ブレイクアウト トレーリング ストップ V2 戦略

概要

この戦略は,ブレイク戦略とトレンド追跡ストップ戦略の優位性を組み合わせて,ロングライングラフのサポートレジスタンスブレイク信号を捕捉し,移動平均を利用してストップトラッキングを行い,ロングライントレンドの方向で利益を得ながらもリスクを制御することを目的としています.

戦略原則

戦略は,まず,トレンド判断,サポートレジスタンス,ストップダメージトラッキングとして使用される複数の異なるパラメータの移動平均を計算します.

そして,指定された周期内の最高点と最低点を,入場するサポート・レジスタンス領域として見つけます. 価格がこれらのサポート・レジスタンスを突破すると,シグナルが作られます.

策略は,突破高点で多信号に買い,突破低点で空信号に売る.

入場後,突破最低点の低点をストップ損失位としてポジションを保持する.

ポジションが利益状態に入ると,ストップ・ロスは移動平均を追跡する.価格が移動平均を下回ると,ストップ・ロスは,このルートK線の最低点に設定する.

取引先が取引先の取引を監視し,取引先の取引先の取引を監視する.

策略は同時に平均の実際の波動を加えることで,適切な区間でのみ突破買いを確実にするため,過度な拡大の突破を避ける.

戦略的優位分析

突破戦略とトレンド追跡戦略を組み合わせたストップ・ロスの二重の利点.

長期トレンドで突破買いをすることで,利益の確率を高めることができます.

ストップ・ロスの戦略は,ポジションを保護するだけでなく,ポジションに十分なスペースを与えます.

波動率のフィルタを加え,過度の上昇を避ける不利な突破を避ける.

自動取引は,時折の請求書に適しています.

異なる周期平均線の操作をカスタマイズできます.

ストップダストトラッキングは柔軟に調整できます.

戦略的リスク分析

突破策は偽突破の危険性がある. 突破確認は適切に緩やかである.

突破シグナルを生成するには十分な波動が必要で,逆転の状況では無効にされやすい.

突破口のいくつかは 捉え難いほどに短く, タイムラインを下げて チャンスを探すこともできます.

追跡ストップは,震動の状況で頻繁にストップすることがあります. ストップ距離を適切に緩めることができます.

波動率のフィルタリングは,いくつかのチャンスを逃す可能性があります.フィルタリングパラメータを下げることができます.

戦略最適化の方向性

異なる均線参数組をテストして,最適な参数を見つけます.

経路,K線形など,さまざまな突破確認機構をテストする.

ストップ・トラッキングの様々な方法を試して,最適のストップ・トラッキングを探してください.

資金管理戦略の最適化,ポジトンスコアなど

統計技術指標のフィルタリングが加えられ,フィルタリングの精度が向上する.

この戦略の効果を様々な品種でテストする.

戦略の効果を高めるために,機械学習アルゴリズムを組み込む.

要約する

この戦略は,突破思考とトレンド追跡のストップ思考を統合し,長線を正しく判断した前提で,利益の空間を最適化することができる. 鍵は,最適なパラメータの組み合わせを見つけ,良き資金管理戦略と連携して,長線の機会を掴むと同時に,リスクを制御できるようにすることである. この戦略は,さらなる最適化によって,より信頼性の高い長線のトレンド戦略になる見込みである.

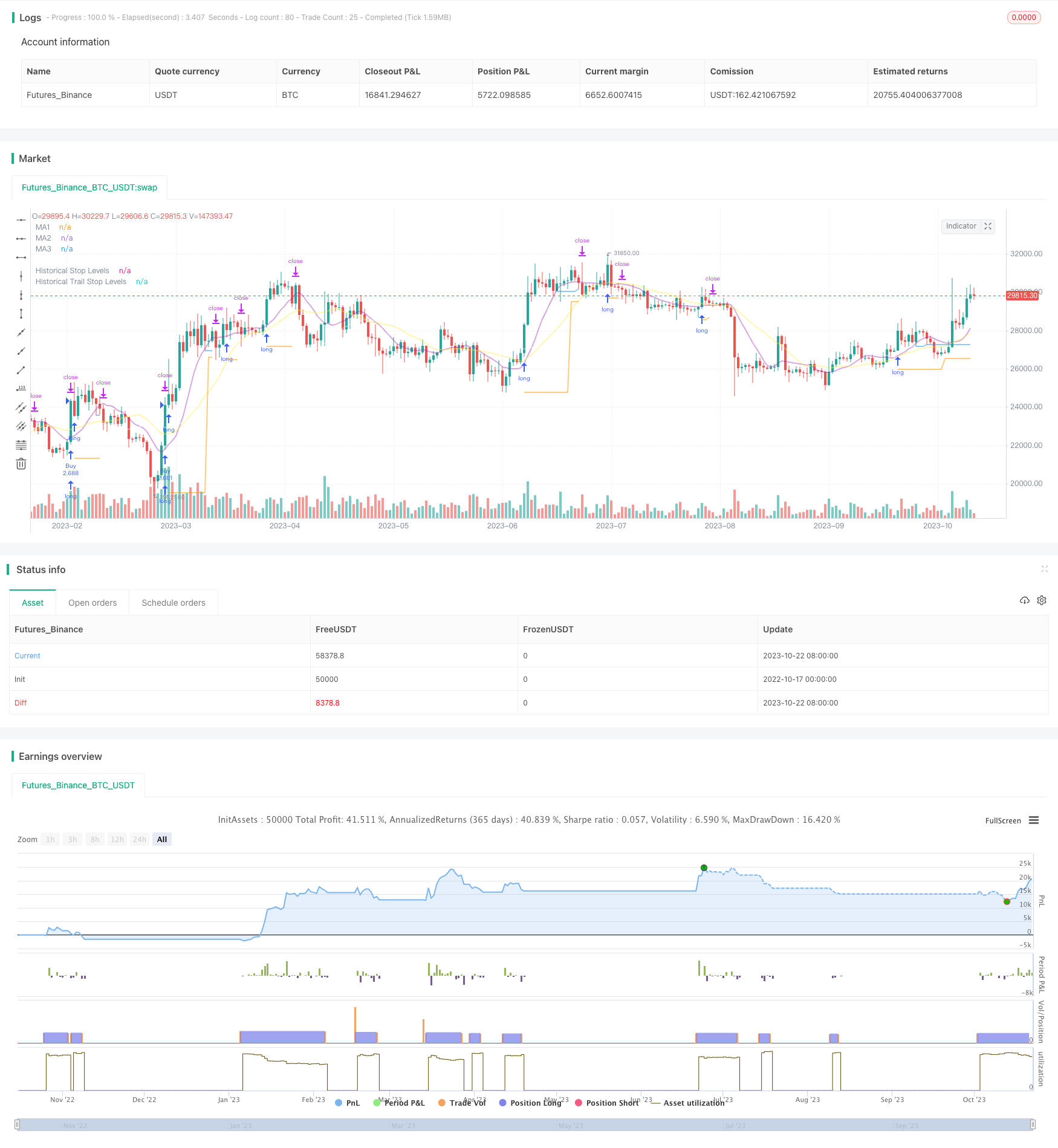

/*backtest

start: 2022-10-17 00:00:00

end: 2023-10-23 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © millerrh

// The intent of this strategy is to buy breakouts with a tight stop on smaller timeframes in the direction of the longer term trend.

// Then use a trailing stop of a close below either the 10 MA or 20 MA (user choice) on that larger timeframe as the position

// moves in your favor (i.e. whenever position price rises above the MA).

// Option of using daily ADR as a measure of finding contracting ranges and ensuring a decent risk/reward.

// (If the difference between the breakout point and your stop level is below a certain % of ATR, it could possibly find those consolidating periods.)

// V2 - updates code of original Qullamaggie Breakout to optimize and debug it a bit - the goal is to remove some of the whipsaw and poor win rate of the

// original by incorporating some of what I learned in the Breakout Trend Follower script.

//@version=4

strategy("Qullamaggie Breakout V2", overlay=true, initial_capital=100000, currency='USD', calc_on_every_tick = true,

default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.1)

// === BACKTEST RANGE ===

Start = input(defval = timestamp("01 Jan 2019 06:00 +0000"), title = "Backtest Start Date", type = input.time, group = "backtest window and pivot history")

Finish = input(defval = timestamp("01 Jan 2100 00:00 +0000"), title = "Backtest End Date", type = input.time, group = "backtest window and pivot history")

// Inputs

showPivotPoints = input(title = "Show Historical Pivot Points?", type = input.bool, defval = false, group = "backtest window and pivot history",

tooltip = "Toggle this on to see the historical pivot points that were used. Change the Lookback Periods to adjust the frequency of these points.")

htf = input(defval="D", title="Timeframe of Moving Averages", type=input.resolution, group = "moving averages",

tooltip = "Allows you to set a different time frame for the moving averages and your trailing stop.

The default behavior is to identify good tightening setups on a larger timeframe

(like daily) and enter the trade on a breakout occuring on a smaller timeframe, using the moving averages of the larger timeframe to trail your stop.")

maType = input(defval="SMA", options=["EMA", "SMA"], title = "Moving Average Type", group = "moving averages")

ma1Length = input(defval = 10, title = "1st Moving Average Length", minval = 1, group = "moving averages")

ma2Length = input(defval = 20, title = "2nd Moving Average Length", minval = 1, group = "moving averages")

ma3Length = input(defval = 50, title = "3rd Moving Average Length", minval = 1, group = "moving averages")

useMaFilter = input(title = "Use 3rd Moving Average for Filtering?", type = input.bool, defval = true, group = "moving averages",

tooltip = "Signals will be ignored when price is under this slowest moving average. The intent is to keep you out of bear periods and only

buying when price is showing strength or trading with the longer term trend.")

trailMaInput = input(defval="1st Moving Average", options=["1st Moving Average", "2nd Moving Average"], title = "Trailing Stop", group = "stops",

tooltip = "Initial stops after entry follow the range lows. Once in profit, the trade gets more wiggle room and

stops will be trailed when price breaches this moving average.")

trailMaTF = input(defval="Same as Moving Averages", options=["Same as Moving Averages", "Same as Chart"], title = "Trailing Stop Timeframe", group = "stops",

tooltip = "Once price breaches the trail stop moving average, the stop will be raised to the low of that candle that breached. You can choose to use the

chart timeframe's candles breaching or use the same timeframe the moving averages use. (i.e. if daily, you wait for the daily bar to close before setting

your new stop level.)")

currentColorS = input(color.new(color.orange,50), title = "Current Range S/R Colors: Support", type = input.color, group = "stops", inline = "lineColor")

currentColorR = input(color.new(color.blue,50), title = " Resistance", type = input.color, group = "stops", inline = "lineColor")

// Pivot lookback

lbHigh = 3

lbLow = 3

// MA Calculations (can likely move this to a tuple for a single security call!!)

ma(maType, src, length) =>

maType == "EMA" ? ema(src, length) : sma(src, length) //Ternary Operator (if maType equals EMA, then do ema calc, else do sma calc)

ma1 = security(syminfo.tickerid, htf, ma(maType, close, ma1Length))

ma2 = security(syminfo.tickerid, htf, ma(maType, close, ma2Length))

ma3 = security(syminfo.tickerid, htf, ma(maType, close, ma3Length))

plot(ma1, color=color.new(color.purple, 60), style=plot.style_line, title="MA1", linewidth=2)

plot(ma2, color=color.new(color.yellow, 60), style=plot.style_line, title="MA2", linewidth=2)

plot(ma3, color=color.new(color.white, 60), style=plot.style_line, title="MA3", linewidth=2)

// === USE ADR FOR FILTERING ===

// The idea here is that you want to buy in a consolodating range for best risk/reward. So here you can compare the current distance between

// support/resistance vs. the ADR and make sure you aren't buying at a point that is too extended.

useAdrFilter = input(title = "Use ADR for Filtering?", type = input.bool, defval = false, group = "adr filtering",

tooltip = "Signals will be ignored if the distance between support and resistance is larger than a user-defined percentage of ADR (or monthly volatility

in the stock screener). This allows the user to ensure they are not buying something that is too extended and instead focus on names that are consolidating more.")

adrPerc = input(defval = 120, title = "% of ADR Value", minval = 1, group = "adr filtering")

tableLocation = input(defval="Bottom", options=["Top", "Bottom"], title = "ADR Table Visibility", group = "adr filtering",

tooltip = "Place ADR table on the top of the pane, the bottom of the pane, or off.")

adrValue = security(syminfo.tickerid, "D", sma((high-low)/abs(low) * 100, 21)) // Monthly Volatility in Stock Screener (also ADR)

adrCompare = (adrPerc * adrValue) / 100

// === PLOT SWING HIGH/LOW AND MOST RECENT LOW TO USE AS STOP LOSS EXIT POINT ===

ph = pivothigh(high, lbHigh, lbHigh)

pl = pivotlow(low, lbLow, lbLow)

highLevel = valuewhen(ph, high[lbHigh], 0)

lowLevel = valuewhen(pl, low[lbLow], 0)

barsSinceHigh = barssince(ph) + lbHigh

barsSinceLow = barssince(pl) + lbLow

timeSinceHigh = time[barsSinceHigh]

timeSinceLow = time[barsSinceLow]

//Removes color when there is a change to ensure only the levels are shown (i.e. no diagonal lines connecting the levels)

pvthis = fixnan(ph)

pvtlos = fixnan(pl)

hipc = change(pvthis) != 0 ? na : color.new(color.maroon, 0)

lopc = change(pvtlos) != 0 ? na : color.new(color.green, 0)

// Display Pivot lines

plot(showPivotPoints ? pvthis : na, color=hipc, linewidth=1, offset=-lbHigh, title="Top Levels")

plot(showPivotPoints ? pvthis : na, color=hipc, linewidth=1, offset=0, title="Top Levels 2")

plot(showPivotPoints ? pvtlos : na, color=lopc, linewidth=1, offset=-lbLow, title="Bottom Levels")

plot(showPivotPoints ? pvtlos : na, color=lopc, linewidth=1, offset=0, title="Bottom Levels 2")

// BUY AND SELL CONDITIONS

buyLevel = valuewhen(ph, high[lbHigh], 0) //Buy level at Swing High

// Conditions for entry

stopLevel = float(na) // Define stop level here as "na" so that I can reference it in the ADR calculation before the stopLevel is actually defined.

buyConditions = (useMaFilter ? buyLevel > ma3 : true) and

(useAdrFilter ? (buyLevel - stopLevel[1]) < adrCompare : true)

buySignal = crossover(high, buyLevel) and buyConditions

// Trailing stop points - when price punctures the moving average, move stop to the low of that candle - Define as function/tuple to only use one security call

trailMa = trailMaInput == "1st Moving Average" ? ma1 : ma2

f_getCross() =>

maCrossEvent = crossunder(low, trailMa)

maCross = valuewhen(maCrossEvent, low, 0)

maCrossLevel = fixnan(maCross)

maCrossPc = change(maCrossLevel) != 0 ? na : color.new(color.blue, 0) //Removes color when there is a change to ensure only the levels are shown (i.e. no diagonal lines connecting the levels)

[maCrossEvent, maCross, maCrossLevel, maCrossPc]

crossTF = trailMaTF == "Same as Moving Averages" ? htf : ""

[maCrossEvent, maCross, maCrossLevel, maCrossPc] = security(syminfo.tickerid, crossTF, f_getCross())

plot(showPivotPoints ? maCrossLevel : na, color = maCrossPc, linewidth=1, offset=0, title="Ma Stop Levels")

// == STOP AND PRICE LEVELS ==

inPosition = strategy.position_size > 0

buyLevel := inPosition ? buyLevel[1] : buyLevel

stopDefine = valuewhen(pl, low[lbLow], 0) //Stop Level at Swing Low

inProfit = strategy.position_avg_price <= stopDefine[1]

// stopLevel := inPosition ? stopLevel[1] : stopDefine // Set stop loss based on swing low and leave it there

stopLevel := inPosition and not inProfit ? stopDefine : inPosition and inProfit ? stopLevel[1] : stopDefine // Trail stop loss until in profit

trailStopLevel = float(na)

// trying to figure out a better way for waiting on the trail stop - it can trigger if above the stopLevel even if the MA hadn't been breached since opening the trade

notInPosition = strategy.position_size == 0

inPositionBars = barssince(notInPosition)

maCrossBars = barssince(maCrossEvent)

trailCross = inPositionBars > maCrossBars

// trailCross = trailMa > stopLevel

trailStopLevel := inPosition and trailCross ? maCrossLevel : na

plot(inPosition ? stopLevel : na, style=plot.style_linebr, color=color.new(color.orange, 50), linewidth = 2, title = "Historical Stop Levels", trackprice=false)

plot(inPosition ? trailStopLevel : na, style=plot.style_linebr, color=color.new(color.blue, 50), linewidth = 2, title = "Historical Trail Stop Levels", trackprice=false)

// == PLOT SUPPORT/RESISTANCE LINES FOR CURRENT CHART TIMEFRAME ==

// Use a function to define the lines

// f_line(x1, y1, y2, _color) =>

// var line id = na

// line.delete(id)

// id := line.new(x1, y1, time, y2, xloc.bar_time, extend.right, _color)

// highLine = f_line(timeSinceHigh, highLevel, highLevel, currentColorR)

// lowLine = f_line(timeSinceLow, lowLevel, lowLevel, currentColorS)

// == ADR TABLE ==

tablePos = tableLocation == "Top" ? position.top_right : position.bottom_right

var table adrTable = table.new(tablePos, 2, 1, border_width = 3)

lightTransp = 90

avgTransp = 80

heavyTransp = 70

posColor = color.rgb(38, 166, 154)

negColor = color.rgb(240, 83, 80)

volColor = color.new(#999999, 0)

f_fillCellVol(_table, _column, _row, _value) =>

_transp = abs(_value) > 7 ? heavyTransp : abs(_value) > 4 ? avgTransp : lightTransp

_cellText = tostring(_value, "0.00") + "%\n" + "ADR"

table.cell(_table, _column, _row, _cellText, bgcolor = color.new(volColor, _transp), text_color = volColor, width = 6)

srDistance = (highLevel - lowLevel)/highLevel * 100

f_fillCellCalc(_table, _column, _row, _value) =>

_c_color = _value >= adrCompare ? negColor : posColor

_transp = _value >= adrCompare*0.8 and _value <= adrCompare*1.2 ? lightTransp :

_value >= adrCompare*0.5 and _value < adrCompare*0.8 ? avgTransp :

_value < adrCompare*0.5 ? heavyTransp :

_value > adrCompare*1.2 and _value <= adrCompare*1.5 ? avgTransp :

_value > adrCompare*1.5 ? heavyTransp : na

_cellText = tostring(_value, "0.00") + "%\n" + "Range"

table.cell(_table, _column, _row, _cellText, bgcolor = color.new(_c_color, _transp), text_color = _c_color, width = 6)

if barstate.islast

f_fillCellVol(adrTable, 0, 0, adrValue)

f_fillCellCalc(adrTable, 1, 0, srDistance)

// f_fillCellVol(adrTable, 0, 0, inPositionBars)

// f_fillCellCalc(adrTable, 1, 0, maCrossBars)

// == STRATEGY ENTRY AND EXIT ==

strategy.entry("Buy", strategy.long, stop = buyLevel, when = buyConditions)

stop = stopLevel > trailStopLevel ? stopLevel : close[1] > trailStopLevel and close[1] > trailMa ? trailStopLevel : stopLevel

strategy.exit("Sell", from_entry = "Buy", stop=stop)