二重移動平均クロスタイムフレーム取引戦略

概要

この戦略は,2つの異なる種類の移動平均を計算することで,2つの異なる時間枠で買入と売却の信号を生成します. これは,異なる種類の移動平均と異なる時間枠の組み合わせを実験するために使用できる非常に良いサンドボックス戦略です.

戦略原則

この戦略は,2つの移動平均,つまり,高速移動平均と遅い移動平均を使用しています. 急速移動平均の時間枠は,グラフの時間枠より大きいか等しいです. 急速移動平均が,遅い移動平均を上方突破すると,買い信号が生じ, 急速移動平均が,遅い移動平均を下方突破すると,売り信号が生じます.

ユーザは,SMA,EMA,KAMAなどの様々な種類の移動平均を選択し,時間枠は異なるので,組み合わせ実験によって最適なパラメータを特定することができます.

優位分析

この戦略の最大の利点は,パラメータ実験の異なる組み合わせを,最適なパラメータ設定を探すために,非常に簡単に調整できるということです.

ユーザは,移動平均の種類,時間長,時間枠を自由に選択し,システムはリアルタイムで計算し,結果を表示します.これは,1つのパラメータをテストする組み合わせ戦略よりもはるかに簡単です.

この戦略は,リスクの軽減と利益の拡大を目的とした Stop Loss Stop function を内蔵しています.

リスク分析

この戦略の最大のリスクは,パラメータの不適切な設定が,取引シグナルの過度な頻度につながり,取引コストとスライドポイントの損失を増加させる可能性があることです.

さらに,双動平均はそれ自体で偽信号を生じやすいため,パラメータが正しく選択されていない場合,買入信号は信頼できない可能性があります.

これらのリスクは,パラメータの最適化や他の指標の組み合わせによって軽減できます.

最適化の方向

二重移動平均に基づいて他の指標の組み合わせを加え,RSIなどのRSI指標を,偽の信号を減らすために,買入販売信号を確認するためにフィルタリングすることを考えることができます.

また,移動平均のパラメータトレーニングを最適化して,最適なパラメータ組み合わせを見つけることもできます.また,機械学習の方法を使用してパラメータを動的に最適化することも考えることができます.

要約する

この戦略は,非常に良い双動平均実験サンドボックスである.その優点は,最適な取引戦略を見つけるために,異なるパラメータの組み合わせを素早く代できるという点にある.もちろん,パラメータの設定が不適切であるリスクもあります.これは,他の指標の組み合わせを加えることで,フィルタリングを行うことで,リスクを軽減する必要があります.この戦略を継続的に最適化すれば,より良い取引効果が得られる可能性が高い.

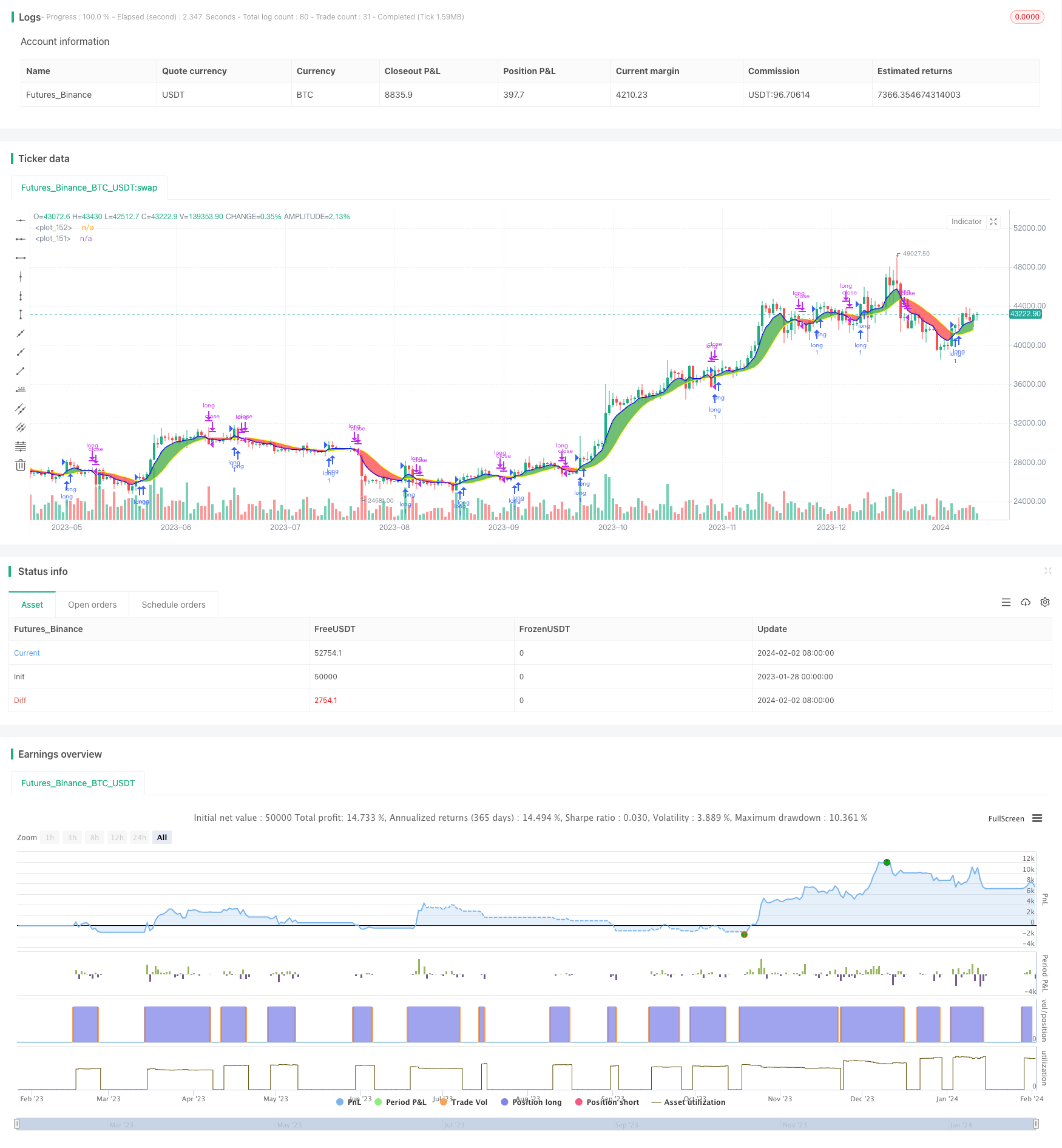

/*backtest

start: 2023-01-28 00:00:00

end: 2024-02-03 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License https://creativecommons.org/licenses/by-sa/4.0/

// © dman103

// A moving averages SandBox strategy where you can experiment using two different moving averages (like KAMA, ALMA, HMA, JMA, VAMA and more) on different time frames to generate BUY and SELL signals, when they cross.

// Great sandbox for experimenting with different moving averages and different time frames.

//

// == How to use ==

// We select two types of moving averages on two different time frames:

//

// First is the FAST moving average that should be at the same time frame or higher.

// Second is the SLOW moving average that should be on the same time frame or higher.

// When FAST moving average cross over the SLOW moving average we have a BUY signal (for LONG)

// When FAST moving average cross under the SLOW moving average we have a SELL signal (for SHORT)

// WARNING: Using a lower time frame than your chart time frame will result in unrealistic results in your backtesting and bar replay.

// == NOTES ==

// You can select BOTH, LONG, SHORT or NONE in the strategy settings.

// You can also enable Stop Loss and Take Profit.

// More sandboxes to come, Follow to get notified.

// Can also act as indicator by settings 'What trades should be taken' to 'NONE'

//@version=4

strategy("Multi MA MTF SandBox Strategy","Multi MA SandBox",overlay=true)

tradeType = input("LONG", title="What trades should be taken:", options=["LONG", "SHORT", "BOTH", "NONE"])

fast_title = input(true, title='---------------- Fast Moving Average (BLUE)----------------', type=input.bool)

ma_select1 = input(title="First Slow moving average", defval="EMA", options=["SMA", "EMA", "WMA", "HMA", "JMA", "KAMA", "TMA", "VAMA", "SMMA", "DEMA" , "VMA", "WWMA", "EMA_NO_LAG", "TSF","ALMA"])

resma_fast = input(title="First Time Frame", type=input.resolution, defval="")

lenma_fast = input(title="First MA Length", type=input.integer, defval=6)

slow_title = input(true, title='---------------- Slow Moving Average (YELLOW)----------------', type=input.bool)

ma_select2 = input(title="Second Fast moving average", defval="JMA", options=["SMA", "EMA", "WMA", "HMA", "JMA", "KAMA", "TMA", "VAMA", "SMMA", "DEMA" , "VMA", "WWMA", "EMA_NO_LAG", "TSF","ALMA"])

resma_slow = input(title="Second time frame", type=input.resolution, defval="")

lenma_slow = input(title="Second MA length", type=input.integer, defval=14)

settings = input(true, title='---------------- Other Settings ----------------', type=input.bool)

lineWidth = input(2,title="Line Width")

colorTransparency=input(50,title="Color Transparency",step=10,minval=0,maxval=100)

color_fast=input(color.blue,type=input.color)

color_slow=input(color.yellow,type=input.color)

fillColor = input(title="Fill Color", type=input.bool, defval=true)

IndicatorSettings = input(true, title='---------------- Indicators Settings ----------------', type=input.bool)

offset=input(title="Alma Offset (only for ALMA)",defval=0.85, step=0.05)

volatility_lookback =input(title="Volatility lookback (only for VAMA)",defval=12)

i_fastAlpha = input(1.25,"KAMA's alpha (only for KAMA)", minval=1,step=0.25)

fastAlpha = 2.0 / (i_fastAlpha + 1)

slowAlpha = 2.0 / (31)

///////Moving Averages

MA_selector(src, length,ma_select) =>

ma = 0.0

if ma_select == "SMA"

ma := sma(src, length)

ma

if ma_select == "EMA"

ma := ema(src, length)

ma

if ma_select == "WMA"

ma := wma(src, length)

ma

if ma_select == "HMA"

ma := hma(src,length)

ma

if ma_select == "JMA"

beta = 0.45*(length-1)/(0.45*(length-1)+2)

alpha = beta

tmp0 = 0.0, tmp1 = 0.0, tmp2 = 0.0, tmp3 = 0.0, tmp4 = 0.0

tmp0 := (1-alpha)*src + alpha*nz(tmp0[1])

tmp1 := (src - tmp0[0])*(1-beta) + beta*nz(tmp1[1])

tmp2 := tmp0[0] + tmp1[0]

tmp3 := (tmp2[0] - nz(tmp4[1]))*((1-alpha)*(1-alpha)) + (alpha*alpha)*nz(tmp3[1])

tmp4 := nz(tmp4[1]) + tmp3[0]

ma := tmp4

ma

if ma_select == "KAMA"

momentum = abs(change(src, length))

volatility = sum(abs(change(src)), length)

efficiencyRatio = volatility != 0 ? momentum / volatility : 0

smoothingConstant = pow((efficiencyRatio * (fastAlpha - slowAlpha)) + slowAlpha, 2)

var kama = 0.0

kama := nz(kama[1], src) + smoothingConstant * (src - nz(kama[1], src))

ma:=kama

ma

if ma_select == "TMA"

ma := sma(sma(src, ceil(length / 2)), floor(length / 2) + 1)

ma

if ma_select == "VMA"

valpha=2/(length+1)

vud1=src>src[1] ? src-src[1] : 0

vdd1=src<src[1] ? src[1]-src : 0

vUD=sum(vud1,9)

vDD=sum(vdd1,9)

vCMO=nz((vUD-vDD)/(vUD+vDD))

VAR=0.0

VAR:=nz(valpha*abs(vCMO)*src)+(1-valpha*abs(vCMO))*nz(VAR[1])

ma := VAR

ma

if ma_select == "WWMA"

wwalpha = 1/ length

WWMA = 0.0

WWMA := wwalpha*src + (1-wwalpha)*nz(WWMA[1])

ma := WWMA

ma

if ma_select == "EMA_NO_LAG"

EMA1= ema(src,length)

EMA2= ema(EMA1,length)

Difference= EMA1 - EMA2

ma := EMA1 + Difference

ma

if ma_select == "TSF"

lrc = linreg(src, length, 0)

lrc1 = linreg(src,length,1)

lrs = (lrc-lrc1)

TSF = linreg(src, length, 0)+lrs

ma := TSF

ma

if ma_select =="VAMA" // Volatility Adjusted from @fractured

mid=ema(src,length)

dev=src-mid

vol_up=highest(dev,volatility_lookback)

vol_down=lowest(dev,volatility_lookback)

ma := mid+avg(vol_up,vol_down)

ma

if ma_select == "SMMA"

smma = float (0.0)

smaval=sma(src, length)

smma := na(smma[1]) ? smaval : (smma[1] * (length - 1) + src) / length

ma := smma

if ma_select == "DEMA"

e1 = ema(src, length)

e2 = ema(e1, length)

ma := 2 * e1 - e2

ma

if ma_select == "ALMA"

ma := alma(src, length,offset, 6)

ma

ma

// Calculate EMA

ma_fast = MA_selector(close, lenma_fast,ma_select1)

ma_slow = MA_selector(close, lenma_slow,ma_select2)

maFastStep = security(syminfo.tickerid, resma_fast, ma_fast)

maSlowStep = security(syminfo.tickerid, resma_slow, ma_slow)

ma1_plot=plot(maFastStep, color=color_fast,linewidth=lineWidth,transp=colorTransparency)

ma2_plot=plot(maSlowStep, color=color_slow,linewidth=lineWidth,transp=colorTransparency)

colors=ma_fast>ma_slow ? color.green : color.red

fill(ma1_plot,ma2_plot, color=fillColor? colors: na,transp=colorTransparency+15)

closeStatus = strategy.openprofit > 0 ? "win" : "lose"

////////Long Rules

long = crossover(maFastStep,maSlowStep) and (tradeType == "LONG" or tradeType == "BOTH")

longClose =crossunder(maFastStep,maSlowStep)//and falling(maSlowStep,1)

///////Short Rules

short =crossunder(maFastStep,maSlowStep) and (tradeType == "SHORT" or tradeType == "BOTH")

shortClose = crossover(maFastStep,maSlowStep)

longShape= crossover(maFastStep,maSlowStep) and tradeType == "NONE"

shortShape = crossunder(maFastStep,maSlowStep) and tradeType == "NONE"

plotshape(longShape, style=shape.triangleup,location=location.belowbar, color=color.lime,size=size.small)

plotshape(shortShape,style=shape.triangledown,location=location.abovebar, color=color.red,size=size.small)

// === Stop LOSS ===

useStopLoss = input(false, title='----- Add Stop Loss / Take profit -----', type=input.bool)

sl_inp = input(2.5, title='Stop Loss %', type=input.float, step=0.1)/100

tp_inp = input(5, title='Take Profit %', type=input.float, step=0.1)/100

stop_level = strategy.position_avg_price * (1 - sl_inp)

take_level = strategy.position_avg_price * (1 + tp_inp)

stop_level_short = strategy.position_avg_price * (1 + sl_inp)

take_level_short = strategy.position_avg_price * (1 - tp_inp)

if (long)

strategy.entry("long", strategy.long)

if (short)

strategy.entry("short", strategy.short)

strategy.close ("long", when = longClose, comment=closeStatus)

strategy.close ("short", when = shortClose, comment=closeStatus)

if (useStopLoss)

strategy.exit("Stop Loss/Profit Long","long", stop=stop_level, limit=take_level,comment =closeStatus )

strategy.exit("Stop Loss/Profit Short","short", stop=stop_level_short, limit=take_level_short, comment = closeStatus)