持続可能なトレーリングストップ取引戦略

概要

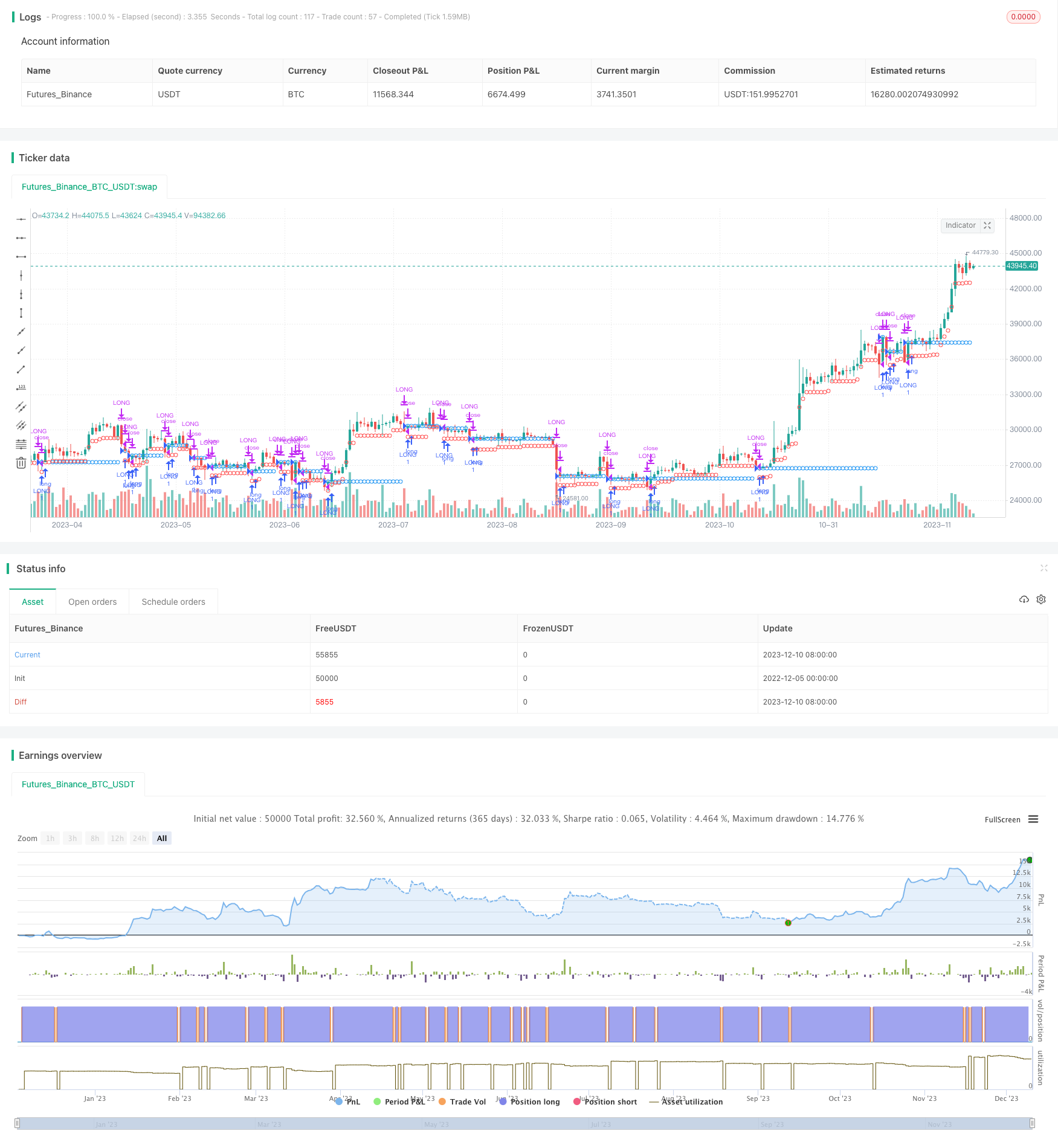

サステナブル・トラッキング・ストップ・ローズ取引戦略は,仮想通貨取引のための自動取引戦略である.これは,トラッキング・ストップ・ローズと部分停止の機能を備えており,持続可能な成長の取引目標を達成することができる.

戦略原則

この戦略は,ストップ・ロスを設定し,ストップ・ロスを追跡することで取引目標を達成する.具体的には,ポジションを開く際に初期ストップ・ロスが設定される.価格が好調であるとき,ストップ・ロスは価格とともに一定割合で移動し,利益の一部をロックする.価格が不利な方向に逆転したとき,ストップ・ロスは変更されず,損失を制限する.

この戦略は,多額と空白の2つの形式に分かれます.多額を選択すると,多額条件を満たす場合は,現在の価格で多額を開き,初期ストップ・ロスの価格を設定します.その後,1%の上昇ごとに,ストップ・ロスの価格は固定パーセントを上値に調整します.価格の低下がストップ・ロスを引き起こすか,平仓条件を満たすときは,現在のポジションを平らにします.空白の状況も同様です.

優位分析

この戦略の最大の利点は,ストップと部分ストップを追跡でき,利益を保証しながらリスクを制御し,取引口座の持続可能な成長を可能にすることです.この戦略は,状況がどうであれ,取引者が利益の一部をロックして,損失を拡大するのを避けるのに役立ちます.さらに,この戦略のパラメータは,異なるリスクの好みに合わせて調整できます.

リスク分析

この戦略の主なリスクは,ストップポイントがあまりにも近づいていることであり,短期市場の騒音によって引き起こされる可能性がある.さらに,部分ストップの割合が過大であることも,利益区間を制限する.これらのリスクを軽減するために,ストップポイントを適切に緩和し,部分ストップパラメータを最適化することができる.

最適化の方向

この戦略は以下の方向から最適化できます.

ポジション開設と停止条件の最適化,ポジション開設の精度向上

ストップポイント比率を最適化し,ストップを保証しながら利益を最大化します.

利潤を固定する為の 停止条件の追加

パラメータ化制御を追加し,戦略の柔軟性を向上させる

要約する

この戦略は,全体として,非常に実戦的な価値のある自動取引戦略である. 自動で止損と停止を管理し,アカウントの持続可能な成長を可能にすることができる. 参数調整と最適化により,この戦略は,異なる市場状況に適用され,投資家の異なるリスク好みを満たすことができる. 全体的に,この戦略は,推奨される仮想通貨取引戦略である.

/*backtest

start: 2022-12-05 00:00:00

end: 2023-12-11 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// -----------------------------------------------------------------------------

// Copyright 2019 Mauricio Pimenta | exit490

// Trailing Stop Loss script may be freely distributed under the MIT license.

//

// Permission is hereby granted, free of charge,

// to any person obtaining a copy of this software and associated documentation files (the "Software"),

// to deal in the Software without restriction, including without limitation the rights to use, copy, modify, merge,

// publish, distribute, sublicense, and/or sell copies of the Software, and to permit persons to whom the Software is furnished to do so,

// subject to the following conditions:

//

// The above copyright notice and this permission notice shall be included in all copies or substantial portions of the Software.

//

// THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

// EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

// FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM,

// DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

// OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

//

// -----------------------------------------------------------------------------

//

// Authors: @exit490

// Revision: v1.0.0

// Date: 03-Aug-2019

//

// DESCRIPTION

// ===========

//

// This TradingView strategy it is designed to integrate with other strategies with indicators.

// It performs a trailing stop loss from entry and exit conditions.

// In this strategy you can add conditions for long and short positions.

// The strategy will ride up your stop loss when price moviment 1%.

// The strategy will close your operation when the market price crossed the stop loss.

// Also is possible to select the period that strategy will execute the backtest.

//

// The strategy has the following parameters:

// INITIAL STOP LOSS - Where can isert the value to first stop.

// POSITION TYPE - Where can to select trade position.

// BACKTEST PERIOD - To select range.

//

// -----------------------------------------------------------------------------

//

// DISCLAIMER:

// 1. I am not licensed financial advisors or broker dealers. I do not tell you

// when or what to buy or sell. I developed this software which enables you

// execute manual or automated trades multiple trades using TradingView. The

// software allows you to set the criteria you want for entering and exiting

// trades.

// 2. Do not trade with money you cannot afford to lose.

// 3. I do not guarantee consistent profits or that anyone can make money with no

// effort. And I am not selling the holy grail.

// 4. Every system can have winning and losing streaks.

// 5. Money management plays a large role in the results of your trading. For

// example: lot size, account size, broker leverage, and broker margin call

// rules all have an effect on results. Also, your Take Profit and Stop Loss

// settings for individual pair trades and for overall account equity have a

// major impact on results. If you are new to trading and do not understand

// these items, then I recommend you seek education materials to further your knowledge.

//

// YOU NEED TO FIND AND USE THE TRADING SYSTEM THAT WORKS BEST FOR YOU AND YOUR

// TRADING TOLERANCE.

//

// I HAVE PROVIDED NOTHING MORE THAN A TOOL WITH OPTIONS FOR YOU TO TRADE WITH THIS PROGRAM ON TRADINGVIEW.

//

// I accept suggestions to improve the script.

// If you encounter any problems I will be happy to share with me.

// -----------------------------------------------------------------------------

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

strategy("TRAILING STOP LOSS TO LONG AND SHORT", overlay=true)

// === ADD YOUR CONTIDIONAL HERE ====

hasEntryLongConditional() => 1 == 1

hasCloseLongConditional() => 1 != 1

hasEntryShortConditional() => 1 == 1

hasCloseShortConditional() => 1 != 1

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

// === BACKTEST RANGE ===

backTestSectionFrom = input(title = "═══════════════ FROM ═══════════════", defval = true, type = input.bool)

FromMonth = input(defval = 1, title = "Month", minval = 1)

FromDay = input(defval = 1, title = "Day", minval = 1)

FromYear = input(defval = 2014, title = "Year", minval = 2014)

backTestSectionTo = input(title = "════════════════ TO ════════════════", defval = true, type = input.bool)

ToMonth = input(defval = 31, title = "Month", minval = 1)

ToDay = input(defval = 12, title = "Day", minval = 1)

ToYear = input(defval = 9999, title = "Year", minval = 2014)

backTestPeriod() => (time > timestamp(FromYear, FromMonth, FromDay, 00, 00)) and (time < timestamp(ToYear, ToMonth, ToDay, 23, 59))

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

parameterSection = input(title = "═════════════ STRATEGY ═════════════", defval = true, type = input.bool)

// === INPUT TO SELECT POSITION ===

positionType = input(defval="LONG", title="Position Type", options=["LONG", "SHORT"])

// === INPUT TO SELECT INITIAL STOP LOSS

initialStopLossPercent = input(defval = 3.0, minval = 0.0, title="Initial Stop Loss")

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

// === GLOBAL VARIABLES AND FUNCTIONS TO STORE IMPORTANT CONDITIONALS

stopLossPercent = positionType == "LONG" ? initialStopLossPercent * -1 : initialStopLossPercent

var entryPrice = 0.0

var updatedEntryPrice = 0.0

var stopLossPrice = 0.0

hasOpenTrade() => strategy.opentrades != 0

notHasOpenTrade() => strategy.opentrades == 0

strategyClose() =>

if positionType == "LONG"

strategy.close("LONG", when=true)

else

strategy.close("SHORT", when=true)

strategyOpen() =>

if positionType == "LONG"

strategy.entry("LONG", strategy.long, when=true)

else

strategy.entry("SHORT", strategy.short, when=true)

isLong() => positionType == "LONG" ? true : false

isShort() => positionType == "SHORT" ? true : false

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

// === LOGIC TO TRAILING STOP IN LONG POSITION

if (isLong() and backTestPeriod())

crossedStopLoss = close <= stopLossPrice

terminateOperation = hasOpenTrade() and (crossedStopLoss or hasCloseLongConditional())

if (terminateOperation)

entryPrice := 0.0

updatedEntryPrice := entryPrice

stopLossPrice := 0.0

strategyClose()

startOperation = notHasOpenTrade() and hasEntryLongConditional()

if(startOperation)

entryPrice := close

updatedEntryPrice := entryPrice

stopLossPrice := entryPrice + (entryPrice * stopLossPercent) / 100

strategyOpen()

strategyPercentege = (close - updatedEntryPrice) / updatedEntryPrice * 100.00

rideUpStopLoss = hasOpenTrade() and strategyPercentege > 1

if (isLong() and rideUpStopLoss)

stopLossPercent := stopLossPercent + strategyPercentege - 1.0

newStopLossPrice = updatedEntryPrice + (updatedEntryPrice * stopLossPercent) / 100

stopLossPrice := max(stopLossPrice, newStopLossPrice)

updatedEntryPrice := stopLossPrice

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

// === LOGIC TO TRAILING STOP IN SHORT POSITION

if (isShort() and backTestPeriod())

crossedStopLoss = close >= stopLossPrice

terminateOperation = hasOpenTrade() and (crossedStopLoss or hasCloseShortConditional())

if (terminateOperation)

entryPrice := 0.0

updatedEntryPrice := entryPrice

stopLossPrice := 0.0

strategyClose()

startOperation = notHasOpenTrade() and hasEntryShortConditional()

if(startOperation)

entryPrice := close

updatedEntryPrice := entryPrice

stopLossPrice := entryPrice + (entryPrice * stopLossPercent) / 100

strategyOpen()

strategyPercentege = (close - updatedEntryPrice) / updatedEntryPrice * 100.00

rideDownStopLoss = hasOpenTrade() and strategyPercentege < -1

if (rideDownStopLoss)

stopLossPercent := stopLossPercent + strategyPercentege + 1.0

newStopLossPrice = updatedEntryPrice + (updatedEntryPrice * stopLossPercent) / 100

stopLossPrice := min(stopLossPrice, newStopLossPrice)

updatedEntryPrice := stopLossPrice

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

// === DRAWING SHAPES

entryPricePlotConditinal = entryPrice == 0.0 ? na : entryPrice

trailingStopLossPlotConditional = stopLossPrice == 0.0 ? na : stopLossPrice

plotshape(entryPricePlotConditinal, title= "Entry Price", color=color.blue, style=shape.circle, location=location.absolute, size=size.tiny)

plotshape(trailingStopLossPlotConditional, title= "Stop Loss", color=color.red, style=shape.circle, location=location.absolute, size=size.tiny)