1

フォロー

1664

フォロワー

概要

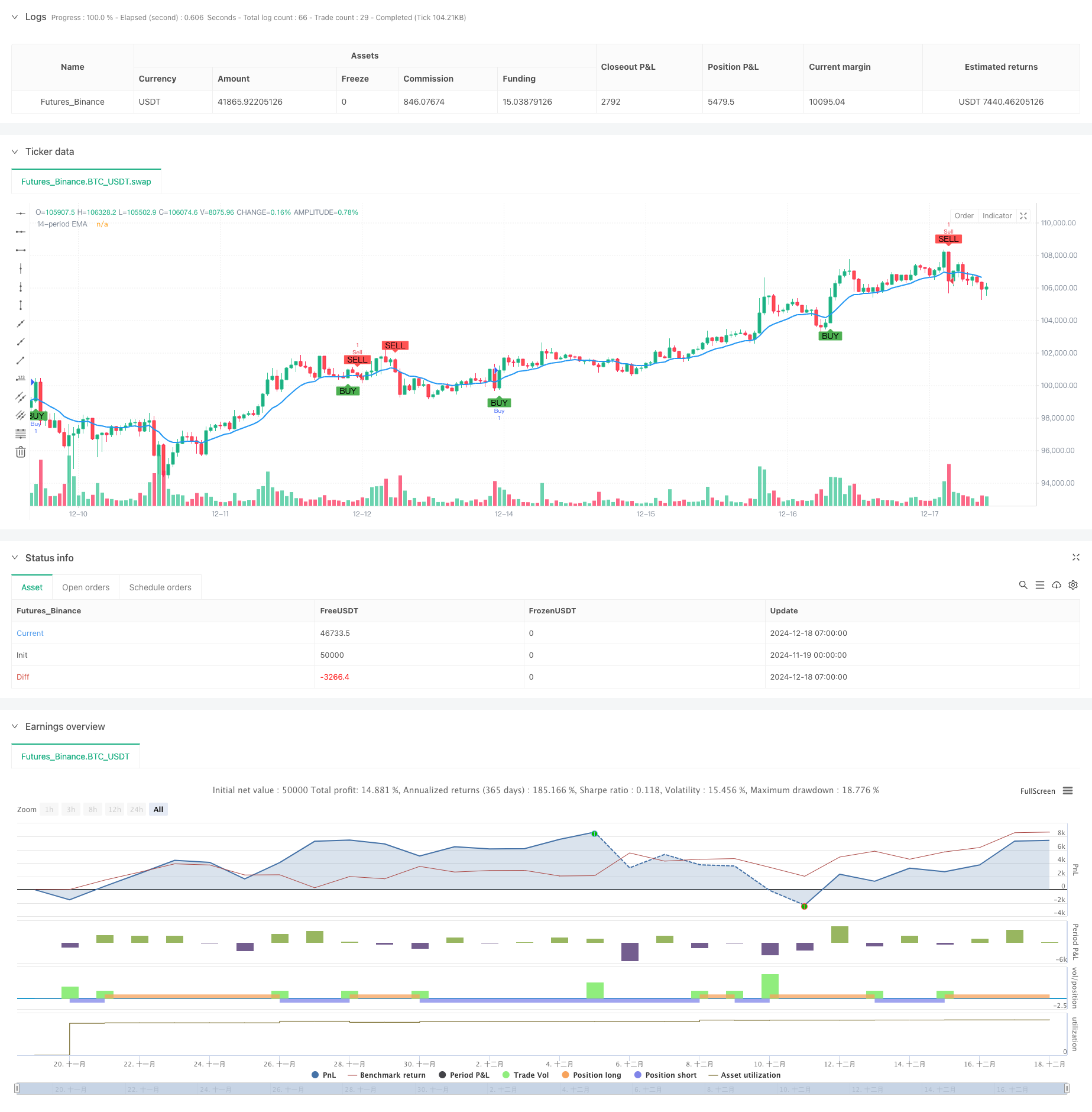

この戦略は,14周期指数移動平均 ((EMA) に基づく取引システムで,図形状分析と価格動量特性を組み合わせている.この戦略は,価格とEMAの交差関係を分析し,また図の形状特性を考慮しながら ((実体対影線比など) 取引信号を決定し,市場動向の変化点を捕捉する.

戦略原則

戦略の中核となるロジックは、次の主要な要素に基づいています。

- EMA突破確認: 14サイクルEMAを動的サポートとレジスタンス位置として使用.

- グラフの形状分析:

- 購入条件は,が陽線であることを要求する (閉店価格が開店価格より高い)

- 売却条件は, (閉店価格が開店価格より低い)

- 価格のチェック:

- 購入時に少なくとも50%のがEMAを通過することを要求する

- EMAを完全に破る必要があります.

- シェードラインの比例制御:

- 購入信号は,上下影線の合計がの総長さの40%を超えないことを要求する

- 信号の販売制限は,シャドウラインの総長さの20%を超えない.

戦略的優位性

- 厳格な信号品質管理:複数の条件の検証により,偽突破のリスクを低減する

- 形状認識精度:図実体と影線の比率分析を組み合わせ,信号信頼性を向上させる

- トレンド追跡能力:EMAのダイナミックな特性により,市場トレンドを効果的に追跡できます.

- リスク管理の改善:厳格なシャドライン比率管理により,取引リスクを低減する

- 適応性:戦略のパラメータは,異なる市場条件に応じて柔軟に調整できます.

戦略リスク

- 横軸市場リスク: 波動的な市場では頻繁に偽信号が生じる可能性がある

- 遅滞のリスク:EMA指数はそれ自体には遅滞があり,最適な入場点を逃す可能性がある

- ギャップリスク:大空飛ぶと止損効果が低下する

- パラメータの感受性: 戦略の有効性を維持するために,異なる市場環境でパラメータを調整する必要がある

戦略最適化の方向性

- 波動率のフィルタを導入する.

- 市場変動を評価するATR指標を追加

- 高波動期に信号確認のスレッジを上げること

- 多周期検証:

- 複数のタイムサイクルを増やす傾向が確認

- 多周期信号一致性検証機構の構築

- 動的パラメータ最適化:

- 市場変動に応じて動的に調整するEMAサイクル

- 影線の比率の値を自律的に調整する

- ポジション管理の最適化:

- 市場変動に基づいて設計されたダイナミックポジションシステム

- ピラミッド加減の導入

要約する

この戦略は,EMA,グラフ形状,価格行動分析を総合的に適用することで,完全な取引システムを構築している.戦略の優点は,信号確認の厳密さとリスク管理の完善性にあるが,市場環境が戦略のパフォーマンスに与える影響にも注意する必要がある.推奨された最適化方向によって,戦略の安定性と適応性がさらに向上する見込みがある.

ストラテジーソースコード

/*backtest

start: 2024-11-19 00:00:00

end: 2024-12-18 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Buy and Sell Signals with EMA", overlay=true)

// Define the 14-period EMA

ema14 = ta.ema(close, 14)

// --- Buy Conditions ---

ema_length = input.int(14, title="EMA Length")

// Calculate the 14 EMA

ema_14 = ta.ema(close, ema_length)

// Calculate the candle body and wicks

body = close - open

upper_wick = high - close

lower_wick = open - low

total_candle_length = high - low

// Define the condition for the candle to be green (bullish)

is_green_candle = close > open

// Condition for crossing the 14 EMA (previous close was below, current close is above)

crossing_ema = ta.crossover(close, ema_14)

// Condition for at least 50% of the candle's body crossing the 14 EMA

body_crossed_ema = (close - open) * 0.5 <= (close - ema_14) and close > ema_14

// Condition for wick percent being less than or equal to 40% of the total candle length

wick_percent = (upper_wick + lower_wick) / total_candle_length

valid_wick_condition = wick_percent <= 0.4

// Define the buy condition

buy_condition = is_green_candle and crossing_ema and body_crossed_ema and valid_wick_condition

// --- Sell Conditions ---

candleIsRed = close < open

priceBelowEMA = close < ema14

prevLowAboveEMA = low[1] > ema14[1] // Previous candle's low must be above the EMA

wickTooLarge = (low - math.min(open, close)) / (high - low) <= 0.2 // Lower wick should not exceed 20%

// Sell signal condition

sellSignal = priceBelowEMA and candleIsRed and prevLowAboveEMA and wickTooLarge

// --- Plotting ---

plot(ema14, color=color.blue, linewidth=2, title="14-period EMA") // Plot the 14-period EMA

// Plot the buy signal as an arrow on the chart

plotshape(buy_condition, color=color.green, style=shape.labelup, location=location.belowbar, text="BUY")

// Plot the sell signal as an arrow on the chart

plotshape(sellSignal, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal", text="SELL")

// Optional: Add strategies for backtesting

if (buy_condition)

strategy.entry("Buy", strategy.long)

if (sellSignal)

strategy.entry("Sell", strategy.short)