この戦略の強さは?

市場では90%のトレーダーが 落とし穴を狙っているのに,本当の高手たちは “価格の空白”を探している!Advanced FVG Strategy Pro+は,これらの謎の穴を捕まえるためのスーパー武器です.

FVG (フェアバリューギャップ) は,単に価格が跳ね上がったときに残される”空白地帯”であり,まるであなたが水槽を横切って歩いているように,いつか戻ってきて”穴を補う”のです.

ブラック・テクノロジーの3つのコア

1. 多時間枠分析 戦略は5分間の図で実行できますが,1時間のFVG信号で,望遠鏡で遠くの山を見るようなもので,拡大鏡で細部を見て,視野はより広範囲です!

2. IIRトレンドフィルター

これは普通の移動平均値ではありません! 工学的なIIR低通波フィルターで,トレンドの方向を正確に識別できます. 想像してみて下さい,これはあなたの取引に”トレンドレーダー”を装着して,風が通っているときにのみ攻撃します!

3. スマートリスクマネジメント パーセンテージと固定金利の2つのリスクモードをサポートし,防爆貯金保護機能もあります. 車の安全帯と安全袋の2つの保護があるように,あなたの口座はより安全です!

実戦用シナリオ

適切な状況とは

- 震災の中,突破口を探す

- トレンドの逆戻り

- 重要支援抵抗点の近くの精密狙撃

洞窟のガイドライン:

- 重要なニュースの前に停止

- 流動性が低い小銭には注意

- 市場変動に合わせてリスクパラメータを調整する

:なぜこの戦略を選んだの?

伝統的な戦略では,信号が少ないからチャンスを逃すか,信号が多すぎて偽突破の穴に突入する.この戦略は,複数のフィルタリングメカニズムを介して, “むしろ欠けていた”の精度の攻撃を成し遂げた!

調律師の調律のように,様々な市場の状況に合わせて,最も適切な取引のリズムを”調律”することができます.

FVGの魅力とは,あなたが毎日取引するのではなく,あなたが最も確実なときに取引することを意味します.

ストラテジーソースコード

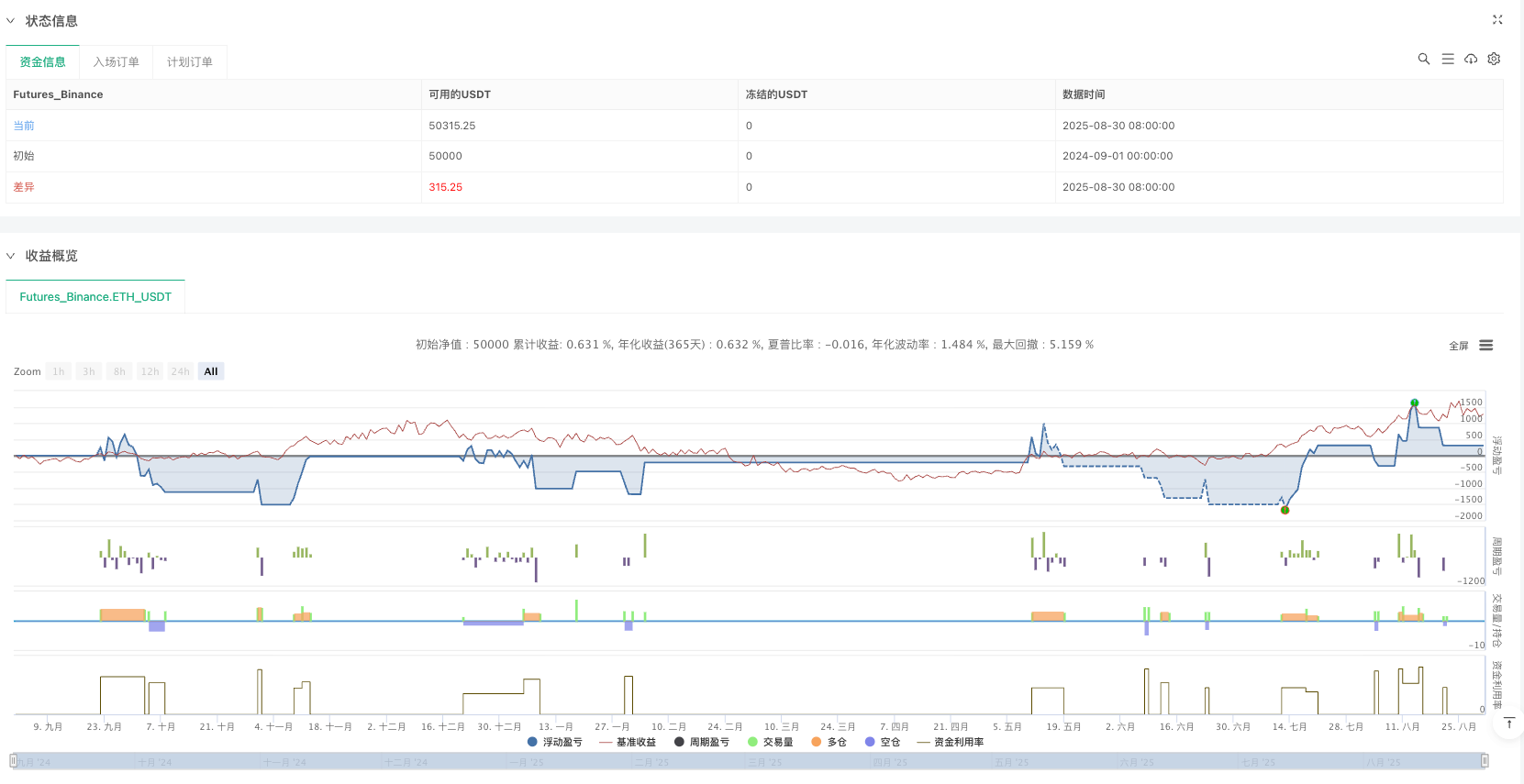

/*backtest

start: 2024-09-01 00:00:00

end: 2025-08-31 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Advanced FVG Strategy Pro+ (v6)", overlay=true,

initial_capital=10000,

default_qty_type=strategy.fixed,

default_qty_value=1,

commission_type=strategy.commission.percent,

commission_value=0.05,

calc_on_every_tick=true,

process_orders_on_close=true)

// ---------------- Inputs ----------------

fvg_tf = input.timeframe("", "FVG Timeframe (MTF)")

bodySens = input.float(1.0, "FVG Body Sensitivity", step=0.1, minval=0.0)

mitigate_mid = input.bool(true, "Mitigation on Midpoint")

rr_ratio = input.float(2.0, "Risk/Reward Ratio", step=0.1)

risk_mode = input.string("Percent", "Risk Mode", options=["Percent","Fixed $"])

risk_perc = input.float(1.0, "Risk % (of Equity)", minval=0.1, maxval=10.0)

risk_fixed = input.float(100.0, "Fixed $ Risk", minval=1.0)

useTrend = input.bool(true, "Filter with FVG Trend")

rp = input.float(10.0, "Trend Filter Ripple (dB)", minval=0.1, step=0.1)

fc = input.float(0.1, "Trend Filter Cutoff (0..0.5)", minval=0.01, maxval=0.5, step=0.01)

extendLength = input.int(10, "Extend Boxes (bars)", minval=0)

// ---------------- MTF candles ----------------

c1 = fvg_tf == "" ? close : request.security(syminfo.tickerid, fvg_tf, close, lookahead = barmerge.lookahead_on)

o1 = fvg_tf == "" ? open : request.security(syminfo.tickerid, fvg_tf, open, lookahead = barmerge.lookahead_on)

h1 = fvg_tf == "" ? high : request.security(syminfo.tickerid, fvg_tf, high, lookahead = barmerge.lookahead_on)

l1 = fvg_tf == "" ? low : request.security(syminfo.tickerid, fvg_tf, low, lookahead = barmerge.lookahead_on)

h2 = fvg_tf == "" ? high[2] : request.security(syminfo.tickerid, fvg_tf, high[2], lookahead = barmerge.lookahead_on)

l2 = fvg_tf == "" ? low[2] : request.security(syminfo.tickerid, fvg_tf, low[2], lookahead = barmerge.lookahead_on)

// ---------------- FVG detection ----------------

float wick = math.abs(c1 - o1)

float avg_body = ta.sma(wick, 50)

bool bullFVG = (l1 > h2) and (c1 > h2) and (wick >= avg_body * bodySens)

bool bearFVG = (h1 < l2) and (c1 < l2) and (wick >= avg_body * bodySens)

// ---------------- Trend Filter (IIR low-pass) ----------------

float src = (h1 + l1) / 2.0

float epsilon = math.sqrt(math.pow(10.0, rp/10.0) - 1.0)

float d = math.sqrt(1.0 + epsilon * epsilon)

float c = 1.0 / math.tan(math.pi * fc)

float norm = 1.0 / (1.0 + d * c + c * c)

float b0 = norm

float b1 = 2.0 * norm

float b2 = norm

float a1 = 2.0 * norm * (1.0 - c * c)

float a2 = norm * (1.0 - d * c + c * c)

var float trend = na

var float trend1 = na

var float trend2 = na

trend := bar_index < 2 ? src : (b0 * src + b1 * src[1] + b2 * src[2] - a1 * nz(trend1) - a2 * nz(trend2))

trend2 := trend1

trend1 := trend

bool trendUp = trend > nz(trend[1])

bool trendDown = trend < nz(trend[1])

// ---------------- Strategy Conditions ----------------

bool longCond = bullFVG and (not useTrend or trendUp)

bool shortCond = bearFVG and (not useTrend or trendDown)

// stop loss / take profit (based on MTF gap edges)

float longSL = l1

float shortSL = h1

float longRisk = close - longSL

float shortRisk = shortSL - close

float longTP = close + (close - longSL) * rr_ratio

float shortTP = close - (shortSL - close) * rr_ratio

// ---------------- Position sizing ----------------

float equity = strategy.equity

float riskCash = risk_mode == "Percent" ? (equity * risk_perc / 100.0) : risk_fixed

float longQty = (longRisk > 0.0) ? (riskCash / longRisk) : na

float shortQty = (shortRisk > 0.0) ? (riskCash / shortRisk) : na

// safety cap: avoid ridiculously large position sizes (simple protective cap)

float maxQty = math.max(1.0, (equity / math.max(1e-8, close)) * 0.25) // cap ~25% equity worth of base asset

if not na(longQty)

longQty := math.min(longQty, maxQty)

if not na(shortQty)

shortQty := math.min(shortQty, maxQty)

// small extra guard (do not trade if qty becomes extremely small or NaN)

bool canLong = longCond and not na(longQty) and (longQty > 0.0)

bool canShort = shortCond and not na(shortQty) and (shortQty > 0.0)

// ---------------- Orders ----------------

if canLong

strategy.entry("Long", strategy.long, qty = longQty)

strategy.exit("Long TP/SL", "Long", stop = longSL, limit = longTP)

if canShort

strategy.entry("Short", strategy.short, qty = shortQty)

strategy.exit("Short TP/SL", "Short", stop = shortSL, limit = shortTP)

// ---------------- Visuals ----------------

plotshape(longCond, title="Bull FVG", color=color.new(color.green, 0), style=shape.triangleup, location=location.belowbar, size=size.small)

plotshape(shortCond, title="Bear FVG", color=color.new(color.red, 0), style=shape.triangledown, location=location.abovebar, size=size.small)

plot(useTrend ? trend : na, title="FVG Trend", color=trendUp ? color.lime : trendDown ? color.red : color.gray, linewidth=2)