개요

이 전략은 이동 평균 지표, 부린 띠 지표 및 UT Bot Alerts 지표를 결합하여 간단한 돌파구 운영 전략을 구현합니다. 가격이 부린 띠를 돌파 할 때, 더 많이하고, 가격이 부린 띠를 돌파 할 때, 더 많이하지 않습니다.

전략 원칙

- 200주기 EMA를 사용하여 트렌드를 판단하는 중축선. EMA 위쪽의 가격은 호불호가 있고, EMA 아래쪽의 가격은 호불호가 있다.

- UT Bot Alerts 지표는 ATR과 결합하여 매매 신호를 생성한다. 가격과 빠른 EMA 교차 부린이 궤도에 오르면 다중 신호가 발생하며, 가격과 빠른 EMA 교차 부린이 궤도에 오르면 공백 신호가 발생한다.

- ATR 스톱 로드 지표는 스톱 로드 포인트를 설정하는 데 사용됩니다. 스톱 로드 거리는 ATR 값의 1.5배입니다.

- 진입 후 리스크 수익률을 통해 진입 가격에 스톱로스, 스톱스톱, 스톱로스를 이동한다.

우위 분석

- 브린 벨트 지표를 사용하여 더 많은 코카이드를 할 때 적절한 시간을 판단하여 수익률을 높일 수 있습니다.

- UT Bot Alerts 지표는 비교적 정확한 신호를 생성할 수 있다.

- 리스크/이익 비율을 사용하여 손실을 막는 것은 위험을 효과적으로 통제할 수 있다.

위험 분석

- 브린 벨트는 흔들리는 도시에서 잘못된 신호를 유발할 수 있습니다.

- ATR은 지연성이 있으며, 트렌드 초기에 막힘이 너무 커질 수 있다.

- 위험과 이익의 비율을 잘못 설정하면 너무 급진적이거나 너무 보수적이 될 수 있습니다.

최적화 방향

- 다른 지표들을 사용해서 UT Bot Alerts 지표를 대체할 수 있습니다.

- ATR의 주기 및 배수를 최적화하여 스톱더스 거리를 더 적절하게 만들 수 있다.

- 다양한 리스크/이익 비율을 테스트하여 최적의 변수를 찾을 수 있다.

요약하다

이 전략은 여러 지표의 장점을 통합하여 강력한 실용성을 갖는다. 매개 변수를 최적화하면 안정적이고 신뢰할 수 있는 돌파구 시스템이 될 수 있다. 그러나 또한 지표의 실패와 매개 변수가 부적절하게 발생하는 위험을 예방하는 데 주의를 기울여야 한다.

전략 소스 코드

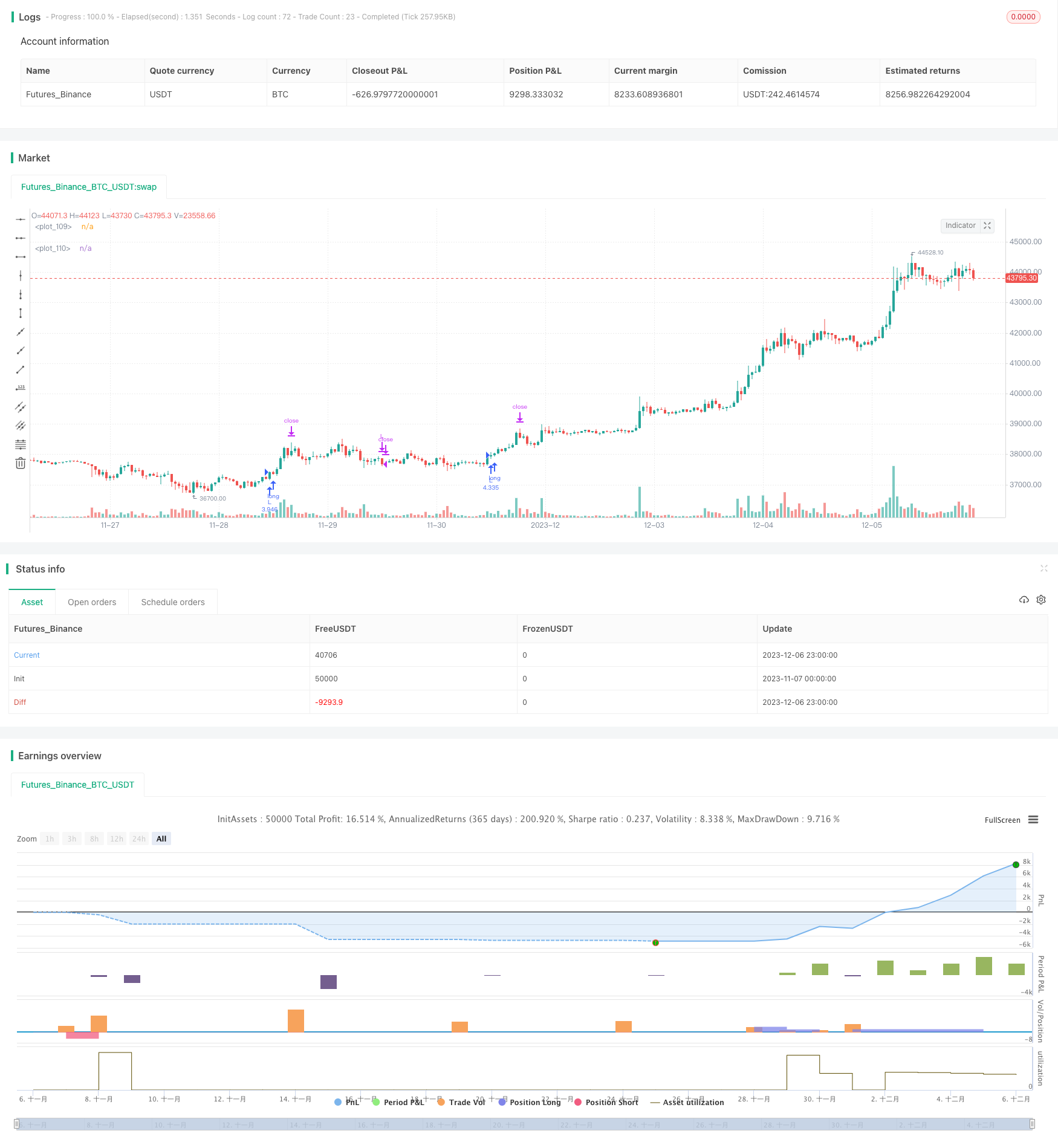

/*backtest

start: 2023-11-07 00:00:00

end: 2023-12-07 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

//Developed by StrategiesForEveryone

strategy("UT Bot alerts strategy", overlay=true, process_orders_on_close = true, initial_capital = 1000000, default_qty_type=strategy.cash, precision = 2, calc_on_every_tick = true, commission_value = 0.03)

// ------ Inputs for calculating position --------

initial_actual_capital = input.float(defval=10000, title = "Enter initial/current capital", group = "Calculate position")

risk_c = input.float(2.5, '% account risk per trade', step=1, group = "Position amount calculator", tooltip = "Percentage of total account to risk per trade. The USD value that should be used to risk the inserted percentage of the account. Appears green in the upper left corner")

// ------ Date filter (obtained from ZenAndTheArtOfTrading) ---------

initial_date = input(title="Initial date", defval=timestamp("10 Feb 2014 13:30 +0000"), group="Time filter", tooltip="Enter the start date and time of the strategy")

final_date = input(title="Final date", defval=timestamp("01 Jan 2030 19:30 +0000"), group="Time filter", tooltip="Enter the end date and time of the strategy")

dateFilter(int st, int et) => time >= st and time <= et

colorDate = input.bool(defval=false, title="Date background", tooltip = "Add color to the period of time of the strategy tester")

bgcolor(colorDate and dateFilter(initial_date, final_date) ? color.new(color.blue, transp=90) : na)

// ------ Session limits (obtained from ZenAndTheArtOfTrading) -------

timeSession = input(title="Time session", defval="0000-2400", group="Time filter", tooltip="Session time to operate. It may be different depending on your time zone, you have to find the correct hours manually.")

colorBG = input.bool(title="Session background", defval=false, tooltip = "Add color to session time background")

inSession(sess) => na(time(timeframe.period, sess + ':1234567')) == false

bgcolor(inSession(timeSession) and colorBG ? color.rgb(0, 38, 255, 84) : na)

// ----------- Ema ----------------------

ema = input.int(200, title='Ema length', minval=1, maxval=500, group = "Trend")

ema200 = ta.ema(close, ema)

bullish = close > ema200

bearish = close < ema200

show_ema = input.bool(defval=false, title="Show ema ?", group = "Appearance")

// plot(show_ema ? ema200 : na, title = "Ema", color=color.white, linewidth=2, display = display.all - display.status_line - display.price_scale)

// -------------- UT BOT ALERTS INDICATOR by @QuantNomad -------------------------

// Inputs

a = input(3, title='Key Vaule', group = "UT BOT ALERTS", tooltip = "Higher amount, less trades. Changing this could be useful in some assets or time frames")

c = input(1, title='ATR Period', group = "UT BOT ALERTS", tooltip = "Higher amount, less trades. Changing this could be useful in some assets or time frames")

h = input(false, title='Signals from Heikin Ashi Candles', group = "UT BOT ALERTS")

xATR = ta.atr(c)

nLoss = a * xATR

src = h ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, close, lookahead=barmerge.lookahead_off) : close

xATRTrailingStop = 0.0

iff_1 = src > nz(xATRTrailingStop[1], 0) ? src - nLoss : src + nLoss

iff_2 = src < nz(xATRTrailingStop[1], 0) and src[1] < nz(xATRTrailingStop[1], 0) ? math.min(nz(xATRTrailingStop[1]), src + nLoss) : iff_1

xATRTrailingStop := src > nz(xATRTrailingStop[1], 0) and src[1] > nz(xATRTrailingStop[1], 0) ? math.max(nz(xATRTrailingStop[1]), src - nLoss) : iff_2

show_atr_ut = input.bool(defval=false, title="Show atr from ut bot alerts ?", group = "Appearance")

// plot(show_atr_ut ? xATRTrailingStop : na, color = color.orange, linewidth = 2, display = display.all - display.price_scale - display.status_line)

pos = 0

iff_3 = src[1] > nz(xATRTrailingStop[1], 0) and src < nz(xATRTrailingStop[1], 0) ? -1 : nz(pos[1], 0)

pos := src[1] < nz(xATRTrailingStop[1], 0) and src > nz(xATRTrailingStop[1], 0) ? 1 : iff_3

xcolor = pos == -1 ? color.red : pos == 1 ? color.green : color.blue

ema_ut = ta.ema(src, 1)

show_ema_ut = input.bool(defval=false, title="Show ema from ut bot alerts ?", group = "Appearance")

// plot(show_ema_ut ? ema_ut : na, color = color.white, linewidth = 2, display = display.all - display.price_scale - display.status_line)

above = ta.crossover(ema_ut, xATRTrailingStop)

below = ta.crossover(xATRTrailingStop, ema_ut)

buy = src > xATRTrailingStop and above

sell = src < xATRTrailingStop and below

close_buy = src < xATRTrailingStop and below

close_sell = src > xATRTrailingStop and above

barbuy = src > xATRTrailingStop

barsell = src < xATRTrailingStop

show_signals = input.bool(true, title = "Show signals ?", group = "Appearance")

paint_candles = input.bool(false, title = "Paint candles ?", group = "Appearance")

// plotshape(bullish and show_signals ? buy : na, title='Buy', text='Buy', style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), textcolor=color.new(color.white, 0), size=size.tiny , display = display.all - display.price_scale - display.status_line)

// plotshape(bearish and show_signals ? sell : na, title='Sell', text='Sell', style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny, display = display.all - display.price_scale - display.status_line)

// plotshape(bullish and show_signals ? close_buy : na, title='Close Buy', text='Cl Buy', style=shape.labelup, location=location.belowbar, color=color.new(color.green, 80), textcolor=color.new(color.white, 0), size=size.tiny, display = display.all - display.price_scale - display.status_line)

// plotshape(bearish and show_signals ? close_sell : na, title='Close Sell', text='Cl Sell', style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 80), textcolor=color.new(color.white, 0), size=size.tiny, display = display.all - display.price_scale - display.status_line)

barcolor(barbuy and paint_candles ? color.green : na)

barcolor(barsell and paint_candles ? color.red : na)

// -------------- Atr stop loss by garethyeo (modified) -----------------

long_condition_atr = src > xATRTrailingStop and above

short_condition_atr = src < xATRTrailingStop and below

source_atr = input(close, title='Source', group = "Atr stop loss", inline = "A")

length_atr = input.int(14, minval=1, title='Period', group = "Atr stop loss" , inline = "A")

multiplier = input.float(1.5, minval=0.1, step=0.1, title='Atr multiplier', group = "Atr stop loss", inline = "A", tooltip = "Defines the stop loss distance based on the Atr stop loss indicator")

show_atr = input.bool(defval = true, title = "Show Atr stop loss ?", group = "Appearance")

var float shortStopLoss = na

var float longStopLoss = na

var float atr_past_candle_long = na

var float atr_past_candle_short = na

//shortStopLoss = source_atr + ta.atr(length_atr) * multiplier

//longStopLoss = source_atr - ta.atr(length_atr) * multiplier

//atr_past_candle_short = close[1] + ta.atr(length_atr)[1] * multiplier[1]

//atr_past_candle_long = close[1] - ta.atr(length_atr)[1] * multiplier[1]

candle_of_stoploss = input.string(defval = "Current candle", title = "Source of stoploss", group = "Risk management for trades", options = ["Current candle","Past candle"])

if candle_of_stoploss == "Current candle"

shortStopLoss := source_atr + ta.atr(length_atr) * multiplier

longStopLoss := source_atr - ta.atr(length_atr) * multiplier

if candle_of_stoploss == "Past candle"

shortStopLoss := close[1] + ta.atr(length_atr)[1] * multiplier[1]

longStopLoss := close[1] - ta.atr(length_atr)[1] * multiplier[1]

plot(show_atr and long_condition_atr and bullish ? longStopLoss : na, color = color.white, style = plot.style_circles, linewidth = 2)

plot(show_atr and short_condition_atr and bearish ? shortStopLoss : na, color = color.white, style = plot.style_circles, linewidth = 2)

// ------------- Money management --------------

strategy_contracts = strategy.equity / close

distance_sl_atr_long = -1 * (longStopLoss - close) / close

distance_sl_atr_short = (shortStopLoss - close) / close

risk = input.float(2.5, '% Account risk per trade for backtesting', step=1, group = "Risk management for trades", tooltip = "Percentage of total account to risk per trade")

long_amount = strategy_contracts * (risk / 100) / distance_sl_atr_long

short_amount = strategy_contracts * (risk / 100) / distance_sl_atr_short

// ---- Fixed amounts ----

//fixed_amounts = input.bool(defval = false, title = "Fixed amounts ?", group = "Risk management for trades")

//fixed_amount_input = input.float(defval = 1000, title = "Fixed amount in usd", group = "Risk management for trades")

//if fixed_amounts

// long_amount := fixed_amount_input / close

//if fixed_amounts

// short_amount := fixed_amount_input / close

//

leverage=input.bool(defval=true, title="Use leverage for backtesting ?", group = "Risk management for trades", tooltip = "If it is activated, there will be no monetary units or amount of assets limit for each operation (That is, each operation will not be affected by the initial / current capital since it would be using leverage). If it is deactivated, the monetary units or the amount of assets to use for each operation will be limited by the initial/current capital.")

if not leverage and long_amount>strategy_contracts

long_amount:=strategy.equity/close

if not leverage and short_amount>strategy_contracts

short_amount:=strategy.equity/close

// ---------- Risk management ---------------

risk_reward_breakeven_long= input.float(title="Risk/reward for breakeven long", defval=0.75, step=0.1, group = "Risk management for trades")

risk_reward_take_profit_long= input.float(title="Risk/reward for take profit long", defval=3.0, step=0.1, group = "Risk management for trades")

risk_reward_breakeven_short= input.float(title="Risk/reward for break even short", defval=0.75, step=0.1, group = "Risk management for trades")

risk_reward_take_profit_short= input.float(title="Risk/reward for take profit short", defval=3.0, step=0.1, group = "Risk management for trades")

tp_percent=input.float(title="% of trade for first take profit", defval=50, step=5, group = "Risk management for trades", tooltip = "Closing percentage of the current position when the first take profit is reached.")

// ------------ Trade conditions ---------------

bullish := close > ema200

bearish := close < ema200

bought = strategy.position_size > 0

sold = strategy.position_size < 0

buy := src > xATRTrailingStop and above

sell := src < xATRTrailingStop and below

var float sl_long = na

var float sl_short = na

var float be_long = na

var float be_short = na

var float tp_long = na

var float tp_short = na

if not bought

be_long:=na

sl_long:=na

tp_long:=na

if not sold

be_short:=na

sl_short:=na

tp_short:=na

long_positions = input.bool(defval = true, title = "Long positions ?", group = "Positions management")

short_positions = input.bool(defval = true, title = "Short positions ?", group = "Positions management")

// ---------- Strategy -----------

// Long position

if not bought and buy and long_positions and bullish and inSession(timeSession)

sl_long:=longStopLoss

long_stoploss_distance = close - longStopLoss

be_long := close + long_stoploss_distance * risk_reward_breakeven_long

tp_long:=close+(long_stoploss_distance*risk_reward_take_profit_long)

strategy.entry('L', strategy.long, long_amount, alert_message = "Long")

strategy.exit("Tp", "L", stop=sl_long, limit=tp_long, qty_percent=tp_percent)

strategy.exit('Exit', 'L', stop=sl_long)

if bought and high > be_long

sl_long := strategy.position_avg_price

strategy.exit("Tp", "L", stop=sl_long, limit=tp_long, qty_percent=tp_percent)

strategy.exit('Exit', 'L', stop=sl_long)

if bought and sell and strategy.openprofit>0

strategy.close("L", comment="CL")

// Short position

if not sold and sell and short_positions and bearish and inSession(timeSession)

sl_short:=shortStopLoss

short_stoploss_distance=shortStopLoss - close

be_short:=((short_stoploss_distance*risk_reward_breakeven_short)-close)*-1

tp_short:=((short_stoploss_distance*risk_reward_take_profit_short)-close)*-1

strategy.entry("S", strategy.short, short_amount, alert_message = "Short")

strategy.exit("Tp", "S", stop=sl_short, limit=tp_short, qty_percent=tp_percent)

strategy.exit("Exit", "S", stop=sl_short)

if sold and low < be_short

sl_short:=strategy.position_avg_price

strategy.exit("Tp", "S", stop=sl_short, limit=tp_short, qty_percent=tp_percent)

strategy.exit("Exit", "S", stop=sl_short)

if sold and buy and strategy.openprofit>0

strategy.close("S", comment="CS")

// ---------- Draw positions and signals on chart (strategy as an indicator) -------------

if high>tp_long

tp_long:=na

if low<tp_short

tp_short:=na

if high>be_long

be_long:=na

if low<be_short

be_short:=na

show_position_on_chart = input.bool(defval=true, title="Draw position on chart ?", group = "Appearance", tooltip = "Activate to graphically display profit, stop loss and break even")

// position_price = plot(show_position_on_chart? strategy.position_avg_price : na, style=plot.style_linebr, color = color.new(#ffffff, 10), linewidth = 1, display = display.all - display.status_line - display.price_scale)

// sl_long_price = plot(show_position_on_chart and bought ? sl_long : na, style = plot.style_linebr, color = color.new(color.red, 10), linewidth = 1, display = display.all - display.status_line - display.price_scale)

// sl_short_price = plot(show_position_on_chart and sold ? sl_short : na, style = plot.style_linebr, color = color.new(color.red, 10), linewidth = 1, display = display.all - display.status_line - display.price_scale)

// tp_long_price = plot(strategy.position_size>0 and show_position_on_chart? tp_long : na, style = plot.style_linebr, color = color.new(#4cd350, 10), linewidth = 1, display = display.all - display.status_line - display.price_scale)

// tp_short_price = plot(strategy.position_size<0 and show_position_on_chart? tp_short : na, style = plot.style_linebr, color = color.new(#4cd350, 10), linewidth = 1, display = display.all - display.status_line - display.price_scale)

// breakeven_long = plot(strategy.position_size>0 and high<be_long and show_position_on_chart ? be_long : na , style = plot.style_linebr, color = color.new(#1fc9fd, 60), linewidth = 1, display = display.all - display.status_line - display.price_scale)

// breakeven_short = plot(strategy.position_size<0 and low>be_short and show_position_on_chart ? be_short : na , style = plot.style_linebr, color = color.new(#1fc9fd, 60), linewidth = 1, display = display.all - display.status_line - display.price_scale)

show_break_even_on_chart = input.bool(defval=true, title="Draw first take profit/breakeven price on chart ?", group = "Appearance", tooltip = "Activate to display take profit and breakeven price. It appears as a green point in the chart")

long_stoploss_distance = close - longStopLoss

short_stoploss_distance=shortStopLoss - close

be_long_plot = close + long_stoploss_distance * risk_reward_breakeven_long

be_short_plot =((short_stoploss_distance*risk_reward_breakeven_short)-close)*-1

// plot(show_break_even_on_chart and buy and bullish? be_long_plot : na, color=color.new(#1fc9fd, 10), style = plot.style_circles, linewidth = 2, display = display.all - display.price_scale)

// plot(show_break_even_on_chart and sell and bearish? be_short_plot : na, color=color.new(#1fc9fd, 10), style = plot.style_circles, linewidth = 2, display = display.all - display.price_scale)

// position_profit_long = plot(bought and show_position_on_chart and strategy.openprofit>0 ? close : na, style = plot.style_linebr, color = color.new(#4cd350, 10), linewidth = 1, display = display.all - display.status_line - display.price_scale)

// position_profit_short = plot(sold and show_position_on_chart and strategy.openprofit>0 ? close : na, style = plot.style_linebr, color = color.new(#4cd350, 10), linewidth = 1, display = display.all - display.status_line - display.price_scale)

// fill(plot1 = position_price, plot2 = position_profit_long, color = color.new(#4cd350, 90))

// fill(plot1 = position_price, plot2 = position_profit_short, color = color.new(#4cd350, 90))

// fill(plot1 = position_price, plot2 = sl_long_price, color = color.new(color.red,90))

// fill(plot1 = position_price, plot2 = sl_short_price, color = color.new(color.red,90))

// fill(plot1 = position_price, plot2 = tp_long_price, color = color.new(color.green,90))

// fill(plot1 = position_price, plot2 = tp_short_price, color = color.new(color.green,90))

// --------------- Positions amount calculator -------------

contracts_amount_c = initial_actual_capital / close

distance_sl_long_c = -1 * (longStopLoss - close) / close

distance_sl_short_c = (shortStopLoss - close) / close

long_amount_c = close * (contracts_amount_c * (risk_c / 100) / distance_sl_long_c)

short_amount_c = close * (contracts_amount_c * (risk_c / 100) / distance_sl_short_c)

long_amount_lev = close * (contracts_amount_c * (risk_c / 100) / distance_sl_long_c)

short_amount_lev = close * (contracts_amount_c * (risk_c / 100) / distance_sl_short_c)

leverage_for_calculator=input.bool(defval=true, title="Use leverage ?", group = "Calculate position", tooltip = "If it is activated, there will be no monetary units or amount of assets limit for each operation (That is, each operation will not be affected by the initial / current capital since it would be using leverage). If it is deactivated, the monetary units or the amount of assets to use for each operation will be limited by the initial/current capital.")

if not leverage_for_calculator and long_amount_lev>initial_actual_capital

long_amount_lev:=initial_actual_capital

if not leverage_for_calculator and short_amount_lev>initial_actual_capital

short_amount_lev:=initial_actual_capital

// plot(buy and leverage_for_calculator ? long_amount_c : na, color = color.rgb(136, 255, 0), display = display.all - display.pane - display.price_scale)

// plot(sell and leverage_for_calculator ? short_amount_c : na, color = color.rgb(136, 255, 0), display = display.all - display.pane - display.price_scale)

// plot(buy and not leverage_for_calculator ? long_amount_lev : na, color = color.rgb(136, 255, 0), display = display.all - display.pane - display.price_scale)

// plot(sell and not leverage_for_calculator ? short_amount_lev : na, color = color.rgb(136, 255, 0), display = display.all - display.pane - display.price_scale)