マルチファクター定量取引戦略

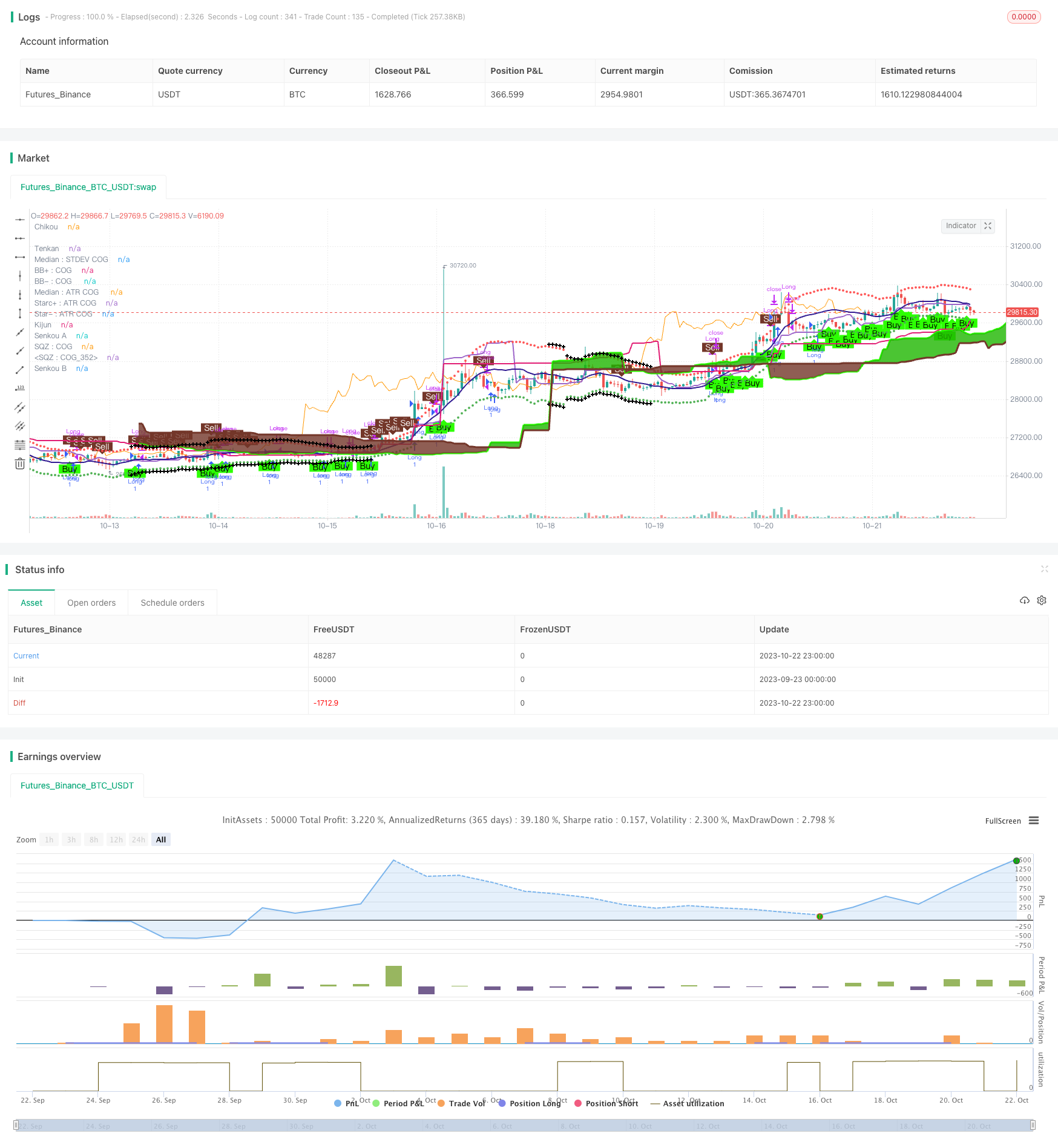

これは,複数の技術指標を組み合わせて多空判断を行う定量取引戦略である.この戦略は,動態指標,トレンド指標,イチモク雲図などの複数の要因を総合的に考慮して,最終的な買入判断を形成する.この戦略は,強い安定性とリスク抵抗性がある.

原則分析

この戦略は以下の部分から構成されています.

動量指標:パラボリックSAR,Leledc強度指標,Kaufman自主移動平均など

トレンド・インジケータ:ラフール・モヒンダール・シェイバー,トレンド・マジック

イチモク雲図: テンカン線,キジュン線など

ボリューム・フロー・インジケーター

波動指標: 波動トレンドオシレータ

TDシーケンス

これらの指標は,それぞれ異なる角度から現在の市場トレンドと強さを判断する.パラボリックSARはトレンドの逆転点を判断する,Leledc強度指標はモメンタムを判断する,Ichimoku雲図はサポート圧力を判断する.ほとんどの指標が同方向のシグナルを与えるとき,最終的な買いまたは売り判断を形成する.

この戦略は,月,日の指定日間の範囲でのみ取引を行うためのフィルタリング条件を同時に設定し,無効取引の回数を減らす.

優位分析

多因子総合判断,より高い精度,より強いリスク抵抗性

単一の指標が失敗するリスクを回避するために,さまざまなタイプの指標をクロス検証する

フィルタリング条件を設定し,不適切な時間帯で無効取引を避ける

パイン・スクリプトで作成され,TradingViewのプラットフォームに直接アクセスできます.

指数のパラメータは,異なる市場向けに最適化することができます.

市場構造を直感的に判断する指標信号を可視化

リスク分析

多因子組合せは重みとパラメータの調整を必要とし,ある程度の最適化困難がある.

単一の指標は,特定の市場の状況で有効でない可能性があります.

フィルタリング条件を正しく設定しない場合, 機会が失われます.

過剰な最適化には注意が必要です

交易者は指標の失敗のリスクに注意し,戦略を適時に調整する必要があります.

対策として

現在の市場に対してより効果的になるように指標のパラメータを最適化

体重を調整し,有効な指標の作用を大きくし,無効な指標の作用を小さくする.

フィルタリング条件を適時調整し,機会とリスクの両方を把握する

思考を最適化する

機械学習アルゴリズムを追加し,指標の重みを自動的に調整する

感情指数や資金流動指数など

取引品種や期間をテストし,最適なパラメータを設定する.

ポジションの長さの違いを検証する

季節性や経済データなどの フィルタリング条件が加わります

ストップ・ロスの追加

要約する

この戦略は,複数の指標を統合して最終判断を形成し,リスクに対する強い強さの優位性を持っています.同時に,単一の指標の失敗のリスク,継続的な最適化および調整パラメータにも注意する必要があります.将来,指標の重量設定をさらに最適化し,より多くの要因を追加し,最適なポジション周期をテストすることができます.

//@version=2

persistent_bull = nz(persistent_bull[1],0)

persistent_bear = nz(persistent_bear[1],0)

strategy("Strategy for The Bitcoin Buy/Sell Indicator", overlay=true, calc_on_every_tick=true)

// ****************************************Inputs***************************************************************

//@fixme if there is a buy and sell signal on the same bar, then it displays the first one and skips the second one. Fix this issue

buySellSignal = true // Make this false if you do not want to show Buy/Sell signal

inputIndividualSiganlPlot = true // = input (false, "Do you want to display each individual indicator's signal on the chart?")

sp = input (false, "Do you want to display Parabolic SAR?")

spLines = input (false, "Do you want to display Parabolic SAR on the chart?")

sCloud = input(false, "Do you want to display the Tenkan and Kijun lines of Ichimoku lines on the chart?")

sL = input (false, "Do you want to display Leledec Exhausion - Leledc on the chart?")

sTD = false

sRMO = input(false, "Do you want to display Rahul Mohindar Oscillator - RMO on the chart?")

inputAma = input(false, title="Do you want to display Kaufman AMA wave - AMA on the chart?")

tm = input (false, "Do you want to display Trend Magic signals on the chart?")

wtoLB = input (false, "Do you want to display WaveTrend Oscillator - WTO on the chart?")

vfiLB = input (false, "Do you want to display Volume Flow Indicator - VFI on the chart?")

cogRegionFillTransp = 100 // input(false, "Do you want to display COG Region Fill and ATR Starc+/-")

inputNeutralMinorSignals = input (false, title="Do you want to not display the minor or the not so strong signals from Ichimoku")

maj=true // input(true,title="Show Major Leledc Exhausion Bar signal")

min=input(false,title="Show Minor Leledc Exhausion Bar signal")

tenkanPeriods = input(20, minval=9, title="Tenkan Period - Ichimoku [9 or 10 or 20]")

kijunPeriods = input(60, minval=26, title="Kijun Period - Ichimoku [26 or 30 or 60]")

chikouPeriods = input(120, minval=52, title="Chikou - Ichimoku [52 or 60 or 120]")

displacement = input(30, minval=26, title="Displacement - Ichimoku [26 or 30]")

// ****************************************General Color Variables***************************************************************

colorLime = #006400 // Warning sign for long trade

colorBuy= #2DFF03 // Good sign for long trade

colorSell = #733629 // Good sign for short trade

colorMaroon =#8b0000 // Warning sign for short trade

colorBlue =#0000ff // No clear sign

colorGray = #a9a9a9 // Gray Color (For Squeeze momentum indicator)

colorBlack = #000000 // Black

colorWhite = #ffffff // White

colorTenkanViolet = #800000 // Tenkan-sen line color

colorKijun = #0000A6 // Kijun-sen line color

// TD Sequential bar colors

tdSell = #ff6666

tdSellOvershoot = #ff1a1a

tdSellOvershoot1 = #cc0000

tdSellOverShoot2 = #990000

tdSellOverShoot3 = #732626

tdBuy = #80ff80

tdBuyOverShoot = #33ff33

tdBuyOvershoot1 = #00cc00

tdBuyOverShoot2 = #008000

tdBuyOvershoot3 = #004d00

// ****************************************Icons***************************************************************

upSign = '↑' // indicates the indicator shows uptrend

downSign = '↓' // incicates the indicator showing downtrend

exitSign ='x' //indicates the indicator uptrend/downtrend ending

// diamond signals weakBullishSignal or weakBearishsignal

// flag signals neutralBullishSignal or neutralBearishSignal

// ****************************************Parabolic SAR code***************************************************************

start = 2

increment = 2

maximum = 2

sus = true

sds = true

disc = false

startCalc = start * .01

incrementCalc = increment * .01

maximumCalc = maximum * .10

sarUp = sar(startCalc, incrementCalc, maximumCalc)

sarDown = sar(startCalc, incrementCalc, maximumCalc)

colUp = spLines and close >= sarDown ? colorLime : na

colDown = spLines and close <= sarUp ? colorSell : na

//@fixme Does not display the correct values for up and down pSAR

plot(sp and sus and sarUp ? sarUp : na, title="↓ SAR", style=cross, linewidth=3,color=colUp)

plot(sp and sds and sarDown ? sarDown : na, title="↑ SAR", style=circles, linewidth=3,color=colDown)

startSAR = 0.02

incrementSAR = 0.02

maximumSAR = 0.2

psar = sar(startSAR, incrementSAR, maximumSAR)

bullishPSAR = psar < high and psar[1] > low

bearishPSAR= psar > low and psar[1] < high

//***********************Leledc Exhausion Bar***********************************************

maj_qual=6

maj_len=30

min_qual=5

min_len=5

lele(qual,len)=>

bindex=nz(bindex[1],0)

sindex=nz(sindex[1],0)

ret=0

if (close>close[4])

bindex:=bindex + 1

if(close<close[4])

sindex:=sindex + 1

if (bindex>qual) and (close<open) and high>=highest(high,len)

bindex:=0

ret:=-1

if ((sindex>qual) and (close>open) and (low<= lowest(low,len)))

sindex:=0

ret:=1

return=ret

major=lele(maj_qual,maj_len)

minor=lele(min_qual,min_len)

leledecMajorBullish = maj ? (major==1?low:na) : na

leledecMajorBearish = maj ? (major==-1?high:na) : na

//****************Ichimoku ************************************

donchian(len) => avg(lowest(len), highest(len))

tenkan = donchian(tenkanPeriods)

kijun = donchian(kijunPeriods)

senkouA = avg(tenkan, kijun)

senkouB = donchian(chikouPeriods)

displacedSenkouA = senkouA[displacement]

displacedSenkouB = senkouB[displacement]

bullishSignal = crossover(tenkan, kijun)

bearishSignal = crossunder(tenkan, kijun)

bullishSignalValues = iff(bullishSignal, tenkan, na)

bearishSignalValues = iff(bearishSignal, tenkan, na)

strongBullishSignal = crossover(tenkan, kijun) and bullishSignalValues > displacedSenkouA and bullishSignalValues > displacedSenkouB and low > tenkan and displacedSenkouA > displacedSenkouB

strongBearishSignal = bearishSignalValues < displacedSenkouA and bearishSignalValues < displacedSenkouB and high < tenkan and displacedSenkouA < displacedSenkouB

neutralBullishSignal = (bullishSignalValues > displacedSenkouA and bullishSignalValues < displacedSenkouB) or (bullishSignalValues < displacedSenkouA and bullishSignalValues > displacedSenkouB)

weakBullishSignal = bullishSignalValues < displacedSenkouA and bullishSignalValues < displacedSenkouB

neutralBearishSignal = (bearishSignalValues > displacedSenkouA and bearishSignalValues < displacedSenkouB) or (bearishSignalValues < displacedSenkouA and bearishSignalValues > displacedSenkouB)

weakBearishSignal = bearishSignalValues > displacedSenkouA and bearishSignalValues > displacedSenkouB

//*********************Kaufman AMA wave*********************//

src=close

lengthAMA=20

filterp = 10

d=abs(src-src[1])

s=abs(src-src[lengthAMA])

noise=sum(d, lengthAMA)

efratio=s/noise

fastsc=0.6022

slowsc=0.0645

smooth=pow(efratio*fastsc+slowsc, 2)

ama=nz(ama[1], close)+smooth*(src-nz(ama[1], close))

filter=filterp/100 * stdev(ama-nz(ama), lengthAMA)

amalow=ama < nz(ama[1]) ? ama : nz(amalow[1])

amahigh=ama > nz(ama[1]) ? ama : nz(amahigh[1])

bw=(ama-amalow) > filter ? 1 : (amahigh-ama > filter ? -1 : 0)

s_color=bw > 0 ? colorBuy : (bw < 0) ? colorSell : colorBlue

amaLongConditionEntry = s_color==colorBuy and s_color[1]!=colorBuy

amaShortConditionEntry = s_color==colorSell and s_color[1]!=colorSell

//***********************Rahul Mohindar Oscillator ******************************//

C=close

cm2(x) => sma(x,2)

ma1=cm2(C)

ma2=cm2(ma1)

ma3=cm2(ma2)

ma4=cm2(ma3)

ma5=cm2(ma4)

ma6=cm2(ma5)

ma7=cm2(ma6)

ma8=cm2(ma7)

ma9=cm2(ma8)

ma10=cm2(ma9)

SwingTrd1 = 100 * (close - (ma1+ma2+ma3+ma4+ma5+ma6+ma7+ma8+ma9+ma10)/10)/(highest(C,10)-lowest(C,10))

SwingTrd2=ema(SwingTrd1,30)

SwingTrd3=ema(SwingTrd2,30)

RMO= ema(SwingTrd1,81)

Buy=cross(SwingTrd2,SwingTrd3)

Sell=cross(SwingTrd3,SwingTrd2)

Bull_Trend=ema(SwingTrd1,81)>0

Bear_Trend=ema(SwingTrd1,81)<0

Ribbon_kol=Bull_Trend ? colorBuy : (Bear_Trend ? colorSell : colorBlue)

Impulse_UP= SwingTrd2 > 0

Impulse_Down= RMO < 0

bar_kol=Impulse_UP ? colorBuy : (Impulse_Down ? colorSell : (Bull_Trend ? colorBuy : colorBlue))

rahulMohindarOscilllatorLongEntry = Ribbon_kol==colorBuy and Ribbon_kol[1]!=colorBuy and Ribbon_kol[1]==colorSell and bar_kol==colorBuy

rahulMohindarOscilllatorShortEntry = Ribbon_kol==colorSell and Ribbon_kol[1]!=colorSell and Ribbon_kol[1]==colorBuy and bar_kol==colorSell

//***********************TD Sequential code ******************************//

transp=0

Numbers=false

SR=false

Barcolor=true

TD = close > close[4] ?nz(TD[1])+1:0

TS = close < close[4] ?nz(TS[1])+1:0

TDUp = TD - valuewhen(TD < TD[1], TD , 1 )

TDDn = TS - valuewhen(TS < TS[1], TS , 1 )

priceflip = barssince(close<close[4])

sellsetup = close>close[4] and priceflip

sell = sellsetup and barssince(priceflip!=9)

sellovershoot = sellsetup and barssince(priceflip!=13)

sellovershoot1 = sellsetup and barssince(priceflip!=14)

sellovershoot2 = sellsetup and barssince(priceflip!=15)

sellovershoot3 = sellsetup and barssince(priceflip!=16)

priceflip1 = barssince(close>close[4])

buysetup = close<close[4] and priceflip1

buy = buysetup and barssince(priceflip1!=9)

buyovershoot = barssince(priceflip1!=13) and buysetup

buyovershoot1 = barssince(priceflip1!=14) and buysetup

buyovershoot2 = barssince(priceflip1!=15) and buysetup

buyovershoot3 = barssince(priceflip1!=16) and buysetup

TDbuyh = valuewhen(buy,high,0)

TDbuyl = valuewhen(buy,low,0)

TDsellh = valuewhen(sell,high,0)

TDselll = valuewhen(sell,low,0)

//***********************Volume Flow Indicator [LazyBear] ******************************//

lengthVFI = 130

coefVFI = 0.2

vcoefVFI = 2.5

signalLength= 5

smoothVFI=true

ma(x,y) => smoothVFI ? sma(x,y) : x

typical=hlc3

inter = log( typical ) - log( typical[1] )

vinter = stdev(inter, 30 )

cutoff = coefVFI * vinter * close

vave = sma( volume, lengthVFI )[1]

vmax = vave * vcoefVFI

vc = iff(volume < vmax, volume, vmax)

mf = typical - typical[1]

vcp = iff( mf > cutoff, vc, iff ( mf < -cutoff, -vc, 0 ) )

vfi = ma(sum( vcp , lengthVFI )/vave, 3)

vfima=ema( vfi, signalLength )

dVFI=vfi-vfima

bullishVFI = vfi > 0 and vfi[1] <=0

bearishVFI = vfi < 0 and vfi[1] >=0

//***********************WaveTrend Oscillator [WT] ******************************//

n1 = 10

n2 = 21

obLevel1 = 60

obLevel2 = 53

osLevel1 = -60

osLevel2 = -53

ap = hlc3

esa = ema(ap, n1)

dWTI = ema(abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * dWTI)

tci = ema(ci, n2)

wt1 = tci

wt2 = sma(wt1,4)

wtiSignal = wt1-wt2

bullishWTI = wt1 > osLevel1 and wt1[1] <= osLevel1 and wtiSignal > 0

bearishWTI = wt1 < obLevel1 and wt1[1] >= obLevel1 and wtiSignal < 0

// **************** Trend Magic code adapted from Glaz ********************* /

CCI = 20 // input(20)

ATR = 5 // input(5)

Multiplier=1 // input(1,title='ATR Multiplier')

original=true // input(true,title='original coloring')

thisCCI = cci(close, CCI)

lastCCI = nz(thisCCI[1])

bufferDn= high + Multiplier * sma(tr,ATR)

bufferUp= low - Multiplier * sma(tr,ATR)

if (thisCCI >= 0 and lastCCI < 0)

bufferUp := bufferDn[1]

if (thisCCI <= 0 and lastCCI > 0)

bufferDn := bufferUp[1]

if (thisCCI >= 0)

if (bufferUp < bufferUp[1])

bufferUp := bufferUp[1]

else

if (thisCCI <= 0)

if (bufferDn > bufferDn[1])

bufferDn := bufferDn[1]

x=thisCCI >= 0 ?bufferUp:thisCCI <= 0 ?bufferDn:x[1]

swap=x>x[1]?1:x<x[1]?-1:swap[1]

swap2=swap==1?lime:red

swap3=thisCCI >=0 ?lime:red

swap4=original?swap3:swap2

bullTrendMagic = swap4 == lime and swap4[1] == red

bearTrendMagic = swap4 == red and swap4[1] == lime

// ************ Indicator: Custom COG channel by Lazy Bear **************** //

srcCOG = close

lengthCOG = 34

median=0

multCOG= 2.5 // input(2.5)

offset = 20 //input(20)

tr_custom() =>

x1=high-low

x2=abs(high-close[1])

x3=abs(low-close[1])

max(x1, max(x2,x3))

atr_custom(x,y) =>

sma(x,y)

dev = (multCOG * stdev(srcCOG, lengthCOG))

basis=linreg(srcCOG, lengthCOG, median)

ul = (basis + dev)

ll = (basis - dev)

tr_v = tr_custom()

acustom=(2*atr_custom(tr_v, lengthCOG))

uls=basis+acustom

lls=basis-acustom

// Plot STDEV channel

plot(basis, linewidth=1, color=navy, style=line, linewidth=1, title="Median : STDEV COG")

lb=plot(ul, color=red, linewidth=1, title="BB+ : COG", style=hline.style_dashed)

tb=plot(ll, color=green, linewidth=1, title="BB- : COG ", style=hline.style_dashed)

fill(tb,lb, silver, title="Region fill: STDEV COG", transp=cogRegionFillTransp)

// Plot ATR channel

plot(basis, linewidth=2, color=navy, style=line, linewidth=2, title="Median : ATR COG ")

ls=plot(uls, color=red, linewidth=1, title="Starc+ : ATR COG", style=circles, transp=cogRegionFillTransp)

ts=plot(lls, color=green, linewidth=1, title="Star- : ATR COG", style=circles, transp=cogRegionFillTransp)

fill(ts,tb, green, title="Region fill : ATR COG", transp=cogRegionFillTransp)

fill(ls,lb, red, title="Region fill : ATR COG", transp=cogRegionFillTransp)

// Mark SQZ

plot_offs_high=0.002

plot_offs_low=0.002

sqz_f=(uls>ul) and (lls<ll)

b_color=sqz_f ? colorBlack : na

plot(sqz_f ? lls - (lls * plot_offs_low) : na, color=b_color, style=cross, linewidth=3, title="SQZ : COG", trasp=0)

plot(sqz_f ? uls + (uls * plot_offs_high) : na, color=b_color, style=cross, linewidth=3, title="SQZ : COG", trasp=0)

// ****************************************All the plots and coloring of bars***************************************************************

// Trend Magic

plotchar(tm and bullTrendMagic, title="TM", char=upSign, location=location.belowbar, color=colorBuy, transp=0, text="TM", textcolor=colorBuy, size=size.auto)

plotchar(tm and bearTrendMagic, title="TM", char=downSign, location=location.abovebar, color=colorSell, transp=0, text="TM", textcolor=colorSell, size=size.auto)

// WaveTrend Oscillator

plotshape(wtoLB and bullishWTI, color=colorBuy, style=shape.labelup, textcolor=#000000, text="WTI", location=location.belowbar, transp=0)

plotshape(wtoLB and bearishWTI, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="WTI", location=location.abovebar, transp=0)

// VFI

plotshape(vfiLB and bullishVFI, color=colorBuy, style=shape.labelup, textcolor=#000000, text="VFI", location=location.belowbar, transp=0)

plotshape(vfiLB and bearishVFI, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="VFI", location=location.abovebar, transp=0)

// PSAR

plotshape(inputIndividualSiganlPlot and sp and bullishPSAR, color=colorBuy, style=shape.labelup, textcolor=#000000, text="Sar", location=location.belowbar, transp=0)

plotshape(inputIndividualSiganlPlot and sp and bearishPSAR, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="Sar", location=location.abovebar, transp=0)

// Leledec

plotshape(inputIndividualSiganlPlot and sL and leledecMajorBearish, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="Leledec", location=location.abovebar, transp=0)

plotshape(inputIndividualSiganlPlot and sL and leledecMajorBullish, color=colorBuy, style=shape.labelup, textcolor=#000000, text="Leledec", location=location.belowbar, transp=0)

plotshape(min ? (minor==1?low:na) : na, style=shape.diamond, text="Leledec", size=size.tiny, location=location.belowbar, title="Weak Bullish Signals - Leledec", color=colorLime)

plotshape(min ? (minor==-1?high:na) : na, style=shape.diamond, text="Leledec", size=size.tiny, location=location.abovebar, title="Weak Bearish Signals - Leleded", color=colorSell)

// Ichimoku

plot(tenkan, color=iff(sCloud, colorTenkanViolet, na), title="Tenkan", linewidth=2, transp=0)

plot(kijun, color=iff(sCloud, colorKijun, na), title="Kijun", linewidth=2, transp=0)

plot(close, offset = -displacement, color=iff(sCloud, colorLime, na), title="Chikou", linewidth=1)

p1 = plot(senkouA, offset=displacement, color=colorBuy, title="Senkou A", linewidth=3, transp=0)

p2 = plot(senkouB, offset=displacement, color=colorSell, title="Senkou B", linewidth=3, transp=0)

fill(p1, p2, color = senkouA > senkouB ? #1eb600 : colorSell)

plotshape(inputIndividualSiganlPlot and strongBearishSignal, color=colorSell, style=shape.labelup, textcolor=#000000, text="Ichimoku", location=location.abovebar, transp=0)

plotshape(inputIndividualSiganlPlot and strongBullishSignal, color=colorBuy, style=shape.labeldown, textcolor=#ffffff, text="Ichimoku", location=location.belowbar, transp=0)

plotshape(inputNeutralMinorSignals and neutralBullishSignal, style=shape.flag, text="Ichimoku", size=size.small, location=location.belowbar, title="Neutral Bullish Signals - Ichimoku", color=colorLime)

plotshape(inputNeutralMinorSignals and weakBullishSignal, style=shape.diamond, text="Ichimoku", size=size.tiny, location=location.belowbar, title="Weak Bullish Signals - Ichimoku", color=colorLime)

plotshape(inputNeutralMinorSignals and neutralBearishSignal, style=shape.flag, text="Ichimoku", size=size.small, location=location.abovebar, title="Neutral Bearish Signals - Ichimoku", color=colorMaroon)

plotshape(inputNeutralMinorSignals and weakBearishSignal, style=shape.diamond, text="Ichimoku", size=size.tiny, location=location.abovebar, title="Weak Bearish Signals - Ichimoku", color=colorMaroon)

// AMA

plotshape(inputIndividualSiganlPlot and inputAma and amaLongConditionEntry, color=colorBuy, style=shape.labelup, textcolor=#000000, text="AMA", location=location.belowbar, transp=0)

plotshape(inputIndividualSiganlPlot and inputAma and amaShortConditionEntry, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="AMA", location=location.abovebar, transp=0)

// RMO

plotshape(inputIndividualSiganlPlot and sRMO and rahulMohindarOscilllatorLongEntry, color=colorBuy, style=shape.labelup, textcolor=#000000, text="RMO", location=location.belowbar, transp=0)

plotshape(inputIndividualSiganlPlot and sRMO and rahulMohindarOscilllatorShortEntry, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="RMO", location=location.abovebar, transp=0)

// TD

plot(sTD and SR?(TDbuyh ? TDbuyl: na):na,style=circles, linewidth=1, color=red)

plot(sTD and SR?(TDselll ? TDsellh : na):na,style=circles, linewidth=1, color=lime)

barColour = sell? tdSell : buy? tdBuy : sellovershoot? tdSellOvershoot : sellovershoot1? tdSellOvershoot1 : sellovershoot2?tdSellOverShoot2 : sellovershoot3? tdSellOverShoot3 : buyovershoot? tdBuyOverShoot : buyovershoot1? tdBuyOvershoot1 : buyovershoot2? tdBuyOverShoot2 : buyovershoot3? tdBuyOvershoot3 : na

barcolor(color=barColour, title ="TD Sequential Bar Colour")

// ****************************************BUY/SELL Signal ***************************************************************

bull = leledecMajorBullish or bullishPSAR or strongBullishSignal or amaLongConditionEntry or rahulMohindarOscilllatorLongEntry or bullishVFI

bear = leledecMajorBearish or bearishPSAR or strongBearishSignal or amaShortConditionEntry or rahulMohindarOscilllatorShortEntry or bearishVFI

if bull

persistent_bull := 1

persistent_bear := 0

if bear

persistent_bull := 0

persistent_bear := 1

plotshape(bull and persistent_bull[1] != 1, style=shape.labelup, location=location.belowbar, color=colorBuy, text="Buy", textcolor=#000000, transp=0)

plotshape(bear and persistent_bear[1] != 1, style=shape.labeldown, color=colorSell, text="Sell", location=location.abovebar, textcolor =#ffffff, transp=0)

// ****************************************Alerts***************************************************************

// For global buy/sell

alertcondition(bull and persistent_bull[1] != 1, title='Buy', message='Buy')

alertcondition(bear and persistent_bear[1] != 1, title='Sell', message='Sell')

// Strategy

longCondition = leledecMajorBullish or bullishPSAR or strongBullishSignal or amaLongConditionEntry or rahulMohindarOscilllatorLongEntry or bullishVFI

closeLongCondition = leledecMajorBearish or bearishPSAR or strongBearishSignal or amaShortConditionEntry or rahulMohindarOscilllatorShortEntry or bearishVFI

monthfrom =input(1)

monthuntil =input(12)

dayfrom=input(1)

dayuntil=input(31)

yearfrom=input(2017)

yearuntil=input(2020)

leverage=input(1)

if (longCondition )

strategy.entry("Long", strategy.long, leverage, comment="Enter Long")

else

strategy.close("Long", when=closeLongCondition)

//if (closeLongCondition and month>=monthfrom and month <=monthuntil and dayofmonth>=dayfrom and dayofmonth <= dayuntil and year <= yearuntil and year>=yearfrom)

// strategy.entry("Short", strategy.short, leverage, comment="Enter Short")

//else

// strategy.close("Short", when=longCondition)