概要

この戦略は,複数の移動平均 ((SMA) とランダムな指標 ((KDJ) を組み合わせたトレンド追跡取引システムである.価格区間とトレンド判断条件を設定し,市場傾向が明確であるときに取引を行う.戦略は,市場動向に応じてポジション管理を調整するダイナミック・ストップ・ロスの仕組みを採用し,利潤を保護し,また早めに退場しない.

戦略原則

この戦略は、次のコアコンポーネントに基づいています。

- 双均線システム: 19周期および74周期SMAをトレンド判断ツールとして使用

- 価格区間: 市場の強さや弱さを判断するために5つの価格区間に分けます.

- ランダム指数:60周期のランダム指数を用いて,超買超売判断

- トレンド確認:連続した3つのK線の動きからトレンドの持続性を判断する

- 入場条件:価格が74サイクルSMAを突破し,相応の価格範囲にあるときに入場

- ストップ・ローズ:トレンドの変化に適したタイミングでストップ・ローズを追跡する

戦略的優位性

- システムの整合性:トレンド追跡と動態指標を組み合わせて,市場全体の分析を提供

- リスク管理:硬性ストップと追跡ストップを含む複数のストップメカニズムを使用

- 適応性:パラメータの調整により,異なる市場環境に対応できる

- トレンド把握:中長期のトレンドを効果的に捉え,誤った信号を避ける

- ポジション管理:市場の動向に応じてポジションを調整し,資金の使用効率を向上させる

戦略リスク

- 横盤市場での取引が頻発する可能性がある

- スライドポイントリスク:高速で大きなスライドポイントが発生する可能性がある

- パラメータ感度: 異なるパラメータの組み合わせにより、戦略のパフォーマンスに大きな違いが生じる可能性があります。

- 市場環境依存: 戦略はトレンドが顕著な市場においてよりよく機能する

- 資金管理のリスク:全額運用は,より大きな撤収リスクをもたらす可能性があります.

戦略最適化の方向性

- 波動率指標の導入:ストップポジションを動的に調整するためにATR指標の追加を検討する

- 入場時間を最適化:入場の正確性を高めるため,出荷量確認を追加できます.

- 資金管理の改善: ポジション管理モジュールを追加し,リスクの動向に応じてポジションを調整することを提案

- 市場環境の判断を増やす:トレンドの強さの指標を追加して取引信号をフィルターする

- パーセンテージ・トラッキング・ストップを活用して柔軟性を高める

要約する

この戦略は,複数の技術指標を組み合わせて,完ぺきな取引システムを構築し,良好なトレンド追跡能力とリスク管理機構を有している.特定の市場環境下では課題に直面する可能性があるが,継続的な最適化と完善によって,戦略は,異なる市場環境下でも安定したパフォーマンスを維持する見込みがある.

ストラテジーソースコード

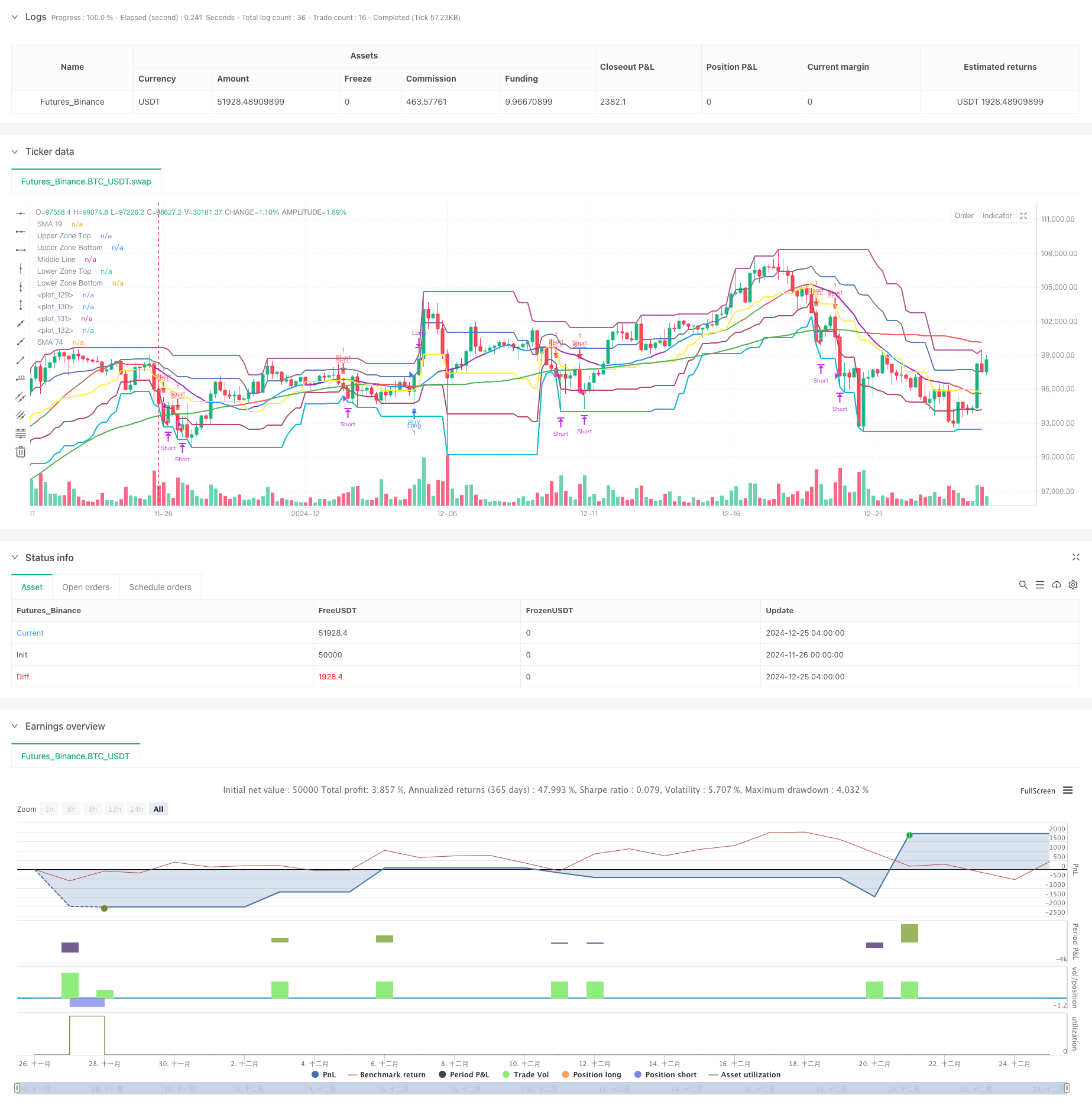

/*backtest

start: 2024-11-26 00:00:00

end: 2024-12-25 08:00:00

period: 4h

basePeriod: 4h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Purple SMA Strategy", overlay=true)

// === INPUTS ===

zoneLength = input.int(20, "Price Zone Length", minval=5)

tickSize = input.float(1.0, "Tick Size for Hard Stop")

hardStopTicks = input.int(50, "Hard Stop Loss in Ticks")

// === CALCULATE ZONES ===

h = ta.highest(high, zoneLength)

l = ta.lowest(low, zoneLength)

priceRange = h - l

lvl5 = h

lvl4 = l + (priceRange * 0.75) // Orange line

lvl3 = l + (priceRange * 0.50) // Yellow line

lvl2 = l + (priceRange * 0.25) // Green line

lvl1 = l

// === INDICATORS ===

sma19 = ta.sma(close, 19)

sma74 = ta.sma(close, 74)

// === CANDLE COLOR CONDITIONS ===

isGreenCandle = close > open

isRedCandle = close < open

// === CONTINUOUS TREND DETECTION ===

isThreeGreenCandles = close > open and close[1] > open[1] and close[2] > open[2]

isThreeRedCandles = close < open and close[1] < open[1] and close[2] < open[2]

var bool inGreenTrend = false

var bool inRedTrend = false

// Update trends

if isThreeGreenCandles

inGreenTrend := true

inRedTrend := false

if isThreeRedCandles

inRedTrend := true

inGreenTrend := false

if (inGreenTrend and isRedCandle) or (inRedTrend and isGreenCandle)

inGreenTrend := false

inRedTrend := false

// === STOCHASTIC CONDITIONS ===

k = ta.stoch(close, high, low, 60)

d = ta.sma(k, 10)

isOverbought = d >= 80

isOversold = d <= 20

stochUp = d > d[1]

stochDown = d < d[1]

// === SMA COLOR LOGIC ===

sma19Color = if isOverbought and stochUp

color.green

else if isOverbought and stochDown

color.red

else if isOversold and stochUp

color.green

else if isOversold and stochDown

color.red

else if stochUp

color.blue

else if stochDown

color.purple

else

color.gray

sma74Color = sma74 < sma19 ? color.green : color.red

// === CROSSING CONDITIONS ===

crossUpSMA = ta.crossover(close, sma74)

crossDownSMA = ta.crossunder(close, sma74)

// === ENTRY CONDITIONS ===

buyCondition = crossUpSMA and close > lvl4

sellCondition = crossDownSMA and close < lvl2

// === POSITION MANAGEMENT ===

var float stopLevel = na

var bool xMode = false

// Entry and Stop Loss

if buyCondition

strategy.entry(id="Long", direction=strategy.long)

stopLevel := close - (hardStopTicks * tickSize)

xMode := false

if sellCondition

strategy.entry(id="Short", direction=strategy.short)

stopLevel := close + (hardStopTicks * tickSize)

xMode := false

// Update stops based on X's

if strategy.position_size != 0 and (inGreenTrend or inRedTrend)

xMode := true

if strategy.position_size > 0 // Long position

stopLevel := low

else // Short position

stopLevel := high

// Exit logic

if strategy.position_size > 0 // Long position

if low <= stopLevel

strategy.close(id="Long")

else if xMode and not (inGreenTrend or inRedTrend)

strategy.close(id="Long")

if strategy.position_size < 0 // Short position

if high >= stopLevel

strategy.close(id="Short")

else if xMode and not (inGreenTrend or inRedTrend)

strategy.close(id="Short")

// === PLOTTING ===

plot(sma19, "SMA 19", color=sma19Color, linewidth=2)

plot(sma74, "SMA 74", color=sma74Color, linewidth=2)

plot(lvl5, "Upper Zone Top", color=color.red, linewidth=2)

plot(lvl4, "Upper Zone Bottom", color=color.orange, linewidth=2)

plot(lvl3, "Middle Line", color=color.yellow, linewidth=2)

plot(lvl2, "Lower Zone Top", color=color.green, linewidth=2)

plot(lvl1, "Lower Zone Bottom", color=color.blue, linewidth=2)

// Plot X signals

plotshape(inGreenTrend, title="Bullish Line", style=shape.xcross, location=location.belowbar, color=color.white, size=size.tiny)

plotshape(inRedTrend, title="Bearish Line", style=shape.xcross, location=location.abovebar, color=color.white, size=size.tiny)

// Zone fills

var p1 = plot(lvl5, display=display.none)

var p2 = plot(lvl4, display=display.none)

var p3 = plot(lvl2, display=display.none)

var p4 = plot(lvl1, display=display.none)

fill(p1, p2, color=color.new(color.red, 90))

fill(p3, p4, color=color.new(color.green, 90))

// Plot entry signals

plotshape(buyCondition, title="Buy", style=shape.square, location=location.belowbar, color=color.new(color.blue, 20), size=size.tiny, text="BUY", textcolor=color.blue)

plotshape(sellCondition, title="Sell", style=shape.square, location=location.abovebar, color=color.new(color.red, 20), size=size.tiny, text="SELL", textcolor=color.red)