概要

ダウスト理論のトレンド自在動量戦略は,クラシックダウスト理論の原理に基づく,取引決定を導くための先進的な取引方法である.この戦略は,価格の傾向の基本的な動態を検出し,確認することに焦点を当てており,より高い高値 (Higher Highs) とより高い低値 (Higher Lows) を使用して上昇傾向を定義し,より低い高値 (Lower Highs) とより低い低値 (Lower Lows) を使用して下降傾向を定義する.この方法は,市場動向を捕捉し,傾向が変化する時に迅速に反応するための体系的な方法を提供することを目的としています.

戦略原則

この戦略の核心原理は,ダウスト理論のクラシックなトレンド識別方法に基づいています. この戦略は,ta.pivothigh (●) とta.pivotlow (●) の関数を使用して,重要な転換点を検出します.具体的には,以下の重要なステップが含まれています.

- ターニングポイント検定:ピボットLookbackパラメータを使用して,高点と低点を識別するために,左右の柱の数を決定する.

- トレンド確認:高い高点と低い低点の条件が同時に満たされた場合にのみ,上昇傾向が確認される. 同様に,低い高点と低い低点の条件が同時に満たされた場合にのみ,下降傾向が確認される.

- トレンド継続性: トレンド転換条件が満たされていない場合,戦略は以前のトレンド状態を維持し,よりスムーズなトレンド追跡を実現します.

戦略的優位性

- ダイナミックなトレンド識別: 戦略は,継続的に重要な転換点を分析することで,市場のトレンドの変化をダイナミックに捉えることができます.

- 柔軟な取引モード: 自動,多額,空白の3つの取引モードを提供して,異なるトレーダーのニーズを満たします.

- リスクマネジメント: 単一取引のリスクを効果的に制御する内置の止損と停止メカニズム.

- ビジュアル化トレンド:背景の色と標識によってトレンドの方向を直感的に表示し,トレーダーが市場の状況を迅速に理解できるようにする.

- 低遅延:従来の移動平均策と比較して,トレンドの変化により迅速に反応します.

戦略リスク

- 遅れのリスク:ターニングポイント検出を使用しているため,戦略には固有の遅れのリスクがあり,トレンドの初期のシグナルを捕捉できない可能性があります.

- 波動性のない市場では,頻繁に起こる小さな価格変動が,不必要な取引を引き起こす可能性があります.

- 参数感性:ピボット・ルックバックの参数選択は,戦略のパフォーマンスに大きな影響を与えるため,異なる市場と時間枠で調整する必要があります.

- 取引コスト: 取引の頻度が高く,特に手数料が高くなる場合,取引コストが高くなる可能性があります.

戦略最適化の方向性

- 追加フィルタを導入:トレンドの強さ指標 ((ATRのような) と組み合わせて弱気トレンド信号をフィルタリングする.

- ダイナミックパラメータ調整:市場の波動性に基づいて自主適応のピボット・ルックバックパラメータメカニズムの開発.

- 多時間枠検証:異なる時間枠でトレンド信号をクロス検証し,信号の信頼性を高めます.

- 機械学習の強化:トレンド認識と入場タイミングを最適化するために機械学習アルゴリズムを使用する方法を探索する.

- リスク管理の最適化:市場の波動的な動向に応じて,ストップ・ロズとストップ・ディスタンスを調整する.

要約する

ダウスト理論のトレンド自己適応動量戦略は,革新的なターニングポイント分析技術によって,トレーダーに体系的なトレンド識別ツールを提供する強力なトレンド追跡方法である.いくつかの固有のリスクがあるにもかかわらず,その柔軟性とダイナミクスは,近代的な量化取引戦略の価値ある方法にそれを作る.この戦略を成功に適用するには,その働きの原理を深く理解し,特定の市場環境に応じて常に最適化および調整する必要があります.

Overview

The Dow Theory Trend Adaptive Momentum Strategy is an advanced trading approach based on classic Dow Theory principles, designed to guide trading decisions by identifying key turning points in market trends. The strategy focuses on detecting and confirming the fundamental dynamics of price trends, using Higher Highs and Higher Lows to define uptrends, and Lower Highs and Lower Lows to define downtrends. This method aims to provide a systematic approach to capturing market trends and responding promptly when trends change.

Strategy Principles

The core principle of this strategy is based on the classic Dow Theory trend identification method. The strategy detects key turning points using ta.pivothigh() and ta.pivotlow() functions. Specific implementation includes the following key steps:

- Turning Point Detection: Use the pivotLookback parameter to determine the number of bars on both sides for identifying highs and lows.

- Trend Confirmation: An uptrend is confirmed only when both Higher Highs and Higher Lows conditions are met; similarly, a downtrend is confirmed only when both Lower Highs and Lower Lows conditions are satisfied.

- Trend Persistence: If trend conversion conditions are not met, the strategy maintains the previous trend state, achieving smoother trend tracking.

Strategy Advantages

- Dynamic Trend Identification: By continuously analyzing key turning points, the strategy can dynamically capture market trend changes.

- Flexible Trading Modes: Provides three trading modes - automatic, long-only, and short-only - to meet different traders’ needs.

- Risk Management: Built-in stop-loss and take-profit mechanisms effectively control the risk of individual trades.

- Trend Visualization: Intuitively displays trend direction through background colors and markers, making it easy for traders to understand market conditions.

- Low Latency: Compared to traditional moving average strategies, this method can respond to trend changes more quickly.

Strategy Risks

- Lag Risk: Due to using pivot point detection, the strategy inherently carries a lag risk and may not capture the earliest trend signals.

- Ranging Market Risk: In markets with unclear fluctuations, frequent small price changes may lead to unnecessary trades.

- Parameter Sensitivity: The choice of pivotLookback parameter significantly impacts strategy performance and requires adjustment for different markets and timeframes.

- Trading Costs: Frequent trading may result in high transaction costs, especially with higher commission rates.

Strategy Optimization Directions

- Introduce Additional Filters: Combine trend strength indicators (such as ATR) to filter weak trend signals.

- Dynamic Parameter Adjustment: Develop an adaptive pivotLookback parameter mechanism based on market volatility.

- Multi-Timeframe Verification: Cross-verify trend signals across different timeframes to improve signal reliability.

- Machine Learning Enhancement: Explore using machine learning algorithms to optimize trend identification and entry timing.

- Risk Management Optimization: Dynamically adjust stop-loss and take-profit distances based on market volatility.

Conclusion

The Dow Theory Trend Adaptive Momentum Strategy is a powerful trend-following method that provides traders with a systematic trend identification tool through innovative turning point analysis techniques. Despite some inherent risks, its flexibility and dynamism make it a valuable approach in modern quantitative trading strategies. Successfully applying this strategy requires a deep understanding of its working principles and continuous optimization and adjustment based on specific market environments.

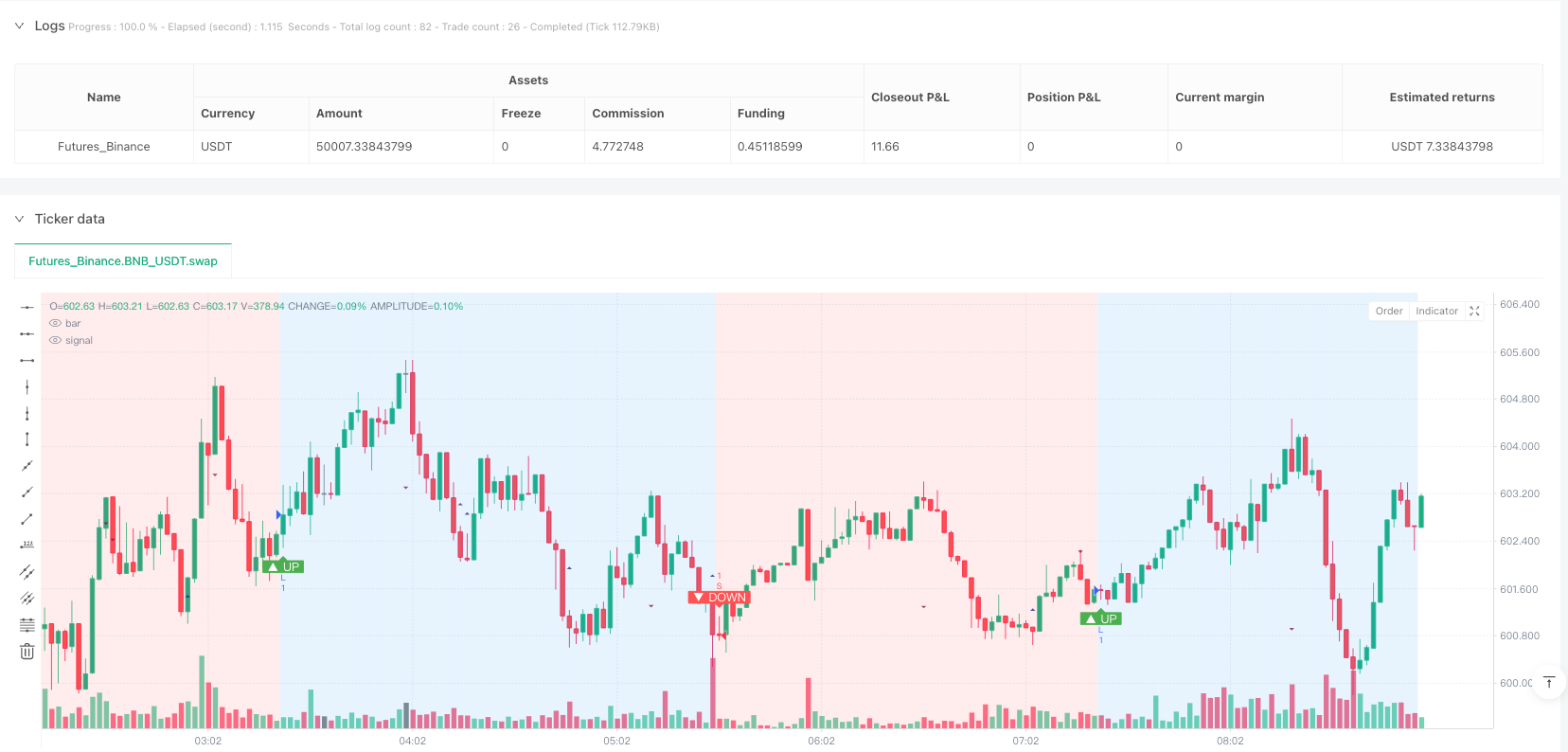

/*backtest

start: 2025-03-29 00:00:00

end: 2025-03-30 09:00:00

period: 2m

basePeriod: 2m

exchanges: [{"eid":"Futures_Binance","currency":"BNB_USDT"}]

*/

//@version=5

// strategy(title="Dow Theory Trend Strategy v3", shorttitle="Dow Trend Strat v3", overlay=true,

// initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=10,

// commission_type=strategy.commission.percent, commission_value=0.1, // Example strategy settings with commission

// process_orders_on_close=true) // Consider processing on bar close for more stable backtests

strategy(title="Dow Theory Trend Strategy v3", shorttitle="Dow Trend Strat v3", overlay=true) // Basic strategy settings

// --- 設定 ---

// Calculation Settings

pivotLookback = input.int(10, title="Pivot Lookback Period", minval=1, tooltip="ピボットハイ/ローを検出するための左右のバーの数", group="Calculation Settings")

// Display Settings

showPivotPoints = input.bool(true, title="Show Pivot Points", tooltip="ピボットハイ/ローのポイントを表示します", group="Display Settings")

showTrendChange = input.bool(true, title="Show Trend Change Signals", tooltip="トレンド転換のシグナル(エントリーポイント)を表示します", group="Display Settings")

// Strategy Settings

// --- Manual Trend Override (配列定義を input 内に変更) ---

manualTrendMode = input.string("Auto", title="Manual Trend Mode",

options=["Auto", "Long Only", "Short Only"], // オプションをここで直接定義

tooltip="手動でトレード方向を指定 (Auto: ダウ理論に従う, Long Only: ロングのみ, Short Only: ショートのみ)",

group="Strategy Settings")

// Risk Management Settings

useStopLoss = input.bool(true, title="Use Stop Loss", group="Risk Management")

stopLossTicks = input.float(100, title="Stop Loss (Ticks)", minval=1, group="Risk Management", tooltip="エントリー価格からのストップロスまでのティック(最小値動き)数。例:EURUSDで20 pips (tick=0.00001)なら200。")

useTakeProfit = input.bool(true, title="Use Take Profit", group="Risk Management")

takeProfitTicks = input.float(200, title="Take Profit (Ticks)", minval=1, group="Risk Management", tooltip="エントリー価格からのテイクプロフィットまでのティック(最小値動き)数。例:EURUSDで40 pips (tick=0.00001)なら400。")

// --- ピボットハイ/ローの検出 ---

pivotHighPrice = ta.pivothigh(high, pivotLookback, pivotLookback)

pivotLowPrice = ta.pivotlow(low, pivotLookback, pivotLookback)

// --- ピボットポイントの値を保持するための変数 ---

var float lastPivotHigh = na

var float prevPivotHigh = na

var float lastPivotLow = na

var float prevPivotLow = na

var int lastPivotHighBar = na

var int prevPivotHighBar = na

var int lastPivotLowBar = na

var int prevPivotLowBar = na

// --- 新しいピボットが確定したかどうかの検出と値の更新 ---

if not na(pivotHighPrice)

if na(lastPivotHigh) or pivotHighPrice != lastPivotHigh

prevPivotHigh := lastPivotHigh

prevPivotHighBar := lastPivotHighBar

lastPivotHigh := pivotHighPrice

lastPivotHighBar := bar_index - pivotLookback

if not na(pivotLowPrice)

if na(lastPivotLow) or pivotLowPrice != lastPivotLow

prevPivotLow := lastPivotLow

prevPivotLowBar := lastPivotLowBar

lastPivotLow := pivotLowPrice

lastPivotLowBar := bar_index - pivotLookback

// --- ダウ理論に基づくトレンド判定 (改良版) ---

var int trendDirection = 0

bool hasEnoughPivots = not na(lastPivotHigh) and not na(prevPivotHigh) and not na(lastPivotLow) and not na(prevPivotLow)

if hasEnoughPivots

isHigherHigh = lastPivotHigh > prevPivotHigh

isHigherLow = lastPivotLow > prevPivotLow

isUptrendConfirmed = isHigherHigh and isHigherLow

isLowerHigh = lastPivotHigh < prevPivotHigh

isLowerLow = lastPivotLow < prevPivotLow

isDowntrendConfirmed = isLowerHigh and isLowerLow

if isUptrendConfirmed

trendDirection := 1

else if isDowntrendConfirmed

trendDirection := -1

else

trendDirection := trendDirection[1]

// --- トレンド転換の検出 ---

bool trendChanged = ta.change(trendDirection) != 0

bool changedToUp = trendChanged and trendDirection == 1

bool changedToDown = trendChanged and trendDirection == -1

// --- 描画処理 ---

bgcolor(trendDirection == 1 ? color.new(color.blue, 85) : trendDirection == -1 ? color.new(color.red, 85) : color.new(color.gray, 90), title="Trend Background")

plotshape(showPivotPoints and not na(pivotHighPrice), title="Pivot High", location=location.abovebar, color=color.new(color.maroon, 20), style=shape.triangledown, size=size.tiny, offset=-pivotLookback)

plotshape(showPivotPoints and not na(pivotLowPrice), title="Pivot Low", location=location.belowbar, color=color.new(color.navy, 20), style=shape.triangleup, size=size.tiny, offset=-pivotLookback)

plotshape(showTrendChange and changedToUp, title="Uptrend Start Signal", location=location.belowbar, color=color.new(color.green, 0), style=shape.labelup, text="▲ UP", textcolor=color.white, size=size.small)

plotshape(showTrendChange and changedToDown, title="Downtrend Start Signal", location=location.abovebar, color=color.new(color.red, 0), style=shape.labeldown, text="▼ DOWN", textcolor=color.white, size=size.small)

// --- ストラテジーロジック ---

bool allowLong = manualTrendMode == "Auto" or manualTrendMode == "Long Only"

bool allowShort = manualTrendMode == "Auto" or manualTrendMode == "Short Only"

if (changedToUp and allowLong)

strategy.entry("L", strategy.long, comment="Go Long")

if (useStopLoss or useTakeProfit)

float slValue = useStopLoss and stopLossTicks > 0 ? stopLossTicks : na

float tpValue = useTakeProfit and takeProfitTicks > 0 ? takeProfitTicks : na

strategy.exit("LX", from_entry="L", loss=slValue, profit=tpValue, comment_loss="SL Long", comment_profit="TP Long")

if (changedToDown and allowShort)

strategy.entry("S", strategy.short, comment="Go Short")

if (useStopLoss or useTakeProfit)

float slValue = useStopLoss and stopLossTicks > 0 ? stopLossTicks : na

float tpValue = useTakeProfit and takeProfitTicks > 0 ? takeProfitTicks : na

strategy.exit("SX", from_entry="S", loss=slValue, profit=tpValue, comment_loss="SL Short", comment_profit="TP Short")

// --- デバッグ用 ---

// plot(trendDirection, title="Trend Direction Value")