概要

この戦略は,多周期移動平均帯とMACD指標を組み合わせた取引システムである.戦略は,主に,短期と長期の移動平均とMACD指標の信号の交差によって,市場の傾向と取引のタイミングを決定する.この戦略は,日中の取引の再設定論理を統合し,夜間リスクを効果的に防止する.

戦略原則

戦略の核心的な論理は,移動平均線帯システム,MACD指標システム,および日中取引再設定機構の3つの主要な部分で構成されています.移動平均線帯は,2つの異なる周期 ((9と21) の均線で構成され,SMA,EMA,SMMA,WMA,VWMAを含む複数の均線タイプを選択できます. MACDシステムは標準の12/26/9パラメータ設定を採用し,快線と遅線の差値信号および線によってトレンドの動きを判断します.

戦略的優位性

- 信号確認の二重信頼性:トレンド追跡と動態指標の組み合わせにより,偽信号のリスクが著しく低下する

- フレキシブルなパラメータ配置:異なる市場特性に合わせて最適化できる複数の種類の移動平均をサポート

- リスク管理の改善: 昼間取引のリセットメカニズムを導入し,夜間リスクを回避

- ビジュアル効果が目立つ: 取引の意思決定を容易にするために,明確な買入シグナル標識と均線帯表示を統合

戦略リスク

- トレンド転換遅延:均線システムを使用しているため,市場の急速な転換時に反応が遅くなる可能性があります.

- 振動市場には適用されない:横盤振動市場では頻繁に偽信号が生じる可能性がある

- パラメータ最適化の難しさ:異なる市場環境で最適なパラメータには大きな違いがある可能性がある

- 執行遅延の影響: 高い波動性のある市場では,実際の実行に大きな価格差がある可能性があることを確認するシグナル

戦略最適化の方向性

- 波動率フィルタを導入:高波動環境で信号トリガー値の調整のためにATRまたは波動率指数を追加することを推奨する

- シグナル確認の最適化: 取引量確認や価格形態確認を加え,信号の信頼性を向上させる.

- リスク管理の改善:ダイナミックなストップ・ローと利益目標の追加で戦略のリスク/利益の比率を向上させる

- 市場環境の適応:異なる市場状況の動態に応じてパラメータを調整して,戦略の適応性を向上させる

要約する

この戦略は均線帯とMACD指標を組み合わせて,比較的完ぺきな取引システムを構築している.ある程度の遅れのリスクがあるものの,合理的なパラメータ最適化とリスク管理によって,戦略はトレンド市場で良い効果を上げることができる.トレーダーは,実況使用の前に十分な反射を行い,特定の市場の特徴に応じてパラメータ設定を調整することをお勧めする.

ストラテジーソースコード

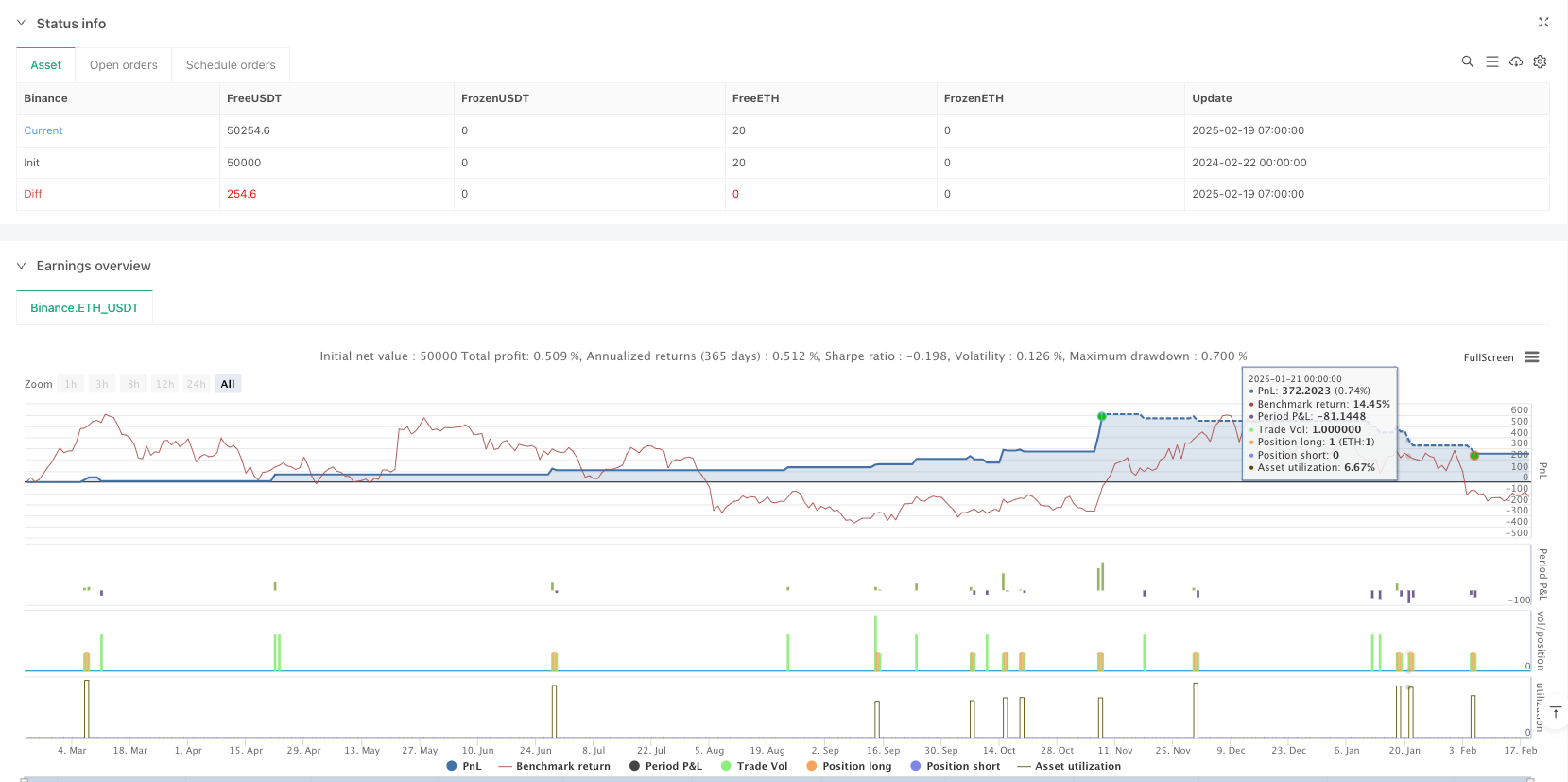

/*backtest

start: 2024-02-22 00:00:00

end: 2025-02-19 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Daily MA Ribbon + MACD Crossover with Buy/Sell Signals", overlay=true)

// === Daily Reset Logic ===

var bool newDay = false // Initialize newDay as a boolean variable

newDay := bool(ta.change(time("D"))) // Cast the result of ta.change to boolean

// === Moving Average Ribbon ===

ma(source, length, type) =>

type == "SMA" ? ta.sma(source, length) :

type == "EMA" ? ta.ema(source, length) :

type == "SMMA (RMA)" ? ta.rma(source, length) :

type == "WMA" ? ta.wma(source, length) :

type == "VWMA" ? ta.vwma(source, length) :

na

// MA1 (Short-term MA)

show_ma1 = input(true, "MA №1", inline="MA #1")

ma1_type = input.string("EMA", "", inline="MA #1", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"])

ma1_source = input(close, "", inline="MA #1")

ma1_length = input.int(9, "", inline="MA #1", minval=1) // Short-term MA (e.g., 9-period)

ma1_color = input(color.blue, "", inline="MA #1")

ma1 = ma(ma1_source, ma1_length, ma1_type)

plot(show_ma1 ? ma1 : na, color = ma1_color, title="MA №1")

// MA2 (Long-term MA)

show_ma2 = input(true, "MA №2", inline="MA #2")

ma2_type = input.string("EMA", "", inline="MA #2", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"])

ma2_source = input(close, "", inline="MA #2")

ma2_length = input.int(21, "", inline="MA #2", minval=1) // Long-term MA (e.g., 21-period)

ma2_color = input(color.red, "", inline="MA #2")

ma2 = ma(ma2_source, ma2_length, ma2_type)

plot(show_ma2 ? ma2 : na, color = ma2_color, title="MA №2")

// === MACD ===

fast_length = input(12, "Fast Length")

slow_length = input(26, "Slow Length")

signal_length = input.int(9, "Signal Smoothing", minval=1, maxval=50)

sma_source = input.string("EMA", "Oscillator MA Type", options=["SMA", "EMA"])

sma_signal = input.string("EMA", "Signal Line MA Type", options=["SMA", "EMA"])

// Calculate MACD

fast_ma = sma_source == "SMA" ? ta.sma(close, fast_length) : ta.ema(close, fast_length)

slow_ma = sma_source == "SMA" ? ta.sma(close, slow_length) : ta.ema(close, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal == "SMA" ? ta.sma(macd, signal_length) : ta.ema(macd, signal_length)

hist = macd - signal

// Plot MACD

hline(0, "Zero Line", color = color.new(#787B86, 50))

plot(hist, title = "Histogram", style = plot.style_columns, color = (hist >= 0 ? (hist[1] < hist ? #26A69A : #B2DFDB) : (hist[1] < hist ? #FFCDD2 : #FF5252)))

plot(macd, title = "MACD", color = #2962FF)

plot(signal, title = "Signal", color = #FF6D00)

// === Buy/Sell Signal Logic ===

// Condition 1: MA1 (Short-term) crosses above MA2 (Long-term)

ma_crossover = ta.crossover(ma1, ma2)

// Condition 2: MACD line crosses above Signal line

macd_crossover = ta.crossover(macd, signal)

// Buy Signal: Both conditions must be true

buy_signal = ma_crossover and macd_crossover

// Sell Signal: MA1 crosses below MA2 or MACD crosses below Signal

sell_signal = ta.crossunder(ma1, ma2) or ta.crossunder(macd, signal)

// Reset signals at the start of each new day

if (newDay)

buy_signal := false

sell_signal := false

// Plot Buy/Sell Signals

plotshape(buy_signal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(sell_signal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Strategy Entry/Exit

if (buy_signal)

strategy.entry("Buy", strategy.long)

if (sell_signal)

strategy.close("Buy", comment="Sell")