1

フォロー

1664

フォロワー

概要

この戦略は,3つの異なる周期の指数移動平均 ((EMA) と相対的に強い指数 ((RSI) を使って市場の傾向と取引信号を判断する.価格が200日EMAを突破し,RSIが50より大きいときに買い信号を生成し,逆に価格が200日EMAを突破し,RSIが50より小さいときに売り信号を生成する.この戦略は日線レベルの波段取引に適用される.

戦略原則

- 200日目,50日目,21日目のEMAを計算し,青,赤,緑の線で表示する.

- 14サイクルRSIを計算する.

- 閉店価格が200日EMAを超え,RSIが50を超えると,買入シグナルが生成されます.

- 閉店価格が200日EMAを下回り,RSIが50未満であるとき,セールシグナルが生成されます.

- ポジションの大きさは,口座の純額の1%である.

- 購入取引のストップ・ロスは,200日EMAの50点以下で,ストップ・ストップは購入価格の100点上である.

- 販売取引のストップ・ロスは,200日EMA上50点,販売価格の下100点のストップ・ストップ・ポジションである.

戦略的優位性

- 価格と動力の指標を組み合わせることで,トレンドの形成と逆転のタイミングを捉えるのに役立ちます.

- 3つの異なる周期のEMAは,短期,中期,長期のトレンドを全面的に反映し,信号周波数と偽信号を減少させる.

- RSIは,波動的な市場の取引信号をフィルターして,損失を伴う取引を減らすことができます.

- 固定比率のポジションはリスク管理に役立ちます.

- ストップ・ロスト・ストップを設定し,単一取引のリスクを防ぐ.

戦略リスク

- トレンド・ターニング・ポイントの信号遅延は,部分的な利益の損失を引き起こす可能性があります.

- RSIシグナルは,強いトレンドの中で,早すぎる反転シグナルの発生を引き起こす可能性があります.

- 固定比率のポジションは,大きな波動の状況でリスクが高い.

- 200日平均線に近いストップポジションは,頻繁なストップを引き起こす可能性があります.

戦略最適化の方向性

- 信号を最適化するために,より多くの中長期均線組合せを導入する.

- RSIの偏差と超買いと超売りを考慮してシグナルを調整する.

- ATRなどの波動率指標に基づいて動的にポジションの大きさを調整する.

- サポートレジスタンス位,パーセント,ATRなどの設定によるストップダストストップ位置を最適化します.

- ADXのようなトレンドフィルター条件を導入し,波動的な市場での取引を避ける.

- 異なる基準と周期に対してパラメータ最適化と反測検証を行う.

要約する

この戦略は,EMAの多頭並びとRSIの強い区間の取引シグナルによって,比較的明確な中長期のトレンド状況を捉えることができます. しかし,トレンドの転換の初期と振動的な市場では,一般的に,全体的にトレンド市場に適しています. その後,シグナル,ポジション,ストップ・ローズ・ストップ,フィルター条件などからさらに最適化して,戦略の安定性と利益リスク比率を向上させることができます.

ストラテジーソースコード

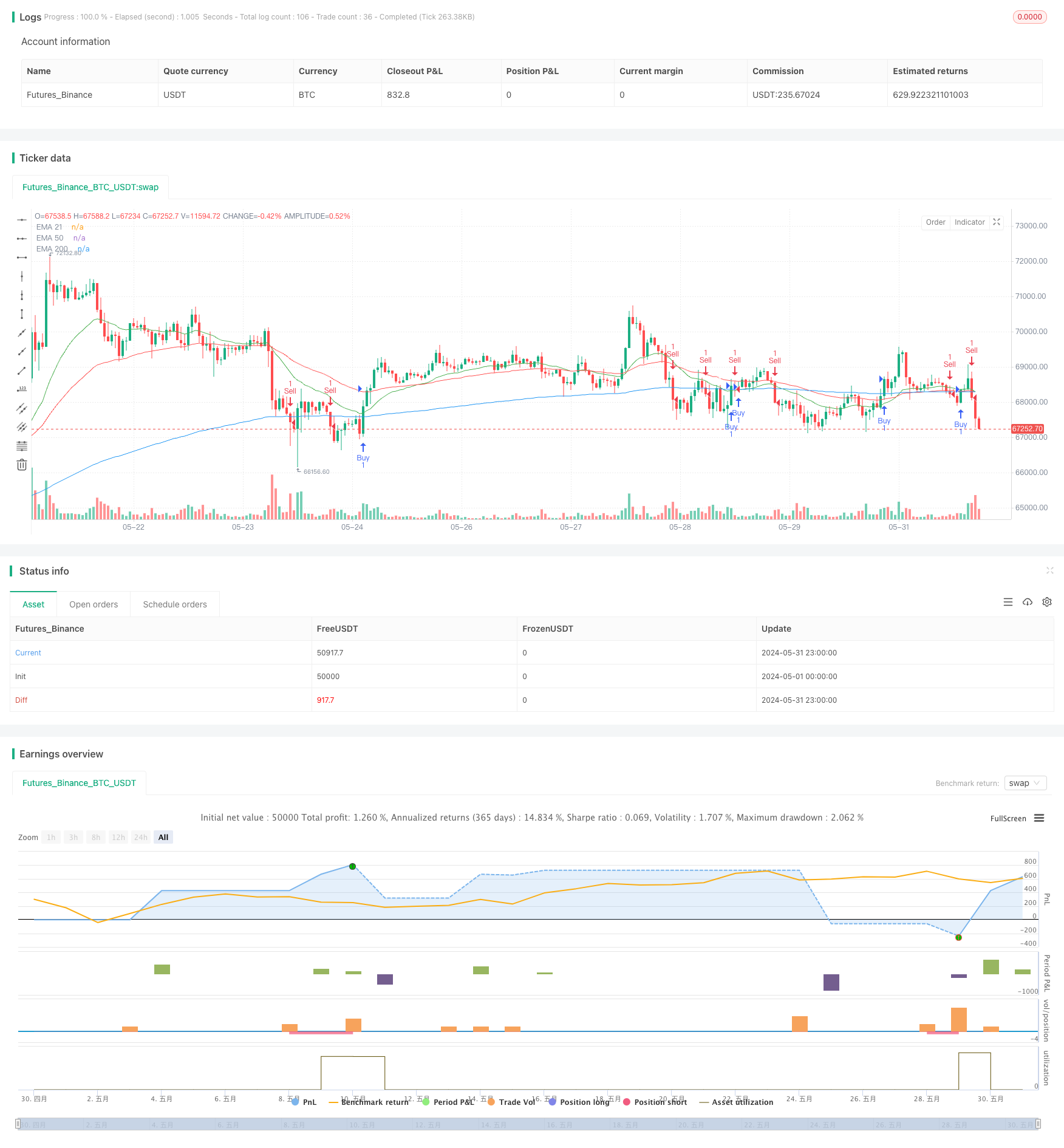

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Lexi Supreme", overlay=true)

// Calculate EMA 200

ema200 = ta.ema(close, 200)

// Calculate EMA 50

ema50 = ta.ema(close, 50)

// Calculate EMA 21

ema21 = ta.ema(close, 21)

// Calculate RSI

rsiValue = ta.rsi(close, 14)

// Buy condition: RSI above 50 and price crosses above EMA 200

buyCondition = ta.crossover(close, ema200) and rsiValue > 50

// Sell condition: RSI below 50 and price crosses below EMA 200

sellCondition = ta.crossunder(close, ema200) and rsiValue < 50

// Position Size (1% of account balance)

positionSize = 1

// Stop Loss and Take Profit values for buy trades

stopLossBuy = ema200 - 0.00050

takeProfitBuy = 0.00100

// Stop Loss and Take Profit values for sell trades

stopLossSell = ema200 + 0.00050

takeProfitSell = 0.00100

// Plot EMA 200 line in blue

plot(ema200, color=color.blue, title="EMA 200")

// Plot EMA 50 line in red

plot(ema50, color=color.red, title="EMA 50")

// Plot EMA 21 line in green

plot(ema21, color=color.green, title="EMA 21")

// Plot buy entry points in yellow

plotshape(series=buyCondition, title="Buy Signal", color=color.yellow, style=shape.triangleup, location=location.belowbar, size=size.small)

// Plot sell entry points in white

plotshape(series=sellCondition, title="Sell Signal", color=color.white, style=shape.triangledown, location=location.abovebar, size=size.small)

// Strategy entry and exit conditions with position size, stop loss, and take profit for buy trades

if (buyCondition)

strategy.entry("Buy", strategy.long, qty=positionSize)

strategy.exit("Take Profit/Stop Loss Buy", from_entry="Buy", stop=stopLossBuy, limit=close + takeProfitBuy)

// Strategy entry and exit conditions with position size, stop loss, and take profit for sell trades

if (sellCondition)

strategy.entry("Sell", strategy.short, qty=positionSize)

strategy.exit("Take Profit/Stop Loss Sell", from_entry="Sell", stop=stopLossSell, limit=close - takeProfitSell)