トレンドリバープルバック戦略

EMA RSI ATR CHANDELIER

“トレンド・リバー”とは何か?

この戦略は5つのEMA均線を”川”として考えます. 川の底と川面があるように,5つの均線が整列すると,その間の領域が”トレンド川”になります. 焦点を絞りましょう. 川の方向が明確になったとき (多頭:快線上,空頭:快線下) 稼ぐチャンスです.

川の流れの方向を見るのと 同じくらい簡単です 川の流れがどこへ行くか,私たちもどこへ行くか

魚が水に泳ぎ戻り,網を張るためのコア戦略

この戦略の最も賢いところは,価格が急上昇した時に上昇を促すのではなく,忍耐強く”逆調”を待つことです.

具体的にはどうでしょうか?

- 多頭シグナル:上昇傾向 + RSI≥60 + 価格が40%の深さまで戻る + 急速なEMAを再び突破する

- 空頭シグナル:下向きのトレンド + RSI≤40 + 価格が40%の高さまで反発 + 急速なEMAを再び破る

魚が飛び上がった時に落ちるのではなく 慣れた水域に戻るまで待つように!

リスクマネジメント:本金”%でリスクをとる

この戦略の最も親切なところは,ポジションの大きさを自動的に計算することです.

- 取引のリスクは本金1%に制限されます.

- ATRでストップを設定します.

- 利益と損失の比率は2:1に設定されています.

- そして,Chandlerは,ストップダメージ保護の利得を追跡

車の安全帯のようなものです 事故を避けるためではなく,安全で楽しい運転をするために!

この戦略はなぜ重要なのか?

取引者の3つの痛みを解決しました.

- 追いついた選手は,高位接着を避けるために,再開を待った.

- 購入した金額は不明です自動でポジションを計算し,リスクをコントロールする

- 逃げるときがわからないストップ・ダメージ,ストップ・ストップ,ストップ・トラッキング

この戦略は”安定して勝ちたい”トレーダーに特に適しています. 一夜にして金持ちになるのではなく,トレンドの中で安定して儲けるのに役立ちます.

||

🌊 What is “Trend River”? This Analogy is Brilliant!

You know what? This strategy imagines 5 EMA lines as a “river”! Just like a real river has riverbed and surface, when 5 EMAs align properly, the area between them forms our “trend river”. Key point! When the river direction is clear (bullish: fast line above, bearish: fast line below), that’s when our money-making opportunities arrive!

It’s as simple as watching water flow direction - wherever the river flows, that’s where we profit! 💰

🎯 Core Strategy: Wait for Fish to Return Before Casting the Net

What’s the smartest part of this strategy? It doesn’t chase prices during rallies, but patiently waits for “pullbacks”!

How does it work exactly?

- Long signal: Uptrend + RSI≥60 + Price pulls back to 40% river depth + Re-breaks above fast EMA

- Short signal: Downtrend + RSI≤40 + Price bounces to 40% river height + Re-breaks below fast EMA

It’s like fishing - you don’t cast when fish jump highest, but wait for them to return to familiar waters! 🎣

💡 Risk Management: Only Risk 1% Capital Each Time

Here’s the pitfall guide! The most thoughtful part of this strategy is automatic position sizing:

- Each trade risks only 1% of capital

- Uses ATR indicator for stop loss (2x ATR)

- Risk-reward ratio set at 2:1 (earn 2 to risk 1)

- Plus Chandelier trailing stop to protect profits

It’s like wearing a seatbelt while driving - not because you expect an accident, but to enjoy the ride with peace of mind! 🚗

🚀 Why is This Strategy Worth Attention?

Solves three major trader pain points:

- FOMO trading: Wait for pullbacks instead of buying tops

- Position sizing confusion: Auto-calculates position size with controlled risk

- Exit uncertainty: Has stop loss, take profit, and trailing stop

This strategy is perfect for traders who want “steady wins”. It doesn’t promise overnight riches, but helps you profit steadily in trends! Remember: In the river of trading, the most important thing isn’t swimming fastest, but swimming most steadily 🏊♀️

[/trans]

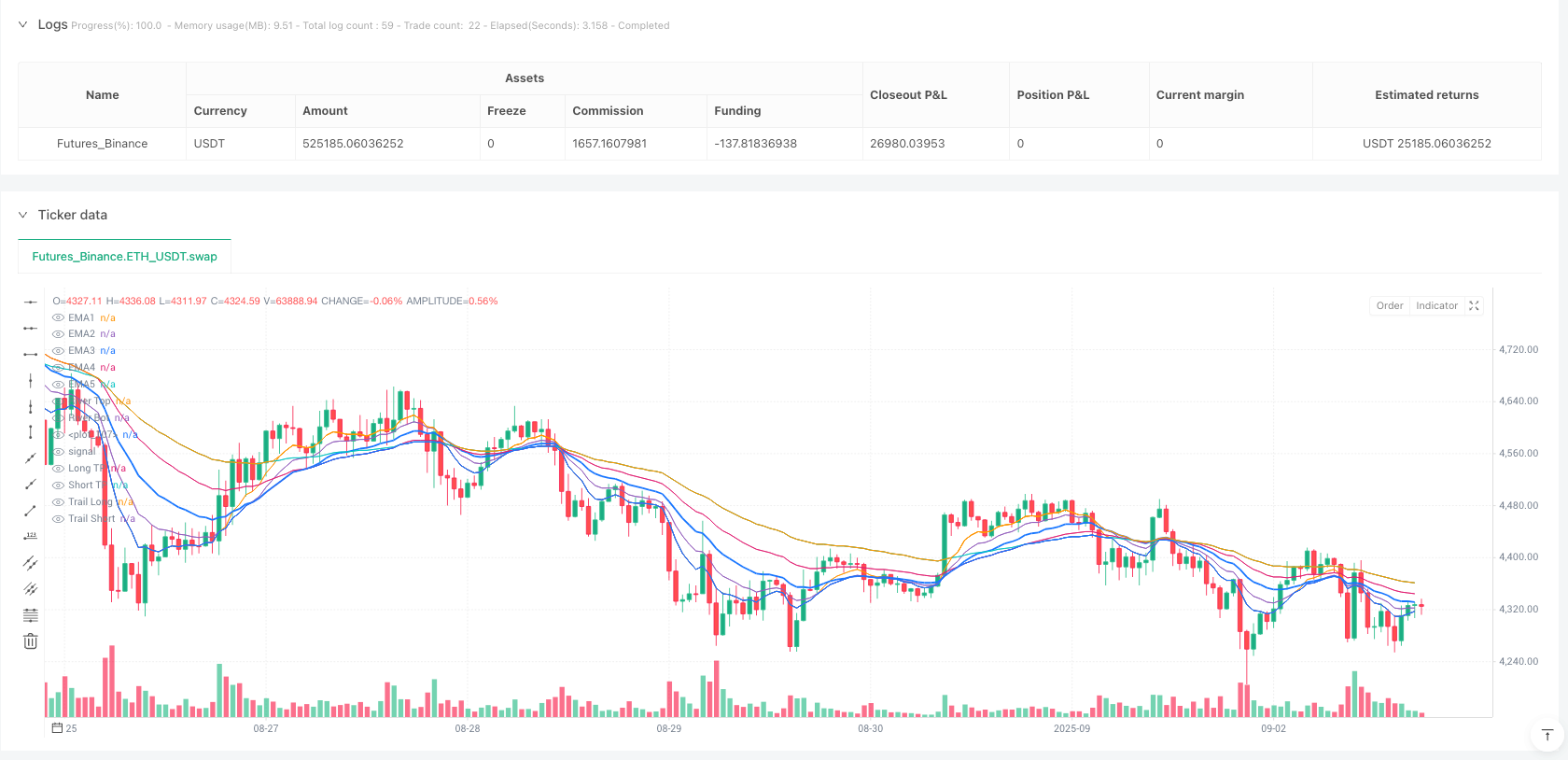

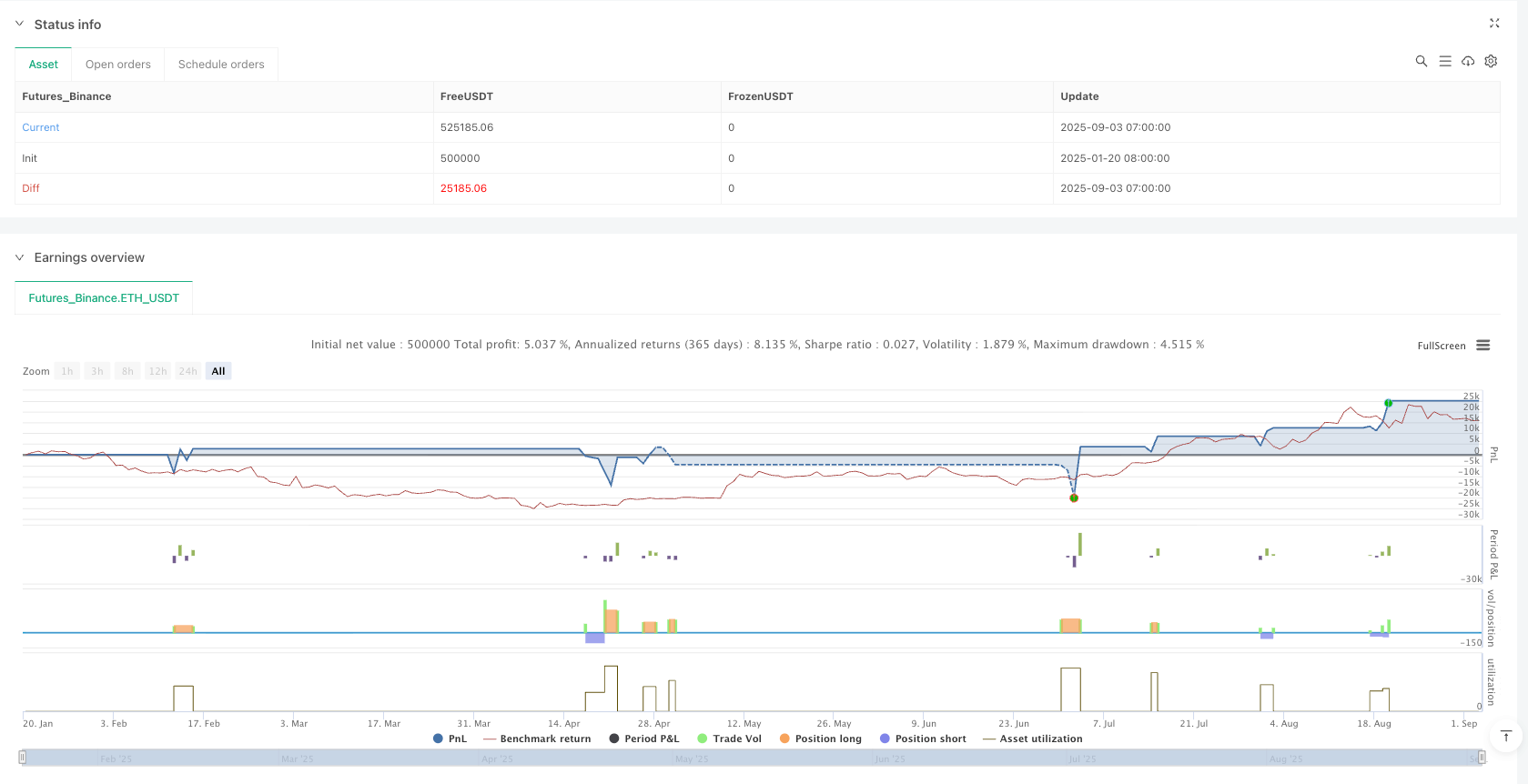

/*backtest

start: 2025-01-20 08:00:00

end: 2025-09-03 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":500000}]

*/

//@version=5

strategy("Trend River Pullback Strategy v1",

overlay=true, initial_capital=10000, commission_type=strategy.commission.percent, commission_value=0.02,

pyramiding=0, calc_on_order_fills=true, calc_on_every_tick=true, margin_long=1, margin_short=1)

// ===== Inputs

// EMA river

emaFastLen = input.int(8, "EMA1 (fast)")

ema2Len = input.int(13, "EMA2")

emaMidLen = input.int(21, "EMA3 (middle)")

ema4Len = input.int(34, "EMA4")

emaSlowLen = input.int(55, "EMA5 (slow)")

// Pullback and momentum

rsiLen = input.int(14, "RSI length")

rsiOB = input.int(60, "RSI trend threshold (long)")

rsiOS = input.int(40, "RSI trend threshold (short)")

pullbackPct = input.float(40.0, "Pullback depth % of river width", minval=0, maxval=100)

// Risk management

riskPct = input.float(1.0, "Risk per trade % of capital", step=0.1, minval=0.1)

atrLen = input.int(14, "ATR length (stop/trailing)")

atrMultSL = input.float(2.0, "ATR multiplier for stop", step=0.1)

tpRR = input.float(2.0, "Take profit R-multiple", step=0.1)

// Trailing stop

useTrail = input.bool(true, "Enable trailing stop (Chandelier)")

trailMult = input.float(3.0, "ATR multiplier for trailing", step=0.1)

// ===== Calculations

ema1 = ta.ema(close, emaFastLen)

ema2 = ta.ema(close, ema2Len)

ema3 = ta.ema(close, emaMidLen)

ema4 = ta.ema(close, ema4Len)

ema5 = ta.ema(close, emaSlowLen)

// River: top/bottom as envelope of averages

riverTop = math.max(math.max(ema1, ema2), math.max(ema3, math.max(ema4, ema5)))

riverBot = math.min(math.min(ema1, ema2), math.min(ema3, math.min(ema4, ema5)))

riverMid = (riverTop + riverBot) / 2.0

riverWidth = riverTop - riverBot

// Trend conditions: EMA alignment

bullAligned = ema1 > ema2 and ema2 > ema3 and ema3 > ema4 and ema4 > ema5

bearAligned = ema1 < ema2 and ema2 < ema3 and ema3 < ema4 and ema4 < ema5

// Momentum

rsi = ta.rsi(close, rsiLen)

// Pullback into river

pullbackLevelBull = riverTop - riverWidth * (pullbackPct/100.0)

pullbackLevelBear = riverBot + riverWidth * (pullbackPct/100.0)

pullbackOkBull = bullAligned and rsi >= rsiOB and low <= pullbackLevelBull

pullbackOkBear = bearAligned and rsi <= rsiOS and high >= pullbackLevelBear

// Entry trigger: return to momentum (fast EMA crossover)

longTrig = pullbackOkBull and ta.crossover(close, ema1)

shortTrig = pullbackOkBear and ta.crossunder(close, ema1)

// ATR for stops

atr = ta.atr(atrLen)

// ===== Position sizing by risk

capital = strategy.equity

riskMoney = capital * (riskPct/100.0)

// Preliminary stop levels

longSL = close - atrMultSL * atr

shortSL = close + atrMultSL * atr

// Tick value and size

tickValue = syminfo.pointvalue

// Avoid division by zero

slDistLong = math.max(close - longSL, syminfo.mintick)

slDistShort = math.max(shortSL - close, syminfo.mintick)

// Number of contracts/lots

qtyLong = riskMoney / (slDistLong * tickValue)

qtyShort = riskMoney / (slDistShort * tickValue)

// Limit: not less than 0

qtyLong := math.max(qtyLong, 0)

qtyShort := math.max(qtyShort, 0)

// ===== Entries

if longTrig and strategy.position_size <= 0

strategy.entry("Long", strategy.long, qty=qtyLong)

if shortTrig and strategy.position_size >= 0

strategy.entry("Short", strategy.short, qty=qtyShort)

// ===== Exits: fixed TP by R and stop

// Store entry price

var float entryPrice = na

if strategy.position_size != 0 and na(entryPrice)

entryPrice := strategy.position_avg_price

if strategy.position_size == 0

entryPrice := na

// Targets

longTP = na(entryPrice) ? na : entryPrice + tpRR * (entryPrice - longSL)

shortTP = na(entryPrice) ? na : entryPrice - tpRR * (shortSL - entryPrice)

// Trailing: Chandelier

trailLong = close - trailMult * atr

trailShort = close + trailMult * atr

// Final exit levels

useTrailLong = useTrail and strategy.position_size > 0

useTrailShort = useTrail and strategy.position_size < 0

// For long

if strategy.position_size > 0

stopL = math.max(longSL, na)

tStop = useTrailLong ? trailLong : longSL

strategy.exit("L-Exit", from_entry="Long", stop=tStop, limit=longTP)

// For short

if strategy.position_size < 0

stopS = math.min(shortSL, na)

tStopS = useTrailShort ? trailShort : shortSL

strategy.exit("S-Exit", from_entry="Short", stop=tStopS, limit=shortTP)

// ===== Visuals

plot(ema1, "EMA1", display=display.all, linewidth=1)

plot(ema2, "EMA2", display=display.all, linewidth=1)

plot(ema3, "EMA3", display=display.all, linewidth=2)

plot(ema4, "EMA4", display=display.all, linewidth=1)

plot(ema5, "EMA5", display=display.all, linewidth=1)

plot(riverTop, "River Top", style=plot.style_linebr, linewidth=1)

plot(riverBot, "River Bot", style=plot.style_linebr, linewidth=1)

fill(plot1=plot(riverTop, display=display.none), plot2=plot(riverBot, display=display.none), title="River Fill", transp=80)

plot(longTP, "Long TP", style=plot.style_linebr)

plot(shortTP, "Short TP", style=plot.style_linebr)

plot(useTrailLong ? trailLong : na, "Trail Long", style=plot.style_linebr)

plot(useTrailShort ? trailShort : na, "Trail Short", style=plot.style_linebr)

// Signal markers

plotshape(longTrig, title="Long Trigger", style=shape.triangleup, location=location.belowbar, size=size.tiny, text="L")

plotshape(shortTrig, title="Short Trigger", style=shape.triangledown, location=location.abovebar, size=size.tiny, text="S")

// ===== Alerts

alertcondition(longTrig, title="Long Signal", message="Long signal: trend aligned + pullback + momentum")

alertcondition(shortTrig, title="Short Signal", message="Short signal: trend aligned + pullback + momentum")