概要

これは,ブリン帯の指標に基づいた高級格子取引戦略である.この戦略は,ブリン帯の上下軌道と中軌道動態によって格子位置を決定し,市場変動に応じて格子間隔を自動的に調整する.価格が格子線を突破したときに,システムは,それに対応する多空取引を実行し,完全な自動化された格子取引を実現する.

戦略原則

策略は20周期の移動平均をブリン帯の中軌として,標準差を2倍にして幅として使用する.ブリン帯の基礎で,策略は上下軌間の4格の階層を設定し,格の間隔は1%である.価格が上向きに格子線を突破すると,システムは複数の操作を実行し,価格が下向きに格子線を突破すると,システムは空白操作を実行する.この設計は,戦略を揺れ動いている市場で継続的に利益を得ることができるようにする.

戦略的優位性

- ダイナミックな調整 - 格子位置はブリン帯に沿って移動し,異なる市場状況に戦略を適応させる

- リスク管理 - ブリン帯を通じた取引区間の制限により,極端な状況下での過剰なポジションを避ける

- 高度な自動化 - システムによる自動取引,人間の介入なし

- 双方向取引 - 上下両方で利益を得られる

- パラメータの調整 - 格子間隔と層の数は,必要に応じて柔軟に調整できます

戦略リスク

- トレンド市場リスク - 一面的なトレンド市場では,より大きなリターンが生じる可能性がある

- 資金管理のリスク - 複数のグリッドが同時にトリガーされ,過重ポジションに繋がる

- スライドポイントリスク - 市場が激しく波動すると,取引価格が網格価格から偏る可能性があります.

- 技術上のリスク - ブリン帯に偽の突破信号が表示される可能性

解決:

- ポジションの総保有制限を設定する

- トレンドフィルターを導入します.

- オーダー実行メカニズムの最適化

- 確認信号のフィルタを追加

戦略最適化の方向性

- 格子間隔を自律的に調整する.

- 量と価格の関係導入 - 交差量指標を組み合わせて市場参入を最適化するタイミング

- 損失を抑える仕組みの最適化 - より柔軟な損失を抑える方法を設計する

- 資金管理の最適化 - リスクベースのポジション管理を実現

- マルチタイムサイクルのシンクロ - マルチサイクルの信号確認メカニズムを導入する

要約する

この戦略は,ブリン帯とグリッド取引を組み合わせることで,柔軟性と安定性の両方を兼ね備えた自動化された取引システムを実現している.戦略の核心的な優位性は,異なる市場環境に適応し,パラメータ調整によってリスク制御を実現することにある.いくつかの固有のリスクがあるものの,継続的な最適化と改善により,より安定した取引システムを構築することができる.

ストラテジーソースコード

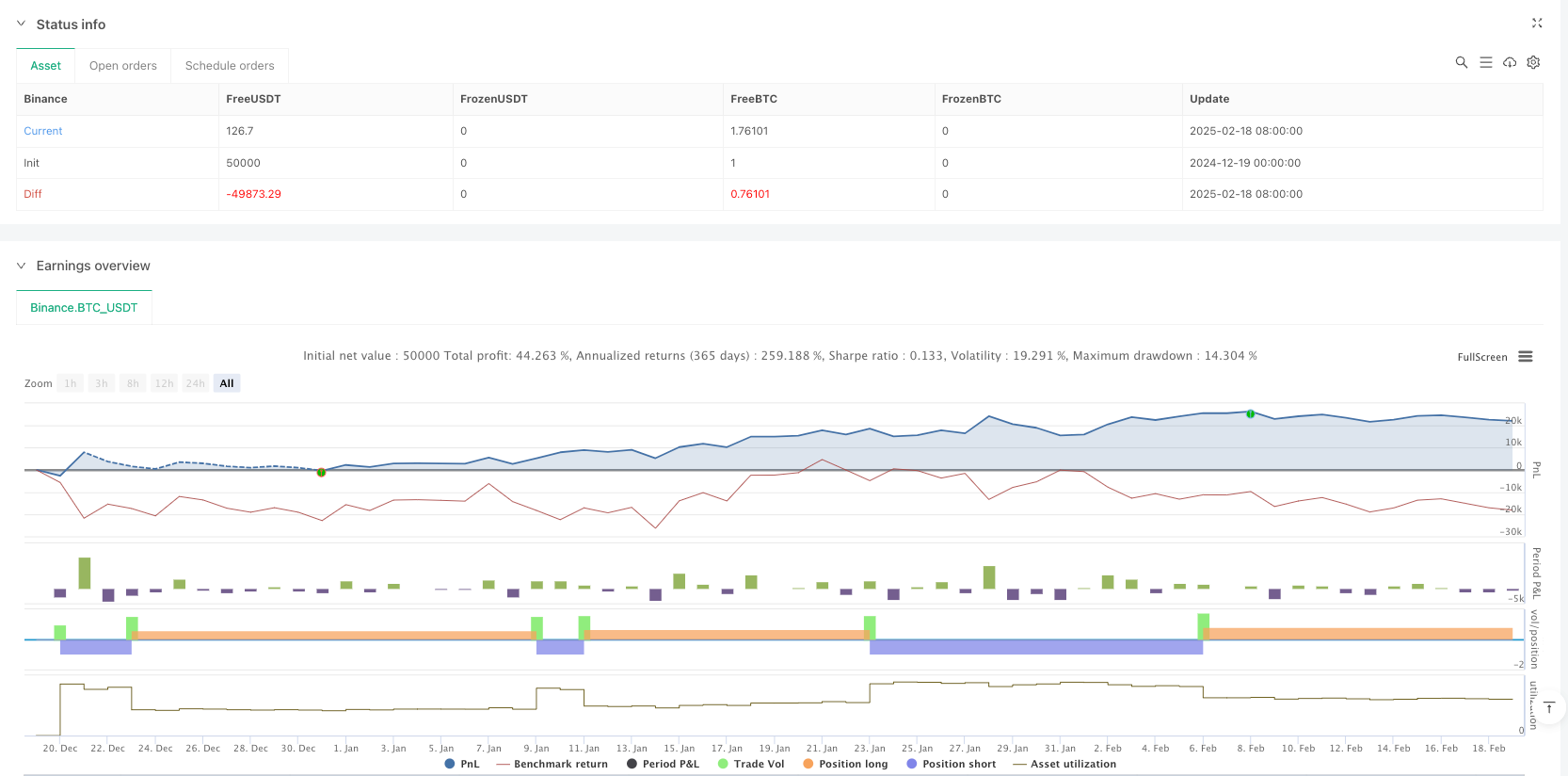

/*backtest

start: 2024-12-19 00:00:00

end: 2025-02-19 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Grid Bot based on Bollinger Bands with Adjustable Levels", overlay=true)

// Settings

source = close

length = input.int(20, minval=1, title="Bollinger Bands Length")

mult = input.float(2.0, minval=0.001, maxval=50, title="Bollinger Bands Multiplier")

gridDistancePercent = input.float(1.0, title="Distance Between Levels (%)") / 100 // Distance between grid levels in percentage

gridSize = input.int(4, title="Number of Grid Levels") // Number of grid levels

// Bollinger Bands Calculation

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

upper = basis + dev

lower = basis - dev

// Middle line between the upper and lower Bollinger Bands

middle = (upper + lower) / 2

// Levels for long and short positions

var float[] longLevels = array.new_float(gridSize)

var float[] shortLevels = array.new_float(gridSize)

// Filling levels for long and short positions

for i = 0 to gridSize - 1

array.set(longLevels, i, lower * (1 + gridDistancePercent * (i + 1))) // For longs, increase the lower band

array.set(shortLevels, i, upper * (1 - gridDistancePercent * (i + 1))) // For shorts, decrease the upper band

// Logic for entering a long position (buy) at the first level crossover

longCondition = ta.crossover(source, array.get(longLevels, 0)) // Condition for buying — crossover with the first long level

if longCondition

strategy.entry("GridLong", strategy.long, comment="GridLong")

// Logic for entering a short position (sell) at the first level crossunder

shortCondition = ta.crossunder(source, array.get(shortLevels, 0)) // Condition for selling — crossunder with the first short level

if shortCondition

strategy.entry("GridShort", strategy.short, comment="GridShort")

// Logic for additional buys/sells when reaching subsequent levels

// For longs:

for i = 1 to gridSize - 1

if ta.crossover(source, array.get(longLevels, i))

strategy.entry("GridLong" + str.tostring(i), strategy.long, comment="GridLong")

// For shorts:

for i = 1 to gridSize - 1

if ta.crossunder(source, array.get(shortLevels, i))

strategy.entry("GridShort" + str.tostring(i), strategy.short, comment="GridShort")

// Visualization of the levels

plot(upper, color=color.red, linewidth=2, title="Upper Bollinger Band")

plot(lower, color=color.green, linewidth=2, title="Lower Bollinger Band")

plot(middle, color=color.blue, linewidth=2, title="Middle Line")

// Display additional grid levels (fixed titles)

plot(array.get(longLevels, 0), color=color.green, linewidth=1, title="Long Level 1") // For the 1st long level

plot(array.get(longLevels, 1), color=color.green, linewidth=1, title="Long Level 2") // For the 2nd long level

plot(array.get(longLevels, 2), color=color.green, linewidth=1, title="Long Level 3") // For the 3rd long level

plot(array.get(longLevels, 3), color=color.green, linewidth=1, title="Long Level 4") // For the 4th long level

plot(array.get(shortLevels, 0), color=color.red, linewidth=1, title="Short Level 1") // For the 1st short level

plot(array.get(shortLevels, 1), color=color.red, linewidth=1, title="Short Level 2") // For the 2nd short level

plot(array.get(shortLevels, 2), color=color.red, linewidth=1, title="Short Level 3") // For the 3rd short level

plot(array.get(shortLevels, 3), color=color.red, linewidth=1, title="Short Level 4") // For the 4th short level