EMAブレイクアウトダイナミックストップロス戦略

EMA ATR VOLUME BREAKOUT TRAILING_STOP

作成日:

2025-08-26 11:50:41

最終変更日:

2025-08-26 11:50:41

コピー:

17

クリック数:

399

2

フォロー

366

フォロワー

“三重保険のトレンドは神器を突破する”

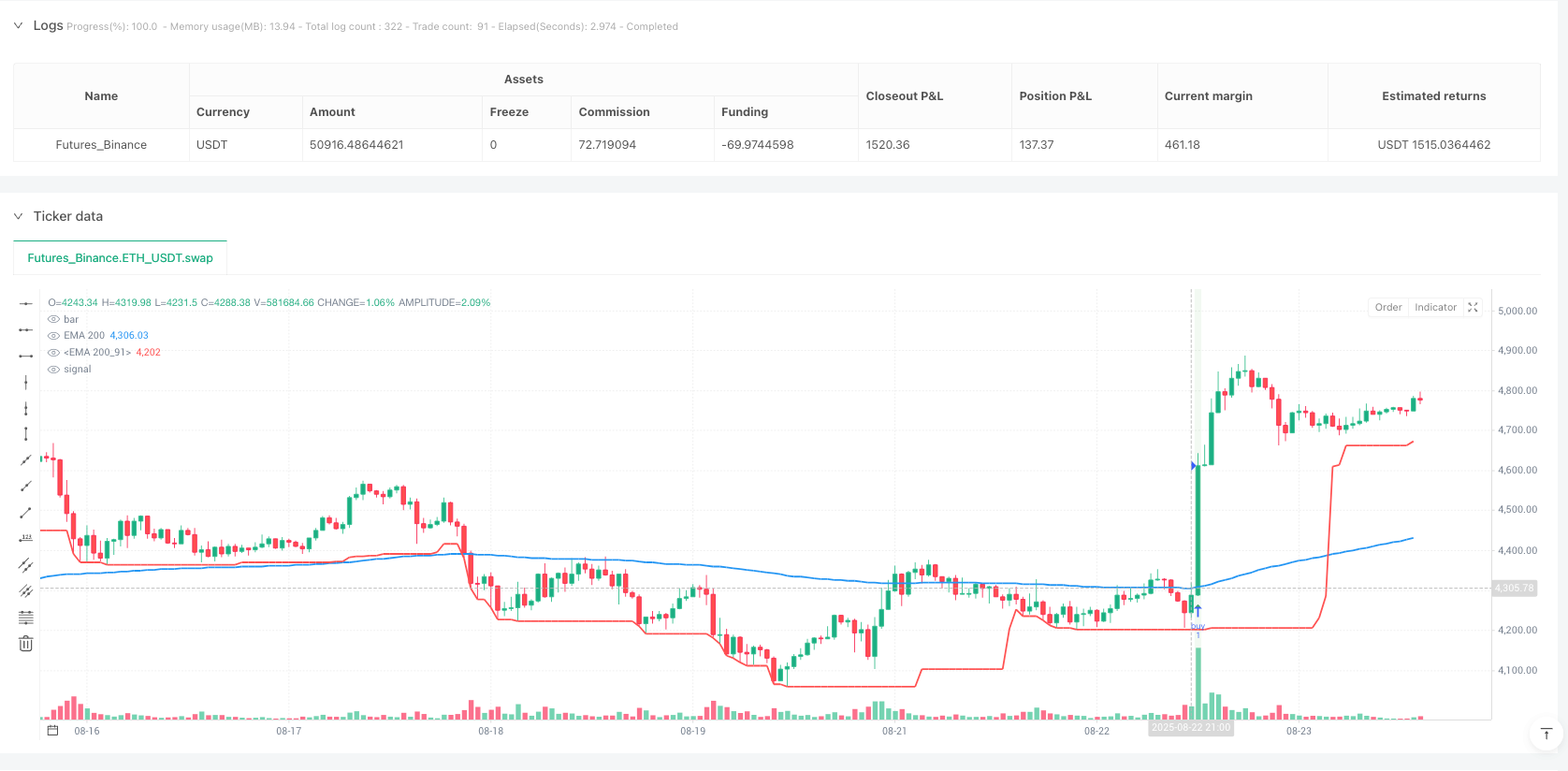

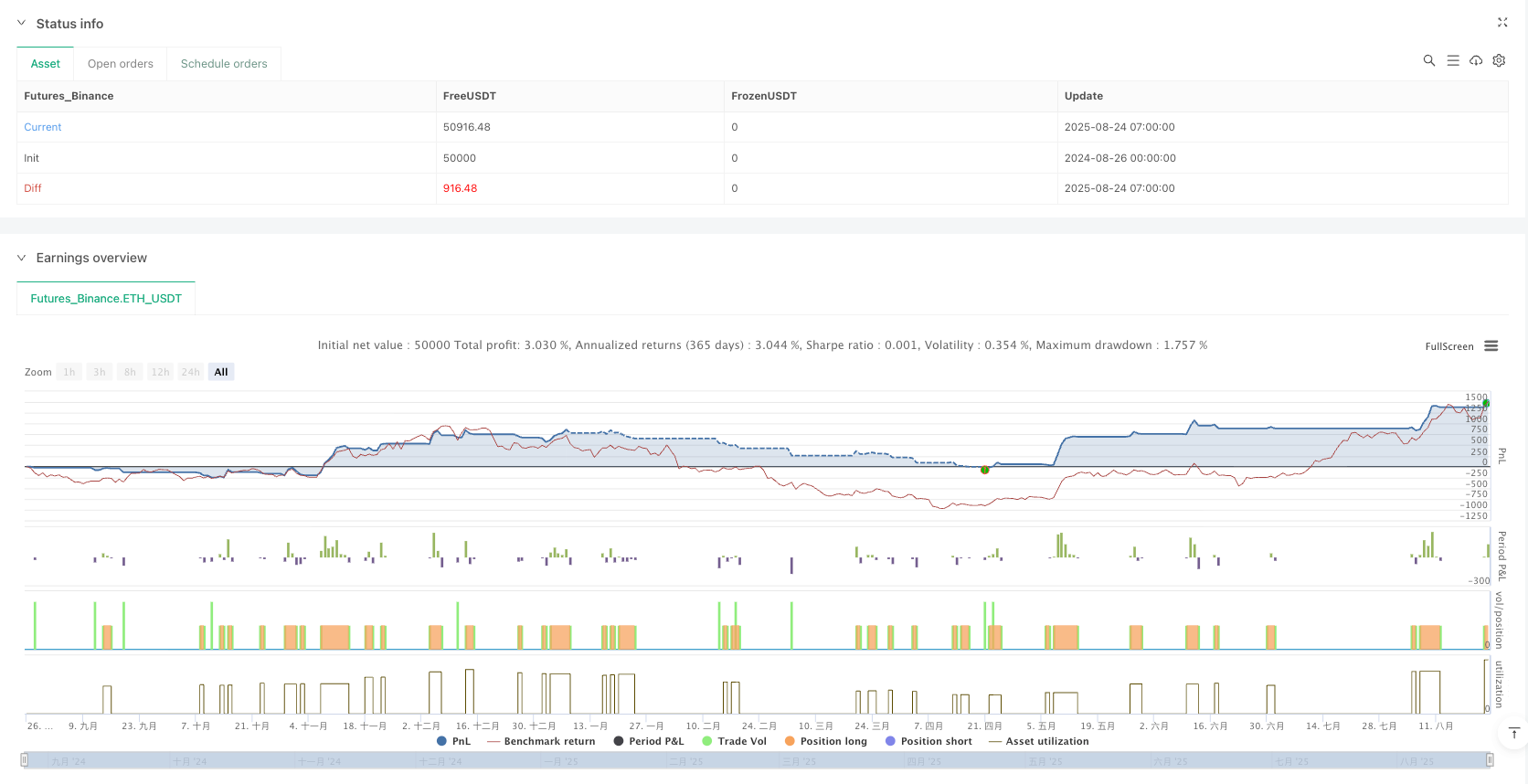

この戦略は,あなたの取引に3重の保険を装着しているようなものです!まずは,EMA200で大きなトレンドの方向性を判断し,次に,取引量で突破の真偽を確認し,最後にATRで動的ストップを活用して利益を保護します.

集中する! これは機械的な取引ではなく”,見守る”というスマートな戦略です. 価格がEMA200を突破すると,取引量が十分に大きいかどうかをチェックし (標準は平均の1.5倍),偽の突破の穴を避ける必要があります.

ダイナミック・ダメージ・ストップ・メカニズム: “階段を登る”保護神

この戦略のストップダメージは,固定値ではなく,階段を登るダイナミックな保護です.

シンプルな仕組みです:

- 入場時:入場価格より2倍ATRの距離でストップを設定する

- 持仓:ストップは20サイクル最低値の上昇に続く

- 価格がダイナミックストップラインを突破して平仓

階段を登る時のように,安全ロープを上へと押し上げ,下へと下がらないようにします.

の供給量確認: 坑道回避ガイドラインの核心兵器

“狼が来た”の物語のように,多くの突破策の最大の問題は偽突破です. この戦略は,取引量確認によって,この痛みを解決します.

20日間の平均の1.5倍以上の取引をしなければならない.想像してみて下さい! ほんの少しの人だけが話題にするニュースは偽りかもしれないけど,街中の人が話題にするニュースは注目に値する!

このデザインは,偽の突破口をフィルターし,本当の資金の有るトレンドのみを捉えるのに役立ちます.

の実戦:この戦術が解決する問題

適した人材:

- 中長期のトレンドに注目する投資家の方へ

- 偽の突破を恐れた慎重な派

- 理性主義者は,システム化された防災を望んでいます.

解決された問題:

- 方向を迷ったEMA200はトレンドを見極めるのに役立ちます.

- 偽の突破を困らせている渋滞確認 騒音フィルター

- 損害防止問題動的ATR停止は保護と柔軟性がある

- 感情の取引完全に自動で実行され,人間の弱さを告げる.

この戦略の最大の価値は,一晩で金持ちになるのではなく,トレンドマーケットで安定して利益を得て,あなたの資金を最大限に保護することです. それは,あなたの取引にGPSナビゲーション+安全気筒+衝突防止システムを装着しているようなものです!

ストラテジーソースコード

/*backtest

start: 2024-08-26 00:00:00

end: 2025-08-24 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("EMA Break + Stop ATR", overlay = true)

// =============================================================================

// STRATEGY PARAMETERS

// =============================================================================

// User inputs for strategy customization

shortPeriod = input.int(20, title = "Stop Period", minval = 1, maxval = 100, tooltip = "Period for lowest low calculation")

atrPeriod = 1 // ATR period always set to 1

initialStopLoss = 0.0 // Initial stop loss always set to 0 (auto based on ATR)

// Confirmation indicator settings

useVolumeConfirmation = input.bool(true, title = "Use Volume Confirmation", tooltip = "Require volume above average for breakout confirmation")

volumeMultiplier = input.float(1.5, title = "Volume Multiplier", minval = 1.0, maxval = 5.0, step = 0.1, tooltip = "Volume must be this times above average")

// Strategy variables

var float STOP_LOSS = 0.0 // Dynamic stop loss value

var float TRAILING_STOP = na // Trailing stop based on lowest low

// =============================================================================

// TECHNICAL INDICATORS

// =============================================================================

// Calculate True Range and its Simple Moving Average

trueRange = ta.tr(true)

smaTrueRange = ta.sma(trueRange, atrPeriod)

// Calculate 200-period Exponential Moving Average

ema200 = ta.ema(close, 200)

// Calculate lowest low over the short period

lowestLow = ta.lowest(input(low), shortPeriod)

// Calculate potential stop loss level (always available)

potentialStopLoss = close - 2 * smaTrueRange

// Volume confirmation for breakout validation

volumeSMA = ta.sma(volume, 20) // 20-period average volume

isVolumeConfirmed = not useVolumeConfirmation or volume > volumeSMA * volumeMultiplier

// =============================================================================

// STOP LOSS MANAGEMENT

// =============================================================================

// Update trailing stop based on lowest low (always, not just when in position)

if na(TRAILING_STOP) or lowestLow > TRAILING_STOP

TRAILING_STOP := lowestLow

// Update stop loss if we have an open position and new lowest low is higher

if (strategy.position_size > 0) and (STOP_LOSS < lowestLow)

strategy.cancel("buy_stop")

STOP_LOSS := lowestLow

// Soft stop loss - exit only when close is below stop level

if (strategy.position_size > 0) and (close < STOP_LOSS)

strategy.close("buy", comment = "Soft Stop Loss")

alert("Position closed: Soft Stop Loss triggered at " + str.tostring(close), alert.freq_once_per_bar)

// =============================================================================

// ENTRY CONDITIONS

// =============================================================================

// Enhanced entry signal with volume confirmation to avoid false breakouts

isEntrySignal = ta.crossover(close, ema200) and (strategy.position_size == 0) and isVolumeConfirmed

if isEntrySignal

// Cancel any pending orders

strategy.cancel("buy")

strategy.cancel("sell")

// Enter long at market on crossover

strategy.entry("buy", strategy.long)

// Set initial stop loss (2 * ATR below close, or use custom value if specified)

if initialStopLoss > 0

STOP_LOSS := initialStopLoss

else

STOP_LOSS := close - 2 * smaTrueRange

// Alert for position opened

alert("Position opened: Long entry at " + str.tostring(close) + " with stop loss at " + str.tostring(STOP_LOSS), alert.freq_once_per_bar)

// =============================================================================

// PLOTTING

// =============================================================================

// Plot EMA 200

plot(ema200, color = color.blue, title = "EMA 200", linewidth = 2)

// Plot Stop Loss

plot(strategy.position_size > 0 ? STOP_LOSS : lowestLow, color = color.red, title = "Stop Loss", linewidth = 2)

// Plot confirmation signals

plotshape(isEntrySignal, title="Confirmed Breakout", location=location.belowbar,

color=color.green, style=shape.triangleup, size=size.normal)

// Plot volume confirmation (only if enabled)

bgcolor(useVolumeConfirmation and isVolumeConfirmed and ta.crossover(close, ema200) ? color.new(color.green, 90) : na, title="Volume Confirmed")