개요

이 전략은 가격 분산 신호에 기반한 트렌드 거래 전략이다. RSI, MACD, Stochastics 등과 같은 여러 지표들을 사용하여 가격 분산 신호를 검출하고, 머레이 매트 진동기를 통해 확인한다. 가격 분산 신호가 발생하면, 진동기가 현재 트렌드 방향이라고 확인하면, 입장이 이루어진다.

전략 원칙

이 전략의 핵심은 가격 분산 이론이다. 가격 혁신이 높지만 지표가 혁신이 높지 않은 경우를 곰 시장 가격 분산이라고 하며; 가격 혁신이 낮지만 지표가 혁신이 낮지 않은 경우를 황소 시장 가격 분산이라고 한다. 이것은 트렌드가 역전될 수 있음을 나타낸다. 전략은 상위 하위 유형을 사용하여 오징어와 결합하여 거래 신호를 확인한다.

이 전략의 입시 조건은 다음과 같습니다.

- 정규 분산 및 숨겨진 분산을 포함한 가격 분산 신호를 감지합니다.

- 머레이 매스 진동기는 그 트렌드 영역 안에 있습니다.

출전 조건은 진동기가 중선을 통과할 때 평행한다.

우위 분석

이 전략은 가격 분산 이론과 트렌드 확인을 결합하여 다음과 같은 장점을 가지고 있다:

- 가격 분산 신호를 사용하여 잠재적인 트렌드 전환점을 탐지하십시오.

- 애플리케이션 진동기는 현재 트렌드를 확인하고 가짜 돌파구를 피합니다.

- 다양한 지표와 변수 조합, 유연한 조정

- 트렌드 추적과 손실 방지

- 논리 규칙이 명확하고, 코드 최적화 공간이 넓습니다.

위험 분석

주요 위험은 다음과 같습니다.

- 가격 분산 신호는 가짜 신호일 수 있으며, 트렌드 반전을 완전히 확인할 수 없습니다.

- 오징어 매개 변수 설정이 잘못되면 누출이 발생하고 거래 기회가 놓치게 될 수 있습니다.

- 다중 공백 지위가 지나치게 기울어지면 손실 위험이 커집니다.

- 급격한 변동이 있을 때 거래 횟수와 슬라이드 포인트 비용이 급증할 수 있습니다.

스톱로스를 설정하고, 포지션을 조정하고, 위험을 줄이기 위해 변수 조합을 최적화하는 것이 좋습니다.

최적화 방향

이 전략에는 더 많은 최적화 가능성이 있습니다:

- 기계 학습 알고리즘을 추가하고, 실시간 최적화 파라미터 포지션을 추가합니다.

- 자율적 정지 기술을 추가하는 것, 예를 들어, 추적 정지, 평균 정지

- 더 많은 지표와 필터링 조건과 함께, 더 높은 통신소음 비율

- 동적으로 변동 변수를 조정하고, 트렌드 판단을 최적화

- 리스크 관리를 최적화하고 최대 인출 제한을 설정합니다.

요약하다

이 전략은 가격 분산 이론과 트렌드 분석 지표를 통합하여 잠재적인 트렌드 전환점을 효과적으로 발견할 수 있습니다. 최적화된 위험 관리 조치와 결합하여 더 나은 전략 수익률을 얻을 수 있습니다.

전략 소스 코드

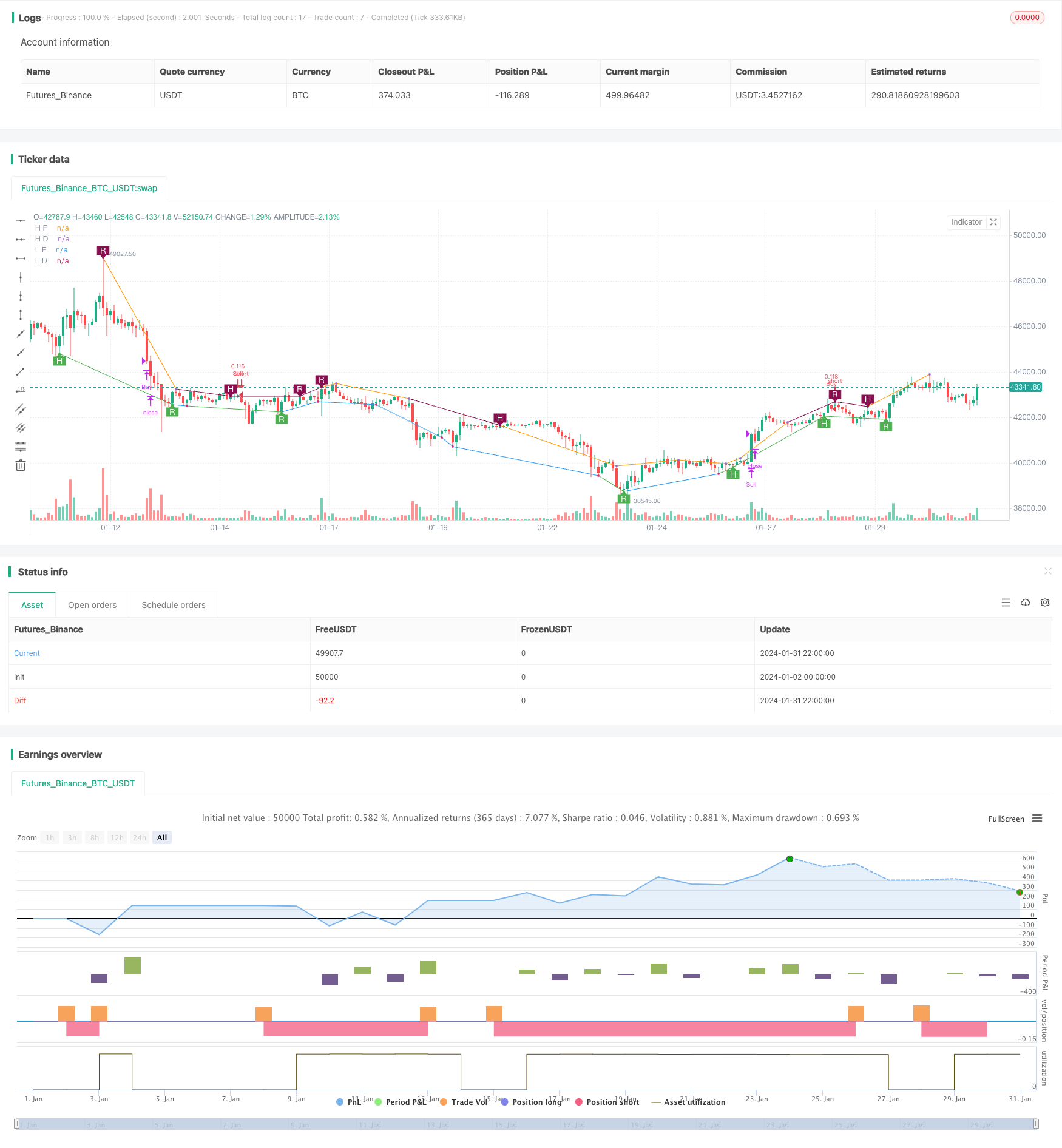

/*backtest

start: 2024-01-02 00:00:00

end: 2024-02-01 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

//

// Title: [STRATEGY][UL]Price Divergence Strategy V1

// Author: JustUncleL

// Date: 23-Oct-2016

// Version: v1.0

//

// Description:

// A trend trading strategy the uses Price Divergence detection signals, that

// are confirmed by the "Murrey's Math Oscillator" (Donchanin Channel based).

//

// *** USE AT YOUR OWN RISK ***

//

// Mofidifications:

// 1.0 - original

//

// References:

// Strategy Based on:

// - [RS]Price Divergence Detector V2 by RicardoSantos

// - UCS_Murrey's Math Oscillator by Ucsgears

// Some Code borrowed from:

// - "Strategy Code Example by JayRogers"

// Information on Divergence Trading:

// - http://www.babypips.com/school/high-school/trading-divergences

//

strategy(title='[STRATEGY][UL]Price Divergence Strategy v1.0', pyramiding=0, overlay=true, initial_capital=10000, calc_on_every_tick=false,

currency=currency.USD,default_qty_type=strategy.percent_of_equity,default_qty_value=10)

// || General Input:

method = input(title='Method (0=rsi, 1=macd, 2=stoch, 3=volume, 4=acc/dist, 5=fisher, 6=cci):', defval=1, minval=0, maxval=6)

SHOW_LABEL = input(title='Show Labels', type=bool, defval=true)

SHOW_CHANNEL = input(title='Show Channel', type=bool, defval=false)

uHid = input(true,title="Use Hidden Divergence in Strategy")

uReg = input(true,title="Use Regular Divergence in Strategy")

// || RSI / STOCH / VOLUME / ACC/DIST Input:

rsi_smooth = input(title='RSI/STOCH/Volume/ACC-DIST/Fisher/cci Smooth:', defval=5)

// || MACD Input:

macd_src = input(title='MACD Source:', defval=close)

macd_fast = input(title='MACD Fast:', defval=12)

macd_slow = input(title='MACD Slow:', defval=26)

macd_smooth = input(title='MACD Smooth Signal:', defval=9)

// || Functions:

f_top_fractal(_src)=>_src[4] < _src[2] and _src[3] < _src[2] and _src[2] > _src[1] and _src[2] > _src[0]

f_bot_fractal(_src)=>_src[4] > _src[2] and _src[3] > _src[2] and _src[2] < _src[1] and _src[2] < _src[0]

f_fractalize(_src)=>f_top_fractal(_src) ? 1 : f_bot_fractal(_src) ? -1 : 0

// ||••> START MACD FUNCTION

f_macd(_src, _fast, _slow, _smooth)=>

_fast_ma = sma(_src, _fast)

_slow_ma = sma(_src, _slow)

_macd = _fast_ma-_slow_ma

_signal = ema(_macd, _smooth)

_hist = _macd - _signal

// ||<•• END MACD FUNCTION

// ||••> START ACC/DIST FUNCTION

f_accdist(_smooth)=>_return=sma(cum(close==high and close==low or high==low ? 0 : ((2*close-low-high)/(high-low))*volume), _smooth)

// ||<•• END ACC/DIST FUNCTION

// ||••> START FISHER FUNCTION

f_fisher(_src, _window)=>

_h = highest(_src, _window)

_l = lowest(_src, _window)

_value0 = .66 * ((_src - _l) / max(_h - _l, .001) - .5) + .67 * nz(_value0[1])

_value1 = _value0 > .99 ? .999 : _value0 < -.99 ? -.999 : _value0

_fisher = .5 * log((1 + _value1) / max(1 - _value1, .001)) + .5 * nz(_fisher[1])

// ||<•• END FISHER FUNCTION

method_high = method == 0 ? rsi(high, rsi_smooth) :

method == 1 ? f_macd(macd_src, macd_fast, macd_slow, macd_smooth) :

method == 2 ? stoch(close, high, low, rsi_smooth) :

method == 3 ? sma(volume, rsi_smooth) :

method == 4 ? f_accdist(rsi_smooth) :

method == 5 ? f_fisher(high, rsi_smooth) :

method == 6 ? cci(high, rsi_smooth) :

na

method_low = method == 0 ? rsi(low, rsi_smooth) :

method == 1 ? f_macd(macd_src, macd_fast, macd_slow, macd_smooth) :

method == 2 ? stoch(close, high, low, rsi_smooth) :

method == 3 ? sma(volume, rsi_smooth) :

method == 4 ? f_accdist(rsi_smooth) :

method == 5 ? f_fisher(low, rsi_smooth) :

method == 6 ? cci(low, rsi_smooth) :

na

fractal_top = f_fractalize(method_high) > 0 ? method_high[2] : na

fractal_bot = f_fractalize(method_low) < 0 ? method_low[2] : na

high_prev = valuewhen(fractal_top, method_high[2], 1)

high_price = valuewhen(fractal_top, high[2], 1)

low_prev = valuewhen(fractal_bot, method_low[2], 1)

low_price = valuewhen(fractal_bot, low[2], 1)

regular_bearish_div = fractal_top and high[2] > high_price and method_high[2] < high_prev

hidden_bearish_div = fractal_top and high[2] < high_price and method_high[2] > high_prev

regular_bullish_div = fractal_bot and low[2] < low_price and method_low[2] > low_prev

hidden_bullish_div = fractal_bot and low[2] > low_price and method_low[2] < low_prev

plot(title='H F', series=fractal_top ? high[2] : na, color=regular_bearish_div or hidden_bearish_div ? maroon : not SHOW_CHANNEL ? na : silver, offset=-2)

plot(title='L F', series=fractal_bot ? low[2] : na, color=regular_bullish_div or hidden_bullish_div ? green : not SHOW_CHANNEL ? na : silver, offset=-2)

plot(title='H D', series=fractal_top ? high[2] : na, style=circles, color=regular_bearish_div or hidden_bearish_div ? maroon : not SHOW_CHANNEL ? na : silver, linewidth=3, offset=-2)

plot(title='L D', series=fractal_bot ? low[2] : na, style=circles, color=regular_bullish_div or hidden_bullish_div ? green : not SHOW_CHANNEL ? na : silver, linewidth=3, offset=-2)

plotshape(title='+RBD', series=not SHOW_LABEL ? na : regular_bearish_div ? high[2] : na, text='R', style=shape.labeldown, location=location.absolute, color=maroon, textcolor=white, offset=-2)

plotshape(title='+HBD', series=not SHOW_LABEL ? na : hidden_bearish_div ? high[2] : na, text='H', style=shape.labeldown, location=location.absolute, color=maroon, textcolor=white, offset=-2)

plotshape(title='-RBD', series=not SHOW_LABEL ? na : regular_bullish_div ? low[2] : na, text='R', style=shape.labelup, location=location.absolute, color=green, textcolor=white, offset=-2)

plotshape(title='-HBD', series=not SHOW_LABEL ? na : hidden_bullish_div ? low[2] : na, text='H', style=shape.labelup, location=location.absolute, color=green, textcolor=white, offset=-2)

// Code borrowed from UCS_Murrey's Math Oscillator by Ucsgears

// - UCS_MMLO

// Inputs

length = input(100, minval = 10, title = "MMLO Look back Length")

quad = input(2, minval = 1, maxval = 4, step = 1, title = "Mininum Quadrant for MMLO Support")

mult = 0.125

// Donchanin Channel

hi = highest(high, length)

lo = lowest(low, length)

range = hi - lo

multiplier = (range) * mult

midline = lo + multiplier * 4

oscillator = (close - midline)/(range/2)

a = oscillator > 0

b = oscillator > 0 and oscillator > mult*2

c = oscillator > 0 and oscillator > mult*4

d = oscillator > 0 and oscillator > mult*6

z = oscillator < 0

y = oscillator < 0 and oscillator < -mult*2

x = oscillator < 0 and oscillator < -mult*4

w = oscillator < 0 and oscillator < -mult*6

// Strategy: (Thanks to JayRogers)

// === STRATEGY RELATED INPUTS ===

//tradeInvert = input(defval = false, title = "Invert Trade Direction?")

// the risk management inputs

inpTakeProfit = input(defval = 0, title = "Take Profit Points", minval = 0)

inpStopLoss = input(defval = 0, title = "Stop Loss Points", minval = 0)

inpTrailStop = input(defval = 100, title = "Trailing Stop Loss Points", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Loss Offset Points", minval = 0)

// === RISK MANAGEMENT VALUE PREP ===

// if an input is less than 1, assuming not wanted so we assign 'na' value to disable it.

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

// === STRATEGY - LONG POSITION EXECUTION ===

enterLong() => ((uReg and regular_bullish_div) or (uHid and hidden_bullish_div)) and (quad==1? a[1]: quad==2?b[1]: quad==3?c[1]: quad==4?d[1]: false)// functions can be used to wrap up and work out complex conditions

exitLong() => oscillator <= 0

strategy.entry(id = "Buy", long = true, when = enterLong() )// use function or simple condition to decide when to get in

strategy.close(id = "Buy", when = exitLong() )// ...and when to get out

// === STRATEGY - SHORT POSITION EXECUTION ===

enterShort() => ((uReg and regular_bearish_div) or (uHid and hidden_bearish_div)) and (quad==1? z[1]: quad==2?y[1]: quad==3?x[1]: quad==4?w[1]: false)

exitShort() => oscillator >= 0

strategy.entry(id = "Sell", long = false, when = enterShort())

strategy.close(id = "Sell", when = exitShort() )

// === STRATEGY RISK MANAGEMENT EXECUTION ===

// finally, make use of all the earlier values we got prepped

strategy.exit("Exit Buy", from_entry = "Buy", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

strategy.exit("Exit Sell", from_entry = "Sell", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

//EOF