1

フォロー

1664

フォロワー

概要

この戦略は,ストップ,リスク報酬比率,およびRSI極点の退出をダイナミックに追跡する高度な取引システムである.戦略は,市場内の特定の形状 (平行K線形状と針状K線形状) を識別して取引し,ATRと最近の低値を活用してダイナミックなストップ・ローズを設定し,既定のリスク報酬比率に基づいて利益の目標を決定する.システムは,RSI指標に基づく市場過熱/過冷判断機構を統合し,市場が極点に達したときに平衡を保つことができる.

戦略原則

戦略の中核となるロジックには、次の主要な部分が含まれます。

- 入場信号は,平行K線形 ((大陽線が大陰線に続く) と二針形K線形) の2つの形状に基づいている.

- ダイナミック・トラッキング・ストップは,ATRの倍数を使用して,最近のN根K線の最低価格に調整し,ストップが市場の変動に動的に適応できるようにします.

- 利益目標は,固定されたリスク・リターン比率の設定に基づいて,各取引のリスク値 (® を計算することによって決定される.

- ポジションの規模は,固定リスク額と各取引のリスク価値の動的計算に基づいています.

- RSI極限退出メカニズムは,市場が過熱または過冷しているときに平仓シグナルを触発する.

戦略的優位性

- ダイナミックなリスク管理:ATRと最近の低点の組み合わせにより,ストップ・ローズは市場の変動の動態に応じて調整できます.

- 精密なポジション制御:固定リスク金額に基づくポジション計算方法により,各取引のリスクが一致することを保証する.

- 多次元退出メカニズム: ストップ・ロスを追跡し,固定利益目標とRSI極限を組み合わせた三重退出メカニズム.

- 柔軟な取引方向の選択:多額,空額,双方向の取引を選択できます

- 明確なリスク・リターン設定: 既定のリスク・リターン比で,取引毎の収益目標が明確である.

戦略リスク

- 形状認識の正確性のリスク:平行K線と針状K線の識別に誤判がある可能性がある.

- 止損設定の滑落リスク: 波動が激しい市場では大きな滑落に直面する可能性があります.

- RSIの極限から早めに離脱する可能性がある: 強いトレンドの市場では,早めに離脱してより多くの利益を逃す可能性がある.

- 固定リスク・リターン比率の限界:異なる市場環境で最適なリスク・リターン比率は異なるかもしれない.

- パラメータ最適化の過適合リスク:複数のパラメータの組み合わせは過最適化につながる可能性がある.

戦略最適化の方向性

- 入場信号の最適化: 取引量,トレンド指標など,より多くの形状確認指標を追加できます.

- ダイナミック・リスク・リターン・比率:市場の波動的な動向に応じて調整されたリスク・リターン・比率。

- スマートパラメータの自己適応:機械学習アルゴリズムを導入してパラメータを動的に最適化する.

- 多時間周期確認:より多くの時間周期の信号確認メカニズムを追加する.

- 市場環境の分類:異なる市場環境に応じて異なるパラメータの組み合わせを採用する.

要約する

これは,よく設計された取引戦略であり,複数の成熟した技術分析概念を組み合わせて,完全な取引システムを構築している.戦略の優点は,その包括的なリスク管理システムと柔軟な取引ルールにあるが,同時に,パラメータ最適化と市場適応性の問題にも注意する必要がある.提案された最適化方向によって,戦略にはさらに向上する余地がある.

ストラテジーソースコード

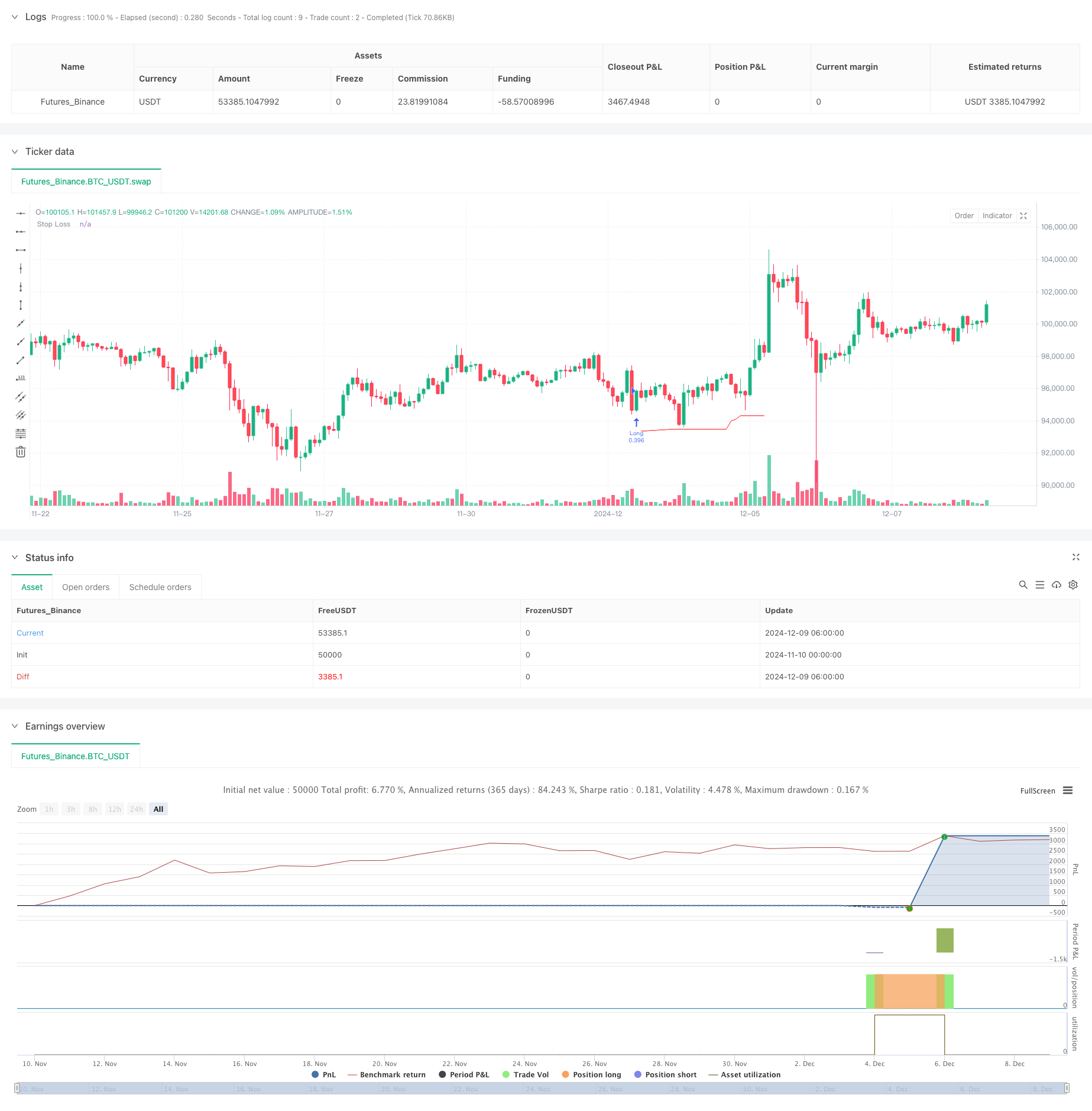

/*backtest

start: 2024-11-10 00:00:00

end: 2024-12-09 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ZenAndTheArtOfTrading | www.TheArtOfTrading.com

// @version=5

strategy("Trailing stop 1", overlay=true)

// Get user input

int BAR_LOOKBACK = input.int(10, "Bar Lookback")

int ATR_LENGTH = input.int(14, "ATR Length")

float ATR_MULTIPLIER = input.float(1.0, "ATR Multiplier")

rr = input.float(title="Risk:Reward", defval=3)

// Basic definition

var float shares=na

risk = 1000

var float R=na

E = strategy.position_avg_price

// Input option to choose long, short, or both

side = input.string("Long", title="Side", options=["Long", "Short", "Both"])

// RSI exit option

RSIexit = input.string("Yes", title="Exit at RSI extreme?", options=["Yes", "No"])

RSIup = input(75)

RSIdown = input(25)

// Get indicator values

float atrValue = ta.atr(ATR_LENGTH)

// Calculate stop loss values

var float trailingStopLoss = na

float longStop = ta.lowest(low, BAR_LOOKBACK) - (atrValue * ATR_MULTIPLIER)

float shortStop = ta.highest(high, BAR_LOOKBACK) + (atrValue * ATR_MULTIPLIER)

// Check if we can take trades

bool canTakeTrades = not na(atrValue)

bgcolor(canTakeTrades ? na : color.red)

//Long pattern

//Two pin bar

onepinbar = (math.min(close,open)-low)/(high-low)>0.6 and math.min(close,open)-low>ta.sma(high-low,14)

twopinbar = onepinbar and onepinbar[1]

notatbottom = low>ta.lowest(low[1],10)

// Parallel

bigred = (open-close)/(high-low)>0.8 and high-low>ta.sma(high-low,14)

biggreen = (close-open)/(high-low)>0.8 and high-low>ta.sma(high-low,14)

parallel = bigred[1] and biggreen

atbottom = low==ta.lowest(low,10)

// Enter long trades (replace this entry condition)

longCondition = parallel

if (longCondition and canTakeTrades and strategy.position_size == 0 and (side == "Long" or side == "Both"))

R:= close-longStop

shares:= risk/R

strategy.entry("Long", strategy.long,qty=shares)

// Enter short trades (replace this entry condition)

shortCondition = parallel

if (shortCondition and canTakeTrades and strategy.position_size == 0 and (side == "Short" or side == "Both"))

R:= shortStop - close

shares:= risk/R

strategy.entry("Short", strategy.short,qty=shares)

// Update trailing stop

if (strategy.position_size > 0)

if (na(trailingStopLoss) or longStop > trailingStopLoss)

trailingStopLoss := longStop

else if (strategy.position_size < 0)

if (na(trailingStopLoss) or shortStop < trailingStopLoss)

trailingStopLoss := shortStop

else

trailingStopLoss := na

// Exit trades with trailing stop

strategy.exit("Long Exit", "Long", stop=trailingStopLoss, limit = E + rr*R )

strategy.exit("Short Exit", "Short", stop=trailingStopLoss, limit = E - rr*R)

//Close trades at RSI extreme

if ta.rsi(high,14)>RSIup and RSIexit == "Yes"

strategy.close("Long")

if ta.rsi(low,14)<RSIdown and RSIexit == "Yes"

strategy.close("Short")

// Draw stop loss

plot(trailingStopLoss, "Stop Loss", color.red, 1, plot.style_linebr)