ローソク足パターン戦略

作成日:

2023-11-27 18:26:52

最終変更日:

2023-11-27 18:26:52

コピー:

2

クリック数:

721

1

フォロー

1628

フォロワー

概要

形戦略は,線形を利用して取引決定を行う戦略である.この戦略は,線形を含む多くの一般的な線形を検知し,これらの形を検知すると取引信号を生成する.この戦略は,カスタムストップ,ストップ,尾随ストップのパラメータを同時にサポートし,リスクを効果的に制御する.

戦略原則

この戦略の核心的な論理は,Pine Scriptのコードの条件判断によって,異なるタイプの形を識別することです.例えば,吞食形を判断するコード論理は,

bullish_engulfing = high[0]>high[1] and low[0]<low[1] and open[0]<open[1] and close[0]>close[1] and close[0]>open[0] and close[1]<close[2] and close[0]>open[1]

上記の論理は,現在のK線と前2つのK線の高点,低点,開値,閉値の大きさの関係を判断し,吞食形態の定義を満たせば,trueを返します.他の形判断も同様の論理です.

条件を満たす形が認識されると,対応する多頭または空頭取引シグナル変数はtrueに設定されます. 戦略は,取引時間内に取引シグナルが誘発されるかどうかを判断し,誘発された場合は注文し,リスクを管理するために止損,止損,尾行止損を設定します.

優位分析

- 広範囲で,一般的なの形が多種多種に対応

- リスク管理のカスタマイズ可能なパラメータ,柔軟性

- 形状をはっきりと識別するための多種多様な描画ツールが含まれています

- K線で現実のトレンドを組み合わせて,騙されないようにする

リスクと解決策

- の形状は必ずしも信頼できる信号ではありません

解決策:トレンド指標を組み合わせて,波動的な市場での使用を避ける

- シングルモードでは偽信号が発生する可能性があります.

解決方法: 短すぎる形状信号を適切にフィルターする

- パラメータを正しく設定しない場合,損失を拡大する可能性があります.

解決方法: リスク承受能力に厳密に準拠したストップ・ロストの設定

最適化の方向

- トレンドの判断を高め,トレンドに合わない形を避ける

- 他の指標と組み合わせたフィルター信号

- 形状パラメータを最適化し,偽信号率を下げる

- 機械学習アルゴリズムと組み合わせたより信頼性の高い形状認識

要約する

形戦略は,グラフィック技術分析を用いて短期的な転換点を判断する,より一般的なショートライン戦略である.この戦略は,複数の形状をサポートし,リスク管理をカスタマイズし,使用の柔軟性がある.しかし,形状信号の信頼性は高くなく,単独では使用できません.トレンドや他の要因と連携して価値を発揮する必要があります.

ストラテジーソースコード

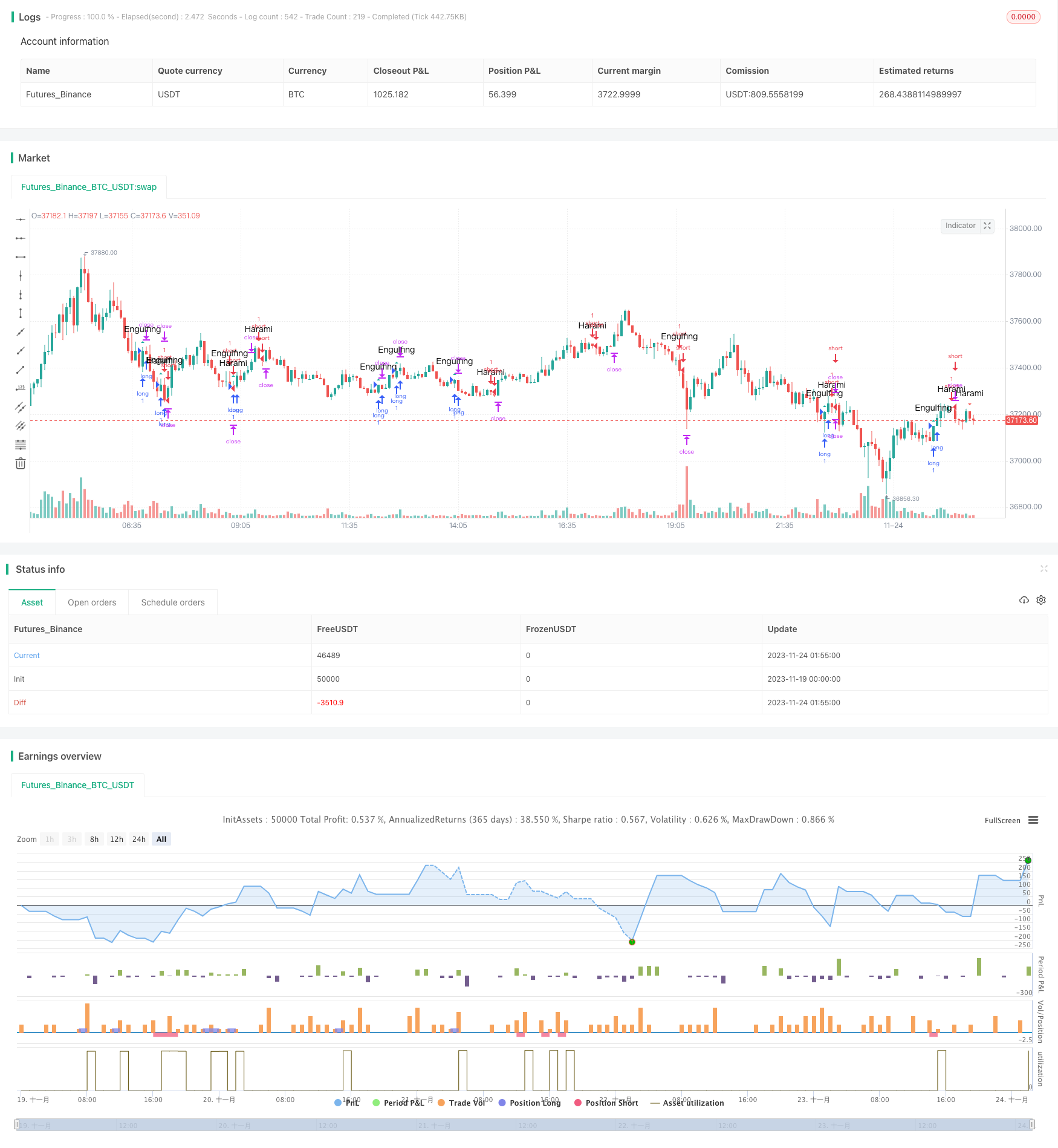

/*backtest

start: 2023-11-19 00:00:00

end: 2023-11-24 02:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//DanyChe

//The script allows you to test popular candlestick patterns on various instruments and timeframes. In addition, you can configure risk management (if the value is zero, it means the function is disabled), and you can also specify the time of the trading session (for example, so that the positions are not transferred to the next day).

//The author is grateful to JayRogers and Phi35, their code examples helped a lot in writing the strategy.

strategy("Candle Patterns Strategy", shorttitle="CPS", overlay=true)

//--- Patterns Input ---

OnEngulfing = input(defval=true, title="Engulfing")

OnHarami = input(defval=true, title="Harami")

OnPiercingLine = input(defval=true, title="Piercing Line / Dark Cloud Cover")

OnMorningStar = input(defval=true, title="Morning Star / Evening Star ")

OnBeltHold = input(defval=true, title="Belt Hold")

OnThreeWhiteSoldiers = input(defval=true, title="Three White Soldiers / Three Black Crows")

OnThreeStarsInTheSouth = input(defval=true, title="Three Stars in the South")

OnStickSandwich = input(defval=true, title="Stick Sandwich")

OnMeetingLine = input(defval=true, title="Meeting Line")

OnKicking = input(defval=true, title="Kicking")

OnLadderBottom = input(defval=true, title="Ladder Bottom")

//--- Risk Management Input ---

inpsl = input(defval = 100, title="Stop Loss", minval = 0)

inptp = input(defval = 1000, title="Take Profit", minval = 0)

inptrail = input(defval = 40, title="Trailing Stop", minval = 0)

// If the zero value is set for stop loss, take profit or trailing stop, then the function is disabled

sl = inpsl >= 1 ? inpsl : na

tp = inptp >= 1 ? inptp : na

trail = inptrail >= 1 ? inptrail : na

//--- Session Input ---

sess = input(defval = "0000-0000", title="Trading session")

t = time('60', sess)

session_open = na(t) ? false : true

// --- Candlestick Patterns ---

//Engulfing

bullish_engulfing = high[0]>high[1] and low[0]<low[1] and open[0]<open[1] and close[0]>close[1] and close[0]>open[0] and close[1]<close[2] and close[0]>open[1] ? OnEngulfing : na

bearish_engulfing = high[0]>high[1] and low[0]<low[1] and open[0]>open[1] and close[0]<close[1] and close[0]<open[0] and close[1]>close[2] and close[0]<open[1] ? OnEngulfing : na

//Harami

bullish_harami = open[1]>close[1] and close[1]<close[2] and open[0]>close[1] and open[0]<open[1] and close[0]>close[1] and close[0]<open[1] and high[0]<high[1] and low[0]>low[1] and close[0]>=open[0] ? OnHarami : na

bearish_harami = open[1]<close[1] and close[1]>close[2] and open[0]<close[1] and open[0]>open[1] and close[0]<close[1] and close[0]>open[1] and high[0]<high[1] and low[0]>low[1] and close[0]<=open[0] ? OnHarami : na

//Piercing Line/Dark Cloud Cover

piercing_line = close[2]>close[1] and open[0]<low[1] and close[0]>avg(open[1],close[1]) and close[0]<open[1] ? OnPiercingLine : na

dark_cloud_cover = close[2]<close[1] and open[0]>high[1] and close[0]<avg(open[1],close[1]) and close[0]>open[1] ? OnPiercingLine : na

//Morning Star/Evening Star

morning_star = close[3]>close[2] and close[2]<open[2] and open[1]<close[2] and close[1]<close[2] and open[0]>open[1] and open[0]>close[1] and close[0]>close[2] and open[2]-close[2]>close[0]-open[0] ? OnMorningStar : na

evening_star = close[3]<close[2] and close[2]>open[2] and open[1]>close[2] and close[1]>close[2] and open[0]<open[1] and open[0]<close[1] and close[0]<close[2] and close[2]-open[2]>open[0]-close[0] ? OnMorningStar : na

//Belt Hold

bullish_belt_hold = close[1]<open[1] and low[1]>open[0] and close[1]>open[0] and open[0]==low[0] and close[0]>avg(close[0],open[0]) ? OnBeltHold :na

bearish_belt_hold = close[1]>open[1] and high[1]<open[0] and close[1]<open[0] and open[0]==high[0] and close[0]<avg(close[0],open[0]) ? OnBeltHold :na

//Three White Soldiers/Three Black Crows

three_white_soldiers = close[3]<open[3] and open[2]<close[3] and close[2]>avg(close[2],open[2]) and open[1]>open[2] and open[1]<close[2] and close[1]>avg(close[1],open[1]) and open[0]>open[1] and open[0]<close[1] and close[0]>avg(close[0],open[0]) and high[1]>high[2] and high[0]>high[1] ? OnThreeWhiteSoldiers : na

three_black_crows = close[3]>open[3] and open[2]>close[3] and close[2]<avg(close[2],open[2]) and open[1]<open[2] and open[1]>close[2] and close[1]<avg(close[1],open[1]) and open[0]<open[1] and open[0]>close[1] and close[0]<avg(close[0],open[0]) and low[1]<low[2] and low[0]<low[1] ? OnThreeWhiteSoldiers : na

//Three Stars in the South

three_stars_in_the_south = open[3]>close[3] and open[2]>close[2] and open[2]==high[2] and open[1]>close[1] and open[1]<open[2] and open[1]>close[2] and low[1]>low[2] and open[1]==high[1] and open[0]>close[0] and open[0]<open[1] and open[0]>close[1] and open[0]==high[0] and close[0]==low[0] and close[0]>=low[1] ? OnThreeStarsInTheSouth : na

//Stick Sandwich

stick_sandwich = open[2]>close[2] and open[1]>close[2] and open[1]<close[1] and open[0]>close[1] and open[0]>close[0] and close[0]==close[2] ? OnStickSandwich : na

//Meeting Line

bullish_ml = open[2]>close[2] and open[1]>close[1] and close[1]==close[0] and open[0]<close[0] and open[1]>=high[0] ? OnMeetingLine : na

bearish_ml = open[2]<close[2] and open[1]<close[1] and close[1]==close[0] and open[0]>close[0] and open[1]<=low[0] ? OnMeetingLine : na

//Kicking

bullish_kicking = open[1]>close[1] and open[1]==high[1] and close[1]==low[1] and open[0]>open[1] and open[0]==low[0] and close[0]==high[0] and close[0]-open[0]>open[1]-close[1] ? OnKicking : na

bearish_kicking = open[1]<close[1] and open[1]==low[1] and close[1]==high[1] and open[0]<open[1] and open[0]==high[0] and close[0]==low[0] and open[0]-close[0]>close[1]-open[1] ? OnKicking : na

//Ladder Bottom

ladder_bottom = open[4]>close[4] and open[3]>close[3] and open[3]<open[4] and open[2]>close[2] and open[2]<open[3] and open[1]>close[1] and open[1]<open[2] and open[0]<close[0] and open[0]>open[1] and low[4]>low[3] and low[3]>low[2] and low[2]>low[1] ? OnLadderBottom : na

// ---Plotting ---

plotshape(bullish_engulfing, text='Engulfing', style=shape.triangleup, color=#1FADA2, editable=true, title="Bullish Engulfing Text")

plotshape(bearish_engulfing,text='Engulfing', style=shape.triangledown, color=#F35A54, editable=true, title="Bearish Engulfing Text")

plotshape(bullish_harami,text='Harami', style=shape.triangleup, color=#1FADA2, editable=true, title="Bullish Harami Text")

plotshape(bearish_harami,text='Harami', style=shape.triangledown, color=#F35A54, editable=true, title="BEarish Harami Text")

plotshape(piercing_line,text='Piercing Line', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(dark_cloud_cover,text='Dark Cloud Cover', style=shape.triangledown, color=#F35A54, editable=false)

plotshape(morning_star,text='Morning Star', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(evening_star,text='Evening Star', style=shape.triangledown, color=#F35A54, editable=false)

plotshape(bullish_belt_hold,text='Belt Hold', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(bearish_belt_hold,text='Belt Hold', style=shape.triangledown, color=#F35A54, editable=false)

plotshape(three_white_soldiers,text='Three White Soldiers', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(three_black_crows,text='Three Black Crows', style=shape.triangledown, color=#F35A54, editable=false)

plotshape(three_stars_in_the_south,text='3 Stars South', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(stick_sandwich,text='Stick Sandwich', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(bullish_ml,text='Meeting Line', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(bearish_ml,text='Meeting Line', style=shape.triangledown, color=#F35A54, editable=false)

plotshape(bullish_kicking,text='Kicking', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(bearish_kicking,text='Kicking', style=shape.triangledown, color=#F35A54, editable=false)

plotshape(ladder_bottom,text='Ladder Bottom', style=shape.triangleup, color=#1FADA2, editable=false)

// --- STRATEGY ---

SignalUp = bullish_engulfing or bullish_harami or piercing_line or morning_star or bullish_belt_hold or three_white_soldiers or three_stars_in_the_south or stick_sandwich or bullish_ml or bullish_kicking or ladder_bottom

SignalDown = bearish_engulfing or bearish_harami or dark_cloud_cover or evening_star or bearish_belt_hold or three_black_crows or bearish_ml or bearish_kicking

strategy.entry("long", true, when = SignalUp and session_open)

strategy.entry("short", false, when = SignalDown and session_open)

strategy.close("long", when = not session_open)

strategy.close("short", when = not session_open)

strategy.exit("Risk Exit long", from_entry = "long", profit = tp, trail_points = trail, loss = sl)

strategy.exit("Risk Exit short", from_entry = "short", profit = tp, trail_points = trail, loss = sl )