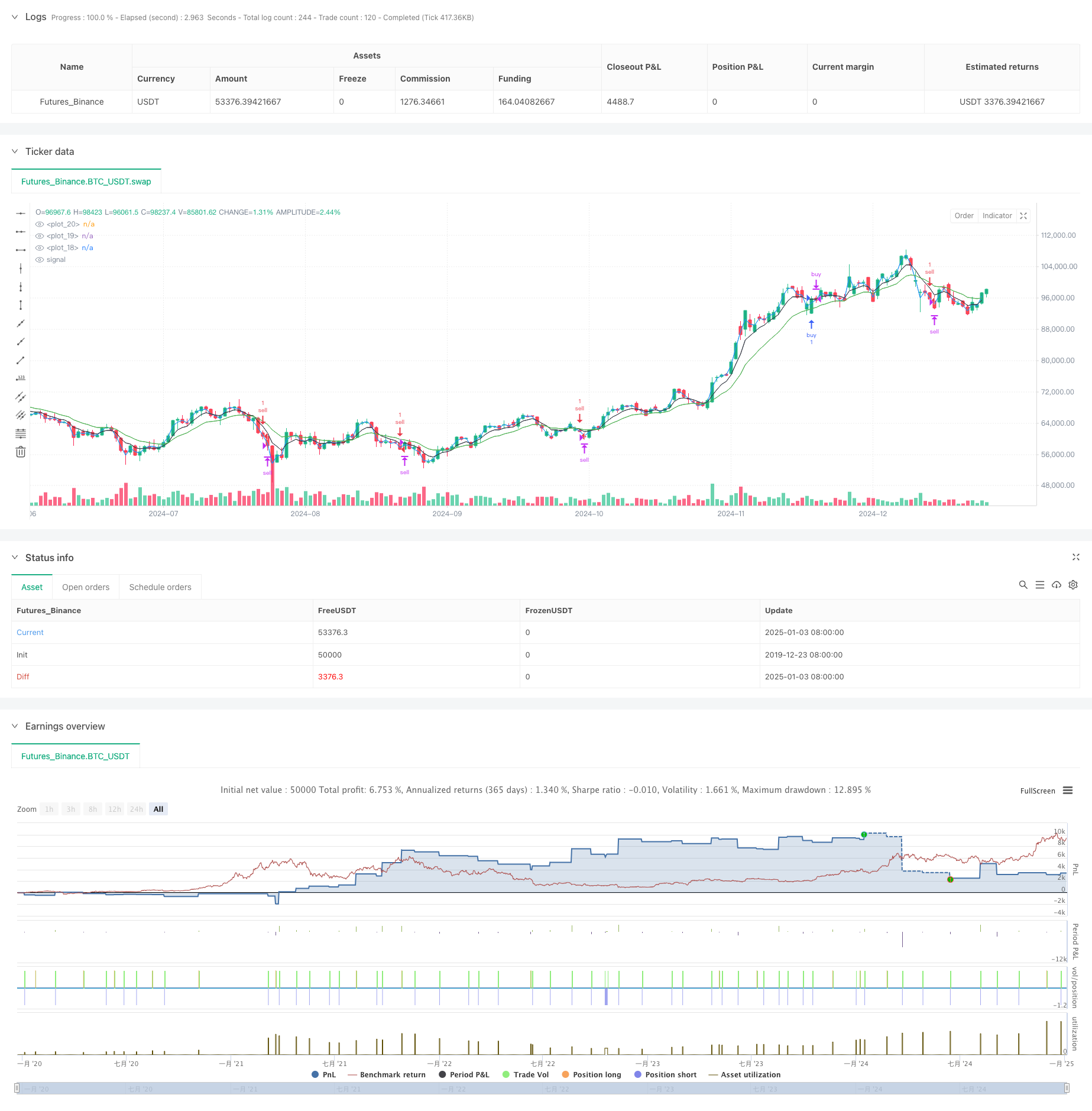

これは、複数の移動平均クロスオーバー指標と出来高価格指標に基づいた包括的なモメンタム取引戦略です。この戦略は、高速および低速の指数移動平均(EMA)クロスオーバー、出来高加重平均価格(VWAP)、およびスーパートレンドの組み合わせに基づいて取引シグナルを生成するとともに、日中の取引時間ウィンドウと価格変動範囲などの条件を組み合わせてエントリーを制御するために使用されます。そして終了します。

戦略原則

この戦略では、5日間と13日間のEMAを主なトレンド判断指標として使用します。高速EMAが低速EMAを上回り、終値がVWAPを上回ると、ロングシグナルがトリガーされます。高速EMAが低速EMAを下回ると、ロングシグナルがトリガーされます。終値が VWAP を下回ると、ロング シグナルがトリガーされます。下がると、ショート シグナルがトリガーされます。同時に、この戦略では、トレンドの確認とストップロスの基礎として SuperTrend インジケーターも導入されています。この戦略では、前取引日の終値と比較した価格変動範囲、当日の最高値と最低値の変動範囲など、取引日ごとに異なるエントリー条件を設定します。

戦略的優位性

- 複数のテクニカル指標を協調して使用することで、取引シグナルの信頼性が向上します。

- 市場特性に適応するために、取引日ごとに異なるエントリー条件を設定します。

- 動的なストッププロフィットとストップロスのメカニズムを採用することで、リスクを効果的に制御できます。

- 日中取引時間枠の制限と組み合わせることで、高ボラティリティ期間のリスクを回避できます。

- 過去の高値・安値や価格変動幅を制限することで、高値を追い求めて安値で売るリスクを軽減します。

戦略リスク

- 急速に変化する市場状況では誤ったシグナルが現れる可能性がある

- トレンド反転の初期段階では遅れが生じる可能性がある

- パラメータの最適化には過剰適合のリスクがある可能性がある

- 取引コストは戦略のリターンに影響を与える可能性がある

- ボラティリティが高い時期には市場は大きな下落に直面する可能性がある

戦略最適化の方向性

- トレンドの強さをさらに確認するために、ボリューム分析指標の導入を検討する

- 取引日ごとにパラメータ設定を最適化し、戦略の適応性を向上させる

- 市場感情指標を追加して予測精度を向上させる

- 資本利用の効率性を向上させるために、ストッププロフィットとストップロスのメカニズムを改善する

- ポジション管理を最適化するためにボラティリティ指標の追加を検討する

要約する

この戦略は、複数のテクニカル指標を総合的に使用して、トレンド追跡とモメンタム取引を組み合わせます。戦略設計では市場の多様性を十分に考慮し、取引日ごとに異なる取引ルールを採用しています。厳格なリスク管理と柔軟なストッププロフィットおよびストップロスのメカニズムにより、この戦略は優れた実用的応用価値を示します。将来的には、より多くのテクニカル指標を導入し、パラメータ設定を最適化することで、戦略の安定性と収益性を向上させることができます。

ストラテジーソースコード

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=6

strategy("S1", overlay=true)

fastEMA = ta.ema(close, 5)

slowEMA = ta.ema(close,13)

ema9 = ta.ema(close, 9)

ema100 = ta.ema(close, 100)

ema5 = ta.ema(close, 5)

ema200 = ta.ema(close, 200)

ma = ta.sma(close, 50)

mult = input.float(defval=3)

len = input.int(defval=11)

[superTrend, dir] = ta.supertrend(mult, len)

vwap1= ta.vwap(hlc3)

plot(slowEMA,color = color.green)

plot(fastEMA,color = color.black)

plot(vwap1, color = color.blue)

var dailyTaskDone = false

var gapdown = false

var gapup = false

var runup = 0.0

var biggapdown = false

var biggapup = false

var prevDayClose = 0.0

var todayLow = 0.0

var todayHigh = 0.0

var noBuyNow = false

var noSellNow = false

var buyPrice = 0.0

var sellPrice = 0.0

var todayBuyDone = false

var todaySellDone = false

var dragonflyDoji = false

var candleCount = 0

var candleCount1 = 0

var lastTrade = 9

var lastFiveCandles = false

var lastSevenCandlesS = false

var fiveEMACC = 0

candleCount := candleCount + 1

candleCount1 := candleCount1 + 1

if fiveEMACC > 0

fiveEMACC := fiveEMACC + 1

if fiveEMACC == 6

fiveEMACC := 0

if strategy.openprofit == 0

candleCount := 0

if hour == 9 and minute ==15

prevDayClose := close[1]

todayLow := low

todayHigh := high

lastTrade := 9

if hour == 9 and minute ==15 and (open - close[1]) > close*0.01

gapup := true

if hour == 9 and minute ==15 and (open - close[1]) < close*0.005*-1

gapdown := true

if hour == 9 and minute ==15 and (close - close[1]) > 200

biggapup := true

if hour == 9 and minute ==15 and (close - close[1]) < 200

biggapdown := true

if low < todayLow

todayLow := low

candleCount1 := 0

if high > todayHigh

todayHigh := high

if close > todayLow + 200

noBuyNow := true

if close < todayHigh - 200//0.01*close

noSellNow := false

lastFiveCandles := (close[4]<open[4] or close[3]<open[3] or close[2] < open[2] or close[1]<open[1])

lastSevenCandlesS := (close[6]>open[6] or close[5]>open[5] or close[4]>open[4] or close[3]>open[3] or close[2] > open[2] or close[1]>open[1])

if hour == 15

dailyTaskDone := false

gapdown := false

gapup := false

biggapup := false

biggapdown := false

noBuyNow := false

noSellNow := false

todayLow := 0.0

todayHigh := 0.0

buyPrice := 0.0

sellPrice := 0.0

todayBuyDone := false

todaySellDone := false

dragonflyDoji := false

lastTrade := 9

// if fastEMA < slowEMA and lastTrade == 1 and strategy.openprofit==0

// lastTrade := 9

if fastEMA > slowEMA and lastTrade == 0 and strategy.openprofit==0

lastTrade := 9

buy = (dayofweek==dayofweek.thursday and (fastEMA - slowEMA > close*0.001) and close > vwap1 and close[1] > vwap1[1]) or

(dayofweek==dayofweek.monday and (fastEMA - slowEMA > close*0.001) and close > vwap1 and close[1] > vwap1[1] and close-prevDayClose < close*0.011) or

(dayofweek==dayofweek.tuesday and (fastEMA - slowEMA > close*0.001) and close > vwap1 and close[1] > vwap1[1] and lastFiveCandles and close-prevDayClose < close*0.015 and close-todayLow < close*0.012) or

(dayofweek==dayofweek.wednesday and (fastEMA - slowEMA > close*0.001) and close > vwap1 and close-prevDayClose < close*0.015 and (hour!=9 or minute>=35) and close-todayLow < close*0.012) or

(dayofweek==dayofweek.friday and ((fastEMA - slowEMA > close*0.001))and close > vwap1 and close[1] > vwap1[1] and (hour!=9 or minute>=35))

sell= (dayofweek==dayofweek.thursday and (hour!=9 or minute>=35) and ((slowEMA - fastEMA > close*0.00089)) and close < vwap1 and lastSevenCandlesS and close[1] < vwap1[1]) or

(dayofweek==dayofweek.monday and ((slowEMA - fastEMA > close*0.00089)) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and todayHigh-close < close*0.008 and todayHigh-close[1] < close * 0.01 ) or

(dayofweek==dayofweek.tuesday and (hour!=9 or minute>=35) and (open - low < 2*(high-close)) and (close-open<10) and not dragonflyDoji and (slowEMA - fastEMA > close*0.00089) and close < vwap1 and close[1] < vwap1[1] and prevDayClose-close<close*0.012 and todayHigh-close < close*0.009 and todayHigh-close[1] < close * 0.009) or

(dayofweek==dayofweek.wednesday and (hour!=9 or minute>=40) and close<open and (slowEMA - fastEMA > close*0.00089) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and (close-todayLow>30 or candleCount1<1) ) or

(dayofweek==dayofweek.friday and ((slowEMA - fastEMA > close*0.00089)) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and (hour!=9 or minute>=55) )

// buy = (dayofweek==dayofweek.thursday and (fastEMA > slowEMA) and close > vwap1 and close[1] > vwap1[1]) or

// (dayofweek==dayofweek.monday and (fastEMA > slowEMA) and close > vwap1 and close[1] > vwap1[1] and close-prevDayClose < close*0.011) or

// (dayofweek==dayofweek.tuesday and (fastEMA > slowEMA) and close > vwap1 and close[1] > vwap1[1] and lastFiveCandles and close-prevDayClose < close*0.015 and close-todayLow < close*0.012) or

// (dayofweek==dayofweek.wednesday and (fastEMA > slowEMA) and close > vwap1 and close-prevDayClose < close*0.015 and (hour!=9 or minute>=35) and close-todayLow < close*0.012) or

// (dayofweek==dayofweek.friday and ((fastEMA > slowEMA))and close > vwap1 and close[1] > vwap1[1] and (hour!=9 or minute>=35))

// sell= (dayofweek==dayofweek.thursday and (hour!=9 or minute>=35) and ((slowEMA > fastEMA)) and close < vwap1 and lastSevenCandlesS and close[1] < vwap1[1]) or

// (dayofweek==dayofweek.monday and ((slowEMA > fastEMA)) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and todayHigh-close < close*0.008 and todayHigh-close[1] < close * 0.01 ) or

// (dayofweek==dayofweek.tuesday and (hour!=9 or minute>=35) and (open - low < 2*(high-close)) and (close-open<10) and not dragonflyDoji and (slowEMA > fastEMA) and close < vwap1 and close[1] < vwap1[1] and prevDayClose-close<close*0.012 and todayHigh-close < close*0.009 and todayHigh-close[1] < close * 0.009) or

// (dayofweek==dayofweek.wednesday and (hour!=9 or minute>=40) and close<open and (slowEMA > fastEMA) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and (close-todayLow>30 or candleCount1<1) ) or

// (dayofweek==dayofweek.friday and ((slowEMA > fastEMA)) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and (hour!=9 or minute>=55) )

dragonflyDoji:= false

// (slowEMA - fastEMA > close*0.00089 or (slowEMA-fastEMA>close*0.00049 and (high[2]>vwap or high[1]>vwap)))

if sellPrice != 0 and runup < sellPrice - low

runup := sellPrice - low

if buyPrice != 0 and runup < high - buyPrice

//ourlabel = label.new(x=bar_index, y=na, text=tostring(runup), yloc=yloc.belowbar)

runup := high - buyPrice

NoBuySellTime = (hour == 15) or ((hour==14 and minute>=25)) or (hour==9 and minute<=35) or hour >= 14

//(fiveEMACC > 0 and low < fastEMA and close < vwap1)

buyexit = fastEMA<slowEMA or (close<superTrend and close < vwap1 and close[1] < vwap1[1]) //or strategy.openprofit > 400 or strategy.openprofit < -5000

sellexit = slowEMA<fastEMA or (close > vwap1 and close[1] > vwap1[1] and close>superTrend) //or strategy.openprofit > 400 or strategy.openprofit < -5000

exitPosition = (dayofweek==dayofweek.thursday and buyPrice!=0.0 and (high - buyPrice) > 50) or (dayofweek==dayofweek.thursday and sellPrice!=0.0 and (sellPrice - low) > 80) or (dayofweek==dayofweek.monday and buyPrice !=0.0 and high-buyPrice > 30) or (dayofweek==dayofweek.monday and sellPrice!=0.0 and (sellPrice - low) > 30) or (dayofweek!=dayofweek.thursday and dayofweek!=dayofweek.monday and buyPrice!=0.0 and (high - buyPrice) > 30) or (dayofweek!=dayofweek.thursday and dayofweek!=dayofweek.monday and sellPrice!=0.0 and (sellPrice - low) > 30)

//code such that 2 fastema is > than 2 slowema

//exitPosition = (sellPrice!=0 and runup >21 and strategy.openprofit < -2000) or (candleCount > 18 and strategy.openprofit > 50 and strategy.openprofit < 1000) or (dayofweek==dayofweek.thursday and buyPrice!=0.0 and (high - buyPrice) > buyPrice * 0.007) or (dayofweek==dayofweek.thursday and sellPrice!=0.0 and (sellPrice - low) > sellPrice * 0.007) or (dayofweek==dayofweek.monday and buyPrice !=0.0 and high-buyPrice > 30) or (dayofweek!=dayofweek.thursday and dayofweek!=dayofweek.monday and buyPrice!=0.0 and (high - buyPrice) > buyPrice * 0.002) or (dayofweek!=dayofweek.thursday and sellPrice!=0.0 and (sellPrice - low) > sellPrice * 0.002)

//(runup >21 and strategy.openprofit < -2000) or

if buy and fastEMA>vwap1 and (not todayBuyDone or lastTrade != 1) and not NoBuySellTime// and not dailyTaskDone //and (dayofweek==dayofweek.friday or (close-prevDayClose)<150)//and not biggapup

strategy.entry("buy", strategy.long)

//dailyTaskDone := true

if buyPrice == 0.0

fiveEMACC := 1

buyPrice := close

//ourlabel = label.new(x=bar_index, y=na, text=tostring(todayLow + 500), yloc=yloc.belowbar9

todayBuyDone := true

lastTrade := 1

runup := 0.0

if sell and (not todaySellDone or lastTrade != 0) and not NoBuySellTime// and not dailyTaskDone // and dayofweek!=dayofweek.friday //and (dayofweek==dayofweek.friday or (prevDayClose-close)<150)//and not biggapdown

strategy.entry("sell", strategy.short)

//dailyTaskDone := true

if sellPrice == 0.0

fiveEMACC := 1

sellPrice := close

todaySellDone := true

lastTrade := 0

runup := 0.0

// if ((fastEMA-slowEMA>18 and close>vwap and close[1]>vwap[1] and (not todayBuyDone or candleCount>12)) or (slowEMA-fastEMA>10 and close < vwap and close[1]<vwap[1] and (not todaySellDone or candleCount > 12))) and strategy.openprofit==0

// ourlabel = label.new(x=bar_index, y=na, text=tostring(abs(prevDayClose-close)), yloc=yloc.belowbar)

IntraDay_SquareOff = minute >=15 and hour >= 15

if true and (IntraDay_SquareOff or exitPosition)

strategy.close("buy")

strategy.close("sell")

buyPrice := 0

sellPrice := 0

runup := 0.0

if buyexit

strategy.close("buy")

buyPrice := 0

if sellexit

strategy.close("sell")

sellPrice := 0

buy1 = ((dayofweek==dayofweek.thursday and (fastEMA - slowEMA > close*0.001) and close > vwap1 and close[1] > vwap1[1]) or

(dayofweek==dayofweek.monday and (fastEMA - slowEMA > close*0.0013) and close > vwap1 and close[1] > vwap1[1]) or

(dayofweek==dayofweek.tuesday and (fastEMA - slowEMA > close*0.0013) and close > vwap1 and close[1] > vwap1[1] and not gapup) or

(dayofweek==dayofweek.wednesday and (fastEMA - slowEMA > close*0.0013) and close > vwap1 and close[1] > vwap1[1] and close-prevDayClose < close*0.0085) or

(dayofweek==dayofweek.friday and (fastEMA - slowEMA > close*0.0013) and close > vwap1 and close[1] > vwap1[1] and close - todayLow < close*0.012))

and dayofweek!=dayofweek.friday and (not todayBuyDone or lastTrade != 1) and not NoBuySellTime// and not dailyTaskDone //and (dayofweek==dayofweek.friday or (close-prevDayClose)<150)//and not biggapup

sell1= ((dayofweek==dayofweek.thursday and (slowEMA - fastEMA > close*0.00079) and close < vwap1 and close[1] < vwap1[1]) or

(dayofweek==dayofweek.monday and (slowEMA - fastEMA > close*0.00079) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and todayHigh-close < close*0.01 and todayHigh-close[1] < close * 0.01) or

(dayofweek==dayofweek.tuesday and (slowEMA - fastEMA > close*0.00079) and close < vwap1 and close[1] < vwap1[1] and not gapdown and not dragonflyDoji and todayHigh-close < close*0.009 and todayHigh-close[1] < close * 0.009) or

(dayofweek==dayofweek.wednesday and (slowEMA - fastEMA > close*0.00079) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and prevDayClose-close < 0.005*close) or

(dayofweek==dayofweek.friday and (slowEMA - fastEMA > close*0.00079) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and prevDayClose-close < 0.005*close)) and

dayofweek!=dayofweek.friday and (not todaySellDone or lastTrade != 0) and not NoBuySellTime// and not dailyTaskDone

// if buy1 and strategy.openprofit==0

// ourlabel = label.new(x=bar_index, y=na, text=tostring(fastEMA - slowEMA), yloc=yloc.belowbar)

// if sell1 and strategy.openprofit==0

// ourlabel = label.new(x=bar_index, y=na, text=tostring(slowEMA - fastEMA), yloc=yloc.belowbar)

// buy = ((fastEMA > slowEMA and fastEMA[1] < slowEMA[1]) and (fastEMA - slowEMA) > 10) or ((fastEMA > slowEMA and fastEMA[1] > slowEMA[1] and fastEMA[2] < slowEMA[2]) and (fastEMA - slowEMA) > 20)

// sell= ((fastEMA < slowEMA and fastEMA[1] > slowEMA[1] ) and (slowEMA - fastEMA) > 10) or ((fastEMA < slowEMA and fastEMA[1] < slowEMA[1] and fastEMA[2] > slowEMA[2]) and (slowEMA - fastEMA) > 20)

// buy = (fastEMA > slowEMA and fastEMA[1] < slowEMA[1])

// sell= (fastEMA < slowEMA and fastEMA[1] > slowEMA[1] )

// buy = ((fastEMA > slowEMA and fastEMA[1] < slowEMA[1]) and (fastEMA - slowEMA) > 10) or ((fastEMA > slowEMA and fastEMA[1] > slowEMA[1] and fastEMA[2] < slowEMA[2]) and (fastEMA - slowEMA) > 1)

// sell= ((fastEMA < slowEMA and fastEMA[1] > slowEMA[1] ) and (slowEMA - fastEMA) > 5)

// buy = fastEMA > slowEMA and fastEMA[1] > slowEMA[1] and fastEMA[2] < slowEMA[2]

// sell= fastEMA < slowEMA and fastEMA[1] < slowEMA[1] and fastEMA[2] > slowEMA[2]

//Daily chart

// buyexit = (close + 40 < slowEMA)//rsi > 65 and fastEMA > ema9 // fastEMA > ema9// close < fastEMA//(rsi > 65 and close < fastEMA and fastEMA > ema3 and close > ema200) //strategy.openprofit < -10000 and slowEMA > ema3 and slowEMA[1] < ema3[1] and 1==2

// sellexit = (close - 40 > slowEMA)//rsi < 35 // and close > ema200) or (rsi < 35 and close < ema200 and fastEMA < ema3) //strategy.openprofit < -10000 and fastEMA < ema3 and fastEMA[1] > ema3[1] and 1==2

// buyexit = (close < superTrend)// and (close < vwap1 and close[1] < vwap1[1] and close < close[1])//and close[2] < vwap1[2]//rsi > 65 and close < fastEMA// fastEMA > ema9// close < fastEMA//(rsi > 65 and close < fastEMA and fastEMA > ema3 and close > ema200) //strategy.openprofit < -10000 and slowEMA > ema3 and slowEMA[1] < ema3[1] and 1==2

// sellexit = (close > superTrend)// and (close > vwap1 and close[1] > vwap1[1] and close > close[1]) //and close[2] > vwap1[2]//rsi < 35// and close > ema200) or (rsi < 35 and close < ema200 and fastEMA < ema3) //strategy.openprofit < -10000 and fastEMA < ema3 and fastEMA[1] > ema3[1] and 1==2

// buyexit = (close < superTrend and close < vwap1 and close[1] < vwap1[1] and close[1] < superTrend[1]) //or strategy.openprofit > 400 or strategy.openprofit < -5000

// sellexit = (close > superTrend and close > vwap1 and close[1] > vwap1[1] and close[1] > superTrend[1]) //or strategy.openprofit > 400 or strategy.openprofit < -5000