2

フォロー

366

フォロワー

概要

この戦略は,複数の指標を組み合わせたトレンド追跡システムであり,主に価格の突破,取引量確認,均線システムの配合によって市場のトレンドの機会を捉えるためのものです. この戦略は,最近の高点/低点に対する価格の突破,取引量の顕著な拡大,および複数の指数の移動平均 (EMA) の配列を監視することによって取引シグナルを決定します.

戦略原則

戦略の核心的な論理は,以下の重要な要素に基づいています.

- 価格突破システム:過去20サイクルにおける価格の高点/低点への突破を監視する

- 取引量確認:突破時の取引量が過去20サイクル平均の取引量の少なくとも2倍である必要があります

- 均線システム:30/50/200周期のEMAを用いたトレンド確認システム構築

- 複数の条件:価格が新高を突破し,取引量が増加し,価格が200EMAに達し,短期平均線は中期平均線の上にあり,中期平均線は長期平均線の上にあり

- 条件:入場には2つのメカニズムがあります.

- 伝統的な空白の突破:価格が新しい低値を突破し,取引量が増加し,平均線空頭並びで200EMAは下向きに傾いています

- 狭窄整理空白:価格が中期平均線以下で狭窄整理を形成し,ATRの0.5倍未満の整理幅

戦略的優位性

- 多重確認メカニズム:価格突破,取引量,平均線三重確認により,信号の信頼性を高める

- フレキシブルな空白メカニズム: 2つの独立した空白入場方法を提供し,取引機会を増やす

- 適応性:ATRによって細かい整理が定義され,異なる市場の変動環境に適応する戦略が提供されます.

- リスク管理の改善: 200EMAをストップ・レファレンスとして使用し,明確な退出メカニズムを提供

- パラメータの可変性: 異なる市場特性に応じて重要なパラメータを最適化できます.

戦略リスク

- 偽のブレイクリスク: 市場が偽のブレイクを起こし,誤ったシグナルを生む可能性

- スライドポイントリスク:取引量急増の突破時に,大きなスライドポイントに直面する可能性がある

- トレンド逆転リスク: 強いトレンドの市場では,平均線ストップを使用すると,早退が起こり得る

- パラメタセンシビリティ: 策略のパフォーマンスはパラメタ設定に敏感であり,慎重に最適化する必要があります.

- 市場環境依存: 波動的な市場では頻繁に誤信号が生じる可能性

戦略最適化の方向性

- トレンド強度フィルタを導入: 弱傾向環境下からの信号をフィルタリングするために,ADXなどのトレンド強度指標を追加できます.

- オプティマイズされた止損メカニズム:ATRベースのダイナミックな止損を導入し,止損の柔軟性を向上させる

- ポジション管理の改善:突破の強さや市場の波動的な動向に応じてポジションの規模を調整する

- タイムフィルターを追加: 波動性の高い開盤と閉盤時に取引を避けるために,日中の時間フィルターを追加

- 市場環境の分類を導入:異なる市場環境 ((トレンド/揺れ) に応じて動的に調整する戦略パラメータ

要約する

多重トレンド突破量取引戦略は,複数の技術指標の組み合わせによる総合的なトレンド追跡システムであり,信号の信頼性を保証しながら,柔軟な取引機会を提供します.戦略の革新は,伝統的な突破取引方法と新型の狭い整理識別機構を組み合わせることで,異なる市場環境に適応することを可能にします.ある程度のリスクがあるものの,合理的なパラメータの最適化とリスク管理措置により,戦略は,トレンド市場において安定したパフォーマンスを期待しています.

ストラテジーソースコード

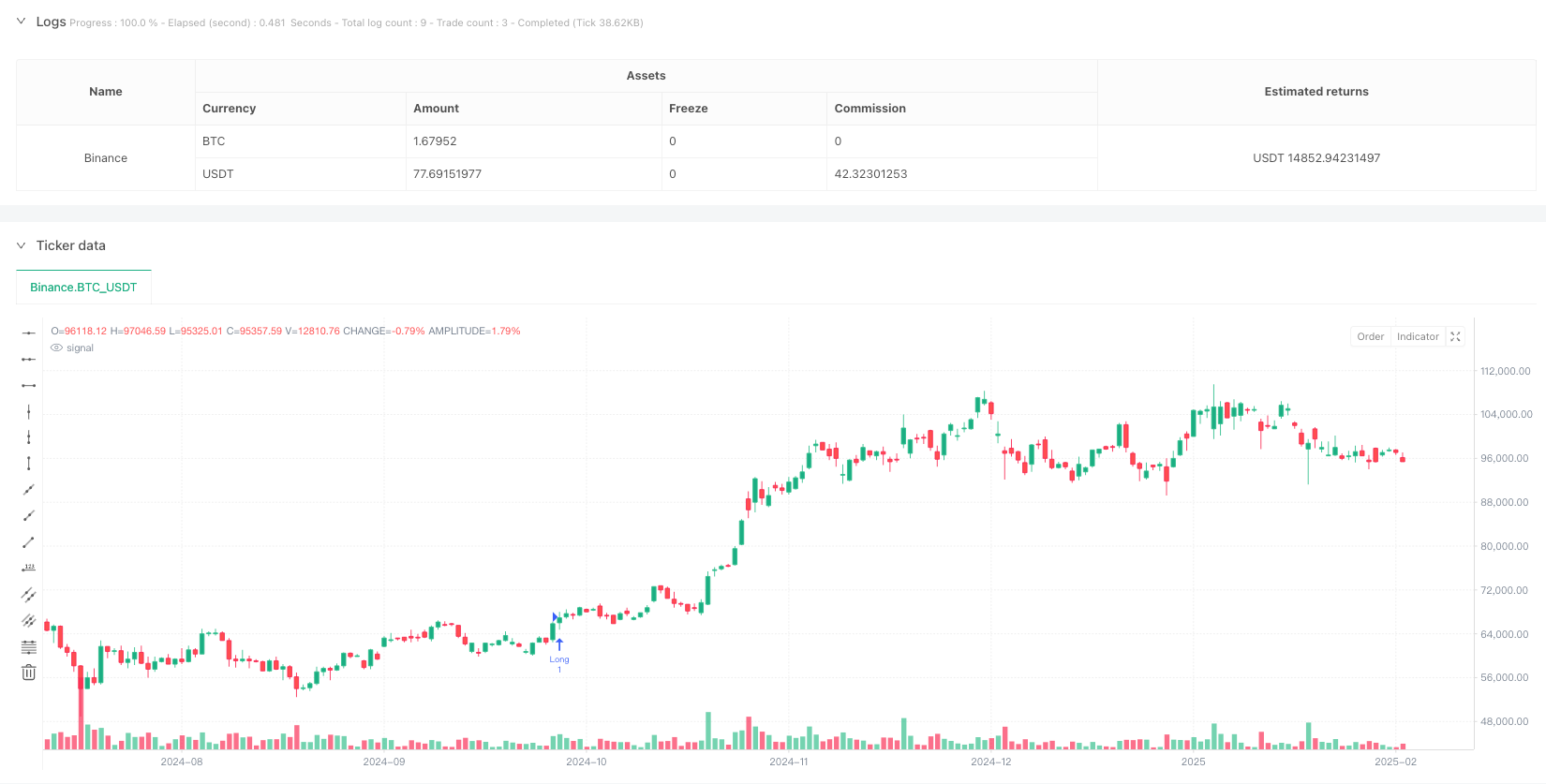

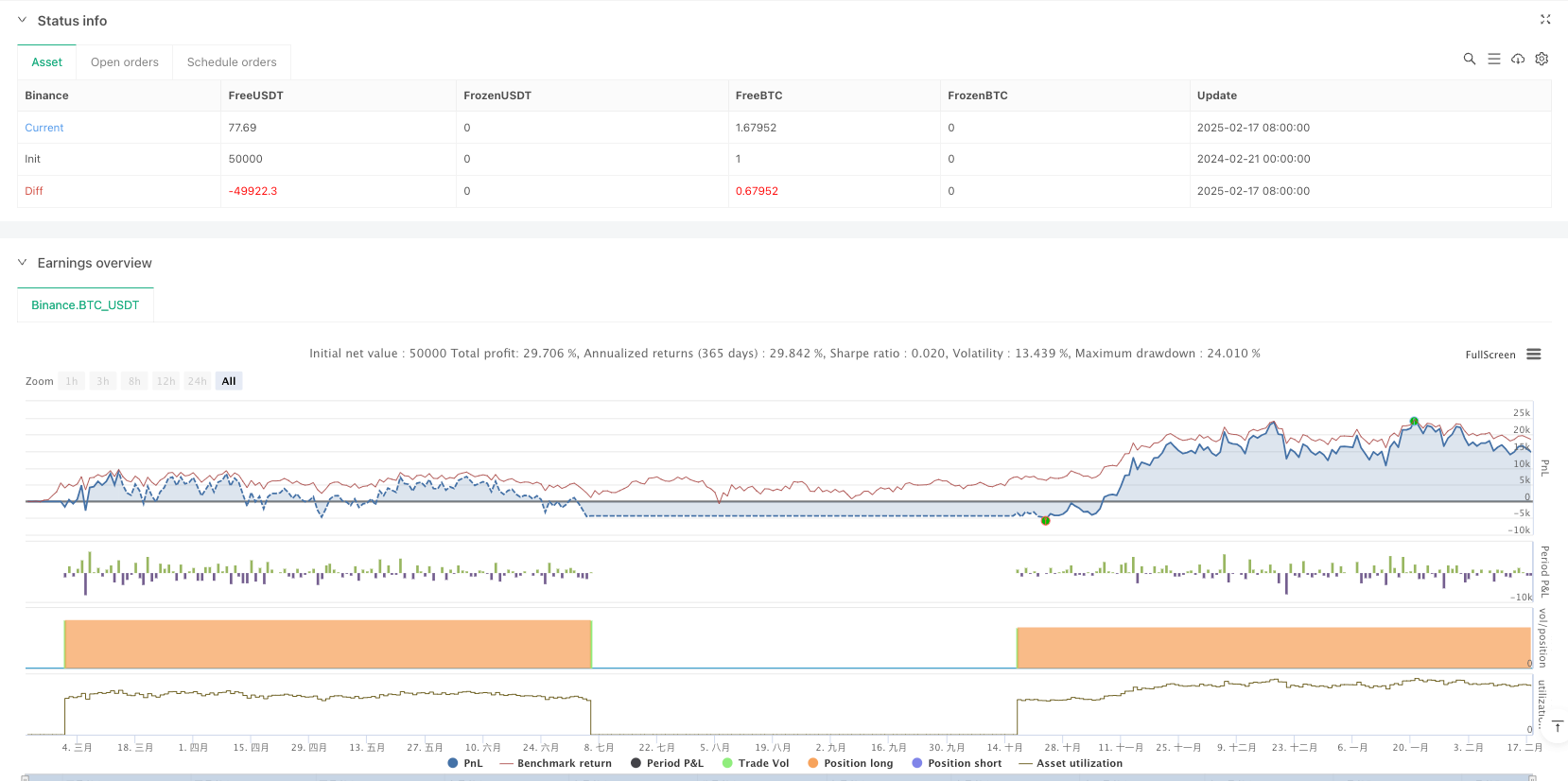

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Breakout Strategy (Long & Short) + Slope of 200 EMA", overlay=true)

// -------------------

// 1. Settings

// -------------------

breakout_candles = input.int(20, title="Number of Candles for Breakout")

range_candles = input.int(10, title="Number of Candles for Previous Range")

ema_long_period = input.int(200, title="Long EMA Period")

ema_medium_period = input.int(50, title="Medium EMA Period")

ema_short_period = input.int(30, title="Short EMA Period")

// Checkbox to allow/disallow short positions

allowShort = input.bool(true, title="Allow Short Positions")

// Inputs for the new Narrow Consolidation Short setup

consolidationBars = input.int(10, "Consolidation Bars", minval=1)

narrowThreshInAtr = input.float(0.5,"Narrowness (ATR Mult.)",minval=0.0)

atrLength = input.int(14, "ATR Length for Range")

// -------------------

// 2. Calculations

// -------------------

breakout_up = close > ta.highest(high, breakout_candles)[1]

breakout_down = close < ta.lowest(low, breakout_candles)[1]

prev_range_high = ta.highest(high, range_candles)[1]

prev_range_low = ta.lowest(low, range_candles)[1]

ema_long = ta.ema(close, ema_long_period)

ema_medium = ta.ema(close, ema_medium_period)

ema_short = ta.ema(close, ema_short_period)

average_vol = ta.sma(volume, breakout_candles)

volume_condition = volume > 2 * average_vol

// 200 EMA sloping down?

ema_long_slope_down = ema_long < ema_long[1]

// For the Narrow Consolidation Short

rangeHigh = ta.highest(high, consolidationBars)

rangeLow = ta.lowest(low, consolidationBars)

rangeSize = rangeHigh - rangeLow

atrValue = ta.atr(atrLength)

// Condition: Price range is "narrow" if it's less than (ATR * threshold)

narrowConsolidation = rangeSize < (atrValue * narrowThreshInAtr)

// Condition: All bars under Medium EMA if the highest difference (high - ema_medium) in last N bars is < 0

allBelowMedium = ta.highest(high - ema_medium, consolidationBars) < 0

// -------------------

// 3. Long Entry

// -------------------

breakout_candle_confirmed_long = ta.barssince(breakout_up) <= 3

long_condition = breakout_candle_confirmed_long

and volume_condition

and close > prev_range_high

and close > ema_long

and ema_short > ema_medium

and ema_medium > ema_long

and strategy.opentrades == 0

if long_condition

strategy.entry("Long", strategy.long)

// -------------------

// 4. Short Entries

// -------------------

// (A) Original breakout-based short logic

breakout_candle_confirmed_short = ta.barssince(breakout_down) <= 3

short_condition_breakout = breakout_candle_confirmed_short

and volume_condition

and close < prev_range_low

and close < ema_long

and ema_short < ema_medium

and ema_medium < ema_long

and ema_long_slope_down

and strategy.opentrades == 0

// (B) NEW: Narrow Consolidation Short

short_condition_consolidation = narrowConsolidation

and allBelowMedium

and strategy.opentrades == 0

// Combine them: if either short scenario is valid, go short

short_condition = (short_condition_breakout or short_condition_consolidation) and allowShort

if short_condition

// Use a different order ID if you want to distinguish them

// but "Short" is fine for a single position

strategy.entry("Short", strategy.short)

// -------------------

// 5. Exits

// -------------------

if strategy.position_size > 0 and close < ema_long

strategy.close("Long", qty_percent=100)

if strategy.position_size < 0 and close > ema_long

strategy.close("Short", qty_percent=100)

// ======================================================================

// 5. ADDITIONAL PARTIAL EXITS / STOPS

// ======================================================================

// You can add partial exits for shorts or longs similarly.

// For example:

// if strategy.position_size < 0 and close > stop_level_for_short

// strategy.close("Short", qty_percent=50)