この戦略の強さは?

この戦略は,あなたの取引に”火の目”を装着しているようなものです.これは,1分と5分間の超短線取引のために特別に設計されており,最も強力な5つの技術指標を組み合わせています.

は重点を置く! この組み合わせはどのように打つのか?

この戦略は,非常に厳格な”面接官”のようなもので,複数の条件を同時に満たす取引先だけが, 審査を通過させられると想像してください.

マルチヘッド信号は,満たさなければならない価格が急速なEMAを上回り,MACDが正し,ブリンを突破し,RSIが50から80の間で,十分な取引量のサポートが必要です.これは,人が高貴で,才能があり,性格が良いことを要求するのと同じくらい厳しいです!

空気信号は逆です契約の条件を逆向きに満たすことで, 取引が十分に技術的にサポートされていることを保証します.

の穴を避けるためのガイド:なぜ超短線を選んだのか

この戦略の最も賢いところは,そのリスク管理です! ストップ・ロスは0.5%で, ストップ・ストップは1.0%で, リスクと利益の比率は1:2です. これは”小“の完璧な解釈です - 損失は小さいが,利益は倍増します!

超短線のK線形状のノイズが大きいので,判断を誤導しやすいので,1分間のグラフで自動的に図形状認識をオフにします.これは,騒音のある環境で自動的にノイズを抑えるようにスマートです!

戦闘用:この戦術はどんな問題解決に役立つのか?

適した人材: 仮想通貨市場で日中取引をしたい方,特に,小規模で頻繁な取引で利益を得たい方へ.

痛みを解消する: 単一の指標の偽信号困惑に別れ! 複数の確認メカニズムにより,信号の信頼性が大きく向上する. 同時に,厳格なリスク管理は,判断が間違っても,損失は制御範囲内にあることを可能にします.

この戦略は,流動性の高い暗号通貨のペアに対して,精巧な手術刀のようなものだと覚えておいてください. 資金管理が上手く行われれば,あなたの取引の武器庫に役立つでしょう!

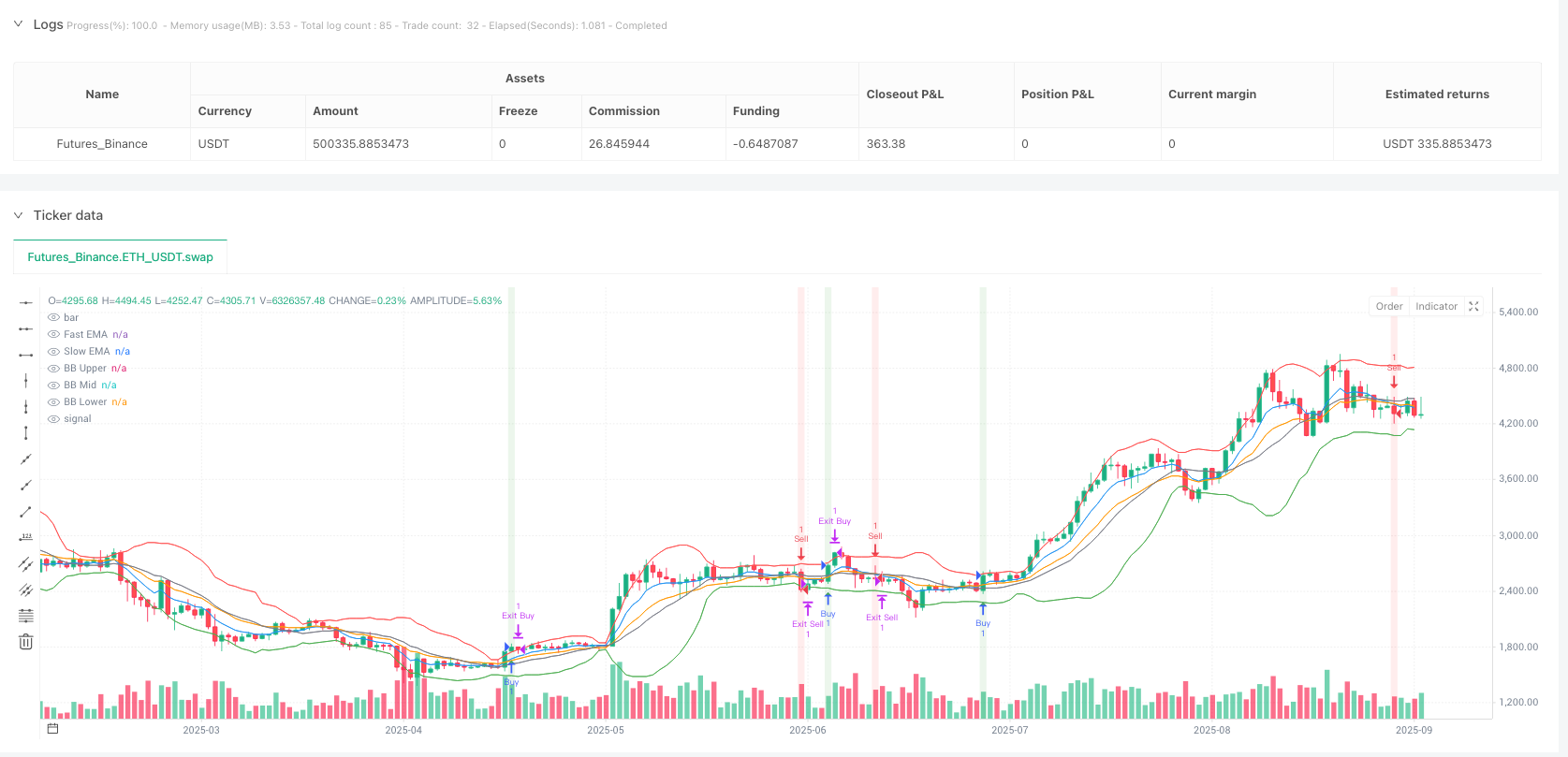

/*backtest

start: 2024-09-08 00:00:00

end: 2025-09-06 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":500000}]

*/

//@version=5

strategy("Advanced Crypto Scalping Strategy - 1 & 5 Min Charts", overlay=true, margin_long=100, margin_short=100)

// Inputs for customization (optimized for 1-min and 5-min timeframes)

emaFastLen = input.int(7, "Fast EMA Length", minval=1, tooltip="Use 5-8 for 1-min, 7-10 for 5-min")

emaSlowLen = input.int(14, "Slow EMA Length", minval=1, tooltip="Use 10-15 for 1-min, 14-21 for 5-min")

rsiLen = input.int(10, "RSI Length", minval=1, tooltip="Use 8-12 for 1-min, 10-14 for 5-min")

rsiOverbought = input.int(80, "RSI Overbought", minval=50, maxval=100, tooltip="Use 80-85 for 1-min, 75-80 for 5-min")

rsiOversold = input.int(20, "RSI Oversold", minval=0, maxval=50, tooltip="Use 15-20 for 1-min, 20-25 for 5-min")

macdFast = input.int(8, "MACD Fast Length", minval=1, tooltip="Use 6-10 for 1-min, 8-12 for 5-min")

macdSlow = input.int(21, "MACD Slow Length", minval=1, tooltip="Use 15-21 for 1-min, 21-26 for 5-min")

macdSignal = input.int(5, "MACD Signal Smoothing", minval=1, tooltip="Use 4-6 for 1-min, 5-9 for 5-min")

bbLen = input.int(15, "Bollinger Bands Length", minval=1, tooltip="Use 10-15 for 1-min, 15-20 for 5-min")

bbMult = input.float(1.8, "Bollinger Bands Multiplier", minval=0.1, step=0.1, tooltip="Use 1.5-1.8 for 1-min, 1.8-2.0 for 5-min")

slPerc = input.float(0.5, "Stop Loss %", minval=0.1, step=0.1, tooltip="Use 0.3-0.6 for 1-min, 0.5-0.8 for 5-min")

tpPerc = input.float(1.0, "Take Profit %", minval=0.5, step=0.1, tooltip="Use 0.8-1.2 for 1-min, 1.0-1.5 for 5-min")

useCandlePatterns = input.bool(false, "Use Candlestick Patterns", tooltip="Disable for 1-min to reduce noise, enable for 5-min")

useVolumeFilter = input.bool(true, "Use Volume Filter", tooltip="Enable for both timeframes to filter low-volume signals")

signalSize = input.float(2.0, "Signal Arrow Size", minval=1.0, maxval=3.0, step=0.5, tooltip="1.0=tiny, 2.0=small, 3.0=normal")

bgTransparency = input.int(85, "Background Highlight Transparency", minval=0, maxval=100)

labelOffset = input.float(0.8, "Label Offset %", minval=0.5, maxval=5, step=0.1)

// Calculate indicators

emaFast = ta.ema(close, emaFastLen)

emaSlow = ta.ema(close, emaSlowLen)

rsi = ta.rsi(close, rsiLen)

[macdLine, signalLine, _] = ta.macd(close, macdFast, macdSlow, macdSignal)

[bbMid, bbUpper, bbLower] = ta.bb(close, bbLen, bbMult)

volMa = ta.sma(volume, 15)

// Trend determination

bullTrend = close > emaFast and emaFast > emaSlow

bearTrend = close < emaFast and emaFast < emaSlow

// EMA crossover signals

emaCrossBuy = ta.crossover(emaFast, emaSlow)

emaCrossSell = ta.crossunder(emaFast, emaSlow)

// Momentum signals

bullMacd = ta.crossover(macdLine, signalLine) and macdLine > 0

bearMacd = ta.crossunder(macdLine, signalLine) and macdLine < 0

// Channel breakouts

bullBreak = ta.crossover(close, bbUpper)

bearBreak = ta.crossunder(close, bbLower)

// RSI conditions

bullRsi = rsi > 50 and rsi < rsiOverbought

bearRsi = rsi < 50 and rsi > rsiOversold

// Candlestick patterns (optional, less reliable on 1-min)

bullEngulf = close > open and open < low[1] and close > high[1] and useCandlePatterns

bearEngulf = close < open and open > high[1] and close < low[1] and useCandlePatterns

hammer = (high - low) > 2 * (close - open) and close > open and (close - low) / (high - low) > 0.6 and useCandlePatterns

shootingStar = (high - low) > 2 * (open - close) and close < open and (high - close) / (high - low) > 0.6 and useCandlePatterns

bullCandle = bullEngulf or hammer

bearCandle = bearEngulf or shootingStar

// Volume filter

volFilter = volume > volMa * 1.8 or not useVolumeFilter

// Combined buy/sell conditions

mainBuyCondition = bullTrend and bullMacd and bullBreak and bullRsi and bullCandle and volFilter

mainSellCondition = bearTrend and bearMacd and bearBreak and bearRsi and bearCandle and volFilter

buyCondition = mainBuyCondition or emaCrossBuy

sellCondition = mainSellCondition or emaCrossSell

// Strategy entries

var bool isBuyActive = false

var bool isSellActive = false

if (buyCondition and strategy.position_size == 0 and not isBuyActive)

strategy.entry("Buy", strategy.long)

label.new(bar_index, low * (1 - labelOffset / 100), emaCrossBuy ? "EMA BUY" : "BUY", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.large)

isBuyActive := true

isSellActive := false

if (sellCondition and strategy.position_size == 0 and not isSellActive)

strategy.entry("Sell", strategy.short)

label.new(bar_index, high * (1 + labelOffset / 100), emaCrossSell ? "EMA SELL" : "SELL", color=color.red, style=label.style_label_down, textcolor=color.white, size=size.large)

isSellActive := true

isBuyActive := false

// Exits

if (strategy.position_size > 0) // Long position

strategy.exit("Exit Buy", "Buy", stop=strategy.position_avg_price * (1 - slPerc / 100), limit=strategy.position_avg_price * (1 + tpPerc / 100))

if (strategy.position_size == 0)

isBuyActive := false

if (strategy.position_size < 0) // Short position

strategy.exit("Exit Sell", "Sell", stop=strategy.position_avg_price * (1 + slPerc / 100), limit=strategy.position_avg_price * (1 - tpPerc / 100))

if (strategy.position_size == 0)

isSellActive := false

// Plot indicators

plot(emaFast, color=color.blue, title="Fast EMA")

plot(emaSlow, color=color.orange, title="Slow EMA")

plot(bbUpper, color=color.red, title="BB Upper")

plot(bbMid, color=color.gray, title="BB Mid")

plot(bbLower, color=color.green, title="BB Lower")

// Plot signals with fixed size to avoid type mismatch

plotshape(buyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.normal)

plotshape(sellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.normal)

// Background highlights

bgcolor(buyCondition ? color.new(color.green, bgTransparency) : sellCondition ? color.new(color.red, bgTransparency) : na)