2

フォロー

331

フォロワー

概要

この戦略は,複数の技術指標を融合した自主的なトレンド追跡取引システムである.この戦略は,均線システム (EMA),動量指標 (RSI),トレンド指標 (MACD) とSuperTrendの信号確認を組み合わせており,停止,停止,移動停止などの機能を含む完全なリスク管理機構を備えている.戦略の設計は,市場の変動を十分に考慮し,複数の信号フィルタリングとリスク制御によって取引の安定性と信頼性を向上させる.

戦略原則

戦略は,複数のシグナル確認メカニズムを活用しています.

- 9サイクルと21サイクルEMAの交差で初期トレンド方向を決定する

- RSI ((14) を用いて超買超売りフィルター,買い信号はRSI>40と<70を要求し,売信号はRSI<60と>30を要求する

- MACD指標は,トレンド動力を検証し,信号線とMACD線の方向を一致するように要求する

- 超トレンド指数は,トレンドの確認を追加します.

- リスク管理は5%のストップ,10%のストップ,2%のトラッキングストップ,1%の本位保安 すべての条件が同時に満たされたときに取引シグナルが誘発され,偽の突破のリスクを効果的に軽減します.

戦略的優位性

- 複数の信号確認メカニズムにより,偽信号の干渉が著しく減少する

- 固定ストップ,移動ストップ,保安ストップを含む優れたリスク管理システム

- 戦略は,異なる市場環境に適応し,自律性がある

- 入場と出場の論理が明確で,理解し,維持しやすい

- 取引論理には優れた理論的基礎があり,それぞれの指標には特定の機能があります.

戦略リスク

- 複数のシグナルの確認により,重要な取引機会を逃す可能性があります.

- 固定ストップは,波動の激しい市場では柔軟性がない可能性があります.

- パラメータの最適化により、過去のデータが過剰適合する可能性がある

- 横盤市場における複数の指標による混乱信号 解決策は,ストップ・ローズパラメータの動的調整,波動率指標の導入,パラメータの定期的な再最適化などである.

戦略最適化の方向性

- 市場変動率の動向に応じてパラメータを動的に調整する適応パラメータメカニズムを導入する

- 取引量指標を追加し,確認の補助ツールとして使用

- ATRベースのダイナミック・ストップを導入

- 市場環境認識モジュールに追加し,異なる市場条件で異なるパラメータの組み合わせを使用する

- 機械学習に基づくパラメータ最適化システム開発

要約する

この戦略は,多次元的な技術指標の協調的な配合によって,堅牢な取引システムを構築している. 完善なリスク制御機構と明確な取引ロジックは,その優れた実用性を有している. 特定の最適化の余地があるものの,戦略の基本的枠組みは,堅固な理論的基盤を有し,継続的な最適化と改善によって,その取引効果をさらに向上させる見込みがある.

ストラテジーソースコード

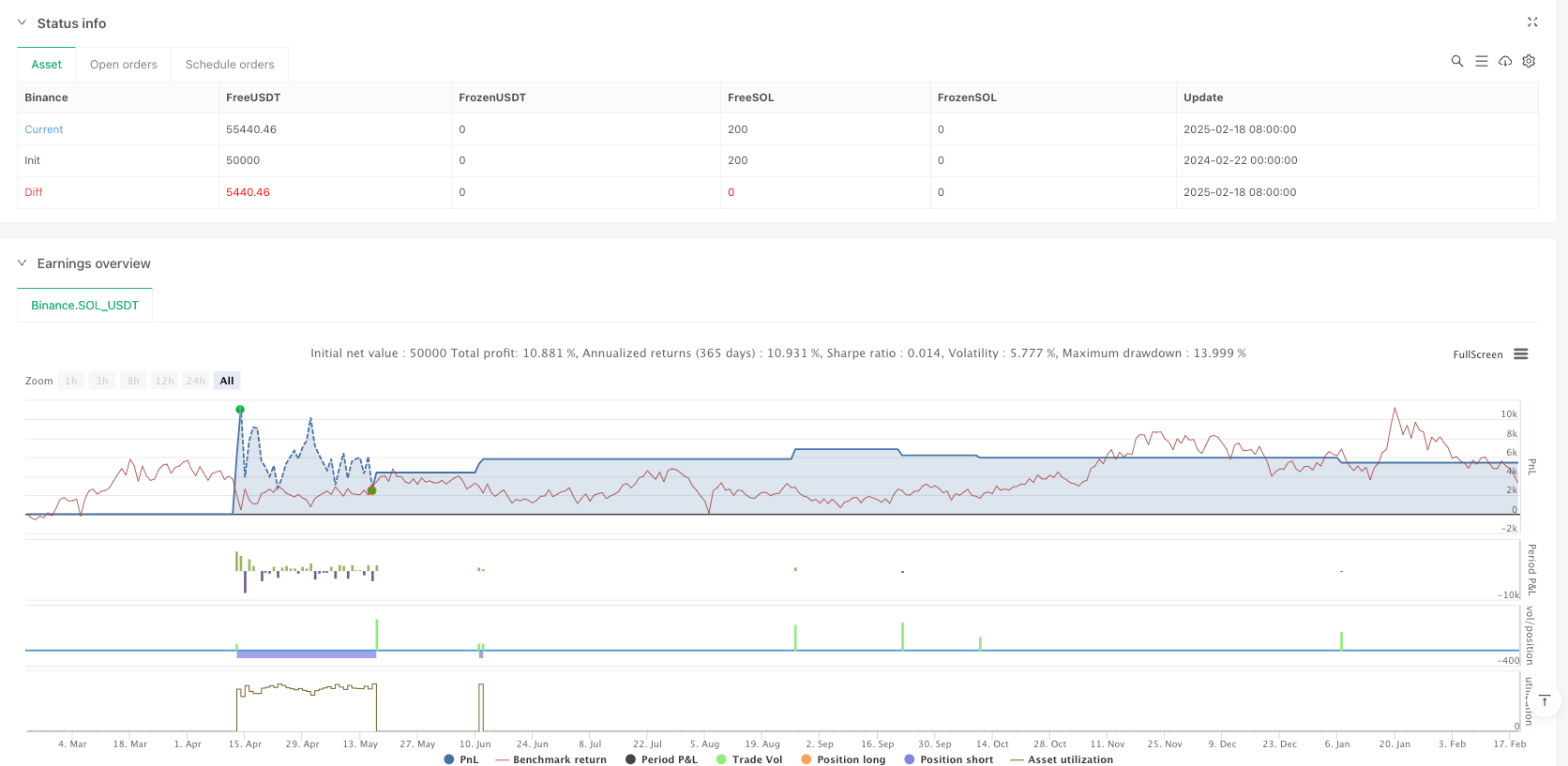

/*backtest

start: 2024-02-22 00:00:00

end: 2025-02-19 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("Optimized BTC Trading Strategy v2", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.1)

// Input parameters

emaShort = ta.ema(close, 9)

emaLong = ta.ema(close, 21)

// RSI settings

rsi = ta.rsi(close, 14)

rsiBuyLevel = 40

rsiSellLevel = 60

// MACD settings

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// Supertrend settings

factor = input.float(3, title="Supertrend Factor")

atrLength = input.int(10, title="ATR Length")

[superTrend, superTrendDirection] = ta.supertrend(factor, atrLength)

// Risk Management (Stop Loss & Take Profit)

stopLossPercent = 0.05 // 5%

takeProfitPercent = 0.10 // 10%

trailingStopPercent = 0.02 // 2% trailing stop for additional security

breakevenBuffer = 0.01 // 1% breakeven buffer

// Fetching average price once to avoid repeated calculations

var float avgPrice = na

if strategy.position_size != 0

avgPrice := strategy.position_avg_price

// Stop Loss & Take Profit Levels

longSL = avgPrice * (1 - stopLossPercent)

longTP = avgPrice * (1 + takeProfitPercent)

shortSL = avgPrice * (1 + stopLossPercent)

shortTP = avgPrice * (1 - takeProfitPercent)

breakevenLevel = avgPrice * (1 + breakevenBuffer)

// Entry Conditions

buyCondition = ta.crossover(emaShort, emaLong) and rsi > rsiBuyLevel and rsi < 70 and (macdLine > signalLine) and superTrendDirection == 1

sellCondition = ta.crossunder(emaShort, emaLong) and rsi < rsiSellLevel and rsi > 30 and (macdLine < signalLine) and superTrendDirection == -1

// Ensure no conflicting trades

if buyCondition and strategy.position_size <= 0

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", from_entry="Long", limit=longTP, stop=longSL, trail_points=trailingStopPercent * avgPrice)

strategy.exit("Breakeven", from_entry="Long", stop=breakevenLevel)

if sellCondition and strategy.position_size >= 0

strategy.close("Long")

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", from_entry="Short", limit=shortTP, stop=shortSL, trail_points=trailingStopPercent * avgPrice)

strategy.exit("Breakeven", from_entry="Short", stop=breakevenLevel)

// Plot Buy & Sell signals with trend-based color indicators

plotshape(series=buyCondition, location=location.belowbar, color=color.green, style=shape.labelup, title="BUY", size=size.small)

plotshape(series=sellCondition, location=location.abovebar, color=color.red, style=shape.labeldown, title="SELL", size=size.small)

// Trend Indicator (for better visualization)

plot(superTrend, color=superTrendDirection == 1 ? color.green : color.red, linewidth=2, title="Supertrend")