概要

この戦略は,相対的に強い弱指数 (RSI),移動平均の収束散布 (MACD),ブルリン帯 (Bollinger Bands) と取引量などの複数の技術指標を組み合わせて,最適な取引時間を決定します. 戦略は,価格と取引量データを分析し,傾向と波動を識別し,動量指標と波動指標を使用して取引信号を生成します. さらに,この戦略は,取引信号をさらに最適化するために流動性領域の概念を導入します.

戦略原則

- RSI,MACD,ブリン帯,取引量指標を計算する.

- 短期および長期の移動平均を使用してトレンドの方向性を識別する.

- 流動性の高点と低点を定義する

- 購入シグナルを生成する:

- RSIが30を下回り,閉盘価格がブリン帯下下軌道より低く,流動性の領域の低点上にあるとき,購入する.

- MACD柱状図が0より大きいとき,上昇傾向が確立され,閉盘価格が前10K線の最高点より高く,流動性の領域の低点の上にあるとき,購入する.

- 取引量が急増し,閉盘価格がブリン帯上線より高く,流動性の領域の低点上にあるとき,購入する.

- 売る信号を生成する:

- RSIが70を超え,閉盘価格がブリン帯上位で,流動性の領域の高点の下にあるとき,売却する.

- MACD柱状図が0より小さいとき,下落傾向が確立され,閉盘価格は前10 K線の最低点より低く,流動性の領域の高点の下にあるとき,売却する.

- 取引量が急増し,閉盘価格がブリン帯下下軌道より低く,流動性の領域の高点の下にあるとき,売却する.

- 取引は買入と売却のシグナルに従って実行し,重複取引を避ける.

戦略的優位性

- マルチ指数ポートフォリオ:この戦略は,価格,取引量,トレンド,変動などの複数の側面を考慮し,より信頼性の高い取引シグナルを提供します.

- トレンド確認: 戦略は,短期と長期の移動平均を比較することで,現在のトレンドの方向を効果的に識別することができます.

- 波動性の考慮: ブリン帯と取引量指標を導入することで,戦略は価格の変動と市場の情緒の変化を捉えることができる.

- 流動性ゾーン:流動性ゾーンを特定することで,戦略は重要なサポートとレジスタンス点の近くで取引することができ,成功率を高めます.

- 過剰取引を防止する:戦略は,不必要な取引コストを回避するために,重複取引を防止する仕組みを内蔵しています.

戦略リスク

- パラメータ最適化のリスク: 策略のパフォーマンスは複数のパラメータの選択に依存し,不適切なパラメータ設定は策略の失敗につながる可能性があります.

- 市場リスク:戦略は,過去のデータに基づいて最適化され,将来の市場変化に対して不十分なパフォーマンスを発揮する可能性があります.

- ブラック・スウィーン事件: 戦略が極端な市場条件の異常な波動に対応できていない

- スライドポイントと取引コスト:実際の取引におけるスライドポイントと取引コストは,戦略の全体的なパフォーマンスに影響を与える可能性があります.

戦略最適化の方向性

- 動的パラメータ最適化:市場の状況に応じて動的に戦略パラメータを調整し,異なる市場段階に適合させる.

- リスク管理: ストップ・ローズ・アンド・ストップ・メカニズムを導入し,単一取引のリスクの限界を制御する.

- マルチマーケットテスト:戦略を異なる金融市場に適用し,その普遍性と安定性を評価する.

- 機械学習の最適化: 機械学習のアルゴリズムを使用して,戦略を最適化し,市場の変化に適応する.

要約する

この戦略は,RSI,MACD,ブリン帯,取引量などの複数の技術指標を組み合わせて,完全な取引システムを形成します. この戦略は,価格,トレンド,波動,市場情緒などの複数の側面を考慮し,取引シグナルを最適化するために流動性領域の概念を導入します. この戦略には一定の優位性がありますが,パラメータ最適化,市場リスクなどの課題があります.

ストラテジーソースコード

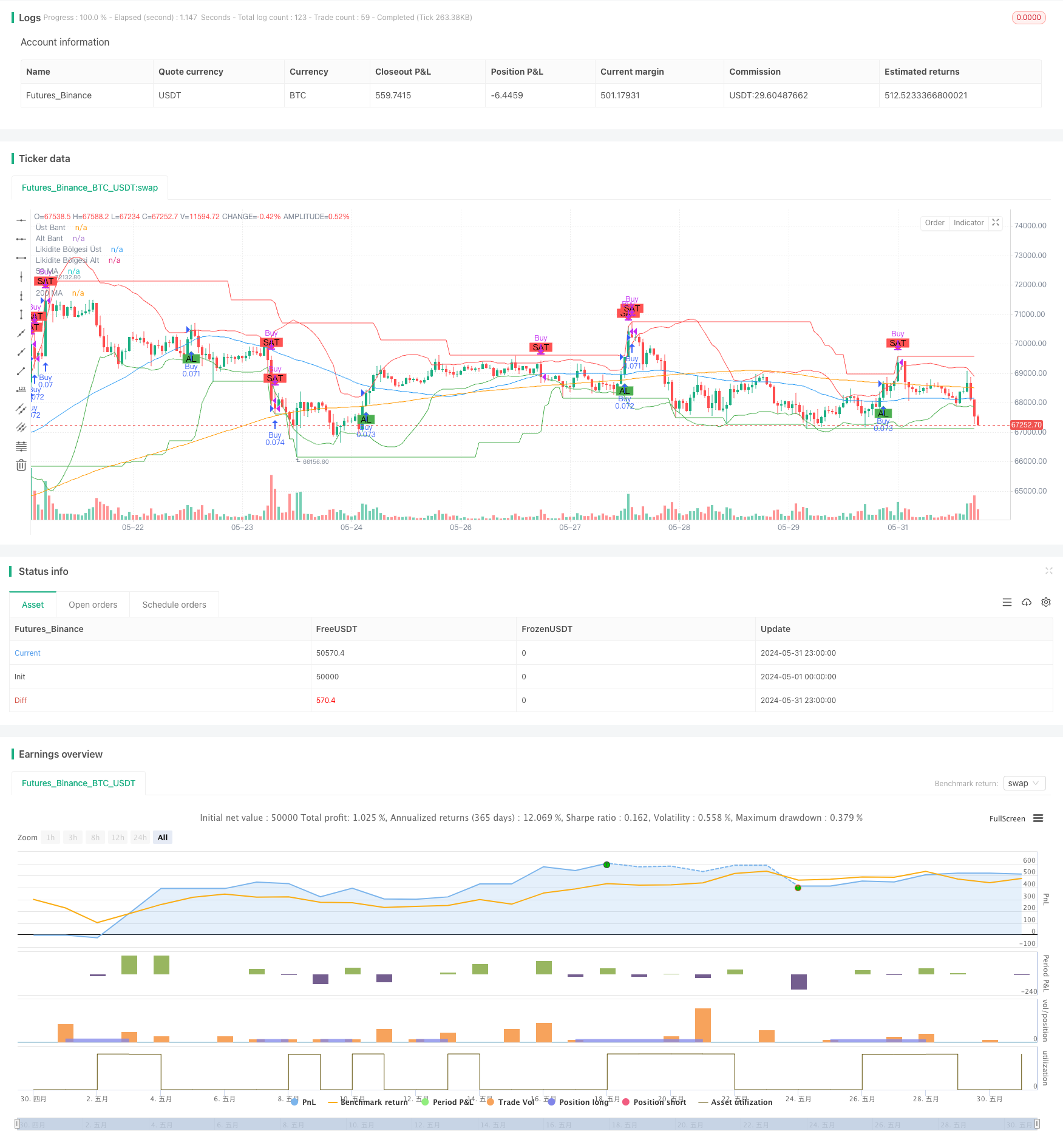

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Optimize Edilmiş Kapsamlı Ticaret Stratejisi - Likidite Bölgeleri ile 30 Dakika", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Optimize edilebilir parametreler

rsiPeriod = input.int(14, minval=5, maxval=30, title="RSI Periyodu")

macdShortPeriod = input.int(12, minval=5, maxval=30, title="MACD Kısa Periyodu")

macdLongPeriod = input.int(26, minval=20, maxval=50, title="MACD Uzun Periyodu")

macdSignalPeriod = input.int(9, minval=5, maxval=20, title="MACD Sinyal Periyodu")

smaPeriod = input.int(20, minval=10, maxval=50, title="SMA Periyodu")

bollingerMultiplier = input.float(2.0, minval=1.0, maxval=3.0, title="Bollinger Bantları Çarpanı")

volumeSpikeMultiplier = input.float(1.5, minval=1.0, maxval=3.0, title="Hacim Artış Çarpanı")

shortTermMAPeriod = input.int(50, minval=20, maxval=100, title="Kısa Dönem MA Periyodu")

longTermMAPeriod = input.int(200, minval=100, maxval=300, title="Uzun Dönem MA Periyodu")

liquidityZonePeriod = input.int(50, minval=10, maxval=100, title="Likidite Bölgesi Periyodu")

// İndikatörleri Tanımla

rsi = ta.rsi(close, rsiPeriod)

[macdLine, signalLine, _] = ta.macd(close, macdShortPeriod, macdLongPeriod, macdSignalPeriod)

macdHist = macdLine - signalLine

basis = ta.sma(close, smaPeriod)

dev = bollingerMultiplier * ta.stdev(close, smaPeriod)

upperBand = basis + dev

lowerBand = basis - dev

volumeSpike = volume > ta.sma(volume, 20) * volumeSpikeMultiplier

// Hareketli Ortalamaları Kullanarak Trend Takibi

shortTermMA = ta.sma(close, shortTermMAPeriod)

longTermMA = ta.sma(close, longTermMAPeriod)

trendUp = shortTermMA > longTermMA

trendDown = shortTermMA < longTermMA

// Likidite Bölgelerini Belirleme

liquidityZoneHigh = ta.highest(high, liquidityZonePeriod)

liquidityZoneLow = ta.lowest(low, liquidityZonePeriod)

// Likidite Bölgelerini Çiz

plot(liquidityZoneHigh, color=color.red, title="Likidite Bölgesi Üst")

plot(liquidityZoneLow, color=color.green, title="Likidite Bölgesi Alt")

// Sinyal Durumlarını Saklamak İçin Değişkenler

var bool inPosition = false

var bool isBuy = false

// Al ve Sat Sinyali Bayrakları

var bool buyFlag = false

var bool sellFlag = false

// Bayrakları Sıfırla

buyFlag := false

sellFlag := false

// Al ve Sat Sinyallerini Tanımla

var bool buySignal = false

var bool sellSignal = false

if (barstate.isconfirmed)

buySignal := ((rsi < 30 and close < lowerBand and close > liquidityZoneLow) or

(macdHist > 0 and trendUp and close > ta.highest(high, 10)[1] and close > liquidityZoneLow) or

(volumeSpike and close > upperBand and close > liquidityZoneLow))

sellSignal := ((rsi > 70 and close > upperBand and close < liquidityZoneHigh) or

(macdHist < 0 and trendDown and close < ta.lowest(low, 10)[1] and close < liquidityZoneHigh) or

(volumeSpike and close < lowerBand and close < liquidityZoneHigh))

// Aynı Sinyali Tekrarlamamak İçin Kontroller

if (buySignal and (not inPosition or not isBuy))

inPosition := true

isBuy := true

buyFlag := true

sellFlag := false

strategy.entry("Buy", strategy.long)

if (sellSignal and inPosition and isBuy)

inPosition := false

isBuy := false

sellFlag := true

buyFlag := false

strategy.close("Buy")

// Sinyalleri Grafiğe Çiz

plotshape(series=buyFlag, location=location.belowbar, color=color.green, style=shape.labelup, text="AL")

plotshape(series=sellFlag, location=location.abovebar, color=color.red, style=shape.labeldown, text="SAT")

// Hareketli Ortalamaları ve Bollinger Bantlarını Çiz

plot(shortTermMA, color=color.blue, title="50 MA")

plot(longTermMA, color=color.orange, title="200 MA")

plot(upperBand, color=color.red, title="Üst Bant")

plot(lowerBand, color=color.green, title="Alt Bant")