デュアル指標定量戦略

作成日:

2023-12-21 10:59:16

最終変更日:

2023-12-21 10:59:16

コピー:

1

クリック数:

673

1

フォロー

1628

フォロワー

概要

この戦略は123の反転指標とRAVI指標を組み合わせて取引信号を生成する.その中,123の反転は反転戦略であり,株価の2日連続の動きを利用して将来の価格動きを判断する.RAVI指標は,価格が超買い超売り領域に入っているかどうかを判断する.この戦略は,2つの信号の総合的な判断によって,空白を余計にすることを決定する.

戦略原則

123 回転する

この指標は,ランダムな指標K値に基づいている.具体的には,当日の閉盘価格が前2日より低く,そして9日のランダムな慢線が50より低ければ多すぎる.当日の閉盘価格が前2日より高く,そして9日のランダムな快線が50より高ければ空いている.このように,逆転点によって入場を確認する.

RAVI指標

この指標は,快線と慢線の離散によって買いを判断する.具体的には,7日平均線と65日平均線の離散である.あるパラメータより大きい時は多し,あるパラメータより小さい時は空し.快慢線金叉死叉によって超買超売り区間判断する.

戦略信号

123の反転とRAVIの同向多空の時に信号が生成する。多空の信号は2つの指標に同1であり,空の信号は2つの指標に同-1である。このように,二重指標によって確認し,単一の指標の誤信号を避ける。

優位分析

- 2つの指標を組み合わせることで,信号の正確性を高め,誤信号を回避できます.

- 123 反転的にK線情報を採用し,RAVIは均線情報を採用し,多角度から市場を判断する

- RAVI パラメータは調整可能で,異なる品種と市場環境に最適化できます.

- 逆転加算で,逆転を捉えることも,トレンドをたどることもできます.

リスクと最適化

- 二重指標の組み合わせで,信号不一致が生じやすい.価格差のパラメータを考慮し,二つの指標価格が特定のパラメータ内で異なる場合でも信号を出せる.

- 123反転は高周波戦略であり,他の低周波戦略と組み合わせて取引頻度を低下させる必要があります.

- RAVIは中長期トレンドを把握し,Combineは中長期トレンドを把握し,戦略のリスク耐性を高めます.

要約する

この戦略は,反転要因とトレンド要因を総合的に考慮し,双指標確認によって誤信号発射の確率を減らす.次のステップは,機械学習アルゴリズムを導入し,自適應パラメータの最適化を実現する.または,戦略の組み合わせを考慮し,他の戦略タイプとの組み合わせを形成し,利益を維持しながら最大限の反転を減らす.

ストラテジーソースコード

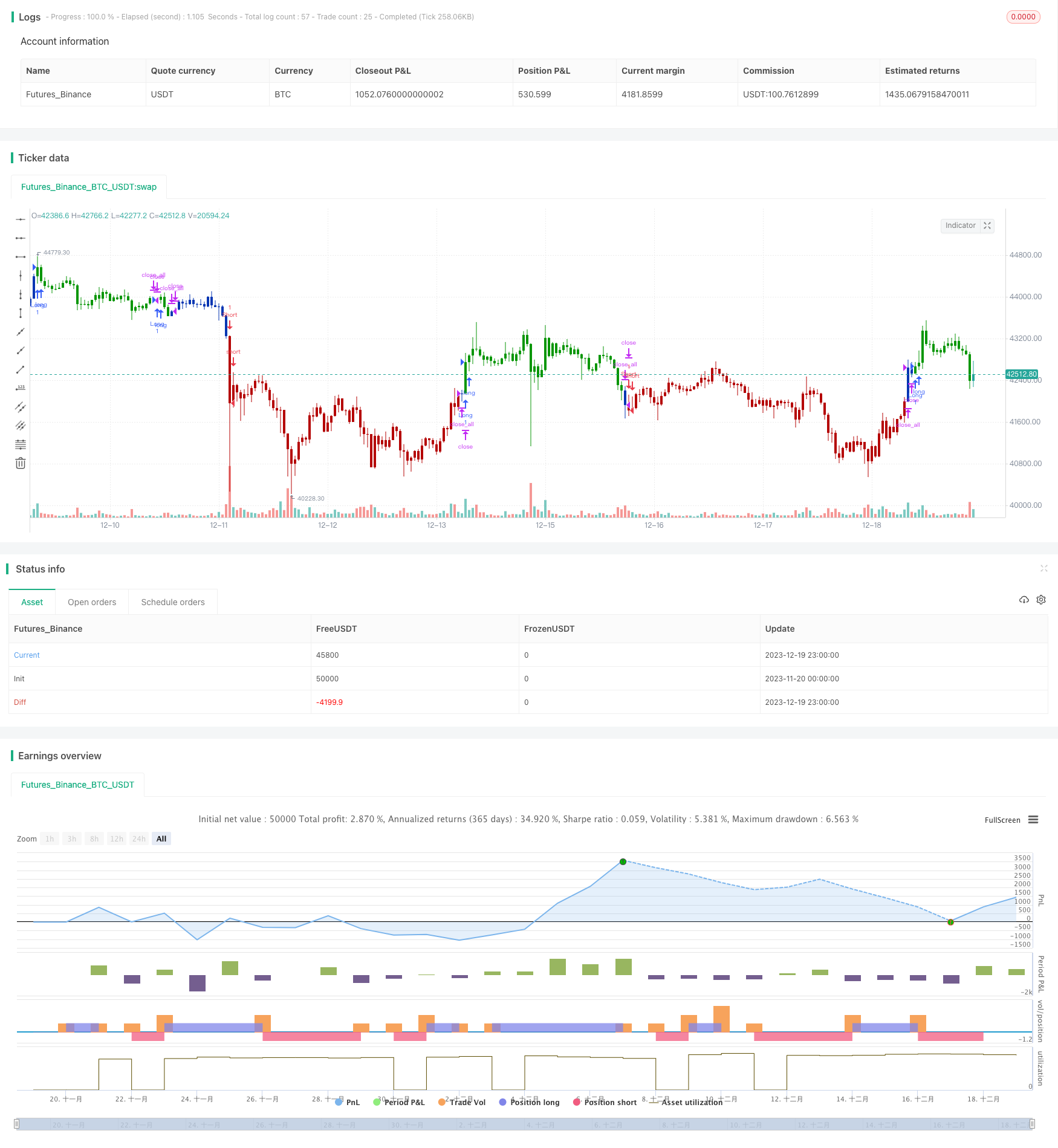

/*backtest

start: 2023-11-20 00:00:00

end: 2023-12-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 31/05/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The indicator represents the relative convergence/divergence of the moving

// averages of the financial asset, increased a hundred times. It is based on

// a different principle than the ADX. Chande suggests a 13-week SMA as the

// basis for the indicator. It represents the quarterly (3 months = 65 working days)

// sentiments of the market participants concerning prices. The short moving average

// comprises 10% of the one and is rounded to seven.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

RAVI(LengthMAFast, LengthMASlow, TradeLine) =>

pos = 0.0

xMAF = sma(close, LengthMAFast)

xMAS = sma(close, LengthMASlow)

xRAVI = ((xMAF - xMAS) / xMAS) * 100

pos:= iff(xRAVI > TradeLine, 1,

iff(xRAVI < TradeLine, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Range Action Verification Index (RAVI)", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Range Action Verification Index (RAVI) ----")

LengthMAFast = input(title="Length MA Fast", defval=7)

LengthMASlow = input(title="Length MA Slow", defval=65)

TradeLine = input(0.14, step=0.01)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posRAVI = RAVI(LengthMAFast, LengthMASlow, TradeLine)

pos = iff(posReversal123 == 1 and posRAVI == 1 , 1,

iff(posReversal123 == -1 and posRAVI == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )