概要

これは,取引量重み平均価格 (AVWAP),固定範囲取引量分布 (FRVP),指数移動平均 (EMA),相対力指数 (RSI),平均方向指数 (ADX),移動平均収束散度 (MACD) などの複数の技術分析ツールを組み合わせた複雑な多指標取引戦略であり,指標の集約によって高確率の取引機会を特定することを目的としています.

戦略原則

戦略は,複数の条件によって入場信号を決定します.

- 価格とAVWAPの交差点

- EMAに対する価格の位置

- RSIの強度判断

- MACDの動態

- ADXトレンドの強さが確認された

- 交付量フィルター

戦略は,アジア,ロンドン,ニューヨークの取引時間に焦点を当てており,これらの時間は通常流動性が高く,取引シグナルがより信頼性があります. 入場論理は,長ポジションと空ポジションの2つのモードを含み,梯度ストップとストップ損失の仕組みを設定しています.

戦略的優位性

- 複数の指標の組み合わせにより,信号の精度が向上する

- 流動性の低い取引を避けるために,動的取引量フィルタリング

- 柔軟なストップ・ストップ・ストラスト戦略

- 異なる取引時間に基づく戦略の最適化

- ダイナミックなリスク管理機構

- 視覚信号による意思決定

戦略リスク

- 複数の指標の組み合わせにより,信号の複雑性が増加する可能性があります.

- 追跡データには過適合の危険性がある

- 異なる市場条件で性能が不安定である可能性

- 取引コストと滑り点は実際の利益に影響する

戦略最適化の方向性

- 機械学習アルゴリズムの動的調整パラメータを導入する

- 取引時間帯の適応性を増やす

- ストップ・ストップ・ロスの最適化

- フィルタリング条件の追加

- 種間共通性戦略モデルを開発する

要約する

これは高度にカスタマイズされ,多次元的な取引戦略であり,複数の技術指標と取引時間特性を統合することによって,取引信号の質と正確性を向上させようとしています.この戦略は,指標集約とダイナミックなリスク管理の複雑さを量化取引で示しています.

ストラテジーソースコード

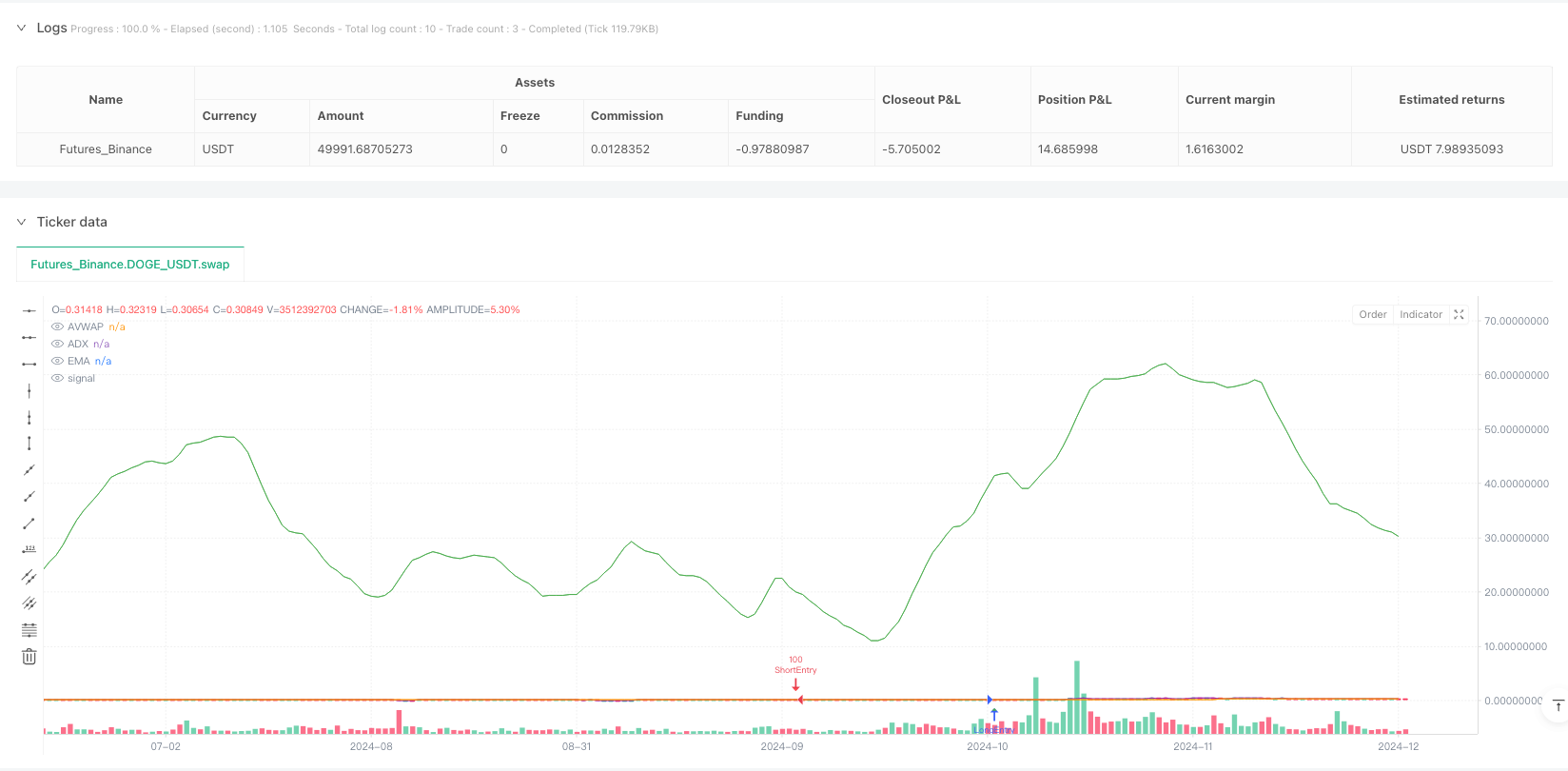

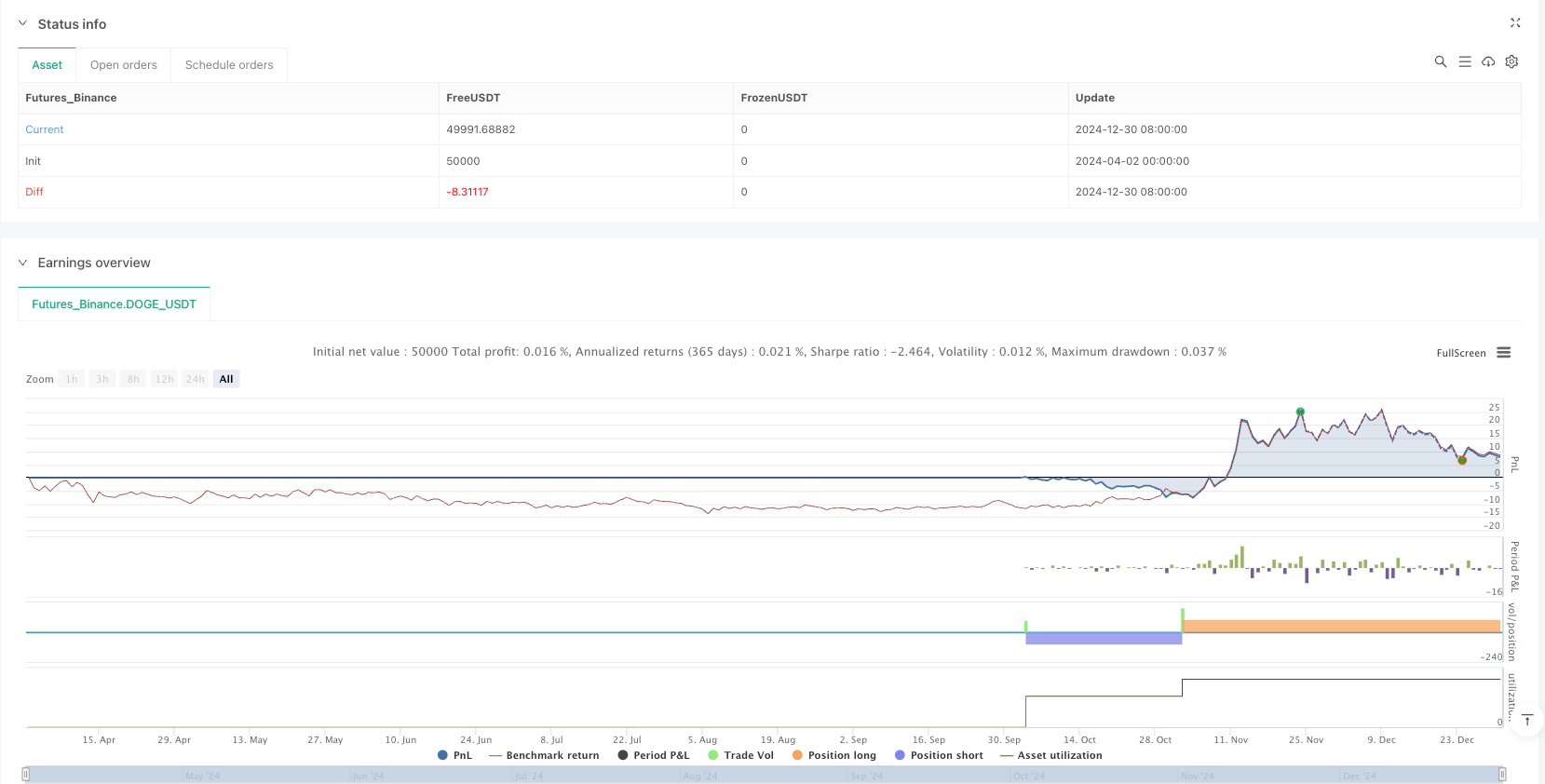

/*backtest

start: 2024-04-02 00:00:00

end: 2024-12-31 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"DOGE_USDT"}]

*/

//@version=6

strategy("FRVP + AVWAP by Grok", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// User Inputs

frvpLength = input.int(20, title="FRVP Length", minval=1)

emaLength = input.int(75, title="EMA Length", minval=1) // Adjusted for stronger trend confirmation

rsiLength = input.int(14, title="RSI Length", minval=1)

adxThreshold = input.int(20, title="ADX Strength Threshold", minval=0, maxval=100)

volumeMultiplier = input.float(1.0, title="Volume Multiplier", minval=0.1)

// Stop Loss & Take Profit for XAUUSD

stopLossPips = 25 // 25 pips SL for Asian, London, NY Sessions

takeProfit1Pips = 35 // TP1 at 35 pips

takeProfit2Pips = 80 // Final TP at 80 pips

// Stop-Loss & Take-Profit Multipliers (XAUUSD: 1 pip = 0.1 points on most platforms)

stopMultiplier = float(stopLossPips) * 0.1

tp1Multiplier = float(takeProfit1Pips) * 0.1

tp2Multiplier = float(takeProfit2Pips) * 0.1

// Indicators

avwap = ta.vwap(close) // Volume Weighted Average Price (VWAP)

ema = ta.ema(close, emaLength) // Exponential Moving Average

rsi = ta.rsi(close, rsiLength) // Relative Strength Index

macdLine = ta.ema(close, 12) - ta.ema(close, 26) // MACD Line

signalLine = ta.ema(macdLine, 9) // MACD Signal Line

atr = ta.atr(14) // Average True Range

// Average Directional Index (ADX)

adxSmoothing = 14

[diplus, diminus, adx] = ta.dmi(14, adxSmoothing) // Corrected syntax for ta.dmi()

// Volume Profile (FRVP - Fixed Range Volume Profile Midpoint)

highestHigh = ta.highest(high, frvpLength)

lowestLow = ta.lowest(low, frvpLength)

frvpMid = (highestHigh + lowestLow) / 2 // Midpoint of the range

// Detect Trading Sessions

currentHour = hour(time, "UTC") // Renamed to avoid shadowing built-in 'hour'

isAsianSession = currentHour >= 0 and currentHour < 8

isLondonSession = currentHour >= 8 and currentHour < 16

isNYSession = currentHour >= 16 and currentHour < 23

// Entry Conditions

longCondition = ta.crossover(close, avwap) and close > ema and rsi > 30 and macdLine > signalLine and adx > adxThreshold

shortCondition = ta.crossunder(close, avwap) and close < ema and rsi < 70 and macdLine < signalLine and adx > adxThreshold

// Volume Filter

avgVolume = ta.sma(volume, 20) // 20-period Simple Moving Average of volume

volumeFilter = volume > avgVolume * volumeMultiplier // Trade only when volume exceeds its moving average

// Trade Execution with SL/TP for Sessions

if (longCondition and volumeFilter and (isAsianSession or isLondonSession or isNYSession))

strategy.entry("LongEntry", strategy.long, qty=100)

strategy.exit("LongTP1", from_entry="LongEntry", limit=close + tp1Multiplier)

strategy.exit("LongExit", from_entry="LongEntry", stop=close - stopMultiplier, limit=close + tp2Multiplier)

if (shortCondition and volumeFilter and (isAsianSession or isLondonSession or isNYSession))

strategy.entry("ShortEntry", strategy.short, qty=100)

strategy.exit("ShortTP1", from_entry="ShortEntry", limit=close - tp1Multiplier)

strategy.exit("ShortExit", from_entry="ShortEntry", stop=close + stopMultiplier, limit=close - tp2Multiplier)

// Plotting for Debugging and Visualization

plot(avwap, "AVWAP", color=color.purple, style=plot.style_line, offset=0)

plot(ema, "EMA", color=color.orange, style=plot.style_line, offset=0)

// plot(rsi, "RSI", color=color.yellow, style=plot.style_histogram, offset=0) // Better in a separate pane

// plot(macdLine, "MACD Line", color=color.blue, style=plot.style_histogram, offset=0) // Better in a separate pane

// plot(signalLine, "Signal Line", color=color.red, style=plot.style_histogram, offset=0) // Better in a separate pane

plot(adx, "ADX", color=color.green, style=plot.style_line, offset=0)

// Optional: Plot entry/exit signals for visualization

plotshape(longCondition and volumeFilter ? close : na, title="Long Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.tiny)

plotshape(shortCondition and volumeFilter ? close : na, title="Short Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.tiny)