概要

これは,RSI指数と取引量に基づいた反転取引戦略である. この戦略は,市場における超買超売状態を識別し,取引量確認を組み合わせ,価格が極端な状態に現れたときに反転取引を行う. この戦略の核心思想は,RSI指数が超買または超売信号を発生させ,取引量が平均レベルより高いときに取引することであり,RSIの中央線 ((50) を退出信号として使用する.

戦略原則

戦略は主に以下のコアコンポーネントに基づいています.

- RSI指数計算: 14サイクルRSI指数を使用して価格動向を監視する

- 取引量確認:取引量移動平均 (SMA) を20サイクル使用

- 入力論理:

- 多頭入場:RSIが30以下で,取引量が移動平均より大きいとき

- 空頭入場:RSIが70以上 (超買い) で取引量が移動平均より大きいとき

- 試合の論理:

- RSIで50着を着る

- RSI下50で空頭出場した

戦略的優位性

- 体系化された取引決定:明確な技術指標の組み合わせで客観的な取引システムを構築する

- 多重確認メカニズム:RSIと取引量2次元を組み合わせ,信号信頼性を向上させる

- リスク管理の改善: 百分比管理と再建禁止

- ビジュアルサポート:分析と監視を容易にするために,完全なグラフ表示機能が含まれています.

- 適応性:主要パラメータをカスタマイズし,異なる市場環境に対応できます

戦略リスク

- トレンド継続リスク: 強いトレンドの市場では,反転戦略はしばしば損をする可能性があります.

- 偽のブレイクリスク:高取引量とは必ずしも本当の市場転換を意味しない

- 参数感性:RSIサイクルと超買い超売り値の選択は,戦略のパフォーマンスに顕著な影響を与える

- スライドポイントの影響: 取引価格が予想から大きく外れる場合

- 資金管理のリスク:固定比率のポジションは,特定の市場状況下で過度に激進的になる可能性があります.

戦略最適化の方向性

- トレンドフィルター: トレンド判断の指標を導入し,強いトレンドの間,逆転取引を避ける

- ダイナミックパラメータ:市場の変動率に基づいて動的に調整されたRSIの超買い超売り値

- 出場最適化: ストップとストップ・トラッキングの強化,リスク管理能力の向上

- 交付量分析強化:交付量形状分析を追加し,信号品質を向上させる

- タイムフィルター:取引時間の窓を追加し,非効率的な取引時間を回避します.

要約する

この戦略は,RSI指標と取引量分析を組み合わせて,完全な反転取引システムを構築している.戦略の設計は合理的で,優れた操作性と柔軟性がある.推奨された最適化の方向によって,戦略はさらに向上する余地がある.実地での適用では,パラメータを十分にテストし,市場特性に合わせてターゲットに最適化することを推奨している.

ストラテジーソースコード

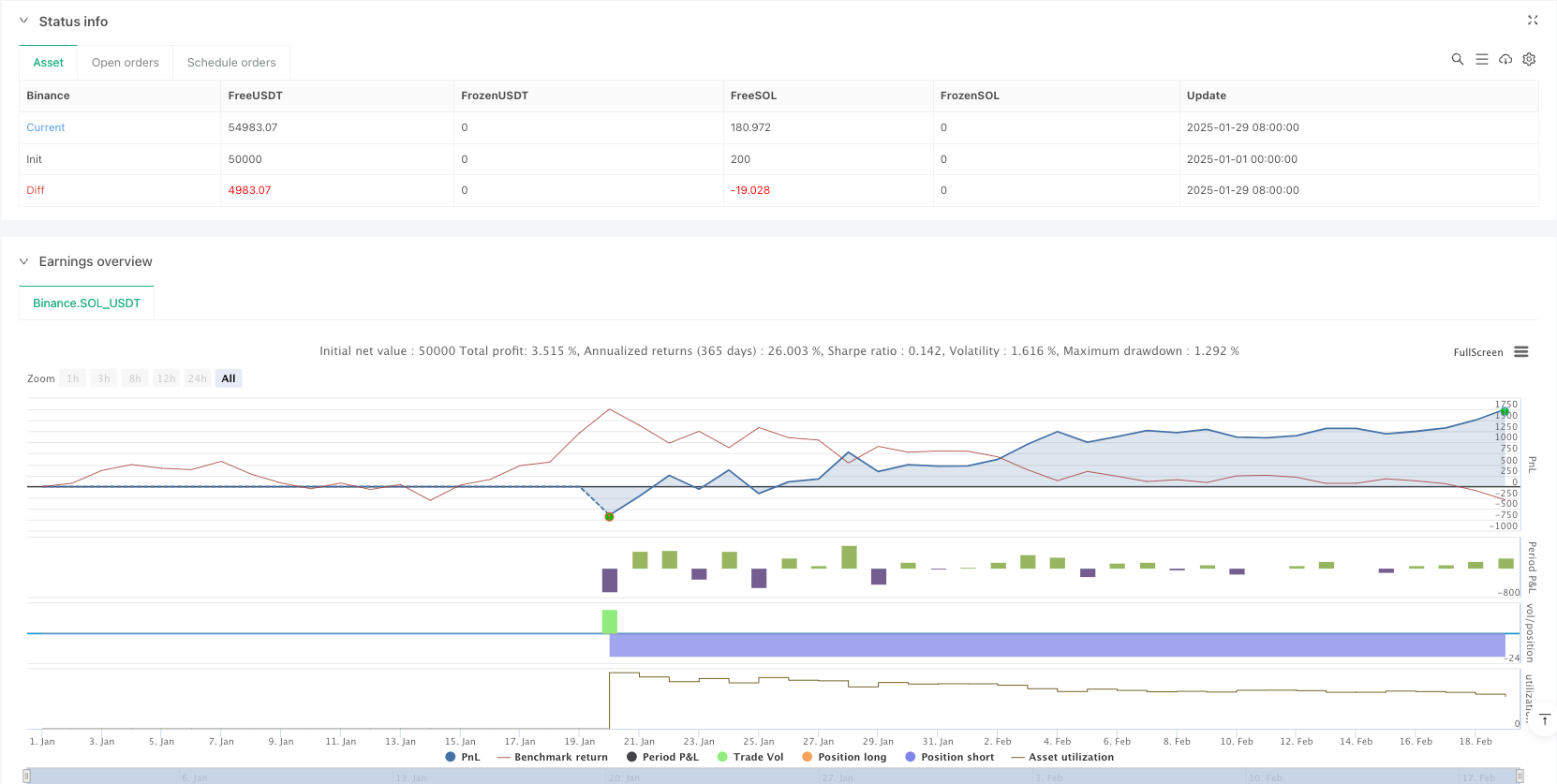

/*backtest

start: 2025-01-01 00:00:00

end: 2025-02-19 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("RSI & Volume Contrarian Strategy", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=10, pyramiding=0)

//---------------------------

// Inputs and Parameters

//---------------------------

rsiPeriod = input.int(14, title="RSI Period", minval=1)

oversold = input.int(30, title="RSI Oversold Level", minval=1, maxval=50)

overbought = input.int(70, title="RSI Overbought Level", minval=50, maxval=100)

volMAPeriod = input.int(20, title="Volume MA Period", minval=1)

//---------------------------

// Indicator Calculations

//---------------------------

rsiValue = ta.rsi(close, rsiPeriod)

volMA = ta.sma(volume, volMAPeriod)

//---------------------------

// Trade Logic

//---------------------------

// Long Entry: Look for oversold conditions (RSI < oversold)

// accompanied by above-average volume (volume > volMA)

// In an uptrend, oversold conditions with high volume may signal a strong reversal opportunity.

longCondition = (rsiValue < oversold) and (volume > volMA)

// Short Entry: When RSI > overbought and volume is above its moving average,

// the temporary strength in a downtrend can be exploited contrarily.

shortCondition = (rsiValue > overbought) and (volume > volMA)

if longCondition

strategy.entry("Long", strategy.long)

if shortCondition

strategy.entry("Short", strategy.short)

// Exit Logic:

// Use a simple RSI midline crossover as an exit trigger.

// For longs, if RSI crosses above 50 (indicating a recovery), exit the long.

// For shorts, if RSI crosses below 50, exit the short.

exitLong = ta.crossover(rsiValue, 50)

exitShort = ta.crossunder(rsiValue, 50)

if strategy.position_size > 0 and exitLong

strategy.close("Long", comment="RSI midline exit")

log.info("strategy.position_size > 0 and exitLong")

if strategy.position_size < 0 and exitShort

strategy.close("Short", comment="RSI midline exit")

log.info("strategy.position_size > 0 and exitLong")

//---------------------------

// Visualization

//---------------------------

// Plot the RSI on a separate pane for reference

plot(rsiValue, title="RSI", color=color.blue, linewidth=2)

hline(oversold, title="Oversold", color=color.green)

hline(overbought, title="Overbought", color=color.red)

hline(50, title="Midline", color=color.gray, linestyle=hline.style_dotted)

// Optionally, you may plot the volume moving average on a hidden pane

plot(volMA, title="Volume MA", color=color.purple, display=display.none)