バイポーラ平滑化オシレーター戦略

SMA stdev EMA CROSSOVER CROSSUNDER

作成日:

2025-10-17 15:20:53

最終変更日:

2025-10-17 15:20:53

コピー:

8

クリック数:

344

2

フォロー

365

フォロワー

これは神仙の策略か?

この戦略は,市場に”情緒探知器”を装着しているようなものです. 双極の平らな振動器によって市場の”喜怒哀楽”を感知し,市場が過度に興奮 (オーバーバイ) したり過度に落ち込んだ (オーバーセール) 時に取引信号を発信します. 重点点! これは普通の振動器ではなく,ダブル美容処理された高級バージョンで,市場のノイズを効果的にフィルターして,本当のトレンドの方向を見ることができます.

の仕組みが明らかになった

この策略は,超敏感な”市場体温計”のようなものだと想像してください. まず,価格が25周期平均線からどのくらい偏っているかを計算し,標準化処理を行います (異なる身長の人を標準身長比率に換算するように). 次に,重要な”二重平滑”プロセスがあります.

この戦略の超能力は

この戦略の最も強力な点は,その”逆信号平仓”メカニズムです - それは,運転中に赤信号を見たときにすぐに車を停止するように賢明です! 逆信号が表示されたときに,戦略はすぐに平仓し,完全に停止しません.

は危険を警告する

集中する! この戦略は素晴らしいですが,万能ではありません. 強いトレンドの市場で,振動器は”迷子”になり,高速道路で都市部ナビゲーションを使用するように,あまり適切ではありません. 固定の値設定は,異なる市場環境で不快になり,実際の状況に応じて柔軟に調整する必要があります.

ストラテジーソースコード

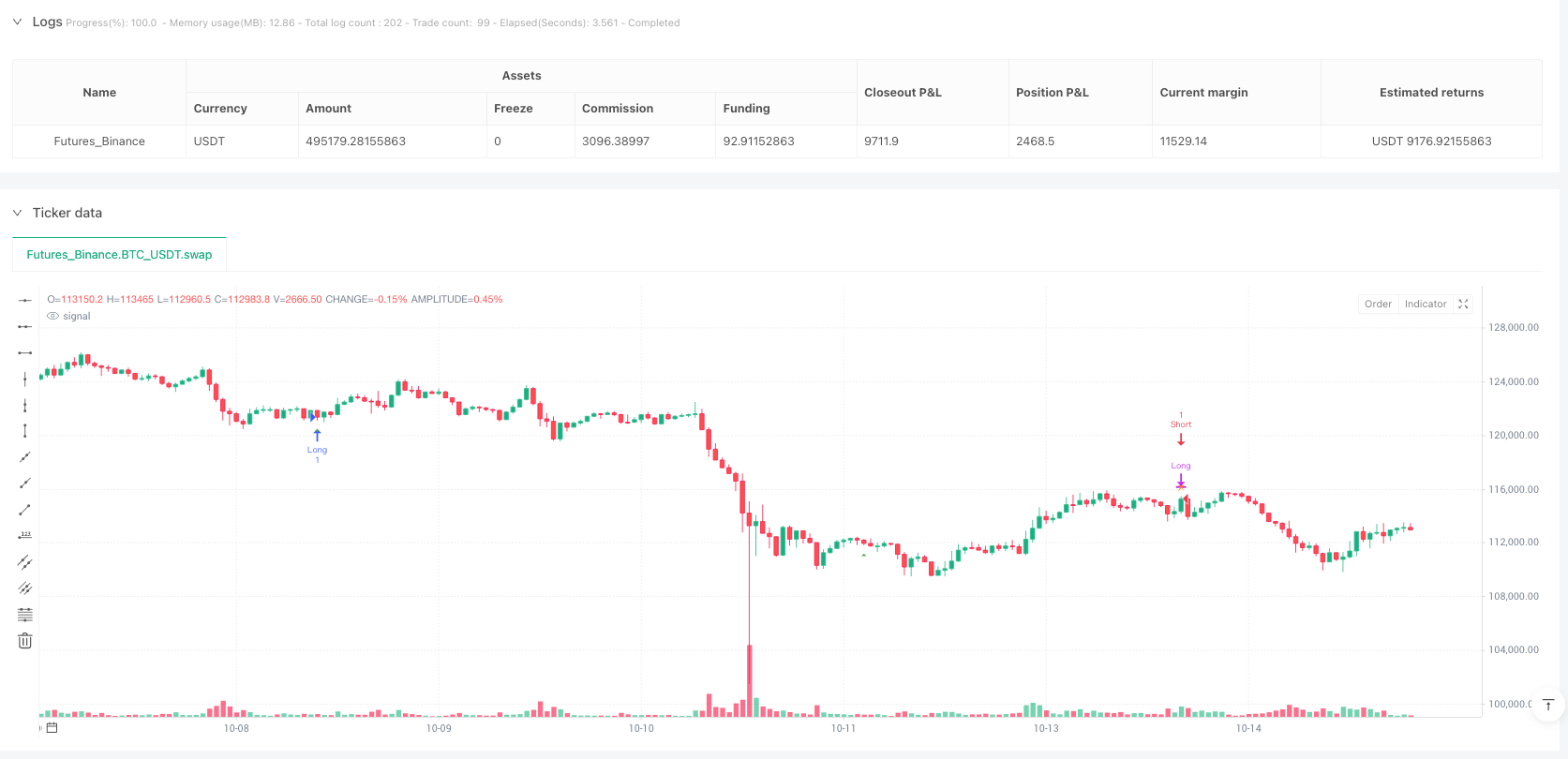

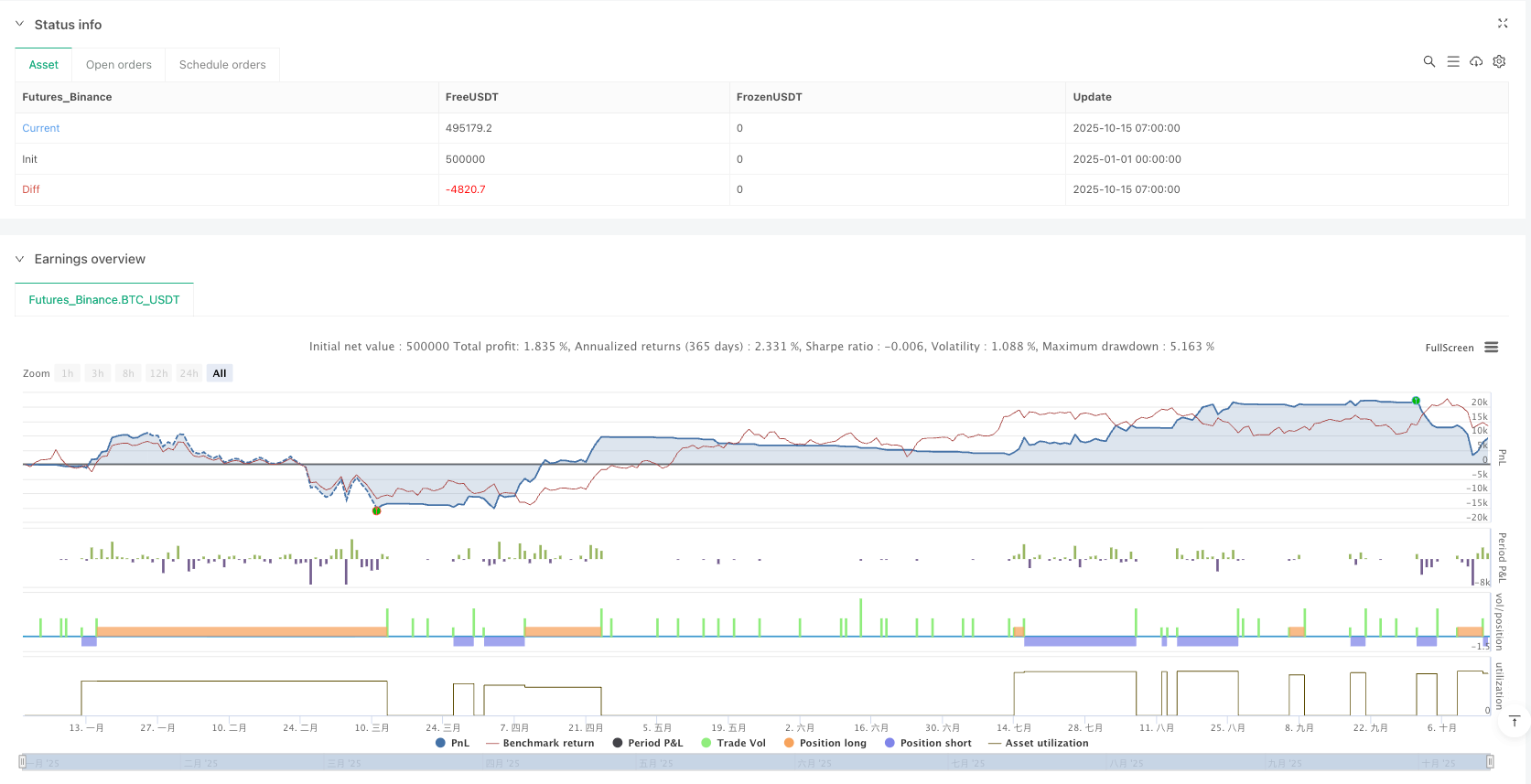

/*backtest

start: 2025-01-01 00:00:00

end: 2025-10-15 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":500000}]

*/

//@version=6

strategy("Two-Pole Threshold Entries + Opposite-Signal & Stop Exits + Stats",

overlay=true,

max_labels_count=500)

// === Inputs ===

length = input.int(20, minval=1, title="Filter Length")

buyTrig = input.float(-0.8, title="Buy Threshold (osc ↑)")

sellTrig = input.float( 0.8, title="Sell Threshold (osc ↓)")

stopLossPts = input.int(10, minval=1, title="Stop Loss (pts)")

// === Two-Pole Oscillator ===

sma25 = ta.sma(close, 25)

dev = (close - sma25) - ta.sma(close - sma25, 25)

norm = dev / ta.stdev(close - sma25, 25)

alpha = 2.0 / (length + 1)

var float s1 = na

var float s2 = na

s1 := na(s1) ? norm : (1 - alpha) * s1 + alpha * norm

s2 := na(s2) ? s1 : (1 - alpha) * s2 + alpha * s1

osc = s2

prevOsc = osc[4]

// === Trigger Cross Signals ===

isLongSig = ta.crossover(osc, buyTrig) and barstate.isconfirmed

isShortSig = ta.crossunder(osc, sellTrig) and barstate.isconfirmed

// === State & Stats Vars ===

var int tradeDir = 0 // 1=long, -1=short, 0=flat

var float entryPrice = na

var int entryBar = na

var int buyTotal = 0

var int buyFailed = 0

var float sumMoveB = 0.0

var int cntMoveB = 0

var float sumPLptsB = 0.0

var int sellTotal = 0

var int sellFailed = 0

var float sumMoveS = 0.0

var int cntMoveS = 0

var float sumPLptsS = 0.0

// === Exit Marker Flags ===

var bool longStopHit = false

var bool shortStopHit = false

var bool longSigExit = false

var bool shortSigExit = false

longStopHit := false

shortStopHit := false

longSigExit := false

shortSigExit := false

// === 1) Opposite-Signal Exit ===

if tradeDir == 1 and isShortSig

float ptsL = close - entryPrice

sumMoveB += ptsL

sumPLptsB += ptsL

cntMoveB += 1

strategy.close("Long")

longSigExit := true

tradeDir := 0

if tradeDir == -1 and isLongSig

float ptsS = entryPrice - close

sumMoveS += ptsS

sumPLptsS += ptsS

cntMoveS += 1

strategy.close("Short")

shortSigExit := true

tradeDir := 0

// === 2) 5-Bar, Bar-Close 10-pt Stop Exit ===

inWindow = (tradeDir != 0) and (bar_index <= entryBar + 5)

longStopPrice = entryPrice - stopLossPts

shortStopPrice = entryPrice + stopLossPts

if tradeDir == 1 and inWindow and close <= longStopPrice

buyFailed += 1

sumPLptsB -= stopLossPts

strategy.close("Long")

longStopHit := true

tradeDir := 0

if tradeDir == -1 and inWindow and close >= shortStopPrice

sellFailed += 1

sumPLptsS -= stopLossPts

strategy.close("Short")

shortStopHit := true

tradeDir := 0

// === 3) New Entries (only when flat) ===

if tradeDir == 0 and isLongSig

buyTotal += 1

entryPrice := close

entryBar := bar_index

strategy.entry("Long", strategy.long)

tradeDir := 1

if tradeDir == 0 and isShortSig

sellTotal += 1

entryPrice := close

entryBar := bar_index

strategy.entry("Short", strategy.short)

tradeDir := -1

// === Stats Computation ===

float avgMoveB = cntMoveB > 0 ? sumMoveB / cntMoveB : na

float successPctB = buyTotal > 0 ? (buyTotal - buyFailed) / buyTotal * 100 : na

float pnlUSD_B = sumPLptsB * 50.0

float avgMoveS = cntMoveS > 0 ? sumMoveS / cntMoveS : na

float successPctS = sellTotal > 0 ? (sellTotal - sellFailed) / sellTotal * 100 : na

float pnlUSD_S = sumPLptsS * 50.0

string tf = timeframe.period

// === On-Chart Markers ===

plotshape(isLongSig, title="Long Entry", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny)

plotshape(isShortSig, title="Short Entry", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny)

plotshape(longSigExit, title="Exit on Sell Sig", style=shape.xcross, location=location.abovebar, color=color.orange, size=size.tiny)

plotshape(shortSigExit, title="Exit on Buy Sig", style=shape.xcross, location=location.belowbar, color=color.orange, size=size.tiny)

plotshape(longStopHit, title="Stop Exit Long", style=shape.xcross, location=location.abovebar, color=color.purple, size=size.tiny)

plotshape(shortStopHit, title="Stop Exit Short", style=shape.xcross, location=location.belowbar, color=color.purple, size=size.tiny)