概要

双均線交差に基づく移動平均戦略は,二つの異なる周期の移動平均の間の関係を分析することによって,市場における潜在的な買入と売却の機会を識別することを目的とした,シンプルで効果的な日中の取引方法である.この戦略は,短期間の平均線を長い平均線に突破すると,看板の信号を示し,潜在的な買入の機会を提示する,短期間の平均線を短い平均線に突破すると,看板の信号を示し,潜在的な売出の機会を提示する,短期間の平均線を長い平均線に突破すると,その逆である.この交差法は,トレーダーが市場動向を捉え,市場騒音の干渉を最小限に抑えるのに役立ちます.

戦略原則

この戦略の核心原則は,異なる周期の移動平均線の傾向特性と滞り性を利用し,短期平均線と長期平均線の相対的な位置関係を比較して,現在の市場の傾向方向を判断し,それに対応した取引意思決定を行うことである.市場が上昇傾向にあるとき,価格は最初に長期平均線を突破し,短期平均線が長期平均線を突破して金叉を形成し,買入シグナルを生成する.市場が下降傾向にあるとき,価格は最初に長期平均線を突破し,短期平均線が長期平均線を突破して金叉を形成し,売出シグナルを生成する.この戦略のパラメータ設定では,短期平均線は周期9で,長期平均線は周期21で,この2つのパラメータは,市場が個人的特徴と好みに応じて調整することができる.また,この戦略は,初期資金管理の概念を導入し,資金の初期設定と取引比率を調整し,各取引先の取引のリスクを制御する.

戦略的優位性

- シンプルで理解しやすい:この戦略は古典的な移動平均理論に基づいています. 論理は明確で,理解しやすく実行できます.

- 適応性:この戦略は,複数の市場と異なる取引品種に適用でき,パラメータ設定を調整することで,異なる市場特性に柔軟に対応できます.

- トレンドキャプチャ: 双平線交差によってトレンドの方向を判断し,トレーダーが主流のトレンドに間に合うように助け,利益の機会を向上させる.

- リスク管理:この戦略は,リスク管理の概念を導入し,ポジション調整によって,各取引のリスクの口を制御し,潜在的な損失を効果的に管理する.

- 騒音の軽減:均線の遅滞特性を利用し,市場のランダムな騒音を効果的にフィルタリングし,取引信号の信頼性を向上させる.

戦略リスク

- パラメータ選択:異なるパラメータ設定は,戦略のパフォーマンスに重要な影響を及ぼし,間違った選択は,戦略の失敗または不良なパフォーマンスを引き起こす可能性があります.

- 市場動向: 動揺する市場やトレンドの転換点で,この戦略が連続して損失を伴う場合.

- スキップポイントコスト: 頻繁に取引すると,戦略の全体的な収益に影響を与える,高いスキップポイントコストが生じることがあります.

- ブラック・スワン事件:この戦略は,極端な状況に適応が不十分で,ブラック・スワン事件は戦略に大きな損失をもたらす可能性があります.

- 過度に適合するリスク:パラメータを最適化すると,過去のデータに過度に依存すると,実際の取引で戦略がうまく機能しない可能性があります.

戦略最適化の方向性

- 動的パラメータ最適化:市場の状況の変化に応じて,動的に戦略パラメータを調整し,適応性を向上させる.

- トレンド確認:取引信号が生成された後,他の指標または価格行動パターンを導入してトレンドを確認し,信号の信頼性を向上させる.

- ストップ・ストップ: 合理的なストップ・ストップの導入により,単一取引のリスクの限界をさらに制御する.

- ポジション管理:ポジションの調整を最適化する方法,例えば波動率指標の導入,市場の波動レベルに応じてポジションの動的調整.

- 多空力度評価:多頭と空頭力の対比関係を評価し,トレンドの初期に介入し,トレンド把握の正確性を向上させる.

要約する

双均線交差に基づく移動平均戦略は,異なる周期平均線の位置関係を比較して,市場トレンド方向を判断し,取引信号を生成する簡単な実用的な日内取引方法である.この戦略の論理は明確で,適応性が強く,市場トレンドを効果的に捉え,リスク管理措置を導入し,潜在的な損失を制御することができる.しかし,この戦略には,パラメータ,トレンド転換選択,頻繁な取引などの潜在的なリスクが存在し,ダイナミック・オプティマイゼーション,シグナル確認,ポジション管理などの方法によって戦略の安定性と収益性をさらに向上させる必要がある.全体的に,移動平均線は,クラシックな技術分析指標として,基本原理と実際の応用価値は,市場で広く実証されており,継続的に深入の研究と最適化される取引戦略に価値がある.

Overview

The Moving Average Crossover Strategy based on dual moving averages is a straightforward and effective intraday trading approach designed to identify potential buy and sell opportunities in the market by analyzing the relationship between two moving averages of different periods. This strategy utilizes a short-term simple moving average (SMA) and a long-term simple moving average. When the short-term moving average crosses above the long-term moving average, it indicates a bullish signal, suggesting a potential buying opportunity. Conversely, when the short-term moving average crosses below the long-term moving average, it indicates a bearish signal, suggesting a potential selling opportunity. This crossover method helps traders capture trending moves in the market while minimizing market noise interference.

Strategy Principle

The core principle of this strategy is to utilize the trend characteristics and lag of moving averages with different periods. By comparing the relative position relationship between the short-term moving average and the long-term moving average, it determines the current market trend direction and makes corresponding trading decisions. When an upward trend emerges in the market, the price will first break through the long-term moving average, and the short-term moving average will subsequently cross above the long-term moving average, forming a golden cross and generating a buy signal. When a downward trend emerges in the market, the price will first break below the long-term moving average, and the short-term moving average will subsequently cross below the long-term moving average, forming a death cross and generating a sell signal. In the parameter settings of this strategy, the period of the short-term moving average is set to 9, and the period of the long-term moving average is set to 21. These two parameters can be adjusted based on market characteristics and personal preferences. Additionally, this strategy introduces the concept of money management by setting the initial capital and risk percentage per trade, using position sizing to control the risk exposure of each trade.

Strategy Advantages

- Simplicity: This strategy is based on the classic moving average theory, with clear logic and easy to understand and implement.

- Adaptability: This strategy can be applied to multiple markets and different trading instruments. By adjusting parameter settings, it can flexibly adapt to different market characteristics.

- Trend Capture: By using the dual moving average crossover to determine the trend direction, it helps traders timely follow the mainstream trend and increase profit opportunities.

- Risk Control: This strategy introduces the concept of risk management, using position sizing to control the risk exposure of each trade, effectively managing potential losses.

- Noise Reduction: By utilizing the lag characteristic of moving averages, it effectively filters out random noise in the market, improving the reliability of trading signals.

Strategy Risks

- Parameter Selection: Different parameter settings can have a significant impact on strategy performance. Improper selection may lead to strategy failure or poor performance.

- Market Trend: In ranging markets or trend turning points, this strategy may experience consecutive losses.

- Slippage Costs: Frequent trading may result in higher slippage costs, affecting the overall profitability of the strategy.

- Black Swan Events: This strategy has poor adaptability to extreme market conditions, and black swan events may cause significant losses to the strategy.

- Overfitting Risk: If parameter optimization relies too heavily on historical data, it may lead to poor performance of the strategy in actual trading.

Strategy Optimization Directions

- Dynamic Parameter Optimization: Dynamically adjust strategy parameters based on changes in market conditions to improve adaptability.

- Trend Confirmation: After generating trading signals, introduce other indicators or price behavior patterns to confirm the trend, improving signal reliability.

- Stop-Loss and Take-Profit: Introduce reasonable stop-loss and take-profit mechanisms to further control the risk exposure of each trade.

- Position Management: Optimize the position sizing method, such as introducing volatility indicators to dynamically adjust positions based on market volatility levels.

- Long-Short Strength Assessment: Assess the comparative relationship between bullish and bearish strengths, entering at the early stage of a trend to improve the accuracy of trend capture.

Summary

The Moving Average Crossover Strategy based on dual moving averages is a simple and practical intraday trading method. By comparing the position relationship of moving averages with different periods, it determines the market trend direction and generates trading signals. This strategy has clear logic, strong adaptability, and can effectively capture market trends while introducing risk management measures to control potential losses. However, this strategy also has potential risks such as parameter selection, trend reversal, frequent trading, etc. It needs to be further improved through dynamic optimization, signal confirmation, position management, and other methods to enhance the robustness and profitability of the strategy. In general, as a classic technical analysis indicator, the basic principles and practical application value of moving averages have been widely verified by the market. It is a trading strategy worthy of in-depth research and continuous optimization.

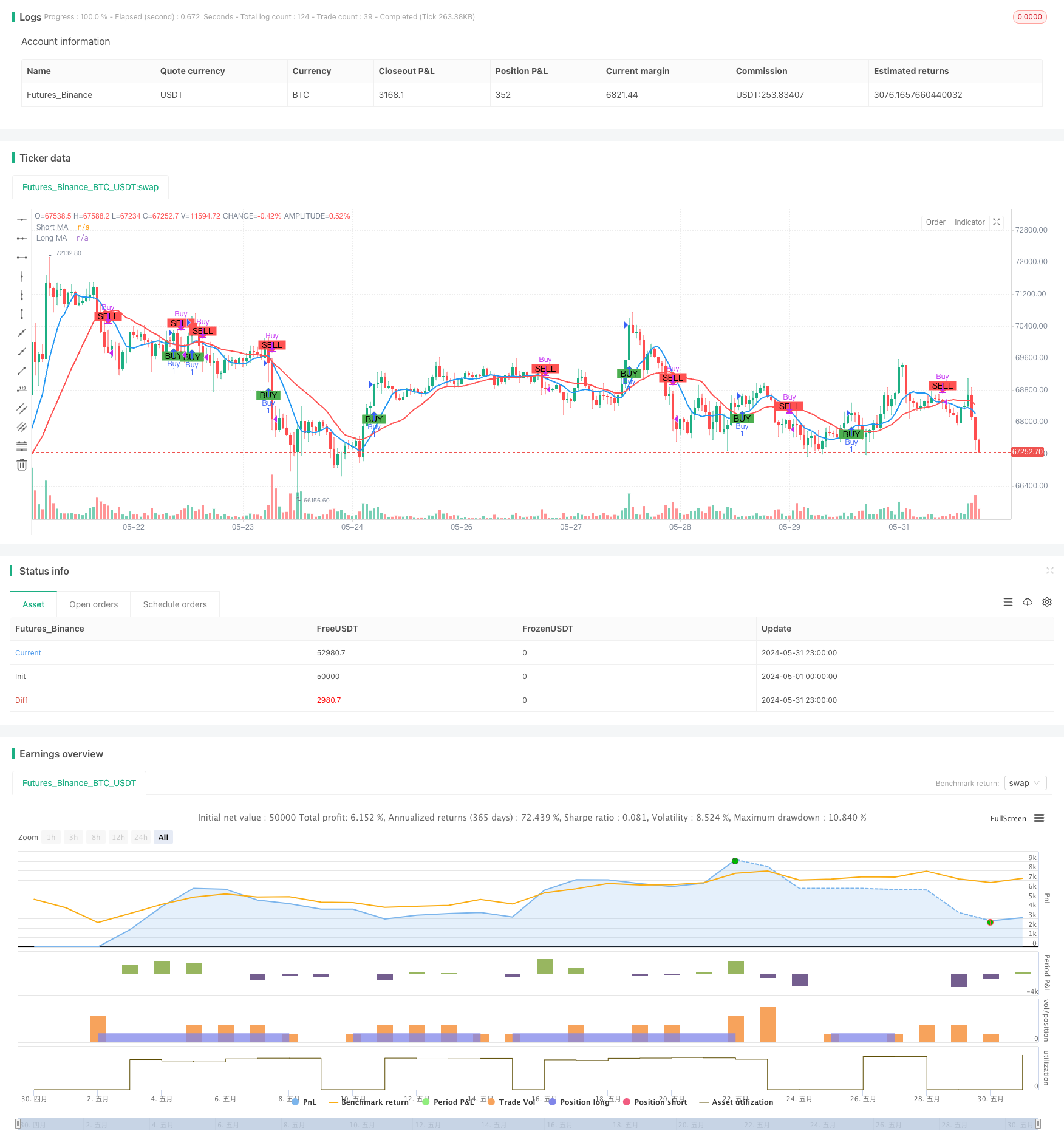

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Moving Average Crossover Strategy", overlay=true)

// Input parameters

shortLength = input.int(9, title="Short Moving Average Length")

longLength = input.int(21, title="Long Moving Average Length")

capital = input.float(100000, title="Initial Capital")

risk_per_trade = input.float(1.0, title="Risk Per Trade (%)")

// Calculate Moving Averages

shortMA = ta.sma(close, shortLength)

longMA = ta.sma(close, longLength)

// Plot Moving Averages

plot(shortMA, title="Short MA", color=color.blue, linewidth=2)

plot(longMA, title="Long MA", color=color.red, linewidth=2)

// Generate Buy/Sell signals

longCondition = ta.crossover(shortMA, longMA)

shortCondition = ta.crossunder(shortMA, longMA)

// Plot Buy/Sell signals

plotshape(series=longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Risk management: calculate position size

risk_amount = capital * (risk_per_trade / 100)

position_size = risk_amount / close

// Execute Buy/Sell orders with position size

if (longCondition)

strategy.entry("Buy", strategy.long, qty=1, comment="Buy")

if (shortCondition)

strategy.close("Buy", comment="Sell")

// Display the initial capital and risk per trade on the chart

var label initialLabel = na

if (na(initialLabel))

initialLabel := label.new(x=bar_index, y=high, text="Initial Capital: " + str.tostring(capital) + "\nRisk Per Trade: " + str.tostring(risk_per_trade) + "%", style=label.style_label_down, color=color.white, textcolor=color.black)

else

label.set_xy(initialLabel, x=bar_index, y=high)