개요

이 전략은 고전적인 스토크 지표와 SMA 지표를 조합하여 강력한 트렌드 추적 능력을 구현한다. 전략의 핵심 아이디어는 스토크 지표를 사용하여 트렌드 방향 신호를 식별하고, SMA 지표와 결합하여 신호 품질을 높이기 위해 필터링하고, 다른 위험 모드를 사용하여 지표 매개 변수를 설정하고, 위험과 수익의 동적인 조정을 실현한다. 또한, 전략은 여러 시간 프레임 판단을 사용하여, 진입 시점 선택을 최적화한다.

전략 원칙

- 전략은 마더스 강화 버전의 스토크 지수를 사용한다. 지수 파라미터는 %K 주기, %K 평준화 주기, %D 평준화 주기 등으로, 파라미터를 설정하여 지수의 감수성을 제어한다.

- SMA 지표 파라미터는 고점 SMA와 저점 SMA를 포함하는 것으로, 신호를 필터링하여 신호 품질을 높이고, 가짜 돌파구를 피한다.

- 다양한 위험 선호에 따라, 전략은 낮은 위험 모드, 중간 위험 모드 및 높은 위험 모드의 선택을 제공합니다. 위험 모드는 스토크 지수의 교차 변수를 영향을 미치며 위험과 수익의 동적인 조정을 수행합니다.

- 전략은 긴 포지션 신호가 스토크 지표 상의 부수값을 넘어서고 가격이 낮은 SMA에서 닫을 때 판단합니다. 짧은 포지션 신호가 스토크 지표 아래의 부수값을 넘어서고 가격이 높은 SMA에서 닫을 때 판단합니다.

- 전략은 여러 시간 프레임을 도입하여 판단 모듈을 도입하고, 다양한 시간 범위에서 신호를 검증하고, 거래 위험을 제어하기 위해 더 좋은 입문 시점을 선택합니다.

전략적 이점

- 마오바이트를 사용하여 스톡 지수를 강화하여 지표의 민감성을 높여 시장의 변화를 빠르게 포착할 수 있습니다.

- SMA 지표 쌍레일 필터 메커니즘을 추가하여 가짜 신호를 효과적으로 필터링하여 신호 품질을 향상시킵니다.

- 다양한 위험 모드를 선택하여 사용자가 자신의 위험 취향에 따라 매개 변수를 조정할 수 있습니다.

- 여러 시간 프레임 판단 모듈을 추가하여 입시 시점을 최적화하고 거래 위험을 줄입니다.

- 전략 매개 변수 설정 합리적인, 지표 사용 자연, 전체 프레임 워크 과학 엄격, 안정성이 좋고, 적응력이 강

전략적 위험

- 전략 자체에는 손해 제도가 없으며, 손해 위험을 제어하기 위해 손해 지점을 수동으로 설정해야 합니다.

- 전략적 신호는 자주 발생하며, 과도한 거래가 발생하여 거래 비용이 증가합니다.

- 전략은 파라미터와 위험 모드 설정에 민감하며, 테스트 최적화를 통해 최적의 파라미터를 찾아내야 한다.

- 전략적 인출은 더 커서 풀 포지션 운영에 적합하지 않으며 거래 자금 규모를 통제해야합니다.

대응 방법:

- 시장의 변동 정도에 따라 합리적으로 스톱로스 비율을 설정하여 손실을 최대한 제어한다.

- 적절히 스트로크 지표 매개 변수를 조정하여 신호 주파수를 줄이거나 최소 스톱을 설정하여 불필요한 거래를 줄이십시오.

- 기본 저위험 모드를 선택하여 재검토 데이터에 따라 다른 매개 변수를 조정하는 것이 좋습니다.

- 포지션 규모를 제어하고, 포지션을 세분화하여, 단일 거래의 위험을 줄입니다.

전략 최적화 방향

- 스토크 지수와 SMA 지수의 파라미터를 전체적으로 테스트하여 최적의 파라미터 조합을 찾습니다.

- 복합 시간 프레임의 수를 늘리고, 판단 기반을 풍부하게 하고, 입학 시점을 최적화한다.

- ATR 스톱과 같은 스톱 지표 포트폴리오를 도입하여 스톱 지점을 동적으로 추적하여 위험을 줄일 수 있습니다.

- 지표 신호 필터링 및 확인 메커니즘을 구축하여 거래량 지표 판단을 높이고, 함정을 피하십시오.

- 포지션 관리 모듈에 가입하여 시장 상황에 따라 포지션을 적극적으로 조정하여 단일 거래 위험을 줄일 수 있습니다.

요약하다

이 전략은 스토크 지표와 SMA 지표의 장점을 통합하여 강력한 트렌드 추적 효과를 달성합니다. 전략 프레임은 합리적이며 지표는 자연적으로 사용되며, 매개 변수 및 위험 모드를 제어하여 지표의 본질을 복원하여 전략의 안정성을 최적화합니다. 다중 시간 프레임 판단 모듈은 다양한 품종과 주기적으로 조정할 수 있는 전략의 적응성을 향상시킵니다.

전략 소스 코드

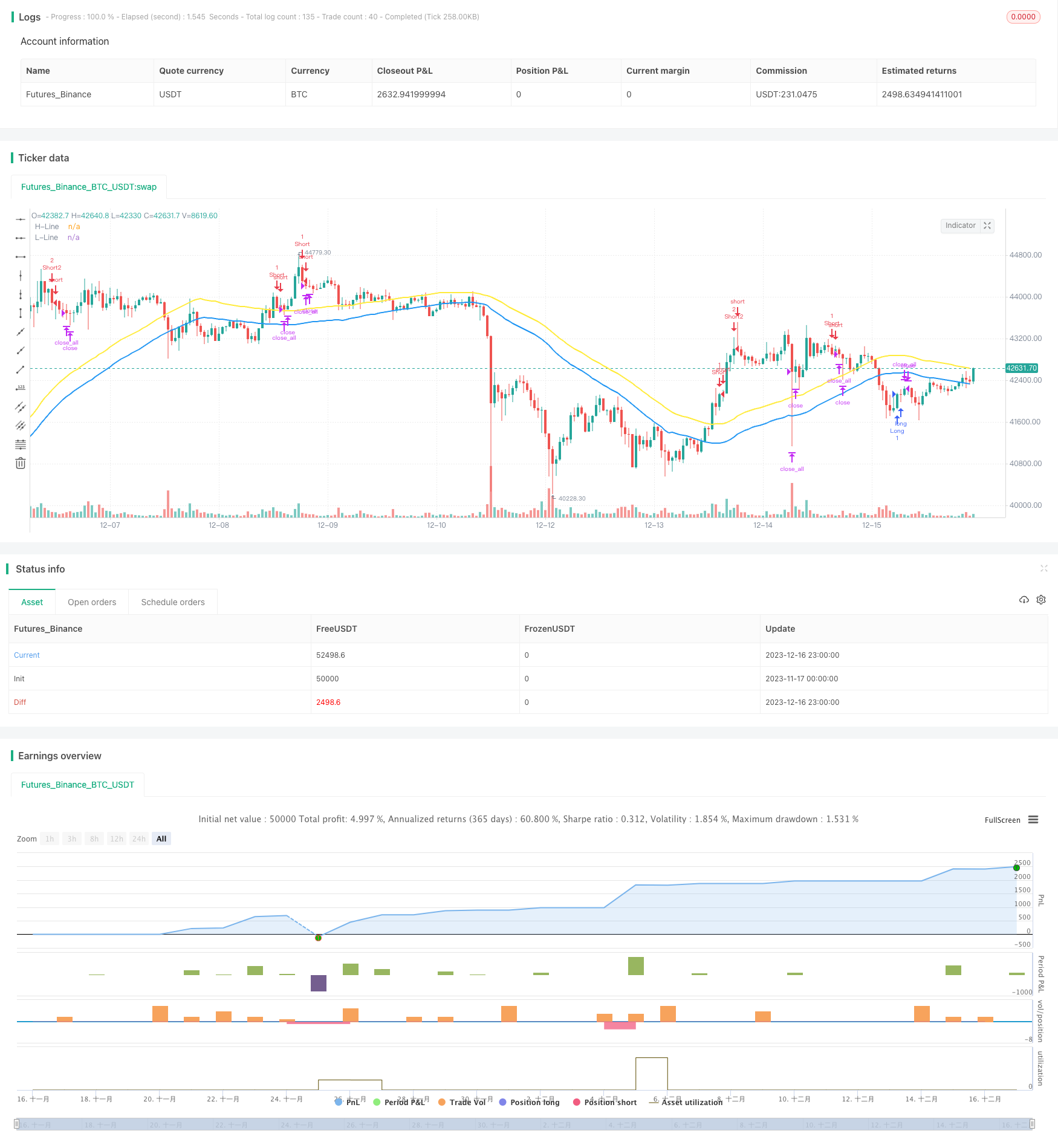

/*backtest

start: 2023-11-17 00:00:00

end: 2023-12-17 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//►►►► Description ►►►►

//1. The Original Pine Script

//- Stochastic

//- SMA

//1.1 Concepts

//- Stochastic crossover and crossunder with range 80/20 or 70/30 or 50/50 from your risk you can adjust it from config

//- Confirm Signal by SMA High and Low Original Range is 50 or you can adjust by your self in config Setting

//1.2 Condition

//- Buy Condition = Stochastic crossover Sto Signal Line and SMA Filter <= 20 or 30 or 50 from your risk

//- Sell Condition = Stochastic crossunder Sto Signal Line and SMA Filter >= 80 or 70 or 50 from your risk

//1.3 Idea For Trading

//- Trend Runing If you use "Trend" Mode is Martingale Your Position Until You Have a Profit

//- Scalping You Can Adjust TP for Little Profit and Increase Your Winrate

//►►►► Strategy results ►►►►

// ►► Use an account size ►►

// - For Newbie i recommend try to use 50$ you can test in MT4 Or MT5 Start With 50$ Leverage : 1000

// - For Some User Have a Exp. Trading : 500$ you can use martingale for help your trading

// - For Expert User : 5000$ or 5000$ (Cent) you can use martingale for help your trading

// ►► realistic commission AND slippage ►►

// - Some Broker Not Have a commission for Gold and Forex.

// - slippage : default i'm Setting is 350 point, (it's mean 35 pip) it's average or your account is ECN or Zero Spread You can Set = 0

// ►► Size For Trading ►►

// - This strategy is Start From 0.01 lot and use martingale for next position

// - This not perfect strategy. it's have equity drawdown. just try and test your config you like.

// ►► Sample size Dataset Trading ►►

// - This Strategy Recommend For Long-Term Trading Becuase It's Have Martingale Help Your Next Position

//►►►► strategy's default Properties ►►►►

// - From Default Setting : Slippage or Spread Set = 0 (Becuase I don't know your account spread) you can set in Properties

// ** Some Broeker Are 2 Digits or 3 Digit You Must Set By Your Self (like 35 point or 350 point from your account spread)

// - From Default Setting : commission = 0 (Becuase I don't know your account commission) you can set in Properties

// ** Some Broeker Are not commission for forex and gold

//@version=5

var int slippage = 0

strategy("X48 - DayLight Hunter | Strategy | V.01.03", overlay=true)

var int hedge_mode = 0

var int sto_buy = 0

var int sto_sell = 0

Trade_Mode = input.string(defval = "Trend", title = "⚖️ Mode For Trade [Oneway / Hedge / ⭐Trend]", options = ["Oneway", "Hedge", "Trend"], group = "=== Mode Trade [Recommend Mode is ⭐Trend and ⭐Low Risk] ===", tooltip = "Oneway = Switching Position Type With Signal\nHedge Mode = Not Switching Position Type Unitl TP or SL")

Risk_Mode = input.string(defval = "Low Risk", title = "⚖️ Risk Signal Mode [⭐Low / Medium / High]", options = ["Low Risk", "Medium Risk", "High Risk"], group = "=== Mode Trade [Recommend Mode is ⭐Trend and ⭐Low Risk] ===", tooltip = "[[Signal Form Stochastic]]\nLow Risk is >= 80 and <= 20\nMedium Risk is >= 70 and <= 30\nHigh Risk is >= 50 and <=50")

if Trade_Mode == "Oneway"

hedge_mode := 0

else if Trade_Mode == "Hedge"

hedge_mode := 1

else if Trade_Mode == "Trend"

hedge_mode := 2

if Risk_Mode == "Low Risk"

sto_buy := 20

sto_sell := 80

else if Risk_Mode == "Medium Risk"

sto_buy := 30

sto_sell := 70

else if Risk_Mode == "High Risk"

sto_buy := 50

sto_sell := 50

periodK = input.int(15, title="%K Length", minval=1, group = "Stochastic Setting", inline = "Sto0")

smoothK = input.int(3, title="%K Smoothing", minval=1, group = "Stochastic Setting", inline = "Sto0")

periodD = input.int(3, title="%D Smoothing", minval=1, group = "Stochastic Setting", inline = "Sto0")

GRSMA = "=== 🧮 SMA Filter Mode ==="

SMA_Mode = input.bool(defval = true, title = "🧮 SMA High and Low Filter Mode", group = GRSMA, tooltip = "Sell Signal With Open >= SMA High\nBuy Signal With Close <= SMA Low")

SMA_High = input.int(defval = 50, title = "SMA High", group = GRSMA, inline = "SMA1")

SMA_Low = input.int(defval = 50, title = "SMA Low", group = GRSMA, inline = "SMA1")

k = ta.sma(ta.stoch(close, high, low, periodK), smoothK)

d = ta.sma(k, periodD)

high_line = ta.sma(high, SMA_High)

low_line = ta.sma(low, SMA_Low)

plot(SMA_Mode ? high_line : na, "H-Line", color = color.yellow, linewidth = 2)

plot(SMA_Mode ? low_line : na, "L-Line", color = color.blue, linewidth = 2)

entrybuyprice = strategy.position_avg_price

var bool longcondition = na

var bool shortcondition = na

if SMA_Mode == true

longcondition := ta.crossover(k,d) and d <= sto_buy and close < low_line and open < low_line// or ta.crossover(k, 20)// and close <= low_line

shortcondition := ta.crossunder(k,d) and d >= sto_sell and close > high_line and open > high_line// or ta.crossunder(k, 80)// and close >= high_line

else

longcondition := ta.crossover(k,d) and d <= sto_buy

shortcondition := ta.crossunder(k,d) and d >= sto_sell

//longcondition_double = ta.crossover(d,20) and close < low_line// and strategy.position_size > 0

//shortcondition_double = ta.crossunder(d,80) and close > high_line// and strategy.position_size < 0

//=============== TAKE PROFIT and STOP LOSS by % =================

tpsl(percent) =>

strategy.position_avg_price * percent / 100 / syminfo.mintick

GR4 = "=====🆘🆘🆘 TAKE PROFIT & STOP LOSS BY [%] 🆘🆘🆘====="

mode= input.bool(title="🆘 Take Profit & Stop Loss By Percent (%)", defval=true, group=GR4, tooltip = "Take Profit & Stop Loss by % Change\n0 = Disable")

tp_l = tpsl(input.float(0, title='🆘 TP [LONG] % >> [OneWay Only]', group=GR4, tooltip = "0 = Disable"))

tp_s = tpsl(input.float(0, title='🆘 TP [SHORT] % >> [OneWay Only]', group=GR4, tooltip = "0 = Disable"))

sl = tpsl(input.float(0, title='🆘 Stop Loss % [All Mode / 1st Position]', group=GR4, tooltip = "0 = Disable"))

tp_pnl = input.float(defval = 1, title = "🆘 TakeProfit by PNL ($) eg. (0.1 = 0.1$)", group = GR4, tooltip = "All Mode TP by PNL")

spread_size = input.float(defval = 0.350, title = "🆘 Spread Point Size(Eg. 35 Point or 350 Point From Your Broker Digits)", tooltip = "Spread Point Form Your Broker \nEg. 1920.124 - 1920.135 or 1920.12 - 1920.13\nPlease Check From Your Broker", group = GR4)

GR5 = "===💮💮💮 Hedge / Martingale Mode 💮💮💮==="

//hedge_mode = input.bool(defval = true, title = "⚖️ Hedge / Martingale Mode", group = GR5)

hedge_point = input.int(defval = 500, title = "💯 Hedge Point Range / Martingale Range", group = GR5, tooltip = "After Entry Last Position And Current Price More Than Point Range Are Open New Hedge Position")

hedge_gale = input.float(defval = 2.0, title = "✳️ Martingale For Hedge Multiply [default = 2]", tooltip = "Martingale For Multiply Hedge Order", group = GR5)

hedge_point_size = hedge_point/100

calcStopLossPrice(OffsetPts) =>

if strategy.position_size > 0

strategy.position_avg_price - OffsetPts * syminfo.mintick

else if strategy.position_size < 0

strategy.position_avg_price + OffsetPts * syminfo.mintick

else

na

calcStopLossL_AlertPrice(OffsetPts) =>

strategy.position_avg_price - OffsetPts * syminfo.mintick

calcStopLossS_AlertPrice(OffsetPts) =>

strategy.position_avg_price + OffsetPts * syminfo.mintick

calcTakeProfitPrice(OffsetPts) =>

if strategy.position_size > 0

strategy.position_avg_price + OffsetPts * syminfo.mintick

else if strategy.position_size < 0

strategy.position_avg_price - OffsetPts * syminfo.mintick

else

na

calcTakeProfitL_AlertPrice(OffsetPts) =>

strategy.position_avg_price + OffsetPts * syminfo.mintick

calcTakeProfitS_AlertPrice(OffsetPts) =>

strategy.position_avg_price - OffsetPts * syminfo.mintick

var stoploss = 0.

var stoploss_l = 0.

var stoploss_s = 0.

var takeprofit = 0.

var takeprofit_l = 0.

var takeprofit_s = 0.

var takeprofit_ll = 0.

var takeprofit_ss = 0.

if mode == true

if (strategy.position_size > 0)

if sl > 0

stoploss := calcStopLossPrice(sl)

stoploss_l := stoploss

else if sl <= 0

stoploss := na

if tp_l > 0

takeprofit := tp_l

takeprofit_ll := close + ((close/100)*tp_l)

//takeprofit_s := na

else if tp_l <= 0

takeprofit := na

if (strategy.position_size < 0)

if sl > 0

stoploss := calcStopLossPrice(sl)

stoploss_s := stoploss

else if sl <= 0

stoploss := na

if tp_s > 0

takeprofit := tp_s

takeprofit_ss := close - ((close/100)*tp_s)

//takeprofit_l := na

else if tp_s <= 0

takeprofit := na

else if strategy.position_size == 0

stoploss := na

takeprofit := na

//takeprofit_l := calcTakeProfitL_AlertPrice(tp_l)

//takeprofit_s := calcTakeProfitS_AlertPrice(tp_s)

//stoploss_l := calcStopLossL_AlertPrice(sl)

//stoploss_s := calcStopLossS_AlertPrice(sl)

//////////// INPUT BACKTEST RANGE ////////////////////////////////////////////////////

var string BTR1 = '════════⌚⌚ INPUT BACKTEST TIME RANGE ⌚⌚════════'

i_startTime = input(defval = timestamp("01 Jan 1945 00:00 +0000"), title = "Start", inline="timestart", group=BTR1, tooltip = 'Start Backtest YYYY/MM/DD')

i_endTime = input(defval = timestamp("01 Jan 2074 23:59 +0000"), title = "End", inline="timeend", group=BTR1, tooltip = 'End Backtest YYYY/MM/DD')

//////////////// Strategy Alert For X4815162342 BOT //////////////////////

Text_Alert_Future = '{{strategy.order.alert_message}}'

copy_Fu = input( defval= Text_Alert_Future , title="Alert Message for BOT", inline = '00' ,group = '═ Bot Setting ═ \n >> If You Dont Use Bot Just Pass It' ,tooltip = 'Alert For X48-BOT > Copy and Paste To Alert Function')

TimeFrame_input = input(defval= 'Input Your TimeFrame [1m, 15m, 1h, 4h, 1d ,1w]' , title="TimeFrame Text Alert", inline = '01' ,group = '═ Bot Setting ═ \n >> If You Dont Use Bot Just Pass It', tooltip = "[1m, 15m, 1h, 4h, 1d ,1w]")

string Alert_EntryL = '🪙 Asset : {{ticker}} \n💱 Status : {{strategy.market_position}}\n🕛 TimeFrame : '+str.tostring(TimeFrame_input)+'\n💸 Price : {{strategy.order.price}} $\n✅ TP : '+str.tostring(takeprofit_ll)+' $\n❌ SL : '+str.tostring(stoploss_l)+' $\n⏰ Time : {{timenow}}'

string Alert_EntryS = '🪙 Asset : {{ticker}} \n💱 Status : {{strategy.market_position}}\n🕛 TimeFrame : '+str.tostring(TimeFrame_input)+'\n💸 Price : {{strategy.order.price}} $\n✅ TP : '+str.tostring(takeprofit_ss)+' $\n❌ SL : '+str.tostring(stoploss_s)+' $\n⏰ Time : {{timenow}}'

string Alert_TPSL = '🪙 Asset : {{ticker}}\n🕛 TimeFrame : '+str.tostring(TimeFrame_input)+'\n💹 {{strategy.order.comment}}\n💸 Price : {{strategy.order.price}} $\n⏰ Time : {{timenow}}'

if true

if (longcondition and strategy.position_size == 0) or (longcondition and strategy.position_size < 0 and hedge_mode == 0)

strategy.entry("Long", strategy.long, comment = "🌙", alert_message = Alert_EntryL)

//if longcondition_double

// //strategy.cancel_all()

// strategy.entry("Long2", strategy.long, comment = "🌙🌙")

// //strategy.exit("Exit",'Long', qty_percent = 100 , profit = takeprofit, stop = stoploss, comment_profit = "TP💚L", comment_loss = "SL💚L")

if (shortcondition and strategy.position_size == 0) or (shortcondition and strategy.position_size > 0 and hedge_mode == 0)

strategy.entry("Short", strategy.short, comment = "👻", alert_message = Alert_EntryS)

//strategy.exit("Exit",'Short', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP❤️️S", comment_loss = "SL❤️️S")

//if shortcondition_double

// //strategy.cancel_all()

// strategy.entry("Short2", strategy.short, comment = "👻👻")

if strategy.position_size > 0 and strategy.opentrades >= 1 and hedge_mode == 1

entrypricel = strategy.opentrades.entry_price(strategy.opentrades - 1)

callpointsize = entrypricel - close

lastsize = strategy.position_size

if callpointsize >= hedge_point_size and longcondition

strategy.order("Long2", strategy.long, qty = lastsize * hedge_gale, comment = "🌙⌛", alert_message = Alert_EntryL)

if shortcondition

strategy.order("Short2", strategy.short, qty = lastsize * hedge_gale, comment = "👻⌛", alert_message = Alert_EntryS)

else if strategy.position_size < 0 and strategy.opentrades >= 1 and hedge_mode == 1

entryprices = strategy.opentrades.entry_price(strategy.opentrades - 1)

callpointsize = (entryprices - close)* -1

lastsize = (strategy.position_size) * -1

if callpointsize >= hedge_point_size and shortcondition

strategy.order("Short2", strategy.short, qty = lastsize * hedge_gale, comment = "👻⌛", alert_message = Alert_EntryS)

if longcondition

strategy.order("Long2", strategy.long, qty = lastsize * hedge_gale, comment = "🌙⌛", alert_message = Alert_EntryL)

if strategy.position_size > 0 and strategy.opentrades >= 1 and hedge_mode == 2

entrypricel = strategy.opentrades.entry_price(strategy.opentrades - 1)

callpointsize = entrypricel - close

lastsize = strategy.position_size

if callpointsize >= hedge_point_size and longcondition

strategy.order("Long2", strategy.long, qty = lastsize * hedge_gale, comment = "🌙⌛", alert_message = Alert_EntryL)

else if strategy.position_size < 0 and strategy.opentrades >= 1 and hedge_mode == 2

entryprices = strategy.opentrades.entry_price(strategy.opentrades - 1)

callpointsize = (entryprices - close)* -1

lastsize = (strategy.position_size) * -1

if callpointsize >= hedge_point_size and shortcondition

strategy.order("Short2", strategy.short, qty = lastsize * hedge_gale, comment = "👻⌛", alert_message = Alert_EntryS)

last_price_l = (strategy.opentrades.entry_price(strategy.opentrades - 1) + (strategy.opentrades.entry_price(strategy.opentrades - 1)/100) * takeprofit) + spread_size

last_price_s = (strategy.opentrades.entry_price(strategy.opentrades - 1) - (strategy.opentrades.entry_price(strategy.opentrades - 1)/100) * takeprofit) - spread_size

current_price = request.security(syminfo.tickerid, "1", close)

current_pricel = request.security(syminfo.tickerid, "1", close) + spread_size

current_prices = request.security(syminfo.tickerid, "1", close) - spread_size

//if mode == true

if strategy.position_size > 0 and strategy.openprofit >= tp_pnl and mode == true and hedge_mode == 1

lastsize = strategy.position_size

lastprofitorder = strategy.openprofit

//if lastprofitorder >= 0.07

//strategy.close('Long', qty = lastsize, comment = "TP💚L", alert_message = Alert_TPSL, immediately = true)

strategy.cancel_all()

strategy.close_all(comment = "TP💚PNL", alert_message = Alert_TPSL, immediately = true)

//strategy.close_all(comment = "TP💚LH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long2', qty_percent = 100, profit = last_price_l, stop = stoploss, comment_profit = "TP💚LH", comment_loss = "SL💚LH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long', qty_percent = 100, profit = last_price_l, stop = stoploss, comment_profit = "TP💚L", comment_loss = "SL💚L", alert_message = Alert_TPSL)

else if strategy.position_size > 0 and strategy.openprofit < tp_pnl and mode == true and hedge_mode == 1

strategy.exit("Exit",'Long', qty_percent = 100, stop = stoploss, comment_loss = "SL💚%L", alert_message = Alert_TPSL)

if strategy.position_size > 0 and strategy.openprofit >= tp_pnl and mode == true and hedge_mode == 2

lastsize = strategy.position_size

lastprofitorder = strategy.openprofit

//if lastprofitorder >= 0.07

//strategy.close('Long', qty = lastsize, comment = "TP💚L", alert_message = Alert_TPSL, immediately = true)

strategy.cancel_all()

strategy.close_all(comment = "TP💚PNL", alert_message = Alert_TPSL, immediately = true)

//strategy.close_all(comment = "TP💚LH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long2', qty_percent = 100, profit = last_price_l, stop = stoploss, comment_profit = "TP💚LH", comment_loss = "SL💚LH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long', qty_percent = 100, profit = last_price_l, stop = stoploss, comment_profit = "TP💚L", comment_loss = "SL💚L", alert_message = Alert_TPSL)

else if strategy.position_size > 0 and strategy.openprofit < tp_pnl and mode == true and hedge_mode == 2

strategy.exit("Exit",'Long', qty_percent = 100, stop = stoploss, comment_loss = "SL💚%L", alert_message = Alert_TPSL)

if strategy.position_size > 0 and mode == true and hedge_mode == 0

//strategy.close_all(comment = "TP💚LH", alert_message = Alert_TPSL, immediately = true)

strategy.exit("Exit",'Long', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP💚%L", comment_loss = "SL💚%L", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP💚LL", comment_loss = "SL💚L", alert_message = Alert_TPSL)

if strategy.position_size < 0 and strategy.openprofit >= tp_pnl and mode == true and hedge_mode == 1

lastsize = (strategy.position_size) * -1

lastprofitorder = strategy.openprofit

//if lastprofitorder >= 0.07

//strategy.close('Short', qty = lastsize, comment = "TP❤️️S", alert_message = Alert_TPSL, immediately = true)

strategy.cancel_all()

strategy.close_all(comment = "TP❤️️PNL", alert_message = Alert_TPSL, immediately = true)

//strategy.close_all(comment = "TP❤️️SH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short2', qty_percent = 100, profit = last_price_s, stop = stoploss, comment_profit = "TP❤️️SH", comment_loss = "SL❤️️SH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short', qty_percent = 100, profit = last_price_s, stop = stoploss, comment_profit = "TP❤️️S", comment_loss = "SL❤️️S", alert_message = Alert_TPSL)

else if strategy.position_size < 0 and strategy.openprofit < tp_pnl and mode == true and hedge_mode == 1

strategy.exit("Exit",'Short', qty_percent = 100, stop = stoploss, comment_loss = "SL❤️️%S", alert_message = Alert_TPSL)

if strategy.position_size < 0 and mode == true and hedge_mode == 0

//strategy.close_all(comment = "TP❤️️SH", alert_message = Alert_TPSL, immediately = true)

strategy.exit("Exit",'Short', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP❤️️%S", comment_loss = "SL❤️️%S", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP❤️️S", comment_loss = "SL❤️️S", alert_message = Alert_TPSL)

if strategy.position_size < 0 and strategy.openprofit >= tp_pnl and mode == true and hedge_mode == 2

lastsize = (strategy.position_size) * -1

lastprofitorder = strategy.openprofit

//if lastprofitorder >= 0.07

//strategy.close('Short', qty = lastsize, comment = "TP❤️️S", alert_message = Alert_TPSL, immediately = true)

strategy.cancel_all()

strategy.close_all(comment = "TP❤️️PNL", alert_message = Alert_TPSL, immediately = true)

//strategy.close_all(comment = "TP❤️️SH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short2', qty_percent = 100, profit = last_price_s, stop = stoploss, comment_profit = "TP❤️️SH", comment_loss = "SL❤️️SH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short', qty_percent = 100, profit = last_price_s, stop = stoploss, comment_profit = "TP❤️️S", comment_loss = "SL❤️️S", alert_message = Alert_TPSL)

else if strategy.position_size < 0 and strategy.openprofit < tp_pnl and mode == true and hedge_mode == 2

strategy.exit("Exit",'Short', qty_percent = 100, stop = stoploss, comment_loss = "SL❤️️%S", alert_message = Alert_TPSL)

//else if strategy.position_size < 0 and strategy.opentrades > 1

// lastsize = (strategy.position_size) * -1

// lastprofitorder = strategy.openprofit

// if lastprofitorder >= 0.07

// strategy.close_all(comment = "TP❤️️SS", alert_message = Alert_TPSL)

//===================== เรียกใช้ library =========================

import X4815162342/X48_LibaryStrategyStatus/2 as fuLi

//แสดงผล Backtest

show_Net = input.bool(true,'Monitor Profit&Loss', inline = 'Lnet', group = '= PNL MONITOR SETTING =')

position_ = input.string('bottom_center','Position', options = ['top_right','middle_right','bottom_right','top_center','middle_center','bottom_center','middle_left','bottom_left'] , inline = 'Lnet')

size_i = input.string('auto','size', options = ['auto','tiny','small','normal'] , inline = 'Lnet')

color_Net = input.color(color.blue,"" , inline = 'Lnet')

// fuLi.NetProfit_Show(show_Net , position_ , size_i, color_Net )