mode

min_confluence = perf_mode == "Conservative" ? confluence_required + 1 : perf_mode == "Aggressive" ? confluence_required - 1 : confluence_required

// Entry signals

long_entry = long_score >= min_confluence and strategy.position_size == 0

short_entry = short_score >= min_confluence and strategy.position_size == 0

// ═══════════════════════════════════════════════════════════════════════════

// POSITION MANAGEMENT

// ═══════════════════════════════════════════════════════════════════════════

var float entry_price = na

var float stop_loss = na

var float take_profit = na

var float trail_stop = na

var bool trailing_activated = false

var int entry_bar = na

// Calculate position size based on risk

calculate_position_size(stop_distance) =>

account_size = strategy.equity

risk_amount = account_size * (risk_per_trade / 100)

position_size = risk_amount / stop_distance

position_size

// LONG ENTRY

if long_entry

stop_distance = atr_smooth * atr_stop_mult

stop_loss := close - stop_distance

take_profit := close + (stop_distance * risk_reward)

position_size = calculate_position_size(stop_distance)

strategy.entry("Long", strategy.long, qty=position_size)

entry_price := close

entry_bar := bar_index

trailing_activated := false

trail_stop := na

alert("🔥 LONG ENTRY 🔥\n" + "Symbol: " + syminfo.ticker + "\n" + "Entry: " + str.tostring(close) + "\n" + "Stop: " + str.tostring(stop_loss) + "\n" + "Target: " + str.tostring(take_profit) + "\n" + "Score: " + str.tostring(long_score) + "/10", alert.freq_once_per_bar_close)

// SHORT ENTRY

if short_entry

stop_distance = atr_smooth * atr_stop_mult

stop_loss := close + stop_distance

take_profit := close - (stop_distance * risk_reward)

position_size = calculate_position_size(stop_distance)

strategy.entry("Short", strategy.short, qty=position_size)

entry_price := close

entry_bar := bar_index

trailing_activated := false

trail_stop := na

alert("🔥 SHORT ENTRY 🔥\n" + "Symbol: " + syminfo.ticker + "\n" + "Entry: " + str.tostring(close) + "\n" + "Stop: " + str.tostring(stop_loss) + "\n" + "Target: " + str.tostring(take_profit) + "\n" + "Score: " + str.tostring(short_score) + "/10", alert.freq_once_per_bar_close)

// ═══════════════════════════════════════════════════════════════════════════

// EXIT MANAGEMENT

// ═══════════════════════════════════════════════════════════════════════════

// Trailing stop logic

if strategy.position_size != 0 and use_trailing

profit_in_r = strategy.position_size > 0 ? (close - entry_price) / (entry_price - stop_loss) : (entry_price - close) / (stop_loss - entry_price)

if profit_in_r >= trail_activate and not trailing_activated

trailing_activated := true

trail_stop := strategy.position_size > 0 ? close - (atr_smooth * trail_offset) : close + (atr_smooth * trail_offset)

if trailing_activated

if strategy.position_size > 0

trail_stop := math.max(trail_stop, close - (atr_smooth * trail_offset))

else

trail_stop := math.min(trail_stop, close + (atr_smooth * trail_offset))

// Exit conditions

if strategy.position_size > 0

strategy.exit("Long Exit", "Long", stop=use_trailing and trailing_activated ? trail_stop : stop_loss, limit=take_profit)

// Early exit on structure break

if bearish_structure

strategy.close("Long", comment="Structure Break")

if strategy.position_size < 0

strategy.exit("Short Exit", "Short", stop=use_trailing and trailing_activated ? trail_stop : stop_loss, limit=take_profit)

// Early exit on structure break

if bullish_structure

strategy.close("Short", comment="Structure Break")

// ═══════════════════════════════════════════════════════════════════════════

// VISUALIZATION

// ═══════════════════════════════════════════════════════════════════════════

// EMA plots

plot(ema_f, "Fast EMA", color.new(color.green, 0), linewidth=2)

plot(ema_s, "Slow EMA", color.new(color.red, 0), linewidth=2)

plot(ema_t, "Trend EMA", color.new(color.blue, 0), linewidth=2)

plot(ema_filt, "Filter EMA", color.new(color.purple, 0), linewidth=3)

// Entry signals

plotshape(long_entry, "Long Signal", shape.triangleup, location.belowbar, color.new(color.green, 0), size=size.normal)

plotshape(short_entry, "Short Signal", shape.triangledown, location.abovebar, color.new(color.red, 0), size=size.normal)

// Position levels

plot(strategy.position_size != 0 ? entry_price : na, "Entry", color.new(color.white, 0), linewidth=2, style=plot.style_linebr)

plot(strategy.position_size != 0 ? stop_loss : na, "Stop Loss", color.new(color.red, 0), linewidth=2, style=plot.style_linebr)

plot(strategy.position_size != 0 ? take_profit : na, "Take Profit", color.new(color.green, 0), linewidth=2, style=plot.style_linebr)

plot(strategy.position_size != 0 and trailing_activated ? trail_stop : na, "Trailing Stop", color.new(color.orange, 0), linewidth=2, style=plot.style_linebr)

// Background color for sessions

bgcolor(in_london ? color.new(color.blue, 95) : na, title="London Session")

bgcolor(in_ny ? color.new(color.green, 95) : na, title="NY Session")

bgcolor(in_tokyo ? color.new(color.red, 95) : na, title="Tokyo Session")

// ═══════════════════════════════════════════════════════════════════════════

// INFORMATION PANEL

// ═══════════════════════════════════════════════════════════════════════════

var table info_panel = table.new(position.top_right, 2, 10, bgcolor=color.new(color.black, 80), border_color=color.white, border_width=1)

if barstate.islast

// Headers

table.cell(info_panel, 0, 0, "METRIC", text_color=color.white, bgcolor=color.new(color.blue, 50))

table.cell(info_panel, 1, 0, "VALUE", text_color=color.white, bgcolor=color.new(color.blue, 50))

// Long Score

table.cell(info_panel, 0, 1, "Long Score", text_color=color.white)

table.cell(info_panel, 1, 1, str.tostring(long_score) + "/10", text_color=long_score >= min_confluence ? color.green : color.white)

// Short Score

table.cell(info_panel, 0, 2, "Short Score", text_color=color.white)

table.cell(info_panel, 1, 2, str.tostring(short_score) + "/10", text_color=short_score >= min_confluence ? color.red : color.white)

// RSI

table.cell(info_panel, 0, 3, "RSI", text_color=color.white)

table.cell(info_panel, 1, 3, str.tostring(math.round(rsi_smooth, 1)), text_color=rsi_smooth > rsi_ob ? color.red : rsi_smooth < rsi_os ? color.green : color.white)

// MACD

table.cell(info_panel, 0, 4, "MACD", text_color=color.white)

table.cell(info_panel, 1, 4, macd_momentum > 0 ? "Bullish" : "Bearish", text_color=macd_momentum > 0 ? color.green : color.red)

// Volume

table.cell(info_panel, 0, 5, "Volume", text_color=color.white)

table.cell(info_panel, 1, 5, str.tostring(math.round(volume_ratio, 1)) + "x", text_color=high_volume ? color.green : color.white)

// Structure

table.cell(info_panel, 0, 6, "Structure", text_color=color.white)

table.cell(info_panel, 1, 6, bullish_structure ? "Bullish" : bearish_structure ? "Bearish" : "Neutral", text_color=bullish_structure ? color.green : bearish_structure ? color.red : color.white)

// Position

table.cell(info_panel, 0, 7, "Position", text_color=color.white)

position_text = strategy.position_size > 0 ? "LONG" : strategy.position_size < 0 ? "SHORT" : "NONE"

table.cell(info_panel, 1, 7, position_text, text_color=strategy.position_size > 0 ? color.green : strategy.position_size < 0 ? color.red : color.white)

// P&L

if strategy.position_size != 0

current_pnl = strategy.position_size > 0 ? ((close - entry_price) / entry_price) * 100 : ((entry_price - close) / entry_price) * 100

table.cell(info_panel, 0, 8, "P&L", text_color=color.white)

table.cell(info_panel, 1, 8, str.tostring(math.round(current_pnl, 2)) + "%", text_color=current_pnl > 0 ? color.green : color.red)

// Mode

table.cell(info_panel, 0, 9, "Mode", text_color=color.white)

table.cell(info_panel, 1, 9, perf_mode, text_color=color.yellow)

// ═══════════════════════════════════════════════════════════════════════════

// ALERTS

// ═══════════════════════════════════════════════════════════════════════════

// Additional alert conditions

alertcondition(long_score >= min_confluence - 1 and long_score < min_confluence, "Long Setup Forming", "Long setup forming - Score: {{plot_0}}/10")

alertcondition(short_score >= min_confluence - 1 and short_score < min_confluence, "Short Setup Forming", "Short setup forming - Score: {{plot_1}}/10")

alertcondition(trailing_activated, "Trailing Stop Activated", "Trailing stop activated")

alertcondition(strategy.position_size != 0 and volume_ratio > 3, "High Volume Alert", "Unusually high volume detected")