1

フォロー

1664

フォロワー

概要

“Z値ベースのトレンドトラッキング戦略”は,Z値という統計指標を活用して,価格が移動平均から偏っている程度を測定し,標準差を統一尺度として使用して,トレンドの機会を捉えます.この戦略は,簡潔さと有効性のために知られており,特に価格運動が常時均等値に戻る市場には適しています.複数の指標に依存する複雑なシステムとは異なり, “Z値トレンド戦略”は,明瞭で統計的に顕著な価格変動に焦点を当てており,精密なデータ駆動型の方法が好まれるトレーダーに最適です.

戦略原則

この戦略の核心は,Z値の計算である.Z値は,現在の価格とユーザ定義の長さの価格指数移動平均 (EMA) の差を計算し,同じ長さの価格基準差を割り算することによって得られます:

z = (x - μ) / σ

その中で,xは現在の価格,μはEMA平均値,σは標準差である.

取引シグナルは,Z値が予期された値を越えた上で生成される:

- 多頭入場:Z値が正値を超えると

- 多頭出場:Z値が負の値を下に突破する.

- 空頭入場:Z値が負の値を下に突破する.

- 空頭出場: Z値が正値を超えたとき.

戦略的優位性

- 簡潔で効果的:この戦略は数少ないパラメータに依存し,理解し,実行しやすく,同時にトレンドの機会を捉えるのに非常に効果的です.

- 統計学的基礎:Z値は,成熟した統計学的ツールとして,この戦略に堅固な理論的基礎を提供している.

- 適応性:値,EMA,標準差の計算周期などのパラメータを調整することにより,この戦略は異なる取引スタイルと市場環境に柔軟に適応します.

- 明確なシグナル:Z値による値越えの取引シグナルが単純で明快で,迅速な意思決定と実行に役立ちます.

戦略リスク

- パラメータが敏感である:不適切なパラメータ設定 (値があまりにも高く,あるいは低すぎると) は,取引信号を誤って,機会を逃したり,損失を招く可能性があります.

- トレンド認識: 波動や市場整合で,この戦略は頻繁に偽信号に直面し,不良なパフォーマンスを発揮する.

- 遅延効果:トレンド追跡策として,その入場と出場シグナルには一定の遅延があり,最適なタイミングを逃す可能性があります.

上記のリスクは,継続的な市場分析,パラメータの最適化,および反省に基づいて慎重に実施することで,制御および緩和することができる.

戦略最適化の方向性

- 動的値:波動率に関連した動的値を導入し,異なる市場状況に効果的に適応し,信号品質を向上させる.

- 組合せ指標:RSI,MACDなどの他の技術指標を統合し,取引信号を二次確認し,信頼性を向上させる.

- ポジション管理:ATRなどのポジション制御メカニズムを組み込み,波動市場では適時減仓,トレンド市場では適時増仓,利益リスク比率を最適化します.

- 複数のタイムスケール:複数のタイムスケールにわたるZ値を計算し,さまざまなレベルのトレンドを捉え,戦略の次元を豊かにする.

要約する

“Z値ベースのトレンド追跡戦略”は,簡潔で,堅牢で,柔軟な特質で,トレンドの機会を捉えるためのユニークな視点を提供します.合理的なパラメータ設定,慎重なリスク管理,継続的な最適化により,この戦略は,変化する市場の中で安定して前進する量化トレーダーの強力な助手になる可能性があります.

ストラテジーソースコード

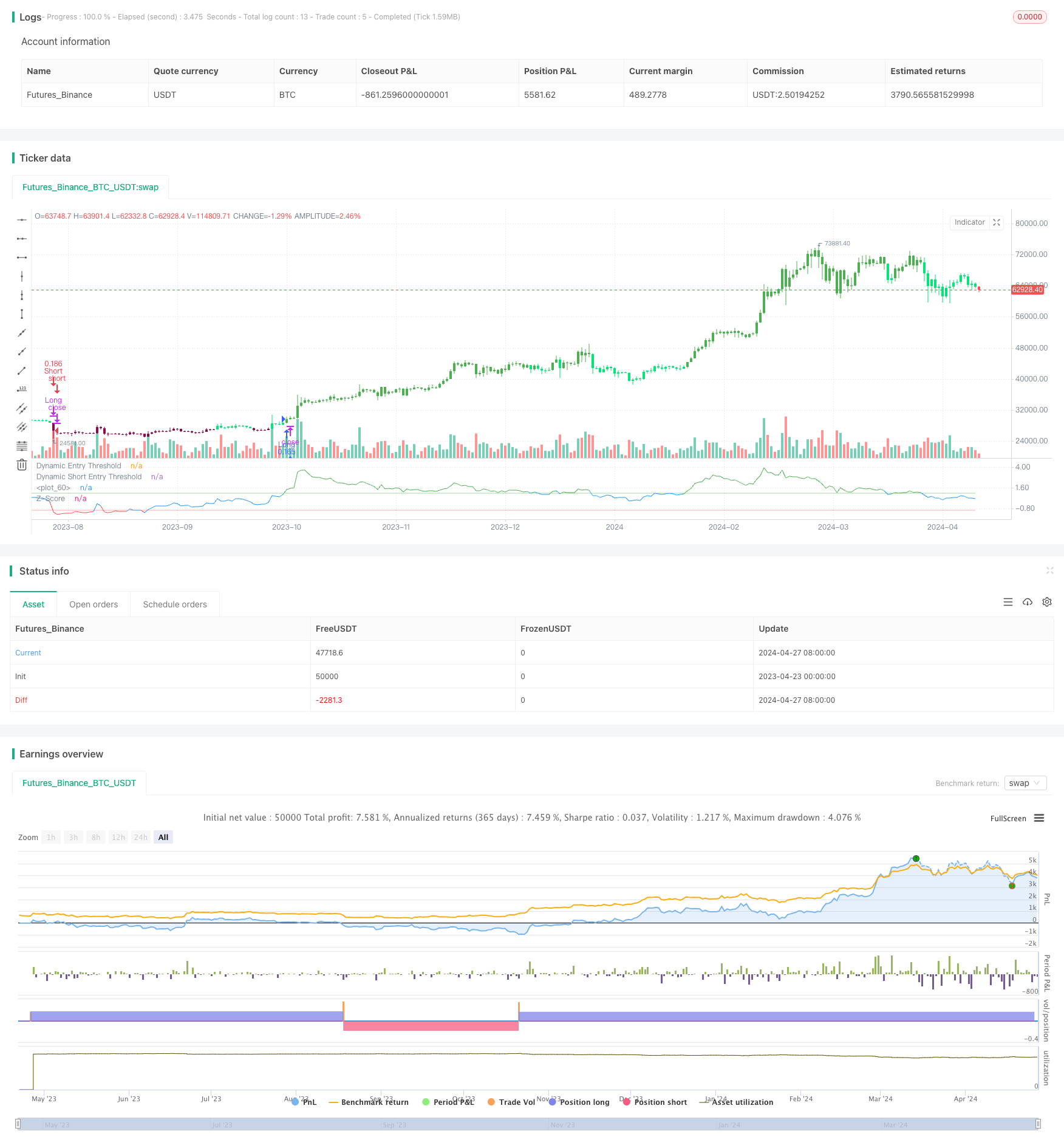

/*backtest

start: 2023-04-23 00:00:00

end: 2024-04-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © PresentTrading

// This strategy employs a statistical approach by using a Z-score, which measures the deviation of the price from its moving average normalized by the standard deviation.

// Very simple and effective approach

//@version=5

strategy('Price Based Z-Trend - strategy [presentTrading]',shorttitle = 'Price Based Z-Trend - strategy [presentTrading]', overlay=false, precision=3,

commission_value=0.1, commission_type=strategy.commission.percent, slippage=1,

currency=currency.USD, default_qty_type=strategy.percent_of_equity, default_qty_value=10, initial_capital=10000)

// User-definable parameters for the Z-score calculation and bar coloring

tradeDirection = input.string("Both", "Trading Direction", options=["Long", "Short", "Both"]) // User selects trading direction

priceDeviationLength = input.int(100, "Standard Deviation Length", step=1) // Length for standard deviation calculation

priceAverageLength = input.int(100, "Average Length", step=1) // Length for moving average calculation

Threshold = input.float(1, "Threshold", step=0.1) // Number of standard deviations for Z-score threshold

priceBar = input(title='Bar Color', defval=true) // Toggle for coloring price bars based on Z-score

// Z-score calculation based on user input for the price source (typically the closing price)

priceSource = input(close, title="Source")

priceZScore = (priceSource - ta.ema(priceSource, priceAverageLength)) / ta.stdev(priceSource, priceDeviationLength) // Z-score calculation

// Conditions for entering and exiting trades based on Z-score crossovers

priceLongCondition = ta.crossover(priceZScore, Threshold) // Condition to enter long positions

priceExitLongCondition = ta.crossunder(priceZScore, -Threshold) // Condition to exit long positions

longEntryCondition = ta.crossover(priceZScore, Threshold)

longExitCondition = ta.crossunder(priceZScore, -Threshold)

shortEntryCondition = ta.crossunder(priceZScore, -Threshold)

shortExitCondition = ta.crossover(priceZScore, Threshold)

// Strategy conditions and execution based on Z-score crossovers and trading direction

if (tradeDirection == "Long" or tradeDirection == "Both") and longEntryCondition

strategy.entry("Long", strategy.long) // Enter a long position

if (tradeDirection == "Long" or tradeDirection == "Both") and longExitCondition

strategy.close("Long") // Close the long position

if (tradeDirection == "Short" or tradeDirection == "Both") and shortEntryCondition

strategy.entry("Short", strategy.short) // Enter a short position

if (tradeDirection == "Short" or tradeDirection == "Both") and shortExitCondition

strategy.close("Short") // Close the short position

// Dynamic Thresholds Visualization using 'plot'

plot(Threshold, "Dynamic Entry Threshold", color=color.new(color.green, 50))

plot(-Threshold, "Dynamic Short Entry Threshold", color=color.new(color.red, 50))

// Color-coding Z-Score

priceZScoreColor = priceZScore > Threshold ? color.green :

priceZScore < -Threshold ? color.red : color.blue

plot(priceZScore, "Z-Score", color=priceZScoreColor)

// Lines

hline(0, color=color.rgb(255, 255, 255, 50), linestyle=hline.style_dotted)

// Bar Color

priceBarColor = priceZScore > Threshold ? color.green :

priceZScore > 0 ? color.lime :

priceZScore < Threshold ? color.maroon :

priceZScore < 0 ? color.red : color.black

barcolor(priceBar ? priceBarColor : na)