概要

これは,多周期平均線トレンドの追跡と動量分析を組み合わせた定量化取引戦略である.戦略は,主に,20,50,100,および200日指数移動平均 ((EMA)) の配列組み合わせを分析し,日線と周線の動量指標を組み合わせて取引する.戦略は,ATRのストップロスを採用し,EMAが動量条件を満たしたときに入場し,ATRの倍数のストップと利益目標を設定することによってリスクを管理する.

戦略原則

戦略の中核となるロジックには、次の主要な部分が含まれます。

- EMAアラインメントシステム: 20日EMAが50日EMAの上にあり,50日EMAが100日EMAの上にあり,100日EMAが200日EMAの上にあり,完璧な多頭列を構成する.

- 動量確認システム:日線および周線の時間周期で計算される線形回帰に基づくカスタム動量指標.この動量指標は,価格とケルトナー通路の中軸の偏差度に対する線形回帰によって測定される.

- リコール入場システム:価格を20日EMAの指定パーセントの範囲までリコールする必要があるが,リコール入場が許されるため,追及を避ける.

- リスク管理システム:ATRの倍数を使用して,ストップと利益の目標を設定し,デフォルトのストップは1.5倍ATR,利益の目標は3倍ATRである.

戦略的優位性

- 多重確認機構:均線配列,多周期動力,価格回調などの多重条件確認により,偽信号を低減する.

- 科学的リスク管理:ATRを活用して,市場の変動に適応して,ストップ・ロズとリターンズを動的に調整する.

- トレンド・トラッキングとモチベーションの組み合わせで,大きなトレンドを把握し,トレンドの入場を把握できます.

- カスタマイズ性: 戦略の各パラメータは,異なる市場特性に合わせて最適化できる.

- 多周期分析:日線と周線の配合により,信号の信頼性を高める.

戦略リスク

- 平均線遅れ:EMAが遅滞の指標として,入場時間が遅れる可能性がある.他の主要指標と組み合わせることが推奨されている.

- 振動市場には適用されない:横盤振動市場では,策略がしばしば偽信号を生成する可能性がある.市場環境フィルターを追加することを推奨する.

- 撤回リスク:ATRの停止があるにもかかわらず,極端な状況では大きな撤回に直面する可能性があります.最大撤回制限を設定することを考慮することができます.

- パラメータ感性: 戦略効果はパラメータ設定に敏感である.十分なパラメータ最適化テストを行うことを推奨する.

戦略最適化の方向性

- 市場環境識別:変動率指数またはトレンド強度指数を加え,異なる市場環境で異なるパラメータの組み合わせを使用する.

- エントリー最適化:RSIなどの変動指標を追加して,回調領域内でより正確なエントリーポイントを探します.

- ダイナミックパラメータ調整:市場の変動に応じてATR倍数と回調範囲を自動的に調整する.

- 取引量分析:取引量によってトレンドの強さを確認し,信号の信頼性を高める.

- 機械学習の導入:機械学習アルゴリズムの動的最適化パラメータを使用して,戦略の適応性を向上させる.

要約する

これは合理的で論理的に厳格に設計されたトレンド追跡戦略である.複数の技術指標の組み合わせによる使用は,戦略の安定性を保証するとともに,優れたリスク管理機構を提供している.戦略のカスタマイズ性が強く,異なる市場の特徴に応じて最適化することができる.いくつかの固有のリスクがあるものの,推奨された最適化の方向によって戦略のパフォーマンスをさらに向上させることができる.全体的に,これは試す価値のある,深く研究された量化取引戦略である.

ストラテジーソースコード

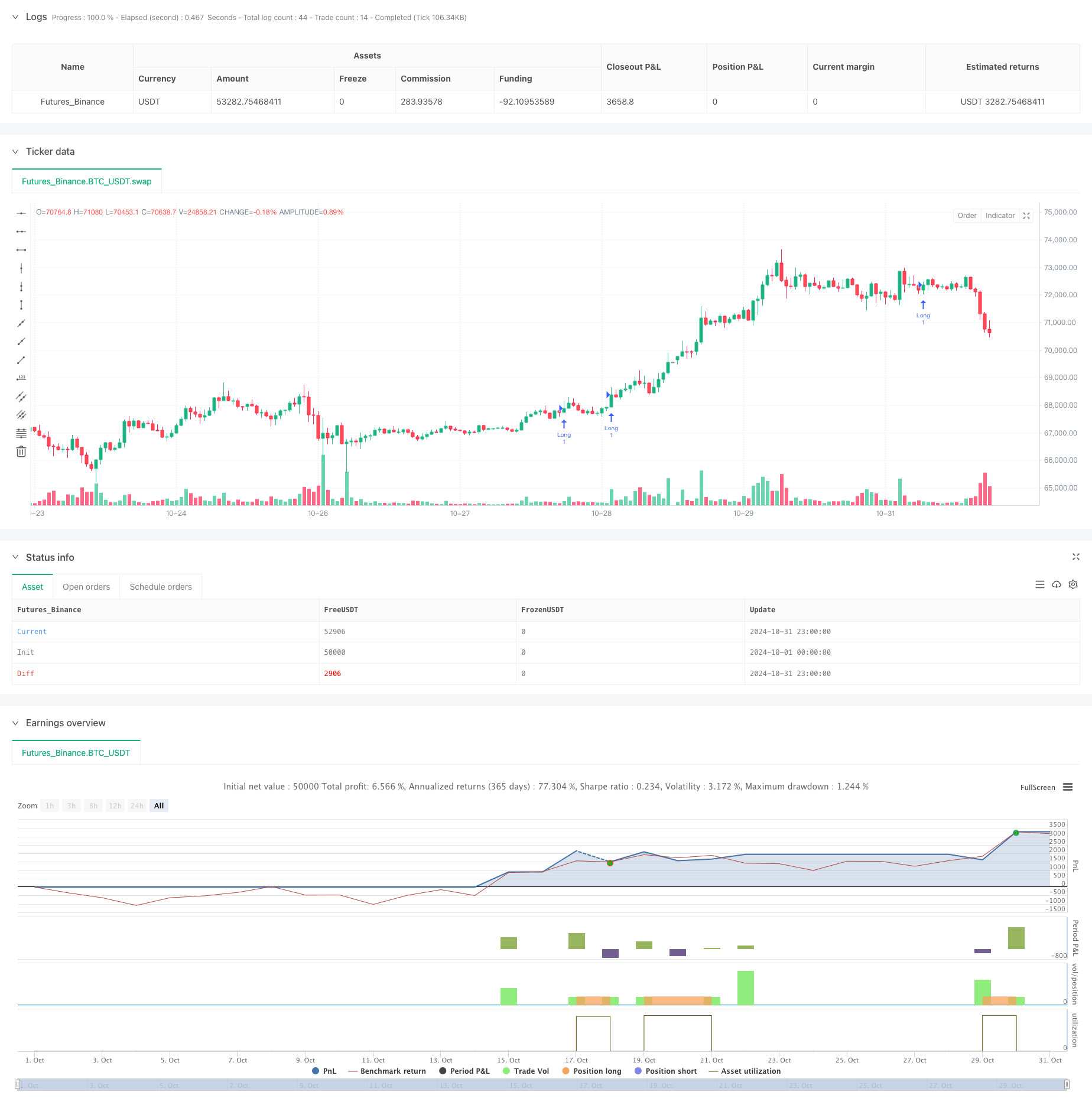

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Swing Trading with EMA Alignment and Custom Momentum", overlay=true)

// User inputs for customization

atrLength = input.int(14, title="ATR Length", minval=1)

atrMultiplierSL = input.float(1.5, title="Stop-Loss Multiplier (ATR)", minval=0.1) // Stop-loss at 1.5x ATR

atrMultiplierTP = input.float(3.0, title="Take-Profit Multiplier (ATR)", minval=0.1) // Take-profit at 3x ATR

pullbackRangePercent = input.float(1.0, title="Pullback Range (%)", minval=0.1) // 1% range for pullback around 20 EMA

lengthKC = input.int(20, title="Length for Keltner Channels (Momentum Calculation)", minval=1)

// EMA settings

ema20 = ta.ema(close, 20)

ema50 = ta.ema(close, 50)

ema100 = ta.ema(close, 100)

ema200 = ta.ema(close, 200)

// ATR calculation

atrValue = ta.atr(atrLength)

// Custom Momentum Calculation based on Linear Regression for Daily Timeframe

highestHighKC = ta.highest(high, lengthKC)

lowestLowKC = ta.lowest(low, lengthKC)

smaCloseKC = ta.sma(close, lengthKC)

// Manually calculate the average of highest high and lowest low

averageKC = (highestHighKC + lowestLowKC) / 2

// Calculate daily momentum using linear regression

dailyMomentum = ta.linreg(close - (averageKC + smaCloseKC) / 2, lengthKC, 0) // Custom daily momentum calculation

// Fetch weekly data for momentum calculation using request.security()

[weeklyHigh, weeklyLow, weeklyClose] = request.security(syminfo.tickerid, "W", [high, low, close])

// Calculate weekly momentum using linear regression on weekly timeframe

weeklyHighestHighKC = ta.highest(weeklyHigh, lengthKC)

weeklyLowestLowKC = ta.lowest(weeklyLow, lengthKC)

weeklySmaCloseKC = ta.sma(weeklyClose, lengthKC)

weeklyAverageKC = (weeklyHighestHighKC + weeklyLowestLowKC) / 2

weeklyMomentum = ta.linreg(weeklyClose - (weeklyAverageKC + weeklySmaCloseKC) / 2, lengthKC, 0) // Custom weekly momentum calculation

// EMA alignment condition (20 EMA > 50 EMA > 100 EMA > 200 EMA)

emaAligned = ema20 > ema50 and ema50 > ema100 and ema100 > ema200

// Momentum increasing condition (daily and weekly momentum is positive and increasing)

dailyMomentumIncreasing = dailyMomentum > 0 and dailyMomentum > dailyMomentum[1] //and dailyMomentum[1] > dailyMomentum[2]

weeklyMomentumIncreasing = weeklyMomentum > 0 and weeklyMomentum > weeklyMomentum[1] //and weeklyMomentum[1] > weeklyMomentum[2]

// Redefine Pullback condition: price within 1% range of the 20 EMA

upperPullbackRange = ema20 * (1 + pullbackRangePercent / 100)

lowerPullbackRange = ema20 * (1 - pullbackRangePercent / 100)

pullbackToEma20 = (close <= upperPullbackRange) and (close >= lowerPullbackRange)

// Entry condition: EMA alignment and momentum increasing on both daily and weekly timeframes

longCondition = emaAligned and dailyMomentumIncreasing and weeklyMomentumIncreasing and pullbackToEma20

// Initialize stop loss and take profit levels as float variables

var float longStopLevel = na

var float longTakeProfitLevel = na

// Calculate stop loss and take profit levels based on ATR

if (longCondition)

longStopLevel := close - (atrMultiplierSL * atrValue) // Stop loss at 1.5x ATR below the entry price

longTakeProfitLevel := close + (atrMultiplierTP * atrValue) // Take profit at 3x ATR above the entry price

// Strategy execution

if (longCondition)

strategy.entry("Long", strategy.long)

// Exit conditions: Stop-loss at 1.5x ATR and take-profit at 3x ATR

if (strategy.position_size > 0)

strategy.exit("Take Profit/Stop Loss", "Long", stop=longStopLevel, limit=longTakeProfitLevel)