概要

この戦略は,複合平均線に基づくトレンド追跡と反転取引システムである.これは,異なる周期の移動平均を組み合わせて,平均線に対する価格の反応と組み合わせて,取引の機会を識別する.戦略の核心は,価格と平均線との関係を観察し,特定の下落時に価格の反応を判断することによって,取引のタイミングを判断する.

戦略原則

戦略は,複数の移動平均型 (EMA,TEMA,DEMA,WMA,SMA) の組み合わせを使用して,2つの異なる周期 (デフォルト20と30) の加重または算術平均を使って複合平均線を構築する.価格が平均線上にあると上昇傾向とみなされ,平均線下にあると下降傾向とみなされる.戦略は,トレンドが確立された後に価格が平均線近くに戻ることを待つ.

戦略的優位性

- システムには良好な適応性があり,複数の均線タイプをサポートし,異なる市場特性に応じて最も適した均線を選択することができます.

- 複合平均線によって,単周期平均線がもたらす偽信号を効果的に減らす.

- 戦略は,反応パーセントの概念を加え,単純な均線横断取引を避け,取引の信頼性を高めます.

- トレンドの方向が明確である場合,リコール入場を待つことでより良い取引価格を得ることができます.

戦略リスク

- 波動的な市場では,頻繁に偽信号が生み出され,取引コストが増加する可能性があります.

- 複合均線の遅滞は,入場と出場のタイミングの遅延を引き起こす可能性があります.

- 固定反応比率は,異なる市場環境で調整が必要になる可能性があります.

- 市場が急激にトレンドを変えた場合,大きな後退が起こる可能性があります.

戦略最適化の方向性

- 波動率指標を導入することで,反応パーセントを動的に調整し,異なる市場環境に戦略をより適当に適応させることができます.

- 価格逆転の有効性を確認するために取引量要素を追加します.

- リスク管理の改善のため,ストップ・アンド・ストップ・メカニズムを追加することを検討する.

- トレンドの強さを判断し,強いトレンドではより激進的なパラメータ設定を使用することができます.

- 市場環境の判断を考慮し,異なる市場特性の下で異なるパラメータの組み合わせを使用する.

要約する

これは,トレンド追跡と反転取引の理念を組み合わせた戦略であり,均線と価格反応の合わさった仕組みによって取引機会を捉える.戦略の核心的な優位性は,その柔軟性と偽信号をフィルターする能力にあるが,同時に,異なる市場環境におけるパラメータ最適化の問題にも注意する必要がある.合理的なリスク制御と継続的な最適化改善により,この戦略は,実際の取引で安定した収益を期待する.

ストラテジーソースコード

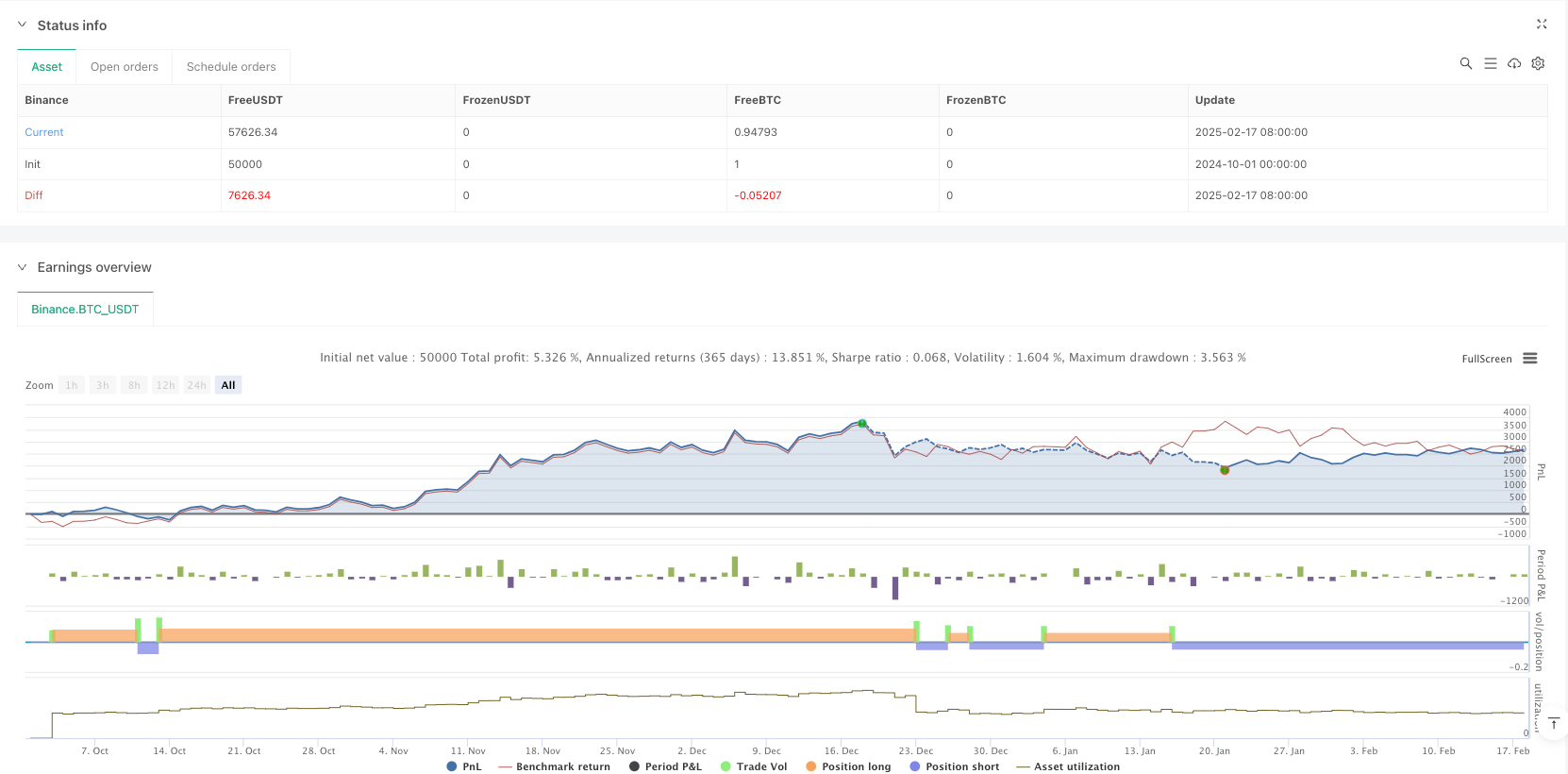

/*backtest

start: 2024-10-01 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Ultrajante MA Reaction Strategy", overlay=true, initial_capital=10000,

default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// ===== Custom Functions for DEMA and TEMA =====

dema(src, length) =>

ema1 = ta.ema(src, length)

ema2 = ta.ema(ema1, length)

2 * ema1 - ema2

tema(src, length) =>

ema1 = ta.ema(src, length)

ema2 = ta.ema(ema1, length)

ema3 = ta.ema(ema2, length)

3 * ema1 - 3 * ema2 + ema3

// ===== Configuration Parameters =====

// MA Type Selection

maType = input.string(title="MA Type", defval="EMA", options=["SMA", "EMA", "WMA", "DEMA", "TEMA"])

// Parameters for composite periods

periodA = input.int(title="Period A", defval=20, minval=1)

periodB = input.int(title="Period B", defval=30, minval=1)

compMethod = input.string(title="Composite Method", defval="Average", options=["Average", "Weighted"])

// Reaction percentage (e.g., 0.5 means 0.5%)

reactionPerc = input.float(title="Reaction %", defval=0.5, step=0.1)

// ===== Composite Period Calculation =====

compPeriod = compMethod == "Average" ? math.round((periodA + periodB) / 2) : math.round((periodA * 0.6 + periodB * 0.4))

// ===== Moving Average Calculation based on selected type =====

ma = switch maType

"SMA" => ta.sma(close, compPeriod)

"EMA" => ta.ema(close, compPeriod)

"WMA" => ta.wma(close, compPeriod)

"DEMA" => dema(close, compPeriod)

"TEMA" => tema(close, compPeriod)

=> ta.ema(close, compPeriod) // Default value

plot(ma, color=color.blue, title="MA")

// ===== Trend Definition =====

trendUp = close > ma

trendDown = close < ma

// ===== Reaction Threshold Calculation =====

// In uptrend: expect the price to retrace to or below a value close to the MA

upThreshold = ma * (1 - reactionPerc / 100)

// In downtrend: expect the price to retrace to or above a value close to the MA

downThreshold = ma * (1 + reactionPerc / 100)

// ===== Quick Reaction Detection =====

// For uptrend: reaction is detected if the low is less than or equal to the threshold and the close recovers and stays above the MA

upReaction = trendUp and (low <= upThreshold) and (close > ma)

// For downtrend: reaction is detected if the high is greater than or equal to the threshold and the close stays below the MA

downReaction = trendDown and (high >= downThreshold) and (close < ma)

// ===== Trade Execution =====

if upReaction

// Close short position if exists and open long position

strategy.close("Short", comment="Close Short due to Bullish Reaction")

strategy.entry("Long", strategy.long, comment="Long Entry due to Bullish Reaction in Uptrend")

if downReaction

// Close long position if exists and open short position

strategy.close("Long", comment="Close Long due to Bearish Reaction")

strategy.entry("Short", strategy.short, comment="Short Entry due to Bearish Reaction in Downtrend")

// ===== Visualization of Reactions on the Chart =====

plotshape(upReaction, title="Bullish Reaction", style=shape.arrowup, location=location.belowbar, color=color.green, size=size.small, text="Long")

plotshape(downReaction, title="Bearish Reaction", style=shape.arrowdown, location=location.abovebar, color=color.red, size=size.small, text="Short")