[trans]

概要

多次元枢軸取引戦略と動的フィボナッチ指数システムは,技術分析に基づく取引戦略で,潜在的買入と売却の機会を識別するために,主に日内枢軸,中央区間 (CPR),フィボナッチ回撤レベル,取引量重み平均 (VWAP) と移動平均などの複数の指標を使用している.この戦略は,日内トレーダー,特に3分K線図の短い線取引に適用されます.この戦略は,特定の条件のK線が重要なサポートとレジスタンスに接触しているかどうかを判断し,取引シグナルを誘発することに焦点を当てています.

この戦略は,毎日の高点,低点,および閉盘価格の計算による枢軸のシステムを利用し,交差量加重平均価格 (VWAP) と移動VWAP (MVWAP) を動的サポートレジスタンス参照として使用します.また,相対的に強い指数 (RSI),単純な移動平均 (SMA) と指数移動平均 (EMA) などの技術指標を使用して,包括的な取引意思決定システムを構築します.

戦略は,まず,条件を満たす緑の (上昇) と赤の (下降) K線を識別し,これらのK線が,枢軸点,支柱点,抵抗点,またはVWAPなどの重要な価格レベルに触れているかどうかを判断します. 赤のK線が重要な価格レベルに触れたときに,買入シグナルを誘発します. 緑のK線が重要な価格レベルに触れたときに,売り出シグナルを誘発します.

戦略原則

この戦略の原理は,価格が重要なサポートとレジスタンス位の波動の周りの市場行動に基づいており,K線形状,取引量および動態指標を組み合わせて取引決定を行う.具体的原始理解は以下のとおりである.

K線識別メカニズム:

- 緑のK線 ((上昇):閉盘価格が開盘価格より高く,K線実体高さは少なくとも17点,開盘価格が低点より低くK線範囲の0.382倍,閉盘価格が低点より高くK線範囲の0.682倍.

- 赤のK線 ((下落):閉盘価格が開盘価格より低い,K線実体高さは少なくとも17点である。

枢軸点計算システム:

- 日枢軸点 (PP): (日高点 + 日低点 + 日閉盘価格) / 3

- R1 ,R2 ,R3 ,R4 の抵抗位置

- サポート位置:S1,S2,S3,S4

- 中央区間 ((CPR):底部CPRとトップCPRで構成され,市場が収束する可能性のある価格領域を提供します.

価格動向参照:

- VWAP ((取引量加重平均価格):取引量要因を考慮した平均価格レベルを反映する

- MVWAP (移動取引量重み平均価格):VWAPの移動平均で,より滑らかな価格参照を提供します.

補助指標システム:

- RSI:市場における 過買過売を測定する指標

- SMA ((50サイクル) とEMA ((20サイクル):価格トレンド方向の参考を提供する

- 取引量分析:取引量の傾向を20周期平均線で評価する

取引シグナル生成:

- 適格な赤K線が,任意の枢軸点,支柱点,抵抗点,またはVWAP/MVWAPに触れたとき,買取信号を生成する (CE)

- 適格な緑のK線が,任意の枢軸,支柱,抵抗位,またはVWAP/MVWAPに触れたとき,売り信号 ((PE) を生成する.

戦略の核心思想は,価格が重要なサポート・レジスタンスレベルに近い潜在的反転を捕捉し,特定のK線形状と複数の技術指標をフィルターすることで,信号の有効性を向上させることである.枢軸を触れるK線は,これらの重要な価格レベルで市場が躊躇したり反転したりする可能性が増加することを代表する.

戦略的優位性

この戦略のコードを詳しく分析すると,以下の重要な利点が明らかになる.

多次元検証メカニズム:複数の技術指標 ((枢軸点,VWAP,移動平均,RSI) を組み合わせて取引信号を検証し,偽信号のリスクを低減する.

市場への適応: 日中枢軸のシステムは毎日更新され,異なる市場環境と変動率に対応する戦略を可能にします.

K線を正確に識別する: 厳格なK線形状条件とフィボナッチレベルにより,潜在的な取引機会を出し,信号の質を向上させる.

フレキシブルな表示設定策略: グラフの乱雑を減らすために,適切な時間枠で (日中のグラフで15分以下) 枢軸を表示する自己適応的なビュー機能があります.

逆思考の利点戦略: 赤いK線が重要な位置に触れたときに買い機会を探し,緑のK線が重要な位置に触れたときに売る機会を探し,市場が可能な短期的な超買い超売り状態を利用する.

完全な価格階層システム: 多層のサポート・レジスタンス ((S1-S4とR1-R4) を含み,さまざまな波動幅の市場環境に適した豊富な参照価格を提供します.

統合中央区間 (CPR):CPRは,当日の潜在的集積区域の識別を提供し,これは日内取引において重要な参照価値である.

視覚的な支援: 豊富な標識と形状表示により,グラフ上での適格なK線とキー価格に触れた状況を直視的に識別し,トレーダーに迅速に識別する.

交付確認: 取引量分析を組み合わせて,取引量平均線によって市場参加度を評価し,信号の信頼性を高めます.

日内取引に適している戦略は,短期的な時間枠 (特に3分チャート) のために設計され,市場変動を利用して頻繁に取引する日内トレーダーに適しています.

これらの優位性により,この戦略は総合的で強で適応性のある日内取引システムであり,技術分析を熟知し,価格行動や重要な価格レベルに基づいて取引したい投資家にとって特に適しています.

戦略リスク

この戦略には多くの利点があるものの,いくつかの潜在的なリスクがあり,トレーダーは慎重に対処する必要があります.

信号が危険すぎる: 戦略は複数の枢軸 ((PP,R1-R4,S1-S4) と他の指標を扱うため,波動が激しい市場では過剰なシグナルが生み出され,取引頻度と手数料の増加を引き起こす可能性があります.

- 解決策: 取引時間制限やトレンド確認条件などの追加のフィルタリング条件を追加することを検討できます.

逆の取引の罠: 戦略は逆の論理に基づいている ((赤のK線がキーポジションに触れて購入し,緑のK線がキーポジションに触れて販売する),強いトレンド市場では連続的な損失を引き起こす可能性がある。

- 解決方法:戦略を使用する前に,市場全体のトレンドを評価し,強いトレンドで逆向きの取引を避けるためにトレンドフィルターを追加します.

パラメータ感度策略効果は,K線識別パラメータ (K線の高さが17点以上の場合) と移動平均周期設定に高度に依存し,異なる市場環境では異なるパラメータが必要になる可能性がある.

- 解決方法: 異なる品種と市場条件を反省し,パラメータ設定を最適化する.

リスクの抑制の欠如コードで明確に設定されていないストップ・ロスの策略は,単一の損失が過大になる可能性があります.

- 解決策:ATRベースの動的ストップや固定ポイントストップのような明確なストップ戦略を導入する.

国内戦略の限界3分間のチャートに注目する日中戦略として,中長期の持有には適せず,長期のトレンドの機会を逃している.

- 解決策: 中長期戦略と連携して,この戦略を取引システムの一部として使用する.

枢軸点の限界横軸市場では,価格が頻繁に複数の軸に触れ,混乱のシグナルを生じます.

- 解決方法: 策略を一時的に停止するか,信号確認条件を追加するかを,市場を整合する際に検討する.

取引量の重み調整の欠如:VWAPを使用しているにもかかわらず,戦略は取引量の大きさに合わせて信号の重さを動的に調整していません.

- 解決方法: 取引量減価条件を増やして,十分な市場参加率で取引を確実にする.

時間の依存性日軸は前日のデータに基づいており,新しい取引日の開始時に,その日の十分なデータがないために不安定なパフォーマンスを示す可能性があります.

- 解決策: 十分な市場情報を得るために,取引日の30〜60分前に戦略を再開することを検討してください.

自動化への挑戦: 策略は複数の条件の判断を伴うため,実際の自動化実行では遅延や不及時な実行の問題に直面する可能性があります.

- 解決方法:実行システムを最適化して,低遅延を確保するか,人工確認と組み合わせた半自動化方法を検討する.

偏差のリスクを測る: コード内の緑/赤K線識別ロジックは,反測とリールディスク環境で不一致に動作する可能性がある。

- 解決方法: 戦略が実際の取引環境で有効であることを確認するために,厳格な実体模擬テストを行う.

これらのリスクを認識し管理することは,この戦略を成功に活用するために不可欠であり,トレーダーは,自身のリスク承受能力と取引習慣に応じて適切な調整を行うべきである.

戦略最適化の方向性

この戦略は,コードの詳細な分析に基づいて,以下のように最適化できます.

動的K線識別パラメータ:

- 現行の策略は,固定値 (例えば,K線の高さが少なくとも17点) を有効なK線を識別するために使用し,ATR (平均実際の波動範囲) に基づく動的パラメータに変更し,異なる波動率環境に策略をより良く適応させる.

- 最適化理由:固定パラメータは,異なる波動率環境で効果の差が大きい.動的パラメータは,戦略の適応性を向上させる.

トレンドフィルター:

- より高い時間枠 (例えば15分または30分) を追加してトレンド判断を行い,主トレンドの方向にのみ取引を実行するか,信号の重さを調整する.

- 優化理由: 強いトレンドで頻繁に逆転する取引を避け,勝率と損益比率を向上させる.

信号品質評価機構:

- 各取引シグナルに対して,K線強度,触れた枢軸点の重要性,RSI値,取引量異常など,複数の要因を考慮して総合的なスコアシステムを構築する.

- 優化理由:全ての信号の質は等しくありません.評価システムは低品質の信号をフィルターして取引効率を向上させます.

資金管理統合:

- 信号の強さや市場条件の動向に応じてポジションの大きさを調整し,高確率のチャンスでポジションを増やし,低確率の状況でリスクの穴を減らす.

- 優化理由: 効果的な資金管理は長期的な利益に不可欠であり,戦略のパフォーマンスを大幅に改善します.

複数時間枠確認:

- シグナル生成前に複数の時間枠の条件一致性をチェックする.例えば,3分と15分チャートのシグナル一致時に取引する.

- 最適化理由:多時間枠確認は誤信号の確率を低くし,取引の精度を向上させる.

止損と停止メカニズム:

- 変動率に基づくダイナミックストップまたは重要な構造位置のストップなどのインテリジェントストップシステムを実装し,自動停止目標を設定します.

- 優化理由: リスク管理が上手く行われれば,大幅な撤収を回避し,利益を守ることが可能になる.

取引時間フィルター:

- 高効率と低効率の取引時間を識別し,市場の波動が低いまたは混乱の時期 (昼食時間または市場の開閉前後に) を避ける.

- 優化理由: 市場行動の特徴は,異なる時期によって異なるため,選択的取引は,全体的な効率性を向上させる.

適応指数パラメータ:

- 固定技術指標のパラメータ (RSIの14周期,EMAの20周期など) を,市場の状況に基づいて自動的に調整されるパラメータに変更する.

- 最適化理由:市場条件が変化すると,最適指標のパラメータも相応に調整され,指標の感度が向上する.

市場環境の分類:

- 追加されたアルゴリズムは,現在の市場環境を自動で識別し (トレンド,整合,高波動など),異なる環境に適用して異なるパラメータ設定を行う.

- 最適化理由:単一のパラメータ設定は,すべての市場環境で最適のパフォーマンスを発揮することは困難であり,環境適応性の調整は,戦略の安定性を著しく向上させることができる.

機械学習の強化:

- 機械学習モデルを統合し,信号の成功確率を予測し,歴史的パターンの認識に基づいて取引信号をフィルターし,優先順位を付けます.

- 優化理由:機械学習は,人工的に識別することが難しい複雑なパターンを発見し,戦略の知性化レベルを高めます.

上記の最適化方向を適用することで,戦略は,既存の優位性を維持しながら,適応性,正確性,長期的な収益性を大幅に向上させ,さまざまな市場条件の課題によりうまく対応することができます.

要約する

多次元枢軸取引戦略とダイナミック・フィボナッチ指標システムは,統合的に強固で構造的に完ぺきな日内取引戦略システムである.これは,伝統的な技術分析ツール ((枢軸,フィボナッチ・リトロール,移動平均) と近代的なダイナミック指標 ((V,WAP,CPR) を巧妙に組み合わせ,厳格なK線条件のフィルタリングと多重指標の確認により,トレーダーに潜在的な日内取引の枠組みを提供している.

この戦略の核心的な優位性は,重要な価格レベルを全面的にカバーし,潜在的な転換点を敏感に捉えることです.厳格なK線識別条件を設定することで,戦略は,多くの無意味な市場騒音をフィルターし,高い確率の取引機会に焦点を当てることができます.同時に,交差量と動量指標の組み合わせの使用は,信号の信頼性をさらに高めます.

しかし,この戦略には,過剰な信号,逆転取引のリスク,パラメータ最適化の問題などのいくつかの限界があります. これらの問題に対応するために,我々は,ダイナミックパラメータ調整,複数時間枠確認,スマート資金管理,市場環境への適応など,複数の最適化方向を提案しました. これらの最適化は,トレーダーが自身のニーズと市場特性に合わせて戦略を調整し,全体の取引効果を向上させることができます.

注目すべきは,いかなる取引戦略も”ポイント・ストーン・ゴールド”のツールではないことであり,成功する取引は戦略そのものに依存するだけでなく,トレーダーの忍耐,規律,継続的な学習を必要とします.この戦略については,トレーダーに最初にシミュレーション環境で充分にテストし,異なる市場条件下でのそのパフォーマンス特性を熟知し,特定の取引品種と個人のスタイルに合わせてパラメータを徐々に調整し,最終的に個性的で持続的な収益性の高い取引システムを形成することをお勧めします.

継続的な練習,フィードバック,最適化により,多次元枢軸取引戦略とダイナミックなフィボナッチ指数システムは,インデックストレーダーのツールキットに強力な武器となり,インデックス市場の変動を把握するための信頼できる技術分析の枠組みを提供します.

Overview

The Multi-Dimensional Pivot Point Trading System with Dynamic Fibonacci Indicators is a technical analysis-based trading strategy that utilizes daily pivot points, Central Pivot Range (CPR), Fibonacci retracement levels, Volume Weighted Average Price (VWAP), and moving averages to identify potential buying and selling opportunities. This strategy is particularly suitable for intraday traders, especially those focusing on 3-minute chart timeframes. The core of the strategy is determining whether candles meeting specific conditions touch key support and resistance levels, thereby triggering trading signals.

The strategy employs a pivot point system calculated from daily high, low, and close prices, combined with Volume Weighted Average Price (VWAP) and Moving VWAP (MVWAP) as dynamic support and resistance references. It also incorporates technical indicators such as the Relative Strength Index (RSI), Simple Moving Average (SMA), and Exponential Moving Average (EMA) to create a comprehensive trading decision system.

The strategy first identifies qualifying green (bullish) and red (bearish) candles, then determines if these candles touch key price levels such as pivot points, support levels, resistance levels, or VWAP. When a red candle touches a key price level, it triggers a buy signal (CE); when a green candle touches a key price level, it triggers a sell signal (PE). This contrarian approach reflects the core concept of seeking potential reversal points at key price levels.

Strategy Principles

The principles of this strategy are built on market behavior where prices fluctuate around key support and resistance levels, combined with candle patterns, volume, and momentum indicators for trading decisions. The specific principles are analyzed as follows:

Candle Identification Mechanism:

- Green Candle (Bullish): Close higher than open, candle body height at least 17 points, open lower than low plus 0.382 times candle range, close higher than low plus 0.682 times candle range.

- Red Candle (Bearish): Close lower than open, candle body height at least 17 points.

Pivot Point Calculation System:

- Daily Pivot Point (PP): (Daily High + Daily Low + Daily Close) / 3

- Resistance Levels: R1, R2, R3, R4

- Support Levels: S1, S2, S3, S4

- Central Pivot Range (CPR): Comprised of bottom CPR and top CPR, providing a price region where the market may consolidate

Dynamic Price References:

- VWAP (Volume Weighted Average Price): Reflects the average price level considering volume factors

- MVWAP (Moving Volume Weighted Average Price): Moving average of VWAP, providing a smoother price reference

Auxiliary Indicator System:

- RSI: Used to measure market overbought/oversold conditions

- SMA (50-period) and EMA (20-period): Provide price trend direction references

- Volume Analysis: Assesses volume trends through 20-period volume moving average

Trade Signal Generation:

- When qualifying red candles touch any pivot point, support level, resistance level, or VWAP/MVWAP, a buy signal (CE) is generated

- When qualifying green candles touch any pivot point, support level, resistance level, or VWAP/MVWAP, a sell signal (PE) is generated

The core idea of the strategy is to capture potential reversals near key support and resistance levels, filtered through specific candle patterns and multiple technical indicators to enhance signal validity. Candles touching pivot points often represent increased possibility of market hesitation or reversal at these key price levels.

Strategy Advantages

Deep analysis of the strategy code reveals the following significant advantages:

Multi-dimensional Verification Mechanism: Combines multiple technical indicators (pivot points, VWAP, moving averages, RSI) to validate trading signals, reducing false signal risk.

Dynamic Market Adaptation: Daily pivot point system updates daily, allowing the strategy to adapt to different market environments and volatilities.

Precise Candle Identification: Screens potential trading opportunities through strict candle pattern conditions and Fibonacci levels, improving signal quality.

Flexible Display Settings: The strategy features view adaptation functionality, only displaying pivot points in appropriate timeframes (intraday charts below 15 minutes), reducing chart clutter.

Contrarian Thinking Advantage: The strategy looks for buying opportunities when red candles touch key levels and selling opportunities when green candles touch key levels, leveraging potential short-term overbought/oversold market conditions.

Complete Price Level Hierarchy: Includes multiple layers of support and resistance (S1-S4 and R1-R4), providing rich reference prices suitable for market environments with different volatility ranges.

Integrated Central Pivot Range (CPR): CPR provides identification of potential consolidation areas for the day, which has important reference value in intraday trading.

Visual Assistance: Through rich markers and shapes, qualifying candles and instances of touching key price levels are intuitively marked on the chart, enabling traders to quickly identify them.

Volume Confirmation: Incorporates volume analysis, assessing market participation through volume moving averages, enhancing signal reliability.

Suitable for Intraday Trading: The strategy is specially designed for short timeframes (particularly 3-minute charts), suitable for intraday traders looking to capitalize on market fluctuations through frequent trading.

These advantages make this strategy a strong, adaptive intraday trading system, particularly suitable for investors with a good understanding of technical analysis who wish to trade based on price action and key price levels.

Strategy Risks

Despite its many advantages, the strategy also presents several potential risks that traders should carefully address:

Excessive Signal Risk: Due to the strategy involving multiple pivot points (PP, R1-R4, S1-S4) and other indicators, it may generate too many signals in volatile markets, leading to frequent trading and increased fees.

- Solution: Consider adding additional filtering conditions, such as trading session limitations or trend confirmation conditions.

Contrarian Trading Trap: The strategy is based on contrarian logic (buy when red candles touch key levels, sell when green candles touch key levels), which may lead to consecutive losses in strong trending markets.

- Solution: Assess the overall market trend before using the strategy, and add trend filters to avoid counter-trend trading in strong trends.

Parameter Sensitivity: Strategy effectiveness is highly dependent on candle identification parameters (e.g., candle height must exceed 17 points) and moving average period settings, which may require different parameters in different market environments.

- Solution: Backtest different instruments and market conditions to optimize parameter settings.

Lack of Stop-Loss Mechanism: No explicit stop-loss strategy is set in the code, which may lead to excessive single-trade losses.

- Solution: Implement clear stop-loss strategies, such as ATR-based dynamic stop-losses or fixed-point stop-losses.

Intraday Strategy Limitations: As a strategy focusing on 3-minute charts, it is not suitable for medium to long-term holdings, potentially missing opportunities in longer-term trends.

- Solution: View this strategy as part of a trading system, used in conjunction with medium and long-term strategies.

Pivot Point Limitations: In range-bound markets, prices may frequently touch multiple pivot points, generating confusing signals.

- Solution: Consider temporarily disabling the strategy or adding signal confirmation conditions in consolidating markets.

Lack of Volume Weight Adjustment: Although VWAP is used, the strategy does not dynamically adjust signal weights based on volume size.

- Solution: Add volume threshold conditions to ensure trading occurs with sufficient market participation.

Time Dependency: Daily pivot points are based on previous day’s data, and may perform unstably at the beginning of a new trading day due to insufficient current day data.

- Solution: Consider enabling the strategy 30-60 minutes after the trading day begins to gather sufficient market information.

Automation Implementation Challenges: The strategy involves multiple condition judgments, and may face delays or untimely execution during actual automated execution.

- Solution: Optimize execution systems to ensure low latency, or consider semi-automated methods combined with manual confirmation.

Backtest Bias Risk: The green/red candle identification logic in the code may perform inconsistently between backtesting and live trading environments.

- Solution: Conduct rigorous live simulation testing to ensure the strategy remains effective in actual trading environments.

Recognizing and managing these risks is crucial for successfully applying this strategy. Traders should make appropriate adjustments based on their risk tolerance and trading habits.

Strategy Optimization Directions

Based on deep analysis of the code, the following are key directions for optimizing this strategy:

Dynamic Candle Identification Parameters:

- The current strategy uses fixed values (such as candle height of at least 17 points) to identify effective candles. This could be changed to dynamic parameters based on ATR (Average True Range) to better adapt to different volatility environments.

- Optimization rationale: Fixed parameters perform differently in various volatility environments; dynamic parameters can improve strategy adaptability.

Trend Filtering System:

- Add trend determination from higher timeframes (such as 15-minute or 30-minute) to only execute trades in the direction of the main trend or adjust signal weights.

- Optimization rationale: Avoid frequent counter-trend trading in strong trends, improving win rate and risk-reward ratio.

Signal Quality Scoring Mechanism:

- Establish a comprehensive scoring system for each trading signal, considering multiple factors such as candle strength, importance of the pivot point touched, RSI value, volume anomalies, etc.

- Optimization rationale: Not all signals are of equal quality; a scoring system can filter out low-quality signals and improve trading efficiency.

Capital Management Integration:

- Dynamically adjust position size based on signal strength and market conditions, increasing positions on high-probability opportunities and reducing risk exposure in low-probability situations.

- Optimization rationale: Effective capital management is crucial for long-term profitability and can significantly improve strategy performance.

Multiple Timeframe Confirmation:

- Check condition consistency across multiple timeframes before generating signals, for example, trading only when 3-minute and 15-minute chart signals align.

- Optimization rationale: Multiple timeframe confirmation can reduce the probability of false signals and improve trading precision.

Stop-Loss and Take-Profit Mechanisms:

- Implement smart stop-loss systems, such as volatility-based dynamic stop-losses or key structural position stop-losses, while setting automatic take-profit targets.

- Optimization rationale: Sound risk management is crucial for avoiding significant drawdowns and protecting profits.

Trading Time Filters:

- Identify efficient and inefficient trading sessions, avoiding periods of low market volatility or chaotic periods (such as lunch hours or before and after market open and close).

- Optimization rationale: Market behavior characteristics differ across various sessions; selective trading can improve overall efficiency.

Adaptive Indicator Parameters:

- Change fixed technical indicator parameters (such as 14-period RSI, 20-period EMA) to parameters that automatically adjust based on market state.

- Optimization rationale: When market conditions change, optimal indicator parameters should also adjust accordingly, improving indicator sensitivity.

Market Environment Classification:

- Add algorithms to automatically identify the current market environment (trending, consolidating, high volatility, etc.) and apply different parameter settings for different environments.

- Optimization rationale: Single parameter settings are difficult to perform optimally in all market environments; environment-adaptive adjustments can significantly enhance strategy stability.

Machine Learning Enhancement:

- Consider integrating machine learning models to predict signal success probability, filtering and prioritizing trading signals based on historical pattern recognition.

- Optimization rationale: Machine learning can discover complex patterns difficult for humans to identify, raising the strategy’s intelligence level.

By implementing these optimization directions, the strategy can significantly improve adaptability, accuracy, and long-term profitability while maintaining its original advantages, better addressing challenges across various market conditions.

Summary

The Multi-Dimensional Pivot Point Trading System with Dynamic Fibonacci Indicators is a comprehensive, well-structured intraday trading strategy system. It cleverly combines traditional technical analysis tools (pivot points, Fibonacci retracements, moving averages) with modern dynamic indicators (VWAP, CPR). Through strict candle condition screening and multiple indicator confirmation, it provides traders with a promising intraday trading framework.

The core advantage of this strategy lies in its comprehensive coverage of key price levels and sensitive capture of potential reversal points. By setting strict candle identification conditions, the strategy can filter out a large amount of meaningless market noise and focus on high-probability trading opportunities. At the same time, the use of volume and momentum indicators further enhances signal reliability.

However, the strategy also has some limitations, such as potentially excessive signals, contrarian trading risks, and parameter optimization challenges. To address these issues, we’ve proposed several optimization directions, including dynamic parameter adjustment, multiple timeframe confirmation, intelligent capital management, and market environment adaptation. These optimizations can help traders adjust the strategy according to their own needs and market characteristics, improving overall trading effectiveness.

It’s worth noting that no trading strategy is a “magic bullet.” Successful trading depends not only on the strategy itself but also on the trader’s patience, discipline, and continuous learning. For this strategy, it’s recommended that traders first thoroughly test it in a simulated environment, familiarize themselves with its performance characteristics under different market conditions, gradually adjust parameters to adapt to specific trading instruments and personal styles, and ultimately form a personalized, sustainably profitable trading system.

Through continuous practice, feedback, and optimization, the Multi-Dimensional Pivot Point Trading System with Dynamic Fibonacci Indicators can become a powerful weapon in an intraday trader’s toolbox, providing a reliable technical analysis framework for capturing short-term market opportunities.

The strategy’s integration of traditional pivot points with modern technical tools creates a balanced approach that respects market structure while remaining responsive to intraday price movements. By focusing on key price interactions at critical levels, traders can develop a deeper understanding of market psychology and potentially improve their trading performance.

Ultimately, successful implementation will require thoughtful customization, rigorous testing, and disciplined execution. When properly applied as part of a comprehensive trading plan that includes sound risk management principles, this strategy offers a systematic method for navigating the complexities of intraday markets with greater confidence and precision.

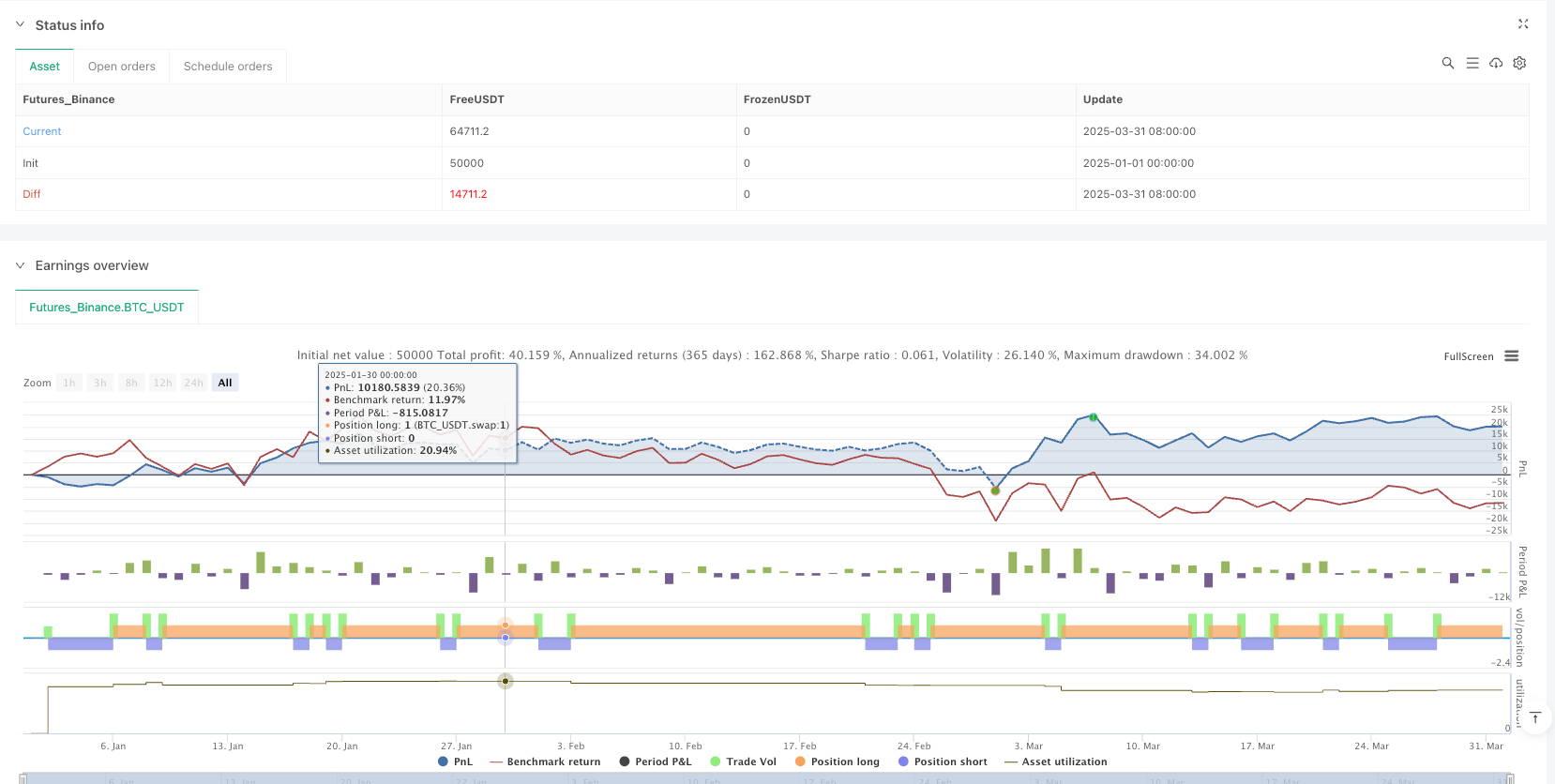

/*backtest

start: 2025-01-01 00:00:00

end: 2025-04-01 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Pivot Point CE/PE Strategy", overlay=true)

// Identify 3-minute candles (Assuming the script is applied to a 3-minute chart)

// Calculate candle range

candleRange = high - low

// Conditions for a qualifying green candle

greenCandle = (close > open) and (candleRange >= 17) and (open < (low + 0.382 * candleRange)) and (close > (low + 0.682 * candleRange))

// Conditions for a qualifying red candle

redCandle = (close < open) and (candleRange >= 17)

// Fibonacci levels for qualifying green and red candles

green_fib_0_382 = greenCandle ? high - 0.382 * candleRange : na

green_fib_0_618 = greenCandle ? high - 0.618 * candleRange : na

red_fib_0_382 = redCandle ? low + 0.382 * candleRange : na

red_fib_0_682 = redCandle ? low + 0.682 * candleRange : na

// Daily Pivot Point Calculation

[daily_high, daily_low, daily_close] = request.security(syminfo.tickerid, "D", [high, low, close])

daily_pivot = (daily_high + daily_low + daily_close) / 3

daily_r1 = daily_pivot + (daily_pivot - daily_low)

daily_s1 = daily_pivot - (daily_high - daily_pivot)

daily_r2 = daily_pivot + (daily_high - daily_low)

daily_s2 = daily_pivot - (daily_high - daily_low)

daily_r3 = daily_high + 2 * (daily_pivot - daily_low)

daily_s3 = daily_low - 2 * (daily_high - daily_pivot)

daily_r4 = daily_high + 3 * (daily_pivot - daily_low)

daily_s4 = daily_low - 3 * (daily_high - daily_pivot)

// Updated CPR Calculation

bottom_cpr = (daily_high + daily_low) / 2

top_cpr = (daily_pivot - bottom_cpr) + daily_pivot

// VWAP and MVWAP Calculation

vwap = ta.vwap(close)

mvwap_length = input.int(20, title="MVWAP Length")

mvwap = ta.sma(vwap, mvwap_length)

// Volume Analysis

volume_ma = ta.sma(volume, 20)

plot(volume, color=color.gray, title="Volume")

plot(volume_ma, color=color.orange, title="Volume MA")

// RSI Calculation

rsi_length = input.int(14, title="RSI Length")

rsi = ta.rsi(close, rsi_length)

plot(rsi, color=color.blue, title="RSI")

// SMA and EMA Calculation

sma_length = input.int(50, title="SMA Length")

ema_length = input.int(20, title="EMA Length")

sma = ta.sma(close, sma_length)

ema = ta.ema(close, ema_length)

plot(sma, color=color.red, title="SMA")

plot(ema, color=color.green, title="EMA")

// Dynamic Visibility Condition Based on Chart Scale

show_pivot = (timeframe.isintraday and timeframe.multiplier <= 15)

// Display daily pivot points

plot(show_pivot ? daily_pivot : na, color=color.blue, title="Daily Pivot", style=plot.style_stepline)

plot(show_pivot ? daily_r1 : na, color=color.red, title="Daily R1", style=plot.style_stepline)

plot(show_pivot ? daily_r2 : na, color=color.red, title="Daily R2", style=plot.style_stepline)

plot(show_pivot ? daily_r3 : na, color=color.red, title="Daily R3", style=plot.style_stepline)

plot(show_pivot ? daily_r4 : na, color=color.red, title="Daily R4", style=plot.style_stepline)

plot(show_pivot ? daily_s1 : na, color=color.green, title="Daily S1", style=plot.style_stepline)

plot(show_pivot ? daily_s2 : na, color=color.green, title="Daily S2", style=plot.style_stepline)

plot(show_pivot ? daily_s3 : na, color=color.green, title="Daily S3", style=plot.style_stepline)

plot(show_pivot ? daily_s4 : na, color=color.green, title="Daily S4", style=plot.style_stepline)

// Display Central Pivot Range (CPR)

plot(show_pivot ? top_cpr : na, color=color.purple, title="Top CPR", style=plot.style_stepline)

plot(show_pivot ? bottom_cpr : na, color=color.orange, title="Bottom CPR", style=plot.style_stepline)

plot(vwap, color=color.fuchsia, title="VWAP")

plot(mvwap, color=color.teal, title="MVWAP")

// Mark qualifying candles

plotshape(greenCandle, title="Green Candle", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(redCandle, title="Red Candle", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Detect Green Candle Touching Pivot Points

greenTouchPivot = greenCandle and ((open <= daily_pivot and high >= daily_pivot) or

(open <= daily_r1 and high >= daily_r1) or

(open <= daily_r2 and high >= daily_r2) or

(open <= daily_r3 and high >= daily_r3) or

(open <= daily_r4 and high >= daily_r4) or

(open <= daily_s1 and high >= daily_s1) or

(open <= daily_s2 and high >= daily_s2) or

(open <= daily_s3 and high >= daily_s3) or

(open <= daily_s4 and high >= daily_s4) or (open <= vwap and high >= vwap) or (open <= mvwap and high >= mvwap))

// Detect Red Candle Touching Pivot Points

redTouchPivot = redCandle and ((low <= daily_pivot and open >= daily_pivot) or

(low <= daily_r1 and open >= daily_r1) or

(low <= daily_r2 and open >= daily_r2) or

(low <= daily_r3 and open >= daily_r3) or

(low <= daily_r4 and open >= daily_r4) or

(low <= daily_s1 and open >= daily_s1) or

(low <= daily_s2 and open >= daily_s2) or

(low <= daily_s3 and open >= daily_s3) or

(low <= daily_s4 and open >= daily_s4) or ((open >= vwap and low <= vwap) or (open >= mvwap and low <= mvwap)))

// Mark Green Candle Touching Pivot

plotshape(greenTouchPivot, title="Green Touch Pivot", location=location.abovebar, color=color.green, style=shape.triangleup, text="GTouch")

// Mark Red Candle Touching Pivot

plotshape(redTouchPivot, title="Red Touch Pivot", location=location.belowbar, color=color.red, style=shape.triangledown, text="RTouch")

// CE Entry Below Red Touch Pivot

if (redTouchPivot)

strategy.entry("CE", strategy.long)

// PE Entry Above Green Touch Pivot

if (greenTouchPivot)

strategy.entry("PE", strategy.short)