堅実なトレンドフォロー戦略

概要

この戦略は,SSLハイブリッドチャネル,QQE改良版,ワダアタ爆破指標の組み合わせに基づいて,安定したトレンド追跡戦略を実現している.BTCやETHなどの大型暗号通貨で安定した収益を上げることができ,中長線操作に適している.

戦略原則

入力論理

条件は以下の通りです.

- SSL混合チャネルのベースラインより高い終了価格

- QQE改良版の指標色が青に

- ワダアタ爆破指数は緑色に

裸足の入場条件:

- SSL混合チャネルのベースラインより低い閉店価格

- QQE改良版の指標色が赤になった

- ワダアタ爆破指数は赤に示されています.

出場論理

試合の条件:

- QQE改良版の指標色が赤になった

空頭出場条件:

- QQE改良版の指標色が青に

優位分析

この戦略は以下の利点があります.

3つの指標の組み合わせにより,取引シグナルの正確性と安定性が保証されます.

SSLチャネルベースラインとQQE改良版の指標は,トレンドの方向を効果的に捉えることができます.

ワダ・アタ・ブレイク指数は,偽のブレイクを防ぐため,取引信号をさらに検証しました.

コード構造は明確で,理解し,修正しやすい.

完全な停止,停止,リスク管理メカニズムで,リスクを効果的に制御できます.

長い時間周期 (例えば,1時間,4時間) の間では,反測のパフォーマンスは優れています.

リスク分析

この戦略には以下のリスクがあります.

短い周期で (例えば5分) 検査結果は劣る.

市場が大きく揺れ動いている場合,ストップ・ロスは頻繁に発動する可能性があります.

特定の暗号通貨の反省は不良かもしれない.

これらのリスクに対して,以下のような対策を講じることができます.

中長線での操作のみで,短線での使用は不適切である.

適当な緩解で止損幅を広げて,止損を頻繁にしないようにしてください.

この戦略の特徴に適合する暗号通貨を見つけるために,より多くの種類の暗号通貨をテストしてください.

最適化の方向

この戦略は,以下の点で改善できます.

異なるパラメータの設定をテストして,最適な組み合わせを見つけます.

機械学習の要素を加えることで,戦略をより適応的にします.

感情の指標などの複数の要因を組み合わせて,システムの全体的な安定性を高めます.

業界特性を研究し,特定の業界に戦略を適用するためにパラメータを調整します.

アルゴリズムの取引モジュールを追加し,プログラム化された注文を利用し,リターンを向上させる.

要約する

この戦略は,全体として推奨されます. それは,安定し,理解しやすい,完全なリスク管理システムがあります. 適切な品種と時間周期で,良い利益を得ることができます. この戦略は,継続的な最適化と調整によって,効率的な量的な投資ツールになることができます.

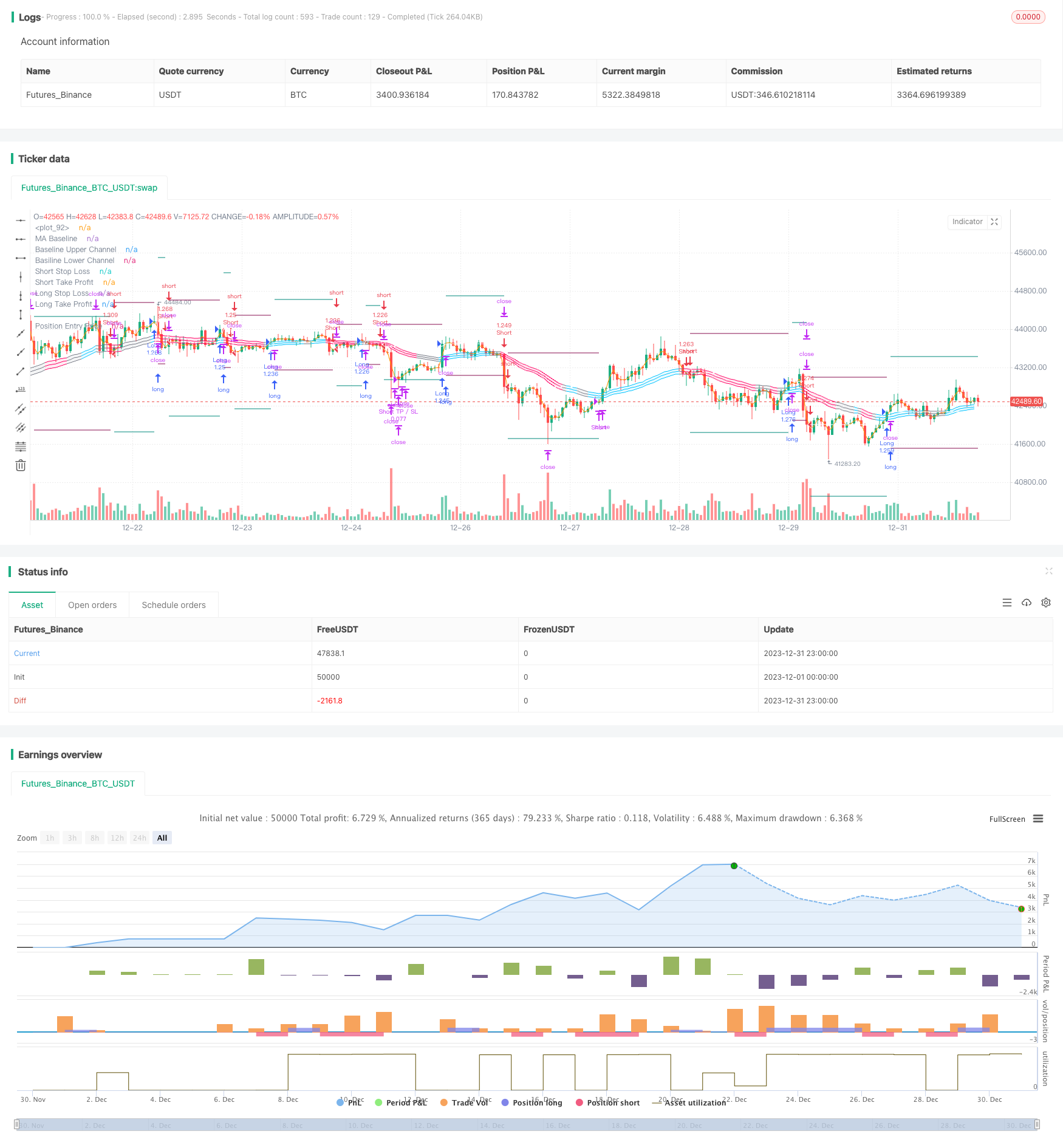

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © fpemehd

// Thanks to myncrypto, jason5480, kevinmck100

// @version=5

strategy(title = '[D] SSL Hybrid + QQE MOD + Waddah Attar Strategy',

shorttitle = '[D] SQW Strategy',

overlay = true,

pyramiding = 0,

currency = currency.USD,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

commission_value = 0.1,

initial_capital = 100000,

max_bars_back = 500,

max_lines_count = 150,

max_labels_count = 300)

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Time, Direction, Etc - Basic Settings Inputs

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// 1. Time: Based on UTC +09:00

i_start = input (defval = timestamp("20 Jan 1990 00:00 +0900"), title = "Start Date", tooltip = "Choose Backtest Start Date", inline = "Start Date", group = "Time" )

i_end = input (defval = timestamp("20 Dec 2030 00:00 +0900"), title = "End Date", tooltip = "Choose Backtest End Date", inline = "End Date", group = "Time" )

inTime = true

// 2. Inputs for direction: Long? Short? Both?

i_longEnabled = input.bool (defval = true , title = "Long?", tooltip = "Enable Long Position Trade?", inline = "Long / Short", group = "Long / Short" )

i_shortEnabled = input.bool (defval = true , title = "Short?", tooltip = "Enable Short Position Trade?", inline = "Long / Short", group = "Long / Short" )

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Filter - Inputs, Indicaotrs

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// 3. Use Filters? What Filters?

//// 3-1. ATR Filter

i_ATRFilterOn = input.bool (defval = false , title = "ATR Filter On?", tooltip = "ATR Filter On? Order will not be made unless filter condition is fulfilled", inline = "1", group = "Filters")

i_ATRFilterLen = input.int (defval = 14, title = "Length for ATR Filter", minval = 1 , maxval = 100 , step = 1 , tooltip = "", inline = "2", group = "Filters")

i_ATRSMALen = input.int (defval = 40, title = "SMA Length for ATR SMA", minval = 1 , maxval = 100000 , step = 1 , tooltip = "ATR should be bigger than this", inline = "2", group = "Filters")

bool ATRFilter = ta.atr(i_ATRFilterLen) >= ta.sma(ta.atr(length = i_ATRFilterLen), i_ATRSMALen) ? true : false

//// 3-2. EMA Filter

i_EMAFilterOn = input.bool (defval = false , title = "EMA Filter On?", tooltip = "EMA Filter On? Order will not be made unless filter condition is fulfilled", inline = "3", group = "Filters")

i_EMALen = input.int (defval = 200, title = "EMA Length", minval = 1 , maxval = 100000 , step = 1 , tooltip = "EMA Length", inline = "4", group = "Filters")

bool longEMAFilter = close >= ta.ema(source = close, length = i_EMALen) ? true : false

bool shortEMAFilter = close <= ta.ema(source = close, length = i_EMALen) ? true : false

plot(i_EMAFilterOn ? ta.ema(source = close, length = i_EMALen) : na, title = "EMA Filter", color = color.new(color = color.orange , transp = 0), linewidth = 1)

//// 3-3. ADX Filter

//// 3-4. DMI Filter (Uses same ADX Length)

i_ADXFilterOn = input.bool (defval = false , title = "ADX Filter On?", tooltip = "ADX Filter On? Order will not be made unless filter condition is fulfilled", inline = "5", group = "Filters")

i_DMIFilterOn = input.bool (defval = false , title = "DMI Filter On?", tooltip = "DMI (Directional Moving Index) Filter On? Order will not be made unless filter condition is fulfilled", inline = "6", group = "Filters")

i_ADXLength = input.int (defval = 20, title = "ADX Length", minval = 1 , maxval = 100000 , step = 1 , tooltip = "ADX Length", inline = "7", group = "Filters")

i_ADXThreshold = input.int (defval = 25, title = "ADX Threshold", minval = 1 , maxval = 100000 , step = 1 , tooltip = "ADX should be bigger than threshold", inline = "8", group = "Filters")

//// 3-5. SuperTrend Filter

i_superTrendFilterOn = input.bool (defval = false , title = "Super Trend Filter On?", tooltip = "Super Trend Filter On? Order will not be made unless filter condition is fulfilled", inline = "9", group = "Filters")

i_superTrendATRLen = input.int (defval = 10, title = "ATR Length", minval = 1 , maxval = 100000 , step = 1 , tooltip = "Super Trend ATR Length", inline = "10", group = "Filters")

i_superTrendATRFactor = input.float (defval = 3, title = "Factor", minval = 1 , maxval = 100000 , step = 0.1 , tooltip = "Super Trend ATR Factor", inline = "11", group = "Filters")

// ADX and DI Thanks to @BeikabuOyaji

int len = i_ADXLength

float th = i_ADXThreshold

TR = math.max(math.max(high - low, math.abs(high - nz(close[1]))), math.abs(low - nz(close[1])))

DMPlus = high - nz(high[1]) > nz(low[1]) - low ? math.max(high - nz(high[1]), 0) : 0

DMMinus = nz(low[1]) - low > high - nz(high[1]) ? math.max(nz(low[1]) - low, 0) : 0

SmoothedTR = 0.0

SmoothedTR := nz(SmoothedTR[1]) - nz(SmoothedTR[1]) / len + TR

SmoothedDMPlus = 0.0

SmoothedDMPlus := nz(SmoothedDMPlus[1]) - nz(SmoothedDMPlus[1]) / len + DMPlus

SmoothedDMMinus = 0.0

SmoothedDMMinus := nz(SmoothedDMMinus[1]) - nz(SmoothedDMMinus[1]) / len + DMMinus

DIPlus = SmoothedDMPlus / SmoothedTR * 100

DIMinus = SmoothedDMMinus / SmoothedTR * 100

DX = math.abs(DIPlus - DIMinus) / (DIPlus + DIMinus) * 100

ADX = ta.sma(source = DX, length = len)

// plot(DIPlus, color=color.new(color.green, 0), title='DI+')

// plot(DIMinus, color=color.new(color.red, 0), title='DI-')

// plot(ADX, color=color.new(color.navy, 0), title='ADX')

// hline(th, color=color.white)

bool ADXFilter = ADX > th ? true : false

bool longDMIFilter = DIPlus >= DIMinus ? true : false

bool shortDMIFilter = DIPlus <= DIMinus ? true : false

// Calculate Super Trend for Filter

[supertrend, direction] = ta.supertrend(factor = i_superTrendATRFactor, atrPeriod = i_superTrendATRLen)

bodyMiddle = plot((open + close) / 2, display=display.none)

upTrend = plot(i_superTrendFilterOn ? direction < 0 ? supertrend : na : na, "Up Trend", color = color.green, style=plot.style_linebr)

downTrend = plot(i_superTrendFilterOn ? direction < 0 ? na : supertrend : na, "Down Trend", color = color.red, style=plot.style_linebr)

fill(bodyMiddle, upTrend, color.new(color.green, 90), fillgaps=false)

fill(bodyMiddle, downTrend, color.new(color.red, 90), fillgaps=false)

bool longSTFilter = direction <= 0

bool shortSTFilter = direction >= 0

// Filter

bool longFilterFilled = (not i_ATRFilterOn or ATRFilter) and (not i_EMAFilterOn or longEMAFilter) and (not i_ADXFilterOn or ADXFilter) and (not i_DMIFilterOn or longDMIFilter) and (not i_superTrendFilterOn or longSTFilter)

bool shortFilterFilled = (not i_ATRFilterOn or ATRFilter) and (not i_EMAFilterOn or shortEMAFilter) and (not i_ADXFilterOn or ADXFilter) and (not i_DMIFilterOn or shortDMIFilter) and (not i_superTrendFilterOn or shortSTFilter)

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Strategy Logic (Entry & Exit Condition) - Inputs, Indicators for Strategy

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

//// Indicators

// Inputs for Strategy Indicators

//// 1. SSL Hybrid Baseline

i_useTrueRange = input.bool (defval = true, title = "use true range for Keltner Channel?", tooltip = "", inline = "1", group = "1: SSL Hybrid")

i_maType = input.string (defval ='EMA', title='Baseline Type', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'LSMA', 'WMA', 'VAMA', 'TMA', 'HMA', 'McGinley'], inline="2", group = "1: SSL Hybrid")

i_len = input.int (defval =30, title='Baseline Length', inline="2", group = "1: SSL Hybrid")

i_multy = input.float (defval = 0.2, title='Base Channel Multiplier', minval = 0, maxval = 100, step=0.05, inline="3", group = "1: SSL Hybrid")

i_volatility_lookback = input.int (defval =10, title='Volatility lookback length(for VAMA)', inline='4',group="1: SSL Hybrid")

tema(src, len) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

3 * ema1 - 3 * ema2 + ema3

f_ma(type, src, len) =>

float result = 0

if type == 'TMA'

result := ta.sma(ta.sma(src, math.ceil(len / 2)), math.floor(len / 2) + 1)

result

if type == 'LSMA'

result := ta.linreg(src, len, 0)

result

if type == 'SMA' // Simple

result := ta.sma(src, len)

result

if type == 'EMA' // Exponential

result := ta.ema(src, len)

result

if type == 'DEMA' // Double Exponential

e = ta.ema(src, len)

result := 2 * e - ta.ema(e, len)

result

if type == 'TEMA' // Triple Exponential

e = ta.ema(src, len)

result := 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

result

if type == 'WMA' // Weighted

result := ta.wma(src, len)

result

if type == 'VAMA' // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid = ta.ema(src, len)

dev = src - mid

vol_up = ta.highest(dev, i_volatility_lookback)

vol_down = ta.lowest(dev, i_volatility_lookback)

result := mid + math.avg(vol_up, vol_down)

result

if type == 'HMA' // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == 'McGinley'

mg = 0.0

mg := na(mg[1]) ? ta.ema(src, len) : mg[1] + (src - mg[1]) / (len * math.pow(src / mg[1], 4))

result := mg

result

result

//// 1-1. SSL Hybrid Keltner Baseline Channel

BBMC = f_ma (i_maType, close, i_len) // BaseLone

Keltma = f_ma (i_maType, close, i_len)

range_1 = i_useTrueRange ? ta.tr : high - low

rangema = ta.ema(range_1, i_len)

upperk = Keltma + rangema * i_multy

lowerk = Keltma - rangema * i_multy

//// 2. QQE MOD, thanks to Mihkel100

RSI_Period = input.int (defval = 6, title = 'RSI Length', inline = "1", group = "2: QQE MOD")

SF = input.int (defval = 5, title = 'RSI Smoothing', inline = "2", group = "2: QQE MOD")

QQE = input.float (defval = 3, title = 'Fast QQE Factor', inline = "3", group = "2: QQE MOD")

ThreshHold = input.int (defval = 3, title = 'Thresh-hold', inline = "4", group = "2: QQE MOD")

src = input (defval = close, title='RSI Source')

Wilders_Period = RSI_Period * 2 - 1

Rsi = ta.rsi(src, RSI_Period)

RsiMa = ta.ema(Rsi, SF)

AtrRsi = math.abs(RsiMa[1] - RsiMa)

MaAtrRsi = ta.ema(AtrRsi, Wilders_Period)

dar = ta.ema(MaAtrRsi, Wilders_Period) * QQE

longband = 0.0

shortband = 0.0

trend = 0

DeltaFastAtrRsi = dar

RSIndex = RsiMa

newshortband = RSIndex + DeltaFastAtrRsi

newlongband = RSIndex - DeltaFastAtrRsi

longband := RSIndex[1] > longband[1] and RSIndex > longband[1] ? math.max(longband[1], newlongband) : newlongband

shortband := RSIndex[1] < shortband[1] and RSIndex < shortband[1] ? math.min(shortband[1], newshortband) : newshortband

cross_1 = ta.cross(longband[1], RSIndex)

trend := ta.cross(RSIndex, shortband[1]) ? 1 : cross_1 ? -1 : nz(trend[1], 1)

FastAtrRsiTL = trend == 1 ? longband : shortband

////////////////////

length = input.int (defval = 50, minval = 1, title = 'Bollinger Length', group = "2: QQE MOD")

mult = input.float (defval = 0.35, minval = 0.01, maxval = 5, step = 0.1, title = 'BB Multiplier', group = "2: QQE MOD")

basis = ta.sma(FastAtrRsiTL - 50, length)

dev = mult * ta.stdev(FastAtrRsiTL - 50, length)

upper = basis + dev

lower = basis - dev

color_bar = RsiMa - 50 > upper ? #00c3ff : RsiMa - 50 < lower ? #ff0062 : color.gray

//

// Zero cross

QQEzlong = 0

QQEzlong := nz(QQEzlong[1])

QQEzshort = 0

QQEzshort := nz(QQEzshort[1])

QQEzlong := RSIndex >= 50 ? QQEzlong + 1 : 0

QQEzshort := RSIndex < 50 ? QQEzshort + 1 : 0

//

// Zero = hline(0, color=color.white, linestyle=hline.style_dotted, linewidth=1)

////////////////////////////////////////////////////////////////

RSI_Period2 = input.int (defval = 6, title = 'RSI 2 Length', group = "2: QQE MOD")

SF2 = input.int (defval = 5, title = 'RSI Smoothing', group = "2: QQE MOD")

QQE2 = input.float (defval = 1.61, title = 'Fast QQE2 Factor', group = "2: QQE MOD")

ThreshHold2 = input.int (defval = 3, title = 'Thresh-hold', group = "2: QQE MOD")

src2 = input (defval = close, title = 'RSI Source', group = "2: QQE MOD")

//

//

Wilders_Period2 = RSI_Period2 * 2 - 1

Rsi2 = ta.rsi(src2, RSI_Period2)

RsiMa2 = ta.ema(Rsi2, SF2)

AtrRsi2 = math.abs(RsiMa2[1] - RsiMa2)

MaAtrRsi2 = ta.ema(AtrRsi2, Wilders_Period2)

dar2 = ta.ema(MaAtrRsi2, Wilders_Period2) * QQE2

longband2 = 0.0

shortband2 = 0.0

trend2 = 0

DeltaFastAtrRsi2 = dar2

RSIndex2 = RsiMa2

newshortband2 = RSIndex2 + DeltaFastAtrRsi2

newlongband2 = RSIndex2 - DeltaFastAtrRsi2

longband2 := RSIndex2[1] > longband2[1] and RSIndex2 > longband2[1] ? math.max(longband2[1], newlongband2) : newlongband2

shortband2 := RSIndex2[1] < shortband2[1] and RSIndex2 < shortband2[1] ? math.min(shortband2[1], newshortband2) : newshortband2

cross_2 = ta.cross(longband2[1], RSIndex2)

trend2 := ta.cross(RSIndex2, shortband2[1]) ? 1 : cross_2 ? -1 : nz(trend2[1], 1)

FastAtrRsi2TL = trend2 == 1 ? longband2 : shortband2

//

// Zero cross

QQE2zlong = 0

QQE2zlong := nz(QQE2zlong[1])

QQE2zshort = 0

QQE2zshort := nz(QQE2zshort[1])

QQE2zlong := RSIndex2 >= 50 ? QQE2zlong + 1 : 0

QQE2zshort := RSIndex2 < 50 ? QQE2zshort + 1 : 0

//

hcolor2 = RsiMa2 - 50 > ThreshHold2 ? color.silver : RsiMa2 - 50 < 0 - ThreshHold2 ? color.silver : na

Greenbar1 = RsiMa2 - 50 > ThreshHold2

Greenbar2 = RsiMa - 50 > upper

Redbar1 = RsiMa2 - 50 < 0 - ThreshHold2

Redbar2 = RsiMa - 50 < lower

//// 3. Waddah Attar Explosion V2 shayankm

sensitivity = input.float (defval = 150, title='Sensitivity', inline = "1", group = "3: Waddah Attar Explosion")

fastLength = input.int (defval = 20, title='FastEMA Length', inline = "2", group = "3: Waddah Attar Explosion")

slowLength = input.int (defval = 40, title='SlowEMA Length', inline = "2", group = "3: Waddah Attar Explosion")

channelLength = input.int (defval = 20, title='BB Channel Length', inline = "3", group = "3: Waddah Attar Explosion")

w_mult = input.float (defval = 2.0, title='BB Stdev Multiplier', inline = "4", group = "3: Waddah Attar Explosion")

// DEAD_ZONE = nz(ta.rma(ta.tr(true), 100)) * 3.7

calc_macd(source, fastLength, slowLength) =>

fastMA = ta.ema(source, fastLength)

slowMA = ta.ema(source, slowLength)

fastMA - slowMA

calc_BBUpper(source, length, mult) =>

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

basis + dev

calc_BBLower(source, length, mult) =>

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

basis - dev

t1 = (calc_macd(close, fastLength, slowLength) - calc_macd(close[1], fastLength, slowLength)) * sensitivity

e1 = calc_BBUpper(close, channelLength, w_mult) - calc_BBLower(close, channelLength, w_mult)

trendUp = t1 >= 0 ? t1 : 0

trendDown = t1 < 0 ? -1 * t1 : 0

// Plot: Indicators

//// 1. SSL Hybrid

var bullSSLColor = #00c3ff

var bearSSLColor = #ff0062

// color_bar = color.new(color = close > upperk ? bullSSLColor : close < lowerk ? bearSSLColor : color.gray, transp = 0)

// i_show_color_bar = input.bool(defval = true , title = "Color Bars")

// barcolor(i_show_color_bar ? color_bar : na)

plot(series = BBMC, title = 'MA Baseline', color = color_bar, linewidth = 1, style = plot.style_line)

up_channel = plot(upperk, color=color_bar, title='Baseline Upper Channel')

low_channel = plot(lowerk, color=color_bar, title='Basiline Lower Channel')

fill(up_channel, low_channel, color.new(color=color_bar, transp=90))

//// 2. QQE MOD: No Plotting because of overlay option

// plot(FastAtrRsi2TL - 50, title='QQE Line', color=color.new(color.white, 0), linewidth=2)

// plot(RsiMa2 - 50, color=hcolor2, title='Histo2', style=plot.style_columns, transp=50)

// plot(Greenbar1 and Greenbar2 == 1 ? RsiMa2 - 50 : na, title='QQE Up', style=plot.style_columns, color=color.new(#00c3ff, 0))

// plot(Redbar1 and Redbar2 == 1 ? RsiMa2 - 50 : na, title='QQE Down', style=plot.style_columns, color=color.new(#ff0062, 0))

//// 3. Waddah Attar Explosion V2 shayankm

// plot(trendUp, style=plot.style_columns, linewidth=1, color=trendUp < trendUp[1] ? color.lime : color.green, title='UpTrend', transp=45)

// plot(trendDown, style=plot.style_columns, linewidth=1, color=trendDown < trendDown[1] ? color.orange : color.red, title='DownTrend', transp=45)

// plot(e1, style=plot.style_line, linewidth=2, color=color.new(color.white, 0), title='ExplosionLine')

// plot(DEAD_ZONE, color=color.new(color.blue, 0), linewidth=1, style=plot.style_cross, title='DeadZoneLine')

////// Entry, Exit

// Long, Short Logic with Indicator

bool longSSLCond = close > BBMC

bool shortSSLCond = close < BBMC

bool longQQECond = (Greenbar1[1] == false or Greenbar2[1] == false) and (Greenbar1 and Greenbar2) == 1

bool shortQQECond = (Redbar1[1] == false or Redbar2[1] == false) and (Redbar1 and Redbar2) == 1

bool longWAECond = trendUp > 0 and trendDown == 0

bool shortWAECond = trendDown > 0 and trendUp == 0

// Basic Cond + Long, Short Entry Condition

bool longCond = (i_longEnabled and inTime) and (longSSLCond and longQQECond and longWAECond)

bool shortCond = (i_shortEnabled and inTime) and (shortSSLCond and shortQQECond and shortWAECond)

// Basic Cond + Long, Short Exit Condition

bool closeLong = (i_longEnabled) and ((Redbar1[1] == false or Redbar2[1] == false) and (Redbar1 and Redbar2) == 1)

bool closeShort = (i_shortEnabled) and ((Greenbar1[1] == false or Greenbar2[1] == false) and (Greenbar1 and Greenbar2) == 1)

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Position Control

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Long, Short Entry Condition + Not entered Position Yet

bool openLong = longCond and not (strategy.opentrades.size(strategy.opentrades - 1) > 0) and longFilterFilled

bool openShort = shortCond and not (strategy.opentrades.size(strategy.opentrades - 1) < 0) and shortFilterFilled

bool enteringTrade = openLong or openShort

float entryBarIndex = bar_index

// Long, Short Entry Fulfilled or Already Entered

bool inLong = openLong or strategy.opentrades.size(strategy.opentrades - 1) > 0 and not closeLong

bool inShort = openShort or strategy.opentrades.size(strategy.opentrades - 1) < 0 and not closeShort

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Stop Loss - Inputs, Indicaotrs

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

//// Use SL? TSL?

i_useSLTP = input.bool (defval = true, title = "Enable SL & TP?", tooltip = "", inline = "1", group = "Stop Loss")

i_tslEnabled = input.bool (defval = false , title = "Enable Trailing SL?", tooltip = "Enable Stop Loss & Take Profit? \n\Enable Trailing SL?", inline = "1", group = "Stop Loss")

// i_breakEvenAfterTP = input.bool (defval = false, title = 'Enable Break Even After TP?', tooltip = 'When Take Profit price target is hit, move the Stop Loss to the entry price (or to a more strict price defined by the Stop Loss %/ATR Multiplier).', inline = '2', group = 'Stop Loss / Take Profit')

//// Sl Options

i_slType = input.string (defval = "ATR", title = "Stop Loss Type", options = ["Percent", "ATR", "Previous LL / HH"], tooltip = "Stop Loss based on %? ATR?", inline = "3", group = "Stop Loss")

i_slATRLen = input.int (defval = 14, title = "ATR Length", minval = 1 , maxval = 200 , step = 1, inline = "4", group = "Stop Loss")

i_slATRMult = input.float (defval = 3, title = "ATR Multiplier", minval = 1 , maxval = 200 , step = 0.1, tooltip = "", inline = "4", group = "Stop Loss")

i_slPercent = input.float (defval = 3, title = "Percent", tooltip = "", inline = "5", group = "Stop Loss")

i_slLookBack = input.int (defval = 30, title = "Lowest Price Before Entry", group = "Stop Loss", inline = "6", minval = 1, step = 1, tooltip = "Lookback to find the Lowest Price. \nStopLoss is determined by the Lowest price of the look back period. Take Profit is derived from this also by multiplying the StopLoss value by the Risk:Reward multiplier.")

// Functions for Stop Loss

float openAtr = ta.valuewhen(condition = enteringTrade, source = ta.atr(i_slATRLen), occurrence = 0)

float openLowest = ta.valuewhen(condition = openLong, source = ta.lowest(low, i_slLookBack), occurrence = 0)

float openHighest = ta.valuewhen(condition = openShort, source = ta.highest(high, i_slLookBack), occurrence = 0)

f_getLongSLPrice(source) =>

switch i_slType

"Percent" => source * (1 - (i_slPercent/100))

"ATR" => source - (i_slATRMult * openAtr)

"Previous LL / HH" => openLowest

=> na

f_getShortSLPrice(source) =>

switch i_slType

"Percent" => source * (1 + (i_slPercent/100))

"ATR" => source + (i_slATRMult * openAtr)

"Previous LL / HH" => openHighest

=> na

// Calculate Stop Loss

var float longSLPrice = na

var float shortSLPrice = na

bool longTPExecuted = false

bool shortTPExecuted = false

longSLPrice := if (inLong and i_useSLTP)

if (openLong)

f_getLongSLPrice (close)

else

// 1. Trailing Stop Loss

if i_tslEnabled

stopLossPrice = f_getLongSLPrice (high)

math.max(stopLossPrice, nz(longSLPrice[1]))

// 2. Normal StopLoss

else

nz(source = longSLPrice[1], replacement = 0)

else

na

shortSLPrice := if (inShort and i_useSLTP)

if (openShort)

f_getShortSLPrice (close)

else

// 1. Trailing Stop Loss

if i_tslEnabled

stopLossPrice = f_getShortSLPrice (low)

math.min(stopLossPrice, nz(shortSLPrice[1]))

// 2. Normal StopLoss

else

nz(source = shortSLPrice[1], replacement = 999999.9)

else

na

// Plot: Stop Loss of Long, Short Entry

var longSLPriceColor = color.new(color.maroon, 0)

plot(series = longSLPrice, title = 'Long Stop Loss', color = longSLPriceColor, linewidth = 1, style = plot.style_linebr, offset = 1)

var shortSLPriceColor = color.new(color.maroon, 0)

plot(series = shortSLPrice, title = 'Short Stop Loss', color = shortSLPriceColor, linewidth = 1, style = plot.style_linebr, offset = 1)

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Take Profit - Inputs, Indicaotrs

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

i_useTPExit = input.bool (defval = true, title = "Use Take Profit?", tooltip = "", inline = "1", group = "Take Profit")

i_RRratio = input.float (defval = 1.5, title = "R:R Ratio", minval = 0.1 , maxval = 200 , step = 0.1, tooltip = "R:R Ratio > Risk Reward Ratio? It will automatically set Take Profit % based on Stop Loss", inline = "2", group = "Take Profit")

i_tpQuantityPerc = input.float (defval = 50, title = 'Take Profit Quantity %', minval = 0.0, maxval = 100, step = 1.0, tooltip = '% of position closed when tp target is met.', inline="34", group = 'Take Profit')

var float longTPPrice = na

var float shortTPPrice = na

f_getLongTPPrice() =>

close + i_RRratio * math.abs (close - f_getLongSLPrice (close))

f_getShortTPPrice() =>

close - i_RRratio * math.abs(close - f_getShortSLPrice (close))

longTPPrice := if (inLong and i_useSLTP)

if (openLong)

f_getLongTPPrice ()

else

nz(source = longTPPrice[1], replacement = f_getLongTPPrice ())

else

na

shortTPPrice := if (inShort and i_useSLTP)

if (openShort)

f_getShortTPPrice ()

else

nz(source = shortTPPrice[1], replacement = f_getShortTPPrice ())

else

na

// Plot: Take Profit of Long, Short Entry

var longTPPriceColor = color.new(color.teal, 0)

plot(series = longTPPrice, title = 'Long Take Profit', color = longTPPriceColor, linewidth = 1, style = plot.style_linebr, offset = 1)

var shortTPPriceColor = color.new(color.teal, 0)

plot(series = shortTPPrice, title = 'Short Take Profit', color = shortTPPriceColor, linewidth = 1, style = plot.style_linebr, offset = 1)

// Plot: Entry Price

var posColor = color.new(color.white, 0)

plot(series = strategy.opentrades.entry_price(strategy.opentrades - 1), title = 'Position Entry Price', color = posColor, linewidth = 1, style = plot.style_linebr)

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Quantity - Inputs

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

i_useRiskManangement = input.bool (defval = true, title = "Use Risk Manangement?", tooltip = "", inline = "1", group = "Quantity")

i_riskPerTrade = input.float (defval = 3, title = "Risk Per Trade (%)", minval = 0, maxval = 100, step = 0.1, tooltip = "Use Risk Manangement by Quantity Control?", inline = "2", group = "Quantity")

// i_leverage = input.float (defval = 2, title = "Leverage", minval = 0, maxval = 100, step = 0.1, tooltip = "Leverage", inline = "3", group = "Quantity")

float qtyPercent = na

float entryQuantity = na

f_calQtyPerc() =>

if (i_useRiskManangement)

riskPerTrade = (i_riskPerTrade) / 100 // 1번 거래시 3% 손실

stopLossPrice = openLong ? f_getLongSLPrice (close) : openShort ? f_getShortSLPrice (close) : na

riskExpected = math.abs((close-stopLossPrice)/close) // 손절가랑 6% 차이

riskPerTrade / riskExpected // 0 ~ 1

else

1

f_calQty(qtyPerc) =>

math.min (math.max (0.000001, strategy.equity / close * qtyPerc), 1000000000)

// TP Execution

longTPExecuted := strategy.opentrades.size(strategy.opentrades - 1) > 0 and (longTPExecuted[1] or strategy.opentrades.size(strategy.opentrades - 1) < strategy.opentrades.size(strategy.opentrades - 1)[1] or strategy.opentrades.size(strategy.opentrades - 1)[1] == 0 and high >= longTPPrice)

shortTPExecuted := strategy.opentrades.size(strategy.opentrades - 1) < 0 and (shortTPExecuted[1] or strategy.opentrades.size(strategy.opentrades - 1) > strategy.opentrades.size(strategy.opentrades - 1)[1] or strategy.opentrades.size(strategy.opentrades - 1)[1] == 0 and low <= shortTPPrice)

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Plot Label, Boxes, Results, Etc

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

i_showSimpleLabel = input.bool(false, "Show Simple Label for Entry?", group = "Strategy: Drawings", inline = "1", tooltip ="")

i_showLabels = input.bool(true, "Show Trade Exit Labels", group = "Strategy: Drawings", inline = "1", tooltip = "Useful labels to identify Profit/Loss and cumulative portfolio capital after each trade closes.\n\nAlso note that TradingView limits the max number of 'boxes' that can be displayed on a chart (max 500). This means when you lookback far enough on the chart you will not see the TP/SL boxes. However you can check this option to identify where trades exited.")

i_showDashboard = input.bool(false, "Show Dashboard", group = "Strategy: Drawings", inline = "2", tooltip = "Show Backtest Results. Backtest Dates, Win/Lose Rates, Etc.")

// Plot: Label for Long, Short Entry

var openLongColor = color.new(#2962FF, 0)

var openShortColor = color.new(#FF1744, 0)

var entryTextColor = color.new(color.white, 0)

if (openLong and i_showSimpleLabel)

label.new (x = bar_index, y = na, text = 'Open', yloc = yloc.belowbar, color = openLongColor, style = label.style_label_up, textcolor = entryTextColor)

entryBarIndex := bar_index

if (openShort and i_showSimpleLabel)

label.new (x = bar_index, y = na, text = 'Close', yloc = yloc.abovebar, color = openShortColor, style = label.style_label_down, textcolor = entryTextColor)

entryBarIndex := bar_index

float prevEntryPrice = strategy.closedtrades.entry_price (strategy.closedtrades - 1)

float pnl = strategy.closedtrades.profit (strategy.closedtrades - 1)

float prevExitPrice = strategy.closedtrades.exit_price (strategy.closedtrades - 1)

f_enteringTradeLabel(x, y, qty, entryPrice, slPrice, tpPrice, rrRatio, direction) =>

if i_showLabels

labelStr = ("Trade Start"

+ "\nDirection: " + direction

+ "\nRisk Per Trade: " + str.tostring (i_useRiskManangement ? i_riskPerTrade : 100, "#.##") + "%"

+ "\nExpected Risk: " + str.tostring (math.abs((close-slPrice)/close) * 100, "#.##") + "%"

+ "\nEntry Position Qty: " + str.tostring(math.abs(qty * 100), "#.##") + "%"

+ "\nEntry Price: " + str.tostring(entryPrice, "#.##"))

+ "\nStop Loss Price: " + str.tostring(slPrice, "#.##")

+ "\nTake Profit Price: " + str.tostring(tpPrice, "#.##")

+ "\nRisk - Reward Ratio: " + str.tostring(rrRatio, "#.##")

label.new(x = x, y = y, text = labelStr, color = color.new(color.blue, 60) , textcolor = color.white, style = label.style_label_up)

f_exitingTradeLabel(x, y, entryPrice, exitPrice, direction) =>

if i_showLabels

labelStr = ("Trade Result"

+ "\nDirection: " + direction

+ "\nEntry Price: " + str.tostring(entryPrice, "#.##")

+ "\nExit Price: " + str.tostring(exitPrice,"#.##")

+ "\nGain %: " + str.tostring(direction == 'Long' ? -(entryPrice-exitPrice) / entryPrice * 100 : (entryPrice-exitPrice) / entryPrice * 100 ,"#.##") + "%")

label.new(x = x, y = y, text = labelStr, color = pnl > 0 ? color.new(color.green, 60) : color.new(color.red, 60), textcolor = color.white, style = label.style_label_down)

f_fillCell(_table, _column, _row, _title, _value, _bgcolor, _txtcolor) =>

_cellText = _title + " " + _value

table.cell(_table, _column, _row, _cellText, bgcolor=_bgcolor, text_color=_txtcolor, text_size=size.auto)

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Orders

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

if (inTime)

if (openLong)

qtyPercent := f_calQtyPerc() > 1 ? 1 : f_calQtyPerc()

entryQuantity := f_calQty(qtyPercent)

strategy.entry(id = "Long", direction = strategy.long, qty = entryQuantity, comment = 'Long(' + syminfo.ticker + '): Started', alert_message = 'Long(' + syminfo.ticker + '): Started')

f_enteringTradeLabel(x = bar_index + 1, y = close-3*ta.tr, entryPrice = close, qty = qtyPercent, slPrice = longSLPrice, tpPrice = longTPPrice, rrRatio = i_RRratio, direction = "Long")

if (openShort)

qtyPercent := f_calQtyPerc() > 1 ? 1 : f_calQtyPerc()

entryQuantity := f_calQty(qtyPercent)

strategy.entry(id = "Short", direction = strategy.short, qty = entryQuantity, comment = 'Short(' + syminfo.ticker + '): Started', alert_message = 'Short(' + syminfo.ticker + '): Started')

f_enteringTradeLabel(x = bar_index + 1, y = close-3*ta.tr, entryPrice = close, qty = qtyPercent, slPrice = shortSLPrice, tpPrice = shortTPPrice, rrRatio = i_RRratio, direction = "Short")

if (closeLong)

strategy.close(id = 'Long', comment = 'Close Long', alert_message = 'Long: Closed at market price')

strategy.position_size > 0 ? f_exitingTradeLabel(x = bar_index, y = close+3*ta.tr, entryPrice = prevEntryPrice, exitPrice = prevExitPrice, direction = 'Long') : na

if (closeShort)

strategy.close(id = 'Short', comment = 'Close Short', alert_message = 'Short: Closed at market price')

strategy.position_size < 0 ? f_exitingTradeLabel(x = bar_index, y = close+3*ta.tr, entryPrice = prevEntryPrice, exitPrice = prevExitPrice, direction = 'Short') : na

if (inLong)

strategy.exit(id = 'Long TP / SL', from_entry = 'Long', qty_percent = i_tpQuantityPerc, limit = longTPPrice, stop = longSLPrice, alert_message = 'Long(' + syminfo.ticker + '): Take Profit or Stop Loss executed')

strategy.exit(id = 'Long SL', from_entry = 'Long', stop = longSLPrice, alert_message = 'Long(' + syminfo.ticker + '): Stop Loss executed')

if (inShort)

strategy.exit(id = 'Short TP / SL', from_entry = 'Short', qty_percent = i_tpQuantityPerc, limit = shortTPPrice, stop = shortSLPrice, alert_message = 'Short(' + syminfo.ticker + '): Take Profit or Stop Loss executed')

strategy.exit(id = 'Short SL', from_entry = 'Short', stop = shortSLPrice, alert_message = 'Short(' + syminfo.ticker + '): Stop Loss executed')

if strategy.position_size[1] > 0 and strategy.position_size == 0

f_exitingTradeLabel(x = bar_index, y = close+3*ta.tr, entryPrice = prevEntryPrice, exitPrice = prevExitPrice, direction = 'Long')

if strategy.position_size[1] < 0 and strategy.position_size == 0

f_exitingTradeLabel(x = bar_index, y = close+3*ta.tr, entryPrice = prevEntryPrice, exitPrice = prevExitPrice, direction = 'Short')

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Backtest Result Dashboard

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

if i_showDashboard

var bgcolor = color.new(color = color.black, transp = 100)

var greenColor = color.new(color = #02732A, transp = 0)

var redColor = color.new(color = #D92332, transp = 0)

var yellowColor = color.new(color = #F2E313, transp = 0)

// Keep track of Wins/Losses streaks

newWin = (strategy.wintrades > strategy.wintrades[1]) and (strategy.losstrades == strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

newLoss = (strategy.wintrades == strategy.wintrades[1]) and (strategy.losstrades > strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

varip int winRow = 0

varip int lossRow = 0

varip int maxWinRow = 0

varip int maxLossRow = 0

if newWin

lossRow := 0

winRow := winRow + 1

if winRow > maxWinRow

maxWinRow := winRow

if newLoss

winRow := 0

lossRow := lossRow + 1

if lossRow > maxLossRow

maxLossRow := lossRow

// Prepare stats table

var table dashTable = table.new(position.top_right, 1, 15, border_width=1)

if barstate.islastconfirmedhistory

dollarReturn = strategy.netprofit

f_fillCell(dashTable, 0, 0, "Start:", str.format("{0,date,long}", strategy.closedtrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.closedtrades.entry_time(0))

f_fillCell(dashTable, 0, 1, "End:", str.format("{0,date,long}", strategy.opentrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.opentrades.entry_time(0))

_profit = (strategy.netprofit / strategy.initial_capital) * 100

f_fillCell(dashTable, 0, 2, "Net Profit:", str.tostring(_profit, '##.##') + "%", _profit > 0 ? greenColor : redColor, color.white)

_numOfDaysInStrategy = (strategy.opentrades.entry_time(0) - strategy.closedtrades.entry_time(0)) / (1000 * 3600 * 24)

_winRate = ( strategy.wintrades / strategy.closedtrades ) * 100

f_fillCell(dashTable, 0, 4, "Percent Profitable:", str.tostring(_winRate, '##.##') + "%", _winRate < 50 ? redColor : _winRate < 75 ? greenColor : yellowColor, color.white)

f_fillCell(dashTable, 0, 5, "Profit Factor:", str.tostring(strategy.grossprofit / strategy.grossloss, '##.###'), strategy.grossprofit > strategy.grossloss ? greenColor : redColor, color.white)

f_fillCell(dashTable, 0, 6, "Total Trades:", str.tostring(strategy.closedtrades), bgcolor, color.white)

f_fillCell(dashTable, 0, 8, "Max Wins In A Row:", str.tostring(maxWinRow, '######') , bgcolor, color.white)

f_fillCell(dashTable, 0, 9, "Max Losses In A Row:", str.tostring(maxLossRow, '######') , bgcolor, color.white)