개요

이 전략은 쌍방향 필터를 사용하여 거래량을 측정하는 전략이다. 이 전략은 전 세계 트렌드 필터와 지역 트렌드 필터를 동시에 결합하여 트렌드 방향이 올바른 경우에만 포지션을 열 수 있도록 한다. 또한, 전략은 RSI 필터, 가격 필터, 기울기 필터 등과 같은 다른 여러 필터 조건을 설정하여 거래 신호의 신뢰성을 더욱 높인다. 외장 측면에서 전략은 중단 가격과 중지 가격을 미리 설정한다.

전략 원칙

이 전략의 핵심 논리는 이중 트렌드 필터에 기반한다. 전 세계 트렌드 필터는 고기주기 EMA에 기반하여 시장의 전반적인 움직임을 판단하고, 지역 트렌드 필터는 저기주기 EMA에 기반하여 지역 움직임을 판단한다. 두 가지 트렌드가 일치하는 경우에만 포지션을 개설한다.

구체적으로, 전략은 BTCUSDT의 EMA 라인을 계산하여 전체 시장이 상승 추세 또는 하락 추세에 있다고 판단합니다. 이것은 전체적인 추세 필터입니다. 동시에, 전략은 이 계약의 EMA 라인을 계산하여 지역 시장의 움직임을 판단합니다. 이것은 지역 추세 필터입니다.

거래 신호를 확인한 후, 전략은 즉시 입장을 열립니다. 동시에, 전략은 미리 스톱 가격과 스톱 손실 가격을 설정합니다. 가격이 스톱 또는 스톱 손실을 유발하면 전략은 자동으로 스톱 또는 스톱합니다.

우위 분석

이것은 안정적이고 신뢰할 수 있는 양적 거래 전략이며, 주요 장점은 다음과 같습니다.

이중 트렌드 필터링 메커니즘을 사용하여 대부분의 가짜 신호를 필터링하여 거래 신호를 더 신뢰할 수 있습니다.

RSI 필터, 가격 필터 등과 같은 여러 보조 필터와 결합하여 신호 품질을 더욱 향상시킵니다.

자동으로 작동하는 스톱 스톱 손실 가격, 수동 모니터링이 필요하지 않고 거래 위험을 줄입니다.

전략의 매개 변수는 더 많은 거래 유형에 맞게 사용자 정의 할 수 있으며, 더 강한 적응력을 가지고 있습니다.

전략적 아이디어는 명확하고 이해하기 쉽다. 최적화 개선이 가능하며, 확장할 수 있는 공간이 넓다.

위험 분석

이 전략은 장점이 많지만, 다음과 같은 거래 위험도 있습니다.

이중 트렌드 필터는 진입 시점을 결정하는 데 정확하지 않습니다. 필터 매개 변수를 조정하여 최적화 할 수 있습니다.

스톱 스톱 손실 가격은 정확하지 않으며, 너무 일찍 스톱 스톱 또는 스톱 스로이스를 설정할 수 있습니다. 다양한 파라미터 조합을 테스트하여 최적의 해결책을 찾을 수 있습니다.

거래 품종과 주기 선택이 부적절하면 전략이 유효하지 않게 될 수 있다. 각 거래 품종에 대해 개별적으로 매개 변수 조정 및 테스트를 수행하는 것이 좋습니다.

과장 적합성의 위험이 있습니다. 전략의 안정성을 보장하기 위해 더 많은 시장 환경에서 재검토가 필요합니다.

최적화 방향

이 전략은 다음과 같은 방향으로 최적화될 수 있습니다.

이중 필터의 파라미터를 조정하여 최적의 파라미터 조합을 찾습니다.

보조 필터를 테스트하고 최적의 것을 선택합니다.

스탠드 로즈 알고리즘을 더 똑똑하게 만들 수 있도록 최적화하고,

기계학습과 같은 방법을 도입하여 전략의 동적 조정 방법을 시도하는 것.

더 많은 거래 종류와 더 긴 기간에 걸쳐 재검토를 통해 전략의 안정성을 높일 수 있습니다.

요약하다

이 전략은 전체적으로 안정적이고, 정확하며, 쉽게 최적화할 수 있는 정량화 거래 전략이다. 이 전략은 이중 트렌드 필터를 여러 보조 필터와 결합하여 거래 신호를 생성하고, 대부분의 잡음을 필터링하여 신호를 더 정확하고 신뢰할 수 있게 한다. 또한, 전략의 내장된 스톱 스톱 손실 설정은 거래 위험을 줄일 수 있다.

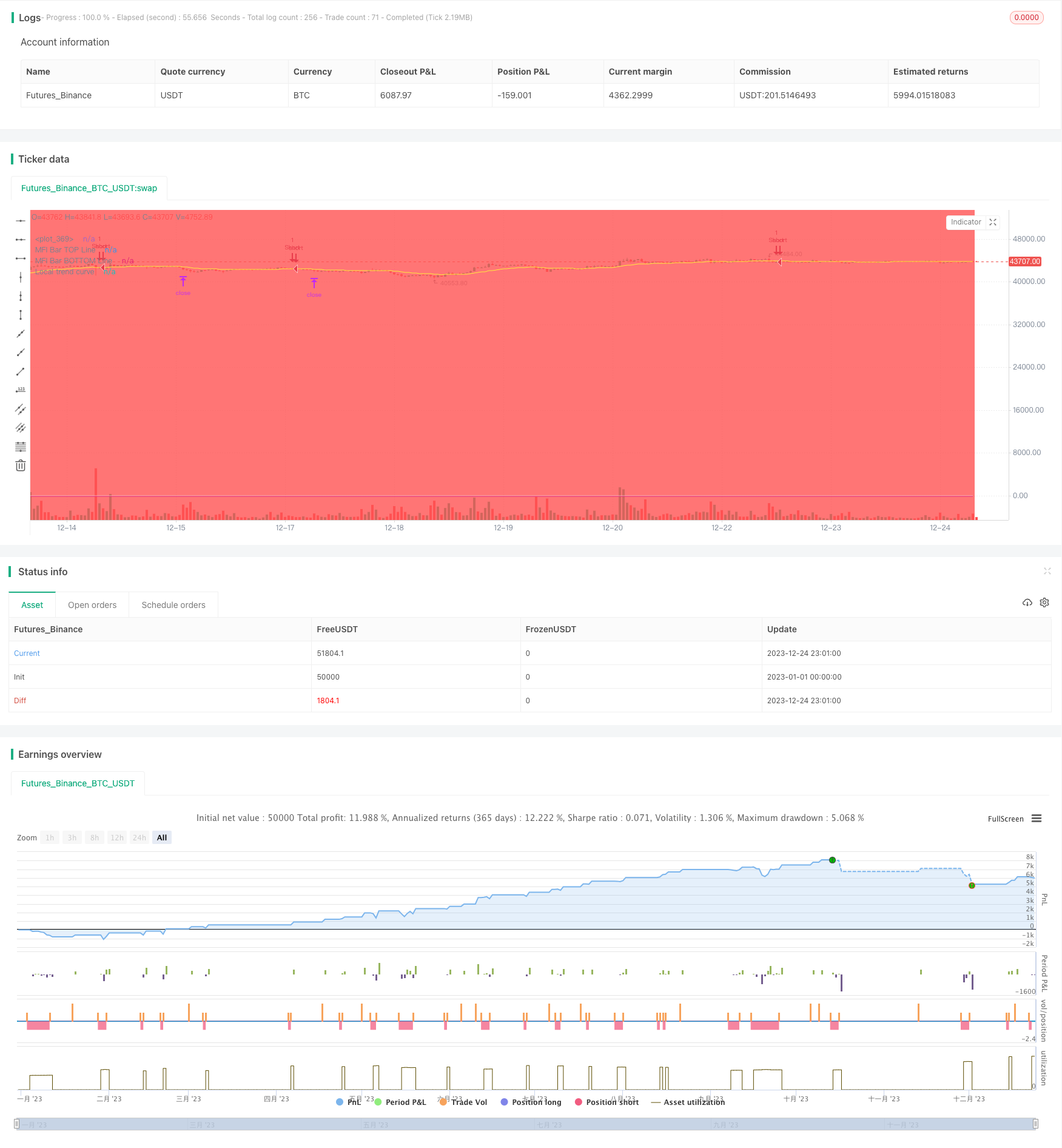

/*backtest

start: 2023-01-01 00:00:00

end: 2023-12-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title = 'Cipher_B', overlay=true )

// PARAMETERS {

// WaveTrend

wtShow = input(true, title = 'Show WaveTrend', type = input.bool)

wtBuyShow = input(true, title = 'Show Buy dots', type = input.bool)

wtGoldShow = input(true, title = 'Show Gold dots', type = input.bool)

wtSellShow = input(true, title = 'Show Sell dots', type = input.bool)

wtDivShow = input(true, title = 'Show Div. dots', type = input.bool)

vwapShow = input(true, title = 'Show Fast WT', type = input.bool)

wtChannelLen = input(9, title = 'WT Channel Length', type = input.integer)

wtAverageLen = input(12, title = 'WT Average Length', type = input.integer)

wtMASource = input(hlc3, title = 'WT MA Source', type = input.source)

wtMALen = input(3, title = 'WT MA Length', type = input.integer)

// WaveTrend Overbought & Oversold lines

obLevel = input(53, title = 'WT Overbought Level 1', type = input.integer)

obLevel2 = input(60, title = 'WT Overbought Level 2', type = input.integer)

obLevel3 = input(100, title = 'WT Overbought Level 3', type = input.integer)

osLevel = input(-53, title = 'WT Oversold Level 1', type = input.integer)

osLevel2 = input(-60, title = 'WT Oversold Level 2', type = input.integer)

osLevel3 = input(-75, title = 'WT Oversold Level 3', type = input.integer)

// Divergence WT

wtShowDiv = input(true, title = 'Show WT Regular Divergences', type = input.bool)

wtShowHiddenDiv = input(false, title = 'Show WT Hidden Divergences', type = input.bool)

showHiddenDiv_nl = input(true, title = 'Not apply OB/OS Limits on Hidden Divergences', type = input.bool)

wtDivOBLevel = input(45, title = 'WT Bearish Divergence min', type = input.integer)

wtDivOSLevel = input(-65, title = 'WT Bullish Divergence min', type = input.integer)

// Divergence extra range

wtDivOBLevel_addshow = input(false, title = 'Show 2nd WT Regular Divergences', type = input.bool)

wtDivOBLevel_add = input(15, title = 'WT 2nd Bearish Divergence', type = input.integer)

wtDivOSLevel_add = input(-40, title = 'WT 2nd Bullish Divergence 15 min', type = input.integer)

// RSI+MFI

rsiMFIShow = input(true, title = 'Show MFI', type = input.bool)

rsiMFIperiod = input(60,title = 'MFI Period', type = input.integer)

rsiMFIMultiplier = input(150, title = 'MFI Area multiplier', type = input.float)

rsiMFIPosY = input(2.5, title = 'MFI Area Y Pos', type = input.float)

// RSI

rsiShow = input(false, title = 'Show RSI', type = input.bool)

rsiSRC = input(close, title = 'RSI Source', type = input.source)

rsiLen = input(14, title = 'RSI Length', type = input.integer)

rsiOversold = input(30, title = 'RSI Oversold', minval = 50, maxval = 100, type = input.integer)

rsiOverbought = input(60, title = 'RSI Overbought', minval = 0, maxval = 50, type = input.integer)

// Divergence RSI

rsiShowDiv = input(false, title = 'Show RSI Regular Divergences', type = input.bool)

rsiShowHiddenDiv = input(false, title = 'Show RSI Hidden Divergences', type = input.bool)

rsiDivOBLevel = input(60, title = 'RSI Bearish Divergence min', type = input.integer)

rsiDivOSLevel = input(30, title = 'RSI Bullish Divergence min', type = input.integer)

// RSI Stochastic

stochShow = input(true, title = 'Show Stochastic RSI', type = input.bool)

stochUseLog = input(true, title=' Use Log?', type = input.bool)

stochAvg = input(false, title='Use Average of both K & D', type = input.bool)

stochSRC = input(close, title = 'Stochastic RSI Source', type = input.source)

stochLen = input(14, title = 'Stochastic RSI Length', type = input.integer)

stochRsiLen = input(14, title = 'RSI Length ', type = input.integer)

stochKSmooth = input(3, title = 'Stochastic RSI K Smooth', type = input.integer)

stochDSmooth = input(3, title = 'Stochastic RSI D Smooth', type = input.integer)

// Divergence stoch

stochShowDiv = input(false, title = 'Show Stoch Regular Divergences', type = input.bool)

stochShowHiddenDiv = input(false, title = 'Show Stoch Hidden Divergences', type = input.bool)

// Schaff Trend Cycle

tcLine = input(false, title="Show Schaff TC line", type=input.bool)

tcSRC = input(close, title = 'Schaff TC Source', type = input.source)

tclength = input(10, title="Schaff TC", type=input.integer)

tcfastLength = input(23, title="Schaff TC Fast Lenght", type=input.integer)

tcslowLength = input(50, title="Schaff TC Slow Length", type=input.integer)

tcfactor = input(0.5, title="Schaff TC Factor", type=input.float)

// Sommi Flag

sommiFlagShow = input(false, title = 'Show Sommi flag', type = input.bool)

sommiShowVwap = input(false, title = 'Show Sommi F. Wave', type = input.bool)

sommiVwapTF = input('720', title = 'Sommi F. Wave timeframe', type = input.string)

sommiVwapBearLevel = input(0, title = 'F. Wave Bear Level (less than)', type = input.integer)

sommiVwapBullLevel = input(0, title = 'F. Wave Bull Level (more than)', type = input.integer)

soomiFlagWTBearLevel = input(0, title = 'WT Bear Level (more than)', type = input.integer)

soomiFlagWTBullLevel = input(0, title = 'WT Bull Level (less than)', type = input.integer)

soomiRSIMFIBearLevel = input(0, title = 'Money flow Bear Level (less than)', type = input.integer)

soomiRSIMFIBullLevel = input(0, title = 'Money flow Bull Level (more than)', type = input.integer)

// Sommi Diamond

sommiDiamondShow = input(false, title = 'Show Sommi diamond', type = input.bool)

sommiHTCRes = input('60', title = 'HTF Candle Res. 1', type = input.string)

sommiHTCRes2 = input('240', title = 'HTF Candle Res. 2', type = input.string)

soomiDiamondWTBearLevel = input(0, title = 'WT Bear Level (More than)', type = input.integer)

soomiDiamondWTBullLevel = input(0, title = 'WT Bull Level (Less than)', type = input.integer)

// macd Colors

macdWTColorsShow = input(false, title = 'Show MACD Colors', type = input.bool)

macdWTColorsTF = input('240', title = 'MACD Colors MACD TF', type = input.string)

darkMode = input(false, title = 'Dark mode', type = input.bool)

// Colors

colorRed = #ff0000

colorPurple = #e600e6

colorGreen = #3fff00

colorOrange = #e2a400

colorYellow = #ffe500

colorWhite = #ffffff

colorPink = #ff00f0

colorBluelight = #31c0ff

colorWT1 = #90caf9

colorWT2 = #0d47a1

colorWT2_ = #131722

colormacdWT1a = #4caf58

colormacdWT1b = #af4c4c

colormacdWT1c = #7ee57e

colormacdWT1d = #ff3535

colormacdWT2a = #305630

colormacdWT2b = #310101

colormacdWT2c = #132213

colormacdWT2d = #770000

// } PARAMETERS

// FUNCTIONS {

// Divergences

f_top_fractal(src) => src[4] < src[2] and src[3] < src[2] and src[2] > src[1] and src[2] > src[0]

f_bot_fractal(src) => src[4] > src[2] and src[3] > src[2] and src[2] < src[1] and src[2] < src[0]

f_fractalize(src) => f_top_fractal(src) ? 1 : f_bot_fractal(src) ? -1 : 0

f_findDivs(src, topLimit, botLimit, useLimits) =>

fractalTop = f_fractalize(src) > 0 and (useLimits ? src[2] >= topLimit : true) ? src[2] : na

fractalBot = f_fractalize(src) < 0 and (useLimits ? src[2] <= botLimit : true) ? src[2] : na

highPrev = valuewhen(fractalTop, src[2], 0)[2]

highPrice = valuewhen(fractalTop, high[2], 0)[2]

lowPrev = valuewhen(fractalBot, src[2], 0)[2]

lowPrice = valuewhen(fractalBot, low[2], 0)[2]

bearSignal = fractalTop and high[2] > highPrice and src[2] < highPrev

bullSignal = fractalBot and low[2] < lowPrice and src[2] > lowPrev

bearDivHidden = fractalTop and high[2] < highPrice and src[2] > highPrev

bullDivHidden = fractalBot and low[2] > lowPrice and src[2] < lowPrev

[fractalTop, fractalBot, lowPrev, bearSignal, bullSignal, bearDivHidden, bullDivHidden]

// RSI+MFI

f_rsimfi(_period, _multiplier, _tf) => security(syminfo.tickerid, _tf, sma(((close - open) / (high - low)) * _multiplier, _period) - rsiMFIPosY)

// WaveTrend

f_wavetrend(src, chlen, avg, malen, tf) =>

tfsrc = security(syminfo.tickerid, tf, src)

esa = ema(tfsrc, chlen)

de = ema(abs(tfsrc - esa), chlen)

ci = (tfsrc - esa) / (0.015 * de)

wt1 = security(syminfo.tickerid, tf, ema(ci, avg))

wt2 = security(syminfo.tickerid, tf, sma(wt1, malen))

wtVwap = wt1 - wt2

wtOversold = wt2 <= osLevel

wtOverbought = wt2 >= obLevel

wtCross = cross(wt1, wt2)

wtCrossUp = wt2 - wt1 <= 0

wtCrossDown = wt2 - wt1 >= 0

wtCrosslast = cross(wt1[2], wt2[2])

wtCrossUplast = wt2[2] - wt1[2] <= 0

wtCrossDownlast = wt2[2] - wt1[2] >= 0

[wt1, wt2, wtOversold, wtOverbought, wtCross, wtCrossUp, wtCrossDown, wtCrosslast, wtCrossUplast, wtCrossDownlast, wtVwap]

// Schaff Trend Cycle

f_tc(src, length, fastLength, slowLength) =>

ema1 = ema(src, fastLength)

ema2 = ema(src, slowLength)

macdVal = ema1 - ema2

alpha = lowest(macdVal, length)

beta = highest(macdVal, length) - alpha

gamma = (macdVal - alpha) / beta * 100

gamma := beta > 0 ? gamma : nz(gamma[1])

delta = gamma

delta := na(delta[1]) ? delta : delta[1] + tcfactor * (gamma - delta[1])

epsilon = lowest(delta, length)

zeta = highest(delta, length) - epsilon

eta = (delta - epsilon) / zeta * 100

eta := zeta > 0 ? eta : nz(eta[1])

stcReturn = eta

stcReturn := na(stcReturn[1]) ? stcReturn : stcReturn[1] + tcfactor * (eta - stcReturn[1])

stcReturn

// Stochastic RSI

f_stochrsi(_src, _stochlen, _rsilen, _smoothk, _smoothd, _log, _avg) =>

src = _log ? log(_src) : _src

rsi = rsi(src, _rsilen)

kk = sma(stoch(rsi, rsi, rsi, _stochlen), _smoothk)

d1 = sma(kk, _smoothd)

avg_1 = avg(kk, d1)

k = _avg ? avg_1 : kk

[k, d1]

// MACD

f_macd(src, fastlen, slowlen, sigsmooth, tf) =>

fast_ma = security(syminfo.tickerid, tf, ema(src, fastlen))

slow_ma = security(syminfo.tickerid, tf, ema(src, slowlen))

macd = fast_ma - slow_ma,

signal = security(syminfo.tickerid, tf, sma(macd, sigsmooth))

hist = macd - signal

[macd, signal, hist]

// MACD Colors on WT

f_macdWTColors(tf) =>

hrsimfi = f_rsimfi(rsiMFIperiod, rsiMFIMultiplier, tf)

[macd, signal, hist] = f_macd(close, 28, 42, 9, macdWTColorsTF)

macdup = macd >= signal

macddown = macd <= signal

macdWT1Color = macdup ? hrsimfi > 0 ? colormacdWT1c : colormacdWT1a : macddown ? hrsimfi < 0 ? colormacdWT1d : colormacdWT1b : na

macdWT2Color = macdup ? hrsimfi < 0 ? colormacdWT2c : colormacdWT2a : macddown ? hrsimfi < 0 ? colormacdWT2d : colormacdWT2b : na

[macdWT1Color, macdWT2Color]

// Get higher timeframe candle

f_getTFCandle(_tf) =>

_open = security(heikinashi(syminfo.tickerid), _tf, open, barmerge.gaps_off, barmerge.lookahead_off)

_close = security(heikinashi(syminfo.tickerid), _tf, close, barmerge.gaps_off, barmerge.lookahead_off)

_high = security(heikinashi(syminfo.tickerid), _tf, high, barmerge.gaps_off, barmerge.lookahead_off)

_low = security(heikinashi(syminfo.tickerid), _tf, low, barmerge.gaps_off, barmerge.lookahead_off)

hl2 = (_high + _low) / 2.0

newBar = change(_open)

candleBodyDir = _close > _open

[candleBodyDir, newBar]

// Sommi flag

f_findSommiFlag(tf, wt1, wt2, rsimfi, wtCross, wtCrossUp, wtCrossDown) =>

[hwt1, hwt2, hwtOversold, hwtOverbought, hwtCross, hwtCrossUp, hwtCrossDown, hwtCrosslast, hwtCrossUplast, hwtCrossDownlast, hwtVwap] = f_wavetrend(wtMASource, wtChannelLen, wtAverageLen, wtMALen, tf)

bearPattern = rsimfi < soomiRSIMFIBearLevel and

wt2 > soomiFlagWTBearLevel and

wtCross and

wtCrossDown and

hwtVwap < sommiVwapBearLevel

bullPattern = rsimfi > soomiRSIMFIBullLevel and

wt2 < soomiFlagWTBullLevel and

wtCross and

wtCrossUp and

hwtVwap > sommiVwapBullLevel

[bearPattern, bullPattern, hwtVwap]

f_findSommiDiamond(tf, tf2, wt1, wt2, wtCross, wtCrossUp, wtCrossDown) =>

[candleBodyDir, newBar] = f_getTFCandle(tf)

[candleBodyDir2, newBar2] = f_getTFCandle(tf2)

bearPattern = wt2 >= soomiDiamondWTBearLevel and

wtCross and

wtCrossDown and

not candleBodyDir and

not candleBodyDir2

bullPattern = wt2 <= soomiDiamondWTBullLevel and

wtCross and

wtCrossUp and

candleBodyDir and

candleBodyDir2

[bearPattern, bullPattern]

// } FUNCTIONS

// CALCULATE INDICATORS {

// RSI

rsi = rsi(rsiSRC, rsiLen)

rsiColor = rsi <= rsiOversold ? colorGreen : rsi >= rsiOverbought ? colorRed : colorPurple

// RSI + MFI Area

rsiMFI = f_rsimfi(rsiMFIperiod, rsiMFIMultiplier, timeframe.period)

rsiMFIColor = rsiMFI > 0 ? #3ee145 : #ff3d2e

// Calculates WaveTrend

[wt1, wt2, wtOversold, wtOverbought, wtCross, wtCrossUp, wtCrossDown, wtCross_last, wtCrossUp_last, wtCrossDown_last, wtVwap] = f_wavetrend(wtMASource, wtChannelLen, wtAverageLen, wtMALen, timeframe.period)

// Stochastic RSI

[stochK, stochD] = f_stochrsi(stochSRC, stochLen, stochRsiLen, stochKSmooth, stochDSmooth, stochUseLog, stochAvg)

// Schaff Trend Cycle

tcVal = f_tc(tcSRC, tclength, tcfastLength, tcslowLength)

// Sommi flag

[sommiBearish, sommiBullish, hvwap] = f_findSommiFlag(sommiVwapTF, wt1, wt2, rsiMFI, wtCross, wtCrossUp, wtCrossDown)

//Sommi diamond

[sommiBearishDiamond, sommiBullishDiamond] = f_findSommiDiamond(sommiHTCRes, sommiHTCRes2, wt1, wt2, wtCross, wtCrossUp, wtCrossDown)

// macd colors

[macdWT1Color, macdWT2Color] = f_macdWTColors(macdWTColorsTF)

// WT Divergences

[wtFractalTop, wtFractalBot, wtLow_prev, wtBearDiv, wtBullDiv, wtBearDivHidden, wtBullDivHidden] = f_findDivs(wt2, wtDivOBLevel, wtDivOSLevel, true)

[wtFractalTop_add, wtFractalBot_add, wtLow_prev_add, wtBearDiv_add, wtBullDiv_add, wtBearDivHidden_add, wtBullDivHidden_add] = f_findDivs(wt2, wtDivOBLevel_add, wtDivOSLevel_add, true)

[wtFractalTop_nl, wtFractalBot_nl, wtLow_prev_nl, wtBearDiv_nl, wtBullDiv_nl, wtBearDivHidden_nl, wtBullDivHidden_nl] = f_findDivs(wt2, 0, 0, false)

wtBearDivHidden_ = showHiddenDiv_nl ? wtBearDivHidden_nl : wtBearDivHidden

wtBullDivHidden_ = showHiddenDiv_nl ? wtBullDivHidden_nl : wtBullDivHidden

wtBearDivColor = (wtShowDiv and wtBearDiv) or (wtShowHiddenDiv and wtBearDivHidden_) ? colorRed : na

wtBullDivColor = (wtShowDiv and wtBullDiv) or (wtShowHiddenDiv and wtBullDivHidden_) ? colorGreen : na

wtBearDivColor_add = (wtShowDiv and (wtDivOBLevel_addshow and wtBearDiv_add)) or (wtShowHiddenDiv and (wtDivOBLevel_addshow and wtBearDivHidden_add)) ? #9a0202 : na

wtBullDivColor_add = (wtShowDiv and (wtDivOBLevel_addshow and wtBullDiv_add)) or (wtShowHiddenDiv and (wtDivOBLevel_addshow and wtBullDivHidden_add)) ? #1b5e20 : na

// RSI Divergences

[rsiFractalTop, rsiFractalBot, rsiLow_prev, rsiBearDiv, rsiBullDiv, rsiBearDivHidden, rsiBullDivHidden] = f_findDivs(rsi, rsiDivOBLevel, rsiDivOSLevel, true)

[rsiFractalTop_nl, rsiFractalBot_nl, rsiLow_prev_nl, rsiBearDiv_nl, rsiBullDiv_nl, rsiBearDivHidden_nl, rsiBullDivHidden_nl] = f_findDivs(rsi, 0, 0, false)

rsiBearDivHidden_ = showHiddenDiv_nl ? rsiBearDivHidden_nl : rsiBearDivHidden

rsiBullDivHidden_ = showHiddenDiv_nl ? rsiBullDivHidden_nl : rsiBullDivHidden

rsiBearDivColor = (rsiShowDiv and rsiBearDiv) or (rsiShowHiddenDiv and rsiBearDivHidden_) ? colorRed : na

rsiBullDivColor = (rsiShowDiv and rsiBullDiv) or (rsiShowHiddenDiv and rsiBullDivHidden_) ? colorGreen : na

// Stoch Divergences

[stochFractalTop, stochFractalBot, stochLow_prev, stochBearDiv, stochBullDiv, stochBearDivHidden, stochBullDivHidden] = f_findDivs(stochK, 0, 0, false)

stochBearDivColor = (stochShowDiv and stochBearDiv) or (stochShowHiddenDiv and stochBearDivHidden) ? colorRed : na

stochBullDivColor = (stochShowDiv and stochBullDiv) or (stochShowHiddenDiv and stochBullDivHidden) ? colorGreen : na

// Small Circles WT Cross

signalColor = wt2 - wt1 > 0 ? color.red : color.lime

// Buy signal.

buySignal = wtCross and wtCrossUp and wtOversold

buySignalDiv = (wtShowDiv and wtBullDiv) or

(wtShowDiv and wtBullDiv_add) or

(stochShowDiv and stochBullDiv) or

(rsiShowDiv and rsiBullDiv)

buySignalDiv_color = wtBullDiv ? colorGreen :

wtBullDiv_add ? color.new(colorGreen, 60) :

rsiShowDiv ? colorGreen : na

// Sell signal

sellSignal = wtCross and wtCrossDown and wtOverbought

sellSignalDiv = (wtShowDiv and wtBearDiv) or

(wtShowDiv and wtBearDiv_add) or

(stochShowDiv and stochBearDiv) or

(rsiShowDiv and rsiBearDiv)

sellSignalDiv_color = wtBearDiv ? colorRed :

wtBearDiv_add ? color.new(colorRed, 60) :

rsiBearDiv ? colorRed : na

// Gold Buy

lastRsi = valuewhen(wtFractalBot, rsi[2], 0)[2]

wtGoldBuy = ((wtShowDiv and wtBullDiv) or (rsiShowDiv and rsiBullDiv)) and

wtLow_prev <= osLevel3 and

wt2 > osLevel3 and

wtLow_prev - wt2 <= -5 and

lastRsi < 30

// } CALCULATE INDICATORS

// DRAW {

bgcolor(darkMode ? color.new(#000000, 80) : na)

zLine = plot(0, color = color.new(colorWhite, 50))

// MFI BAR

rsiMfiBarTopLine = plot(rsiMFIShow ? -95 : na, title = 'MFI Bar TOP Line', transp = 100)

rsiMfiBarBottomLine = plot(rsiMFIShow ? -99 : na, title = 'MFI Bar BOTTOM Line', transp = 100)

fill(rsiMfiBarTopLine, rsiMfiBarBottomLine, title = 'MFI Bar Colors', color = rsiMFIColor, transp = 75)

Global=input(title="Use Global trend?", defval=true, type=input.bool, group="Trend Settings")

regimeFilter_frame=input(title="Global trend timeframe", defval="5", options=['D','60','5'], group="Trend Settings")

regimeFilter_length=input(title="Global trend length", defval=1700, type=input.integer, group="Trend Settings")

localFilter_length=input(title="Local trend filter length", defval=20, type=input.integer, group="Trend Settings")

localFilter_frame=input(title="Local trend filter timeframe", defval="60", options=['D','60', '5'], group="Trend Settings")

Div_1=input(title="Only divergencies for long", defval=true, type=input.bool, group="Trend Settings")

Div_2=input(title="Only divergencies for short", defval=true, type=input.bool, group="Trend Settings")

sommi_diamond_on=input(title="Sommi diamond alerts", defval=false, type=input.bool, group="Trend Settings")

Cancel_all=input(title="Cancel all positions if price crosses local sma? (yellow line)", defval=false, type=input.bool, group="Trend Settings")

a_1=input(title="TP long", defval=0.95,step=0.5, type=input.float, group="TP/SL Settings")

a_1_div=input(title="TP long div", defval=0.95,step=0.5, type=input.float, group="TP/SL Settings")

a_2=input(title="TP short", defval=0.95,step=1, type=input.float, group="TP/SL Settings")

b_1=input(title="SL long", defval=5,step=0.1, type=input.float, group="TP/SL Settings")

b_2=input(title="SL short", defval=5,step=0.1, type=input.float, group="TP/SL Settings")

RSI_filter_checkbox = input(title="RSI filter ON", defval=false, type=input.bool, group="Trend Settings")

Price_filter_checkbox=input(title="Price filter ON", defval=false, type=input.bool, group="Trend Settings")

Price_filter_1_long=input(title="Long Price filter from", defval=1000, type=input.integer, group="Trend Settings")

Price_filter_2_long=input(title="Long Price filter to", defval=1200, type=input.integer, group="Trend Settings")

Price_filter_1_short=input(title="Short Price filter from", defval=1000, type=input.integer, group="Trend Settings")

Price_filter_2_short=input(title="Short Price filter to", defval=1200, type=input.integer, group="Trend Settings")

Local_filter_checkbox=input(title="Use Local trend?", defval=true, type=input.bool, group="Trend Settings")

slope_checkbox = input(title="Use Slope filter?", defval=false, type=input.bool, group="Slope Settings")

slope_number_long = input(title="Slope number long", defval=-0.3,step=0.01, type=input.float, group="Slope Settings")

slope_number_short = input(title="Slope number short", defval=0.16,step=0.01, type=input.float, group="Slope Settings")

slope_period = input(title="Slope period", defval=300, type=input.integer, group="Slope Settings")

long_on = input(title="Only long?", defval=true, type=input.bool, group="Position Settings")

short_on = input(title="Only short?", defval=true, type=input.bool, group="Position Settings")

volume_ETH_spot_checkbox = input(title="Volume filter?", defval=false, type=input.bool, group="Volume Settings")

volume_ETH_spot_number_more = input(title="Volume no more than:", defval=3700, type=input.integer, group="Volume Settings")

volume_ETH_spot_number_less = input(title="Volume no less than:", defval=600, type=input.integer, group="Volume Settings")

limit_checkbox = input(title="Shift open position?", defval=false, type=input.bool, group="Shift Settings")

limit_shift = input(title="How many % to shift?", defval=0.5,step=0.01, type=input.float, group="Shift Settings")

cancel_in = input(title="Cancel position in #bars?", defval=false, type=input.bool, group="Cancel Settings")

cancel_in_num = input(title="Number of bars", defval=96, type=input.integer, group="Cancel Settings")

//Name of ticker

_str=tostring(syminfo.ticker)

_chars = str.split(_str, "")

int _len = array.size(_chars)

int _beg = max(0, _len - 4)

string[] _substr = array.new_string(0)

if _beg < _len

_substr := array.slice(_chars, 0, _beg)

string _return = array.join(_substr, "")

//Hour sma

basis = security(syminfo.tickerid, localFilter_frame, ema(close, localFilter_length))

plot(basis, title="Local trend curve", color=color.yellow, style=plot.style_linebr)

//Trend calculation with EMA

f_sec(_market, _res, _exp) => security(_market, _res, _exp[barstate.isconfirmed ? 0 : 1])

ema = sma(close, regimeFilter_length)

emaValue = f_sec("BTC_USDT:swap", regimeFilter_frame, ema)

marketPrice = f_sec("BTC_USDT:swap", regimeFilter_frame, close)

regimeFilter = Global?(marketPrice > emaValue or marketPrice[1] > emaValue[1]):true

reverse_regime=Global?(marketPrice < emaValue or marketPrice[1] < emaValue[1]):true

bgcolor(Global?regimeFilter ? color.green : color.red:color.yellow)

//Local trend

regimeFilter_local = Local_filter_checkbox ? close > basis: true //or close[1] > basis[1]

reverse_regime_local = Local_filter_checkbox ? close < basis: true //or close[1] < basis[1]

//RSI filter

up = rma(max(change(close), 0), 14)

down = rma(-min(change(close), 0), 14)

rsi_ = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsiMA = ema(rsi_,12)

//local incline

sma =security(syminfo.tickerid, '60', ema(close, 15))

slope = (sma - sma[slope_period]) / slope_period

slope_filter_long = slope_checkbox? slope > slope_number_long : true

slope_filter_short = slope_checkbox? slope < slope_number_short : true

var long_check = true

var short_check = true

if RSI_filter_checkbox

long_check:= rsiMA<40

short_check:= rsiMA>60

//

validlow = Div_1 ? buySignalDiv or wtGoldBuy : buySignal or buySignalDiv or wtGoldBuy

validhigh = Div_2 ? sellSignalDiv : sellSignal or sellSignalDiv

//check volume of ETHUSDT

volume_ETH_spot = volume

volume_ETH_spot_filter = volume_ETH_spot_checkbox? volume_ETH_spot < volume_ETH_spot_number_more and volume_ETH_spot > volume_ETH_spot_number_less : true

// Check if we have confirmation for our setup

var Price_long = true

if Price_filter_checkbox

Price_long:=close>Price_filter_1_long and close<Price_filter_2_long

var Price_short = true

if Price_filter_checkbox

Price_short:=close>Price_filter_1_short and close<Price_filter_2_short

validlong = sommi_diamond_on ? sommiBullishDiamond and strategy.position_size == 0 and barstate.isconfirmed and regimeFilter_local and regimeFilter : validlow and strategy.position_size == 0 and barstate.isconfirmed and regimeFilter_local and Price_long and long_check and slope_filter_long and volume_ETH_spot_filter

validshort = sommi_diamond_on ? sommiBearishDiamond and strategy.position_size == 0 and barstate.isconfirmed and reverse_regime_local and reverse_regime : validhigh and strategy.position_size == 0 and barstate.isconfirmed and reverse_regime_local and Price_short and short_check and slope_filter_short and volume_ETH_spot_filter

// Save trade stop & target & position size if a valid setup is detected

var tradeStopPrice = 0.0

var tradeTargetPrice = 0.0

var TP=0.0

var limit_price=0.0

//Detect valid long setups & trigger alert

if validlong

if buySignalDiv or wtGoldBuy

limit_price:=limit_checkbox? close*(1-limit_shift*0.01) : close

tradeStopPrice := limit_price*(1-b_1*0.01)

tradeTargetPrice := limit_price*(1+a_1_div*0.01)

TP:= a_1_div

else

limit_price:=limit_checkbox? close*(1-limit_shift*0.01) : close

tradeStopPrice := limit_price*(1-b_1*0.01)

tradeTargetPrice := limit_price*(1+a_1*0.01)

TP:= a_1

// if validlong

// if buySignalDiv or wtGoldBuy

// limit_price:=close

// tradeStopPrice := limit_price*(1-b_1*0.01)

// tradeTargetPrice := limit_price*(1+a_1_div*0.01)

// TP:= a_1_div

// else

// limit_price:=close

// tradeStopPrice := limit_price*(1-b_1*0.01)

// tradeTargetPrice := limit_price*(1+a_1*0.01)

// TP:= a_1

// Detect valid short setups & trigger alert

if validshort

limit_price:=limit_checkbox? close*(1+limit_shift*0.01) : close

tradeStopPrice := limit_price*(1+b_2*0.01)

tradeTargetPrice := limit_price*(1-a_2*0.01)

TP:= a_2

// if validshort

// limit_price:= close

// tradeStopPrice := limit_price*(1+b_2*0.01)

// tradeTargetPrice := limit_price*(1-a_2*0.01)

// TP:= a_2

if cancel_in and barssince(validlong) == cancel_in_num or barssince(validshort) == cancel_in_num

strategy.cancel_all()

if long_on

strategy.entry (id="Long", long=strategy.long, limit=limit_price, when=validlong, comment='{\n' + ' "name": "",\n' + ' "secret": "",\n' + ' "side": "buy",\n' + ' "symbol": '+'"'+_return+'"'+',\n' + ' "positionSide": "long"\n' + '}')

if short_on

strategy.entry (id="Short", long=strategy.short, limit=limit_price, when=validshort,comment='{\n' + ' "name": "",\n' + ' "secret": "",\n' + ' "side": "sell",\n' + ' "symbol": '+'"'+_return+'"'+',\n' + ' "positionSide": "short",\n' + ' "sl": {\n' + ' "enabled": true\n' + ' }\n' + '}')

// condition:=true

// if Cancel_all and strategy.position_size > 0 and (reverse_regime_local or reverse_regime)

// strategy.close_all(when=strategy.position_size != 0, comment='{\n' + ' "name": "",\n' + ' "secret": "",\n' + ' "side": "sell",\n' + ' "symbol": '+'"'+_return+'"'+',\n' + ' "positionSide": "flat"\n' + '}')

if Cancel_all and strategy.position_size > 0 and reverse_regime_local

strategy.close_all(when=strategy.position_size != 0, comment='{\n'

+ ' "name": "",\n'

+ ' "secret": "",\n'

+ ' "side": "sell",\n'

+ ' "symbol": '+'"'+_return+'"'+',\n'

+ ' "positionSide": "flat"\n'

+ '}')

if Cancel_all and strategy.position_size < 0 and regimeFilter_local

strategy.close_all(when=strategy.position_size != 0, comment='{\n'

+ ' "name": "",\n'

+ ' "secret": "",\n'

+ ' "side": "buy",\n'

+ ' "symbol": '+'"'+_return+'"'+',\n'

+ ' "positionSide": "flat"\n'

+ '}')

if cancel_in and strategy.position_size > 0 and barssince(validlong) > cancel_in_num

strategy.close_all(when=strategy.position_size != 0, comment='{\n'

+ ' "name": "",\n'

+ ' "secret": "",\n'

+ ' "side": "sell",\n'

+ ' "symbol": '+'"'+_return+'"'+',\n'

+ ' "positionSide": "flat"\n'

+ '}')

if cancel_in and strategy.position_size < 0 and barssince(validshort) > cancel_in_num

strategy.close_all(when=strategy.position_size != 0, comment='{\n'

+ ' "name": "",\n'

+ ' "secret": "",\n'

+ ' "side": "buy",\n'

+ ' "symbol": '+'"'+_return+'"'+',\n'

+ ' "positionSide": "flat"\n'

+ '}')

// Exit trades whenever our stop or target is hit

strategy.exit(id="Long Exit", from_entry="Long", limit=tradeTargetPrice, stop=tradeStopPrice, when=strategy.position_size > 0)

strategy.exit(id="Short Exit", from_entry="Short", limit=tradeTargetPrice,stop=tradeStopPrice, when=strategy.position_size < 0)