概要

これは,流動性地域分析と内部市場構造の動態を組み合わせた革新的な取引戦略で,高確率のエントリーポイントを特定することを目的としています.この戦略は,価格と重要な市場レベルとの相互作用を追跡し,内部市場の変換を利用して取引を誘発することで,トレーダーに柔軟で精密な市場へのアクセス方法を提供します.

戦略原則

戦略の核心的な論理は,流動性の領域の識別と内部市場転換の2つの重要な構成要素に基づいています.流動性の領域は局所的な高点と低点を分析することによって動的に決定され,内部市場転換は,価格が以前のブルイッシュまたはベアリスレベルを突破して市場の方向の変化を判断します.

戦略の核心的な特徴は以下の通りです.

- 内部市場転換の論理:従来の図形ではなく,価格突破の基礎

- 流動性領域の追跡: 流動性の重要な領域を動的に識別し,弱気な市場条件での取引を防ぐ

- モードの柔軟性: “Both” “Bullish Only” “Bearish Only” の3つの取引モードが提供されています.

- リスク管理: スタップ・ロズとストップ・ストップのレベルをカスタマイズ

- タイムスケープ制御:取引の時間帯を正確に制御する

戦略的優位性

- ダイナミックな適応性:市場構造の変化に迅速に対応する戦略

- 精密入場:流動性地域と内部市場変換を組み合わせて,入場精度を向上させる

- リスクは制御可能:内蔵の停止と停止メカニズム

- 柔軟性:異なる市場条件に応じて取引方法の選択

- 多次元分析:価格行動,流動性,市場構造を考慮する

戦略リスク

- 市場変動が激しく,ストップダメージが引き起こす可能性

- 波動的な市場では,頻繁にシグナルを送ると取引コストが上がる可能性があります.

- 不適切なパラメータ設定は戦略のパフォーマンスに影響を与える可能性があります

- 検知結果と実体との差異がある可能性がある

戦略最適化の方向性

- 機械学習アルゴリズムを導入してパラメータ自在化最適化

- 取引量や変動指数などのフィルタリング条件を追加します.

- 複数の時間枠の検証メカニズムを開発する

- 市場波動率の動的調整を考慮したストップ・ロスとストップ・ストップ・アルゴリズムの最適化

要約する

これは,流動性分析と市場構造のダイナミクスを融合した革新的な取引戦略である. 柔軟な内部市場変換の論理と正確な流動性領域の追跡により,トレーダーに強力な取引ツールを提供している. 戦略の鍵は,その適応性と多次元分析能力であり,異なる市場条件下で高い実行効率を維持できるものである.

ストラテジーソースコード

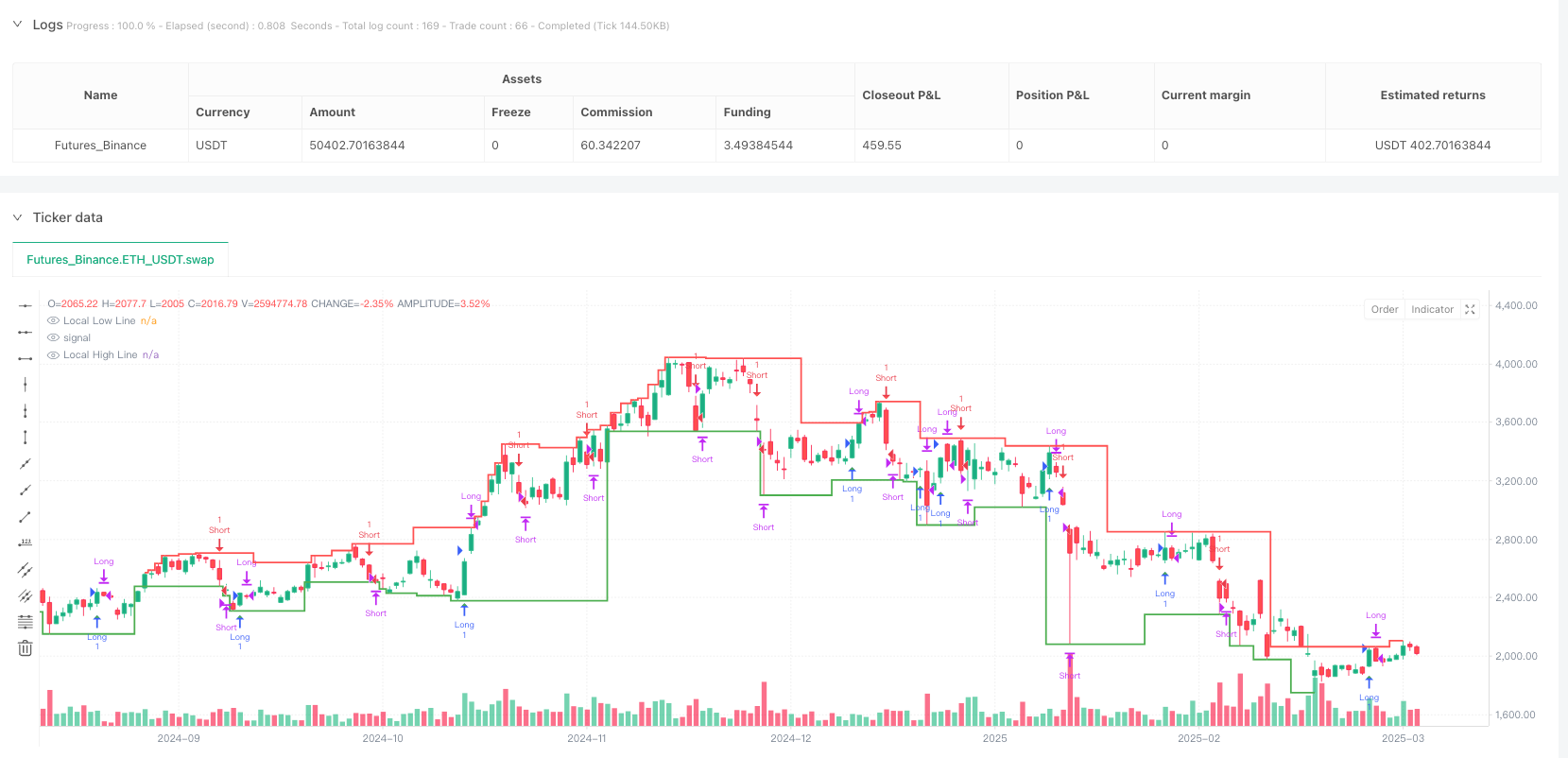

/*backtest

start: 2024-03-28 00:00:00

end: 2025-03-27 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Liquidity + Internal Market Shift Strategy", overlay=true)

// ======== Mode Selection ========

mode = input.string("Both", title="Mode", options=["Both", "Bullish Only", "Bearish Only"])

// ======== Stop-Loss and Take-Profit Input (in pips) ========

enableTakeProfit = input.bool(true, title="Enable Custom Take Profit") // Option to enable/disable take profit

stopLossPips = input.int(10, title="Stop Loss (in pips)", minval=1) // Stop loss in pips

takeProfitPips = input.int(20, title="Take Profit (in pips)", minval=1) // Take profit in pips

// ======== Internal Shift Logic ========

// Fixed number of consecutive candles to track (set to 1)

consecutiveBullishCount = 1

consecutiveBearishCount = 1

// Function to check for bullish and bearish candles

isBullish = close > open

isBearish = close < open

// Variables to track consecutive candles and mark lowest/highest

var int bullishCount = 0

var int bearishCount = 0

var float lowestBullishPrice = na

var float highestBearishPrice = na

var float previousBullishPrice = na // For the previous bullish lowest price

var float previousBearishPrice = na // For the previous bearish highest price

// Variables to track last internal shift type (1 = Bullish, -1 = Bearish, 0 = None)

var int lastInternalShift = 0

// Counting consecutive bullish and bearish candles

if isBullish

bullishCount := bullishCount + 1

bearishCount := 0

if bullishCount == 1 or low < lowestBullishPrice

lowestBullishPrice := low

else if isBearish

bearishCount := bearishCount + 1

bullishCount := 0

if bearishCount == 1 or high > highestBearishPrice

highestBearishPrice := high

else

bullishCount := 0

bearishCount := 0

lowestBullishPrice := na

highestBearishPrice := na

// Internal shift conditions

internalShiftBearish = close < previousBullishPrice and close < lowestBullishPrice

internalShiftBullish = close > previousBearishPrice and close > highestBearishPrice

// Condition to alternate internal shifts

allowInternalShiftBearish = internalShiftBearish and lastInternalShift != -1

allowInternalShiftBullish = internalShiftBullish and lastInternalShift != 1

// Tracking shifts

if bullishCount >= consecutiveBullishCount

previousBullishPrice := lowestBullishPrice

if bearishCount >= consecutiveBearishCount

previousBearishPrice := highestBearishPrice

// ======== Liquidity Seal-Off Points Logic ========

upperLiquidityLookback = input.int(10, title="Lookback Period for Upper Liquidity Line")

lowerLiquidityLookback = input.int(10, title="Lookback Period for Lower Liquidity Line")

isLocalHigh = high == ta.highest(high, upperLiquidityLookback)

isLocalLow = low == ta.lowest(low, lowerLiquidityLookback)

var bool touchedLowerLiquidityLine = false

var bool touchedUpperLiquidityLine = false

if (low <= ta.lowest(low, lowerLiquidityLookback))

touchedLowerLiquidityLine := true

if (high >= ta.highest(high, upperLiquidityLookback))

touchedUpperLiquidityLine := true

var bool lockedBullish = false

var bool lockedBearish = false

var int barSinceLiquidityTouch = na

// ======== Combined Signals ========

bullishSignal = allowInternalShiftBullish and touchedLowerLiquidityLine and not lockedBullish

bearishSignal = allowInternalShiftBearish and touchedUpperLiquidityLine and not lockedBearish

if bullishSignal

lockedBullish := true

touchedLowerLiquidityLine := false

barSinceLiquidityTouch := 0

if bearishSignal

lockedBearish := true

touchedUpperLiquidityLine := false

barSinceLiquidityTouch := 0

if not na(barSinceLiquidityTouch)

barSinceLiquidityTouch := barSinceLiquidityTouch + 1

if barSinceLiquidityTouch >= 3

lockedBullish := false

lockedBearish := false

if touchedLowerLiquidityLine

lockedBullish := false

if touchedUpperLiquidityLine

lockedBearish := false

// ======== Plot Combined Signals ========

plotshape(bullishSignal, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny, title="Bullish Signal")

plotshape(bearishSignal, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny, title="Bearish Signal")

plot(isLocalHigh ? high : na, color=color.red, linewidth=2, style=plot.style_stepline, title="Local High Line")

plot(isLocalLow ? low : na, color=color.green, linewidth=2, style=plot.style_stepline, title="Local Low Line")

// ======== Track Entry and Opposing Signals ========

var float entryPrice = na

var int entryTime = na

var string positionSide = ""

// ======== Strategy Execution (Mode Logic) ========

if (mode == "Both")

// Short Entry Logic (Bearish Signal)

if (bearishSignal and na(entryPrice))

strategy.entry("Short", strategy.short)

entryPrice := close

entryTime := time

positionSide := "short"

// Long Entry Logic (Bullish Signal)

if (bullishSignal and na(entryPrice))

strategy.entry("Long", strategy.long)

entryPrice := close

entryTime := time

positionSide := "long"

// Exit Logic: Close on Opposing Signal (after the current signal is triggered)

if (positionSide == "short" and bullishSignal )

strategy.close("Short")

entryPrice := na

positionSide := ""

if (positionSide == "long" and bearishSignal)

strategy.close("Long")

entryPrice := na

positionSide := ""

// Stop-Loss and Take-Profit Logic (in pips)

stopLossPriceLong = entryPrice - stopLossPips * syminfo.mintick

takeProfitPriceLong = entryPrice + takeProfitPips * syminfo.mintick

stopLossPriceShort = entryPrice + stopLossPips * syminfo.mintick

takeProfitPriceShort = entryPrice - takeProfitPips * syminfo.mintick

// Long Stop-Loss and Take-Profit Conditions

if (positionSide == "long" and close <= stopLossPriceLong)

strategy.close("Long", comment="Stop Loss Triggered")

entryPrice := na

positionSide := ""

if (positionSide == "long" and enableTakeProfit and close >= takeProfitPriceLong)

strategy.close("Long", comment="Take Profit Triggered")

entryPrice := na

positionSide := ""

// Short Stop-Loss and Take-Profit Conditions

if (positionSide == "short" and close >= stopLossPriceShort)

strategy.close("Short", comment="Stop Loss Triggered")

entryPrice := na

positionSide := ""

if (positionSide == "short" and enableTakeProfit and close <= takeProfitPriceShort)

strategy.close("Short", comment="Take Profit Triggered")

entryPrice := na

positionSide := ""

if (mode == "Bullish Only")

if (bullishSignal and na(entryPrice))

strategy.entry("Long", strategy.long)

entryPrice := close

entryTime := time

positionSide := "long"

if (positionSide == "long" and bearishSignal)

strategy.close("Long")

entryPrice := na

positionSide := ""

// Stop-Loss and Take-Profit Logic (in pips)

stopLossPriceLong = entryPrice - stopLossPips * syminfo.mintick

takeProfitPriceLong = entryPrice + takeProfitPips * syminfo.mintick

if (positionSide == "long" and close <= stopLossPriceLong)

strategy.close("Long", comment="Stop Loss Triggered")

entryPrice := na

positionSide := ""

if (positionSide == "long" and enableTakeProfit and close >= takeProfitPriceLong)

strategy.close("Long", comment="Take Profit Triggered")

entryPrice := na

positionSide := ""

if (mode == "Bearish Only")

if (bearishSignal and na(entryPrice))

strategy.entry("Short", strategy.short)

entryPrice := close

entryTime := time

positionSide := "short"

if (positionSide == "short" and bullishSignal)

strategy.close("Short")

entryPrice := na

positionSide := ""

// Stop-Loss and Take-Profit Logic (in pips)

stopLossPriceShort = entryPrice + stopLossPips * syminfo.mintick

takeProfitPriceShort = entryPrice - takeProfitPips * syminfo.mintick

if (positionSide == "short" and close >= stopLossPriceShort)

strategy.close("Short", comment="Stop Loss Triggered")

entryPrice := na

positionSide := ""

if (positionSide == "short" and enableTakeProfit and close <= takeProfitPriceShort)

strategy.close("Short", comment="Take Profit Triggered")

entryPrice := na

positionSide := ""