1

フォロー

1664

フォロワー

この戦略は,EMAの技術指標に基づいたクロスマーケットの夜間ポジション戦略であり,市場閉店前と開店後の取引機会を捉えることを目的としています. この戦略は,正確な時間制御と技術指標のフィルタリングにより,異なる市場環境下でスマートな取引を実現します.

戦略概要

戦略は,市場閉店前の特定の時間に入場し,次の日の開業後の特定の時間に出場することによって利益を得ます. EMA指標をトレンド確認として組み合わせて,複数のグローバル市場での取引機会を探します. 戦略は,自動取引機能を統合し,無人值守操作を実現します.

戦略原則

- タイムコントロール:異なる市場の取引時間に応じて,閉じる前に固定時間入場,開盤後に固定時間出場

- EMAフィルター:選択可能なEMA指標を使用して入場信号を検証する

- 市場選択:米国,アジア,欧州の3大市場の取引時間を自律的にサポートする

- 週末保護:金曜の終盤までにポジションを強制的にクリアし,週末のリスクを回避する

戦略的優位性

- 多市場適応性:異なる市場の特徴に応じて取引時間を柔軟に調整できる

- リスク管理の改善: 週末の平仓保護の導入

- 高い自動化:自動取引インターフェースのペアリングをサポート

- パラメータの柔軟性:取引時間および技術指標のパラメータをカスタマイズできます

- 取引コストの考慮:手数料とスライドポイントの設定を含む

戦略リスク

- 市場変動のリスク:夜間ポジションは空飛ぶリスクがある

- 時間の依存性:戦略の効果は,市場の時間帯の選択によって影響される

- 技術指標の限界:単一のEMA指標が遅滞する可能性がある 推奨: ストップ・ロスを設定し,技術指標の検証を増やす

戦略最適化の方向性

- 技術指標の組み合わせを増やすこと

- 波動率のフィルタリング

- 試合開始時の選択を最適化

- 適応パラメータの調整機能が追加されました

- リスク管理モジュール強化

要約する

この戦略は精密な時間制御と技術指標のフィルタリングにより,信頼性の高い夜間取引システムを実現している.戦略の設計は,多市場適応,リスク管理,自動化取引などの要素を含む実戦需要を全面的に考慮し,強力な実用価値を有している.継続的な最適化と改善により,この戦略は,実体取引で安定した収益を期待している.

ストラテジーソースコード

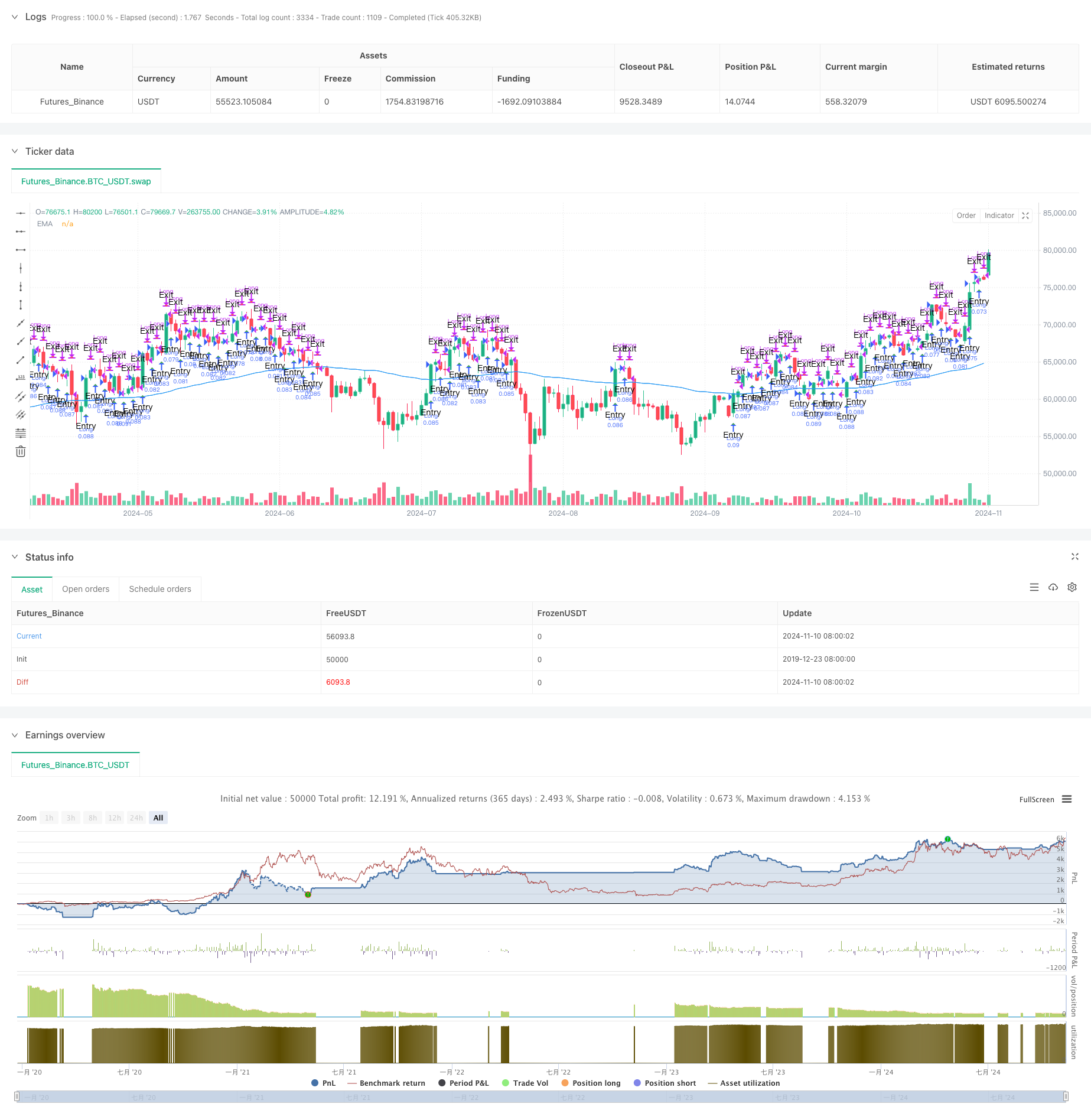

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © PresentTrading

// This strategy, titled "Overnight Market Entry Strategy with EMA Filter," is designed for entering long positions shortly before

// the market closes and exiting shortly after the market opens. The strategy allows for selecting between different global market sessions (US, Asia, Europe) and

// uses an optional EMA (Exponential Moving Average) filter to validate entry signals. The core logic is to enter trades based on conditions set for a specified period before

// the market close and to exit trades either after a specified period following the market open or just before the weekend close.

// Additionally, 3commas bot integration is included to automate the execution of trades. The strategy dynamically adjusts to market open and close times, ensuring trades are properly timed based on the selected market.

// It also includes a force-close mechanism on Fridays to prevent holding positions over the weekend.

//@version=5

strategy("Overnight Positioning with EMA Confirmation - Strategy [presentTrading]", overlay=true, precision=3, commission_value=0.02, commission_type=strategy.commission.percent, slippage=1, currency=currency.USD, default_qty_type=strategy.percent_of_equity, default_qty_value=10, initial_capital=10000)

// Input parameters

entryMinutesBeforeClose = input.int(20, title="Minutes Before Close to Enter", minval=1)

exitMinutesAfterOpen = input.int(20, title="Minutes After Open to Exit", minval=1)

emaLength = input.int(100, title="EMA Length", minval=1)

emaTimeframe = input.timeframe("240", title="EMA Timeframe")

useEMA = input.bool(true, title="Use EMA Filter")

// Market Selection Input

marketSelection = input.string("US", title="Select Market", options=["US", "Asia", "Europe"])

// Timezone for each market

marketTimezone = marketSelection == "US" ? "America/New_York" :

marketSelection == "Asia" ? "Asia/Tokyo" :

"Europe/London" // Default to London for Europe

// Market Open and Close Times for each market

var int marketOpenHour = na

var int marketOpenMinute = na

var int marketCloseHour = na

var int marketCloseMinute = na

if marketSelection == "US"

marketOpenHour := 9

marketOpenMinute := 30

marketCloseHour := 16

marketCloseMinute := 0

else if marketSelection == "Asia"

marketOpenHour := 9

marketOpenMinute := 0

marketCloseHour := 15

marketCloseMinute := 0

else if marketSelection == "Europe"

marketOpenHour := 8

marketOpenMinute := 0

marketCloseHour := 16

marketCloseMinute := 30

// 3commas Bot Settings

emailToken = input.string('', title='Email Token', group='3commas Bot Settings')

long_bot_id = input.string('', title='Long Bot ID', group='3commas Bot Settings')

usePairAdjust = input.bool(false, title='Use this pair in PERP', group='3commas Bot Settings')

selectedExchange = input.string("Binance", title="Select Exchange", group='3commas Bot Settings', options=["Binance", "OKX", "Gate.io", "Bitget"])

// Determine the trading pair based on settings

var pairString = ""

if usePairAdjust

pairString := str.tostring(syminfo.currency) + "_" + str.tostring(syminfo.basecurrency) + (selectedExchange == "OKX" ? "-SWAP" : "")

else

pairString := str.tostring(syminfo.currency) + "_" + str.tostring(syminfo.basecurrency)

// Function to check if it's a trading day (excluding weekends)

isTradingDay(t) =>

dayOfWeek = dayofweek(t, marketTimezone)

dayOfWeek >= dayofweek.monday and dayOfWeek <= dayofweek.friday

// Function to get the timestamp for market open and close times

getMarketTimes(t) =>

y = year(t, marketTimezone)

m = month(t, marketTimezone)

d = dayofmonth(t, marketTimezone)

marketOpenTime = timestamp(marketTimezone, y, m, d, marketOpenHour, marketOpenMinute, 0)

marketCloseTime = timestamp(marketTimezone, y, m, d, marketCloseHour, marketCloseMinute, 0)

[marketOpenTime, marketCloseTime]

// Get the current time in the market's timezone

currentTime = time

// Calculate market times

[marketOpenTime, marketCloseTime] = getMarketTimes(currentTime)

// Calculate entry and exit times

entryTime = marketCloseTime - entryMinutesBeforeClose * 60 * 1000

exitTime = marketOpenTime + exitMinutesAfterOpen * 60 * 1000

// Get EMA data from the specified timeframe

emaValue = request.security(syminfo.tickerid, emaTimeframe, ta.ema(close, emaLength))

// Entry condition with optional EMA filter

longCondition = close > emaValue or not useEMA

// Functions to create JSON strings

getEnterJson() =>

'{"message_type": "bot", "bot_id": "' + long_bot_id + '", "email_token": "' + emailToken + '", "delay_seconds": 0, "pair": "' + pairString + '"}'

getExitJson() =>

'{"action": "close_at_market_price", "message_type": "bot", "bot_id": "' + long_bot_id + '", "email_token": "' + emailToken + '", "delay_seconds": 0, "pair": "' + pairString + '"}'

// Entry Signal

entrySignal = isTradingDay(currentTime) and currentTime >= entryTime and currentTime < marketCloseTime and dayofweek(currentTime, marketTimezone) != dayofweek.friday

// Exit Signal

exitSignal = isTradingDay(currentTime) and currentTime >= exitTime and currentTime < marketCloseTime

// Entry Logic

if strategy.position_size == 0 and longCondition

strategy.entry("Long", strategy.long, alert_message=getEnterJson())

// Exit Logic

if strategy.position_size > 0

strategy.close("Long", alert_message=getExitJson())

// Force Close Logic on Friday before market close

isFriday = dayofweek(currentTime, marketTimezone) == dayofweek.friday

if strategy.position_size > 0 // Close 5 minutes before market close on Friday

strategy.close("Long", comment="Force close on Friday before market close", alert_message=getExitJson())

// Plotting entry and exit points

plotshape( strategy.position_size == 0 and longCondition, title="Entry", text="Entry", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape( strategy.position_size > 0, title="Exit", text="Exit", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

// Plot EMA for reference

plot(useEMA ? emaValue : na, title="EMA", color=color.blue)