概要

この戦略は,ダイナミックな信号線 ((DSL),波動率,動向指標を組み合わせた総合的な取引システムである.この戦略は,ダイナミックな値と自調的な波動帯の方法によって,市場動向を効果的に識別し,動向指標を使用して信号フィルタリングを行い,正確な取引タイミングを把握する.システムは,ダイナミックな止損とリスクに基づく収益率の目標設定を含む完全なリスク管理機構を設計している.

戦略原則

戦略の核心的な論理は,以下の3つの主要な要素に基づいています.

まず,動的信号線システムで,移動平均に基づいて動的上下軌道線を計算する.これらの軌道線は,市場の最近の高点と低点に応じて自動的に位置を調整し,トレンドへの自主的なトラッキングを実現する.システムは,ATR指標と組み合わせて,トレンドの強さを確認するために動的波動帯を構成し,ストップロスを設定する.

次に,運動分析システムで,ゼロの遅延指数移動平均 (ZLEMA) により最適化されたRSI指標を使用します.RSIにダイナミックシグナルラインの概念を適用することにより,システムは,超買い超売り領域をより正確に識別し,運動突破信号を生成します.

3つ目は,信号統合メカニズムである. 取引信号は,トレンド確認と動力の突破の両方の条件を同時に満たさなければならない. 多頭入場は,価格が上線を突破して軌道上にとどまるように要求し,RSIは下部の動的信号ラインを突破する. 空気信号は,逆の条件を同時に満たさなければならない.

戦略的優位性

- 適応性:ダイナミックな信号線と波動帯は,市場の状況に応じて自動的に調整され,戦略が異なる市場環境に適応できるようにします.

- 偽信号フィルター: 傾向と動力の二重確認を要求することで,偽信号の確率を大幅に低下させる.

- リスク管理の改善:ATRベースの動的ストップ損失とリスク収益比率に基づく利益目標設定を統合し,システム化されたリスク制御を実現した.

- 柔軟なカスタマイズ: 戦略のパラメータは,異なる市場と時間周期に応じて最適化調整を行うことができます.

戦略リスク

- トレンド反転リスク:急激な市場の反転では,ダイナミックなシグナルラインの調整が十分には及ばず,より大きな引き下げにつながる可能性があります.

- 振動市場のリスク:区間振動の市場では,頻繁に突破すると,複数のストップが起こる可能性があります.

- パラメータ感性: 策略のパフォーマンスはパラメータ設定に敏感であり,不適切なパラメータは策略の効果に影響を与える可能性があります.

戦略最適化の方向性

- 市場環境識別:市場環境分類機構を追加し,異なる市場状態で異なるパラメータ設定を使用できます.

- ダイナミックパラメータ最適化: 適応パラメータ調整メカニズムを導入し,市場の波動性に応じて信号線と波動帯のパラメータを自動的に最適化する.

- 複数のタイムサイクル分析:複数のタイムサイクルから信号を統合し,取引決定の信頼性を高める.

- 波動率の適応:高波動率の期間中にストップ・ローズとリスク・リターンの比率を調整し,戦略のリスク調整後のリターンを向上させる.

要約する

この戦略は,ダイナミックなシグナルラインと動向指標の革新的な組み合わせにより,市場動向を効果的に捉えることができます. 完善したリスク管理機構とシグナルフィルタリングシステムは,強力な実戦的な応用価値を有します. 継続的な最適化とパラメータ調整により,戦略は,異なる市場環境で安定したパフォーマンスを維持すると見込まれています.

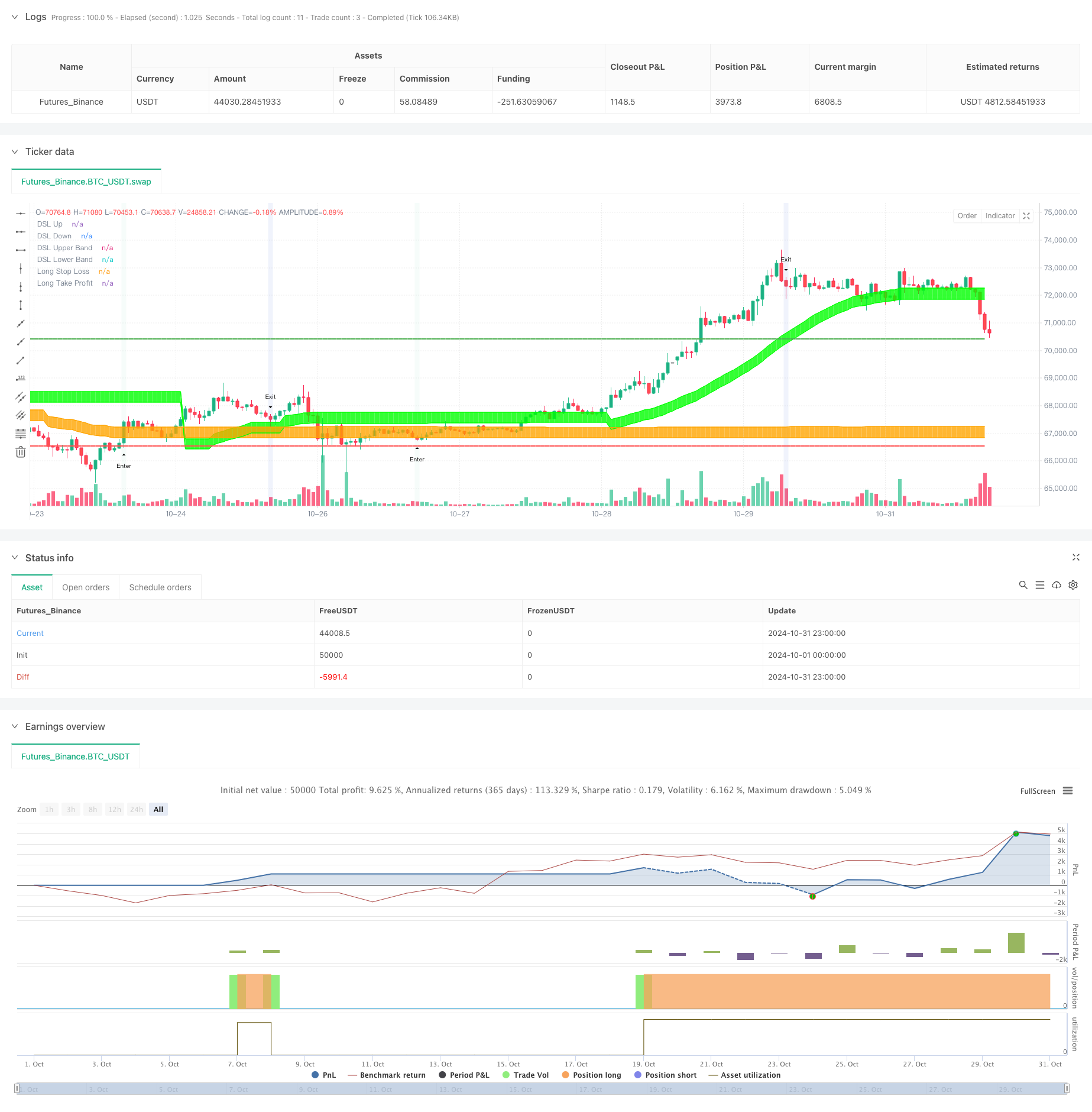

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © DailyPanda

//@version=5

strategy("DSL Strategy [DailyPanda]",

initial_capital = 2000,

commission_value=0.00,

slippage=3,

overlay = true)

//--------------------------------------------------------------------------------------------------------------------

// USER INPUTS

//--------------------------------------------------------------------------------------------------------------------

// DSL Indicator Inputs CP

int len = input.int(34, "Length", group="CP") // Length for calculating DSL

int offset = input.int(30, "Offset", group="CP") // Offset for threshold levels

float width = input.float(1, "Bands Width", step = 0.1, maxval = 2, minval = 0.5, group="CP") // Width for ATR-based bands

float risk_reward = input.float(1.5, "Risk Reward", group="Risk Mgmt") // Risk Reward ratio

// Colors for upper and lower trends

color upper_col = input.color(color.lime, "+", inline = "col")

color lower_col = input.color(color.orange, "-", inline = "col")

// DSL-BELUGA

len_beluga = input.int(10, "Beluga Length", group="BELUGA")

dsl_mode_inp = input.string("Fast", "DSL Lines Mode", options=["Fast", "Slow"], group="BELUGA")

dsl_mode = dsl_mode_inp == "Fast" ? 2 : 1

// Colors for DSL-BELUGA

color color_up = #8BD8BD

color color_dn = #436cd3

i_lossPct = input.int(defval=100, title="% max day DD", minval=1, maxval=100, step=1, group="Risk Management")

i_goal = input.bool(title="Enable Daily Goal", defval=false, group="Risk Management")

i_goalPct = input.int(defval=4, title="% Daily Goal", minval=1, step=1, group="Risk Management")

//############################## RISK MANAGEMENT ##############################

// Set maximum intraday loss to our lossPct input

// strategy.risk.max_intraday_loss(i_lossPct, strategy.percent_of_equity)

//strategy.risk.max_intraday_loss(value=1200, type=strategy.cash)

// Store equity value from the beginning of the day

eqFromDayStart = ta.valuewhen(ta.change(dayofweek) > 0, strategy.equity, 0)

// Calculate change of the current equity from the beginning of the current day

eqChgPct = 100 * ((strategy.equity - eqFromDayStart - strategy.openprofit) / (strategy.equity-strategy.openprofit))

f_stopGain = eqChgPct >= i_goalPct and i_goal ? true : false

//--------------------------------------------------------------------------------------------------------------------

// INDICATOR CALCULATIONS

//--------------------------------------------------------------------------------------------------------------------

// Function to calculate DSL lines based on price

dsl_price(float price, int len) =>

// Initialize DSL lines

float dsl_up = na

float dsl_dn = na

float sma = ta.sma(price, len)

// Dynamic upper and lower thresholds calculated with offset

float threshold_up = ta.highest(len)[offset]

float threshold_dn = ta.lowest(len)[offset]

// Calculate the DSL upper and lower lines based on price compared to the thresholds

dsl_up := price > threshold_up ? sma : nz(dsl_up[1])

dsl_dn := price < threshold_dn ? sma : nz(dsl_dn[1])

// Return both DSL lines

[dsl_up, dsl_dn]

// Function to calculate DSL bands based on ATR and width multiplier

dsl_bands(float dsl_up, float dsl_dn) =>

float atr = ta.atr(200) * width // ATR-based calculation for bands

float upper = dsl_up - atr // Upper DSL band

float lower = dsl_dn + atr // Lower DSL band

[upper, lower]

// Get DSL values based on the closing price

[dsl_up, dsl_dn] = dsl_price(close, len)

// Calculate the bands around the DSL lines

[dsl_up1, dsl_dn1] = dsl_bands(dsl_up, dsl_dn)

//--------------------------------------------------------------------------------------------------------------------

// DSL-BELUGA INDICATOR CALCULATIONS

//--------------------------------------------------------------------------------------------------------------------

// Calculate RSI with a period of 10

float RSI = ta.rsi(close, 10)

// Zero-Lag Exponential Moving Average function

zlema(src, length) =>

int lag = math.floor((length - 1) / 2)

float ema_data = 2 * src - src[lag]

float ema2 = ta.ema(ema_data, length)

ema2

// Discontinued Signal Lines function

dsl_lines(src, length)=>

float up = 0.

float dn = 0.

up := (src > ta.sma(src, length)) ? nz(up[1]) + dsl_mode / length * (src - nz(up[1])) : nz(up[1])

dn := (src < ta.sma(src, length)) ? nz(dn[1]) + dsl_mode / length * (src - nz(dn[1])) : nz(dn[1])

[up, dn]

// Calculate DSL lines for RSI

[lvlu, lvld] = dsl_lines(RSI, len_beluga)

// Calculate DSL oscillator using ZLEMA of the average of upper and lower DSL Lines

float dsl_osc = zlema((lvlu + lvld) / 2, 10)

// Calculate DSL Lines for the oscillator

[level_up, level_dn] = dsl_lines(dsl_osc, 10)

// Detect crossovers for signal generation

bool up_signal = ta.crossover(dsl_osc, level_dn) and dsl_osc < 55

bool dn_signal = ta.crossunder(dsl_osc, level_up) and dsl_osc > 50

//--------------------------------------------------------------------------------------------------------------------

// VISUALIZATION

//--------------------------------------------------------------------------------------------------------------------

// Plot the DSL lines on the chart

plot_dsl_up = plot(dsl_up, color=color.new(upper_col, 80), linewidth=1, title="DSL Up")

plot_dsl_dn = plot(dsl_dn, color=color.new(lower_col, 80), linewidth=1, title="DSL Down")

// Plot the DSL bands

plot_dsl_up1 = plot(dsl_up1, color=color.new(upper_col, 80), linewidth=1, title="DSL Upper Band")

plot_dsl_dn1 = plot(dsl_dn1, color=color.new(lower_col, 80), linewidth=1, title="DSL Lower Band")

// Fill the space between the DSL lines and bands with color

fill(plot_dsl_up, plot_dsl_up1, color=color.new(upper_col, 80))

fill(plot_dsl_dn, plot_dsl_dn1, color=color.new(lower_col, 80))

// Plot signals on the chart

plotshape(up_signal, title="Buy Signal", style=shape.triangleup, location=location.belowbar, size=size.tiny, text="Enter")

plotshape(dn_signal, title="Sell Signal", style=shape.triangledown, location=location.abovebar, size=size.tiny, text="Exit")

// Color the background on signal occurrences

bgcolor(up_signal ? color.new(color_up, 90) : na, title="Up Signal Background", editable = false)

bgcolor(dn_signal ? color.new(color_dn, 90) : na, title="Down Signal Background", editable = false)

//--------------------------------------------------------------------------------------------------------------------

// STRATEGY CONDITIONS AND EXECUTION

//--------------------------------------------------------------------------------------------------------------------

// Variables to hold stop loss and take profit prices

var float long_stop_loss_price = na

var float long_take_profit_price = na

var float short_stop_loss_price = na

var float short_take_profit_price = na

float pos_size = math.abs(strategy.position_size)

// Long Entry Conditions

bool long_condition1 = not na(dsl_up1) and not na(dsl_dn) and dsl_up1 > dsl_dn

bool long_condition2 = open > dsl_up and close > dsl_up and open[1] > dsl_up and close[1] > dsl_up and open[2] > dsl_up and close[2] > dsl_up

bool long_condition3 = up_signal and pos_size == 0

bool long_condition = long_condition1 and long_condition2 and long_condition3 and (not f_stopGain)

// Short Entry Conditions

bool short_condition1 = not na(dsl_dn1) and not na(dsl_up) and dsl_dn < dsl_up1

bool short_condition2 = open < dsl_dn1 and close < dsl_dn1 and open[1] < dsl_dn1 and close[1] < dsl_dn1 and open[2] < dsl_dn1 and close[2] < dsl_dn1

bool short_condition3 = dn_signal and pos_size == 0

bool short_condition = short_condition1 and short_condition2 and short_condition3 and (not f_stopGain)

// Long Trade Execution

if (long_condition and not na(dsl_up1))

long_stop_loss_price := dsl_up1

float risk = close - long_stop_loss_price

if (risk > 0)

long_take_profit_price := close + risk * risk_reward

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", from_entry="Long", stop=long_stop_loss_price, limit=long_take_profit_price)

else if (strategy.position_size <= 0)

// Reset when not in a long position

long_stop_loss_price := na

long_take_profit_price := na

// Short Trade Execution

if (short_condition and not na(dsl_dn1))

short_stop_loss_price := dsl_dn1

float risk = short_stop_loss_price - close

if (risk > 0)

short_take_profit_price := close - risk * risk_reward

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", from_entry="Short", stop=short_stop_loss_price, limit=short_take_profit_price)

else if (strategy.position_size >= 0)

// Reset when not in a short position

short_stop_loss_price := na

short_take_profit_price := na

//--------------------------------------------------------------------------------------------------------------------

// PLOTTING STOP LOSS AND TAKE PROFIT LEVELS

//--------------------------------------------------------------------------------------------------------------------

// Plot the stop loss and take profit levels only when in a position

float plot_long_stop_loss = strategy.position_size > 0 ? long_stop_loss_price : na

float plot_long_take_profit = strategy.position_size > 0 ? long_take_profit_price : na

float plot_short_stop_loss = strategy.position_size < 0 ? short_stop_loss_price : na

float plot_short_take_profit = strategy.position_size < 0 ? short_take_profit_price : na

plot(plot_long_stop_loss, title="Long Stop Loss", color=color.red, linewidth=2, style=plot.style_linebr, editable=false)

plot(plot_long_take_profit, title="Long Take Profit", color=color.green, linewidth=2, style=plot.style_linebr, editable=false)

plot(plot_short_stop_loss, title="Short Stop Loss", color=color.red, linewidth=2, style=plot.style_linebr, editable=false)

plot(plot_short_take_profit, title="Short Take Profit", color=color.green, linewidth=2, style=plot.style_linebr, editable=false)