1

フォロー

1664

フォロワー

概要

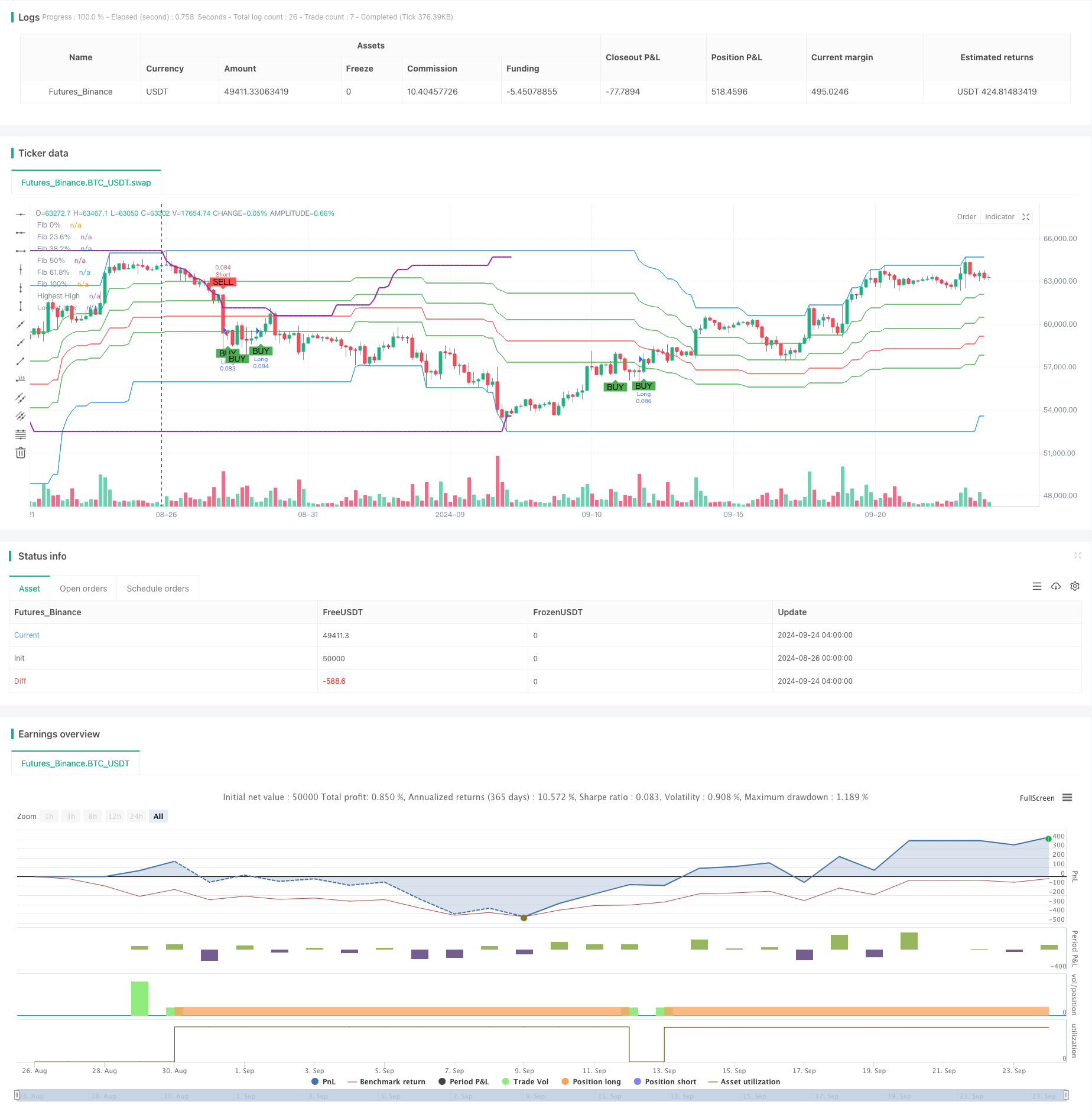

この戦略は,フィボナッチ・リトラクション理論に基づいた自己適応の多レベル取引システムである.フィボナッチ・リトラクションレベルを使用して,市場における重要なサポートとレジスタンス値を識別し,それらのレベルとの価格の相互作用に基づいて取引信号を生成する.この戦略の核心は,市場の状況と個人の好みに応じて,トレーダーが重要なパラメータを調整することを可能にする柔軟性である.

戦略原則

戦略の核心的な論理は以下のステップで構成されています.

- 高低点の特定:ユーザー定義の回顧周期を使用して最高点と最低点を識別する.

- フィボナッチレベルを計算する:高低点を基に計算する重要なフィボナッチ逆戻りレベル ((23.6%,38.2%,50%,61.8%) ≫.

- 取引シグナルを生成する:価格が特定のフィボナッチレベルを突破すると,買ったり売ったりするシグナルをトリガーする.

- リスク管理: ストップとストップ・ロスを使って,各取引のリスクを管理する.

戦略の特徴は,ユーザがフィボナッチ計算の方向を選択することを許すことである (上から下へ,あるいは下から上へ),また,買取と売却のシグナルのために異なるフィボナッチレベルを選択することである.この柔軟性は,戦略を異なる市場環境と取引スタイルに適応させることを可能にする.

戦略的優位性

- 適応性: 策略は,ユーザが重要なパラメータを調整できるようにすることで,異なる市場条件と取引品種に適応できます.

- リスク管理: 取引のリスクをコントロールするために,内蔵のストップとストップ・ロスの仕組みが使われます.

- ビジュアルフィードバック:戦略はフィボナッチレベルをグラフに描き,トレーダーに市場構造の直感的な見方を提供します.

- 多次元分析:価格行動とフィボナcci_level 0.0ebo85と cci_level 0.0ebo62との間のキャッシュを組み合わせることで,プログラムの安定性を考慮する.もしプログラムの安定性に特別な要求がないなら, cci_level 0.0ebo85を0.85に変更し, cci_level 0.0ebo62を0.62に変更することもできます.

戦略リスク

- 偽の突破: 価格がフィボナッチレベルを頻繁に突破し,誤ったシグナルを引き起こす可能性があります.

- パラメータ感性:戦略の性能はパラメータ設定に大きく依存し,不適切なパラメータは過剰取引や重要な機会を逃す可能性があります.

- トレンド依存性: 強いトレンドの市場では,戦略はしばしば逆転取引を誘発し,損失のリスクを増加させる可能性があります.

これらのリスクを軽減するために,以下のようなことを考えられます.

- 他の技術指標 (RSIや移動平均など) と組み合わせて信号を確認する.

- より厳しい入場条件を導入し,価格が突破後一定期間維持されるように要求する.

- 市場変動の動向に応じて,ストップとストップ・ロスのレベルを調整する.

戦略最適化の方向性

- ダイナミックパラメータ調整:市場の変動に応じてリビューサイクルとフィボナッチレベルを自動的に調整する仕組みを開発する.

- 多時間枠分析:信号の信頼性を高めるために,複数の時間枠を統合したフィボナッチレベル.

- 市場環境の量化:市場環境の識別機構を導入し,異なる市場状態で異なる取引論理を採用する.

- 機械学習統合:機械学習アルゴリズムを使用してパラメータ選択と信号生成プロセスを最適化する.

- 情緒指標の統合: 市場情緒指標 (VIXなど) を意思決定プロセスに組み込むことを検討し,市場転換点をよりよく把握する.

これらの最適化は,戦略の適応性と強さを大幅に向上させ,より広範な市場条件下で有効性を維持することができます.

要約する

フィボナッチ・リトラクションに基づく自己適応型多層取引戦略は,金融市場における潜在的な取引機会を識別するための柔軟でカスタマイズ可能な枠組みを提供します. クラシックな技術分析の原理と現代的なリスク管理技術の組み合わせにより,この戦略は,異なる市場環境で高確率の取引機会を探す強力なツールとしてトレーダーに提供されます. しかし,すべての取引戦略のように,それは万能ではありません. この戦略の成功適用には,その原理を深く理解し,パラメータを慎重に調整し,他の分析ツールと組み合わせることが必要です.

ストラテジーソースコード

/*backtest

start: 2024-08-26 00:00:00

end: 2024-09-24 08:00:00

period: 4h

basePeriod: 4h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Simple Fibonacci Retracement Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Input period for high and low points identification

lookback = input.int(100, title="Lookback Period", minval=10)

// Input to choose Fibonacci calculation direction

fib_direction = input.string(title="Fibonacci Direction", defval="Top to Bottom", options=["Top to Bottom", "Bottom to Top"])

// Input for Fibonacci levels

fib_level_236 = input.float(0.236, title="Fib 23.6% Level")

fib_level_382 = input.float(0.382, title="Fib 38.2% Level")

fib_level_50 = input.float(0.5, title="Fib 50% Level")

fib_level_618 = input.float(0.618, title="Fib 61.8% Level")

// Input to choose the level for entry signals

buy_entry_level = input.string(title="Buy Entry Level", defval="Fib 61.8%", options=["Fib 23.6%", "Fib 38.2%", "Fib 50%", "Fib 61.8%"])

sell_entry_level = input.string(title="Sell Entry Level", defval="Fib 38.2%", options=["Fib 23.6%", "Fib 38.2%", "Fib 50%", "Fib 61.8%"])

// Input for take profit and stop loss in pips

take_profit_pips = input.int(50, title="Take Profit (pips)")

stop_loss_pips = input.int(20, title="Stop Loss (pips)")

// Identify high and low points within the lookback period

highestHigh = ta.highest(high, lookback)

lowestLow = ta.lowest(low, lookback)

// Calculate Fibonacci levels based on the selected direction

var float fib_0 = na

var float fib_100 = na

var float fib_236 = na

var float fib_382 = na

var float fib_50 = na

var float fib_618 = na

if fib_direction == "Top to Bottom"

fib_0 := highestHigh

fib_100 := lowestLow

fib_236 := highestHigh - (highestHigh - lowestLow) * fib_level_236

fib_382 := highestHigh - (highestHigh - lowestLow) * fib_level_382

fib_50 := highestHigh - (highestHigh - lowestLow) * fib_level_50

fib_618 := highestHigh - (highestHigh - lowestLow) * fib_level_618

else

fib_0 := lowestLow

fib_100 := highestHigh

fib_236 := lowestLow + (highestHigh - lowestLow) * fib_level_236

fib_382 := lowestLow + (highestHigh - lowestLow) * fib_level_382

fib_50 := lowestLow + (highestHigh - lowestLow) * fib_level_50

fib_618 := lowestLow + (highestHigh - lowestLow) * fib_level_618

// Determine which level to use for buy and sell signals based on user input

var float buy_fib_level = na

var float sell_fib_level = na

if buy_entry_level == "Fib 23.6%"

buy_fib_level := fib_236

if buy_entry_level == "Fib 38.2%"

buy_fib_level := fib_382

if buy_entry_level == "Fib 50%"

buy_fib_level := fib_50

if buy_entry_level == "Fib 61.8%"

buy_fib_level := fib_618

if sell_entry_level == "Fib 23.6%"

sell_fib_level := fib_236

if sell_entry_level == "Fib 38.2%"

sell_fib_level := fib_382

if sell_entry_level == "Fib 50%"

sell_fib_level := fib_50

if sell_entry_level == "Fib 61.8%"

sell_fib_level := fib_618

// Convert pips to price units (assuming 1 pip = 0.0001 for currency pairs like EURUSD)

pip_value = syminfo.mintick * 10

take_profit = take_profit_pips * pip_value

stop_loss = stop_loss_pips * pip_value

// Trading signals

var bool longSignal = na

var bool shortSignal = na

if fib_direction == "Top to Bottom"

longSignal := ta.crossover(close, buy_fib_level) and close > buy_fib_level

shortSignal := ta.crossunder(close, sell_fib_level) and close < sell_fib_level

else

longSignal := ta.crossover(close, buy_fib_level) and close > buy_fib_level

shortSignal := ta.crossunder(close, sell_fib_level) and close < sell_fib_level

// Execute trades based on signals with take profit and stop loss

if (longSignal)

strategy.entry("Long", strategy.long, comment="BUY")

strategy.exit("Take Profit/Stop Loss", "Long", limit=close + take_profit, stop=close - stop_loss)

if (shortSignal)

strategy.entry("Short", strategy.short, comment="SELL")

strategy.exit("Take Profit/Stop Loss", "Short", limit=close - take_profit, stop=close + stop_loss)

// Plot Fibonacci levels

plot(fib_0, title="Fib 0%", color=color.blue, linewidth=1, style=plot.style_line)

plot(fib_236, title="Fib 23.6%", color=color.green, linewidth=1, style=plot.style_line)

plot(fib_382, title="Fib 38.2%", color=color.green, linewidth=1, style=plot.style_line)

plot(fib_50, title="Fib 50%", color=color.red, linewidth=1, style=plot.style_line)

plot(fib_618, title="Fib 61.8%", color=color.green, linewidth=1, style=plot.style_line)

plot(fib_100, title="Fib 100%", color=color.blue, linewidth=1, style=plot.style_line)

// Create labels for Fibonacci levels with white text

var label fibLabel0 = na

var label fibLabel236 = na

var label fibLabel382 = na

var label fibLabel50 = na

var label fibLabel618 = na

var label fibLabel100 = na

if (na(fibLabel0))

fibLabel0 := label.new(bar_index, fib_0, text="Fib 0%", color=na, textcolor=color.white, style=label.style_label_right, yloc=yloc.price)

fibLabel236 := label.new(bar_index, fib_236, text="Fib 23.6%", color=na, textcolor=color.white, style=label.style_label_right, yloc=yloc.price)

fibLabel382 := label.new(bar_index, fib_382, text="Fib 38.2%", color=na, textcolor=color.white, style=label.style_label_right, yloc=yloc.price)

fibLabel50 := label.new(bar_index, fib_50, text="Fib 50%", color=na, textcolor=color.white, style=label.style_label_right, yloc=yloc.price)

fibLabel618 := label.new(bar_index, fib_618, text="Fib 61.8%", color=na, textcolor=color.white, style=label.style_label_right, yloc=yloc.price)

fibLabel100 := label.new(bar_index, fib_100, text="Fib 100%", color=na, textcolor=color.white, style=label.style_label_right, yloc=yloc.price)

else

label.set_xy(fibLabel0, bar_index, fib_0)

label.set_xy(fibLabel236, bar_index, fib_236)

label.set_xy(fibLabel382, bar_index, fib_382)

label.set_xy(fibLabel50, bar_index, fib_50)

label.set_xy(fibLabel618, bar_index, fib_618)

label.set_xy(fibLabel100, bar_index, fib_100)

// Plot signals

plotshape(series=longSignal, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal", text="BUY")

plotshape(series=shortSignal, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal", text="SELL")

// Plot highest and lowest points

plot(highestHigh, title="Highest High", color=color.purple, linewidth=2, offset=-lookback)

plot(lowestLow, title="Lowest Low", color=color.purple, linewidth=2, offset=-lookback)