1

フォロー

1664

フォロワー

概要

“MACD RSI一目均衡イチモク動量トレンド多頭戦略”は,MACD,RSIと一目均衡雲図の信号を分析することによって,市場の傾向と動力を捕捉し,トレンドを追跡し,買い売りのタイミングを把握する目的を実現する,MACD,RSIと一目均衡雲図の信号を総合的に使用する量化取引戦略である.戦略は,指標のパラメータと取引周期を柔軟に設定し,異なる取引スタイルと市場に適用する.

戦略原則

この戦略の核心は,MACD,RSI,および一目瞭然の均衡指標を統合したものです.

- MACDは,急速な移動平均と遅い移動平均の差値から構成され,トレンドの方向と動力の変化を判断するために使用される. MACDは,速線上の遅い線を横断すると,買入シグナルを生成し,速線下の遅い線を横断すると,売り出しシグナルを生成する.

- RSIは,期間中の価格の上昇と下落を測定し,超買いと超売り状態を示す.RSIが30を下回ると,市場は超売り状態にある可能性があります.70を超えると,市場は超売り状態にある可能性があります.

- 一見均衡雲図は,転換線,基準線,先行上線,先行下線から構成され,サポート位,レジスタンス位,トレンド強度などの多方面情報を提供する. この戦略は,MACDが多頭で,価格が雲のグラフ上にあり,RSIが超買いしないときに多頭;MACDがデッドフォークまたは価格が雲のグラフを下回ったときに平仓.

戦略的優位性

- 多指標検証により,トレンド判断の正確性が向上する.MACDはトレンドの方向を把握し,RSIはタイミングの選択を補助し,一目瞭然の均衡により,より全面的な市場概要を提供し,戦略の信頼性を高めます.

- パラメータは柔軟で適応性がある. MACD,RSI,一見均衡のパラメータ設定を異なる取引スタイルと市場の特徴に合わせて調整することができます.

- リスク管理。 ストップ・ロズとストップ・ストップを設定し,撤収を制御する. 購入リスクを低減するために,分量で倉庫を建設する。

- 適用範囲は広い.様々な市場や品種で利用でき,さまざまなトレンドの機会を把握できます.

戦略リスク

- 指数信号の衝突 △MACD,RSI,一目均衡は時折相反する信号を生じ,判断の誤りを引き起こします.

- パラメータ設定不適切.不適切なパラメータは,戦略を無効にし,市場の特徴と反省に基づいて最適化する必要があります.

- 振動する市場では不良なパフォーマンスをしている.トレンド戦略は振動する市場では頻繁に取引され,高いコストが利潤を蝕む可能性がある.

- 突発的事件のリスク 特定の事件により,指数信号に反して価格の異常な波動が起こる

戦略最適化の方向性

- トレンド確認条件の強化,例えば,価格がクラウドグラフで上昇し,MACDは背離するなど,開場品質の向上.

- ストップ・ストップ・ストップとポジション管理を導入し,引き下げを制御し,収益リスク比率を向上させる.

- パラメータを最適化して,異なる品種と周期特性に適応し,安定性を向上させる.

- 移動式ストップを追加し,収益を追跡し,優位性を高めることも検討できます.

要約する

“MACD RSI 一目均衡 Ichimoku動量トレンド多頭策略”は,MACD,RSIと一目均衡指標を総合的に使用して,トレンドと動力を全面的に考慮し,方向性のある市場で良好なトレンドを捕捉し,節奏をコントロールする能力を発揮する強力な定量取引策である.パラメータの最適化とリスク管理措置により,この戦略は,市場機会を把握し,安定した収益を得るために強力なツールになることができます.

ストラテジーソースコード

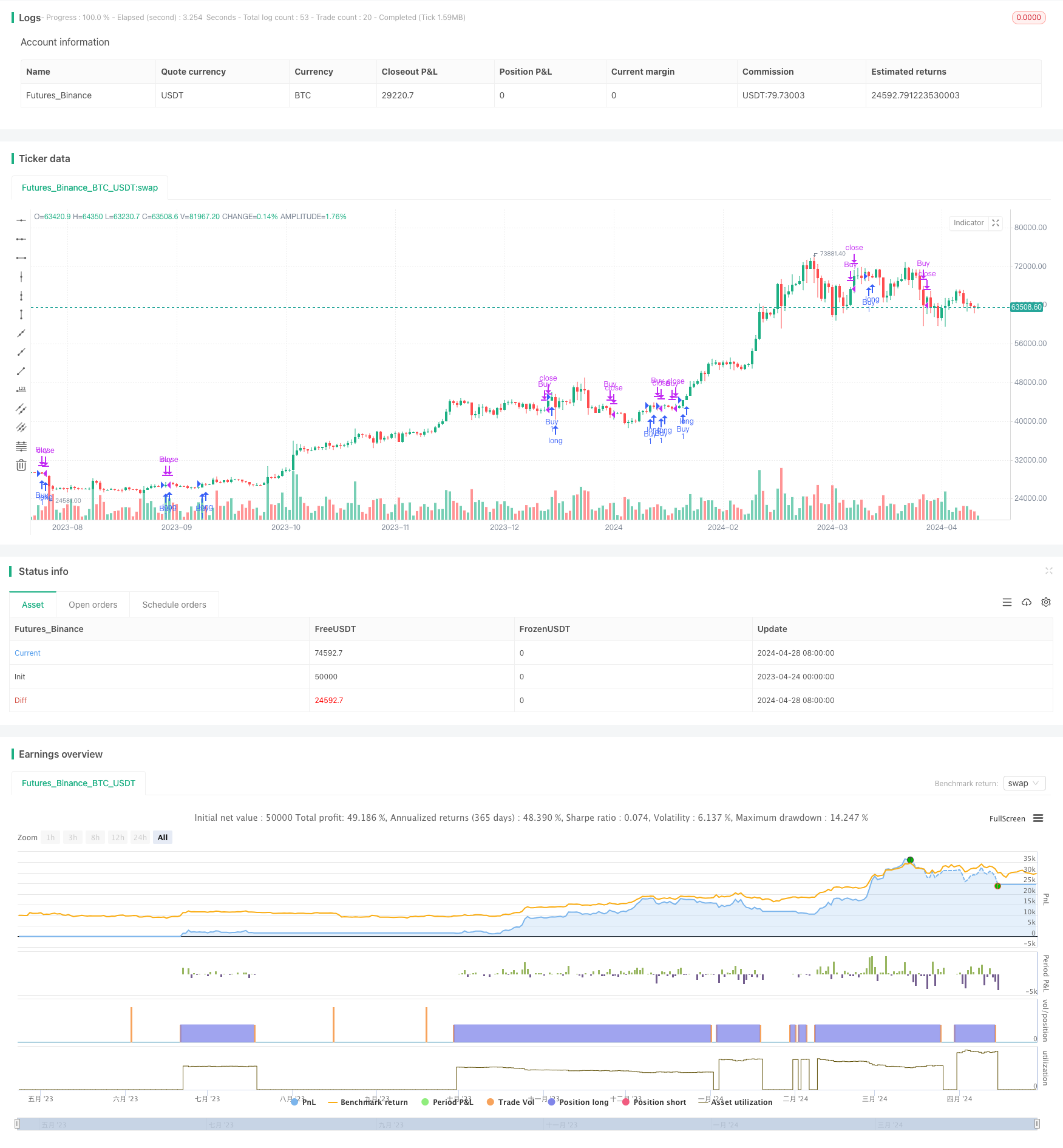

/*backtest

start: 2023-04-24 00:00:00

end: 2024-04-29 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @ Julien_Eche

//@version=5

strategy("MACD RSI Ichimoku Strategy", overlay=true)

string t1 = ("If checked, this strategy is suitable for those who buy and sell. If unchecked, it is suitable for those who only want to take long positions—buying and closing buys.")

start_date = input(timestamp("1975-01-01T00:00:00"), title="Start Date")

end_date = input(timestamp("2099-01-01T00:00:00"), title="End Date")

// Input settings for Ichimoku Cloud lengths

length1 = input.int(9, title="Tenkan-sen Length", minval=1)

length2 = input.int(26, title="Kijun-sen Length", minval=1)

length3 = input.int(52, title="Senkou Span Length", minval=1)

// Calculate Ichimoku Cloud components based on input lengths

tenkanSen = ta.sma(high + low, length1) / 2

kijunSen = ta.sma(high + low, length2) / 2

senkouSpanA = ((tenkanSen + kijunSen) / 2)[length2]

senkouSpanB = ta.sma(high + low, length3) / 2

// Input settings for MACD parameters

macdFastLength = input(12, title="MACD Fast Length")

macdSlowLength = input(26, title="MACD Slow Length")

macdSignalLength = input(9, title="MACD Signal Length")

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalLength)

// Input settings for RSI length

rsiLength = input(14, title="RSI Length")

// Calculate RSI

rsiValue = ta.rsi(close, rsiLength)

// Determine Buy/Sell behavior based on input

buySell = input(false, title="Buy/Sell", tooltip=t1)

// More sensitive entry conditions (Buy Only)

canEnter = ta.crossover(tenkanSen, kijunSen) or (close > senkouSpanA and close > senkouSpanB and macdLine > signalLine and rsiValue < 70)

// Enter long position (Buy) with time condition

if (canEnter)

strategy.entry("Buy", strategy.long)

// More sensitive exit conditions (Close Buy) with time condition

canExit = ta.crossunder(tenkanSen, kijunSen) or (close < senkouSpanA and close < senkouSpanB)

// Determine exit behavior based on user input

if buySell

// Sell to close long position (Short) with time condition

if (canExit )

strategy.entry("Sell", strategy.short)

else

// Sell to exit long position (Buy/Sell) with time condition

if (canExit )

strategy.close("Buy", comment="Sell for exit")