概要

この戦略は,MACD (移動平均収束散乱指数) に基づく高度な量化取引システムで,ダイナミックな背景表示と複数の既定のパラメータの組み合わせによって取引決定の正確性を強化しています.この戦略の核心は,MACD指数の交差信号によって市場のトレンドの転換点を捕捉し,視覚的な方法で市場の空白状態を直感的に表示することです.

戦略原則

戦略は,異なる市場環境と取引スタイルに適応するために,標準設定 ((12,26,9),短期 ((5,35,5),長期 ((19,39,9) などを含む10種類の異なるMACDパラメータの既定を採用している. MACDラインとシグナルラインが金色の交差したとき,システムは買入シグナルを生成し,死亡交差したとき,システムは販売を生成する. 信号戦略は,ダイナミックな背景の色変化 ((緑色は多頭,赤色は空頭) を介して視覚的認識を強化し,トレーダーが市場動向をよりよく把握するのを助ける.

戦略的優位性

- パラメータの柔軟性:異なる市場環境に対応する10の既定のパラメータの組み合わせ

- 視覚フィードバックの明快さ:背景の色の動的変化によって市場動向を直感的に表示する

- 信号明晰:MACD交差に基づく明確な買出信号を生成する

- 適応性:異なるタイムサイクルでの取引

- コード構造の明瞭性:スイッチ構造を使用してパラメータの切り替えを実現し,維持と拡張を容易にします.

戦略リスク

- 遅滞性リスク:MACDは,急激な波動のある市場で遅延信号を生じさせる遅滞指標である

- 偽の突破リスク:横軸市場で偽のクロスシグナルが生じる可能性

- パラメータ依存性:異なる市場環境で異なるパラメータの組み合わせにより大きな差異が生じる

- 市場条件の制限: 市場環境の激しい変動や流動性の欠如で不良なパフォーマンスを引き起こす可能性

戦略最適化の方向性

- 波動率のフィルターを導入し,過度の波動期間の取引信号をフィルターします.

- RSIやATRのようなトレンド確認指標を追加し,信号の信頼性を向上させる

- 適応パラメータの最適化を実現し,市場状況に応じてMACDパラメータを動的に調整する

- リスク管理能力の向上

- 取引量分析を追加し,信号の信頼性を向上させる

要約する

これは,構造が整った,論理が明確なMACD戦略の進捗版である.多パラメータの設定と動的視覚フィードバックにより,戦略の実用性と操作性が大きく向上している.いくつかの固有のリスクがあるものの,提供された最適化方向による改善により,この戦略は,健全な取引システムになる見込みがある.トレーダーは,実用化される前に十分なフィードバックを行い,特定の市場環境に応じて適切なパラメータ設定を選択することを推奨している.

ストラテジーソースコード

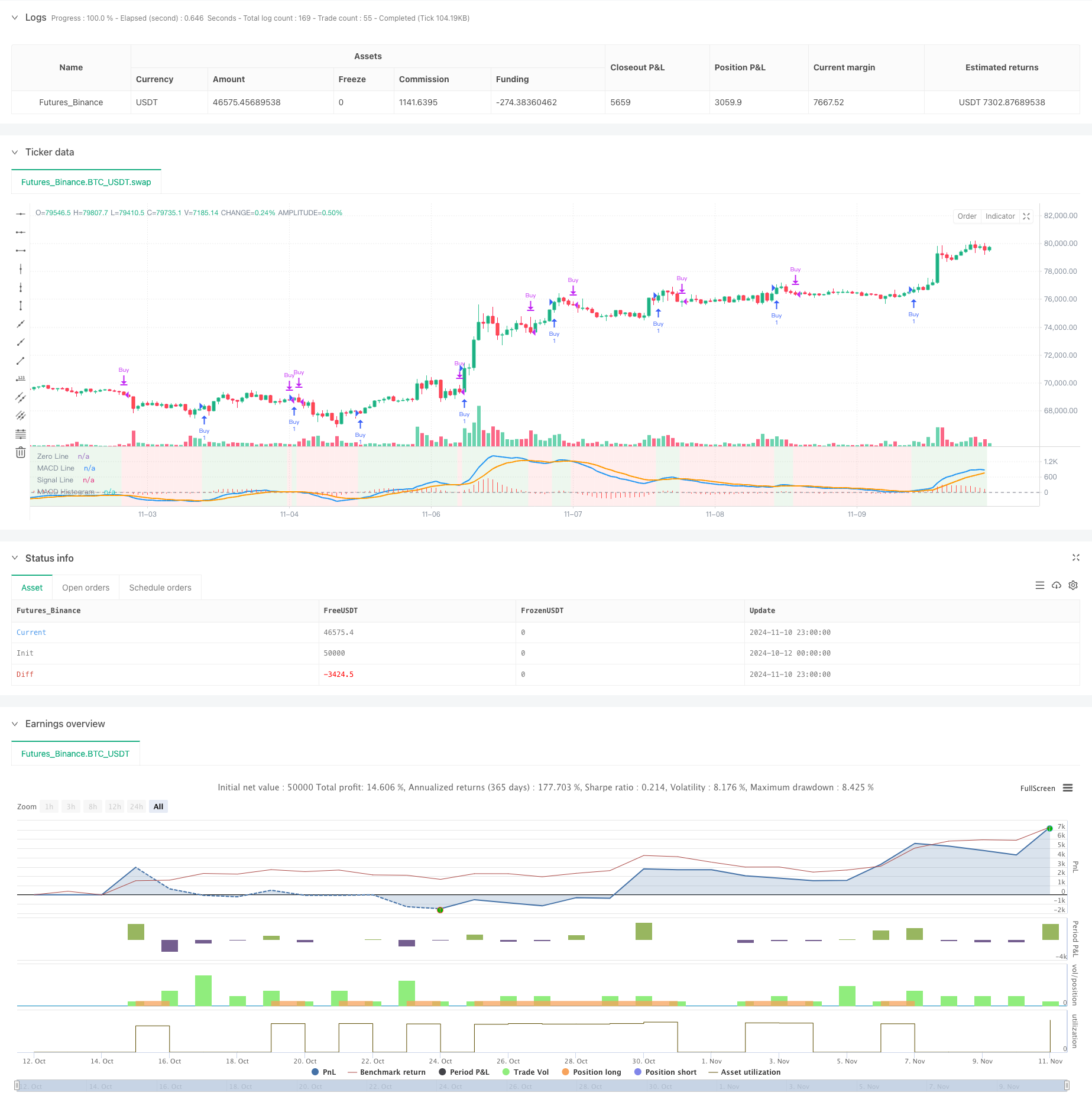

/*backtest

start: 2024-10-12 00:00:00

end: 2024-11-11 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Hanzo - Top 10 MACD Strategy", overlay=false) // MACD in a separate pane

// Define dropdown options for MACD settings

macdOption = input.string(title="Select MACD Setting",

defval="Standard (12, 26, 9)",

options=["Standard (12, 26, 9)",

"Short-Term (5, 35, 5)",

"Long-Term (19, 39, 9)",

"Scalping (3, 10, 16)",

"Cryptocurrency (20, 50, 9)",

"Forex (8, 17, 9)",

"Conservative (24, 52, 18)",

"Trend-Following (7, 28, 7)",

"Swing Trading (5, 15, 5)",

"Contrarian (15, 35, 5)"])

// MACD setting based on user selection

var int fastLength = 12

var int slowLength = 26

var int signalLength = 9

switch macdOption

"Standard (12, 26, 9)" =>

fastLength := 12

slowLength := 26

signalLength := 9

"Short-Term (5, 35, 5)" =>

fastLength := 5

slowLength := 35

signalLength := 5

"Long-Term (19, 39, 9)" =>

fastLength := 19

slowLength := 39

signalLength := 9

"Scalping (3, 10, 16)" =>

fastLength := 3

slowLength := 10

signalLength := 16

"Cryptocurrency (20, 50, 9)" =>

fastLength := 20

slowLength := 50

signalLength := 9

"Forex (8, 17, 9)" =>

fastLength := 8

slowLength := 17

signalLength := 9

"Conservative (24, 52, 18)" =>

fastLength := 24

slowLength := 52

signalLength := 18

"Trend-Following (7, 28, 7)" =>

fastLength := 7

slowLength := 28

signalLength := 7

"Swing Trading (5, 15, 5)" =>

fastLength := 5

slowLength := 15

signalLength := 5

"Contrarian (15, 35, 5)" =>

fastLength := 15

slowLength := 35

signalLength := 5

// MACD Calculation

[macdLine, signalLine, _] = ta.macd(close, fastLength, slowLength, signalLength)

macdHist = macdLine - signalLine

// Buy and Sell conditions based on MACD crossovers

enterLong = ta.crossover(macdLine, signalLine)

exitLong = ta.crossunder(macdLine, signalLine)

// Execute buy and sell orders with price labels in the comments

if (enterLong)

strategy.entry("Buy", strategy.long, comment="Buy at " + str.tostring(close, "#.##"))

if (exitLong)

strategy.close("Buy", comment="Sell at " + str.tostring(close, "#.##"))

// Plot the signal price using plotchar for buy/sell prices

//plotchar(enterLong ? close : na, location=location.belowbar, color=color.green, size=size.small, title="Buy Price", offset=0)

//plotchar(exitLong ? close : na, location=location.abovebar, color=color.red, size=size.small, title="Sell Price", offset=0)

// Background highlighting based on bullish or bearish MACD

isBullish = macdLine > signalLine

isBearish = macdLine < signalLine

// Change background to green for bullish periods and red for bearish periods

bgcolor(isBullish ? color.new(color.green, 90) : na, title="Bullish Background")

bgcolor(isBearish ? color.new(color.red, 90) : na, title="Bearish Background")

// Plot the MACD and Signal line in a separate pane

plot(macdLine, title="MACD Line", color=color.blue, linewidth=2)

plot(signalLine, title="Signal Line", color=color.orange, linewidth=2)

hline(0, "Zero Line", color=color.gray)

plot(macdHist, title="MACD Histogram", style=plot.style_histogram, color=color.red)