개요

이 전략은 파라폴릭 SAR, 트리플 지수 이동 평균 (TEMA), 일반 지수 이동 평균 (EMA), 상대적으로 약한 지수 (RSI), 균형 지수 (OBV) 등과 같은 여러 가지 기술 지표를 결합하여 주식 가격의 역전 신호를 식별하고 트렌드 필터링 및 스톱 손실 설정과 결합하여 구매 및 판매 신호를 생성합니다.

전략 원칙

이 전략은 파라폴릭 SAR를 주요 가격 역전 신호 지표로 사용한다. SAR는 가격 위쪽에서 다중 상태, 가격 아래쪽에서 빈 상태를 나타낸다. SAR는 가격 아래에서 상향으로 돌파할 때 판매 신호를 발생시키고, 가격 위쪽에서 하향으로 돌파할 때 구매 신호를 발생시킨다.

가짜 신호를 필터링하기 위해 이 전략은 TEMA 또는 EMA 기술 지표를 확인 신호로 사용합니다. SAR 신호와 TEMA (고속선에서 느린 선) 또는 EMA (고속선에서 느린 선) 이 동시에 나타나는 경우에만 구매 신호가 생성됩니다. SAR 신호와 TEMA (고속선에서 느린 선) 또는 EMA (고속선에서 느린 선) 이 동시에 나타나는 경우에만 판매 신호가 생성됩니다.

이 전략은 RSI 지표와 OBV 지표를 선택의 확인 신호로 제공합니다.

또한, 이 전략은 트리플 EMA 기술 지표 그래픽을 제공하여 가격 추세를 더 명확하게 관찰할 수 있습니다. eMAMA 모형 지표의 표시를 제공하여 추세 전환점을 판단하는 데 도움을줍니다.

이 전략은 또한 여러 지표에 대한 최신 상황을 빠르게 볼 수 있는 도표 아래의 종합 지표 정보를 제공합니다.

우위 분석

이 전략은 SAR, EMA/TEMA, RSI, OBV 등의 여러 지표를 결합하여 가격 반전 신호를 효과적으로 발견하고 가짜 돌파구를 방지할 수 있습니다. 트리플 EMA와 모모형 평균 eMAMA의 트렌드 판단을 추가하면 정확도를 높일 수 있습니다.

그래프는 지표가 풍부하여 시장 상황을 전체적으로 볼 수 있습니다. 추가된 지표 종합표는 여러 지표의 최신 상태를 빠르게 얻을 수 있습니다.

거래 논리 규칙은 명확하고, 매개 변수는 조정 가능하며, 다른 거래 품종에 적응할 수 있다.

위험 분석

이 전략은 지표 변환에 의존하여 신호를 발산합니다. 지표 설정이 부적절하면 많은 양의 노이즈 트레이딩 신호가 발생합니다. 지표 매개 변수는 다른 트레이딩 품종에 따라 최적화된 설정이 필요합니다.

수평으로 정리된 시장에서 SAR 지표는 자주 잘못된 신호를 일으킬 수 있습니다. 이 경우 트렌드를 판단하는 지표의 확인을 주의해야 합니다.

거래 품종 선택이 잘못되면 전략이 실패할 수 있습니다. 전략을 적용하기 위해 명백한 경향을 가진 품종을 선택해야합니다.

최적화 방향

이 전략은 다음과 같은 방향으로 최적화될 수 있습니다.

- SAR 매개 변수를 최적화하여 노이즈 신호를 감소시킵니다.

- 이동 평균 변수를 최적화하여 트렌드 판단의 정확성을 향상시킵니다.

- RSI, OBV 등의 지표의 효과를 테스트하는 확인 지표의 교체

- 추가적인 지표와 풍부한 다중 시간 프레임 분석

- 단편적 손실을 제한하기 위한 최적화된 손해 방지 전략

요약하다

이 횡평선 다중 지표 거래 전략은 여러 가지 일반적인 기술 분석 지표를 통합하여 구매 결정 신호를 형성합니다. 가격 역점을 효과적으로 식별 할 수 있으며, 파라미터가 조정 가능하며, 최적화 할 수있는 특징이 있으며, 숙련 된 양적 거래자의 응용에 적합합니다. 그러나 다양한 품종의 특성에 따라 파라미터를 최적화하고 트렌드가 명백한 거래 품종을 선택해야 전략 효과를 발휘하고 많은 잡음 신호를 발생하지 않도록합니다.

/*backtest

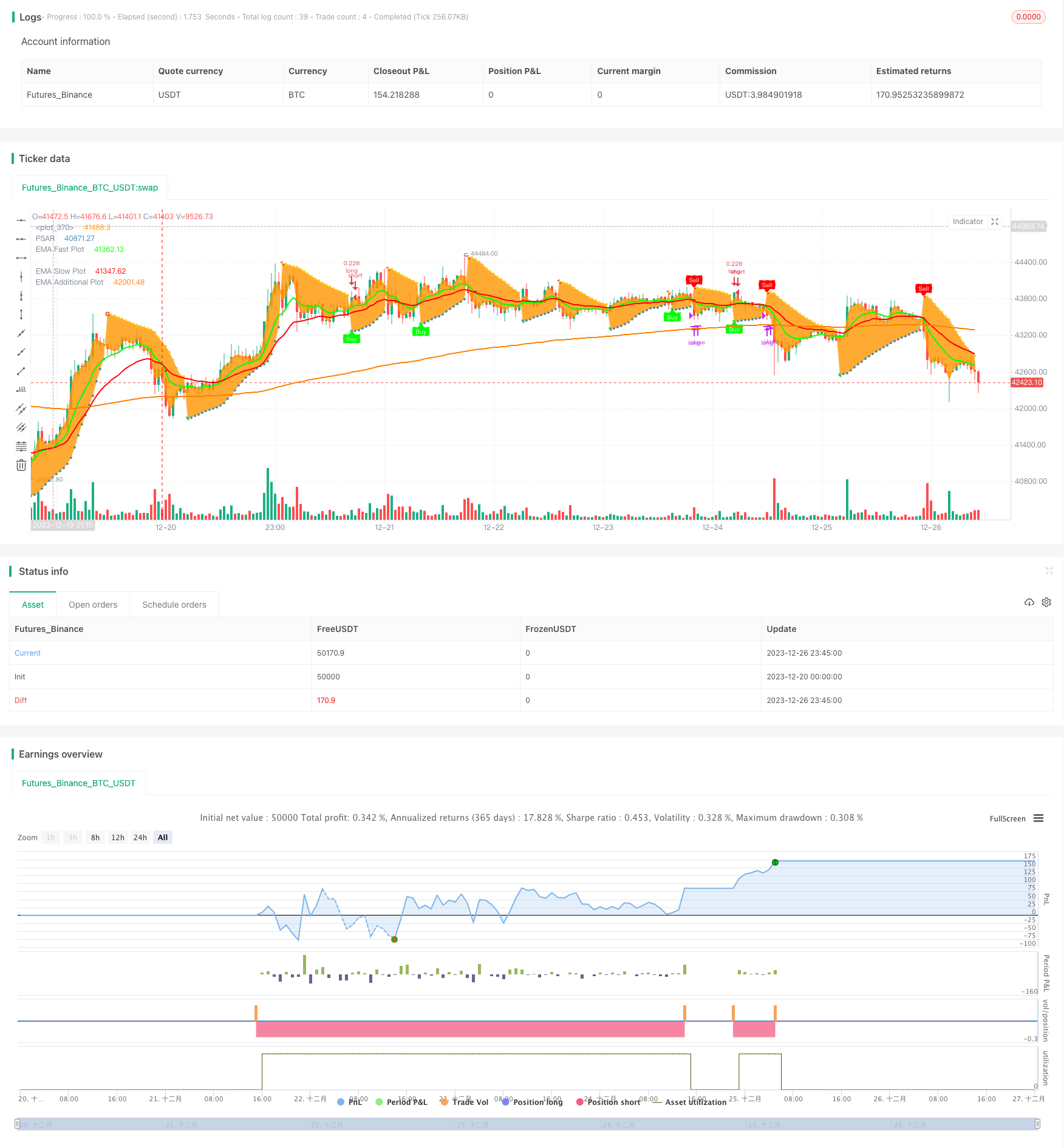

start: 2023-12-20 00:00:00

end: 2023-12-27 00:00:00

period: 45m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//

// ██╗ █████╗ ███████╗ ██████╗██╗██╗ ██╗██╗ ██████╗ ██╗ ██╗███████╗ ███╗ ███╗ ██████╗ ███╗ ██╗██╗ ██╗

// ██║ ██╔══██╗██╔════╝██╔════╝██║██║ ██║██║██╔═══██╗██║ ██║██╔════╝ ████╗ ████║██╔═══██╗████╗ ██║██║ ██╔╝

// ██║ ███████║███████╗██║ ██║██║ ██║██║██║ ██║██║ ██║███████╗ ██╔████╔██║██║ ██║██╔██╗ ██║█████╔╝

// ██║ ██╔══██║╚════██║██║ ██║╚██╗ ██╔╝██║██║ ██║██║ ██║╚════██║ ██║╚██╔╝██║██║ ██║██║╚██╗██║██╔═██╗

// ███████╗██║ ██║███████║╚██████╗██║ ╚████╔╝ ██║╚██████╔╝╚██████╔╝███████║ ██║ ╚═╝ ██║╚██████╔╝██║ ╚████║██║ ██╗

// ╚══════╝╚═╝ ╚═╝╚══════╝ ╚═════╝╚═╝ ╚═══╝ ╚═╝ ╚═════╝ ╚═════╝ ╚══════╝ ╚═╝ ╚═╝ ╚═════╝ ╚═╝ ╚═══╝╚═╝ ╚═╝

// https://www.tradingview.com/u/LasciviousMonk/

// © LasciviousMonk

//

//

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// This script provided freely. No guarantee of functionality is provided. You are welcome to use, revise, or modify

// this code in any way you wish. However, I kindly request that you publish any scripts originating from this code as

// 'Public'. Please do not use this code as a basis for "Protected" or "Invite Only" scripts.

//

//

// PSAR + EMA + TEMA combines Parabolic PSAR plus EMA and TEMA trendlines.

// - EMA and TEMA crossovers have an up or down triangle to indicate direction of cross. Please note

// that because these are Moving Averages (MAs), the triangle may not exactly line up with the crossover.

// - Added MESA Adaptive Moving Average (eMAMA). Crossovers of the fast and slow eMAMA may be used instead of

// EMA or TEMA.

// - Added third EMA line. May be used to filter entries. For example, set the additional EMA to 200. Buy signals

// wil only be sent if the price is greater than the additional EMA.

// - Added RSI and OBV as alternative PSAR confirmations.

//

// "Traffic Light" table: summarizes PSAR, RSI, SRSI, TEMA, EMA, eMAMA, MACD, OBV, and CMF indicators in a table.

// This is intended as a quick "heads up", not to replace the indicators themselves.

// - Arrows indicate direction of change since the last bar.

// - Moving average indicators are indicated as green if the fast MA > slow MA and fast [T]EMA is increasing, red otherwise.

// [T]EMA will be yellow if fast MA has increased over the last 2 periods but fast MA < slow MA.

// - PSAR is as green if the PSAR is increasing, red if it is decreasing.

// - RSI is indicated as green if RSI < oversold, red if RSI > overbought, yellow otherwise.

// - SRSI is indicated as green K < oversold, and red if K > overbought. If oversold < K < overbought,

// green if K > D and red if K < D.

// - MACD, OBV and CMF are green if bullish, red if bearish.

//

//

// Suggestions for use:

// - Use fast EMA crossing above slow EMA as a confirmation for PSAR signals.

// - TEMA or eMAMA can also be used for confirmation signals insead.

// - Instead of using a moving average (EMA, TEMA, etc) for confirmation, you may use RSI or OBV.

// - The "traffic light" table is intended as a "heads up" to call your attention to other indicators

// you may want to check. I suggest Cipher B/VMC Cipher_B, Neglected Volume, and/or CM_Ult_MacD_MTF

// as useful comparions.

//

// Please don't rely solely on the table. It is intended to alert you to look more closely at a plot, not to

// provide all the information you need to enter or exit a position. I find the table to be a nice companion

// to VMC Cipher_B, which can be overwhelming in its complexity.

//

// Code used:

// - TEMA With Alert by BerkSay

// - Parabolic SAR by Alex Orekhov (everget)

// - Ehlers MESA Adaptive Moving Average [LazyBear]

// - EMA, RSI and SRSI built-ins.

//@version=4

strategy(overlay=true, title="PSAR + EMA/TEMA/RSI/OBV", currency = 'USD', shorttitle="PSAR+",

pyramiding = 0, default_qty_type=strategy.percent_of_equity, default_qty_value=20,

initial_capital=5000, calc_on_every_tick=true, calc_on_order_fills=false,

commission_type=strategy.commission.percent, commission_value=0.1)

// ------------------------------------------------<[ Color Constants ]>----------------------------------------------

// Color values used from Pine Magic. https://www.tradingview.com/script/yyDYIrRQ-Pine-Color-Magic-and-Chart-Theme-Simulator/

var transparent = color.new(color.black, 100)

var darkpurple = #550055, dpurple = darkpurple // Alias for dark purple, Not recommended for use on "Dark Charts"

var purple = #990099

var fuchsia = #FF00FF

var violet = #AA00FF

var hanpurple = #6000FF

var blue = #0000FF

var cichlid = #0040FF

var azure = #0080FF

var skyblue = #00C0FF

var aqua = #00FFFF // Not recommended for use on "Light Charts" with 1px line thickness

var mint = #00FF80

var lime = #00FF00

var chartreuse = #80FF00

var yellow = #FFFF00 // Not recommended for use on "Light Charts"

var amber = #FFCC00

var orange = #FF8000

var redorange = #FF4000

var red = #FF0000

var hotpink = #FF0080

var pink = #FF80FF // Not recommended for use on "Light Charts"

// ------------------------------------------------<[ User Input ]>---------------------------------------------------

sourceGlobal = input(title="Source for indicator", defval=close, type=input.source, group="Global")

tradeLong = input(title="Create long positions?", defval=true, type=input.bool, group="Global")

tradeShort = input(title="Create short positions?", defval=false, type=input.bool, group="Global")

showPSAR = input(true, "Show PSAR?", group="PSAR")

psarStart = input(title="PSAR Start", type=input.float, step=0.001, defval=0.02, group="PSAR")

psarIncrement = input(title="PSAR Increment", type=input.float, step=0.001, defval=0.02, group="PSAR")

psarMaximum = input(title="PSAR Maximum", type=input.float, step=0.01, defval=0.2, group="PSAR")

psarConfirmation = input(title="Confirmation signal:", defval="EMA",

options=["EMA", "TEMA", "eMAMA", "RSI", "OBV"], group="PSAR")

psarHighlightStartPoints = input(title="PSAR Highlight Start Points?", type=input.bool, defval=true, group="PSAR")

psarShowLabels = input(title="PSAR Show Buy/Sell Labels?", type=input.bool, defval=true, group="PSAR")

psarHighlightState = input(title="PSAR Highlight State?", type=input.bool, defval=false, group="PSAR")

colorPSARLong = input(title="Long", type=input.color, defval=lime, group="PSAR", inline="colors")

colorPSARShort = input(title="Short", type=input.color, defval=red, group="PSAR", inline="colors")

useSL = input(defval=false, type=input.bool, title="Set stop loss to PSAR plot?")

showTEMA = input(false, "Show TEMA?", group="Triple EMA", inline="showTEMA")

showTEMAfill = input(title="Shade TEMA?", defval=false, type=input.bool, group="Triple EMA", inline="showTEMA")

lengthTEMAFast = input(title="TEMA Fast length", defval=13, minval=1, group="Triple EMA", inline="TemaFast")

colorTEMAFast = input(title="",type=input.color, defval=lime, inline="TemaFast", group="Triple EMA")

lengthTEMASlow = input(title="TEMA Slow length", defval=34, minval=1, group="Triple EMA", inline="TemaSlow")

colorTEMASlow = input(title="",type=input.color, defval=red, group="Triple EMA", inline="TemaSlow")

thicknessTEMA=input(title="Line thickness", defval=2, type=input.integer, minval=1, maxval=4, step=1, group="Triple EMA")

showEMA = input(defval=true, type=input.bool, title="Show EMA?", group="EMA", inline="showEMA")

showEMAfill = input(title="Shade EMA?", defval=false, type=input.bool, group="EMA", inline="showEMA")

lengthEMAFast = input(9, title='EMA Fast Length', step=1, type=input.integer, group="EMA", inline="EmaFast")

colorEMAFast = input(title="",type=input.color, defval=lime, inline="EmaFast", group="EMA")

lengthEMASlow = input(21, title='EMA Slow Length', step=1, type=input.integer, group="EMA", inline="EmaSlow")

colorEMASlow = input(title="",type=input.color, defval=red, group="EMA", inline="EmaSlow")

lengthEMA200 = input(200, title='EMA Additional Length', step=1, type=input.integer, group="EMA", inline="EMA200")

colorEMA200 = input(title="",type=input.color, defval=orange, group="EMA", inline="EMA200")

filterEMA200 = input(title="Use as filter?", defval=false, type=input.bool, group="EMA", inline="EMA200", tooltip="Buy and sell signals are filtered on the additional EMA line, commonly set to 200. This takes effect even if the PSAR confirmation is set to something other than EMA.")

thicknessEMA=input(title="Line thickness", defval=2, type=input.integer, minval=1, maxval=4, step=1, group="EMA")

lengthRSI = input(title="RSI Length", type=input.integer, defval=14, group="RSI")

rsiOverbought = input(title="Overbought Level", type=input.integer, defval=60, group="RSI", inline="levels")

rsiOversold = input(title="Oversold Level", type=input.integer, defval=40, group="RSI", inline="levels")

showeMAMA = input(defval=false, title="Show eMAMA?", type=input.bool, group="Ehler's MESA Adaptive Moving Average", inline="fill")

showEMAMAfill = input(title="Shade eMAMA?", defval=false, type=input.bool, group="Ehler's MESA Adaptive Moving Average", inline="fill")

fastlimitEMAMA=input(.5, title="Fast Limit", group="Ehler's MESA Adaptive Moving Average")

slowlimitEMAMA=input(.05, title="Slow Limit", group="Ehler's MESA Adaptive Moving Average")

thicknessEMAMA=input(title="Line thickness", defval=2, type=input.integer, minval=1, maxval=4, step=1, group="Ehler's MESA Adaptive Moving Average")

coloreMAMA = input(title="eMAMA",type=input.color, defval=lime, group="Ehler's MESA Adaptive Moving Average", inline="colors")

coloreFAMA = input(title="eFAMA",type=input.color, defval=red, group="Ehler's MESA Adaptive Moving Average", inline="colors")

lengthOBV = input(defval=20, title="OBV Length", type=input.integer, group="On Balance Volume")

emaOBV = input(defval=9, title="EMA length", type=input.integer, group="On Balance Volume")

lengthStoch = input(14, "Stochastic Length", minval=1, group="SRSI")

smoothK = input(3, "SRSI K Smoothing", minval=1, group="SRSI")

smoothD = input(3, "SRSI D Smoothing", minval=1, group="SRSI")

srsiOverbought = input(defval=80, title="Overbought level", type=input.integer, group="SRSI", inline="levels")

srsiOversold = input(defval=20, title="Oversold level", type=input.integer, group="SRSI", inline="levels")

lengthMACDfast = input(title="Fast Length", type=input.integer, defval=12, group="MACD")

lengthMACDslow = input(title="Slow Length", type=input.integer, defval=26, group="MACD")

lengthMACDsignal = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9, group="MACD")

lengthCMF = input(20, minval=1, group="Chaiken Money Flow")

showTable = input(defval=false, title="Show summary table?", type=input.bool, group="Summary Table")

tablePosition = input(title="Summary Table Position", defval=position.bottom_left,

options=[position.bottom_left,

position.top_left, position.bottom_right, position.top_right], group="Summary Table")

tableTextSize = input(title="Table Text Size", defval=size.tiny,

options=[size.auto, size.tiny, size.small, size.normal, size.large, size.huge], group="Summary Table")

useDateRange = input(defval=true, title="Limit backtesting by date", type=input.bool, group="Limit by date",

tooltip="Limit window for backtesting. This allows you to compare different TFs over the same period.")

rangeType = input(defval="30 Days", title="Date range:", options=["Custom", "30 Days", "90 Days", "180 Days", "Year to Date"], group="Limit by date")

startDate = input(title="Start Date (DD/MM/YYYY)", type=input.time,

defval=timestamp("1 Jan 2021 1:01 -0400"), group="Limit by date")

endDate = input(title="End Date (DD/MM/YYYY) ", type=input.time,

defval=timestamp("31 Dec 2100 19:59 -0400"), group="Limit by date", tooltip="You likely want to leave this far in the future.")

startDate := rangeType == "Custom" ? startDate :

rangeType == "30 Days" ? timenow - 2592000000 :

rangeType == "90 Days" ? timenow - 7776000000 :

rangeType == "180 Days" ? timenow - 15552000000 :

rangeType == "Year to Date" ? timestamp(syminfo.timezone, year(timenow), 01, 01, 00, 01) : na

inDateRange = (time >= startDate) and (time < endDate)

inDateRange := true

// ------------------------------------------------<[ Variable Declarations ]>----------------------------------------------

var bool psarConfirmationBuy = na

var bool psarConfirmationSell = na

var float eMAMA = na

var float eFAMA = na

var float historicalHigh = 0 // for OBV scaling

// -------------------------------------------------------<[ Functions ]>----------------------------------------------------

fDirection(series, length) =>

rising(series,length) ? "↑" : "↓"

fTEMA(sourceTEMA, length) =>

Tema1 = ema(sourceTEMA, length)

Tema2 = ema(Tema1, length)

Tema3 = ema(Tema2, length)

3 * Tema1 - 3 * Tema2 + Tema3

fMAMA(sourceEMAMA, slowlimitEMAMA, fastlimitEMAMA) =>

var float p = na

var float i2 = na

var float q2 = na

var float re = na

var float im = na

var float spp = na

sp = (4*sourceEMAMA + 3*sourceEMAMA[1] + 2*sourceEMAMA[2] + sourceEMAMA[3]) / 10.0

dt = (.0962*sp + .5769*nz(sp[2]) - .5769*nz(sp[4])- .0962*nz(sp[6]))*(.075*nz(p[1]) + .54)

q1 = (.0962*dt + .5769*nz(dt[2]) - .5769*nz(dt[4])- .0962*nz(dt[6]))*(.075*nz(p[1]) + .54)

i1 = nz(dt[3])

jI = (.0962*i1 + .5769*nz(i1[2]) - .5769*nz(i1[4])- .0962*nz(i1[6]))*(.075*nz(p[1]) + .54)

jq = (.0962*q1 + .5769*nz(q1[2]) - .5769*nz(q1[4])- .0962*nz(q1[6]))*(.075*nz(p[1]) + .54)

i2_ = i1 - jq

q2_ = q1 + jI

i2 := .2*i2_ + .8*nz(i2[1])

q2 := .2*q2_ + .8*nz(q2[1])

re_ = i2*nz(i2[1]) + q2*nz(q2[1])

im_ = i2*nz(q2[1]) - q2*nz(i2[1])

re := .2*re_ + .8*nz(re[1])

im := .2*im_ + .8*nz(im[1])

p1 = iff(im!=0 and re!=0, 360/atan(im/re), nz(p[1]))

p2 = iff(p1 > 1.5*nz(p1[1]), 1.5*nz(p1[1]), iff(p1 < 0.67*nz(p1[1]), 0.67*nz(p1[1]), p1))

p3 = iff(p2<6, 6, iff (p2 > 50, 50, p2))

p := .2*p3 + .8*nz(p3[1])

spp := .33*p + .67*nz(spp[1])

phaseEMAMA = atan(q1 / i1)

dphase_ = nz(phaseEMAMA[1]) - phaseEMAMA

dphase = iff(dphase_< 1, 1, dphase_)

alpha_ = fastlimitEMAMA / dphase

alpha = iff(alpha_ < slowlimitEMAMA, slowlimitEMAMA, iff(alpha_ > fastlimitEMAMA, fastlimitEMAMA, alpha_))

fOBV(src) =>

changeOBV = change(src)

cum(changeOBV > 0 ? volume : changeOBV < 0 ? -volume : 0*volume)

// -------------------------------------------<[ Variable Calculations ]>------------------------------------------

temaSlow = fTEMA(sourceGlobal, lengthTEMASlow)

temaFast = fTEMA(sourceGlobal, lengthTEMAFast)

shortTema = crossover(temaSlow, temaFast)

longTema = crossunder(temaSlow, temaFast)

fillTema = temaFast>temaSlow ? color.new(colorTEMAFast,80) : color.new(colorTEMASlow,80)

emaFast = ema(sourceGlobal, lengthEMAFast)

emaSlow = ema(sourceGlobal, lengthEMASlow)

ema200 = ema(sourceGlobal, lengthEMA200)

longEMA = crossover(emaFast, emaSlow)

shortEMA = crossunder(emaFast , emaSlow)

fillEMA = emaFast>emaSlow ? color.new(colorEMAFast,80) : color.new(colorEMASlow,80)

cumOBV = fOBV(sourceGlobal)

oscOBV = (cumOBV - ema(cumOBV,lengthOBV))

changeOBV = change(sourceGlobal)

shortOBV = ema(cumOBV, lengthOBV)

psar = sar(psarStart, psarIncrement, psarMaximum)

psarDir = psar < close ? 1 : -1

colorPSAR = psarDir == 1 ? color.new(#3388bb,0) : color.new(#fdcc02,0)

colorPSARFill = psarHighlightState ? (psarDir == 1 ? color.new(colorPSARLong,90) : color.new(colorPSARShort,90)) : na

psarChangeCond = psarDir != psarDir[1]

valueRSI = rsi(sourceGlobal, lengthRSI)

if psarConfirmation == "EMA"

if emaFast > emaSlow

psarConfirmationBuy := true

psarConfirmationSell := false

else if emaFast < emaSlow

psarConfirmationSell := true

psarConfirmationBuy := false

else if psarConfirmation == "TEMA"

if temaFast > temaSlow

psarConfirmationBuy := true

psarConfirmationSell := false

else if temaFast < temaSlow

psarConfirmationSell := true

psarConfirmationBuy := false

else if psarConfirmation == "eMAMA"

if eMAMA > eFAMA

psarConfirmationBuy := true

psarConfirmationSell := false

else if eMAMA < eFAMA

psarConfirmationSell := true

psarConfirmationBuy := false

else if psarConfirmation == "RSI"

if valueRSI < 40

psarConfirmationBuy := true

psarConfirmationSell := false

else if valueRSI > 60

psarConfirmationSell := true

psarConfirmationBuy := false

else if psarConfirmation == "OBV"

if oscOBV > 0

psarConfirmationBuy := true

psarConfirmationSell := false

else if oscOBV < 0

psarConfirmationSell := true

psarConfirmationBuy := false

psarBuySignal = psarDir == 1 and psarDir[1] == -1 and (filterEMA200 ? open > ema200 : true) and inDateRange

psarSellSignal = psarDir == -1 and psarDir[1] == 1 and (filterEMA200 ? open < ema200 : true) and inDateRange

eMAMA := fMAMA(sourceGlobal, slowlimitEMAMA, fastlimitEMAMA)*sourceGlobal + (1 - fMAMA(sourceGlobal, slowlimitEMAMA, fastlimitEMAMA))*nz(eMAMA[1])

eFAMA := .5*fMAMA(sourceGlobal, slowlimitEMAMA, fastlimitEMAMA)*eMAMA + (1 - .5*fMAMA(sourceGlobal, slowlimitEMAMA, fastlimitEMAMA))*nz(eFAMA[1])

longMAMA=crossover(eMAMA, eFAMA)

shortMAMA=crossunder(eMAMA,eFAMA)

fillEMAMA = eMAMA>eFAMA ? color.new(coloreMAMA, 80) : color.new(coloreFAMA, 80)

srsiK = sma(stoch(valueRSI, valueRSI, valueRSI, lengthStoch), smoothK)

srsiD = sma(srsiK, smoothD)

fastMACD = ema(sourceGlobal, lengthMACDfast)

slowMACD = ema(sourceGlobal, lengthMACDslow)

macd = fastMACD - slowMACD

signalMACD = ema(macd, lengthMACDsignal)

adCMF = close==high and close==low or high==low ? 0 : ((2*close-low-high)/(high-low))*volume

mfCMF = sum(adCMF, lengthCMF) / sum(volume, lengthCMF)

// ================================== //

// ----> Conditional Parameters <---- //

// ================================== //

// ================================== //

// -------> Risk Mitigation <-------- //

// ================================== //

// ================================== //

// --------> Logical Order <--------- //

// ================================== //

// -------------------------------------------<[ Graphical Display ]>------------------------------------------

// TEMA plots

plotTemaSlow = plot(showTEMA ? temaSlow: na, color=color.new(colorTEMASlow,20), title="TEMA Slow plot", linewidth=thicknessTEMA)

plotTemaFast = plot(showTEMA ? temaFast: na, color=color.new(colorTEMAFast,20), title="TEMA Fast plot", linewidth=thicknessTEMA)

plotshape(showTEMA and longTema ? temaFast: na, style=shape.triangleup, location=location.absolute,

size=size.tiny, title="TEMA Cross Up", color=color.new(colorTEMAFast,10))

plotshape(showTEMA and shortTema ? temaSlow: na, style=shape.triangledown, location=location.absolute,

size=size.tiny, title="TEMA Cross Down", color=color.new(colorTEMASlow,10))

fill(plotTemaFast, plotTemaSlow, color=showTEMAfill ? fillTema : transparent, title="TEMA fill")

// EMA plots

plotEmaFast = plot(showEMA ? emaFast: na, title='EMA Fast Plot', color=colorEMAFast, linewidth=thicknessEMA)

plotEmaSlow = plot(showEMA ? emaSlow: na, title='EMA Slow Plot', color=colorEMASlow, linewidth=thicknessEMA)

plotEMA200 = plot(showEMA ? ema200: na, title='EMA Additional Plot', color=colorEMA200, linewidth=thicknessEMA)

plotshape(showEMA and longEMA ? emaFast : na, style=shape.triangleup, location=location.absolute, size=size.tiny,

title="EMA Cross Up",color=colorEMAFast)

plotshape(showEMA and shortEMA ? emaFast : na, style=shape.triangledown, location=location.absolute, size=size.tiny,

title="EMA Cross Down",color=colorEMASlow)

fill(plotEmaFast, plotEmaSlow, color=showEMAfill ? fillEMA : transparent, title="EMA fill")

// PSAR plots

psarPlot = plot(showPSAR ? psar: na, title="PSAR", style=plot.style_circles, linewidth=1, color=colorPSAR)

plotshape(showPSAR and psarBuySignal and psarHighlightStartPoints ? psar : na, title="PSAR Long Start", location=location.absolute,

style=shape.circle, size=size.tiny, color=colorPSARLong)

plotshape(showPSAR and psarBuySignal and psarShowLabels and psarConfirmationBuy ? psar : na, title="PSAR Buy Label", text="Buy", location=location.absolute,

style=shape.labelup, size=size.tiny, color=colorPSARLong, textcolor=color.white)

plotshape(showPSAR and psarSellSignal and psarHighlightStartPoints ? psar : na, title="PSAR Short Start", location=location.absolute,

style=shape.circle, size=size.tiny, color=colorPSARShort)

plotshape(showPSAR and psarSellSignal and psarShowLabels and psarConfirmationSell ? psar : na, title="PSAR Sell Label", text="Sell", location=location.absolute,

style=shape.labeldown, size=size.tiny, color=colorPSARShort, textcolor=color.white)

psarMidPricePlot = plot(ohlc4, title="", display=display.none, editable=false)

fill(psarMidPricePlot, psarPlot, title="PSAR Trade State Filling", color=colorPSARFill)

ploteMAMA = plot(showeMAMA ? eMAMA : na, title="Ehler's MAMA", linewidth=thicknessEMAMA, style=plot.style_line, color=coloreMAMA)

ploteFAMA = plot(showeMAMA ? eFAMA : na, title="Ehler's FAMA", linewidth=thicknessEMAMA, style=plot.style_line, color=coloreFAMA)

plotshape(showeMAMA and longMAMA ? eFAMA: na, style=shape.triangleup, location=location.absolute, size=size.tiny, title="eMAMA Cross Up",

color=color.new(coloreMAMA,10))

plotshape(showeMAMA and shortMAMA ? eFAMA: na, style=shape.triangledown, location=location.absolute, size=size.tiny, title="eMAMA Cross Down",

color=color.new(coloreFAMA,10))

fill(ploteMAMA, ploteFAMA, color=showEMAMAfill ? fillEMAMA : transparent, title="eMAMA fill")

// ---------------------------------------------------<[ Strategy Execution ]>-------------------------------------------------

strategy.entry(id="long", long=strategy.long, comment="enL", when=psarBuySignal and psarConfirmationBuy and tradeLong)

if useSL

strategy.exit(id="long", stop=psar, comment="SL")

strategy.close(id="long", comment="exL", when=psarSellSignal and psarConfirmationSell and tradeLong)

strategy.entry(id="short", long=strategy.short, comment="enS", when=psarSellSignal and psarConfirmationSell and tradeShort)

if useSL

strategy.exit(id="short", stop=psar, comment="SL")

strategy.close(id="short", comment="exS", when=psarBuySignal and psarConfirmationBuy and tradeShort)

// -------------------------------------------------------<[ Tables ]>---------------------------------------------------------

// Shows red for bearish signals, green for bullish signals.

var table summaryTable = table.new(tablePosition, 3, 3)

if (barstate.islast and showTable)

table.cell(summaryTable, 0, 0, "PSAR",text_size=tableTextSize, bgcolor = psarDir == 1 ? color.green : color.red)

rsiDirection = fDirection(valueRSI,1)

table.cell(summaryTable, 0, 1, "RSI " + tostring(round(valueRSI,0)) + rsiDirection,text_size=tableTextSize,

bgcolor = iff(valueRSI > rsiOverbought, color.red, iff(valueRSI < rsiOversold, color.green, color.yellow)))

srsiDirection = fDirection(srsiK,1)

table.cell(summaryTable, 0, 2, "K " + tostring(round(srsiK,0)) + srsiDirection, text_size=tableTextSize,

bgcolor=iff(srsiK > srsiOverbought, color.red, iff(srsiK < srsiOversold, color.green, srsiK > srsiD ? color.green : color.red)))

emaDirection = fDirection(emaFast,1)

table.cell(summaryTable, 1, 0, "EMA" + emaDirection,text_size=tableTextSize,

bgcolor = emaFast > emaSlow and emaFast > emaFast[1] ? color.green : color.red)

// See if emaFast has increased over the last two periods.

if rising(emaFast,2) and emaFast < emaSlow

table.cell_set_bgcolor(summaryTable, 1, 0, color.yellow)

directionTEMA = fDirection(temaFast,1)

table.cell(summaryTable, 1, 1, "TEMA" + directionTEMA,text_size=tableTextSize,

bgcolor = temaFast > temaSlow and temaFast > temaFast[1] ? color.green : color.red)

// See if temaFast has increased over the last two periods.

if rising(temaFast,2) and temaFast < temaSlow

table.cell_set_bgcolor(summaryTable, 1, 1, color.yellow)

directionMAMA = fDirection(eMAMA,1)

table.cell(summaryTable, 1, 2, "eMAMA" + directionMAMA,text_size=tableTextSize,

bgcolor = eMAMA > eFAMA and eMAMA > eFAMA[1] ? color.green : color.red)

// See if temaFast has increased over the last two periods.

if rising(eMAMA,2) and eMAMA < eFAMA

table.cell_set_bgcolor(summaryTable, 1, 2, color.yellow)

directionMACD = fDirection(macd,2)

table.cell(summaryTable, 2, 0, "MACD " + directionMACD, text_size=tableTextSize, bgcolor= macd > signalMACD ? color.green : color.red)

directionOBV = fDirection(shortOBV,2)

table.cell(summaryTable, 2, 1, "OBV " + directionOBV, text_size=tableTextSize, bgcolor= shortOBV > 0 ? color.green : color.red)

directionCMF = fDirection(mfCMF,2)

table.cell(summaryTable, 2, 2, "CMF " + directionCMF + tostring(mfCMF, "#.##"), text_size=tableTextSize, bgcolor= mfCMF > 0 ? color.green : color.red)

// ---------------------------------------------------<[ Alerts ]>-------------------------------------------------

if psarBuySignal and psarConfirmationBuy

alert("PSAR buy/long signal confirmed for {{ticker}} on {{interval}}.", alert.freq_once_per_bar)

if psarSellSignal and psarConfirmationSell

alert("PSAR sell/short signal confirmed for {{ticker}} on {{interval}}.", alert.freq_once_per_bar)

if psarChangeCond

alert("PSAR has changed direction for {{ticker}} on {{interval}}.", alert.freq_once_per_bar)