マーケットコードウェーブB自動売買戦略

概要

この戦略は,市場暗号指標の波動理論を利用し,複数の技術指標と組み合わせて自動売買を実現する.それは,トレンドが始まるときに機会を識別し,トレンド追跡を実現する.

戦略原則

この戦略は,主に市場暗号波B指標に基づいている.この指標は,価格の動きを1波と2波の2層に分けている. 1波は反応が敏感で,2波は反応が平坦である.それらの交差は買入信号である. 1波の上を通るとき,2波は買入機会であり,下を通るときは売りチャンスである.

Wavetrend関数で1波と2波を計算する.そして,超買超売と組み合わせて波の方向を区別する.例えば,Wave1の下からWave2を横切ると,Wave2は超買領域にあり,つまりセール信号である.

また,コードは,意思決定の正確性を高めるために,以下の補助指標を導入しています.

極値地域:RSIとキャピタルフロー指標を組み合わせて価格変動地域を判断する.

KD: 余空の勢いを判断する

逆転: 転換点を発見する

旗の形: 傾向の持続性を判断する

最後に,Waveと補助指標の状況から判断して最終的な取引決定.

戦略的優位性

この戦略の最大の利点は,異なる市場環境に対応できることです.具体的には,以下のような側面が主な特徴です.

- 複数の指標の組み合わせで判断の正確さ

戦略は,Wave自身の交差を判断基準として使用するだけでなく,RSI,KD,偏差などの複数の指標を導入し,組み合わせることで意思決定の正確性を向上させる.

- 旗の形を見抜き,トレンドを捉える

旗形判断モジュールを導入することで,トレンドの持続性を効果的に判断でき,頭重さを避け,トレンドが始まるときに機会を識別することができる.これは,戦略をトレンド追跡に特に優れているものとする.

- パーメータをマニュアルで最適化するには余裕があります.

戦略パラメータは高度にカスタマイズ可能であり,ユーザーは市場に対する自分の判断と理解に基づいて,異なるパラメータを選択して最適化して,より複雑な市場環境に適応することができる.これは,戦略の適用範囲を広げる.

戦略リスク

この戦略にはいくつかの潜在的リスクがあり,以下のような部分に表れています.

- 紛争を判断する多助指標

多くの補助指標があり,極端な状況では,衝突を判断する指標が存在することがあり,最終的な決定に不確実性をもたらす.

- パラメータの調整が難しい

調整可能なパラメータが多く,最適のパラメータ組合せを達成するには,大量のデータ反測とテストが必要で,難しさが高く,過度最適化が容易である.

- 取引頻度が高いと推測される

波動的な状況では,Waveの交差が頻繁に発生し,取引が頻発する可能性があります.

デジタル化がもたらす影響は,

フィルタリング条件の導入により,意思決定の健全性を確保する

戦略に影響するパラメータを優先的に調整する

ストップ・ロスの範囲を拡大し,取引の頻度を減らす

要約する

全体として,この戦略は,市場暗号波理論と複数の技術指標を統合して,自動で買賣点を識別し,トレンドを追跡する能力を実現している.そのパラメータは,調整可能で,適応性があり,トレンドの機会を捉えるのに優れている.同時に,特定の潜在的なリスクに注意する必要があり,判断規則のアップグレードとパラメータの調整などの面で継続的に最適化する必要があり,戦略をより安定させる.

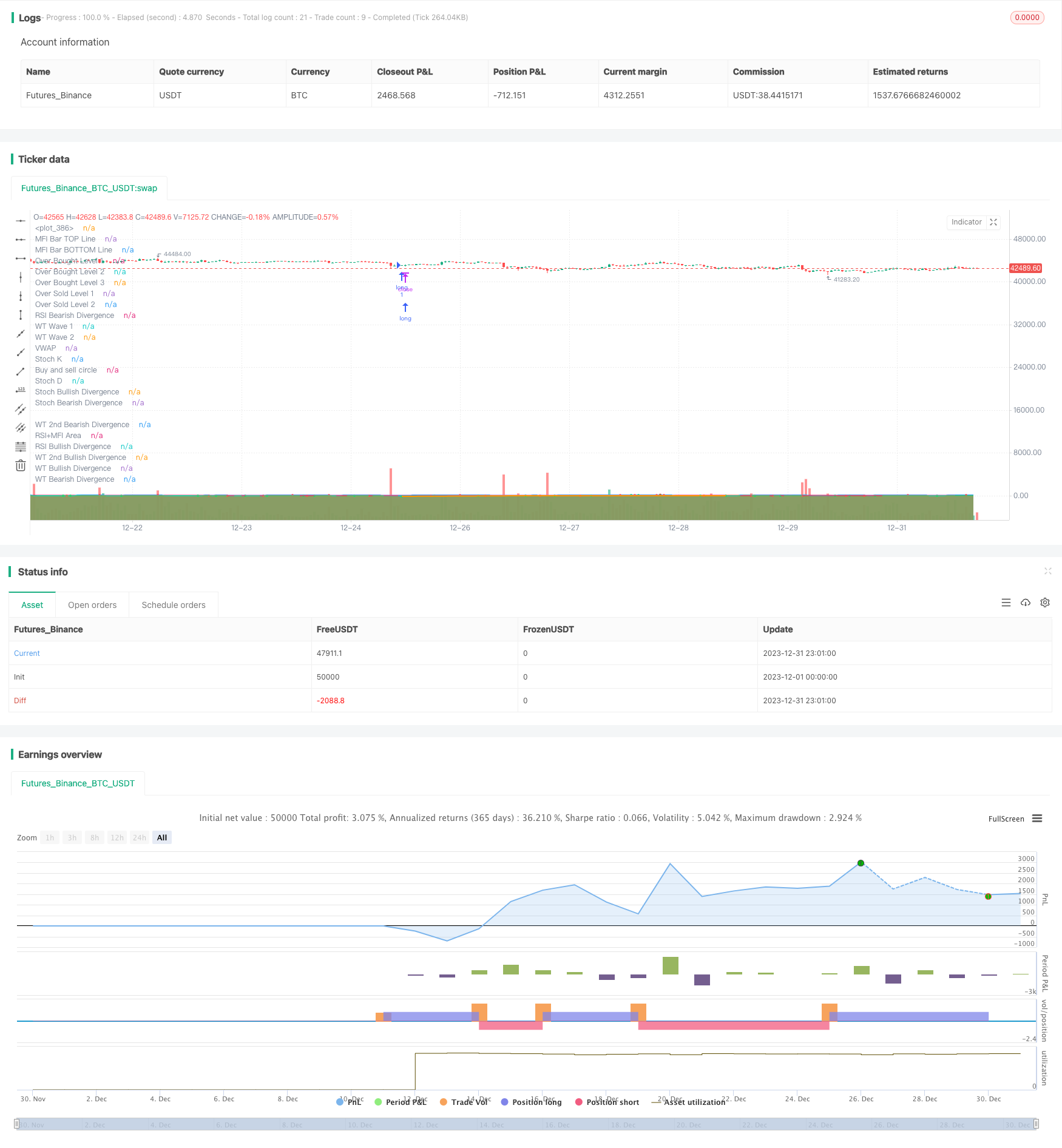

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © vumanchu

//@version=5

// Thanks to dynausmaux for the code

// Thanks to falconCoin for https://www.tradingview.com/script/KVfgBvDd-Market-Cipher-B-Free-version-with-Buy-and-sell/ inspired me to start this.

// Thanks to LazyBear for WaveTrend Oscillator https://www.tradingview.com/script/2KE8wTuF-Indicator-WaveTrend-Oscillator-WT/

// Thanks to RicardoSantos for https://www.tradingview.com/script/3oeDh0Yq-RS-Price-Divergence-Detector-V2/

// Thanks to LucemAnb for Plain Stochastic Divergence https://www.tradingview.com/script/FCUgF8ag-Plain-Stochastic-Divergence/

// Thanks to andreholanda73 for MFI+RSI Area https://www.tradingview.com/script/UlGZzUAr/

// I especially want to thank TradingView for its platform that facilitates development and learning.

//

// CIRCLES & TRIANGLES:

// - LITTLE CIRCLE: They appear at all WaveTrend wave crossings.

// - GREEN CIRCLE: The wavetrend waves are at the oversold level and have crossed up (bullish).

// - RED CIRCLE: The wavetrend waves are at the overbought level and have crossed down (bearish).

// - GOLD/ORANGE CIRCLE: When RSI is below 20, WaveTrend waves are below or equal to -80 and have crossed up after good bullish divergence (DONT BUY WHEN GOLD CIRCLE APPEAR).

// - None of these circles are certain signs to trade. It is only information that can help you.

// - PURPLE TRIANGLE: Appear when a bullish or bearish divergence is formed and WaveTrend waves crosses at overbought and oversold points.

//

// NOTES:

// - I am not an expert trader or know how to program pine script as such, in fact it is my first indicator only to study and all the code is copied and modified from other codes that are published in TradingView.

// - I am very grateful to the entire TV community that publishes codes so that other newbies like me can learn and present their results. This is an attempt to imitate Market Cipher B.

// - Settings by default are for 4h timeframe, divergences are more stronger and accurate. Haven't tested in all timeframes, only 2h and 4h.

// - If you get an interesting result in other timeframes I would be very grateful if you would comment your configuration to implement it or at least check it.

//

// CONTRIBUTIONS:

// - Tip/Idea: Add higher timeframe analysis for bearish/bullish patterns at the current timeframe.

// + Bearish/Bullish FLAG:

// - MFI+RSI Area are RED (Below 0).

// - Wavetrend waves are above 0 and crosses down.

// - VWAP Area are below 0 on higher timeframe.

// - This pattern reversed becomes bullish.

// - Tip/Idea: Check the last heikinashi candle from 2 higher timeframe

// + Bearish/Bullish DIAMOND:

// - HT Candle is red

// - WT > 0 and crossed down

strategy(title='MCB CIRCLE ONLY PGB STRAT BUN TP SL TEST', shorttitle='MCB CIRCLE ONLY PGB STRAT BUN TP SL TEST', overlay=true )

// strategy.cash

//max_bars_back = 200)

// PARAMETERS {

// WaveTrend

wtShow = input(true, title='Show WaveTrend')

wtBuyShow = input(true, title='Show Buy dots')

wtGoldShow = input(true, title='Show Gold dots')

wtSellShow = input(true, title='Show Sell dots')

wtDivShow = input(true, title='Show Div. dots')

vwapShow = input(true, title='Show Fast WT')

wtChannelLen = input(9, title='WT Channel Length')

wtAverageLen = input(12, title='WT Average Length')

wtMASource = input(hlc3, title='WT MA Source')

wtMALen = input(3, title='WT MA Length')

// WaveTrend Overbought & Oversold lines

obLevel = input(70, title='WT Overbought Level 1')

obLevel2 = input(99, title='WT Overbought Level 2')

obLevel3 = input(99, title='WT Overbought Level 3')

osLevel = -obLevel

osLevel2 = input(-99, title='WT Oversold Level 2')

osLevel3 = input(-99, title='WT Oversold Level 3')

// Divergence WT

wtShowDiv = input(true, title='Show WT Regular Divergences')

wtShowHiddenDiv = input(false, title='Show WT Hidden Divergences')

showHiddenDiv_nl = input(true, title='Not apply OB/OS Limits on Hidden Divergences')

wtDivOBLevel = input(81, title='WT Bearish Divergence min')

// wtDivOSLevel = input(-91, title='WT Bullish Divergence min')

wtDivOSLevel = -wtDivOBLevel

// Divergence extra range

wtDivOBLevel_addshow = input(true, title='Show 2nd WT Regular Divergences')

wtDivOBLevel_add = input(63, title='WT 2nd Bearish Divergence')

// wtDivOSLevel_add = input(-40, title='WT 2nd Bullish Divergence 15 min')

wtDivOSLevel_add = -wtDivOBLevel_add

// RSI+MFI

rsiMFIShow = input(true, title='Show MFI')

rsiMFIperiod = input(60, title='MFI Period')

rsiMFIMultiplier = input.float(150, title='MFI Area multiplier')

rsiMFIPosY = input(2.5, title='MFI Area Y Pos')

// RSI

rsiShow = input(false, title='Show RSI')

rsiSRC = input(close, title='RSI Source')

rsiLen = input(14, title='RSI Length')

rsiOversold = input.int(30, title='RSI Oversold', minval=30, maxval=100)

rsiOverbought = input.int(60, title='RSI Overbought', minval=0, maxval=60)

// Divergence RSI

rsiShowDiv = input(false, title='Show RSI Regular Divergences')

rsiShowHiddenDiv = input(false, title='Show RSI Hidden Divergences')

rsiDivOBLevel = input(60, title='RSI Bearish Divergence min')

rsiDivOSLevel = input(30, title='RSI Bullish Divergence min')

// RSI Stochastic

stochShow = input(true, title='Show Stochastic RSI')

stochUseLog = input(true, title=' Use Log?')

stochAvg = input(false, title='Use Average of both K & D')

stochSRC = input(close, title='Stochastic RSI Source')

stochLen = input(14, title='Stochastic RSI Length')

stochRsiLen = input(14, title='RSI Length ')

stochKSmooth = input(3, title='Stochastic RSI K Smooth')

stochDSmooth = input(3, title='Stochastic RSI D Smooth')

// Divergence stoch

stochShowDiv = input(false, title='Show Stoch Regular Divergences')

stochShowHiddenDiv = input(false, title='Show Stoch Hidden Divergences')

// Schaff Trend Cycle

tcLine = input(false, title='Show Schaff TC line')

tcSRC = input(close, title='Schaff TC Source')

tclength = input(10, title='Schaff TC')

tcfastLength = input(23, title='Schaff TC Fast Lenght')

tcslowLength = input(50, title='Schaff TC Slow Length')

tcfactor = input(0.5, title='Schaff TC Factor')

// Sommi Flag

sommiFlagShow = input(false, title='Show Sommi flag')

sommiShowVwap = input(false, title='Show Sommi F. Wave')

sommiVwapTF = input('720', title='Sommi F. Wave timeframe')

sommiVwapBearLevel = input(0, title='F. Wave Bear Level (less than)')

sommiVwapBullLevel = input(0, title='F. Wave Bull Level (more than)')

soomiFlagWTBearLevel = input(0, title='WT Bear Level (more than)')

soomiFlagWTBullLevel = input(0, title='WT Bull Level (less than)')

soomiRSIMFIBearLevel = input(0, title='Money flow Bear Level (less than)')

soomiRSIMFIBullLevel = input(0, title='Money flow Bull Level (more than)')

// Sommi Diamond

sommiDiamondShow = input(false, title='Show Sommi diamond')

sommiHTCRes = input('60', title='HTF Candle Res. 1')

sommiHTCRes2 = input('240', title='HTF Candle Res. 2')

soomiDiamondWTBearLevel = input(0, title='WT Bear Level (More than)')

soomiDiamondWTBullLevel = input(0, title='WT Bull Level (Less than)')

// macd Colors

macdWTColorsShow = input(false, title='Show MACD Colors')

macdWTColorsTF = input('240', title='MACD Colors MACD TF')

darkMode = input(false, title='Dark mode')

// Colors

colorRed = #ff0000

colorPurple = #e600e6

colorGreen = #3fff00

colorOrange = #e2a400

colorYellow = #ffe500

colorWhite = #ffffff

colorPink = #ff00f0

colorBluelight = #31c0ff

colorWT1 = #90caf9

colorWT2 = #0d47a1

colorWT2_ = #131722

colormacdWT1a = #4caf58

colormacdWT1b = #af4c4c

colormacdWT1c = #7ee57e

colormacdWT1d = #ff3535

colormacdWT2a = #305630

colormacdWT2b = #310101

colormacdWT2c = #132213

colormacdWT2d = #770000

// } PARAMETERS

// FUNCTIONS {

// Divergences

f_top_fractal(src) =>

src[4] < src[2] and src[3] < src[2] and src[2] > src[1] and src[2] > src[0]

f_bot_fractal(src) =>

src[4] > src[2] and src[3] > src[2] and src[2] < src[1] and src[2] < src[0]

f_fractalize(src) =>

f_top_fractal(src) ? 1 : f_bot_fractal(src) ? -1 : 0

f_findDivs(src, topLimit, botLimit, useLimits) =>

fractalTop = f_fractalize(src) > 0 and (useLimits ? src[2] >= topLimit : true) ? src[2] : na

fractalBot = f_fractalize(src) < 0 and (useLimits ? src[2] <= botLimit : true) ? src[2] : na

highPrev = ta.valuewhen(fractalTop, src[2], 0)[2]

highPrice = ta.valuewhen(fractalTop, high[2], 0)[2]

lowPrev = ta.valuewhen(fractalBot, src[2], 0)[2]

lowPrice = ta.valuewhen(fractalBot, low[2], 0)[2]

bearSignal = fractalTop and high[2] > highPrice and src[2] < highPrev

bullSignal = fractalBot and low[2] < lowPrice and src[2] > lowPrev

bearDivHidden = fractalTop and high[2] < highPrice and src[2] > highPrev

bullDivHidden = fractalBot and low[2] > lowPrice and src[2] < lowPrev

[fractalTop, fractalBot, lowPrev, bearSignal, bullSignal, bearDivHidden, bullDivHidden]

// RSI+MFI

f_rsimfi(_period, _multiplier, _tf) =>

request.security(syminfo.tickerid, _tf, ta.sma((close - open) / (high - low) * _multiplier, _period) - rsiMFIPosY)

// WaveTrend

f_wavetrend(src, chlen, avg, malen, tf) =>

tfsrc = request.security(syminfo.tickerid, tf, src)

esa = ta.ema(tfsrc, chlen)

de = ta.ema(math.abs(tfsrc - esa), chlen)

ci = (tfsrc - esa) / (0.015 * de)

wt1 = request.security(syminfo.tickerid, tf, ta.ema(ci, avg))

wt2 = request.security(syminfo.tickerid, tf, ta.sma(wt1, malen))

wtVwap = wt1 - wt2

wtOversold = wt2 <= osLevel

wtOverbought = wt2 >= obLevel

wtCross = ta.cross(wt1, wt2)

wtCrossUp = wt2 - wt1 <= 0

wtCrossDown = wt2 - wt1 >= 0

wtCrosslast = ta.cross(wt1[2], wt2[2])

wtCrossUplast = wt2[2] - wt1[2] <= 0

wtCrossDownlast = wt2[2] - wt1[2] >= 0

[wt1, wt2, wtOversold, wtOverbought, wtCross, wtCrossUp, wtCrossDown, wtCrosslast, wtCrossUplast, wtCrossDownlast, wtVwap]

// Schaff Trend Cycle

f_tc(src, length, fastLength, slowLength) =>

ema1 = ta.ema(src, fastLength)

ema2 = ta.ema(src, slowLength)

macdVal = ema1 - ema2

alpha = ta.lowest(macdVal, length)

beta = ta.highest(macdVal, length) - alpha

gamma = (macdVal - alpha) / beta * 100

gamma := beta > 0 ? gamma : nz(gamma[1])

delta = gamma

delta := na(delta[1]) ? delta : delta[1] + tcfactor * (gamma - delta[1])

epsilon = ta.lowest(delta, length)

zeta = ta.highest(delta, length) - epsilon

eta = (delta - epsilon) / zeta * 100

eta := zeta > 0 ? eta : nz(eta[1])

stcReturn = eta

stcReturn := na(stcReturn[1]) ? stcReturn : stcReturn[1] + tcfactor * (eta - stcReturn[1])

stcReturn

// Stochastic RSI

f_stochrsi(_src, _stochlen, _rsilen, _smoothk, _smoothd, _log, _avg) =>

src = _log ? math.log(_src) : _src

rsi = ta.rsi(src, _rsilen)

kk = ta.sma(ta.stoch(rsi, rsi, rsi, _stochlen), _smoothk)

d1 = ta.sma(kk, _smoothd)

avg_1 = math.avg(kk, d1)

k = _avg ? avg_1 : kk

[k, d1]

// MACD

f_macd(src, fastlen, slowlen, sigsmooth, tf) =>

fast_ma = request.security(syminfo.tickerid, tf, ta.ema(src, fastlen))

slow_ma = request.security(syminfo.tickerid, tf, ta.ema(src, slowlen))

macd = fast_ma - slow_ma

signal = request.security(syminfo.tickerid, tf, ta.sma(macd, sigsmooth))

hist = macd - signal

[macd, signal, hist]

// MACD Colors on WT

f_macdWTColors(tf) =>

hrsimfi = f_rsimfi(rsiMFIperiod, rsiMFIMultiplier, tf)

[macd, signal, hist] = f_macd(close, 28, 42, 9, macdWTColorsTF)

macdup = macd >= signal

macddown = macd <= signal

macdWT1Color = macdup ? hrsimfi > 0 ? colormacdWT1c : colormacdWT1a : macddown ? hrsimfi < 0 ? colormacdWT1d : colormacdWT1b : na

macdWT2Color = macdup ? hrsimfi < 0 ? colormacdWT2c : colormacdWT2a : macddown ? hrsimfi < 0 ? colormacdWT2d : colormacdWT2b : na

[macdWT1Color, macdWT2Color]

// Get higher timeframe candle

f_getTFCandle(_tf) =>

_open = request.security(ticker.heikinashi(syminfo.tickerid), _tf, open, barmerge.gaps_off, barmerge.lookahead_on)

_close = request.security(ticker.heikinashi(syminfo.tickerid), _tf, close, barmerge.gaps_off, barmerge.lookahead_on)

_high = request.security(ticker.heikinashi(syminfo.tickerid), _tf, high, barmerge.gaps_off, barmerge.lookahead_on)

_low = request.security(ticker.heikinashi(syminfo.tickerid), _tf, low, barmerge.gaps_off, barmerge.lookahead_on)

hl2 = (_high + _low) / 2.0

newBar = ta.change(_open)

candleBodyDir = _close > _open

[candleBodyDir, newBar]

// Sommi flag

f_findSommiFlag(tf, wt1, wt2, rsimfi, wtCross, wtCrossUp, wtCrossDown) =>

[hwt1, hwt2, hwtOversold, hwtOverbought, hwtCross, hwtCrossUp, hwtCrossDown, hwtCrosslast, hwtCrossUplast, hwtCrossDownlast, hwtVwap] = f_wavetrend(wtMASource, wtChannelLen, wtAverageLen, wtMALen, tf)

bearPattern = rsimfi < soomiRSIMFIBearLevel and wt2 > soomiFlagWTBearLevel and wtCross and wtCrossDown and hwtVwap < sommiVwapBearLevel

bullPattern = rsimfi > soomiRSIMFIBullLevel and wt2 < soomiFlagWTBullLevel and wtCross and wtCrossUp and hwtVwap > sommiVwapBullLevel

[bearPattern, bullPattern, hwtVwap]

f_findSommiDiamond(tf, tf2, wt1, wt2, wtCross, wtCrossUp, wtCrossDown) =>

[candleBodyDir, newBar] = f_getTFCandle(tf)

[candleBodyDir2, newBar2] = f_getTFCandle(tf2)

bearPattern = wt2 >= soomiDiamondWTBearLevel and wtCross and wtCrossDown and not candleBodyDir and not candleBodyDir2

bullPattern = wt2 <= soomiDiamondWTBullLevel and wtCross and wtCrossUp and candleBodyDir and candleBodyDir2

[bearPattern, bullPattern]

// } FUNCTIONS

// CALCULATE INDICATORS {

// RSI

rsi = ta.rsi(rsiSRC, rsiLen)

rsiColor = rsi <= rsiOversold ? colorGreen : rsi >= rsiOverbought ? colorRed : colorPurple

// RSI + MFI Area

rsiMFI = f_rsimfi(rsiMFIperiod, rsiMFIMultiplier, timeframe.period)

rsiMFIColor = rsiMFI > 0 ? #3ee145 : #ff3d2e

// Calculates WaveTrend

[wt1, wt2, wtOversold, wtOverbought, wtCross, wtCrossUp, wtCrossDown, wtCross_last, wtCrossUp_last, wtCrossDown_last, wtVwap] = f_wavetrend(wtMASource, wtChannelLen, wtAverageLen, wtMALen, timeframe.period)

// Stochastic RSI

[stochK, stochD] = f_stochrsi(stochSRC, stochLen, stochRsiLen, stochKSmooth, stochDSmooth, stochUseLog, stochAvg)

// Schaff Trend Cycle

tcVal = f_tc(tcSRC, tclength, tcfastLength, tcslowLength)

// Sommi flag

[sommiBearish, sommiBullish, hvwap] = f_findSommiFlag(sommiVwapTF, wt1, wt2, rsiMFI, wtCross, wtCrossUp, wtCrossDown)

//Sommi diamond

[sommiBearishDiamond, sommiBullishDiamond] = f_findSommiDiamond(sommiHTCRes, sommiHTCRes2, wt1, wt2, wtCross, wtCrossUp, wtCrossDown)

// macd colors

[macdWT1Color, macdWT2Color] = f_macdWTColors(macdWTColorsTF)

// WT Divergences

[wtFractalTop, wtFractalBot, wtLow_prev, wtBearDiv, wtBullDiv, wtBearDivHidden, wtBullDivHidden] = f_findDivs(wt2, wtDivOBLevel, wtDivOSLevel, true)

[wtFractalTop_add, wtFractalBot_add, wtLow_prev_add, wtBearDiv_add, wtBullDiv_add, wtBearDivHidden_add, wtBullDivHidden_add] = f_findDivs(wt2, wtDivOBLevel_add, wtDivOSLevel_add, true)

[wtFractalTop_nl, wtFractalBot_nl, wtLow_prev_nl, wtBearDiv_nl, wtBullDiv_nl, wtBearDivHidden_nl, wtBullDivHidden_nl] = f_findDivs(wt2, 0, 0, false)

wtBearDivHidden_ = showHiddenDiv_nl ? wtBearDivHidden_nl : wtBearDivHidden

wtBullDivHidden_ = showHiddenDiv_nl ? wtBullDivHidden_nl : wtBullDivHidden

wtBearDivColor = wtShowDiv and wtBearDiv or wtShowHiddenDiv and wtBearDivHidden_ ? colorRed : na

wtBullDivColor = wtShowDiv and wtBullDiv or wtShowHiddenDiv and wtBullDivHidden_ ? colorGreen : na

wtBearDivColor_add = wtShowDiv and wtDivOBLevel_addshow and wtBearDiv_add or wtShowHiddenDiv and wtDivOBLevel_addshow and wtBearDivHidden_add ? #9a0202 : na

wtBullDivColor_add = wtShowDiv and wtDivOBLevel_addshow and wtBullDiv_add or wtShowHiddenDiv and wtDivOBLevel_addshow and wtBullDivHidden_add ? #1b5e20 : na

// RSI Divergences

[rsiFractalTop, rsiFractalBot, rsiLow_prev, rsiBearDiv, rsiBullDiv, rsiBearDivHidden, rsiBullDivHidden] = f_findDivs(rsi, rsiDivOBLevel, rsiDivOSLevel, true)

[rsiFractalTop_nl, rsiFractalBot_nl, rsiLow_prev_nl, rsiBearDiv_nl, rsiBullDiv_nl, rsiBearDivHidden_nl, rsiBullDivHidden_nl] = f_findDivs(rsi, 0, 0, false)

rsiBearDivHidden_ = showHiddenDiv_nl ? rsiBearDivHidden_nl : rsiBearDivHidden

rsiBullDivHidden_ = showHiddenDiv_nl ? rsiBullDivHidden_nl : rsiBullDivHidden

rsiBearDivColor = rsiShowDiv and rsiBearDiv or rsiShowHiddenDiv and rsiBearDivHidden_ ? colorRed : na

rsiBullDivColor = rsiShowDiv and rsiBullDiv or rsiShowHiddenDiv and rsiBullDivHidden_ ? colorGreen : na

// Stoch Divergences

[stochFractalTop, stochFractalBot, stochLow_prev, stochBearDiv, stochBullDiv, stochBearDivHidden, stochBullDivHidden] = f_findDivs(stochK, 0, 0, false)

stochBearDivColor = stochShowDiv and stochBearDiv or stochShowHiddenDiv and stochBearDivHidden ? colorRed : na

stochBullDivColor = stochShowDiv and stochBullDiv or stochShowHiddenDiv and stochBullDivHidden ? colorGreen : na

// Small Circles WT Cross

signalColor = wt2 - wt1 > 0 ? color.red : color.lime

// Buy signal.

buySignal = wtCross and wtCrossUp and wtOversold

buySignalDiv = wtShowDiv and wtBullDiv or wtShowDiv and wtBullDiv_add or stochShowDiv and stochBullDiv or rsiShowDiv and rsiBullDiv

buySignalDiv_color = wtBullDiv ? colorGreen : wtBullDiv_add ? color.new(colorGreen, 100) : rsiShowDiv ? colorGreen : na

// Sell signal

sellSignal = wtCross and wtCrossDown and wtOverbought

sellSignalDiv = wtShowDiv and wtBearDiv or wtShowDiv and wtBearDiv_add or stochShowDiv and stochBearDiv or rsiShowDiv and rsiBearDiv

sellSignalDiv_color = wtBearDiv ? colorRed : wtBearDiv_add ? color.new(colorRed, 60) : rsiBearDiv ? colorRed : na

// Gold Buy

lastRsi = ta.valuewhen(wtFractalBot, rsi[2], 0)[2]

wtGoldBuy = (wtShowDiv and wtBullDiv or rsiShowDiv and rsiBullDiv) and wtLow_prev <= osLevel3 and wt2 > osLevel3 and wtLow_prev - wt2 <= -5 and lastRsi < 30

// } CALCULATE INDICATORS

// DRAW {

bgcolor(darkMode ? color.new(#000000, 80) : na, transp=90)

zLine = plot(0, color=color.new(colorWhite, 50))

// MFI BAR

rsiMfiBarTopLine = plot(rsiMFIShow ? -95 : na, title='MFI Bar TOP Line', transp=100)

rsiMfiBarBottomLine = plot(rsiMFIShow ? -99 : na, title='MFI Bar BOTTOM Line', transp=50)

fill(rsiMfiBarTopLine, rsiMfiBarBottomLine, title='MFI Bar Colors', color=rsiMFIColor, transp=75)

// WT Areas

plot(wtShow ? wt1 : na, style=plot.style_area, title='WT Wave 1', color=macdWTColorsShow ? macdWT1Color : colorWT1, transp=0)

plot(wtShow ? wt2 : na, style=plot.style_area, title='WT Wave 2', color=macdWTColorsShow ? macdWT2Color : darkMode ? colorWT2_ : colorWT2, transp=20)

// VWAP

plot(vwapShow ? wtVwap : na, title='VWAP', color=color.new(colorYellow, 45), style=plot.style_area, linewidth=2)

// MFI AREA

rsiMFIplot = plot(rsiMFIShow ? rsiMFI : na, title='RSI+MFI Area', color=rsiMFIColor, transp=20)

fill(rsiMFIplot, zLine, rsiMFIColor, transp=40)

// WT Div

plot(series=wtFractalTop ? wt2[2] : na, title='WT Bearish Divergence', color=wtBearDivColor, linewidth=2, offset=-2)

plot(series=wtFractalBot ? wt2[2] : na, title='WT Bullish Divergence', color=wtBullDivColor, linewidth=2, offset=-2)

// WT 2nd Div

plot(series=wtFractalTop_add ? wt2[2] : na, title='WT 2nd Bearish Divergence', color=wtBearDivColor_add, linewidth=2, offset=-2)

plot(series=wtFractalBot_add ? wt2[2] : na, title='WT 2nd Bullish Divergence', color=wtBullDivColor_add, linewidth=2, offset=-2)

// RSI

plot(rsiShow ? rsi : na, title='RSI', color=rsiColor, linewidth=2, transp=25)

// RSI Div

plot(series=rsiFractalTop ? rsi[2] : na, title='RSI Bearish Divergence', color=rsiBearDivColor, linewidth=1, offset=-2)

plot(series=rsiFractalBot ? rsi[2] : na, title='RSI Bullish Divergence', color=rsiBullDivColor, linewidth=1, offset=-2)

// Stochastic RSI

stochKplot = plot(stochShow ? stochK : na, title='Stoch K', color=color.new(#21baf3, 0), linewidth=2)

stochDplot = plot(stochShow ? stochD : na, title='Stoch D', color=color.new(#673ab7, 60), linewidth=1)

stochFillColor = stochK >= stochD ? color.new(#21baf3, 75) : color.new(#673ab7, 60)

fill(stochKplot, stochDplot, title='KD Fill', color=stochFillColor, transp=90)

// Stoch Div

plot(series=stochFractalTop ? stochK[2] : na, title='Stoch Bearish Divergence', color=stochBearDivColor, linewidth=1, offset=-2)

plot(series=stochFractalBot ? stochK[2] : na, title='Stoch Bullish Divergence', color=stochBullDivColor, linewidth=1, offset=-2)

// Schaff Trend Cycle

plot(tcLine ? tcVal : na, color=color.new(#673ab7, 25), linewidth=2, title='Schaff Trend Cycle 1')

plot(tcLine ? tcVal : na, color=color.new(colorWhite, 50), linewidth=1, title='Schaff Trend Cycle 2')

// Draw Overbought & Oversold lines

plot(obLevel, title='Over Bought Level 1', color=color.new(colorWhite, 11), linewidth=1, style=plot.style_line)

plot(obLevel2, title='Over Bought Level 2', color=color.new(colorWhite, 85), linewidth=1, style=plot.style_stepline)

plot(obLevel3, title='Over Bought Level 3', color=color.new(colorWhite, 95), linewidth=1, style=plot.style_circles)

plot(osLevel, title='Over Sold Level 1', color=color.new(colorWhite, 11), linewidth=1, style=plot.style_line)

plot(osLevel2, title='Over Sold Level 2', color=color.new(colorWhite, 85), linewidth=1, style=plot.style_stepline)

// Sommi flag

plotchar(sommiFlagShow and sommiBearish ? 108 : na, title='Sommi bearish flag', char='⚑', color=color.new(colorPink, 0), location=location.absolute, size=size.tiny)

plotchar(sommiFlagShow and sommiBullish ? -108 : na, title='Sommi bullish flag', char='⚑', color=color.new(colorBluelight, 0), location=location.absolute, size=size.tiny)

plot(sommiShowVwap ? ta.ema(hvwap, 3) : na, title='Sommi higher VWAP', color=color.new(colorYellow, 15), linewidth=2, style=plot.style_line)

// Sommi diamond

plotchar(sommiDiamondShow and sommiBearishDiamond ? 108 : na, title='Sommi bearish diamond', char='◆', color=color.new(colorPink, 0), location=location.absolute, size=size.tiny)

plotchar(sommiDiamondShow and sommiBullishDiamond ? -108 : na, title='Sommi bullish diamond', char='◆', color=color.new(colorBluelight, 0), location=location.absolute, size=size.tiny)

// Circles

plot(wtCross ? wt2 : na, title='Buy and sell circle', color=signalColor, style=plot.style_circles, linewidth=3, transp=15)

plotchar(wtBuyShow and buySignal ? -107 : na, title='Buy circle', char='·', color=color.new(colorGreen, 10), location=location.absolute, size=size.small)

plotchar(wtSellShow and sellSignal ? 105 : na, title='Sell circle', char='·', color=color.new(colorRed, 10), location=location.absolute, size=size.small)

plotchar(wtDivShow and buySignalDiv ? -106 : na, title='Divergence buy circle', char='•', color=buySignalDiv_color, location=location.absolute, size=size.small, offset=-2, transp=70)

plotchar(wtDivShow and sellSignalDiv ? 106 : na, title='Divergence sell circle', char='•', color=sellSignalDiv_color, location=location.absolute, size=size.small, offset=-2, transp=70)

plotchar(wtGoldBuy and wtGoldShow ? -106 : na, title='Gold buy gold circle', char='•', color=color.new(colorOrange, 60), location=location.absolute, size=size.small, offset=-2)

// } DRAW

long = ta.crossover (wt1, wt2) and wt1<osLevel

// long = wtBullDiv or ta.crossover (wt1, wt2) and wt1<osLevel

// long = wtBullDiv

// short= wtBearDiv

// short= wtBearDiv or ta.crossunder(wt1, wt2) and wt1>obLevel

short= ta.crossunder(wt1, wt2) and wt1>obLevel

// Position Management Tools

pos = 0.0

pos:= long? 1 : short? -1 : pos[1]

longCond = long and (pos[1]!= 1 or na(pos[1]))

shortCond = short and (pos[1]!=-1 or na(pos[1]))

// EXIT FUNCTIONS //

i_sl = input.float(0.0, title="Stop Loss % ", minval=0, step=1, inline='sl ')

i_tp = input.float(0.0, title="Take Profit % ", minval=0, step=1, inline='tp ')

i_tsl = input.float(0.0, title="Trailing Stop Loss %", minval=0, step=1, inline='tsl')

sl = i_sl >0? i_sl /100 : 99999

tp = i_tp >0? i_tp /100 : 99999

tsl = i_tsl>0? i_tsl/100 : 99999

long_entry = ta.valuewhen(longCond , close, 0)

short_entry = ta.valuewhen(shortCond, close, 0)

// Trailing Stop Loss

trail_long = 0.0, trail_short = 0.0

trail_long := longCond? high : high>trail_long[1]? high : pos<1 ? 0 : trail_long[1]

trail_short := shortCond? low : low<trail_short[1]? low : pos>-1 ? 99999 : trail_short[1]

trail_long_final = trail_long * (1-tsl)

trail_short_final = trail_short * (1+tsl)

// Simple Stop Loss and Take Profit

sl_long0 = long_entry * (1 - sl)

sl_short0 = short_entry * (1 + sl)

tp_long = long_entry * (1 + tp)

tp_short = short_entry * (1 - tp)

sl_long = math.max(sl_long0, trail_long_final)

sl_short = math.min(sl_short0, trail_short_final)

// Position Adjustment

long_sl = low <sl_long[1] and pos[1]==1

short_sl = high>sl_short[1] and pos[1]==-1

final_long_tp = high>tp_long[1] and pos[1]==1

final_short_tp = low <tp_short[1] and pos[1]==-1

if ((long_sl or final_long_tp) and not shortCond) or ((short_sl or final_short_tp) and not longCond)

pos:=0

// Strategy Backtest Limiting Algorithm

i_startTime = input(defval = timestamp("01 Sep 2002 13:30 +0000"), title = "Backtesting Start Time")

i_endTime = input(defval = timestamp("30 Sep 2099 19:30 +0000"), title = "Backtesting End Time" )

timeCond = true

strategy.initial_capital = 50000

equity = strategy.initial_capital + strategy.netprofit

if equity>0 and timeCond

if longCond

strategy.entry("long" , strategy.long )

if shortCond

strategy.entry("short", strategy.short)

strategy.exit("SL/TP", from_entry = "long" , stop=sl_long , limit=tp_long , comment_profit ='TP', comment_loss='SL')

strategy.exit("SL/TP", from_entry = "short", stop=sl_short, limit=tp_short, comment_profit ='TP', comment_loss='SL')

// ALERTS {

// BUY

alertcondition(longCond, 'Buy (Big green circle)', 'Green circle WaveTrend Oversold')

alertcondition(buySignalDiv, 'Buy (Big green circle + Div)', 'Buy & WT Bullish Divergence & WT Overbought')

alertcondition(wtGoldBuy, 'GOLD Buy (Big GOLDEN circle)', 'Green & GOLD circle WaveTrend Overbought')

alertcondition(sommiBullish or sommiBullishDiamond, 'Sommi bullish flag/diamond', 'Blue flag/diamond')

alertcondition(wtCross and wtCrossUp, 'Buy (Small green dot)', 'Buy small circle')

// SELL

alertcondition(sommiBearish or sommiBearishDiamond, 'Sommi bearish flag/diamond', 'Purple flag/diamond')

alertcondition(sellSignal, 'Sell (Big red circle)', 'Red Circle WaveTrend Overbought')

alertcondition(sellSignalDiv, 'Sell (Big red circle + Div)', 'Buy & WT Bearish Divergence & WT Overbought')

alertcondition(wtCross and wtCrossDown, 'Sell (Small red dot)', 'Sell small circle')

// } ALERTS