並列移動平均と無限インパルス応答移動平均戦略

概要

これは,移動平均,無限脈動応答平均 (IIR) と自適性線形移動平均 (ALMA) を使用した量化戦略である.この戦略には,複数の指標の組み合わせがあり,トレーダーに豊富な取引シグナルを提供することができる.

戦略原則

この戦略は以下の部分から構成されています.

SMA,ALMA,IIRを組み合わせて,それらの間の交差信号を取引入場時刻として検出する.

3つの異なる周期のIIRを使用し,それらの間の距離を計算して,価格が圧縮状態にあるかどうかを判断します.圧縮状態は,波動性の減少を代表し,しばしば価格がより大きな変化を起こすことを予告します.

IIRの傾きを判断する.傾きが上がるときは緑色,下がるときは青色である。IIRの動きを直感的に判断できる。

SMA間の距離が拡大しているかどうかを計算し,もしそうなら,扇形の拡大を表す特殊なマークを付けます.これは通常,価格がトレンド状態に入っていることを意味します.

RSIが比較的弱く,超買超売のシグナルは,取引のシグナルの補足である.

この戦略は,上記のいくつかの部分を組み合わせて,より包括的で豊富な取引の入場,判断,退出信号を提供することができます.

戦略的優位分析

この戦略の最大の利点は,指標のポートフォリオが包括的で豊かで,トレンド判断だけでなく,波動率と超買い超売り状態も考慮し,取引決定に多次元的な参考を提供することです.

もう1つの優点は,パラメータと指標を簡単に調整し,最適化でき,ユーザーが自分のニーズに応じて関連する指標とパラメータを有効にすることができます.

リスク管理の観点から,この戦略は,急速な平均線と遅い平均線の両方に注目し,価格の変動による誤信号の確率を減らすことができます.

リスク分析

この戦略の主なリスクは,

複雑すぎて指標の衝突が起こりやすいため,特定のパラメータの組み合わせで選択すると過適合が起こりうる.

多組均線システムを使用すると,市場が急激に変化する時には (例えば,重大経済事件など) 損失が大きくなる可能性があります.

低深度反射は,実際の戦闘で一定の生存船バイアスのリスクがある可能性があります.

適用過程では,リスク管理に注意し,ポジションの規模を適切に調整し,戦略の実戦効果を確実にするため,より長い時間帯とより大きなデータセットで何度も反省する必要があります.

戦略最適化の方向性

この戦略の指標の組み合わせは複雑で,多くのパラメータを考慮して,以下の側面から最適化することができます.

関連性のない指標や矛盾する指標を削除する.

IIR平均線の選択を最適化して,市場特性に最も適合する長さを選択する.

快慢均線の組み合わせを最適化し,交差信号の安定性を高める.

機械学習モデルによる判断力を高め,戦略の適応力を向上させる.

全国指数との関連性を最適化し,トレンド判断の成功率を向上させる.

要約する

指標の柔軟な組み合わせと最適化により,この戦略は市場状況をより全面的に反映し,取引決定に多面的なサポートを提供します.しかし,一定の実用およびデータ過適合のリスクもあります.

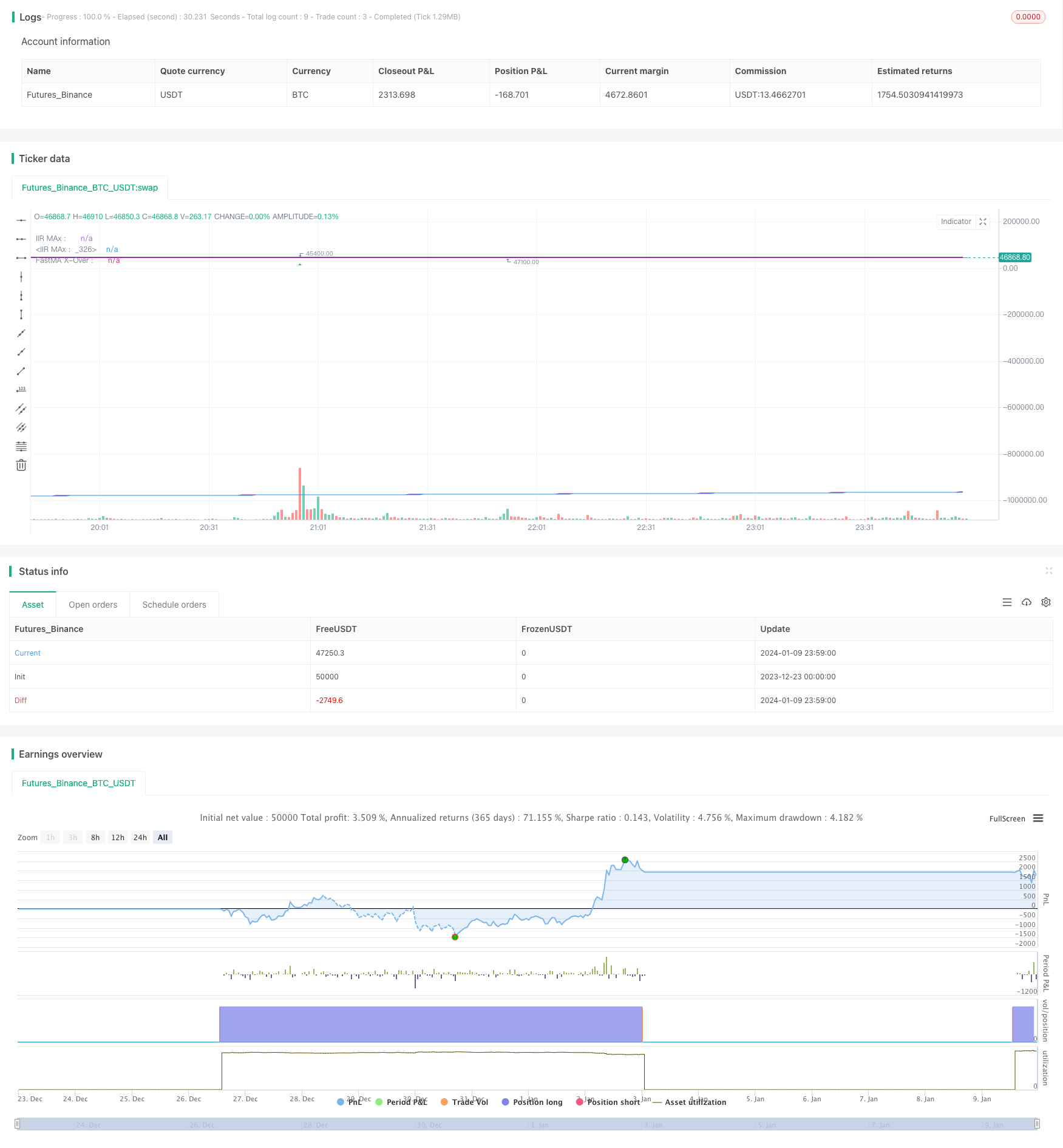

/*backtest

start: 2023-12-23 00:00:00

end: 2024-01-10 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//The plotchar UP/DOWN Arrows is the crossover of the fastest MA and fastest IIR MAs

//

//The dots at the bottom are the two simple averages crossing over

//

//The count over/under the candles is the count of bars that the SMAs on their

//respective resolution are fanning out.

//

//The colored background indicates a squeeze, lime=kinda tight : green=very tight squeeze. based on the 3 IIRs

//

//To answer my own question in a forum, looking at the code, i couldn't figure out how to get it from another timeframe

//and run the same calculations with the same results. My answer in the end was to scale the chosen MA length

//in the corresponding CurrentPeriod/ChosenMAPeriod proportion. This results in the same line in the same place when browsing through the

//different time resolutions. Somebody might find this invaluable

//

//The counts are for MA's fanning out, or going parabolic. Theres IIRs, Almas, one done of the other. A lot.

//The arrows above and below bars are from standard RSI numbers for OB/OS

//

//The IIRs changes color depending on their slope, which can be referenced easily with a variable.

//

//The backgrond on a bar-by-bar basis is colored when 2 sets of moving averages are in a squeeze, aka

//when price is consolidating.

//

//This aims to help the trader combine conditions and entry criteria of the trade and explore these options visually.

//They detail things from all time-frames on the current one. I prefer it because of the fractal nature of price-action, both large and small,

//either yesterday or last year. For best results, go long in short-term trades when the long-term trend is also up.

//and other profitable insights. This is also a great example of an automation algorith.

//

//The pretty ribbon is my script called 'Trading With Colors'. Use them together for fanciest results. 55/233 is my Fib Cross (golden/death) Compare it to the classic 50/200 if

//you get bored. I believe it simply works better, at least for Crypto.

//

//Evidently, I am a day-trader. But this yields higher profits on larger time-frames anyways, so do play around with it. Find what works for you.

//Thanks and credit for code snippets goes to:

//matryskowal

//ChrisMoody, probably twice

//Alex Orekhov (everget)

//author=LucF and midtownsk8rguy, for PineCoders

//If you use code from this, real quick search for perhaps the original and give them a shoutout too. I may have missed something

//Author: Sean Duffy

//@version=4

strategy(title = "Combination Parabolic MA/IIR/ALMA Strategy",

shorttitle = "MA-QuickE",

overlay = true )

// calc_on_order_fills = true,

// calc_on_every_tick = true,

// Input Variables

showFIBMAs = input(false, type=input.bool, title="═══════════════ Show Fibby MAs ═══════════════")

maRes = input(960, type=input.integer, title="MA-Cross Resolution")

mal1 = input(8, type=input.integer, title="MA#1 Length")

mal2 = input(13, type=input.integer, title="MA#2 Length")

mal3 = input(34, type=input.integer, title="MA#3 Length")

loosePercentClose = input(1.1, type=input.float, title="SMA LooseSqueeze Percent")

showIIRs = input(false, type=input.bool, title="═══════════════════ Show IIRs ═══════════════════")

iirRes = input(60, type=input.integer, title="IIR Resolution")

percentClose = input(title="IIR Squeeze PercentClose", type=input.float, defval=.8)

iirlength1 = input(title="IIR Length 1", type=input.integer, defval=34)

iirlength2 = input(title="IIR Length 2", type=input.integer, defval=144)//input(title="ATR Period", type=input.integer, defval=1)

iirlength3 = input(title="IIR Length 3", type=input.integer, defval=720)//input(title="ATR Period", type=input.integer, defval=1)

showIIR1 = input(true, type=input.bool, title="Show IIR1")

showIIR2 = input(true, type=input.bool, title="Show IIR2")

showIIR3 = input(true, type=input.bool, title="Show IIR3")

showCounts = input(true, type=input.bool, title="═════════════ Show Parabolic MA Counts ════════════")

showSignals = input(true, type=input.bool, title="══════════════ Show Buy/Sell Signals ══════════════")

showBackground = input(true, type=input.bool, title="══════════════ Show Background Colors ══════════════")

//runStrategy = input(true, type=input.bool, title="══════════════ Run Strategy ══════════════")

debug = input(false, type=input.bool, title="══════════════ Show Debug ══════════════")

barLookbackPeriod = input(title="══ Bar Lookback Period ══", type=input.integer, defval=5)

percentageLookbackPeriod = input(title="══ Percentage Lookback Period ══", type=input.integer, defval=1)

bullcolor = color.green

bearcolor = color.red

color bgcolor = na

var bool slope1Green = na

var bool slope2Green = na

var bool slope3Green = na

var bool buySignal = na

var bool sellSignal = na

var bool bigbuySignal = na

var bool bigsellSignal = na

bool smbuySignal = false

bool smsellSignal = false

var bool insqueeze = na

var bool intightsqueeze = na

var bool infastsqueeze = na

var bool awaitingEntryIn = false

// My counting variables

var int count1 = 0

var float madist1 = 0

var int count2 = 0

var float madist2 = 0

var int sinceSmSignal = 0

var entryPrice = 0.0

var entryBarIndex = 0

var stopLossPrice = 0.0

// var updatedEntryPrice = 0.0

// var alertOpenPosition = false

// var alertClosePosition = false

// var label stopLossPriceLabel = na

// var line stopLossPriceLine = na

positionType = "LONG" // Strategy type, and the only current option

hasOpenPosition = strategy.opentrades != 0

hasNoOpenPosition = strategy.opentrades == 0

strategyClose() =>

if (hasOpenPosition)

if positionType == "LONG"

strategy.close("LONG", when=true)

else

strategy.close("SHORT", when=true)

strategyOpen() =>

if (hasNoOpenPosition)

if positionType == "LONG"

strategy.entry("LONG", strategy.long, when=true)

else

strategy.entry("SHORT", strategy.short, when=true)

checkEntry() =>

buysignal = false

if (hasNoOpenPosition)

strategyOpen()

buysignal := true

// if (slope1Green and (trend1Green or trend2Green) and awaitingEntryIn and hasNoOpenPosition)

// strategyOpen()

// buysignal := true

buysignal

checkExit() =>

sellsignal = false

// if (trend1Green == false and trend2Green == false) // to later have quicker exit strategy

// sellsignal := true

// strategyClose()

if (hasOpenPosition)

sellsignal := true

strategyClose()

sellsignal

multiplier(_adjRes, _adjLength) => // returns adjusted length

multiplier = _adjRes/timeframe.multiplier

round(_adjLength*multiplier)

//reset the var variables before new calculations

buySignal := false

sellSignal := false

smbuySignal := false

smsellSignal := false

bigbuySignal := false

bigsellSignal := false

ma1 = sma(close, multiplier(maRes, mal1))

ma2 = sma(close, multiplier(maRes, mal2))

ma3 = sma(close, multiplier(maRes, mal3))

madist1 := abs(ma1 - ma2)

madist2 := abs(ma1 - ma3) // check if MA's are fanning/going parabolic

if (ma1 >= ma2 and ma2 >= ma3 and madist1[0] > madist1[1]) //and abs(dataB - dataC >= madist2) // dataA must be higher than b, and distance between gaining, same with C

count1 := count1 + 1

else

count1 := 0

if (ma1 <= ma2 and ma2 <= ma3 and madist1[0] > madist1[1]) //<= madist2 and dataB <= dataC) //and abs(dataB - dataC >= madist2) // dataA must be higher than b, and distance between gaining, same with C

count2 := count2 + 1

else

count2 := 0

crossoverAB = crossover(ma1, ma2)

crossunderAB = crossunder(ma1, ma2)

plot(showFIBMAs ? ma1 : na, linewidth=3)

plot(showFIBMAs ? ma2 : na)

plot(showFIBMAs ? ma3 : na)

// Fast Squeese Check WORK IN PROGRESS

//

float singlePercent = close / 100

if max(madist1, madist2) <= singlePercent*loosePercentClose

bgcolor := color.yellow

infastsqueeze := true

else

infastsqueeze := false

// IIR MOVING AVERAGE

f(a) => a[0] // fixes mutable error

iirma(iirlength, iirsrc) =>

cf = 2*tan(2*3.14159*(1/iirlength)/2)

a0 = 8 + 8*cf + 4*pow(cf,2) + pow(cf,3)

a1 = -24 - 8*cf + 4*pow(cf,2) + 3*pow(cf,3)

a2 = 24 - 8*cf - 4*pow(cf,2) + 3*pow(cf,3)

a3 = -8 + 8*cf - 4*pow(cf,2) + pow(cf,3)

//----

c = pow(cf,3)/a0

d0 = -a1/a0

d1 = -a2/a0

d2 = -a3/a0

//----

out = 0.

out := nz(c*(iirsrc + iirsrc[3]) + 3*c*(iirsrc[1] + iirsrc[2]) + d0*out[1] + d1*out[2] + d2*out[3],iirsrc)

f(out)

iirma1 = iirma(multiplier(iirRes, iirlength1), close)

iirma2 = iirma(multiplier(iirRes, iirlength2), close)

iirma3 = iirma(multiplier(iirRes, iirlength3), close)

// adjusts length for current resolution now, length is lengthened/shortened accordingly, upholding exact placement of lines

// iirmaD1 = security(syminfo.tickerid, tostring(iirRes), iirma1, barmerge.gaps_on, barmerge.lookahead_on)

// iirmaD2 = security(syminfo.tickerid, tostring(iirRes), iirma2, barmerge.gaps_on, barmerge.lookahead_on)

// iirmaD3 = security(syminfo.tickerid, tostring(iirRes), iirma3, barmerge.gaps_on, barmerge.lookahead_on)

slope1color = slope1Green ? color.lime : color.blue

slope2color = slope2Green ? color.lime : color.blue

slope3color = slope3Green ? color.lime : color.blue

plot(showIIR1 and showIIRs ? iirma1 : na, title="IIR1", color=slope1color, linewidth=2, transp=30)

plot(showIIR2 and showIIRs ? iirma2 : na, title="IIR2", color=slope2color, linewidth=3, transp=30)

plot(showIIR3 and showIIRs ? iirma3 : na, title="IIR3", color=slope3color, linewidth=4, transp=30)

// checks slope of IIRs to create a boolean variable and and color it differently

if (iirma1[0] >= iirma1[1])

slope1Green := true

else

slope1Green := false

if (iirma2[0] >= iirma2[1])

slope2Green := true

else

slope2Green := false

if (iirma3[0] >= iirma3[1])

slope3Green := true

else

slope3Green := false

// calculate space between IIRs and then if the price jumps above both

//float singlePercent = close / 100 // = a single percent

var float distIIR1 = na

var float distIIR2 = na

distIIR1 := abs(iirma1 - iirma2)

distIIR2 := abs(iirma1 - iirma3)

if (distIIR1[0] < percentClose*singlePercent and close[0] >= iirma1[0])

if close[0] >= iirma2[0] and close[0] >= iirma3[0]

bgcolor := color.green

insqueeze := true

intightsqueeze := true

else

bgcolor := color.lime

insqueeze := true

intightsqueeze := false

else

insqueeze := false

intightsqueeze := false

// if (true)//sinceSmSignal > 0) // cutting down on fastest MAs noise

// sinceSmSignal := sinceSmSignal + 1

// if (crossoverAB)

// //checkEntry()

// //smbuySignal := true

// sinceSmSignal := 0

// if (crossunderAB) // and all NOT greennot (slope1Green and slope2Green and slope3Green)

// //checkExit()

// //smsellSignal := true

// sinceSmSignal := 0

// else

// sinceSmSignal := sinceSmSignal + 1

f_draw_infopanel(_x, _y, _line, _text, _color)=>

_rep_text = ""

for _l = 0 to _line

_rep_text := _rep_text + "\n"

_rep_text := _rep_text + _text

var label _la = na

label.delete(_la)

_la := label.new(

x=_x, y=_y,

text=_rep_text, xloc=xloc.bar_time, yloc=yloc.price,

color=color.black, style=label.style_labelup, textcolor=_color, size=size.normal)

posx = timenow + round(change(time)*60)

posy = highest(50)

// CONSTRUCTION ZONE

// TODO: program way to eliminate noise and false signals

// MAYBEDO: program it to differentiate between a moving average bump and a cross

// I think the best way would be to calculate the tangent line... OR

// Take the slope of both going back a couple bars and if it's close enough, its a bounce off

// and an excellent entry signal

// program in quickest exit, 2 bars next to eachother both closing under, as to avoid a single wick from

// prompting to close the trade

// Some other time, have it move SMA up or down depending on whether trending up or down. Then use those MA crosses

//THIS CHECKS THE SLOPE FROM CURRENT PRICE TO BACK 10 BARS

checkSlope(_series) => (_series[0]/_series[10])*100 // it now returns it as a percentage

doNewX = input(true, type=input.bool, title="══════════ Show misc MA Cross Strategy ══════════")

iirX = input(555, title="IIRx Length: ", type=input.integer)

iirXperiod = input(30, title="IIRx Period/TF: ", type=input.integer)

iirX2 = input(13, title="IIRx2 Length: ", type=input.integer)

iirX2period = input(5, title="IIRx2 Period/TF: ", type=input.integer) //15

almaXperiod = input(defval=15, title="Alma of IIR1 Period: ", type=input.integer)

almaXalpha = input(title="Alma Alpha Value: ", defval=.7, maxval=.95, type=input.float) // dont forget to try .99

almaXsigma = input(title="Alma Sigma Value: ", defval=500, type=input.float)

iirmaOTF = iirma(multiplier(iirXperiod, iirX), close)

iirma2OTF = iirma(multiplier(iirX2period, iirX2), close)

smaOTF = alma(iirmaOTF, almaXperiod, almaXalpha, almaXsigma) // maybe dont touch, its precise // I took the ALMA of the IIRMA, and i hope thats not cheating ;)

// I could have removed this. the multiplier function adjusts the length to fit the current timeframe while displaying the same

// smaXOTF = security(syminfo.tickerid, smaXperiod, smaOTF, barmerge.gaps_on, barmerge.lookahead_on)

// iirmaXOTF = security(syminfo.tickerid, iirXperiod, iirmaOTF, barmerge.gaps_on, barmerge.lookahead_on)

// iirmaX2OTF = security(syminfo.tickerid, iirX2period, iirma2OTF, barmerge.gaps_on, barmerge.lookahead_on)

plot(doNewX ? smaOTF : na, title="FastMA X-Over : ", color=color.blue, linewidth=1, transp=40)

plot(doNewX ? iirmaOTF : na, title="IIR MAx : ", color=color.purple, linewidth=1, transp=30)

plot(doNewX ? iirma2OTF : na, title="IIR MAx : ", color=color.purple, linewidth=2, transp=20)

iirma2Up = checkSlope(iirma2OTF) > 0 // just another slope up/down variable.

//calculate spaces between averages

distiiralma = abs(iirmaOTF - smaOTF)

crossoverFast = crossover(iirmaOTF, smaOTF) // and (iirmaOTF[1] <= smaOTF[1])

crossunderFast = crossunder(iirmaOTF, smaOTF) // and (iirmaOTF[1] >= smaOTF[1])

if (crossoverFast and iirma2Up == true and infastsqueeze == false and intightsqueeze == false) // and (count1 != 0))// or close[0] < (lowest(barLookbackPeriod) + singlePercent*3))) // must be at most a few percent up from a recent low. Avoid buying highs :P

buySignal := true

strategyOpen()

// if (slope1Green and slope2Green and slope3Green and infastsqueeze == false)

// checkEntry()

if (crossunderFast)

sellSignal := true

checkExit()

// I feel like I didn't cite the OG author for this panel correctly. I hope I did, but there are extentions of his/her work in multiple places.

// I could have gotten it confused.

if (debug)

f_draw_infopanel(posx, posy, 18, "distiiralma from IIR: " + tostring(distiiralma), color.lime)

//f_draw_infopanel(posx, posy, 16, "distiirs: " + tostring(distiirX1), color.lime)

f_draw_infopanel(posx, posy, 14, "Value of iirmaOTF: " + tostring(iirmaOTF), color.lime)

f_draw_infopanel(posx, posy, 6, "slope X: " + tostring(abs(100 - checkSlope(iirmaOTF))), color.lime)

f_draw_infopanel(posx, posy, 12, "value of smaOTF: " + tostring(smaOTF), color.lime)

f_draw_infopanel(posx, posy, 6, "slopeAlma: " + tostring(abs(100 - checkSlope(smaOTF))), color.lime)

f_draw_infopanel(posx, posy, 2, "slopeIIR2 " + tostring(abs(100 - checkSlope(iirma2OTF))), color.lime)

f_draw_infopanel(posx, posy, 2, "slopeIIR2 " + tostring(abs(100 - checkSlope(iirma2OTF))), color.lime)

// I kept this separate because it discludes the calculations. Its hard to hold a train of thought while fishing for the right section

bgcolor(showBackground ? bgcolor : na)

plotshape(showSignals ? buySignal : na, location=location.bottom, style=shape.circle, text="", size=size.tiny, color=color.blue, transp=60)

plotshape(showSignals ? sellSignal : na, location=location.bottom, style=shape.circle, text="", size=size.tiny, color=color.red, transp=60)

plotchar(showSignals and smbuySignal, title="smBuy", location=location.belowbar, char='↑', size=size.tiny, color=color.green, transp=0)

plotchar(showSignals and smsellSignal, title="smSell", location=location.abovebar, char='↓', size=size.tiny, color=color.orange, transp=0)

// can not display a variable. Can only match the count to a corresponding plotchar

// to display a non-constant variable, use the debug box, which was so kindly offered up by our community.

plotchar(showCounts and count1==1, title='', char='1', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==2, title='', char='2', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==3, title='', char='3', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==4, title='', char='4', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==5, title='', char='5', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==6, title='', char='6', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==7, title='', char='7', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==8, title='', char='8', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==9, title='', char='9', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1>=10, title='', char='$', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count2==1, title='', char='1', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==2, title='', char='2', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==3, title='', char='3', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==4, title='', char='4', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==5, title='', char='5', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==6, title='', char='6', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==7, title='', char='7', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==8, title='', char='8', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==9, title='', char='9', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2>=10, title='', char='$', location=location.abovebar, color=#e91e63, transp=0)

showRSIind = input(true, type=input.bool, title="═══════════════════ Show RSI Arrows ═══════════════════")

// Get user input

rsiSource = input(title="RSI Source", type=input.source, defval=close)

rsiLength = input(title="RSI Length", type=input.integer, defval=14)

rsiOverbought = input(title="RSI Overbought Level", type=input.integer, defval=80)

rsiOversold = input(title="RSI Oversold Level", type=input.integer, defval=20)

// Get RSI value

rsiValue = rsi(rsiSource, rsiLength)

isRsiOB = rsiValue >= rsiOverbought

isRsiOS = rsiValue <= rsiOversold

// Plot signals to chart

plotshape(isRsiOB, title="Overbought", location=location.abovebar, color=color.red, transp=0, style=shape.triangledown)

plotshape(isRsiOS, title="Oversold", location=location.belowbar, color=color.green, transp=0, style=shape.triangleup)

//reset the var variables before new calculations

buySignal := false

sellSignal := false

smbuySignal := false

smsellSignal := false

bigbuySignal := false

bigsellSignal := false