概要

この戦略は,複数の技術指標の協同分析に基づく取引信号生成システムである.戦略は,相対的な強弱指数 (RSI),ブリン帯 (BB),日内動量指数 (IMI) および資金流動指数 (MFI) の4つのクラシック技術指標を統合し,指標間のクロス検証によってより信頼性の高い取引を生成する.信号戦略は,設計上4時間の周期に特別に適合し,信号強度に応じて通常の信号と強い信号の2つのレベルに分けられる.

戦略原則

戦略の核心的な論理は,複数の指標の協調的な配合によって取引シグナルを確認することです.具体的には:

- 信号のトリガーの条件:

- RSIが30を下回ると,市場が過剰に売り切れていることがわかります.

- ブリン帯の下位より低い価格,価格偏差が大きいことを示します.

- IMIが30を下回ると,日中の下落は弱まる.

- MFIは20以下で,資金流出圧力が減ったことを示している.

- 信号の引き金となる条件:

- RSIが70を超えると,市場が過買していることがわかります.

- 価格の偏差が大きいことを示すブリン帯より高い価格

- IMIが70以上で,日中の上昇が弱まっていることを示している.

- MFIは80を超えており,資金流入の圧力が減っていることを示しています.

- 強い信号条件 常規信号の基礎でさらに厳格な値要求

戦略的優位性

- 複数の技術指標のクロス検証により,信号の信頼性が著しく向上

- 通常の信号と強い信号を区別し,ポジションを柔軟に調整する

- 戦略の論理は明確でシンプルで,理解し,維持しやすい.

- 指標のパラメータは調整可能で,適応性があります.

- 統合されたフィードバック機能により,戦略の最適化が可能

戦略リスク

- 複数の指標の協調により,信号の遅延が発生する可能性があります. 解決策:適切なトリガー条件の緩和,またはトレンド予測指標の導入

- 固定値は,異なる市場環境では適用されない可能性があります. 解決策:自主減価償却の導入

- 4時間周期は 短期的な機会を逃す可能性があります 解決法:多時間周期分析を追加する

戦略最適化の方向性

- 適応減価償却の仕組みを導入する 戦略の適応性を高めるために,指標の歴史的分数を計算してシグナル・スローズを動的に調整する

- トレンド強度フィルター ADXなどのトレンド強度指標を導入し,波動市場における偽信号をフィルターする

- ポジション管理の最適化 シグナル強さと市場の変動率に合わせてポジション保持比率を動的に調整する

- ストップ・ダメージ・ストップ・メカニズムへの加入 ATR ベースの動的止損位を設定する

要約する

この戦略は,複数のクラシックな技術指標の協同分析によって,比較的信頼性の高い取引信号生成システムを構築している.戦略の設計は,実用性と維持性に重点を置くが,十分な最適化スペースを留めている.合理的なパラメータ調整と最適化方向の実施により,戦略は,実際の取引で安定したパフォーマンスを期待している.

ストラテジーソースコード

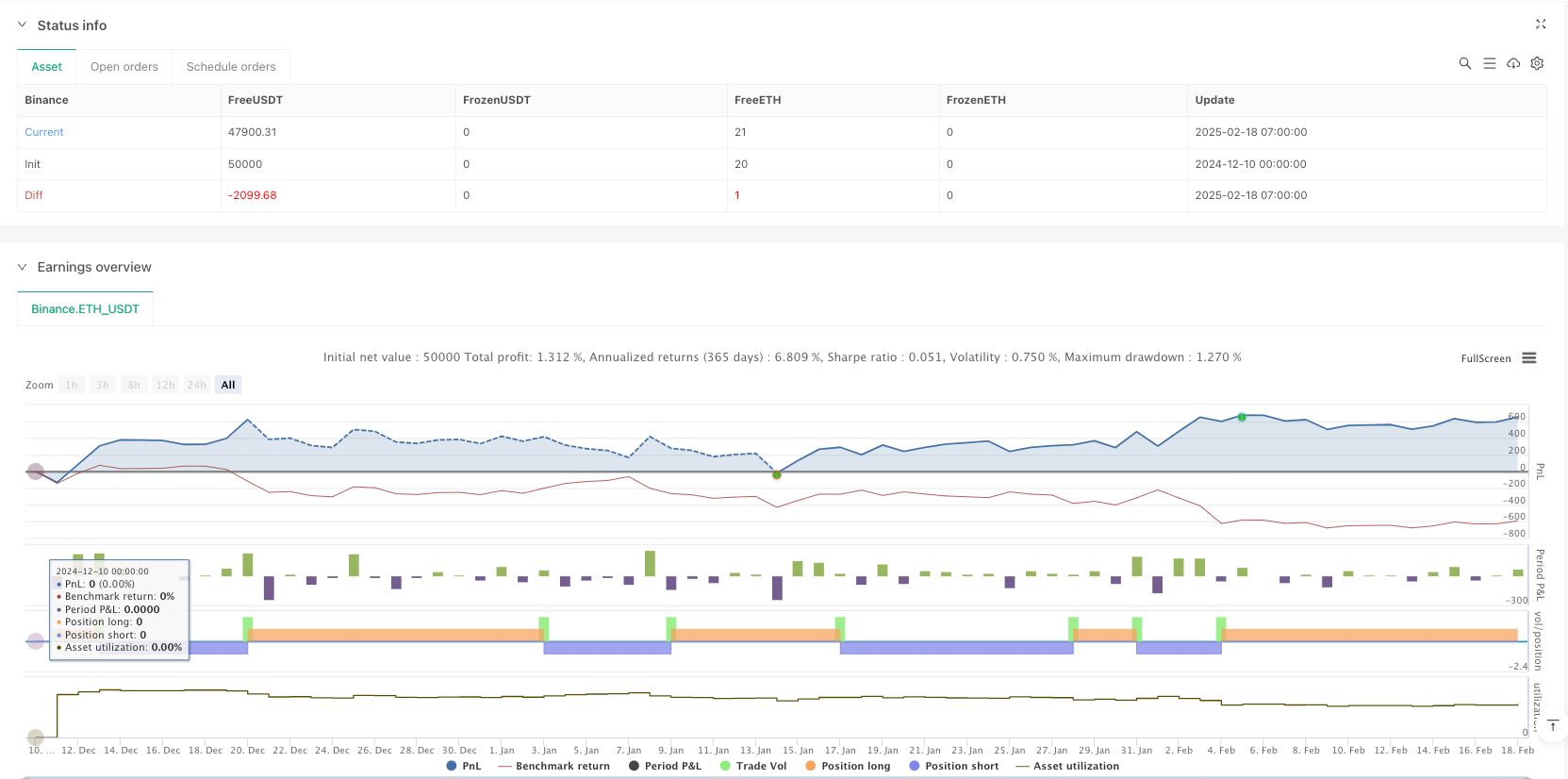

/*backtest

start: 2024-12-10 00:00:00

end: 2025-02-18 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Clear Buy/Sell Signals with RSI, Bollinger Bands, IMI, and MFI", overlay=true)

// Input parameters

rsiLength = input.int(14, title="RSI Length")

bbLength = input.int(20, title="Bollinger Bands Length")

bbStdDev = input.float(2.0, title="Bollinger Bands Std Dev")

imiLength = input.int(14, title="IMI Length")

mfiLength = input.int(14, title="MFI Length")

// RSI Calculation

rsi = ta.rsi(close, rsiLength)

// Bollinger Bands Calculation

[bbUpper, bbMiddle, bbLower] = ta.bb(close, bbLength, bbStdDev)

// Intraday Momentum Index (IMI) Calculation

upSum = math.sum(close > open ? close - open : 0, imiLength)

downSum = math.sum(close < open ? open - close : 0, imiLength)

imi = (upSum / (upSum + downSum)) * 100

// Money Flow Index (MFI) Calculation

typicalPrice = (high + low + close) / 3

mfi = ta.mfi(typicalPrice, mfiLength)

// Buy/Sell Conditions

buyCondition = rsi < 30 and close < bbLower and imi < 30 and mfi < 20

sellCondition = rsi > 70 and close > bbUpper and imi > 70 and mfi > 80

// Strong Buy/Sell Conditions

strongBuyCondition = rsi < 20 and close < bbLower and imi < 20 and mfi < 10

strongSellCondition = rsi > 80 and close > bbUpper and imi > 80 and mfi > 90

// Plot Buy/Sell Signals

plotshape(series=buyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY", size=size.small)

plotshape(series=sellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL", size=size.small)

// Plot Strong Buy/Sell Signals

plotshape(series=strongBuyCondition, title="Strong Buy Signal", location=location.belowbar, color=color.lime, style=shape.labelup, text="STRONG BUY", size=size.normal)

plotshape(series=strongSellCondition, title="Strong Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="STRONG SELL", size=size.normal)

// Strategy Logic (for Backtesting)

if (buyCondition or strongBuyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition or strongSellCondition)

strategy.entry("Sell", strategy.short)