3つのKライントレンド反転戦略

概要

三つのK線反転トレンド戦略 (Three Candle Reversal Trend Strategy) は,三つの連続した陽線または陰線を識別し,それに続く1つの吞食K線を介して,短線トレンドの反転を判断するショートライントレンド戦略である.この戦略は,1:3のストップ・アンド・ストップ比率で取引し,余剰利益を得るのに有利である.

戦略原則

この戦略の核心的な論理は,連続した三つの陽線または陰線のK線形を識別することであり,この形は通常,短期的なトレンドの逆転を予告する.三つの陰線を検出した後に,次の吞型の陽線が現れるまで待って,多めに行う.逆に,三つの陽線を検出した後に,次の吞型の陰線が現れるまで空にする.

さらに,戦略は,入場時間をフィルターするために複数の技術指標を導入している. 2つの異なるパラメータの設定を使用するSMA平均線は,高速線で遅い線を横切るときにのみ入場が考慮され始めている. さらに,線形回帰指標によって市場の揺れとトレンド状態を判断し,トレンド状態でのみ取引されている. 戦略は,平線で金色の交差が起こるとK線形状を組み合わせるか選択するスイッチも提供している. これらの指標の総合判断によって,ほとんどのノイズをフィルターし,入場の正確性を向上させることができる.

ストップ・ストップの設定では,戦略は,リスク・リターンの比率が1:3以下でないことを要求する.最近のN根K線波動幅のATR指標を計算して,波動幅のパーセントと組み合わせてストップ・ポジションの設定を行い,その後,ストップ・ポジションのレベルを計算する.このようにして,一定のリスクを負う前提で適切な余分なリターンを得ることができる.

戦略的優位性

3つのK線反転の戦略は以下の利点があります.

- 短期的なトレンドの転換点を認識し,機会を把握する

- 複数の指標をフィルタリングし,入場率を向上させる

- リスク・リターン・メカニズムは合理的で,リスク・リターン・メカニズムは中等です.

- 簡単なパラメータ設定,操作を理解しやすい

戦略リスク

この戦略にはいくつかのリスクがあります.

- 短期的な反転は必ずしも長期的トレンドの反転を意味するものではなく,より高い時間周期のトレンドに注意する必要がある.より長い周期の平均線をフィルター条件として設定することができる.

- 単一のK線形状信号は誤判を起こす可能性があり,他の補助判断信号を加えることも検討できる.

- ストップポイントの設定は過度に楽観的であり,適切なストップ範囲を絞ることができる.

- 追放データは不十分で,リッドディスクのパフォーマンスには不確実性がある.

戦略最適化の方向性

この戦略は以下の方向から最適化できます.

- 平均線と線形回帰のパラメータを調整し,トレンド状態を判断する効果を最適化

- 信号の精度を最適化するために,ストッチ指標などの他の補助判断指標を追加

- ATRパラメータとストップ幅パラメータの設定を最適化し,リスクとリターンをバランスする

- トレンドブレイクポイントの追跡を拡大し,収益性を向上させる

- より厳格な資金管理戦略を構築し,取引リスクを制御する

要約する

全体として,3つのK線反転トレンド戦略は,簡単な価格形状と複数の補助指標判断を組み合わせて,適度なリスクと利益のバランスに基づいたショートライン取引戦略である.これは,低複雑さで良いパフォーマンスを得ており,投資家の注目とテストに値し,改善の余地がある.パラメータの最適化と規則の補完により,安定した高効率の量化取引戦略として成長する見込みがある.

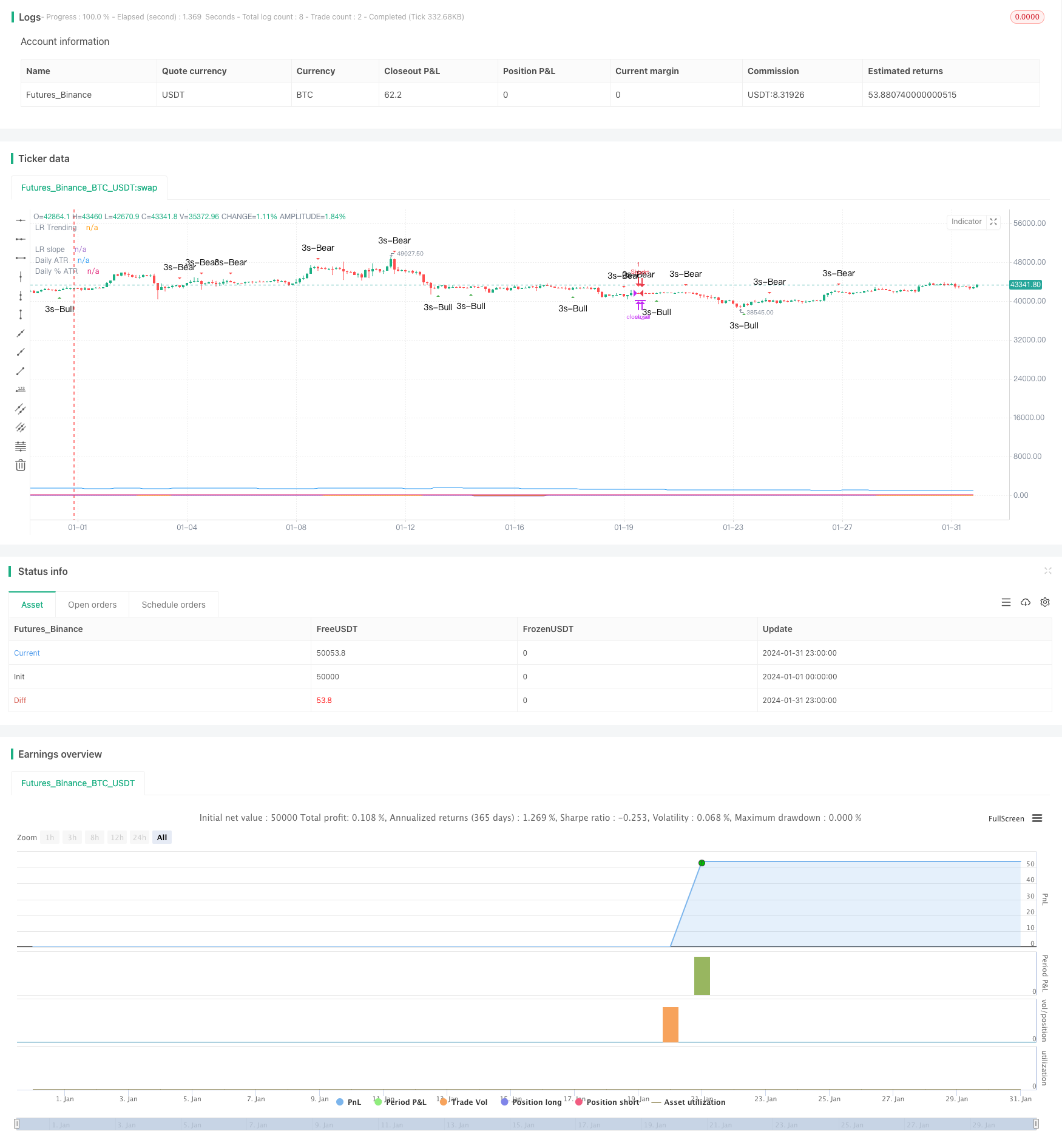

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © platsn

//

// Mainly developed for SPY trading on 1 min chart. But feel free to try on other tickers.

// Basic idea of this strategy is to look for 3 candle reversal pattern within trending market structure. The 3 candle reversal pattern consist of 3 consecutive bullish or bearish candles,

// followed by an engulfing candle in the opposite direction. This pattern usually signals a reversal of short term trend. This strategy also uses multiple moving averages to filter long or short

// entries. ie. if the 21 smoothed moving average is above the 50, only look for long (bullish) entries, and vise versa. There is option change these moving average periods to suit your needs.

// I also choose to use Linear Regression to determine whether the market is ranging or trending. It seems the 3 candle pattern is more successful under trending market. Hence I use it as a filter.

// There is also an option to combine this strategy with moving average crossovers. The idea is to look for 3 canddle pattern right after a fast moving average crosses over a slow moving average.

// By default , 21 and 50 smoothed moving averages are used. This gives additional entry opportunites and also provides better results.

// This strategy aims for 1:3 risk to reward ratio. Stop losses are calculated using the closest low or high values for long or short entries, respectively, with an offset using a percentage of

// the daily ATR value. This allows some price flucuation without being stopped out prematurely. Price target is calculated by multiplying the difference between the entry price and the stop loss

// by a factor of 3. When price target is reach, this strategy will set stop loss at the price target and wait for exit considion to maximize potential profit.

// This strategy will exit an order if an opposing 3 candle pattern is detected, this could happend before stop loss or price target is reached, and may also happen after price target is reached.

// *Note that this strategy is designed for same day SPY option scalping. I haven't determined an easy way to calculate the # of contracts to represent the equivalent option values. Plus the option

// prices varies greatly depending on which strike and expiry that may suits your trading style. Therefore, please be mindful of the net profit shown. By default, each entry is approxiately equal

// to buying 10 of same day or 1 day expiry call or puts at strike $1 - $2 OTM. This strategy will close all open trades at 3:45pm EST on Mon, Wed, and Fri.

// **Note that this strategy also takes into account of extended market data.

// ***Note pyramiding is set to 2 by default, so it allows for multiple entries on the way towards price target.

// Remember that market conditions are always changing. This strategy was only able to be backtested using 1 month of data. This strategy may not work the next month. Please keep that in mind.

// *****************************************************************************************************************************************************************************************************

//@version=5

strategy("3 Candle Strike Stretegy", overlay=true, pyramiding=2, initial_capital=5000, commission_type=strategy.commission.cash_per_contract, commission_value = 0.01)

// ******************** Period **************************************

startY = input(title='Start Year', defval=2011, group = "Trading window")

startM = input.int(title='Start Month', defval=1, minval=1, maxval=12, group = "Trading window")

startD = input.int(title='Start Day', defval=1, minval=1, maxval=31, group = "Trading window")

finishY = input(title='Finish Year', defval=2050, group = "Trading window")

finishM = input.int(title='Finish Month', defval=12, minval=1, maxval=12, group = "Trading window")

finishD = input.int(title='Finish Day', defval=31, minval=1, maxval=31, group = "Trading window")

timestart = timestamp(startY, startM, startD, 00, 00)

timefinish = timestamp(finishY, finishM, finishD, 23, 59)

t1 = time(timeframe.period, "0930-1545:23456")

window = true

// *****************************************************

isSPY = input.bool(defval=true,title="SPY trading only", group = "Trading Options")

SPY_option = input.int(defval=10,title="# of SPY options per trade", group = "Trading Options")

reinvest = input.bool(defval=false,title="reinvest profit?", group = "Trading Options")

src = close

// ***************************************************************************************************** Daily ATR *****************************************************

// Inputs

atrlen = input.int(14, minval=1, title="ATR period", group = "Daily ATR")

iPercent = input.float(5, minval=1, maxval=100, step=0.1, title="% ATR to use for SL / PT", group = "Daily ATR")

// PTPercent = input.int(100, minval=1, title="% ATR for PT")

// Logic

percentage = iPercent * 0.01

datr = request.security(syminfo.tickerid, "1D", ta.rma(ta.tr, atrlen))

datrp = datr * percentage

// datrPT = datr * PTPercent * 0.01

plot(datr,"Daily ATR")

plot(datrp, "Daily % ATR")

// ***************************************************************************************************************** Moving Averages ************************

len0 = input.int(8, minval=1, title='Fast EMA', group= "Moving Averages")

ema1 = ta.ema(src, len0)

len1 = input.int(21, minval=1, title='Fast SMMA', group= "Moving Averages")

smma1 = 0.0

sma_1 = ta.sma(src, len1)

smma1 := na(smma1[1]) ? sma_1 : (smma1[1] * (len1 - 1) + src) / len1

len2 = input.int(50, minval=1, title='Slow SMMA', group= "Moving Averages")

smma2 = 0.0

sma_2 = ta.sma(src, len2)

smma2 := na(smma2[1]) ? sma_2 : (smma2[1] * (len2 - 1) + src) / len2

len3 = input.int(200, minval=1, title='Slow SMMA', group= "Moving Averages")

smma3 = 0.0

sma_3 = ta.sma(src, len3)

smma3 := na(smma3[1]) ? sma_3 : (smma3[1] * (len3 - 1) + src) / len3

ma_bull = smma1 > smma2 and smma1 > smma1[1]

ma_bear = smma1 < smma2 and smma1 < smma1[1]

ma_bull_macro = smma1 > smma3 and smma2 > smma3

ma_bear_macro = smma1 < smma3 and smma2 < smma3

// plot(ma_bull? 1 : 0, "MA bull")

// plot(ma_bear? 1 : 0 , "MA bear")

// **************************************************************************************************************** Linear Regression *************************

//Input

clen = input.int(defval = 50, minval = 1, title = "Linear Regression Period", group = "Linear Regression")

slen = input.int(defval=50, minval=1, title="LR Slope Period" , group = "Linear Regression")

glen = input.int(defval=14, minval=1, title="LR Signal Period", group = "Linear Regression")

LR_thres = input.float(0.03, minval=0, step=0.001, title="LR Threshold for Ranging vs Trending" , group = "Linear Regression")

//Linear Regression Curve

lrc = ta.linreg(src, clen, 0)

//Linear Regression Slope

lrs = (lrc-lrc[1])/1

//Smooth Linear Regression Slope

slrs = ta.ema(lrs, slen)

//Signal Linear Regression Slope

alrs = ta.sma(slrs, glen)

up_accel = lrs > alrs and lrs > 0

down_accel = lrs < alrs and lrs < 0

LR_ranging = math.abs(slrs) <= LR_thres

LR_trending = math.abs(slrs) > LR_thres

plot(slrs, "LR slope")

plot(LR_trending?1:0, "LR Trending")

// *********************************************************************************************************************************** Candle conditions **************************

bull_3s = close[3] <= open[3] and close[2] <= open[2] and close[1] <= open[1] and close > open[1]

bear_3s = close[3] >= open[3] and close[2] >= open[2] and close[1] >= open[1] and close < open[1]

plotshape(bull_3s, style=shape.triangleup, color=color.new(color.green, 0), location=location.belowbar, size=size.small, text='3s-Bull', title='3 Line Strike Up')

plotshape(bear_3s, style=shape.triangledown, color=color.new(color.red, 0), location=location.abovebar, size=size.small, text='3s-Bear', title='3 Line Strike Down')

// ***************************************************************************************************************************************** SL & PT ***********************************

RR = input.float(3.0, minval = 1, step = 0.1, title="Reward to Risk Ratio", group = "Trading Options")

barsSinceLastEntry()=>

strategy.opentrades > 0 ? (bar_index - strategy.opentrades.entry_bar_index(strategy.opentrades-1)) : na

last_high = math.max(high, high[1], high[2], high[3])

last_low = math.min(low, low[1], low[2], low[3])

long_SL = last_low - datrp

short_SL = last_high + datrp

long_PT = last_high

short_PT = last_low

last_entry = strategy.opentrades.entry_price(strategy.opentrades-1)

risk = last_entry - long_SL

if strategy.opentrades > 0

long_SL := math.min(long_SL[barsSinceLastEntry()], last_low)

short_SL := math.max(short_SL[barsSinceLastEntry()], last_high)

risk := last_entry - long_SL

long_PT := last_entry + (last_entry - long_SL) * RR

short_PT := last_entry - (short_SL - last_entry) * RR

else

long_PT := open + (open - long_SL) * RR

short_PT := open - (short_SL - open) * RR

// plot(short_SL,title = "Short SL", color=color.new(color.purple,30))

// plot(long_SL,title = "Long SL", color=color.new(color.purple,30))

// plot(long_PT,title = "Long PT", color=color.new(color.white,50))

// plot(short_PT,title = "Short PT", color=color.new(color.white,50))

// plot(last_entry, title = "Last entry")

// plot(risk, title = "Risk")

// **************************************************************************************************************************************** Trade Pauses ****************************************

bool trade_pause = false

bool trade_pause2 = false

if high - low > datr*0.3

trade_pause := true

else

trade_pause := false

no_longat10 = input.bool(true, title="No long entry between 10 - 10:30 (Avoid 10 am dump)", group = "Trading Options")

// ************************************************************************************************************************************ Entry conditions **************************

trade_3s = input.bool(title='Trade 3s candle pattern', defval=true, group = "Trading Options")

L_entry1 = bull_3s and ma_bull and LR_trending

S_entry1 = bear_3s and ma_bear and LR_trending

trade_ma_reversal = input.bool(title='Trade MA Cross Reversal Signal', defval=true, group = "Trading Options")

L_entry2 = ma_bear_macro and ema1 > smma1 and bull_3s and ta.barssince(ta.cross(ema1,smma1)) < 10

S_entry2 = ma_bull_macro and ema1 < smma1 and bear_3s and ta.barssince(ta.cross(ema1,smma1)) < 10

// ************************************************************************************************************************************** Exit Conditions ********************************

// bsle_thres = input.int(0, "Bar since entry threshold")

// exit0 = barsSinceLastEntry() >= bsle_thres

exit0 = true

L_exit1 = bear_3s

S_exit1 = bull_3s

// ************************************************************************************************************************************ Entry and Exit orders *****************************

strategy.initial_capital = 50000

trade_amount = math.floor(strategy.initial_capital / close)

if isSPY

if strategy.netprofit > 0 and reinvest

trade_amount := math.floor((strategy.initial_capital + strategy.netprofit) * 0.2 / 600) * 10 * SPY_option

else

trade_amount := math.floor(strategy.initial_capital * 0.2 / 600) * 10 * SPY_option

if not(trade_pause) and not(trade_pause2) and time(timeframe.period, "0930-1540:23456")

if trade_3s

if not(time(timeframe.period, "1000-1030:23456")) and no_longat10

strategy.entry("Long", strategy.long, 1, when = L_entry1 and window, comment="Long 3s" + " SL=" + str.tostring(math.round(long_SL,2)) + " PT=" + str.tostring(math.round(long_PT,2)))

strategy.entry("Short", strategy.short, 1, when = S_entry1 and window, comment = "Short 3s" + " SL=" + str.tostring(math.round(short_SL,2)) + " PT=" + str.tostring(math.round(short_PT,2)))

if trade_ma_reversal

strategy.entry("Long", strategy.long, 1, when = L_entry2 and window, comment="Long MA cross" + " SL=" + str.tostring(math.round(long_SL,2)) + " PT=" + str.tostring(math.round(long_PT,2)))

strategy.entry("Short", strategy.short, 1, when = S_entry2 and window, comment = "Short MA corss" + " SL=" + str.tostring(math.round(short_SL,2)) + " PT=" + str.tostring(math.round(short_PT,2)))

if high > long_PT

long_SL := low[1]

strategy.exit("Exit", "Long", when = exit0 and low < long_PT, stop= long_SL, comment = "Exit Long SL/PT hit")

strategy.close("Long", when = L_exit1, comment = "Exit on Bear Signal")

if low < short_PT

short_SL := high[1]

strategy.exit("Exit", "Short", when= exit0 and high > short_PT, stop= short_SL, comment = "Exit Short SL/PT hit")

strategy.close("Short", when = S_exit1, comment = "Exit on Bull Signal")

if time(timeframe.period, "1545-1600:246")

strategy.close_all()